Multi-Chamber Bags for Parenteral Nutrition Market Size and Forecast 2025 to 2034

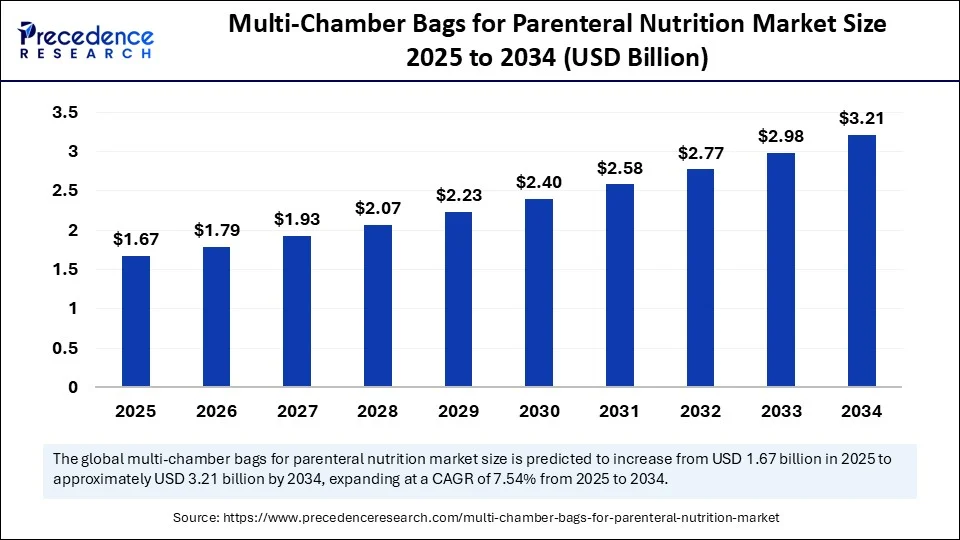

The global multi-chamber bags for parenteral nutrition market size accounted for USD 1.55 billion in 2024 and is predicted to increase from USD 1.67 billion in 2025 to approximately USD 3.21 billion by 2034, expanding at a CAGR of 7.54% from 2025 to 2034. The market is growing due to increasing incidence of chronic diseases and gastrointestinal conditions, advances in safer, more user-friendly bag design, and the enhancement of home-based, nutritional care, clearly upward.

Multi-Chamber Bags for Parenteral Nutrition MarketKey Takeaways

- In terms of revenue, the global multi-chamber bags for parenteral nutrition market was valued at USD 1.55 billion in 2024.

- It is projected to reach USD 3.21 billion by 2034.

- The market is expected to grow at a CAGR of 7.54% from 2025 to 2034.

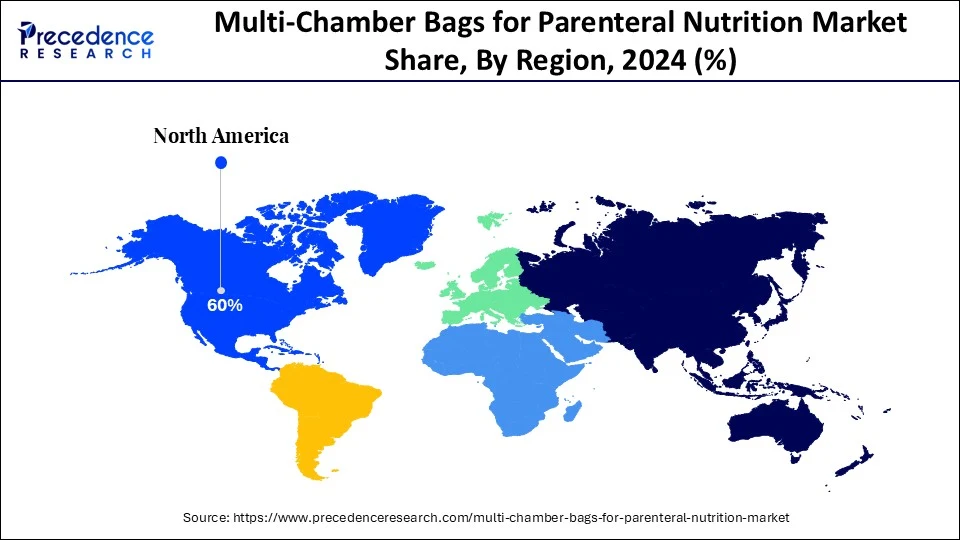

- North America dominated the global multi-chamber bags for parenteral nutrition market with the largest market share of 60% in 2024.

- Asia Pacific is estimated to grow at the fastest CAGR between 2025 and 2034.

- By chamber-count type, the 2-chamber bags segment held the biggest market share 50% in 2024.

- By chamber-count type, the 3-chamber bags segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By material, the PVC (Polyvinyl Chloride) bags segment captured the highest market share of 47% in 2024.

- By material, the EVA (Ethylene-Vinyl Acetate) bags segment will expand at a notable CAGR over the projected period.

- By application context, the parenteral nutrition (standard) segment generated the major market share of 60% in 2024.

- By application context, the high-nutrient-density PN segment is expected to expand at a notable CAGR over the projected period.

- By end-user setting, the hospitals segment accounted for the significant market share of 60% in 2024.

- By end-user setting, the home-healthcare segment is expected to expand at a notable CAGR over the projected period.

AI Combines Safety and Accuracy in Parenteral Nutrition

Artificial intelligence is leading a smarter revolution in the multi-chamber bags industry in parenteral nutrition. AI-powered automation platforms provide precision compounding of the multi-chamber bag, relieving some burden from pharmacists, while reducing risk for manual error. For parenteral nutrition, clever computer-vision algorithms in IV infusion monitoring are being modified to verify real-time mixing integrity and drips-per-minute rates for accurate delivery of specific prescription nutrients to patients prior to administration. Layered polypropylene film designs with an oxygen barrier also benefit: AI-guided quality assurance purposely checks seal integrity and nutrient degradation throughout dual- and triple-chamber bag formats. Helping to remove uncertainty with intelligent integrations promotes safety, sterility, and efficiency across parenteral nutrition workflows.

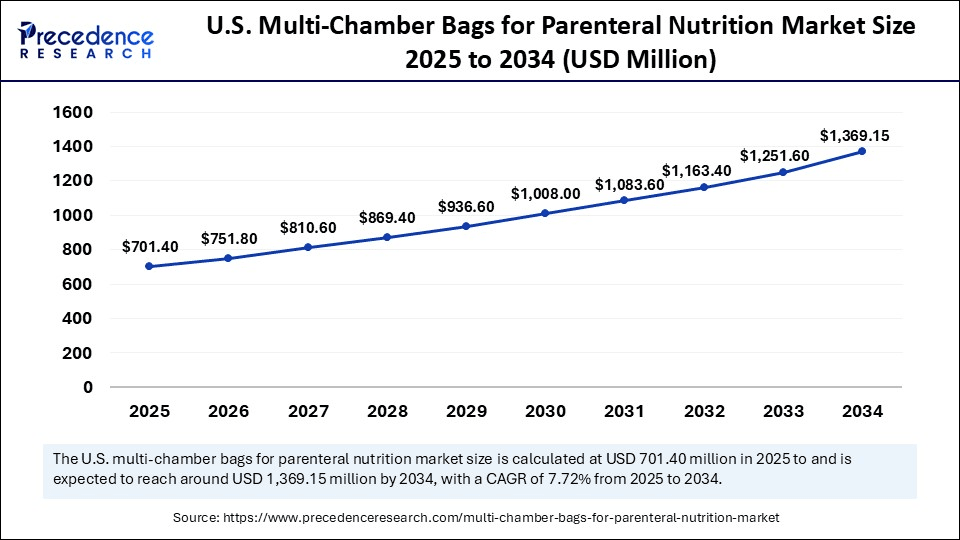

U.S. Multi-Chamber Bags for Parenteral Nutrition Market Size and Growth 2025 to 2034

The U.S. multi-chamber bags for parenteral nutrition market size was exhibited at USD 651.00 billion in 2024 and is projected to be worth around USD 1,369.15 billion by 2034, growing at a CAGR of 7.72% from 2025 to 2034.

Why North America Is Dominating the Multi-Chamber Bags for Parenteral Nutrition Market?

North America is the current leader in the multi-chamber bags for parenteral nutrition market, with a mature critical-care ecosystem, very high penetration of home-infusion services, and large and mostly unused panels of standardized nutrition protocols. Hospitals appreciate bags for having less compounding time, more assurance about sterility, and fewer medication-error opportunities. Vendors find comfort in a regulated but predictable, stable environment supplemented by a defined capacity in contract manufacturing of sterile barrier systems. The execution of post-discharge nutrition programs and increased outpatient infusions has further created potential uses beyond inpatient wards and provided support for the stable, repeat, and robust demand characteristics of multi-chamber PN.

The U.S. anchors the leadership based on a large number of critical-care beds, NICU beds, and comprehensive home-infusion capacity available in hospitals and at home. The clinical societies' recommendations in the areas of screening for malnutrition and early initiation of parenteral nutrition (PN) in complicated situations have increased the standardized use of multi-chamber parenteral nutrition bags. Value-analysis committees often select products that shorten preparation time and reduction of waste. Use by tertiary centers, public, and private providers is supported by payer coverage and an outcomes-oriented procurement environment.

Why is Asia Pacific Projected to Host the Fastest-Growing Region During the Forecast Period?

Asia Pacific is growing at the fastest rate during the forecasted period, with the rapid scaling of tertiary hospitals, the enhancement of critical-care capacity, and the awareness of hospital malnutrition is a movement. Governments are optimizing supply continuity and pharmacovigilance and advocating moving from an ad-hoc mixing model to a validated safe sterile systems model. Investment in local manufacturing and fill-finish reduces lead times and costs, while private hospitals are more inclined to adopt PN protocols to demonstrate quality of care processes. The growth of medical tourism and outpatient infusion centers is straining existing indications and creating a better pathway for multi-year improvements in nutrition therapy operational workflows.

China is at the forefront of regional momentum with a continuing upgrade of hospital infrastructure, increasing levels of complex surgeries, and expanded neonatal and oncology services. Provincial procurement platforms are moving towards prioritizing quality-assured, ready-to-use PN to minimize medication errors and reduce workload on pharmacy operations. As DRG pilots and volume-based procurement prices mature, hospitals are starting to assess their total care costs, focusing on multi-chamber bags to assist with the reduction of compounding time, reduction of waste, and reduction of infection risk, and maintain dose consistency.

Market Overview

Multi-chamber bags for parenteral nutrition market refer to the segment of the healthcare/medical-device industry focused on parenteral nutrition delivery systems, where nutrients are stored in separate chambers, two, three, or more that remain isolated until administration. These multi-compartment bags optimize nutrient stability, reduce contamination risk, simplify mixing, and support both hospital and home-based nutritional therapy. The market is growing due to the increasing number of chronic illnesses, premature births, and cases of malnutrition. There is also a rising demand for convenient, ready-to-use solutions. Innovations in bag materials and design are enhancing safety, extending shelf life, and making them easier to use.

Multi-Chamber Bags for Parenteral Nutrition Marke Growth Factors

- Rising Chronic Disease Incidence- The increase in conditions like cancer, gastrointestinal disorders, and severe illnesses is driving the demand for parenteral nutrition. Many patients need direct nutrient administration because of problems with digestion or absorption.

- Growing Preterm Birth Rates- The rising number of premature infants often requires specialized parenteral nutrition for their growth and development. This is significantly boosting the use of multi-chamber nutrition bags in neonatal care units.

- Advancements in Bag Design and Materials- Innovations like better barrier films, improved sealing technologies, and easy-to-use connectors are making products safer, keeping nutrients stable, and simplifying preparation in both hospitals and homes.

- Shift Toward Home-Based Care- The increasing preference for home parenteral nutrition aims to reduce hospital stays and costs. This is creating a higher demand for ready-to-use, contamination-resistant multi-chamber bags that make preparation and administration easier for caregivers and patients.

- Supportive Healthcare Policies- Government funding, favorable insurance coverage, and clinical guidelines that back the use of parenteral nutrition in critical care are promoting its adoption. This support is particularly strong in areas with growing healthcare infrastructure and aging populations.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.21 Billion |

| Market Size in 2025 | USD 1.67 Billion |

| Market Size in 2024 | USD 1.55 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Chamber-Count Type, Material, Application Context,End User Setting, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is Raising Demand for Ready-to-Use Nutrition Solutions Powering the Multi-Chamber Bags for Parenteral Nutrition Market?

One major factor driving growth in the multi-chamber bags for parenteral nutrition market is the rising shift toward ready-to-use (RTU) parenteral nutrition systems. These systems improve patient safety and cut down preparation time. Hospitals and home healthcare providers are using these pre-formulated bags to reduce compounding errors and lower contamination risks.

Recent healthcare reports show that post-pandemic, the need for sterile, pre-mixed solutions increased due to staffing shortages and a focus on infection control. For instance, in 2024, several European healthcare networks expanded the use of RTU PN to make critical care workflows more efficient. This was especially important in oncology and intensive care units, leading to higher adoption rates in both developed and emerging markets.

Restraint

Are High Costs and Safety Concerns Slowing the Market?

The growth of multi-chamber bags for parenteral nutrition is being slowed mainly by high production costs and safety concerns. These bags require complex manufacturing processes and high-quality materials, which makes them expensive to produce and buy. This creates challenges for hospitals in tight budget situations. At the same time, contamination and administration errors continue to be a concern. A mid-2025 ECRI survey showed that PN component shortages and handling issues sometimes force hospitals to change feeding schedules. This increases the risk of compromised patient care. These factors not only limit accessibility but also create hesitation among healthcare providers.

Opportunity

What is the Greatest Opportunity in the Multi-Chamber Bags for Parenteral Nutrition Market?

As home healthcare continues to experience dramatic growth over the past 10 years, and into the foreseeable future, multi-chamber bags are in a strong position, combining nutrient separation, shelf life, and safety and usability for the patient. These bags enable patients to receive reliable, contamination-free PMN at home, limit unnecessary, expensive hospital stays, and allow for a simple preparation and administration protocol.

ISMP reported that MCB-PN products, including two or three-chamber bags, require fewer compounding procedures relevant to preparation; this drastically reduces the complexity of preparation and helps mitigate errors in hospital and home settings. The greatest opportunity is to provide home-care friendly, digitally enabled multi-chamber bags that enhance ease, safety, and regulatory compliance to help meet the population's burgeoning demand for patient-oriented, technology-friendly nutrition solutions.(Source:https://nutritioncare.org)

Chamber-Count Type Insights

Why are 2-Chamber Bags Dominant in the Multi-Chamber Bags for Parenteral Nutrition Market?

The 2-chamber bags segment led the multi-chamber bags for the parenteral nutrition market in 2024, as these bags are the standard in hospitals for furnishing elemental nutrient formulations with the flexibility of mixing. Given the application context, standard PN is the primary product choice to achieve routine nutrition delivery to patients who require nutritional support, as evidenced through established utilization rates in critical care environments.

The 3-chamber bags segment is growing the fastest by chamber-count type, as the use of ready-to-use, balanced nutrition formulations for late-stage patients continues to rise, which ultimately leads to time-labor cost savings for preparation and reduced risk of contamination. In regard to materials, EVA bags are gaining considerable traction relative to these segments, as they offer non-toxicity, reduced risk of leaching, and applicability of certain formulations over PVC bags. In regard to applications, high-nutrient-density parenteral nutrition has the opportunity to grow rapidly, as the increasing needs for chronic illness management and intensive care are placing greater demands on concentrated nutritional support interventions and treatments.

Material Insights

Which Material Dominates the Multi-Chamber Bags for Parenteral Nutrition Market in 2024?

The PVC (Polyvinyl Chloride) bags segment was the leading segment in terms of material type in 2024. The preferred choice of PVC bags offers sufficient barrier properties, affordability, and greater availability. Proven multi-chamber bag compatibility with a range of nutrient solutions on the market, especially in larger hospitals and health care venues, is a priority for patient safety and hospital administration decisions. Other factors will demonstrate that the initial duration of the PVC bags protects nutrients from degradation while in storage and shipping.

The EVA (Ethylene-Vinyl Acetate) bags segment is the fastest-growing material, driven by patient safety concerns, requiring healthcare facilities to replace PVC with non-PVC bags. The flexibility, transparency, and low risk of chemicals leaching from EVA bags provide a safe option for sensitive and delicate nutrient formulations, which are produced by pharmacies. Furthermore, the regulatory shift towards environmentally friendly and non-toxic materials will further enhance the use of EVA bags, and with the growing healthcare areas of Home-Healthcare and Nutritional Health, the use of EVA bags will continue with their phenomenal growth as a parallel bag, continuing with PVC bags.

Application Context Insights

Why does the Standard PN Dominate the Multi-Chamber Bags for Parenteral Nutrition Market?

The parenteral nutrition (standard) segment accounted for the largest share of the multi-chamber bags for parenteral nutrition market in 2024, due to its wide used to provide standard nutritional requirements for hospitalized patients. Not only are balanced formulations and delivery systems available for numerous clinical contexts, but standard PN is commonly used to provide both short and long-term nutritional support to patients. Also, due to its clinical capacity, availability, comparability, and ease of administration, it is a preferred route of feeding for both clinicians and patients, which is not going to change in the immediate future.

The high-nutrient-density PN segment is the fastest-growing application during the forecasted period, with a higher level of demand for specialized nutrition care for patients who are critically ill, oncology patients receiving therapy or supportive care, and patients who require long-term nutritional support due to chronic disease. High-nutrient density formulations supply concentrated nutrients in smaller amounts, limiting the volume of fluid but still providing sufficient calorie and protein intake. Growth in home care routing and personal nutrition-based care routes is also adding to the increased acceptance of high-nutrient-density PN for complex patient care.

End-User Setting Insights

Which End User Segment Dominated the Multi-Chamber Bags for Parenteral Nutrition Market in 2024?

The hospitals segment is the dominant end-user in the multi-chamber bags for parenteral nutrition market in 2024. This is due to hospitals treating patients in a high-volume environment, having sophisticated infrastructure in place, and owing to a regularly occurring need for parenteral nutrition in areas such as intensive care, post-surgery/nutrition recovery, and overall chronic illness care. Furthermore, hospitals benefited from their centralized procurement systems, which support bulk use of products, making hospitals the dominant player in the use of multi-chamber bags for parenteral nutrition products.

The home-healthcare segment is the fastest-growing during the projected period. Reasons for this faster growth factor include the increasing decentralization of care and subsequent adoption of at-home parenteral nutrition therapy. User-friendly portable multi-chamber bag systems and a growing preference for cost-effective outpatient care are all positively impacting the rapid growth rate of the clinics and home-healthcare segment. Improved patient education and support services are allowing for more at-home PN choices.

Value Chain Analysis

- R&D

Contains advanced formulation development, compatibility challenges for nutrients, and innovative designs of bag materials in order to achieve enhanced stability, shelf life, and safety within the context of specific healthcare standards.

- Clinical trials and regulatory approvals

Manufacturers must conduct tests to demonstrate efficacy, sterility, and nutrient stability, as well as compliance with U.S. FDA, EMA, or similar regulatory frameworks to obtain market approval.

- Distribution to hospitals, pharmacies

Safe and efficient cold chain logistics and medical supply channels ensure a timely delivery of sterile multi-chamber bags to hospitals, clinics, and retail pharmacies so that the integrity of products is maintained until patient administration.

- Patient support and services

Includes counselling for nutrition, remote monitoring, and post-discharge support initiatives to increase adherence, reduce complications, and enhance patient recovery outcomes in either the home or hospital environment where the parenteral nutrition therapy was delivered.

Multi-Chamber Bags for Parenteral Nutrition Market Companies

- B. Braun

- Baxter

- Fresenius Kabi

- Hospira (Pfizer)

- ICU Medical

- Terumo Corporation

- Otsuka Pharmaceutical

- Pfizer Inc.

- Grifols

- Vifor Pharma

- JW Life Science (JW Chemi-Town)

- Technoflex

- Polymedicure Ltd.

- Angiplast Pvt. Ltd.

- Medline Industries

- AdvaCare Pharma

- Haemotronic S.p.A.

- Macopharma

- Shanghai Transfusion Technology Co., Ltd.

- Renolit SE

Segments Covered in the Report

By Chamber-Count Type

- 2-Chamber Bags

- 3-Chamber Bags

- ≥4-Chamber (Quad, etc.) Bags

- Custom-Multi-Chamber Bags (non-standard counts)

By Material

- PVC (Polyvinyl Chloride) Bags

- EVA (Ethylene-Vinyl Acetate) Bags

- Polypropylene Bags

- Polyethylene Bags

- Other Polymers/Blends

By Application Context

- Parenteral Nutrition (standard)

- High-Nutrient-Density PN (e.g., oncology, critical care)

- IV Therapy (non-nutrition)

- Drug-Reconstitution (lyophilized drug + diluent)

- Other Specialized Applications (e.g., chemotherapy, electrolyte mixes)

By End User Setting

- Hospitals (inpatient wards, ICUs)

- Home-Healthcare Settings

- Ambulatory Surgical Centers

- Others (e.g., outpatient infusion centers)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting