What is the Omics Technologies Market Size?

The global omics technologies market is growing rapidly as genomics, proteomics, metabolomics, and transcriptomics advance precision medicine, biomarker discovery, and disease research.The market is poised for significant growth, driven by advancements in genomics, proteomics, and metabolomics, enabling deeper insights into biological systems and personalized medicine.

Market Highlights

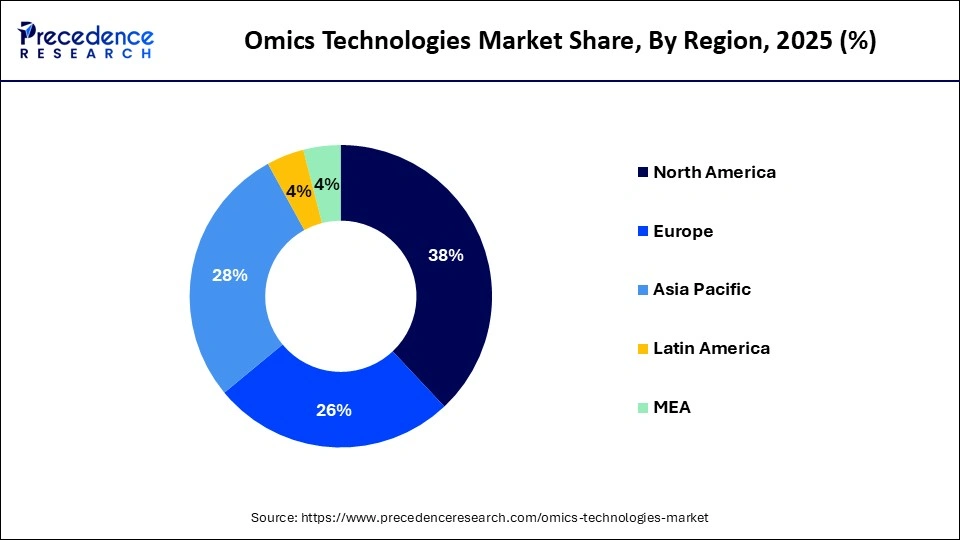

- North America dominated the market, holding more than 38% of market share in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

- By product type, the sequencing platforms segment led the market while holding the biggest market share of 34% in 2025.

- By product type, the mass spectrometry systems segment is expanding at a notable CAGR between 2026 and 2035.

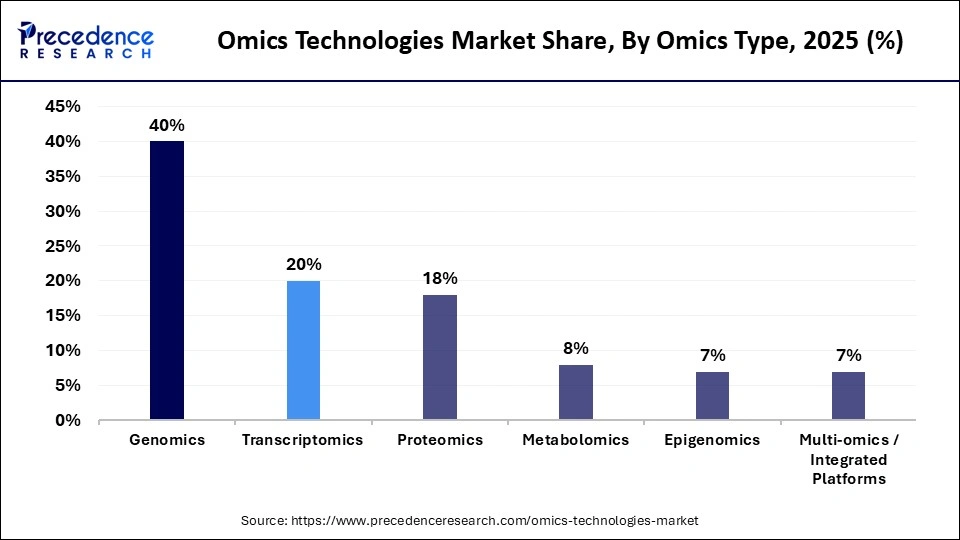

- By omics type, the genomics segment contributed the major market share of 40% in 2025.

- By omics type, the transcriptomics segment is growing at the fastest CAGR from 2026 to 2035.

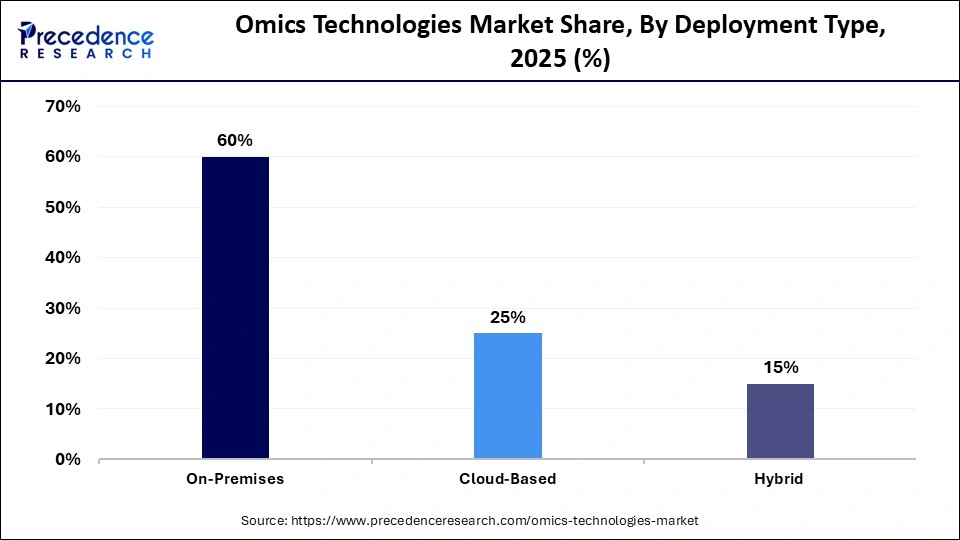

- By deployment type, the on-premises segment held the highest market share of 60% in 2025.

- By deployment type, the cloud-based segment is poised to grow at the fastest CAGR from 2026 to 2035.

- By application, the drug discovery and development segment accounted for the biggest market share 30% in 2025

- By application, the clinical diagnostics and precision medicine segment is expected to grow at a significant CAGR from 2026 to 2035.

- By technology / mode of action, the next-generation sequencing segment captured the highest market share of 45% in 2025.

- By technology / mode of action, the mass spectrometry-based technologies segment is expanding at a significant CAGR from 2026 to 2035.

- By end-user, the academic & research institutes segment held the biggest market share of 35% in 2025.

- By end-user, the pharmaceutical & biotechnology companies segment is expected to expand at the highest CAGR from 2026 to 2035.

- By sample type, the tissue samples segment dominated the market with a 35% share in 2025.

What are Omics Technologies?

Omics technologies refer to a set of advanced scientific methods used to analyze and interpret large-scale biological data across various domains, such as genomics, proteomics, metabolomics, and transcriptomics. These technologies enable researchers to study the entire set of genes (genomics), proteins (proteomics), metabolites (metabolomics), or RNA molecules (transcriptomics) in a biological sample, providing comprehensive insights into cellular processes, disease mechanisms, and the development of personalized medicine.

The omics technologies market encompasses a broad suite of advanced biological analysis tools used to study the structure, function, and dynamics of biological molecules at a systems-wide level. It includes genomics, transcriptomics, proteomics, metabolomics, epigenomics, and related high-throughput platforms that collectively enable comprehensive profiling of genes, RNA, proteins, metabolites, and regulatory mechanisms. These technologies leverage sequencing systems, mass spectrometry, microarrays, bioinformatics platforms, and computational models to decode complex biological processes, support precision medicine, accelerate drug discovery, and enable personalized therapeutic strategies. The market is driven by advancements in high-throughput instruments, falling sequencing costs, expanding clinical applications, and increasing integration of multi-omics data for research, diagnostics, and therapeutic development.

Key Technological Shifts in the Omics Technologies Market

The omics technologies market is evolving due to the combination of high-throughput platforms, automation, and AI-driven analytics. New sequencing technologies, such as single-cell profiling and spatial omics, are transforming our understanding of biological complexity by providing ultra-high-resolution insights into cells, tissues, and molecular networks. The fifth pillar of multi-omics integration, comprising genomics, proteomics, metabolomics, transcriptomics, and epigenomics, driven by cloud computing and machine-learning algorithms capable of analyzing large, multidimensional datasets in real time, becomes a fundamental concept for the future of biology.

The next generation of experiments is enabled by fluidic technologies, nanopores, and lab-on-chips, which are lowering costs, making devices portable, and reducing turnaround times. This allows omics workflows to be performed at POC and NPE. Simultaneously, CRISPR-based readouts, synthetic biology toolkits, and digital bioinformatics pipelines are seamlessly connecting data generation with biological interpretation. Together, they are rapidly advancing the omics field from isolated experimental silos toward unified, automated, and predictive platforms at the heart of precision medicine and next-generation therapeutic discovery.

Key Trends in the Omics Technologies Market

- Integration of Multi-Omics Approaches: There is a growing trend toward combining data from various omics layers such as genomics, proteomics, transcriptomics, and metabolomics. This integration provides a more comprehensive understanding of biological systems and diseases, enhancing insights for precision medicine.

- Advancements in AI and Machine Learning: The application of artificial intelligence and machine learning algorithms is revolutionizing data analysis in the omics field. These technologies enable the real-time interpretation of large, complex datasets, facilitating faster and more accurate biological insights.

- Shift Toward Point-of-Care Testing: There is an increasing demand for portable, cost-effective devices that perform omics analyses at point-of-care (POC) and near-patient environments (NPE). Innovations in fluidic technologies and lab-on-chip systems are making this possible.

- Focus on Single-Cell and Spatial Omics: Technologies that allow single-cell profiling and spatial omics are gaining traction. These technologies provide detailed resolution of cellular and tissue heterogeneity, thereby enhancing understanding of complex biological systems.

- Cloud Computing for Data Management: The use of cloud-based solutions for data storage and analysis is on the rise. This trend supports the management of vast amounts of data generated by omics technologies and allows for collaborative research across different geographies.

Omics Technologies Market Outlook

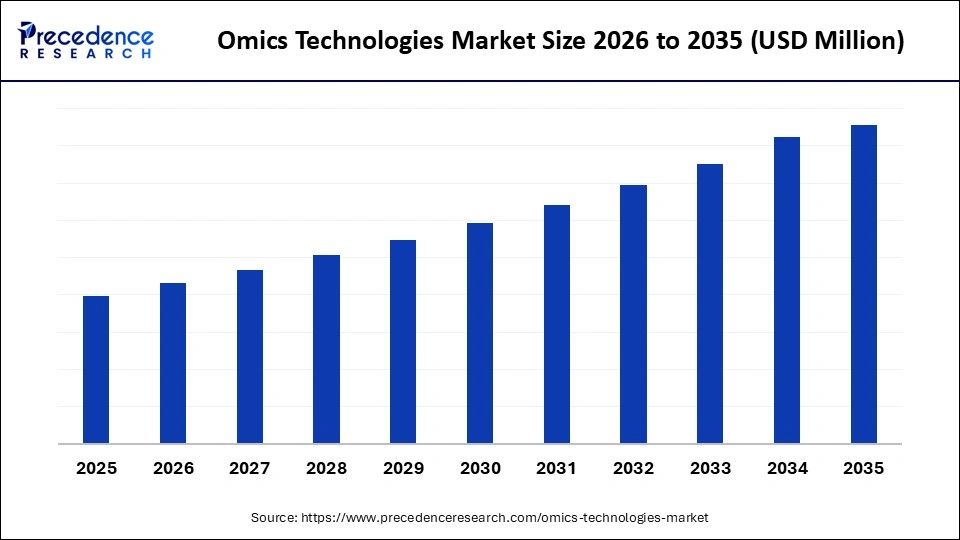

The omics technologies market is expected to expand rapidly from 2026 to 2035, driven by increasing demand for personalized medicine, advancements in high-throughput sequencing, and growing investments in biotechnology research. Rising adoption of precision medicine, technological innovations, and the need for comprehensive biological data to understand complex diseases and treatment responses also drive market growth.

The market is growing worldwide due to the increasing demand for personalized medicine, advancements in genomics, and the need for comprehensive biological insights to better understand diseases. Emerging regions, particularly Asia-Pacific and Latin America, present significant opportunities driven by expanding healthcare infrastructures, rising investments in biotechnology, and a growing focus on precision medicine and disease prevention.

Major investors in the market include venture capital firms, private equity groups, and large pharmaceutical companies like Sequoia Capital, Bertelsmann Investments, and Roche Ventures, who provide funding for innovation and expansion. They also support startups and established companies in developing advanced technologies, accelerating the commercialization of omics platforms, and driving research and development in personalized medicine, genomics, and drug discovery.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Omics Type, Deployment Type, Application, Technology/Mode of Action, End-User, Sample Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Omics Technologies Market Segment Insights

Product Type Insights

The sequencing platforms segment dominated the market by holding a 34% share in 2025 due to their unparalleled ability to generate vast amounts of genetic data essential for research, diagnostics, and therapeutic design. Labs rely heavily on sequencing platforms to produce high-quality, detailed biological insights. The continuous demand for faster, more accurate, and cost-effective sequencing, along with their compatibility with various omics fields such as genomics and metagenomics, ensures their continued dominance as the backbone of modern molecular science.

The mass spectrometry systems segment is expected to grow at the fastest rate over the forecast period, driven by widespread applications in proteomics, metabolomics, and complex molecular profiling. The main strength of mass spectrometry in unveiling and even quantifying large numbers of biomolecules makes it essential for high-resolution biological exploration. Scientists are increasingly using mass spectrometry systems to reveal very subtle molecular changes that are not detectable by sequencing alone. Additionally, advancements in sensitivity, miniaturization, and data analytics are making mass spectrometry the cornerstone of next-generation biological discovery.

Omics Type Insights

The genomics segment dominated the market by holding a 40% share in 2025, driven by its foundational role in understanding biological identity and its pivotal applications in disease prediction, personalized medicine, and biomarker development. Genomic sequencing is so scalable that it is well-suited for large population studies and clinical implementation. Labs continue to invest in genomics as a priority because it is mature, reliable, and clinically relevant. With the progress of precision medicine, genomics is becoming even more strategically important. Such a continuous drive has made genomics the top among the different omics for so long.

The transcriptomics segment is expected to grow at the fastest rate in the upcoming period because it offers an immediate understanding of gene behavior in various situations. Scientists highly value it for its ability to monitor highly dynamic changes in RNA expression, which is crucial for understanding disease mechanisms. The rapid increase in its use is largely driven by the popularity of single-cell and spatial transcriptomics. This technology is ideal for detailed studies of tissue heterogeneity, developmental stages, and treatment effects. The expanding applications of this technology in cancer, immunology, and regenerative medicine are further fueling demand.

Deployment Type Insights

The on-premises segment led the market with a 60% share in 2025, driven by the need for secure data management, workflow customization, and compliance with privacy regulations. Sensitive omics datasets are usually not allowed to be transferred to external servers, which makes local hosting a must. Research institutions prefer on-premise systems as they offer high levels of control, integration with existing laboratory hardware, and access to powerful computing resources for complex analyses, ensuring optimal privacy and operational stability, despite their higher cost.

The cloud-based segment is expected to expand at the fastest rate in the coming years due to its ability to overcome the limitations of local storage and provide easy access to large, complex omics datasets. Cloud platforms enable real-time collaborative analytics, allowing scientists across different locations to work together on the same project, significantly improving research efficiency. Additionally, the pay-as-you-go pricing model makes high-level computational power more affordable, making it accessible for a wider range of research institutions. With the increasing adoption of AI-driven analytics platforms and the ongoing digital transformation of labs, cloud-based services are becoming the preferred solution for labs seeking scalability, flexibility, and future readiness.

Application Insight

The drug discovery & development segment dominated the market by holding a 30% share in 2025. This is because omics technologies significantly accelerate the identification of targets and the design of drugs. The combination of genomics, proteomics, and metabolomics enables researchers to understand disease pathways far more clearly and quickly than before. Pharmaceutical companies use these insights to make their R&D pipelines more efficient and reduce attrition rates. Adoption of multi-omics profiling is leading the way in understanding drug efficacy, toxicity, and patient stratification. As innovation cycles shorten, the value of omics-enabled drug development grows even higher.

The clinical diagnostics & precision medicine segment is expected to grow at the fastest CAGR during the forecast period as omics technologies enable early, accurate detection of cancer, metabolic disorders, and rare genetic diseases. Molecular tests for personalized treatment planning are rapidly being adopted in hospitals and diagnostic labs. Integration into clinics is accelerating because costs are decreasing and doctors are becoming more familiar with genomics and multi-omics tools. The shift toward preventive healthcare further supports segmental growth.

Technology/Mode of Action Insights

The next-generation sequencing segment dominated the market with a 45% share in 2025, owing to its unmatched depth, speed, and scalability in decoding complex biological systems. NGS is central to innovations in genomics, transcriptomics, microbiome research, and large-scale population studies, with its ability to parallelize DNA fragment sequencing drastically reducing both time and costs. The continued advancements in paired-end reads, long-read formats, and single-cell workflows keep NGS at the forefront of omics applications. As the go-to technology for high-accuracy and reproducible data, NGS remains the backbone of both research and clinical workflows.

The mass spectrometry-based technologies segment is expected to grow at the fastest rate in the upcoming period, driven by the increasing demand for comprehensive molecular profiling that goes beyond genetic sequences. These technologies excel at measuring proteins, metabolites, lipids, and molecular signatures, which are key to understanding ongoing biological processes. The shift toward proteomics and metabolomics has spurred greater reliance on mass spectrometry, with advancements in automation, sensitivity, and data-rich workflows accelerating their adoption. The integration of AI-enabled analytics is further enhancing the ability of mass spectrometry-based technologies to interpret biological complexity, contributing to segmental growth.

End-User Insights

The academic & research institutes segment held a 35% share of the omics technologies market in 2025, as they serve as the primary source of initial biological discoveries. These organizations initiate large-scale studies, pilot projects, and exploratory research that heavily rely on multi-omics technologies. They also feature interdisciplinary teams that combine genetics, biotechnology, computational biology, and clinical science within a single laboratory. Their long-term grants and government-backed funding provide the financial flexibility to invest in high-end technologies without commercial pressures. Additionally, the large volume of experiments conducted in these institutions creates a strong demand for advanced omics tools and workflows, positioning academic and research institutes as key leaders in the adoption of omics technologies.

The pharmaceutical & biotechnology companies segment is expected to grow at the fastest CAGR over the forecast period because genomics, proteomics, and metabolomics are increasingly being used to identify drug targets and understand the mechanisms behind treatments. The shift toward precision medicine drives the adoption of advanced molecular profiling tools. Industry labs, unlike academic centers, can quickly scale and invest heavily in technology if they see a clear return on investment. The need to accelerate clinical pipelines makes ongoing investments in advanced omics platforms essential. As a result, pharmaceutical and biotech companies are becoming the most significant drivers of market growth.

Sample Type Insights

The tissue samples segment led the market, holding a 35% share in 2025, owing to the rich, detailed, and contextually accurate molecular data it provides, enabling in-depth disease analysis at its source. These samples are crucial for omics studies in fields like cancer, neurology, and pathology, as they help identify cell-to-cell differences and spatial aspects that blood samples alone cannot reveal. Advanced techniques like single-cell sequencing and spatial omics are specifically tailored for tissue analysis, making them essential for understanding complex biological processes. Clinical research institutions also heavily rely on tissue samples for biomarker validation and therapeutic response studies, further driving demand.

The blood/plasma/serum segment is expected to expand at the fastest rate over the projection period, owing to its ability to quickly and easily capture circulating DNA, RNA, proteins, and metabolic signatures. As advancements in liquid biopsy technologies occur, blood-based omics is becoming increasingly reliable for the early detection and monitoring of diseases. The ease of collection facilitates extensive cohort studies and regular sampling, both of which are challenging with tissue biopsies. The emergence of early diagnostic methods and ongoing monitoring of chronic conditions has broadened their clinical applications.

Omics Technologies Market Regional Insights

North America dominated the omics technologies market, holding a 38% share in 2025. This is due to the strong collaboration between universities, biotech startups, and major pharmaceutical companies, creating a seamless pipeline from scientific discovery to market-ready products. Continued funding for genomics, proteomics, and multi-omics integration provides researchers with access to cutting-edge tools and platforms, while the region's leadership is further supported by innovative sequencing technologies, robust clinical networks, and expanding precision medicine initiatives. The rise of cloud-based analytical ecosystems is also simplifying complex data operations, cementing North America's position as a leader in technological advancement, regulatory developments, and translational research in the omics field.

The U.S. remains the driving force behind omics innovations, combining high-volume R&D with rapid innovation cycles to lead in areas such as single-cell omics, spatial biology, and AI-driven multi-omics integration. The country's robust biotech ecosystem, bolstered by first-class federal and private funding, ensures the ongoing expansion of research pipelines, while collaborations among universities, tech companies, and pharma accelerate the development of real-world applications. The U.S. is also a leader in developing bioinformatics tools that simplify biological interpretation and are scalable for mass production. With a strong focus on precision medicine for cancer, rare diseases, and metabolic disorders, the U.S. remains the largest contributor to the North American market.

Asia Pacific is expected to grow at the fastest rate in the market, driven by significant capital inflows into the biotech sector, rapid development of lab infrastructure, and growing demand for personalized healthcare. Countries in the region are modernizing their research ecosystems to keep pace with global innovations, accelerating the use of genomics, proteomics, and metabolomics as the shift toward preventive and molecular diagnostics takes hold. Native biotech companies are gaining momentum, fostering a dynamic environment for multi-omics research collaborations, while government-supported initiatives make sequencing and digital-first research workflows more affordable and accessible.

China Omics Technologies Market Analysis

China is leading the omics technologies market in Asia Pacific. The country has invested heavily in advanced sequencing platforms and translational genomics. The country has fostered a robust ecosystem with top-tier research institutes, industrial biotech parks, and large-scale manufacturing hubs focused on molecular technologies, while local innovators are increasingly developing home-grown omics tools, reducing reliance on foreign suppliers. China is also accelerating the integration of omics into clinical pathways, particularly in oncology, infectious diseases, and reproductive health, with large-scale genome projects paving the way for population-scale genomics and AI-powered diagnostics. With this rapid progress, China is poised to shape the future of the global market.

Europe is expected to experience notable growth in the market for several reasons. Firstly, Europe has a robust network of research institutions and universities that emphasize life sciences and biotechnology. Secondly, the presence of numerous academic and research institutes fosters innovation and development in omics technologies. Thirdly, European governments and the European Union actively support research and development in omics technologies through various funding programs. Finally, initiatives such as Horizon Europe encourage collaborative research projects that advance the field.

The European biotechnology sector is attracting significant investments from both public and private sources. This funding frequently supports omics research, enabling the development of advanced technologies and applications. Europe is increasingly focusing on precision medicine and personalized healthcare, which align well with the capabilities of omics technologies. Countries like Germany, France, and the UK are at the forefront of initiatives that integrate genomic and other omics data into clinical practice. The collaborative projects and networks formed among European nations improve knowledge sharing and resource use.

Germany Omics Technologies Market Analysis

Germany is a leader in bioinformatics and genomics research, driving advancements in omics through significant funding and technological innovation, while its strong industrial base supports the integration of omics into healthcare applications. The country is home to prominent research institutes, which fuel omics studies. Supportive regulatory frameworks and a strong focus on health and precision medicine also support market growth in Germany.

Omics Technologies MarketValue Chain

The R&D stage focuses on developing advanced omics technologies, including high-throughput sequencing platforms, bioinformatics tools, and molecular profiling systems.

Key Players: Illumina, Thermo Fisher Scientific, Qiagen, and Agilent Technologies.

This stage involves the design and production of the physical instruments and components used in omics studies, such as sequencers, mass spectrometers, microarrays, and chromatography systems.

Key Players: PerkinElmer, Agilent Technologies, and Bio-Rad Laboratories.

This stage involves the collection and initial processing of biological data, including genomic sequences, protein profiles, or metabolite concentrations.

Key Players: Bertelsmann Stiftung, Illumina, and Thermo Fisher Scientific.

Top Companies in the Omics Technologies Market and Their Offerings

- QIAGEN

- PerkinElmer

- Bio-Rad Laboratories

- Bruker Corporation

- Waters Corporation

- Roche Diagnostics

- Pacific Biosciences (PacBio)

- Oxford Nanopore Technologies

- Shimadzu Corporation

- Eurofins Scientific

- Tecan Group

- Charles River Laboratories

- GenScript Biotech

- Sartorius AG

- Merck KGaA (MilliporeSigma)

Recent Developments

- In February 2025, Illumina unveiled a comprehensive portfolio of omics solutions, including innovations in genomics, spatial transcriptomics, single-cell analysis, CRISPR, epigenetics, and data analytics software. Built on Illumina's powerful sequencers, these solutions offer unmatched scale, accuracy, and reliability, enabling researchers to gain breakthrough insights into disease drivers. The expanded multiomics portfolio was presented at the AGBT General Meeting.(Source: https://www.prnewswire.com)

- In January 2025, Enhanc3D Genomics launched a suite of integrated multi-omics solutions to enhance drug discovery precision. Built on the company's proprietary 3D genomics platform, these offerings provide an end-to-end solution, supporting decision-making throughout the drug discovery and development process.(Source: https://www.news-medical.net)

Omics Technologies Market Segments Covered in the Report

By Product Type

- Sequencing Platforms (NGS & Long-read)

- Short-read sequencers

- Long-read sequencers

- Mass Spectrometry Systems

- LC-MS/MS systems

- MALDI-TOF systems

- Bioinformatics & Data Analysis Software

- Cloud analytics platforms

- Local bioinformatics suites

- Sample Preparation Kits & Consumables

- Library prep kits

- Extraction kits

- Microarrays & Hybridization Platforms

- Gene expression arrays

- SNP arrays

- Reagents & Ancillaries

- Enzymes, buffers, controls

By Omics Type

- Genomics

- Transcriptomic

- Proteomic

- Metabolomics

- Epigenomics

- Multi-omics/Integrated Platforms

By Deployment Type

- On-Premises

- Cloud-Based

- Hybrid (On-Premises + Cloud)

By Application

- Drug Discovery & Development

- Clinical Diagnostics & Precision Medicine

- Biomarker Discovery & Validation

- Basic & Translational Research

- Agricultural/Environmental Omics

- Other Applications

By Technology/Mode of Action

- Next-generation Sequencing (NGS)

- Mass Spectrometry-based Technologies

- Single cell & Spatial Omics Technologies

- Microarray Technologies

- Bioinformatics/AI-driven Analytics

- Other Emerging Technologies

By End-User

- Academic & Research Institute

- Pharmaceutical & Biotechnology Companies

- Clinical Laboratories & Hospitals

- Contract Research Organizations (CROs)

- Agricultural/Environmental Labs

- Other End-Users

By Sample Type

- Tissue Samples (incl. FFPE)

- Blood/Plasma/Serum

- Single Cells

- Microbial/Environmental Samples

- FFPE (explicit)

- Other Sample Types

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content