What is Neurovascular Embolization Devices Market Size in 2026?

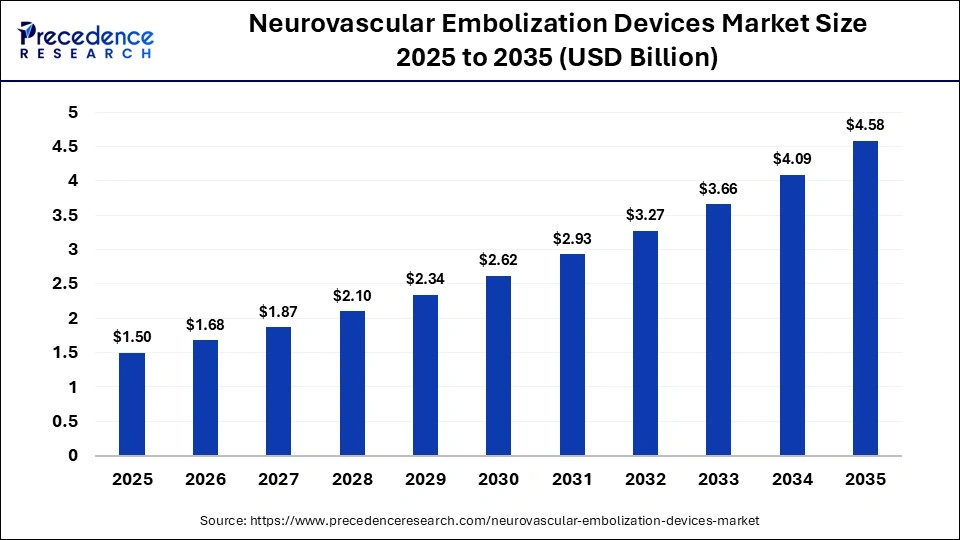

The global neurovascular embolization devices market size was calculated at USD 1.5 billion in 2025 and is predicted to increase from USD 1.68 billion in 2026 to approximately USD 4.58 billion by 2035, expanding at a CAGR of 11.80% from 2026 to 2035. The global neurovascular embolization devices market is experiencing robust growth, driven by the rising prevalence of neurological disorders, advancements in medical technologies, and evolving regulatory landscapes.

Key Takeaways

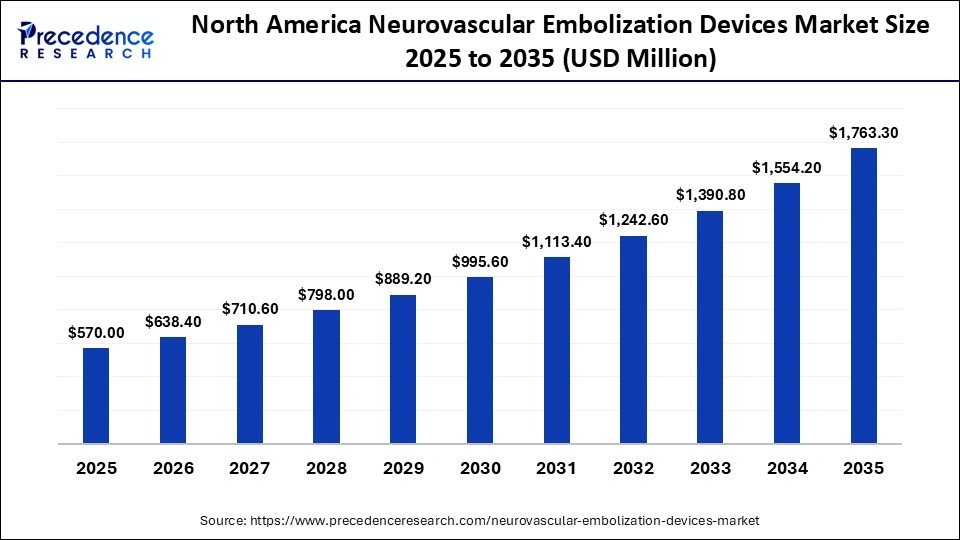

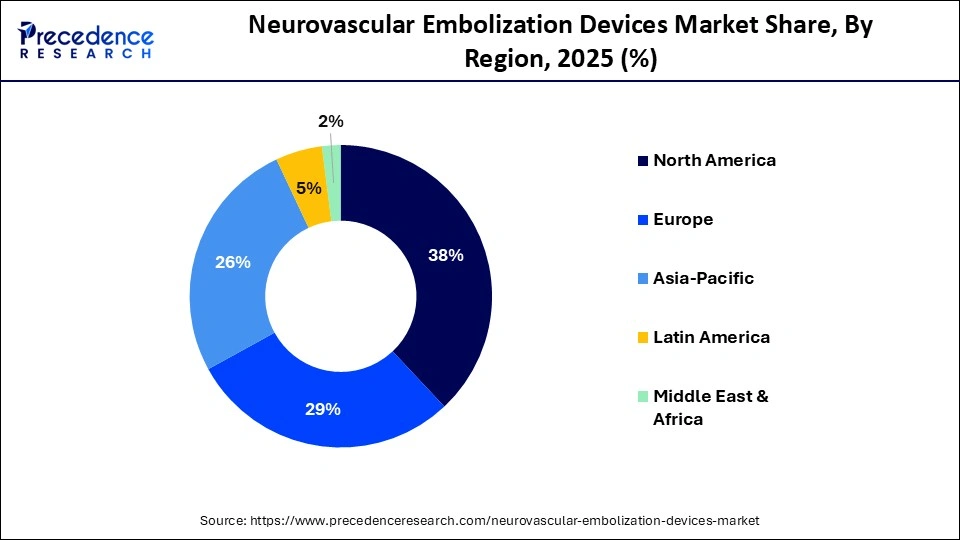

- North America dominated the global market with a share of approximately 38% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR of approximately 12.1% in the market during the forecast period.

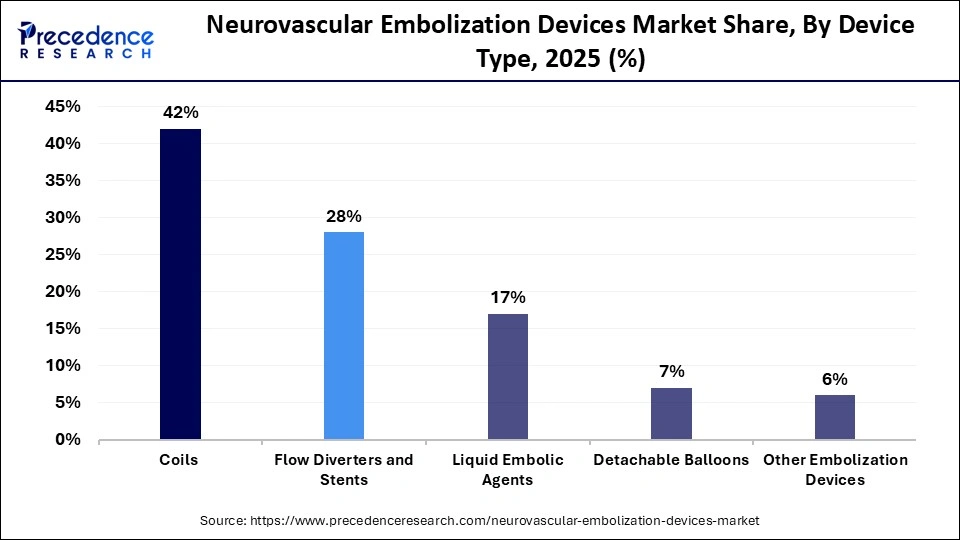

- By device type, the coils segment held a dominant position in the neurovascular embolization devices market with a share of approximately 42% in 2025.

- By device type, the flow diverters and stents segment is expected to grow with the highest CAGR in the market between 2026 and 2035.

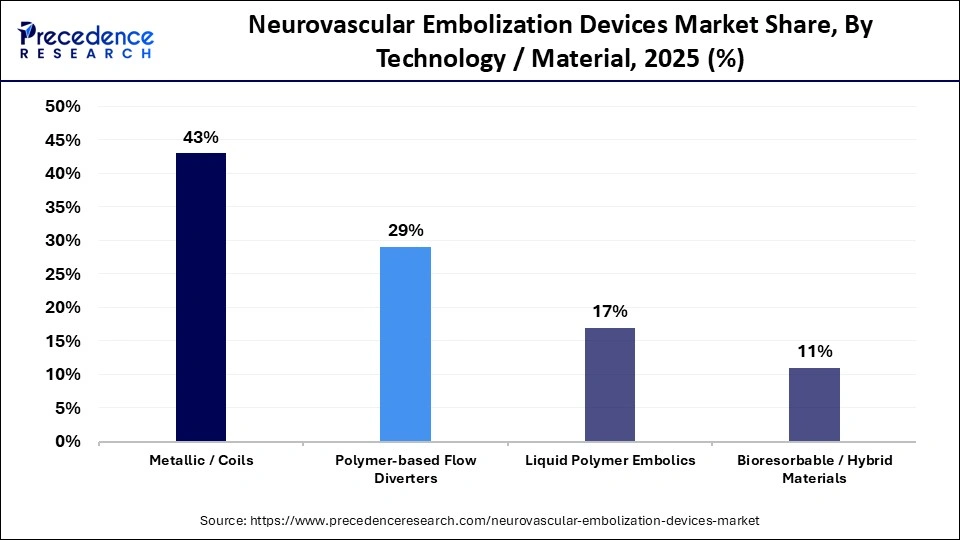

- By technology/material, the metallic/coils segment led the global market with a share of approximately 43% in 2025.

- By technology/material, the bioresorbable/hybrid materials segment is expected to grow with the highest CAGR in the market between 2026 and 2035.

- By application, the cerebral aneurysms segment held the largest revenue share of approximately 48% in the market in 2025.

- By application, the arteriovenous malformations (AVMs) segment is expected to expand rapidly in the market in the coming years.

- By end user, the hospitals and specialty neuro clinics segment contributed the biggest revenue share of approximately 56% in the market in 2025.

- By end user, the ambulatory surgical centers segment is expected to witness the fastest growth in the market over the forecast period.

What is the Neurovascular Embolization Devices Market?

The market includes medical devices and implantables used to occlude blood vessels in the brain and spinal cord for treating aneurysms, arteriovenous malformations (AVMs), dural arteriovenous fistulas (DAVFs), tumors, and other vascular pathologies. Embolization devices include coils, flow diverters, liquid embolics, detachable balloons, and microcatheters. Growth is driven by the rising incidence of neurovascular disorders, procedural adoption, technological innovation, and expanding healthcare infrastructure.

In modern healthcare, the neurovascular embolization device has emerged as a critical tool in the treatment of complex cerebrovascular conditions. It addresses issues such as cerebral aneurysms and AVMs. It plays a crucial role in life-threatening events such as hemorrhagic strokes, enhancing patients' quality of life. Embolization devices include coils, flow diverters, liquid embolics, detachable balloons, and microcatheters. Growth is driven by the rising incidence of neurovascular disorders, procedural adoption, technological innovation, and expanding healthcare infrastructure.

What is the Role of AI in the Neurovascular Embolization Devices Market?

As artificial intelligence is playing a significant role in various sectors, it is also leading to advancements in the treatment of neurovascular conditions. AI helps in precision diagnostics, treatment planning, and outcome prediction, which improves patient care. AI-powered systems help in tracking catheters, coil markers, and guidewires in real time in angiographic screens.

AI helps in morphological analysis for more consistent and accurate measurement over manual methods. AI algorithms also help in the placement of embolization devices like coils and strands within a patient's specific vascular model to predict hemodynamic changes and the success rate, making it a valuable tool in the market.

Neurovascular Embolization Devices Market Trends

- Increasing Neurovascular Diseases

Neurovascular disease, including strokes and related disorders, is becoming a global health burden. Population aging, modern nutrition, brain injury, congenital abnormalities, and lifestyle are some of the major market drivers. Also rising prevalence of stroke, aneurysms, and other cerebrovascular diseases is pushing growth further in the market. - Preference for Minimally Invasive Procedures

Compared to traditional open surgeries, minimally invasive procedures lead to fewer complications, less blood loss, lower infection risks, and reduced pain. Also, the increasing incidence of stroke and AVMs demands more effective and faster treatment options. These procedures using coils, stents, and catheters to treat brain strokes require smaller punches rather than opening a craniotomy, boosting the market further. - Continuous Innovation and Technological Advancements

With continuous innovation and technological advancements in the market, safer, enhanced, and more precise tools have significantly improved patient outcomes in treating stroke and brain aneurysms. To enhance the device efficacy, advanced stain retrievers, improved embolic coils, and superior flow diverters for aneurysms are in continuous development. Additionally, high use of biocompatible and bioresorbable materials is utilized to minimize adverse reactions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.5 Billion |

| Market Size in 2026 | USD 1.68 Billion |

| Market Size by 2035 | USD 4.58 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.80% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Device,Application,Technology/Material, End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Device Insights

Which Device Segment Dominated the Neurovascular Embolization Devices Market?

The coils segment held a major revenue share of approximately 42% in the market in 2025. Coils are one of the important embolization agents due to their ease of use, widespread availability, and visibility on fluoroscopy. As they come in a wide range of sizes, coating materials, shapes, and deployment methods, they are used for effective targeting of embolization in a variety of scenarios.

The flow diverters and stents segment is expected to gain the highest market share between 2026 and 2035. Flow diverters are new indoor secular tools for challenging aneurysms, such as vascular remodeling or reconstructive treatment. These are effective and highly used for large, giant, and wide-necked aneurysms, as they are difficult to treat with traditional coiling.

Technology/Material Insights

Why Did the Metallic/Coils Segment Dominate the Neurovascular Embolization Devices Market?

The metallic/coils segment accounted for the highest revenue share of approximately 43% in the market in 2025, driven by high precision and reliability in treating intracanal aneurysms and AVMs. Coils are usually made from either platinum or stainless steel, with no difference in efficacy. Platinum coils offer better visualization in fluoroscopy, are softer and malleable, thus modern-day coils are usually made from platinum wires.

The bioresorbable/hybrid materials segment is expected to witness the fastest growth in the market over the forecast period. These materials are in high demand as they overcome the limitations of traditional and permanent metal implants, such as long-term inflammation constraint on future repeat interventions and late-stage thrombosis. Bioresorbable/hybrid materials eliminate the need for an additional surgery to remove the device from a patient's body.

Application Insights

How the Cerebral Aneurysms Segment Dominated the Market?

The cerebral aneurysms segment contributed the biggest revenue share of approximately 48% in the neurovascular embolization devices market in 2025, due to its high prevalence in the general population, severity of its complications, and advancements in diagnostic techniques. A large number of these aneurysms are small and remain undetected, making them a common finding in routine neurovascular checks, increasing the demand for these devices. The global prevalence of cerebral aneurysms is approximately 3.2%.

The arteriovenous malformations (AVMs) segment is expected to grow at the fastest CAGR in the market between 2026 and 2035, due to their potential for severe and life-threatening complications, particularly in children and young adults, making them high impact neurovascular disease, causing long-term disability. AVMs cause high-pressure vessels to bleed, making embolization a high priority to block the flow and reduce the risk of catastrophic bleeding, contributing to market growth.

End User Insights

Which type of end user dominated the neurovascular embolization device market?

The hospitals and specialty neuro clinics segment held the largest revenue share of approximately 56% in the neurovascular embolization devices market in 2025. The increasing admissions for stroke, cerebral aneurysms, and other vascular diseases propel the segment's growth. They are critical in the deployment and the success rate of devices as they are highly complex, time-sensitive, and minimally invasive. They provide the necessary infrastructure and specialized medical expertise needed for the treatment.

The ambulatory surgical centers segment is expected to expand rapidly in the market in the coming years, as they provide cost-effectiveness, efficiency, and a patient-centric alternative to hospital-based care for minimally invasive procedures. Compared to traditional hospitals, they provide a lower risk environment for infections, which is crucial for neurovascular cases. Additionally, it enables a more personalized experience, which reduces patients' time in the facility.

Regional Insights

How Big is the North America Neurovascular Embolization Devices Market Size?

The North America neurovascular embolization devices market size is estimated at USD 570.00 million in 2025 and is projected to reach approximately USD 1,763.30 million by 2035, with a 11.96% CAGR from 2026 to 2035.

Why North America Dominated the Neurovascular Embolization Devices Market?

North America held a major revenue share of approximately 38% in the market in 2025. The driving factors include high disease burden, growing awareness in patients, technological advancements, and a robust healthcare infrastructure. The presence of key players, the rising adoption of advanced technologies, and growing research activities foster market growth. Regulatory agencies make suitable regulations for the safe and effective use of medical devices. The region witnesses a strong presence of medical device companies involved in the development and distribution of neurovascular embolization devices.

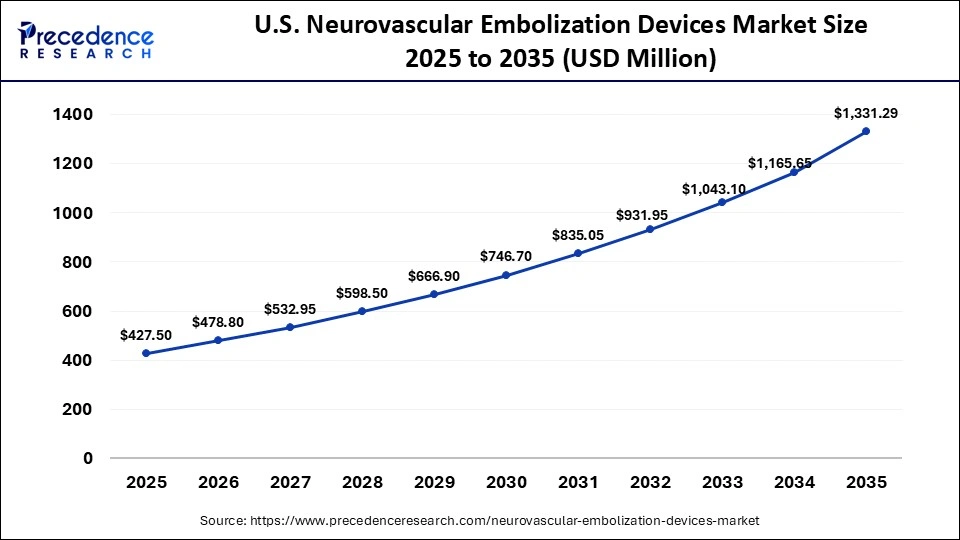

What is the Size of the U.S. Neurovascular Embolization Devices Market?

The U.S. neurovascular embolization devices market size is calculated at USD 427.50 million in 2025 and is expected to reach nearly USD 1,331.29 million in 2035, accelerating at a strong CAGR of 12.03% between 2026 to 2035.

U.S. Market Trends

The U.S. holds the largest share of the market, driven by the high prevalence of strokes and brain aneurysms, which drives the demand for the treatment. The widespread availability of specialized neurosurgical and radiological services allows for faster and more widespread adoption of treatments. Additionally, due to insurance coverage policies from government and private insurers, the use of advanced and expensive devices is rapidly growing. The market is also fueled by advanced adoption of technologies and a hub of innovations.

How Will the Asia Pacific Grow in the Neurovascular Embolization Devices Market?

Asia-Pacific is expected to be the fastest-growing market with a CAGR of approximately 12.1% in 2025. The driving factors include the rising adoption of advanced technologies, the presence of key players and local manufacturing, the high prevalence of neurological disorders, and the rapid adoption of minimally invasive procedures. People are becoming aware of the screening and early diagnosis of neurological disorders. Government organizations launch initiatives and provide funding to promote the indigenous manufacturing of medical devices, enhancing accessibility and affordability.

Japan Market Trends

Japan holds the largest share of the market in the Asia-Pacific region, driven by factors such as an aging population, advanced medical technologies, and high adoption of minimally invasive procedures. Stroke is the third leading cause of death in Japan, which drives the need for expertise in the treatment. Furthermore, along with key players, local players are manufacturing, developing, and commercializing cost-effective neurovascular devices. Additionally, international partnerships and technological advancements, such as AI-integrated decision delivery devices, boost market growth.

Neurovascular Embolization Devices Market Value Chain Analysis

- Research and Development

It includes identifying clinical needs to design new coils, flow diverters, and delivery systems, including preclinical testing and trials.

Key Players – Medtronic, MicroVention, Stryker Corporation, Johnson and Johnson - Device Design and Manufacturing

It includes designing and optimizing precision-engineered medical components to meet regulatory standards and quality control for manufacturing and supply chain management.

Key Players - Boston Scientific Corporation, Terumo Corporation, BALT extrusion - Regulatory Approval

It includes safety and effectiveness evaluation, along with submission of clinical data to regulatory authorities such as the FDA and post-market surveillance.

Key Players - Stryker Corporation, Johnson and Johnson, Medtronic - Distribution and Sales

It includes direct distribution and sales to hospitals and clinics, and digital sales for reusable tools when applicable through manufacturers or through distributors/wholesalers.

Key Players - Boston Scientific Corporation, Terumo Corporation, Stryker Corporation - Patient Support & Services

It includes clinical support and troubleshooting of devices, providing financial assistance, and guiding patients about device usage.

Key players - Penumbra Inc., Johnson and Johnson, Terumo Corporation, Medtronic

Top Companies in the Neurovascular Embolization Devices Market

- Stryker Corporation

- Medtronic plc

- Penumbra, Inc.

- Johnson & Johnson Services, Inc. (CERENOVUS)

- Terumo Corporation (MicroVention, Inc.)

- Acandis GmbH

- Balt Group (Balt SAS)

- MicroPort Scientific Corporation

- phenox GmbH

- Rapid Medical

- Perflow Medical Ltd.

- ASAHI INTECC CO., LTD.

- Imperative Care

Recent Developments

- In October 2025, Penumbra launched the SwiftSET Coil, designed for adaptive embolization in a variety of neurovascular conditions. Through its shape arrangement, the coil is designed to maximize vessel wall apposition. It also makes it easier to deploy and naturally conform to the limited gaps for dense occlusion in small vessels.(Source - https://www.penumbrainc.com)

- In August 2025, MicroPort Neuroscientific launched its Numen coil embolization system in Egypt, in collaboration with PentaMed. The system was used for the treatment of a complex, large anterior communicating artery (ACOM) aneurysm at Neurospitalia Hospital for the first time. (Source:https://www.massdevice.com)

- In February 2025, Stryker announced the acquisition of Inari Medical, Inc., which is a provider of solutions for venous thromboembolism clot removal. This acquisition marks a significant milestone in expanding Stryker's intervention endovascular portfolio with two novel mechanical thrombectomy solutions, including the FlowTriever System and the ClotTriever System.(Source - https://investors.stryker.com)

Segments Covered in the Report

By Device Type

- Coils

- Bare platinum coils

- Detachable coils

- Flow Diverters & Stents

- Dedicated flow diverters

- Assisted stent diversion systems

- Liquid Embolic Agents

- Onyx/EVOH-based agents

- NBCA/Other liquid formulations

- Detachable Balloons

- Other Embolization Devices

By Technology/Material

- Metallic/Coils

- Polymer-based Flow Diverters

- Liquid Polymer Embolics

- Bioresorbable/Hybrid Materials

By Application

- Cerebral Aneurysms

- Arteriovenous Malformations (AVMs)

- Dural Arteriovenous Fistulas (DAVFs)

- Tumor Embolization

- Other Neurovascular Conditions

By End User

- Hospitals & Specialty Neuro Clinics

- Ambulatory Surgical Centers

- Diagnostic & Imaging Centers

- Other End Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting