What is Multispectral Camera Market Size?

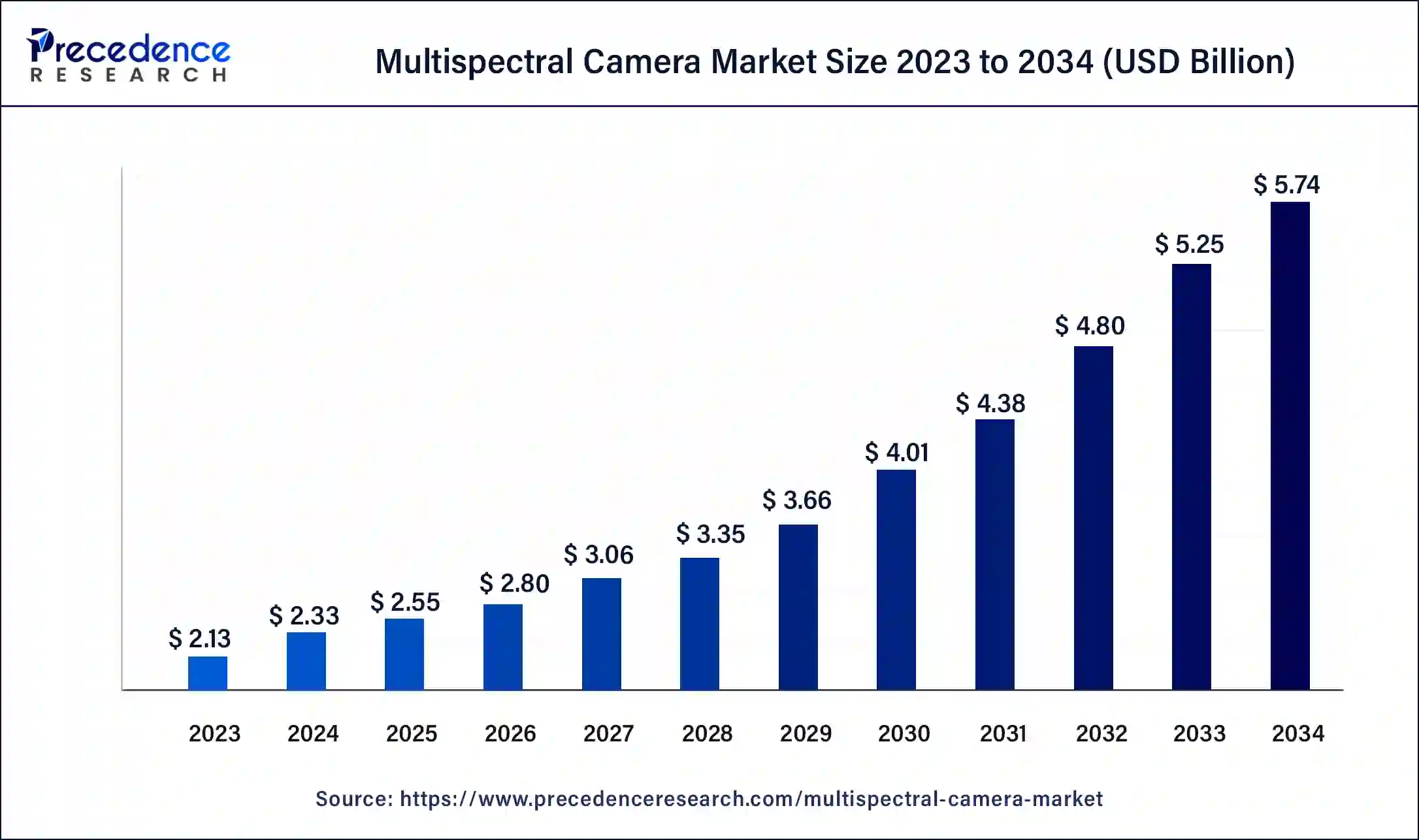

The global multispectral camera market size is estimated at USD2.55 billion in 2025 and is predicted to increase from USD 2.80billion in 2026 to approximately USD 5.74 billion by 2034, expanding at a CAGR of 9.42% from 2025 to 2034. Growing research and development (R&D) activities play a crucial role in driving the multispectral camera market growth.

Market Highlights

- Asia Pacific dominated the multispectral camera market in 2024.

- North America is expected to show the fastest growth in the market throughout the forecast period.

- By cooling technology, the uncooled segment dominated the market in 2024.

- By cooling technology, the cooled segment is expected to grow at the fastest rate in the market over the forecast period.

- By imaging spectrum, the mid-wave infrared (MWIR) segment led the market in 2024.

- By imaging spectrum, the visible/near-infrared (VNIR) segment is anticipated to grow at the fastest rate in the market during the forecast period.

- By platform, the land segment dominated the global market in 2024.

- By application in 2024, the intelligence, surveillance, & reconnaissance segment dominated the global market.

- By application, the target & tracking segment is projected to witness the fastest growth in the market over the forecast period.

- By end use, the payloads segment dominated the market in 2024.

- By end use, the man-portable segment is expected to witness rapid growth in the market over the forecast period.

Market Overview

A multispectral camera is a sophisticated imaging tool that captures data across multiple wavelengths, not just the visible light that humans can see. This ability allows the camera to record information beyond our visual spectrum. For instance, infrared radiation is used for thermal imaging and night vision, helping to detect heat signatures crucial for medical diagnostics. UV radiation can identify minerals, detect sunburn, and monitor ozone depletion. Additionally, near-infrared radiation is valuable for environmental research and assessing plant health, as it can penetrate fog and haze to reveal more details.

Role of AI in the Multispectral Camera Market

The integration of Artificial Intelligence and machine learning into hyperspectral and multispectral imaging is revolutionizing the multispectral camera market. By processing large volumes of spectral data efficiently, AI algorithms enable real-time analysis and quicker decision-making. This advancement is leading to the development of autonomous industrial systems that require less human oversight and can adapt to changing conditions. With these technologies, smarter and more connected systems can make decisions on the spot, reducing reliance on central processing and improving operational efficiency.

- In March 2024, UK-based space tech startup Open Cosmos successfully launched a new AI-powered satellite that can provide near real-time views of Earth. The satellite, HAMMER, short for Hyperspectral AI for Marine Monitoring and Emergency Response, was successfully blasted into orbit Monday aboard a SpaceX Falcon 9 rocket.

Multispectral Camera Market Growth Factors

- The increasing adoption of medical imaging solutions techniques is driving the demand for the multispectral camera market.

- The growing prevalence of chronic diseases can drive the multispectral camera market growth further.

- The rising need for environmental monitoring is expected to fuel the multispectral camera market growth shortly.

Multispectral Camera Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the rising investment by government for strengthening the defence sector along with technological advancements in camera systems.

- Major Investors: Numerous market players are actively entering this market, drawn by collaborations, R&D and business expansions. Various multispectral camera brands such as Ocean Insight, Opgal Optronics Industries Ltd., Paras Aerospace, Spectral Devices and some others have started investing rapidly for developing high-quality spectral cameras to cater the needs of the end-users.

- Startup Ecosystem:Various startup brands are engaged in developing spectral camera systems. The prominent startup brands dealing in spectral camera consists of Pixxel, Cubert, Unispectral and some others.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.55 Billion |

| Market Size in 2026 | USD 2.80 Billion |

| Market Size by 2034 | USD 5.74 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.42% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Cooling Technology, Imaging Spectrum, Platform, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Extensive application in the defense sector

The growth of the multispectral camera market is largely driven by their expanding use across various industries. In particular, the defense sector has significantly contributed to this increase. These cameras enhance situational awareness, detect camouflage, and identify hidden objects by capturing images across multiple wavelengths. Moreover, the rise in national security and defense modernization efforts have boosted the demand for multispectral cameras, which impact their sales not only in defense but also across other applications.

- In October 2023, Leonardo DRS announced the launch of its new high-resolution EMIR-SR multispectral camera for aerial intelligence, surveillance, and reconnaissance (ISR) missions' applications.

Restraint

Rising alternatives

The multispectral camera market faces competition from markets of alternative technologies like hyperspectral cameras, drones with sensors, and satellite imagery. These options might offer various advantages, such as unique features, cost benefits, or broader coverage, which can potentially impact the market share of multispectral cameras. Additionally, multispectral cameras generate vast amounts of data across different spectral bands. Processing and analyzing this extensive data can be challenging and time-consuming. Organizations may struggle to handle and extract useful insights from this large volume of information, which can limit the technology's effectiveness and value.

Opportunity

The rising utilization of precision agriculture

The multispectral camera market has revolutionized farming by providing detailed insights into crop health. Farmers can now make more informed decisions about pest control, fertilization, and irrigation due to the precise information offered by multispectral cameras. Furthermore, these cameras can identify diseases and pests early by allowing for timely intervention. This ability to prevent crop damage and loss is increasing the need for multispectral cameras. The growing demand for multispectral cameras in precision agriculture is driving the development of technology in agriculture.

- In November 2022, DJI will launch the Mavic 3 Multispectral for Precision Agriculture. Designed for organizations engaged in precision agriculture. This new drone comes with a multispectral imaging system that allows rapid capture of crop growth information. Mavic 3M is aimed at helping farmers improve crop production. Mavic 3 Multispectral (Mavic 3M) offers a wide range of application scenarios, including precision agriculture and environmental monitoring.

Segment Insights

Cooling Technology Insights

The uncooled segment dominated the multispectral camera market in 2024. Uncooled cameras provide a more affordable alternative to cooled cameras. They don't need cryogenic cooling systems, which simplifies both their design and production, leading to lower costs. This reduced price makes uncooled cameras more accessible to a broader range of users, and applications can boost their popularity and market growth. Operating at ambient temperatures without the need for cooling mechanisms, these cameras also provide easier operation and maintenance.

- In January 2023, LightPath Technologies introduced the Mantis uncooled multi-spectral camera. Currently, users typically use uncooled longwave cameras (LWIR) and cooled mid-wave cameras (MWIR), the latter having high costs and shorter lifetimes due to the complex cooling requirements. LightPath's uncooled multi-spectral camera images in both the mid-wave and long-wave ranges simultaneously without needing a complicated, heavy, and expensive cooling system.

The cooled segment is expected to grow at the fastest rate in the multispectral camera market over the forecast period. Cooled multispectral cameras use a cooling system to minimize thermal noise from the camera's sensor. By lowering the camera temperature to below freezing, the device's sensitivity is greatly improved, leading to an improved signal-to-noise ratio. This cooling method is especially useful for capturing high-quality images across various wavelengths, as it helps prevent thermal emissions from interfering with the desired signal.

Imaging Spectrum Insights

The mid-wave infrared (MWIR) segment led the multispectral camera market in 2024. The increasing need for mid-wave infrared (MWIR) technology stems from its capability to capture thermal data, which is important for applications like thermal imaging, night vision, and detecting temperature changes. Also, the broad range of uses, from defense and security to environmental monitoring and industrial applications, fuels the rising popularity of MWIR multispectral cameras. This versatility across different fields drives their growing adoption.

The visible/near-infrared (VNIR) segment is anticipated to grow at the fastest rate in the multispectral camera market during the forecast period. The growth of the segment is attributed to its broad range of applications, such as in agriculture, environmental monitoring, and surveillance. This segment's prominence is further supported by the availability of high-quality, cost-effective sensors capable of capturing visible light data. The accessibility and affordability of these sensors improve their usage across various fields, thus fueling the expansion of this market.

Platform Insights

The land segment dominated the global multispectral camera market in 2024. Multispectral cameras are extensively used in agriculture for precision farming, where they help monitor crop health, soil conditions, and irrigation efficiency. The land-based deployment allows farmers to capture detailed images of large fields, enabling better crop management and increased yields. Land-based multispectral cameras are crucial for monitoring forests, wetlands, and other terrestrial ecosystems. They help track vegetation health, detect deforestation, and assess the impact of climate change.

Application Insights

The intelligence, surveillance, & reconnaissance segment dominated the global multispectral camera market in 2024. Multispectral cameras enhance target detection and identification by capturing images across various spectral bands. This capability makes more precise differentiation between objects and helps identify specific materials or features that traditional imaging systems might miss. Moreover, multispectral imaging is effective in spotting camouflage and concealment efforts.

- In June 2023, Sidus Space, a multi-faceted space and defense-as-a-service satellite company, announced that it would launch industry-leading hyperspectral and multispectral imaging and edge artificial intelligence in its LizzieSat™ satellite on SpaceX Transporter missions. Sidus is building its space-based infrastructure of multi-mission satellites with hyperspectral, multispectral, and other sensors to provide monitoring services and solutions to multiple sectors and industries.

The target & tracking segment is projected to witness the fastest growth in the multispectral camera market over the forecast period. Tracking plays an important role in guiding, navigating, and controlling autonomous systems. It involves estimating the number of targets and their states, assessing the situational environment in a specific area of interest, and continuously monitoring these targets over time using their detected kinematic parameters and attributes. At its most basic level, a tracking system can be a single target tracking (STT) system designed for a clutter-free environment, where it assumes only one target is present in interest.

End-use Insights

The payloads segment dominated the multispectral camera market in 2024. Multispectral cameras are widely utilized as payloads in UAVs and drones, and they have become popular across various sectors, such as agriculture, environmental monitoring, and infrastructure inspection. These cameras give crucial data for tasks like precision agriculture, crop monitoring, vegetation analysis, and mapping. The market for these cameras is further growing due to the rising demand for satellite imagery and the increasing frequency of satellite launches.

The man-portable segment is expected to witness rapid growth in the multispectral camera market over the forecast period. Across various industries, there's a growing demand for lightweight and portable multispectral cameras as users prioritize flexibility and mobility for data collection. Designed to be easily deployable and practical for fieldwork, man-portable multispectral cameras offer the convenience of on-the-go usage and adaptability in diverse environments.

Regional Insights

Asia Pacific dominated the multispectral camera market in 2024. In the region, the demand for multispectral cameras is rising due to the thriving agricultural sector, rapid industrial growth, and increased investments in technology. Countries like China, India, and Japan are heavily investing in technological advancements and space research, significantly improving multispectral imaging applications in the area.

In China, multispectral cameras are predominantly used for remote sensing, including monitoring environmental conditions such as air and water quality and observing changes in land use and urban development. The substantial investments by the Chinese government in these areas have significantly boosted the demand for multispectral cameras.

List of defense budget by country 2024

| Rank | Country | Spending in (USD Bn) |

| 1. | United States | 831.73 |

| 2. | China | 227 |

| 3. | Russia | 109 |

| 4. | India | 74 |

| 5. | Saudi Arabia | 71.72 |

| 6. | United Kingdom | 62.81 |

| 7. | Germany | 55.94 |

| 8. | Japan | 53 |

| 9. | Australia | 52.55 |

| 10. | France | 49.73 |

North America is expected to show the fastest growth in the multispectral camera market throughout the forecast period. The regulatory landscape is supportive of advanced imaging technologies like multispectral cameras, fostering their adoption through government initiatives, regulations, and funding. This favorable environment boosts market growth and increases revenue potential. Furthermore, In the United States, the rising use of multispectral cameras is largely driven by their integration into precision agriculture. Major companies are heavily investing in research and development to innovate the capabilities and performance of these imaging systems.

- In November 2023, the U.S. Army awarded L3Harris Technologies a $51.6 million contract to supply viper long-range reconnaissance pods (LRRP). Multispectral sensors are housed in these pods to improve intelligence gathering and long-range target identification.

What led Europe to hold a significant share of the multispectral camera market?

Europe held a significant share of the market. The growing emphasis of armed forces to deploy advanced cameras in numerous countries such as Germany, UK, France, Italy and some others has boosted the market expansion. Also, rapid investment by government for strengthening the defense sector is expected to drive the growth of the multispectral camera market in this region.

Why Latin America held a considerable share of the multispectral camera market?

Latin America held a considerable share of the industry. The increasing adoption of multispectral cameras by the marine commandos of Brazil and Argentina has driven the market growth. Additionally, partnerships among defense organizations and market players to develop advanced cameras for the defense sector is expected to propel the growth of the multispectral camera market in this region.

How is Middle East & Africa contributing to the multispectral camera market?

The Middle East & Africa held a notable share of the market. The rising demand for high-quality cameras from the Airforce organizations in numerous countries including Saudi Arabia, UAE, South Africa, Qatar and some others has boosted the market expansion. Also, the presence of numerous defense equipment companies along with rapid investment in the defense sector is expected to boost the growth of the multispectral camera market in this region.

Key Players: Developing advanced cameras for the end-users

- DJI: DJI is a Chinese company that is a leading manufacturer and distributor of drones and camera equipment. It is known for producing consumer camera drones for aerial photography and videography, but also provides technology for professional applications in industries like filmmaking, agriculture, and search and rescue.

- Collins Aerospace: Collins Aerospace is a major American aviation and defense technology company that designs, manufactures, and services systems for aircraft and other platforms. The company serves a wide range of markets, including commercial aviation, business jets, military aircraft, helicopters, and space exploration, by providing everything from avionics and interiors to mission systems and airport solutions.

- Cubert GMBH: Cubert GmbH is a German company specializing in hyperspectral snapshot cameras, which capture full-frame spectral images in real-time without moving parts. This company develops both hardware and software for a wide range of industrial, scientific, and remote sensing applications, including machine vision, agriculture, and quality control.

- Hensoldt: Hensoldt is a German company that is a leading global supplier of premium sensor technology for security and surveillance, particularly in the defense and aerospace sectors. This brand develops and provides mission-critical sensor systems, including radar, optronics, electronic warfare, and cyber security solutions.

- HGH Group: HGH Holdings Ltd. is a Singapore-based investment holding company focused on leasing, ready-mix concrete, and construction-related services. This brand is engaged in developing 360-degree thermal imaging camera systems for the defense sector.

- Leonardo DRS: Leonardo DRS is an American defense technology company that designs, develops, and manufactures advanced sensing, network computing, and electric power and propulsion systems for U.S. and allied forces. This company specializes in a variety of mission-critical technologies, including naval and maritime systems, avionics, and force protection.

Recent Developments

- In October 2025, FLIR launched an AI-powered multi-spectral maritime camera systems. These cameras are designed for enhancing the capabilities of marine sector.(Source: https://www.marinetechnologynews.com)

- In August 2025, AgEagle launched RedEdge-P Green Camera. RedEdge-P Green is a multispectral camera designed for the precision agriculture sector.

(Source: https://dronelife.com) - In January 2025, Spectricity launched S1-A accessory device. This device is equipped with a 15-channel multispectral imaging sensor that finds application in the food & agriculture and material identification sector.(Source: https://www.imec-int.com/en)

Segments Covered in the Report

By Cooling Technology

- Cooled

- Uncooled

By Imaging Spectrum

- Visible/near-infrared (VNIR)

- Short-wave infrared (SWIR)

- Mid-wave infrared (MWIR)

- Long-wave infrared (LWIR)

By Platform

- Land

- Air

- Marine

By Application

- Intelligence, Surveillance, & Reconnaissance

- Target & Tracking

- Navigation & Guidance

- Others

By End-use

- Man-portable

- Payloads

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting