What is the Oil Refining Market Size?

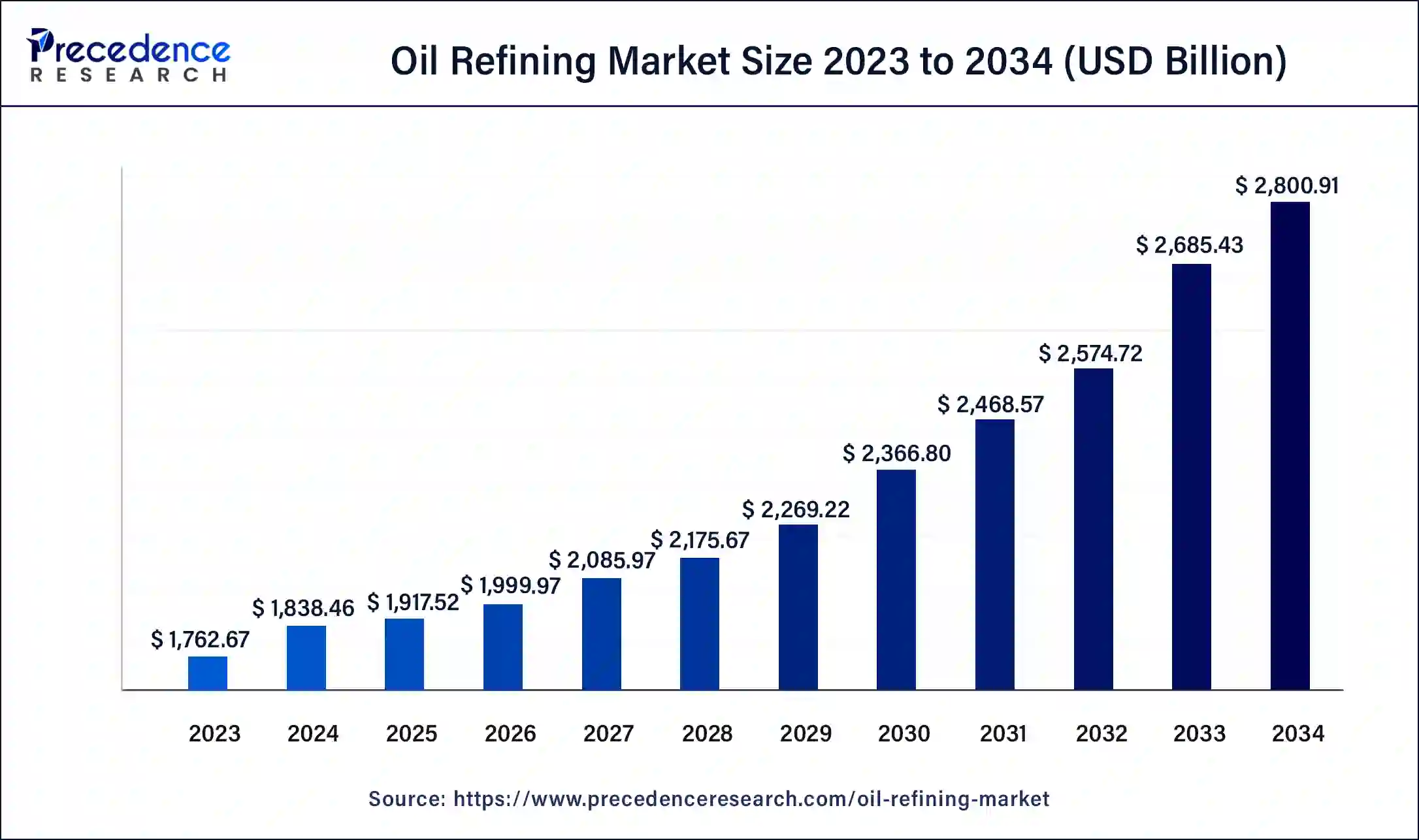

The global oil refining market size accounted at USD 2,800.91 billion in 2025 and is expected to reach around USD 2,913.21 billion by 2035, expanding at a CAGR of 4.27% from 2026 to 2035. Oil refining benefits include helping to remove potential contaminants and harmful substances from oils, which makes them healthier for consumption. Their applications include electricity, agriculture, aviation, petrochemical, transportation, marine bunker, etc., which helps the growth of the market.

Oil Refining Market Key Takeaways

- In terms of revenue, the oil refining market is valued at $1,917.52 billion in 2025.

- It is projected to reach $2,800.91 billion by 2035.

- The oil refining market is expected to grow at a CAGR of 4.30% from 2026 to 2035.

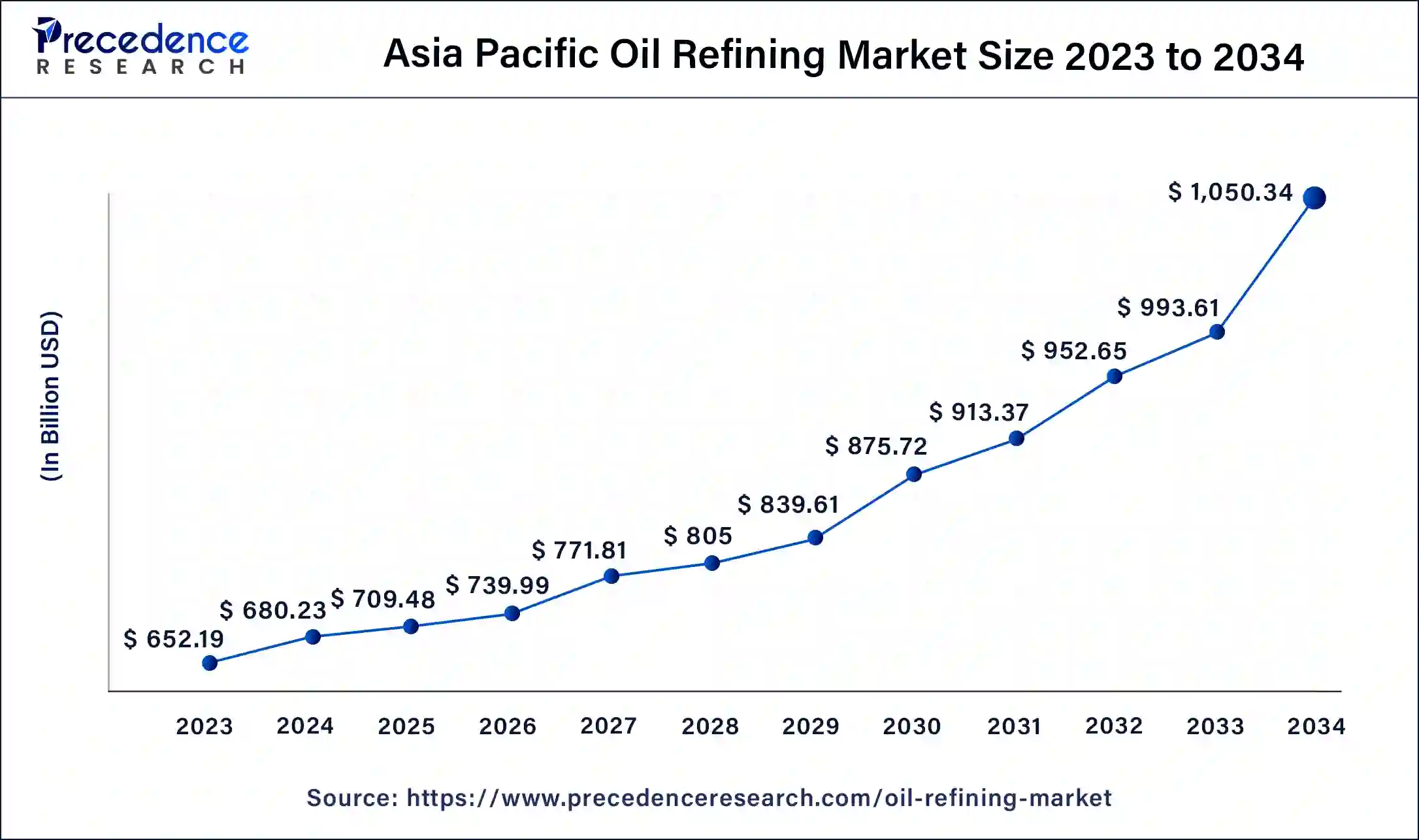

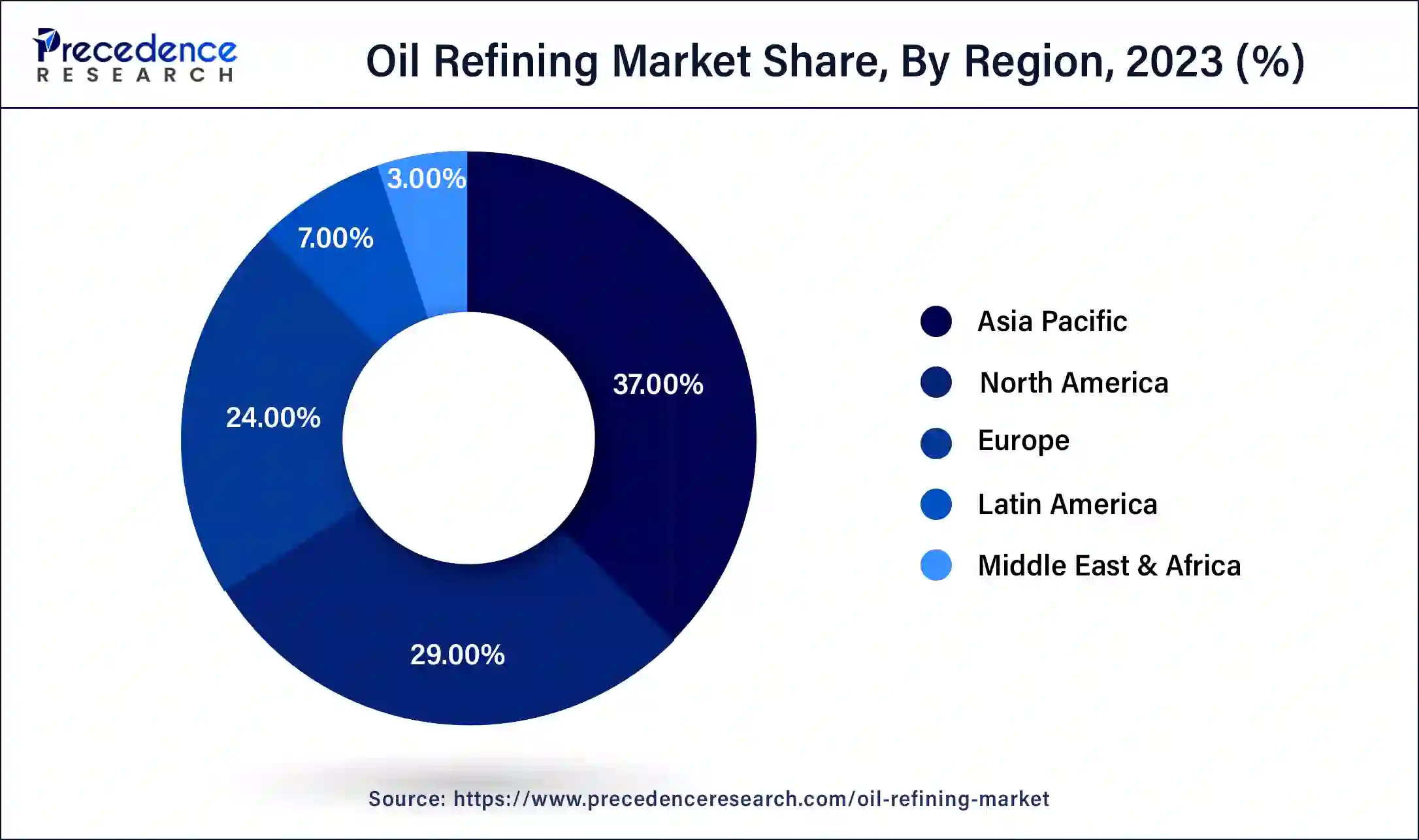

- Asia Pacific dominated the oil refining market with the largest revenue share of 37% in 2025.

- North America is estimated to be significantly growing during the forecast period.

- By product, the middle distillates segment dominated the market in 2025.

- By product, the light distillates segment is expected to be the fastest-growing during the forecast period.

- By fuel, the gasoline segment dominated the oil refining market in 2025.

- By complexity, the hydro-skimming segment dominated the market in 2025.

- By application, the transportation segment dominated the oil refining market in 2025.

- By application, the aviation segment is expected to be the fastest-growing during the forecast period.

Market Overview

The oil refining market refers to the oil refining, or petroleum refinery, which is an industrial process plant where crude oil is transformed and refined into products like kerosine, petroleum naphtha, liquefied petroleum gas, heating oil, fuel oils, asphalt base, diesel fuel, and gasoline (petrol). The benefits of oil refining include the improvement of edible value, more profit, improvement of the quality of cooking oil, ability to extend the storage time of cooking oil, production of transportation and other oils, production of bandages, plastics, shaving creams, and shampoos, and creation of raw materials for the chemical industry. These factors help to the growth of the market.

Artificial Intelligence: The Next Growth Catalyst in Oil Refining

AI is profoundly impacting the oil refining industry by driving significant enhancements in operational efficiency, safety, and profitability. By leveraging machine learning and advanced analytics, refineries can implement a predictive maintenance program, drastically reducing unplanned downtime and associated costs.

Furthermore, AI optimizes complex refining processes in real-time by analyzing vast datasets, leading to improved complex refining processes in real-time by analyzing vast datasets leading to improved product yields, minimized energy consumption, and less waste.

Oil Refining Market Growth Factors

- The benefits of oil refining include improvement of edible value, gain more profit, improvement of the quality of cooking oil, ability to extend the storage time of the cooking oil, production of transportation, and other fuels.

- It also includes the production of bandages, shaving cream, shampoos, and plastics. Creation of raw materials for the chemical industry. These factors help to the growth of the market.

- The application of oil refining includes rail & domestic waterways, residential & commercial, electricity, agriculture, etc.

- It also includes applications in petrochemical, aviation, transportation, marine bunker, etc. These factors help the growth of the oil refining market.

Market Outlook

- Market Growth Overview: The oil refining market is expected to grow significantly between 2025 and 2034, driven by the rising worldwide energy demand, rising transportation fuel consumption, and petrochemical feedstocks.

- Sustainability Trends: Sustainability trends involve decarbonization, integration of renewable and biofuels, and water and waste management.

- Major Investors: Major investors in the market include ExxonMobil, Shell, Chevron, BP, China National Petroleum Corp (CNPC), Indian Oil (IOC), Bharat Petroleum (BPCL), and Hindustan Petroleum (HPCL)

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 2,913.21Billion |

| Market Size in 2025 | USD 1,917.52 Billion |

| Market Size in 2026 | USD 1,999.97 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.27% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Fuel, Complexity, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising investment in oil refinery facilities

Rising investment in upgrades, reconstruction, and expansion of existing oil refinery facilities helps the growth of the market. Oil refining plays a significant role in the production of transportation and other fuels. The crude oil components, once separated, may be sold to different industries for a wide range of purposes. The benefits of investing in oil refining facilities include dividend yields, diversification, and inflation hedge. Oil stocks serve as a hedge against inflation and growth potential in the oil sector as the global economy expands and energy demand increases, mainly in developing nations. These factors help the growth of the oil refining market.

Restraint

Downsides of oil refining

Oil refining processes include alkali or acid treatments, de-gumming, deodorizing, dewaxing, and bleaching. These harmful stages reduce the smell, flavor, chlorophyll content, and other nutrients in the oil. After some time, it is affected by increasing rancidity and oxidation in the edible oil. The rise of biofuels and electric vehicles hamper the growth of the market. Carbon taxes and weakening refining margins put oil refining capacity at risk. Risk of industrial exposure to chemicals or accidents like fire or explosions or health and hygiene hazards. The challenges of oil refining include electric vehicles (EVs), decarbonization, rationalization, and profitability. These factors can restrict the growth of the oil refining market.

Opportunity

Advanced technologies

By using advanced technologies in the oil refining helps to the growth of the market. This helps to achieve diversified employment opportunities and economic growth. The benefits of advanced technologies used in oil refining include a decrease in NOx emissions and CO2 emissions with carbon capture and storage (CCS), production of fuels with low carbon footprints, increased production of petrochemicals, and increased competitiveness and flexibility by digitalization and catalyst management. These factors help the growth of the oil refining market.

Technological Advancement

Technological advancements in the oil refining market feature automation, digitalization, and digital twins. The digital twin technology is a virtual representation of the refinery operations, which helps in decision-making and minimizes errors. Digitalization and automation are mainly approached by the oil and gas industry. IoT monitors and evaluates the process, which consists of sensors for data collection. Further, the data is analyzed with the help of AI, and the automation task continues to process and maintain data. Additionally, the advanced materials and sustainable technologies contribute their large share, meeting the market standard. The advancement and consistency are securing the future growth of the market. The developmental growth and new initiatives are encouraging innovation and technology to boost the oil refining industry.

Segment Insights

Product Insights

The middle distillates segment dominated the market in 2024. The advantages of oil refining for middle distillates include lower plot capital investment than the hydrogen additional processes, no residual liquid product to deal with, preferred in low crude oil price environments, highly used in many references, can handle high contaminants (very poor-quality) feeds, etc. can help to the growth of the segment. Middle distillates are primarily used as fuel for lighting, heating, and transportation worldwide. When crude oil refining is done, middle distillates make up between 25% to 40% of the oil products profit. These factors help the growth of the middle distillate segment and contribute to the growth of the oil refining market.

The light distillates segment is anticipated to be the fastest-growing during the forecast period. Light distillates are refined oil products manufactured by fractional distillation. These have lower boiling points, are flammable substances, and consist of short hydrocarbon chains that may be either liquid or gaseous. Light petroleum distillates (LPDs) are most commonly encountered in products like camp stove fuels and pocket lighter fuels. In the medium-range products used as mineral spirits, dry cleaning solvents, paint thinners, charcoal starter fuels, and some automotive fuel treatments. These are also used in liquified petroleum gas (LPG), motor gasoline, naphtha, etc. These factors help the growth of the light distillates segment and contribute to the growth of the oil refining market.

Fuel Insights

The gasoline segment dominated the oil refining market in 2024. The advantages of gasoline include its support of existing infrastructure like gas, cars, and road stations, quick refueling times, a portable fuel source that can be carried easily into a safe container, readily available, high energy density, etc. Gasoline is used for many purposes, including electricity generators for emergency and portable power supply, powering tools and equipment used in landscaping, forestry, farming, and construction, and fuel for small aircraft, boats, recreational vehicles, motorcycles, light trucks, sports utility vehicles, and cars. These factors help the gasoline segment and contribute to the growth of the market.

The gasoil segment is growing significantly during the forecast period. Gasoil, also called red diesel, is a type of fuel oil refined from petroleum, and it is heavier than paraffin oil. The uses of gasoil include non-commercial purposes like heating and electricity generation, traveling fairs and circuses, boating, sailing, and marine transport, community amateur sports clubs and golf courses, rail transport, etc. Gasoil is also used in rail transport, agriculture, vehicles, generators, powering machinery, etc. These are also used as enriching agents for carbureted water gas manufacturing. The gasoil industry has important economic advantages for communities, including infrastructure development, job creation, and tax revenues. These advantages may have positive social impacts like improved public services, enhanced living standards, and increased economic opportunities. These factors help to the growth of the gasoil segment and contribute to the growth of the oil refining market.

Complexity Insights

The hydro-skimming segment dominated the market in 2024. Hydro-skimming is the simplest type of oil refining used in the petroleum industry. Hydro-skimming oil refining is more complex than topping oil refining. It is also used to generate higher octane reformations like xylene, benzene, toluene, and hydrogen for hydrotreating units. These factors help to the growth of the hydro-skimming segment and contribute to the growth of the oil refining market.

Application Insights

The transportation segment dominated the oil refining market in 2024. Transportation fuels produced by oil refining include jet fuel, gasoline, and diesel fuel. Gasoline is the dominant transportation fuel in the United States. Transportation of oil refining is important because of the rapid development of worldwide industrialization; refined oil consumption is at a high level, and transportation of refined oil is huge. A high amount of crude oil and refined oil products are transported by ship between points of consumption, production sites, and refineries. These factors help to the growth of the transportation segment and contribute to the growth of the market.

The aviation segment is the fastest-growing during the forecast period. Aviation fuel, also called kerosene or jet fuel from the German Kerosin, is used to power aircraft jet engines. Also called Avtur or aviation turbine fuel, which is a highly refined paraffin. The lubrication system of aircraft deals with clearing, sealing, cooling, and fighting rust and corrosion in the engine. Airplanes need protection from corrosion and rust, which can be provided by using good aviation oils. These factors help to the growth of the aviation segment and contribute to the growth of the oil refining market.

- In September 2022, indigenous production of aviation fuel AVGAS 100 LL was launched by the Indian Oil Corporation (IOC) to reduce dependence on imports and to meet energy needs.

- In April 2024, for businesses to reduce their aviation emissions with sustainable aviation fuel (SAF) for unmanned aerial vehicles and piston engine aircraft, Neste Impact Solution was launched by the Neste Corporation.

Regional Insights

What is the Asia Pacific Oil Refining Market Size?

The Asia Pacific oil refining market size was exhibited at USD 709.48 billion in 2025 and is projected to be worth around USD 1,096.56 billion by 2035, poised to grow at a CAGR of 4.45% from 2026 to 2035.

Asia Pacific dominated the oil refining market in 2024. Aviation oils can help to reduce wear and friction in an aviation engine. Rapid urbanization, industrialization, and economic growth play an important role in the growth of the market in the Asia Pacific region. China is the leading country for the growth of the market in the Asia Pacific region.

Asia Pacific is dominating the oil refining market. The region meets the origin factor with the developed background of oil refining industries. The valuable investment from China has leveraged the market in the region. Access to crude oil is a major reason for the growth of this market.

- In October 2023, a subsidiary of Oil India, India's NRL (Numaligarh Refinery Ltd.), planned to start production of ethanol at its biorefinery in the northeastern state of Assam from March, said Bhasker Phukan, the company's managing director.

- In January 2024, two new auctions for subsidies to support the uptake of green hydrogen in ammonia production and oil refining were launched by India's Ministry of New and Renewable Energy.

- In February 2024, in Weifang, Shandong Province, China, the world's largest white oil hydro-processing unit for Hongrun Petrochemical Co., Ltd. was launched by Chevron Lummus Global LLC (CLG). White oil is a highly refined mineral oil that is used in a broad range of applications, including industrial lubricants, food processing, cosmetics, and pharmaceuticals.

China Oil Refining Market Trends

China's refining sector is undergoing a massive structural pivot from simple fuel production toward high-value petrochemical feedstocks and green operations. The industry is currently consolidating to eliminate overcapacity while aggressively integrating AI and carbon capture technologies to meet net-zero targets and improve efficiency.

North America is estimated to be significantly growing during the forecast period of 2024-2034. In North America, there are 149 active oil refineries, which help the oil refining market grow. The United States refines nearly one-fifth of worldwide crude oil, which is considered 18.1 billion barrels per day. Marathon Petroleum Corporation is the leading oil refiner company in the United States.

U.S. Oil Refining Market Trends

U.S.'s digitalization and AI to optimize operations and improve efficiency while maintaining strong output of traditional fuels like gasoline and jet fuel. Refiners are focused on strategic modernization, diversifying their crude inputs to process heavier, sour grades and enhance flexibility amidst geopolitical shifts.

How did Europe experience notable growth in the Oil Refining Market?

Europe's rapid industrialization and strong economic expansion have led to a high demand for gasoline, diesel, and fuel oil necessary for growing mobility and industry. This growth was further bolstered by the strategic discovery and exploitation of domestic resources in the North Sea, which enhanced the region's energy self-sufficiency.

Germany Oil Refining Market Trends

Germany's shift toward electric vehicles and renewable energy weakens long-term demand for traditional oil products. This environment is driving market consolidation and increasing competition from discount retailers, which continues to tighten margins for established players.

Oil Refining Market Companies

- Reliance Industries Limited: The company operates the world's largest single-location refining complex in Jamnagar, India, giving it massive scale and the ability to process a wide variety of crude oils into high-value products.

- BP PLC.: BP operates major refineries, such as the Whiting and Cherry Point facilities in the US, that supply large regional markets with transportation fuels like gasoline, diesel, and jet fuel.

- China National Petroleum Corporation(CNPC): As a state-owned enterprise, CNPC is China's largest oil and gas producer and supplier, operating numerous large-scale refining bases to meet the nation's burgeoning energy demands.

- ExxonMobil Corporation: ExxonMobil is one of the world's largest refiners, with a global network of refineries that are often integrated with chemical plants to efficiently produce a wide range of fuels, lubricants, and chemical feedstocks.

- Bharat Petroleum Corporation Limited (BPCL): BPCL is one of India's major state-owned refining and marketing companies, contributing significantly to the country's energy security through its extensive refining capacity and vast network of fuel retail outlets.

Other Major Key Players

- PJSC LUKOIL COMPANY

- Petroleos De Venezuela

- Hindustan Petroleum Corporation Limited

- Chevron Corporation

- Marathon Petroleum Corporation

- Indian Oil Corporation Limited

- Royal Dutch Shell Plc.

Recent Developments

- In May 2025, the government of Mozambique entered into two strategic agreements that, if finalized, would result in the construction of the country's first crude oil refinery, as well as a grassroots pipeline for the delivery of petroleum-based products from the southeast African coastal republic to neighbouring Zambia. Source: ogj.com

- In April 2025, Middle East oil refineries added 618,000 b/d of production capacity by 2029, transforming the region into a net exporter equal to about 6 million b/d by 2030 and approaching 7 million b/d by 2040. Source: spglobal.com

- In February 2025, Senegal launched oil refining with 90,000 tons produced. The Société Africaine de Raffinage (SAR) announced that it has processed domestic extraction. The launch is a huge contribution to the regional oil refining market. Source: energynews.pro

- In October 2023, an investment plan for Indian Oil NTPC Green Energy Pvt Ltd. to set up renewable energy-based power plants designed to meet RTC (round-the-clock) power requirements of IOC's refineries in India was authorized by Indian Oil.

- In May 2024, the world's first AI-driven autonomous operation of crude oil processing unit was launched by Preferred Networks, Inc. (PFN) and ENEOS Corporation (ENEOS).

- In July 2024, in Makran Coasts, southeastern Iran, the opening of the country's fifth research and technology center for petrochemical industries was announced by the head of Iran's NPC (National Petrochemical Company) Morteza Shahmirzaei. It helps to upgrade the oil qualification units at oil refineries.

Segments Covered in the Report

By Product

- Fuel Oil

- Light Distillates

- Middle Distillates

- Others

By Fuel

- Gasoline

- Kerosine

- Liquified Petroleum Gas (LPG)

- Gasoil

- Others

By Complexity

- Hydro-skimming

- Topping

- Conversion

- Deep Conversion

By Application

- Marine Bunker

- Transportation

- Aviation

- Petrochemical

- Agriculture

- Electricity

- Residential & Commercial

- Rail & domestic waterways

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting