What is Minimal Residual Disease (MRD) Testing Market Size?

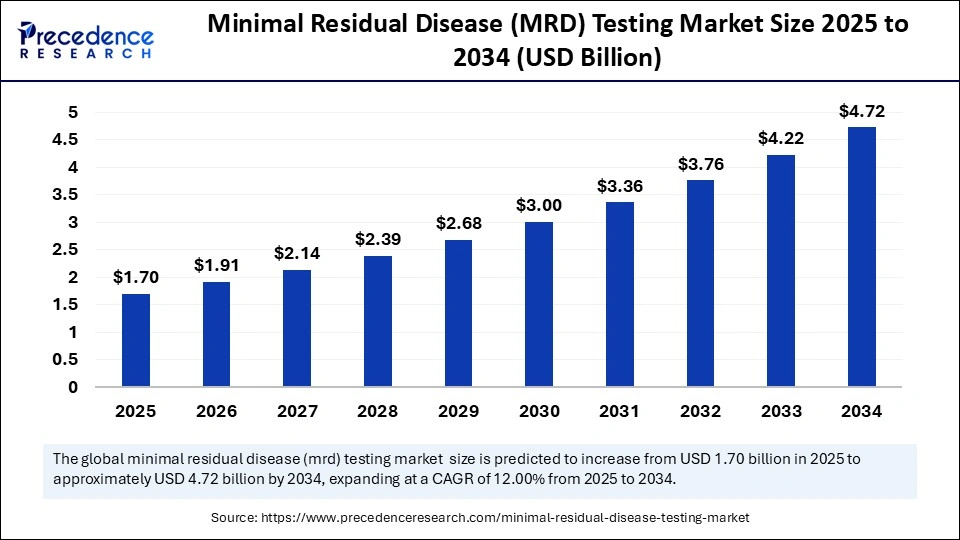

The global minimal residual disease (MRD) testing market size is calculated at USD 1.70 billion in 2025 and is predicted to increase from USD 1.91 billion in 2026 to approximately USD 4.72 billion by 2034, expanding at a CAGR of 12.00% from 2025 to 2034. The market is experiencing substantial growth due to the rising prevalence of cancer, the shift toward personalized medicine, and the increased use of MRD testing in clinical trials. Market growth is significantly driven by demand for highly sensitive technologies like next-generation sequencing (NGS) and digital PCR (dPCR), which accurately detect minimal residual cancer cells to guide treatment decisions and predict patient outcomes.

Market Highlights

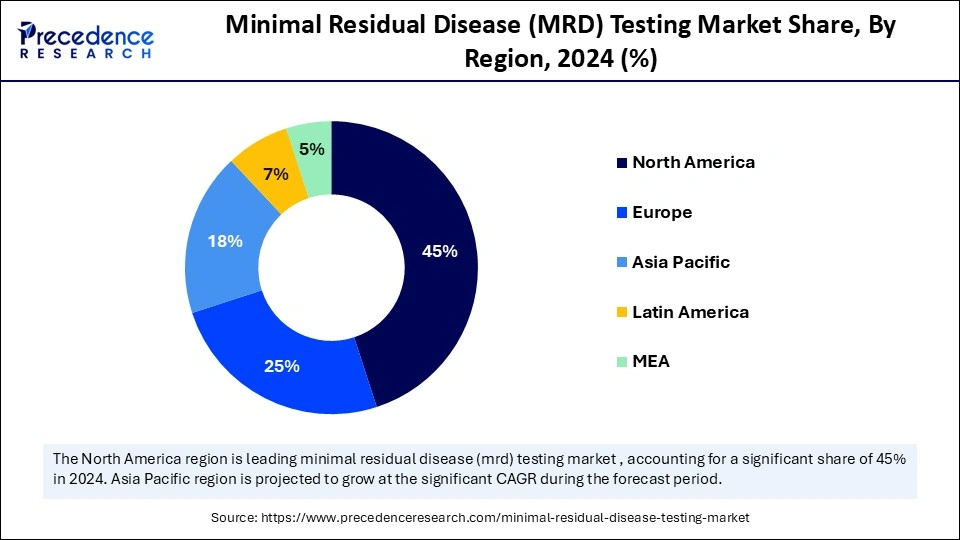

- North America dominated the minimal residual disease (MRD) testing market with around 45% share in 2024.

- Asia Pacific is expected to witness the fastest growth from 2025 to 2034.

- By technology, the flow cytometry (FC) segment held the largest market share of about 40% in 2024.

- By technology, the next-generation sequencing (NGS) segment is expected to grow at the fastest CAGR from 2025 to 2034.

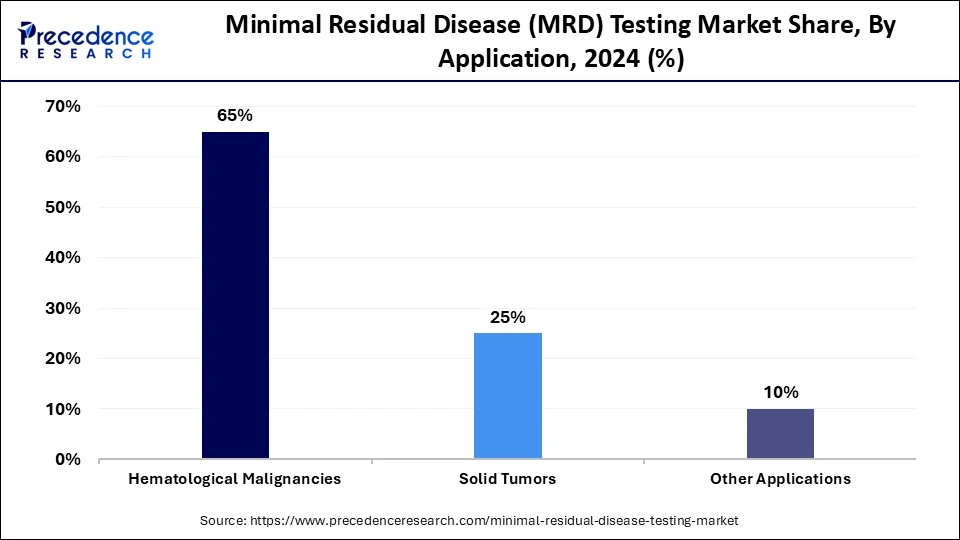

- By application, the hematological malignancies segment dominated the market with around 65% share in 2024.

- By application, the solid tumors segment is expected to grow at a significant CAGR from 2025 to 2034.

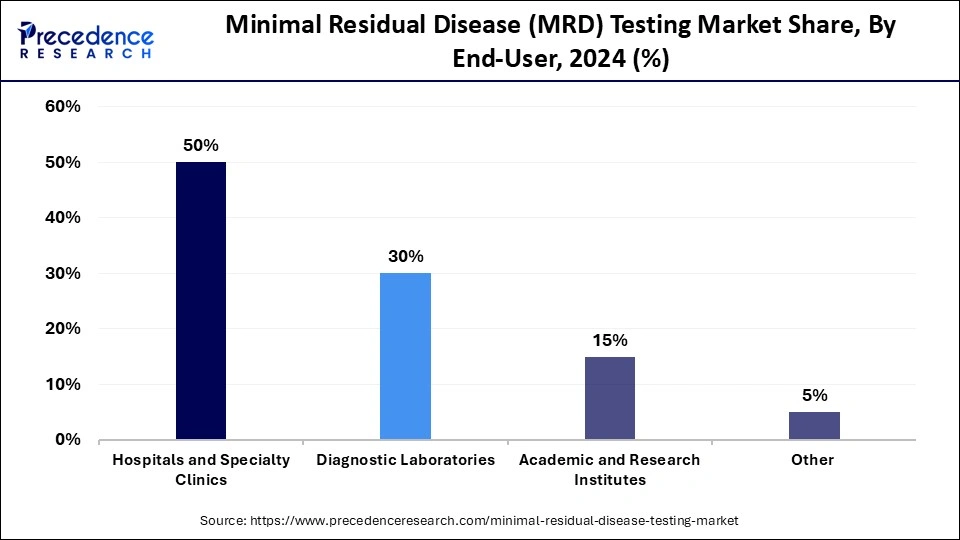

- By end-user, the hospitals & specialty clinics segment led the market with around 50% share in 2024.

- By end-user, the diagnostic laboratories segment is expected to grow at the fastest CAGR from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 1.70 Billion

- Market Size in 2026: USD 1.91 Billion

- Forecasted Market Size by 2034: USD 4.72 Billion

- CAGR (2025-2034): 12.00%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is the Minimal Residual Disease (MRD) Testing?

Minimal residual disease (MRD) testing detects small numbers of cancer cells that remain after treatment and are undetectable by standard methods. These cells can lead to relapse. MRD testing uses highly sensitive techniques like PCR, NGS, and flow cytometry. It is important for the treatment of hematologic cancers such as leukemia and multiple myeloma. These residual cells have the potential to cause a relapse of the disease if not identified and managed appropriately. MRD testing involves highly sensitive laboratory techniques to detect these low levels of cancer cells, aiding in early intervention and monitoring treatment efficacy.

Minimal Residual Disease (MRD) Testing Market Outlook

- Market Growth Overview: The market is projected to experience substantial growth between 2025 and 2034. This acceleration is fueled by the rising global cancer burden, particularly hematological malignancies, and the increasing integration of MRD testing into personalized medicine strategies, including NGS and dPCR technologies, which offer superior sensitivity.

- Major Trend: A major trend in the market is the development and widespread adoption of non-invasive liquid biopsy tests. This approach significantly reduces the reliance on traditional, resource-intensive, and often painful bone marrow biopsies. Liquid biopsies improve patient comfort and safety while streamlining the diagnostic process, which aligns with sustainable healthcare delivery.

- Global Expansion: Leading players are expanding their presence globally, with a particular focus on emerging regions like Asia Pacific and Latin America. This expansion is driven by a rising cancer incidence, improving healthcare infrastructure, and increasing awareness of advanced diagnostics, all of which contribute to market penetration in these markets.

- Major Investors:The market is attracting significant investment from venture capital and strategic investors, mainly due to high technical barriers, robust margins with precision medicine, and oncology diagnostics. Key players like Adaptive Biotechnologies, Natera, and Guardant Health support advancing their liquid biopsy and NGS-based testing portfolios.

- Startup Ecosystem: The startup landscape is thriving, with a focus on improving the sensitivity and speed of MRD detection. Innovation centers on advanced techniques like circulating tumor DNA (ctDNA) analysis and AI-enhanced data interpretation. Emerging firms, including C2i Genomics, are attracting funding by developing scalable and precise solutions

How Can AI Impact the Minimal Residual Disease (MRD) Testing Market?

Artificial Intelligence (AI) is transforming the minimal residual disease (MRD) testing market by improving the speed, accuracy, and standardization of data analysis, particularly in areas like flow cytometry, where it can reduce manual analysis time from minutes to seconds per case. AI can also handle multi-dimensional data to identify better single cells or populations, which can improve the accuracy of MRD detection in complex cases. By automating and simplifying analysis, AI can make sophisticated MRD testing more accessible to a wider range of labs and clinicians, fueling the development of new biomarkers and more precise diagnostic models.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.70 Billion |

| Market Size in 2026 | USD 1.91 Billion |

| Market Size by 2034 | USD 4.72 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Technology, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Technology Insights

What Made Flow Cytometry (FC) the Dominant Segment in the Market in 2024?

The flow cytometry (FC) segment dominated the minimal residual disease (MRD) testing market, holding about 40% share in 2024. This is primarily because of its widespread accessibility in clinical laboratories, relatively lower cost compared to molecular methods, and rapid turnaround time. FC has been a standard tool for diagnosing and monitoring hematological malignancies for decades, meaning most major hospitals and diagnostic labs are already equipped with the instruments and have trained personnel. FC offers rapid results, often within a day, enabling timely clinical decisions regarding patient management and treatment adjustments, making it a more accessible option for routine clinical practice.

The next-generation sequencing (NGS) segment is expected to grow at the fastest rate in the upcoming period. This is mainly due to its superior sensitivity, ability to multiplex, and capacity to track clonal evolution, providing more accurate and prognostic information than traditional methods. NGS can analyze millions of DNA fragments simultaneously across a large panel of cancer-related genes. This yields a comprehensive genomic profile of the tumor from a single test, making it more efficient and cost-effective for detecting diverse mutations and allowing clinicians better to stratify patients' risk and tailor treatment intensity accordingly.

Application Insights

Why Did the Hematological Malignancies Segment Lead the Minimal Residual Disease (MRD) Testing Market?

The hematological malignancies segment led the market by holding about 65% share in 2024. This is due to established clinical utility and standardized guidelines for blood cancers, distinct molecular targets, and the high sensitivity of current testing technologies in these diseases. MRD testing in these malignancies is already a standard of care for monitoring disease progression, assessing treatment response, and predicting relapse risk. MRD status serves as a strong independent prognostic factor across various hematological malignancies, where treatment is intensified or de-escalated based on MRD results, improved patient outcomes.

The solid tumors segment is expected to expand at the fastest CAGR over the forecast period. The segment's growth is mainly driven by significant technological advancements in liquid biopsy, the vast, untapped clinical potential for improving treatment decisions in common cancers, and increasing regulatory and commercial support. These cancers are more prevalent, as a massive opportunity for MRD testing. Pharmaceutical companies are increasingly incorporating MRD status as a surrogate endpoint in clinical trials for new oncology drugs, validating the clinical relevance and driving demand for companion diagnostics.

End-User Insights

Why Did Hospitals & Specialty Clinics Hold the Largest Market Share in 2024?

The hospitals & specialty clinics segment held around 50% share of the minimal residual disease (MRD) testing market in 2024. This is primarily due to the comprehensive management of cancer patients, particularly those with hematological malignancies. Many hospitals, especially specialized cancer centers, are key sites for clinical trials and research. They have a skilled workforce of oncologists, hematologists, and specialized laboratory professionals who interpret complex MRD results and guide patient-specific therapeutic strategies effectively, facilitating the validation of new assays and their adoption into routine clinical practice.

The diagnostic laboratories segment is expected to experience the fastest growth during the forecast period due to the increasing trend of outsourcing, robust infrastructure for advanced molecular diagnostics, and strategic collaborations that enhance service offerings. Diagnostic laboratories are well-equipped with cutting-edge technologies like NGS and dPCR, offering ultra-high sensitivity and precision for detecting minimal residual disease to guide clinical decisions. They provide cost-effective solutions compared to individual hospitals maintaining their own high-throughput testing capabilities.

Regional Insights

How Did North America Dominate the Minimal Residual Disease (MRD) Testing Market?

North America dominated the minimal residual disease (MRD) testing market with around 45% in 2024. This is mainly due to its advanced healthcare infrastructure, a well-developed reimbursement landscape, significant investment in R&D, a high incidence of cancer, and a strong presence of key industry players. A key driver is the well-established and favorable reimbursement ecosystem in the U.S. and Canada. The region is home to major diagnostic and pharmaceutical companies such as Exact Sciences Corporation, Natera, Guardant Health, and Adaptive Biotechnologies, which are leading innovation in the field. The U.S. National Institutes of Health (NIH) increased cancer research funding, accelerating the development of new MRD detection tools.

U.S. Minimal Residual Disease (MRD) Testing Market Trends

The U.S. is a major contributor to the market within North America, serving as a primary hub for innovation and adoption of advanced diagnostic technologies like next-generation sequencing and dPCR. This leadership is driven by a strong ecosystem of key U.S.-based industry players, including Adaptive Biotechnologies, Natera, and Guardant Health, which benefit from substantial R&D investments, a robust healthcare infrastructure, and supportive regulatory environments. These factors have accelerated the integration of MRD testing into standard clinical practice and national oncology guidelines.

Why is Asia Pacific Considered the Fastest-Growing Region in the Market?

Asia Pacific is expected to experience the fastest growth in the market, primarily due to rising cancer rates, a large and aging patient population, and notable improvements in healthcare infrastructure and technology adoption. Emerging economies like China and India are making significant investments in upgrading their healthcare systems and laboratory infrastructure, facilitating the adoption of sophisticated diagnostic technologies. The region is rapidly embracing advanced diagnostic tools such as NGS and ddPCR, which offer high sensitivity and accuracy for MRD detection, aligning with the shift toward precision oncology.

India Minimal Residual Disease (MRD) Testing Market Trends

India plays a distinctive role in the market, marked by its position as a high-growth region within the Asia-Pacific market and a strong focus on developing affordable, accessible diagnostic solutions. Driven by a substantial burden of hematological malignancies, increasing awareness of MRD testing's clinical value, and rising healthcare expenditure, India is witnessing the growing integration of basic MRD assessment methods, such as flow cytometry, into clinical practice. There is also a rising interest in advanced technologies such as NGS and liquid biopsy from domestic companies and startups like 4baseCare and Datar Genetics.

How is the Opportunistic Rise of Europe in the Minimal Residual Disease (MRD) Testing Market?

Europe is expected to grow at a notable rate in the coming years, owing to high adoption of advanced diagnostic technologies, increasing integration of MRD testing into standard clinical guidelines, a focus on personalized medicine, and supportive government funding and research initiatives. MRD testing has become a standard part of treatment protocols for hematological malignancies such as leukemia and lymphoma in major European countries, including Germany, France, the UK, Spain, and Italy. These efforts focus on clinical validation, standardizing methodologies, and expanding MRD testing applications into solid tumors.

Germany Minimal Residual Disease (MRD) Testing Market Trends

Germany is a major force in the market. The country's role is defined by its robust healthcare infrastructure, high investment in precision oncology, and the early adoption of advanced technologies such as NGS, dPCR, and flow cytometry. German clinicians extensively use MRD testing as a standard practice for risk stratification and monitoring in hematological malignancies like acute lymphoblastic leukemia. This aligns with national and European clinical guidelines and contributes to global MRD research.

Minimal Residual Disease (MRD) Testing Market Value Chain Analysis

- Research and Development (R&D) and Technology

This involves the foundational research and innovation necessary for developing and validating sensitive MRD testing methodologies. It focuses on innovating sensitive testing methods like NGS and dPCR, improving detection limits, and expanding applications to solid tumors.

Key Players: Adaptive Biotechnologies, Natera, Inc., Guardant Health, F. Hoffmann-La Roche, QIAGEN, Tempus, Personalis.

- Manufacturing and Production

This phase includes producing the assay kits, instruments, and reagents used in MRD testing. It is driven by the need to scale production to meet rising demand and ensure high-quality, standardized products that maintain accuracy across different lab settings.

Key Players: F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Bio-Rad Laboratories, Sysmex Corporation, QIAGEN.

- Distribution and Sales

Once manufactured, test kits and instruments are distributed to end-users globally. This involves managing logistics, marketing, and sales through a network of distributors and dedicated sales teams to reach markets in different regions, including emerging economies.

Key Players: Labcorp Inc., Quest Diagnostics, Sysmex Corporation, QIAGEN, Bio-Rad Laboratories.

- Sample Collection and Preparation

This is the starting point of the MRD testing process, involving the collection of patient samples, such as bone marrow, peripheral blood, or tissue. Sample integrity and proper handling are critical to ensure accurate results. The growing use of non-invasive liquid biopsy for certain cancers is a key trend in this area.

Key Players: Hospitals and specialty clinics, Diagnostic laboratories (e.g., Labcorp, Quest Diagnostics).

- Test Execution and Analysis

In this stage, the patient's sample is processed using one of the primary MRD testing technologies, NGS, PCR, or flow cytometry. The execution of the test requires specialized equipment and expertise to achieve the necessary sensitivity for detecting minimal residual cells.

Key Players: Diagnostic laboratories like NeoGenomics Laboratories, ARUP Laboratories, Specialized hospital labs, and Research institutions.

- Data Interpretation and Reporting

After the test is executed, the raw data must be interpreted to produce a clinical report. This requires skilled bioinformaticians and pathologists to analyze complex data sets, particularly for NGS-based tests to improve accuracy and speed.

Key Players: Diagnostic laboratories, like NeoGenomics Laboratories, ARUP Laboratories, Tempus, and Academic and research institutes.

Minimal Residual Disease (MRD) Testing Regulatory Landscape

|

Country/Region |

Regulatory Body |

Key Regulations/Framework |

|

U.S. |

FDA (Food and Drug Administration) |

Requires rigorous analytical and clinical validation for IVDs. Uses De Novo and 510(k) pathways. Accepts MRD as a potential surrogate endpoint for accelerated drug approvals. |

|

Europe |

EMA (European Medicines Agency) & NCAs |

Governed by the In Vitro Diagnostic Devices Regulation (IVDR). Most tests are high-risk (Class C), requiring a "Notified Body" assessment and a CE mark for market entry. |

|

China |

NMPA (National Medical Products Administration) |

Class III IVDs (high-risk) require rigorous registration, including local clinical trials. Focus on local performance evaluation and QMS standards. |

Top Companies Operating in the Minimal Residual Disease (MRD) Testing Market

Tier I: Market Leaders (40–50% cumulative share)

These companies are at the forefront of MRD testing, offering a range of diagnostic solutions and holding substantial market shares.

- F. Hoffmann-La Roche Ltd. – A leader in MRD testing, particularly in hematological malignancies, with a comprehensive portfolio of diagnostic solutions.

- Guardant Health – Known for its blood-based MRD tests, such as Guardant Reveal, which detect residual disease in solid tumors.

- Natera, Inc. – Offers the Signatera test, a personalized MRD test for solid tumors, and is expanding its presence in the MRD testing market.

- Exact Sciences – Developing MRD tests like Oncodetect, focusing on early detection and monitoring of minimal residual disease.

- Labcorp – Provides MRD testing services through its extensive laboratory network, contributing to the market's growth.

- QIAGEN– Offers MRD testing solutions, including collaborations with companies like Tracer Biotechnologies and Foresight Diagnostics to enhance its MRD testing portfolio.

- Bio-Rad Laboratories, Inc.– Provides MRD testing solutions, including PCR-based assays, contributing to the market's expansion.

- Sysmex Corporation – Offers diagnostic solutions, including MRD testing technologies, with a strong presence in Asia-Pacific.

Tier II: Emerging Players (20–30% cumulative share)

These companies are making significant strides in MRD testing, with innovative solutions and growing market presence.

- NeoGenomics Laboratories, Inc. – Provides MRD testing services, focusing on personalized oncology diagnostics.

- Adaptive Biotechnologies Corporation – Offers the clonoSEQ MRD test, focusing on hematological malignancies.

- Foundation Medicine – Provides comprehensive genomic profiling, including MRD testing for various cancers.

- Veracyte, Inc. – Expanding into MRD testing, with plans to launch an MRD test for muscle-invasive bladder cancer in 2026.

- Illumina, Inc. – Offers next-generation sequencing platforms utilized in MRD testing applications.

- Bio-Techne Corp – Provides reagents and assays used in MRD testing, contributing to the market's growth.

- Exact Sciences Corp – Expanding its portfolio to include MRD testing, with a focus on precision oncology.

Tier III: Niche & Regional Players (10–20% cumulative share)

These companies focus on specific aspects of MRD testing or serve particular regional markets.

- 3B BlackBio Biotech India – Provides MRD testing solutions in India, contributing to the regional market.

- Bioartis– Offers MRD testing services, focusing on personalized oncology diagnostics.

- EntroGen– Provides molecular diagnostic solutions, including MRD testing assays.

- ArcherDX, Inc. – Develops targeted sequencing technologies utilized in MRD testing applications.

- Asuragen Inc. – Offers molecular diagnostic solutions, including MRD testing assays.

- Arup Laboratories Inc. – Provides MRD testing services, focusing on personalized oncology diagnostics.

- PerkinElmer Inc. – Offers diagnostic solutions, including MRD testing technologies, with a strong presence in the Asia-Pacific region.

Recent Developments

- In June 2025, Tracer Biotechnologies partnered with QIAGEN to develop MRD assays for solid tumors on the QIAcuity dPCR platform, aiming for sensitive and cost-effective testing. Tracer offers two solutions: a tumor-informed dPCR assay and an AI-powered ctDNA platform for ultra-sensitive detection.

- In March 2025,Veracyte revealed the presentation of multiple abstracts at the EAU25 congress, showcasing the performance of its Decipher tests in prostate and bladder cancer, along with new data on its MRD testing for muscle-invasive bladder cancer from the TOMBOLA trial. (Source: https://investor.veracyte.com)

- In January 2025, Adaptive Biotechnologies and NeoGenomics announced a collaboration to enhance MRD monitoring for blood cancers with Adaptive's clonoSEQ, the only FDA-cleared test for MRD detection in lymphoid cancers, integrated with NeoGenomics' COMPASS and CHART. This partnership aims to provide personalized treatment strategies for patients by offering real-time insights into disease progression. (Source: https://investors.adaptivebiotech.com)

- In January 2025, Datar Cancer Genetics (DCG) launched Target-MRD, an advanced blood test for solid organ cancers that uses NGS and personalized droplet digital PCR (dd-PCR) to monitor MRD. This test aims to detect a small number of tumor cells that can lead to relapse by combining tumor-agnostic and tumor-informed biomarkers for effective disease management.

Exclusive Analysis on the Minimal Residual Disease (MRD) Testing Market

The minimal residual disease (MRD) testing market is poised at a critical juncture, driven by a confluence of technological innovation, evolving clinical paradigms, and burgeoning demand for precision oncology solutions. The market's trajectory reflects an escalating prioritization of ultra-sensitive detection methodologies that enable dynamic disease monitoring and risk stratification post-therapy, thereby facilitating personalized treatment modulation and optimized patient outcomes.

From an investment and strategic vantage, MRD testing is transcending its historical niche within hematologic malignancies to establish substantive footholds across a spectrum of solid tumors. This vertical expansion is propelled by advances in next-generation sequencing (NGS), digital PCR, and liquid biopsy platforms, which collectively augment assay sensitivity, specificity, and operational scalability. The resultant data-rich environment fosters integration with artificial intelligence and machine learning frameworks, enhancing predictive analytics and clinical decision support capabilities.

The commercialization landscape is characterized by an oligopolistic core of Tier I incumbents leveraging synergistic alliances, proprietary assay development, and regulatory momentum to cement competitive moats. Meanwhile, Tier II and III innovators exploit differentiated assay chemistries, biomarker panels, and regional market penetrations to capture adjacent growth pockets. Notably, the shift toward minimally invasive, blood-based MRD diagnostics aligns with increasing clinician and patient preferences for real-time, longitudinal surveillance, reinforcing recurring revenue streams and payer receptivity.

Geographically, expansion into emerging markets underscores latent demand, fueled by escalating cancer incidence and the concomitant need for cost-effective diagnostic interventions. Concurrently, value-based healthcare models catalyze reimbursement frameworks predicated on demonstrable clinical utility and outcome improvement, thereby incentivizing broader MRD adoption.

In summation, the market epitomizes a high-growth segment within the oncology diagnostics ecosystem, undergirded by robust technological innovation and a compelling clinical imperative. Entities that adeptly navigate regulatory complexities, foster cross-functional collaborations, and innovate assay platforms with scalability and multiplexing capability unlock substantial shareholder value and redefine the standards of cancer care.

Segments Covered in the Report

By Technology

- Flow Cytometry

- Standard Flow Cytometry

- Mass Cytometry (CyTOF)

- Polymerase Chain Reaction (PCR)

- Digital PCR (dPCR)

- Quantitative PCR (qPCR)

- Next-Generation Sequencing (NGS)

- Whole Genome Sequencing

- Targeted Panel Sequencing

- Others

- Droplet Digital PCR (ddPCR)

- BEAMing (Beads, Emulsion, Amplification, and Magnetics)

By Application

- Hematological Malignancies

- Leukemia

- Lymphoma

- Multiple Myeloma

- Solid Tumors

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Other Applications

- Polycythemia Vera

- Myelofibrosis

- Mastocytosis

By End-User

- Hospitals & Specialty Clinics

- Oncology Departments

- Hematology Units

- Diagnostic Laboratories

- Clinical Laboratories

- Reference Laboratories

- Academic & Research Institutes

- Cancer Research Centers

- Genomics Research Facilities

- Others

- Contract Research Organizations (CROs)

- Biotechnology Companies

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Get a Sample

Get a Sample

Table Of Content

Table Of Content