Electric Control Panel Market Size and Forecast 2025 to 2034

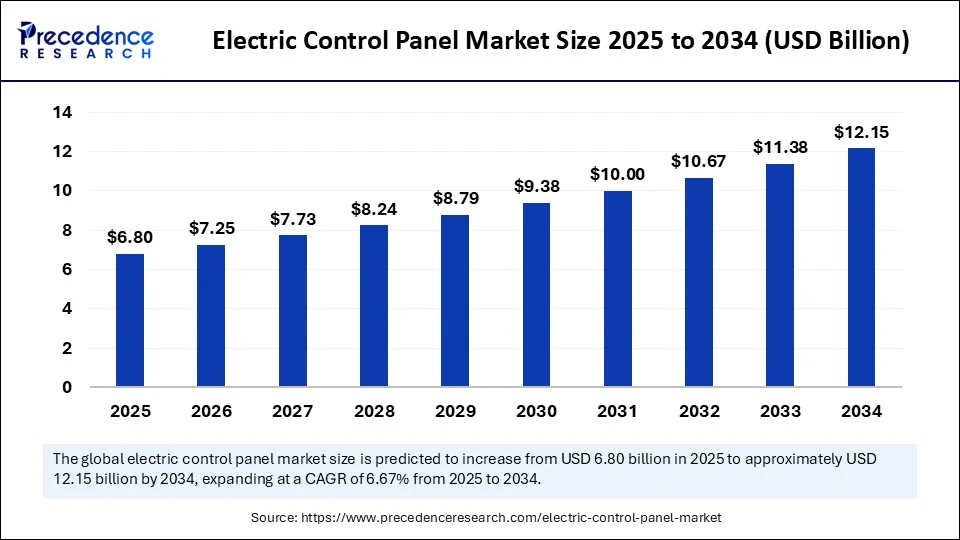

The global electric control panel market size accounted for USD 6.37 billion in 2024 and is predicted to increase from USD 6.80 billion in 2025 to approximately USD 12.15 billion by 2034, expanding at a CAGR of 6.67% from 2025 to 2034. The market growth is attributed to increasing adoption of industrial automation, smart energy management systems, and rising investments in grid modernization initiatives worldwide.

Electric Control Panel Market Key Takeaways

- In terms of revenue, the global electric control panel market was valued at USD 6.37 billion in 2024.

- It is projected to reach USD 12.15 billion by 2034.

- The market is expected to grow at a CAGR of 6.67% from 2025 to 2034.

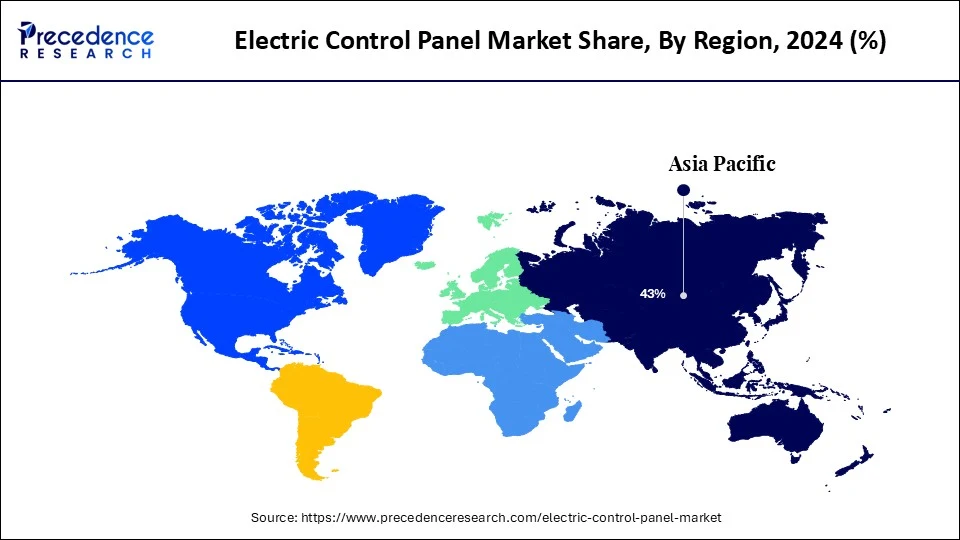

- Asia Pacific dominated the global electric control panel market with the largest share of 43% in 2024.

- The Middle East and Africa is expected to grow at the highest CAGR from 2025 to 2034.

- By type, the power control panels segment held the major market share in 2024.

- By type, the automation control panels segment is projected to grow at the fastest CAGR between 2025 and 2034.

- By component, the PCL & HMIs segment contributed the biggest market share in 2024.

- By component, the surge protector and smart devices segment is expanding at a significant CAGR in between 2025 and 2034.

- By mounting, the free-standing panels segment captured the biggest market share in 2024.

- By mounting, the wall-mounted panels segment is expected to grow at a significant CAGR over the projected period.

- By form factor, the open panels segment generated the major market share in 2024.

- By form factor, the enclosed panels segment is expected to grow at a notable CAGR from 2025 to 2034.

- By application, the industrial automation segment held the major market share in 2024.

- By application, the water and wastewater management segment is projected to grow at a CAGR between 2025 and 2034

- By end-user, the manufacturing industries segment accounted for largest market share in 2024.

- By end-user, the utilities and municipal projects segment is projected to grow at a CAGR between 2025 and 2034.

Impact of Artificial Intelligence on the Electric Control Panel Market

Artificial intelligence (AI) is dramatically enhancing the capability and utility of electric control panels. Smart control panels are currently incorporating artificial intelligence-based sensors and programs to continuously monitor electrical parameters. They detect trends in usage and automatically modify the work of the entire complex to be as efficient as possible. Such smartness counters the effort to reduce human interference, while also saving on energy waste. Moreover, AI-powered electric control panels are an inalienable part of sophisticated manufacturing, smart grid, and critical infrastructure industries.

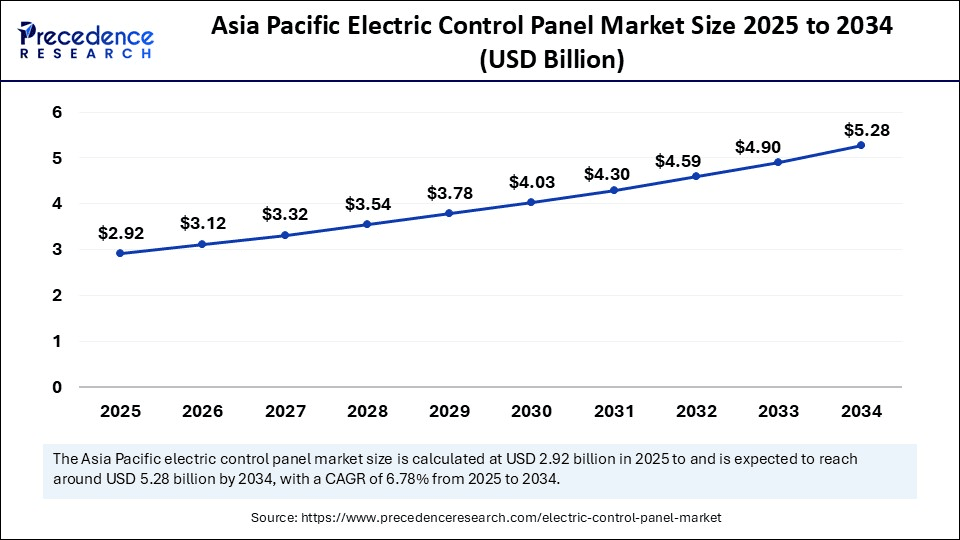

Asia Pacific Electric Control Panel Market Size and Growth 2025 to 2034

The Asia Pacific electric control panel market size is evaluated at USD 2.92 billion in 2025 and is projected to be worth around USD 5.28 billion by 2034, growing at a CAGR of 6.78% from 2025 to 2034.

What Factors Contribute to Asia Pacific's Dominance in the Global Electric Control Panel Market in 2024?

Asia Pacific led the electric control panel market, capturing a 43% share in 2024. This is mainly due to a high level of industrialization, increased automation in manufacturing centers, and massive infrastructure growth in China, India, Japan, and Southeast Asia. There is a high demand for low and medium-voltage control systems to facilitate production lines in the automotive, electronics, and food processing industries.

In 2024, the Ministry of Power (India) brought online its Green Energy Corridor (Phase II), stipulating intelligent electric control solutions on renewable power evacuation grids. Major players, including Mitsubishi Electric, Larsen & Toubro, and Delta Electronics, have expanded their capacity to produce filled panels in Asia to meet local demand. According to the Japan Electrical Manufacturers Association (JEMA), there were also significant trends towards automation in mid-sized enterprises, which further enhanced the area's dependency on smart panel systems. Furthermore, the Asia Pacific is one of the leading countries in adopting AI-enabled control panel solutions in both discrete manufacturing facilities and process manufacturing facilities, further boosting the market in this region.

(Source: https://www.pib.gov.in)

The Middle East & Africa is anticipated to grow at the fastest rate in the market during the forecast period, owing to the rapid transformation of infrastructure, along with energy diversification initiatives and the expansion of smart networks by utilities. Manufacturing is focusing on introducing panel configurations designed specifically for extreme heat and dusty areas, addressing the challenge of operating in areas such as industrial zones and desert cities. Moreover, smart control panels offer an opportunity to support the transition to decentralized and resilient renewable power systems in Africa, particularly in solar mini-grids and community energy centers.

Market Overview

The electric control panel market encompasses the design, manufacturing, and integration of panels that house electrical components used to control, monitor, and regulate mechanical processes and equipment. These panels serve as central command hubs in industrial automation, infrastructure, energy systems, and building management. They include power distribution panels, motor control centers (MCCs), and programmable logic controllers (PLCs), and are essential in ensuring safety, reliability, and operational efficiency.

The growth of electric control panels is fueled by the widespread use of prime control panels across various industries. Such panels enable users to monitor system performance, perform quick tuning, and communicate with building management systems. The increase in renewable capacity, as revealed by the IEA in 2024, also underscores the need for flexible panel solutions. These advanced panels facilitate bidirectional power flow, as grids face the variability of photovoltaic and wind sources. Furthermore, the higher usage of smart buildings and smart grid use cases is driving the application of electric control panels to wider internet of things (IoT) networks.

Electric Control Panel Market Growth Factors

- Boosting Demand for Energy Resilient Infrastructure: Growing concerns over power outages and grid instability are driving the integration of robust electric control panels in mission-critical facilities.

- Rising Adoption of Electric Vehicles (EVs): The electrification of transportation is fueling the installation of smart control panels across EV charging stations, substations, and manufacturing plants.

- Growing Emphasis on Fire and Safety Compliance: Stricter regulatory norms on electrical safety are propelling demand for certified, fault-protected electric control panels in hazardous zones.

- Driving Digital Twin Integration: The trend of digital twin technology in industrial systems is boosting panel-level intelligence for simulation, real-time diagnostics, and lifecycle management.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.15 Billion |

| Market Size in 2025 | USD 6.80 Billion |

| Market Size in 2024 | USD 6.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.67% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North Ameirca |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Component, Mounting Type, Mounting Type, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is Surging Infrastructure Development in Emerging Economies Accelerating Expansion in the Electric Control Panel Market?

The surge in infrastructure development in emerging economies is projected to accelerate market growth. A boom in infrastructure development in emerging markets, such as India, Brazil, Indonesia, and Vietnam, is expected to accelerate the adoption of electric control panels across various industries. Further urbanization, increased demand for electricity, and government-based industrial corridors are compelling the installation of substations, commercial buildings, smart grids, and renewable energy systems. All these applications need close control, fault monitoring, and system fault protection, which modern panels perform effectively. Capital spending on infrastructure experienced a significant increase in 2024 in low- and middle-income countries, with energy and transport sectors facilitating an increase in investments in electric control panels.

- In May 2024, the World Bank reported that private infrastructure investment in low- and middle-income countries reached $86 billion in 2023, marking a significant rise from the previous year. A total of 322 projects were financed across 68 countries, up from 260 projects in 54 countries in 2022, reflecting growing investor confidence and expanding infrastructure development across emerging markets.

(Source:https://www.worldbank.org)

- Further growth can also be catalyzed by increasing foreign direct investment and infrastructure capital, given the importance of medium- and low-voltage distribution panels. In 2024, the Ministry of Power (India) announced plans for the commissioning of 12 new substations in smart cities, featuring new electrical control infrastructure that meets CEA and BIS requirements. Furthermore, the growing grid modernization programs associated with the modernization of digital control panels further boost the market.

(Source:https://www.investindia.gov.in)

Restraint

Lack of Standardization Across Regions Restrains Market Expansion

The lack of harmonized technical standards and certification processes across different countries is anticipated to restrain the market. The inadequate alignment of technical standards and the certification process in various nations is expected to be a barrier to the global growth of electric control panel systems. Manufacturers and integrators face the challenge of conforming to various regional safety codes, wiring standards, and testing procedures. Furthermore, such discrepancies cause procurement delays and drive up costs, which in turn impact deployment schedules, thereby hampering market growth.

Opportunity

What Role Does the Rising Adoption of Smart Building Technologies Play in Advancing the Electric Control Panel Market?

The rising adoption of smart building technologies is expected to create significant opportunities for market players. The expected growth in the use of smart building technologies in commercial, institutional, and residential infrastructure is projected to increase the use of electric control panels in building automation systems. Contemporary buildings feature HVAC controls, lighting systems, access control, and energy metering, all of which are centrally and automatically controlled. Moreover, several funded retrofitting programs involving automated electric controls as a core part of energy-positive buildings are expected to fuel the market.

Type Insights

Why Did the Power Control Panels Segment Dominate the Electric Control Panel Market in 2024?

The power control panels segment dominated the market while holding a 35% share in 2024. This is due to the increasing demand for power distribution systems in the industry. These panels are the core of electrical facilities, which control the supply of electricity to motors, generators, and critical machinery.

They are used to regulate voltage and protect against short circuits and overloading. Thus, they are deemed vital in high-load power supply applications and data centers. The increase in projects for renewable energy sources, particularly solar and wind farms, was also dependent on power control panels to maintain stability during integration into the grid. Firms like Schneider Electric, Siemens, and Eaton enhanced their solutions in medium-voltage panels, resulting in an increase in their market share in this segment.

On February 14, 2024, Schneider Electric, a global leader in energy management and automation, announced the launch of its SureSeT Medium Voltage (MV) switchgear for the Canadian market. This next-generation solution, featuring the award-winning EvoPacT circuit breaker, delivers a more compact, robust, and intelligent design tailored for primary switchgear applications. Engineered to support digital operational demands, the system enhances safety, reliability, and real-time monitoring capabilities for modern energy infrastructure.

(Source: https://www.se.com)

The automation control panels segment is expected to grow at the fastest rate in the future years, owing to the rise of industrial digitization, the need to monitor processes in real-time, and the application of Industry 4.0 principles into practice. They combine programmable logic controllers (PLCs), human-machine interfaces (HMIs), and industrial communication networks. Furthermore, the introduction of enhanced panel systems with analytics embedded in the automotive, food production, and electronics manufacturing industries further boosts segmental growth.

Component Insights

What Made PLCs & HMIs the Core Components of Electric Control Panels?

The PLC & HMIs segment dominated the electric control panel market, holding a 30% share in 2024. They play a central role in automating, visualizing, and controlling industrial activity. PLCs ensure the real-time control of complex electromechanical processes and facilitate informed decision-making. On the other hand, Human-Machine Interfaces (HMIs) enable workers to effectively control the equipment and monitor the system's efficiency.

Industries, including automotive, chemicals, and food processing, were implementing more of these technologies to minimize human error and enhance equipment utilization. Colossal manufacturers, such as Siemens, Rockwell Automation, and Delta Electronics, have submitted new PLC-HMI modules that incorporate edge computing and AI algorithms, adding predictive control and anomaly detection capabilities. Furthermore, in 2024, the modernization of an additional 1,200+ industrial feeders in the Ministry of Power (India) with PLC-based control systems further strengthened the market.

The surge protectors & smart devices segment is expected to grow at the fastest CAGR in the coming years, owing to the high focus on equipment protection, data integrity, and infrastructure connected to it due to the increased usage of fragile electronics and data-based systems in buildings, factories, and substations. The threat to the value of damage caused by voltage transients and power irregularities becomes significantly higher, necessitating the use of these devices. Moreover, the sensor-based protection in the public power grids and hospitals is an indicator of increasing institutional recognition of intelligent protection technology.

Mounting Insights

How Does the Free-Standing Panels Segment Dominate the Market in 2024?

The free-standing panels segment dominated the electric control panel market, accounting for a 42% share in 2024, as they are well-suited for large-scale industrial activities that require defined circuit densities and complex designs. The panels are very spacious and can accommodate heavy-duty devices, such as circuit breakers, transformers, PLCs, and motor controllers. This is particularly advantageous in manufacturing facilities, power stations, and infrastructure construction. They are designed to facilitate easier maintenance, scalability, and cable management in high-voltage and multi-equipment environments.

The 2024 Indian modernization grid directive of the Central Electricity Authority (CEA) also required new industrial corridors to install modular free-standing panels. Companies such as Larsen and Toubro and Eaton have increased their capacities of manufacturing these panels. Due to the rising demand for smart substations and large public infrastructure projects that are lining up, thus further fueling the market.

(Source: https://cercind.gov.in)

The wall-mounted panels segment is expected to grow at the fastest CAGR in the coming years as more compact industrial facilities, commercial buildings, and residential automation systems are demanding their products. These panels are a space-economizing option that can accommodate the number of control relays, lighting modules, and low-voltage supply element units. The mobility of the wall domain and the preference toward wall-mounted construction are facilitating the segment growth in the coming years.

Form Factor Insights

What Made Open Panels the Dominant Segment in the Electric Control Panel Market in 2024?

The open panels segment held the largest revenue share in the electric control panel market in 2024, as they find wide application in low-hazard industrial industries where manageability and efficiency of maintenance are of primary concern. Major small-to-medium industrial users in North America employed open panel configurations due to their cost-effectiveness and shorter lead times. Additionally, the simplification of these open-panel electric control panel systems further fuels the market.

The enclosed panels segment is expected to grow at the fastest CAGR in the coming years, owing to an increase in focus on worker safety, equipment safety, and adherence to changing industrial standards in both developed and emerging areas. These panels feature built-in anti-dust, anti-moisture, and non-conductive properties, making them essential in harsh environments or outdoor installations. Furthermore, they have introduced weather-impervious and run-away enclosures in opposition and coordinated towards oil and gas plants to further facilitate the segment.

Application Insights

How Does the Industrial Automation Segment Dominate the Electric Control Panel Market in 2024?

The industrial automation segment dominated the market in 2024, accounting for approximately 38% share. This is primarily due to the increased digitization in industries such as automotive, electronics, food and beverage, and pharmaceuticals. Manufacturers were becoming more dependent on integrated control panels. This technology facilitates operations, making them consistent and requiring minimal manual intervention in an environment where many things are running at a very fast pace. Additionally, the high increase in the installation of industrial control systems, especially in the Asia-Pacific and North America, further drives the market in this sector.

The water & wastewater management segment is expected to grow at a rapid pace in the coming years, owing to increased investments in sustainable infrastructure, stringent environmental policies, and the emerging requirement for dependable utility operations. Electric control panels are important in the monitoring and control of pumps, filtration systems, chemical dosing, and remote telemetry. Moreover, the development of sophisticated panel technologies tailored to meet the demands of both operational and environmental challenges further boosts the demand for these technologies.

End-User Insights

Why Did the Manufacturing Industries Segment Dominate the Market in 2024?

The manufacturing industries segment held a 40% share in the electric control panel market in 2024. This is due to the widespread use of automation technology and process control technology in the automotive, aerospace, consumer goods, and electronics industries. The mentioned industries need powerful, scalable, and interconnected electric control panels. This helps deliver uninterrupted work, energy efficiency, and the accuracy of production.

(Source: https://www.ispatguru.com)

The International Electrotechnical Commission (IEC) published new standards of performance and wiring of control panels in heavy-duty industrial areas in 2024. This has urged many people to adopt standard systems. In 2024, the United Nations Industrial Development Organization (UNIDO) worked together with the national government. Further encouraging sustainable manufacturing processes, such as installing digital control panels to reduce breakdowns and enhance facility safety, thus facilitating market growth.

(Source: https://sdgs.un.org)

The utilities & municipal projects segment is expected to grow at the fastest rate in the coming years, owing to the rising modernization programs for electricity grids and the increasing number of investments in renewable sources. Electric control panels play an essential role in substations, street lighting systems, water pumping stations, and smart grid applications. They provide sophisticated control, safety, and energy management features. Additionally, the increase in utility infrastructure and territories in Sub-Saharan Africa and Southeast Asia, due to the high presence of compact devices, further promotes the utilization of electric control panel technology.

Electric Control Panel Market Companies

- ABB India Limited

- ACCU-Panels Energy Pvt Ltd

- Advance Private Limited

- Highvolt Power & Control Systems Private Limited.

- JC Industries Private Limited

- LS Power Control Private Limited

- Precise Technofab India Private Limited

- Ramyaa Electro Gear Private Limited

- Rashmi Electricals Private Limited

- Schneider Electric India Private Limited

Recent Developments

- In June 2024, ABB launched the ReliaHome Smart Panel in the U.S. and Canada, its first residential energy management platform in collaboration with Lumin, offering responsive load control and real-time energy savings across all 50 states and territories.

(Source: https://new.abb.com)

- In December 2024, Enphase Energy introduced Busbar Power Control software, enabling homeowners to install larger solar and battery systems without expensive panel upgrades, enhancing solar system performance and safety.

(Source: https://investor.enphase.com)

- In May 2025, Singapore-based 81 Electrical launched a new control panel automation service, delivering advanced remote monitoring and energy-efficient solutions across industries such as ACMV, water treatment, and building management.

(Source: https://thebruneian.news)

Latest Announcement by Industry Leader

- In February 2025, SPAN introduced two new smart panel models, the SPAN Panel MAIN 40 +MID and SPAN Panel MLO 48, marking a pivotal move toward its mission of delivering energy management to every home. “With more demand on our electric grid than ever before, we're at a pivotal moment in our nation's energy transformation,” stated Arch Rao, SPAN's co-founder and CEO. “SPAN is revolutionizing the 100-year-old electric panel, and the expansion of our smart panel family is a critical next step in this journey. We're proud to help builders cut costs, deliver an unparalleled customer experience, and set modern standards for new-build homes.”

(Source: https://www.businesswire.com)

Segments covered in the report

By Type

- Power Control Panels

- Low Voltage Panels

- Medium Voltage Panels

- High Voltage Panels

- Motor Control Panels (MCPs)

- Direct-On-Line (DOL) Starters

- Soft Starters

- Variable Frequency Drives (VFDs)

- Automation Control Panels

- PLC Panels

- SCADA Panels

- HMI Panels

- Lighting Control Panels

- Timer-Based Panels

- Smart Lighting Panels

- Remote-Control Panels

- Instrument Control Panels

- Pressure/Temperature Controllers

- Flow Monitoring Panels

- Sensor Interface Panels

By Component

- Circuit Breakers

- Contactors & Relays

- Terminal Blocks

- PLC & HMIs

- Push Buttons & Indicators

- Wiring & Cables

- Surge Protectors

By Mounting Type

- Wall-Mounted Panels

- Free-Standing Panels

- Flush-Mounted Panels

By Form Factor

- Open Panels

- Enclosed Panels

- Custom Modular Panels

By Application

- Industrial Automation

- Assembly Lines

- Packaging Systems

- Robotics & Material Handling

- Power Distribution

- Grid Substations

- Backup Generators

- Renewable Integration

- HVAC Systems

- Building Climate Control

- Smart Thermostats

- Chiller Plant Control

- Water & Wastewater Management

- Pump Control

- SCADA Systems

- Water Treatment Monitoring

- Oil & Gas

- Drilling Rig Panels

- Explosion-Proof Panels

- Pipeline Monitoring

- Infrastructure & Buildings

- Building Automation Systems (BAS)

- Lighting Control

- Elevator & Security System Panels

By End-User

- Manufacturing & Process Industries

- Commercial Buildings

- Utilities & Power Generation

- Oil & Gas Companies

- Municipal Infrastructure (Water, Waste)

- Data Centers & IT Parks

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting