Mini Data Centers Market Size and Forecast 2025 to 2034

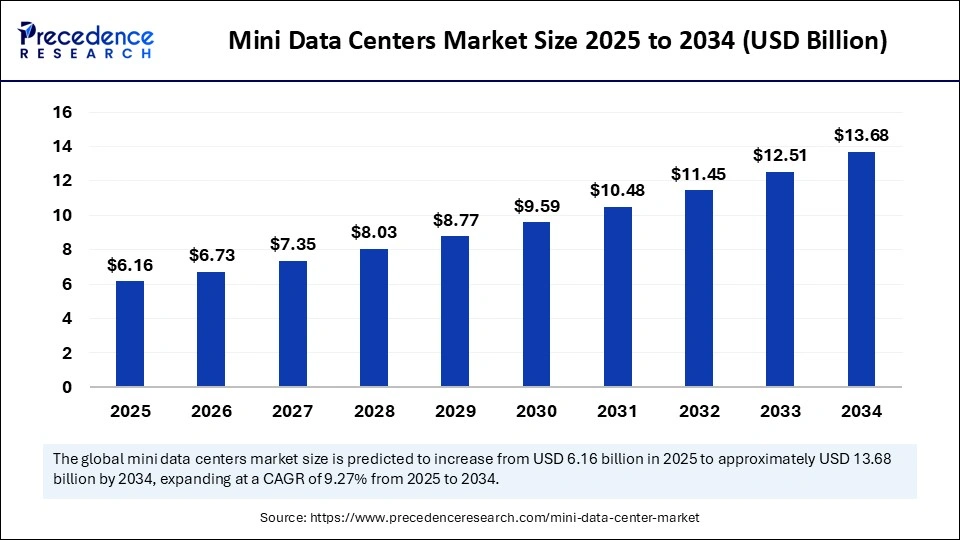

The global mini data centers market size was calculated at USD 5.64 billion in 2024 and is predicted to increase from USD 6.16 billion in 2025 to approximately USD 13.68 billion by 2034, expanding at a CAGR of 9.27% from 2025 to 2034. The growing demand for edge computing, continuous growth in digital services, integration of Artificial Intelligence (AI) and Machine Learning (ML), and growing reliable and efficient data storage solutions are expected to boost the growth of the global market for mini data centers over the forecast period. Additionally, the market is expanding in emerging regions, particularly the Asia Pacific, fuelled by the supportive government framework and rapid adoption of digital transformation initiatives.

Mini Data Centers Market Key Takeaways

- In terms of revenue, the global mini data centers market was valued at USD 5.64 billion in 2024.

- It is projected to reach USD 13.68 billion by 2034.

- The market is expected to grow at a CAGR of 9.27% from 2025 to 2034.

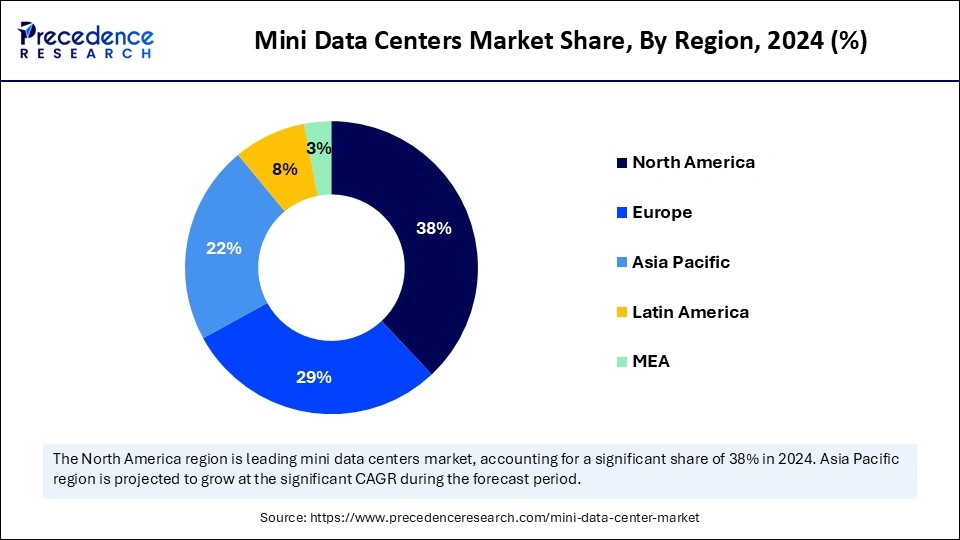

- North America dominated the global mini data centers market with the largest share of 38% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By product type, the rack-based segment captured the biggest market share of 45% in 2024.

- By product type, the prefabricated pod/enclosure mini data centers segment is set to experience the fastest growth during the forecasted period.

- By deployment application, the enterprise edge segment contributed the highest market share of 35% in 2024.

- By deployment application, the telecom edge (5G/MEC) segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By power capacity, the 6–50 kW segment held the maximum market share of 50% in 2024.

- By power capacity, the above 50 kW segment is expanding at a significant CAGR from 2025 to 2034.

- By cooling technology, the air-cooled systems segment accounted for the significant market share of 55% in 2024.

- By cooling technology, the liquid-cooled systems segment is experiencing rapid growth during the forecast period.

- By management approach, the remote-managed segment generated the major market share of 40% in 2024.

- By management approach, the cloud-integrated & AI-managed segment is expected to witness remarkable growth during the forecast period.

Market Overview

Mini data centers are a new generation of infrastructure that offer flexible and fast solutions at a much smaller scale. The mini data centers market is significantly transforming the way organizations process and store data, offering a more compact and efficient solution for a wide range of industries. Mini data centers are compact and modular structures designed to meet the small-scale data processing and storage needs of small and medium-sized businesses. Mini data centers are portable and come in various sizes, ranging from a half-rack to a single rack or multiple racks.

How Can Artificial Intelligence Improve the Mini Data Centers Market?

In today's rapidly evolving digital transformation, Artificial Intelligence (AI) emerges as a transformative force and holds potential for growth and innovation in the Mini data centers market. The growth of AI-driven applications is assisting in increasing the efficiency and competitiveness of businesses across various sectors. AI seamlessly integrates into mini data center management tools and workflows to significantly enhance operational efficiency and reduce disruption. By leveraging advanced techniques such as anomaly detection, AI-driven security monitoring systems can effectively identify any suspicious activities and mitigate security risks to protect sensitive data and infrastructure. AI can analyze data to predict potential equipment failures, significantly reduce downtime, and extend the lifespan of infrastructure. AI can significantly optimize resource allocation, boost energy consumption, and improve the cooling system, which leads to reduced operational costs and enhances sustainability.

What Are the Key Trends in the Mini Data Centers Market?

- The rapid digitization transformation across industries, along with the increasing investment in expanding their data center infrastructure by key players, is estimated to promote the growth of the mini data centers market during the forecast period.

- The increasing demand from small and medium-sized enterprises (SMEs) is expected to contribute to the overall growth of the mini data centers market. SMEs are increasingly adopting mini data centers as efficient data storage solutions.

- The surge in IoT Adoption is anticipated to boost the growth of the trade management software (TMS) market during the forecast period. The incorporation of Internet of Things (IoT) devices generates massive amounts of data, which creates a need for localized processing and storage solutions extensively offered by mini data centers.

- The surge in popularity of cloud-based solutions, remote working environments and AI-powered applications has led to an increasing need for reliable data storage and processing, driving the market's growth during the forecast period.

- The favourable government framework and the deployment of 5G networks, particularly in emerging economies, are anticipated to accelerate the market's growth during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.68 Billion |

| Market Size in 2025 | USD 6.16 Billion |

| Market Size in 2024 | USD 5.64 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.27% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Deployment Application, Power Capacity, Cooling Technology, Management Approach, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Surging Demand for Edge Computing

The proliferation of edge computing is expected to boost the growth of the mini data centers market during the forecast period. Mini data centers process data closer to its source, which plays a crucial role for various applications such as Artificial Intelligence (AI), Internet of Things (IoT), and autonomous systems that require real-time responses. Mini data centers provide the significant infrastructure to achieve this by efficiently placing compute resources at the network's edge. The rising volume of data generated by IoT devices and real-time applications has led to an increasing need for low-latency processing. Therefore, the rising demand for low-latency and real-time data processing for applications such as smart cities, IoT, healthcare, retail, and others is anticipated to drive the market's expansion during the forecast period.

Restraint

High Cost of Initial Investment Even at Scale

The high initial investment and operational costs are anticipated to hamper the market's growth. The cost of deployment can be a barrier, as high upfront costs are required for hardware, cooling, power, and security systems, particularly for small and medium-sized businesses (SMBs) with limited budgets in middle and lower-income countries. Mini data centers also require costs for maintenance, staffing, and security, which increases the overall total cost of ownership. In addition, a lack of skilled workforce and integration complexity may hinder the growth of the global mini data centers market during the forecast period.

Opportunity

How Are the Sustainability Initiatives Impacting the Market Expansion?

The favourable sustainability initiatives are projected to offer lucrative growth opportunities to the mini data centers market in the coming years. Sustainability initiatives play a crucial role in driving the growth of the data center market. Several mini data center operators are aggressively focusing on embracing energy-efficient solutions, integration of renewable energy, and adoption of modern cooling technologies to reduce carbon footprints. Relocating computer resources to the data source significantly lowers the energy required to send the data over a network. Several Governments and regulatory bodies around the world are encouraging the adoption of green data center practices, which in turn accelerate the investments in sustainable infrastructure. Moreover, mini data centers offer a more cost-effective option as compared to large-scale data centers for many businesses, especially small and medium enterprises (SMEs), to align with their data storage and processing needs.

Product Type Insights

What Made the Rack-Based Segment Lead the Mini Data Centers Market in 2024?

The rack-based mini data centers segment was dominant, with the biggest share of the global Mini data centers market in 2024. The growth of the segment is attributed to the rapid digitalization, Internet of Things, AI, and edge computing, which increase data generation and create a significant need for flexible, localized, and economical solutions. Rack-based mini data centers are generally compact and self-contained units that provide the core functionalities of a large data center, like computing, power, storage, cooling, and networking within a rack-mounted enclosure. On the other hand, the prefabricated pod/enclosure mini data centers segment is also experiencing the fastest growth. Prefabricated pod/enclosure mini data centers are self-contained and pre-engineered units. These modular solutions are widely deployed on-site for edge computing and other localized needs, providing a flexible and scalable solution for IT infrastructure in locations such as hospitals and schools.

Cooling Technology Insights

What Made the Air-Cooled Systems Segment Lead the Mini Data Centers Market in 2024?

The air-cooled systems segment was dominant, with the biggest share of the global Mini data centers market in 2024. Mini data centers primarily utilize air-cooled systems to dissipate heat from servers by circulating cool air through the equipment, which helps prevent overheating and potential malfunctions. These systems extensively employ Computer Room Air Handlers (CRAHs), Computer Room Air Conditioners (CRACs), fans, and vents & ducts to maintain a stable temperature. On the other hand, the liquid-cooled systems segment is also experiencing the fastest growth. The growth of the segment is driven by the increasing demand for energy efficiency, the high heat density of modern IT infrastructure, and the rapid expansion of edge computing. Advanced IT infrastructure, particularly for AI and high-performance computing (HPC), generates significant heat, thereby increasing the demand for advanced liquid cooling solutions. Liquid cooling systems are widely adopted as a more energy-efficient solution than conventional air-cooling methods, reducing power consumption and operational costs.

Power Capacity Insights

How Did the 6–50 kW Segment Dominate the Mini Data Centers Market in 2024?

The 6–50 kW segment dominated the market in 2024. The 6–50 kW power capacity is primarily used for edge computing. The self-contained design and reduced footprint make them gain immense popularity for various uses, from remote offices to industrial environments. On the other hand, the above 50 kW segment is expected to register the fastest growth. The above 50 kW power capacity is considered a viable alternative to centralized mega data centers. The above 50 kW power capacity mini data centers are widely used for low-latency computing at the network's edge. These are modular units that can be deployed easily and cost-effectively to support advanced and data-intensive applications.

Management Approach Insights

What Causes the Remote-Managed Segment to Dominate the Mini Data Centers Market?

The remote-managed segment held a dominant presence in the market in 2024. The remote-managed mini data centers are monitored and controlled from a distance, enabling businesses to effectively manage critical IT infrastructure without the need for constant on-site presence. Businesses gain 24/7 monitoring and proactive maintenance, ensuring seamless operational continuity. They also provide a cost-effective IT infrastructure, eliminating the high capital expenditure of a large data center and reducing its footprint. On the other hand, the cloud-integrated & AI-managed segment is expected to grow at a notable rate. The incorporation of mini data centers with cloud computing and AI-managed systems helps lower downtime, enhance reliability, and reduce maintenance costs, making them smarter and more self-sufficient. The cloud integration & AI-managed is expanding rapidly owing to the growing demand for edge computing and hybrid cloud solutions.

Deployment Application Insights

How Enterprise Edge Segment Dominates the Mini Data Centers Market in 2024?

The enterprise edge segment dominated the market in 2024. The enterprise edge segment includes corporate offices and SMBs. Mini data centers play a pivotal role in enabling enterprise edge computing. The growth of the segment is driven by the rising need for real-time data processing, the integration of connected devices, AI, and 5G networks, and the growing demand for scalable and cost-effective infrastructure solutions. On the other hand, the telecom edge segment is witnessing the fastest growth. The telecom edge segment includes 5G, Base Stations, and MEC. In the telecom industry, edge computing with mini data centers supports various advanced applications such as the Internet of Things (IoT), 5G networks, and real-time analytics. Mini data centers located at cell towers and central offices assist in supporting applications that increasingly require ultra-low latency.

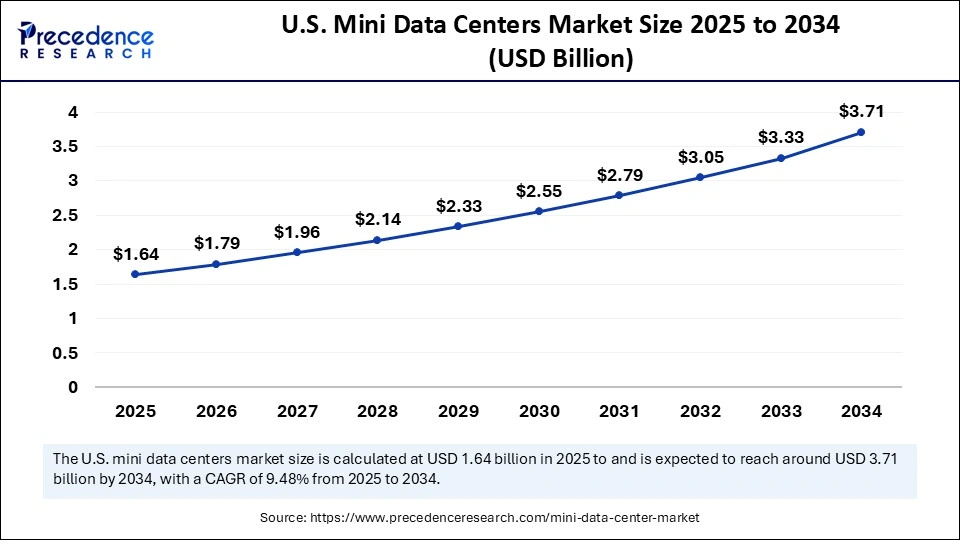

U.S. Mini Data Centers Market Size and Growth 2025 to 2034

The U.S. mini data centers market size was evaluated at USD 1.50 billion in 2024 and is projected to be worth around USD 3.71 billion by 2034, growing at a CAGR of 9.48% from 2025 to 2034.

How Did North America Lead the Mini Data Centers Market in 2024?

North America held the dominant share of the mini data centers market in 2024. The region benefits from a well-developed IT-driven infrastructure, surging investment in modern infrastructure, a supportive government framework, the evolution of cloud services & the increased use of hybrid cloud architectures. Additionally, there is an increasing awareness of the sustainability benefits of micro data centers, as well as the rapid expansion of 5G infrastructure.

The United States is a major contributor to the expansion of the mini data centers market. The regional market is experiencing growth from the proliferation of IoT devices, AI, cloud computing, and the increasing need for localized data processing. The increasing demand for low-latency processing from various industries such as smart cities, manufacturing, retail, and autonomous vehicles requires real-time data analysis, which is met by edge computing and mini data centers. Additionally, the shift towards decentralized IT infrastructure and rapid digital transformation in the region is anticipated to fuel the market's growth. Such a combination of factors is expected to propel the growth of the Mini data centers market in the North American region.

Mini Data Centers Market Companies

- Schneider Electric

- Vertiv

- Eaton

- Huawei

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- IBM

- Lenovo

- Rittal

- APC by Schneider

- Panduit

- ABB

- Delta Electronics

- Legrand (Server Technology division)

- Fujitsu

- ZTE Corporation

- EdgeMicro

- Cannon Technologies

- Iceotope

Industry Leader Announcements

- In July 2025, Schneider Electric, the leader in the digital transformation of energy management and automation, announced new data center solutions specifically engineered to meet the intensive demands of next-generation AI cluster architectures. Schneider Electric launched new data center solutions to meet the challenges of high-density AI and accelerated compute applications.(Source: https://www.se.com)

Recent Developments

- In February 2025, Infibeam Avenues Ltd, a fintech firm headquartered in GIFT City, Gujarat, unveiled its plan to establish a network of small-scale data centers at 10 locations across India, including Mumbai, Bengaluru, Hyderabad, Chennai, Gujarat, and Delhi. These data centres will cost at least ₹200 crore and are expected to be set up within the next 12-18 months. (Source:https://www.thehindubusinessline.com)

- In March 2024, Eaton, an intelligent power management company, announced the North American launch of an innovative new modular data center solution for organizations seeking to rapidly meet the growing requirements for edge computing, machine learning, and AI. Eaton's SmartRack modular data centers can be deployed in a matter of days in facilities such as enterprise or colocation data centers, manufacturing facilities, and warehouses.(Source: https://www.eaton.com)

Segments Covered in the Report

By Product Type

- Rack-based Mini Data Centers

- Containerized Mini Data Centers

- Prefabricated Pod/Enclosure Mini Data Centers

By Deployment Application

- Enterprise Edge (Corporate offices, SMBs)

- Industrial Edge (Manufacturing, Oil & Gas, Energy)

- Telecom Edge (5G, Base Stations, MEC)

- Public Sector & Defense (Government, Military, Disaster Recovery)

- Retail & Branch Edge (Retail outlets, Banking, POS)

By Power Capacity

- Up to 5 kW

- 6–50 kW

- Above 50 kW

By Cooling Technology

- Air-cooled Systems

- Liquid-cooled Systems

- Hybrid Cooling Systems

By Management Approach

- Standalone (Basic / Manual)

- Remote-managed

- Cloud-integrated & AI-managed

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting