What is the Oncolytic Virus Therapy Market Size?

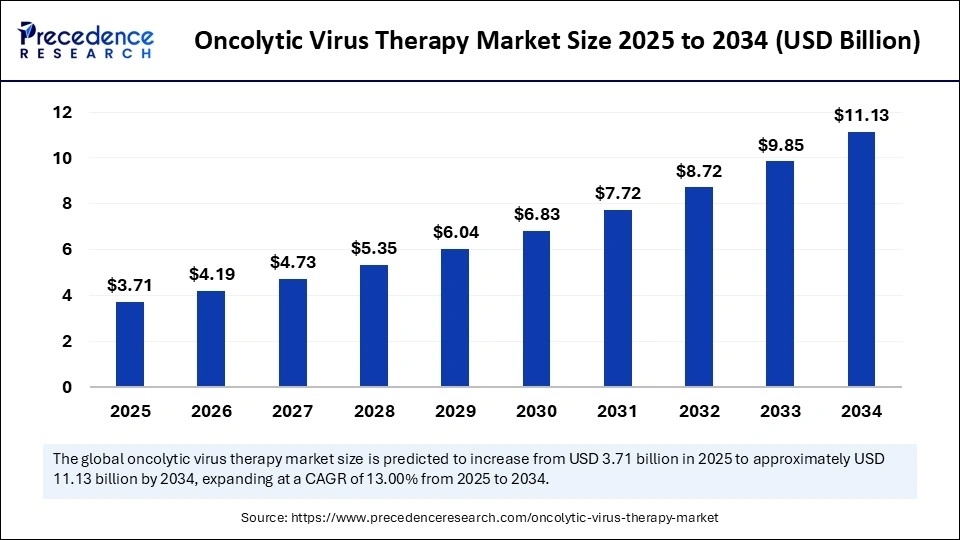

The global oncolytic virus therapy market size accounted for USD 3.71 billion in 2025 and is predicted to increase from USD 4.19 billion in 2025 to approximately USD 11.13 billion by 2034, expanding at a CAGR of 13.00% from 2025 to 2034. The oncolytic virus therapy market is witnessing steady growth, driven by rising cancer prevalence, increased clinical trials, and growing adoption of innovative viral-based treatments worldwide.

Market Highlights

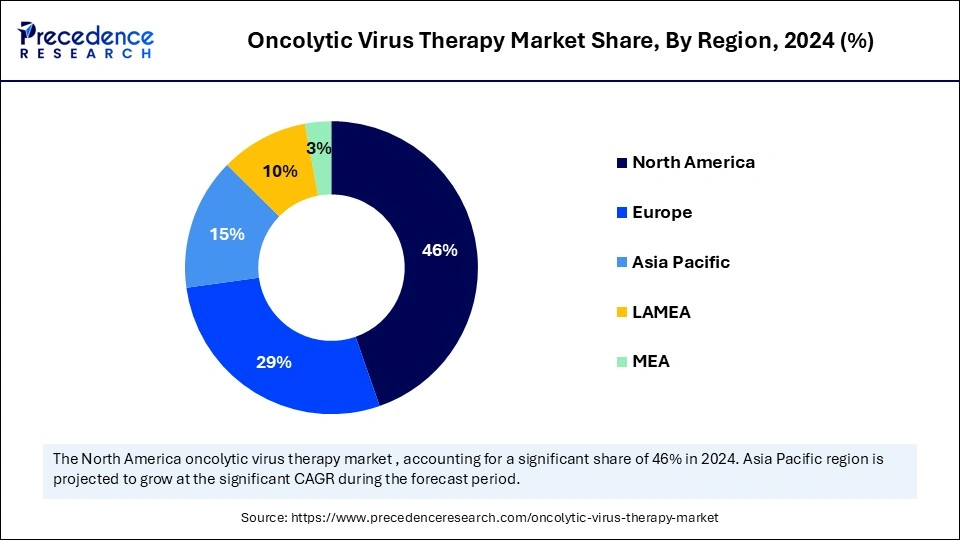

- North America led the market with largest market share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR in the market between 2025 and 2034.

- By virus type, the adenovirus segment held the largest market share in 2024.

- By virus type, the vaccinia virus segment is anticipated to grow at the fastest CAGR between 2025 and 2034.

- By modification / engineering, the genetically engineered segment captured the biggest market share in 2024.

- By modification / engineering, the retargeted / tumor-selective tropism engineering segment is expected to expand at a notable CAGR over the projected period.

- By mechanism of action, the direct oncolysis segment captured the highest market share in 2024.

- By mechanism of action, the virotherapy-mediated gene delivery segment is expected to expand at the highest CAGR over the projection period.

- By indication / cancer type, the melanoma segment held the largest market share in 2024.

- By indication / cancer type, the lung cancer (NSCLC, SCLC) segment is expected to expand at a notable CAGR over the projected period.

- By end-user, the small & mid-sized biotech companies / startups segment led the market in 2024.

What are the Major Factors Behind the Growth of the Market?

The oncolytic virus therapy market is experiencing rapid growth due to the rising prevalence of cancer and increased demand for targeted therapies. Oncolytic virus therapies utilize genetically modified viruses to preferentially infect and kill cancer cells, while enhancing anti-tumor immunity. The oncolytic virus therapy market encompasses the research, development, and commercialization of oncolytic viruses for the treatment of various high-morbidity cancers, including melanoma, glioblastoma, and solid tumors.

The expansion of clinical trials, supportive regulatory approvals, and advances in viral engineering are expanding therapeutic options. Growing collaborations between biotechnology companies and academic institutions further augment innovation in oncolytic virus therapies, making it a promising and rapidly evolving segment of the oncology treatment market.

How is Artificial Intelligence Impacting the Oncolytic Virus Therapy Market?

Artificial Intelligence is revolutionizing the oncolytic virus therapy landscape by enhancing various facets of research, development, and commercialization. AI-driven computational models accelerate the identification and engineering of novel oncolytic viruses with optimized tumor-targeting capabilities and reduced off-target effects. Machine learning algorithms analyze vast biomedical datasets to uncover novel biomarkers, enabling more precise patient stratification and personalized treatment regimens.

Artificial intelligence (AI) is emerging as an exciting new approach to oncolytic virus therapy, unlocking precision design, accelerated therapy development, and enhanced safety profiling. AI is now being harnessed to model tumor–virus interactions, optimize viral payloads, and discover biomarkers for patient selection. For example, in 2025, Biotech Company Guska and AI company Marvik announced their collaboration to develop a generative AI platform for designing tumor-targeting viruses with higher selectivity and fewer side effects. (Source: https://www.entnerd.com)

Oncolytic Virus Therapy Market Outlook

- Overview of Industry Growth: The market is set for accelerated growth from 2025 through 2034, driven primarily by an increase in clinical trial activity. A substantial number of sponsored clinical trials focusing on oncolytic viruses, as documented in ClinicalTrials.gov, reflect not only a broader and more diverse pipeline of indications but also sustained research and development (R&D) investment. This strategic diversification across development phases effectively mitigates risk, creating a favorable environment for robust deal flow and expanded licensing opportunities.

- Global Expansion: Although regulatory approvals remain limited, Imlygic/T-VEC being the sole FDA-approved oncolytic therapy, multinational trials and cross-border collaborations are expanding geographic trial coverage, indicating strong potential for late-stage global launches pending successful pivotal outcomes.

- Research and Development: Mechanistic advances (e.g., arming viruses to modify the tumor microenvironment and block TGF-β) and combination approaches with checkpoint inhibitors are shifting the clinical design toward durable systemic responses, increasing the scientific value of these assets.

- Key Investors: Investment is driven by biopharma companies, particularly in conjunction with public sector funding and academic/NIH-funded programs, creating a hybrid funding model that combines industry sponsorship, grants, and venture funding to accelerate translational activity.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.71 Billion |

| Market Size in 2026 | USD 3.71 Billion |

| Market Size by 2034 | USD 11.13 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Virus Type, Modification / Engineering, Mechanism of Action, Indication / Cancer Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Global Incidences of Cancer

The growing global burden of cancer is one of the most significant drivers for growth in oncolytic virus therapy. According to the World Health Organization (WHO), by 2050, more than 35 million people are expected to be diagnosed with cancer annually, a 77% increase from 20 million incidences in 2022. This growth is linked to aging populations and changing lifestyles.

As the burden of cancer rises, there is a need for new and effective treatment options. Oncolytic virus therapy has potential as a new and exciting way to mitigate the increasing burden of cancer. Oncolytic therapies utilize genetically modified viruses that preferentially infect and kill cancer cells. These therapies can precisely target tumors and activate the immune system, making them a significant step forward in cancer treatment.

Restraint

What Makes the Tumor Microenvironment a Major Barrier to Oncolytic Virus Therapy?

The tumor microenvironment (TME) is one of the greatest limiting factors of oncolytic virus therapy due to the physical and immunosuppressive barriers it presents. A dense extracellular matrix, hypoxia, and immunosuppressive cytokines such as TGF-β and IL-10 severely hinder viral entry, spread, and replication.

In a leading biotech news article, it was noted that the TME continues to limit the efficacy of advanced candidates, such as CLD-201 and pelareorep. In addition, a recent mathematical model suggested that hypoxic tumor zones reduced viral infectivity and that therapeutic spread was slowed by 30-50% in their simulations.

Opportunity

Could Combination Therapies Be the Key to the Next Major Advancement in Oncolytic Virus Therapy?

The oncolytic virus therapy market presents a significant opportunity in the realm of combination therapies, particularly in conjunction with immune checkpoint inhibitors. In recent years, clinical trials have started to demonstrate increasing patient responses when combining checkpoint inhibitors or other immunotherapy with a virus. For instance, in March 2025, Genelux's Olvi-Vec achieved a 71% disease control rate in patients with small-cell lung cancer, with one patient experiencing nearly 79% tumor reduction when given Olvi-Vec as part of the dose escalation co-horts.

Most other ongoing research in the U.S. and Europe provides clear evidence of the ability of these combinations to escape immune resistance or immune escape targeting cancer cells. The evidence is growing, and combinations stand out as a change agent in patients previously deemed untreatable with advanced-stage cancers.

Segment Insights

Virus Type Insights

Why Did the Adenovirus Segment Dominate the Market in 2024?

The adenovirus segment dominated the oncolytic virus therapy market with the largest share in 2024. This is mainly due to its proven safety and efficacy in clinical trials, its ease of genetic modification, and high levels of transduction efficiency across various cancer types. It has been a key component in approved therapies, such as Oncorine in China, making it the most widely used oncolytic virus platform for therapeutic development.

The vaccinia virus segment is expected to grow at the fastest rate in the coming years because of its larger genome capacity, which allows for the insertion of more therapeutic genes and its innate tumor selectivity. The available preclinical and early clinical data to date support its safety and immune activation, making it a reasonable option for developing next-generation oncolytic virotherapy programs.

Modification / Engineering Insights

How Does the Genetically Engineered Segment Lead the Market in 2024?

The genetically engineered segment led the oncolytic virus therapy market in 2024 due to its ability to precisely incorporate genes that boost the immune response, cytokines, and elements that target malignant tumor cells. In terms of safety, selectivity, and efficacy, genetically engineered constructs are superior to wild-type viruses. The flexibility of engineered viruses, particularly in ongoing clinical trials, represents the most logical platform for emphasizing engineered constructs as the best option for new virotherapies.

The retargeting / tumor-selective tropism engineering segment is likely to grow at the fastest CAGR over the forecast period. This is primarily due to its ability to target the virus's attack only at malignant cells, while causing minimal damage to normal tissues. This concept or methodology is truly cutting-edge, as it enhances combination precision while exacerbating side effects; hence, there has been increased investment in research, including next-generation platforms with greater selectivity and oncolytic virotherapy.

Mechanism of Action Insights

What Made Direct Oncolysis the Dominant Segment in the Market in 2024?

The direct oncolysis segment dominated the oncolytic virus therapy market in 2024. This is due to its demonstrated clinical efficacy, simplified mechanism of action, and favorable regulatory traction. Unlike genetically modified approaches, direct oncolytic viruses utilize innate tumor-selective replication and lytic activity, enabling faster translation from bench to bedside. This mechanism has been validated across numerous tumors in both models and clinical contexts, providing a reliable therapeutic avenue. Its established success continues to put it ahead of strategies employing oncolytic viruses.

The virotherapy-mediated gene delivery segment is likely to grow at the fastest rate in the coming years, driven by its dual therapeutic advantage, direct oncolysis coupled with targeted transgene expression. This mechanism converts oncolytic viruses into platforms for delivering therapeutic transgenes, such as cytokines and immune modulators. The simultaneous effect of destroying tumor cells, combined with immune receptor activation, makes this approach extremely appealing. As vector engineering ideal continues to improve, this mechanism will likely serve as a primary growth driver in virotehapy research and development.

Indication / Cancer Type Insights

Which Indication / Cancer Type Holds the Largest Share of the Market?

The melanoma segment held the largest share of the oncolytic virus therapy market in 2024, as it was the first malignancy to receive regulatory approval for oncolytic virus treatment with talimogene laherparepvec (T-VEC). Melanoma's high immunogenicity lends to greater responsiveness to virotherapy, which has resulted in more clinical studies of oncolytic virus therapies in melanoma, and therefore wider acceptance of oncolytic virus treatment into oncology treatment pathways.

The lung cancer segment is expected to grow at the fastest rate in the upcoming period, given the increasing global burden and pressing unmet need for therapies other than standard of care. Oncolytic viruses have shown promise in both non-small cell and small cell lung cancer indications, and ongoing trials are exploring combined approaches that could potentially alter immune responses and expand treatment options.

End-User Insights

Which End-User Leads the Market in 2024?

The small & mid-sized biotech companies / startups segment led the oncolytic virus therapy market in 2024, as these organizations conduct ground-breaking clinical trials and are leading the way to address informational gaps regarding the status of oncolytic viruses. These firms were at the forefront of advancing novel viral platforms, personalized transgene payloads, and combination strategies, often outpacing larger pharmaceutical companies in translational speed and scientific differentiation.

The large pharmaceutical companies / big biotech segment is expected to grow at the fastest rate over the projection period, driven by their late-stage clinical programs to augment their oncology pipelines. Their dominance was further reinforced by the ability to scale complex manufacturing, navigate regulatory pathways across multiple jurisdictions, and integrate oncolytic virus therapies into broader immuno-oncology portfolios.

Regional Insights

U.S. Oncolytic Virus Therapy Market Size and Growth 2025 to 2034

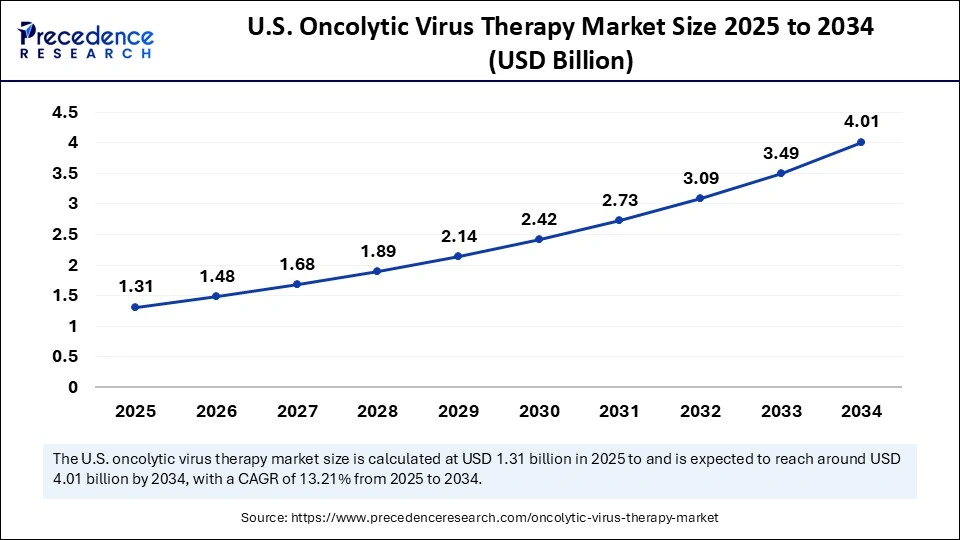

The U.S. oncolytic virus therapy market size is evaluated at USD 1.31 billion in 2025 and is projected to be worth around USD 4.01 billion by 2034, growing at a CAGR of 13.21% from 2025 to 2034.

What Made North America a Leader in the Oncolytic Virus Therapy Market?

North America registered dominance in the oncolytic virus therapy market by capturing the largest share in 2024. The region's dominance is attributed to several factors, including robust research infrastructure, substantial investments in biotechnology, and a favorable regulatory environment. In fact, the FDA granted Fast Track designations for therapies such as ImmVira's MVR-T3011 and Genelux's Olvi-Vec in March 2024, which demonstrates North America's commitment to fast-tracking groundbreaking therapies. The U.S. was the first to approve an oncolytic virus therapy, Talimogene laherparepvec (T-VEC), for melanoma as well.

The U.S. is the predominant force in North America and has contributed a substantial share of the oncolytic virus therapy market in North America. The U.S. became a leader due to its advanced healthcare system, leading research institutions, and collaboration between academia and industry. Additionally, the FDA took a major step in this direction by grant Fast-Track designations to the oncolytic virus therapies.

Why is Asia Pacific Considered the Fastest-Growing Market?

Asia Pacific is expected to experience the fastest growth during the forecast period, driven by a combination of increasing incidences of cancer and advancements in biotechnology. Important players in the region, such as China, Japan, and South Korea, are competing for supremacy, with China currently leading in the number of clinical trials. During the period from 2019 to 2024, the Asia Pacific has experienced remarkable growth in the number of clinical trials in oncolytic virus therapy, supported by the countries' ability to recruit and enroll patients effectively, as well as the size of the oncology patient population in these countries.

China has emerged as a significant player in the development of oncolytic virus therapy, accounting for a notable share of oncolytic virus therapy clinical trials in the region. The large patient population in China, government support, healthcare investments, and the development of a biomedical ecosystem in the country position China as a leader in the development and initiation of oncolytic virus therapies.

How is Europe Advancing in Oncolytic Virus Therapy?

Europe is rapidly emerging as a region for oncolytic virus therapy, facilitated by a robust biomedical research infrastructure, strong networks for conducting clinical trials, and permissive healthcare regulations. Increased government support for cancer immunotherapy, along with increasing collaborations between academia and biotechnology companies, is furthering innovation in viral oncology platforms. Europe is also well-positioned with a high emphasis on precision medicine and favorable reimbursement policies for advanced biologics.

United Kingdom Oncolytic Virus Therapy Market Trend

The United Kingdom is a standout country in Europe, owing to the strong life sciences ecosystem and early adoption of gene and viral therapy. Organizations such as Cancer Research UK and the University of Oxford are leading efforts in conducting studies utilizing engineered oncolytic viruses for the treatment of solid and hematologic tumors. The government is working to support these initiatives through initiatives such as the UK Life Sciences Vision, which intends to accelerate development in new biologics, including oncolytic immunotherapy.

Is the Middle East & Africa Rising in Viral Oncology?

The Middle East and Africa (MEA) region is starting to take off in the oncolytic virus therapy space due to healthcare modernization and the buildout of cancer treatment capability. Increasing epidemiologic awareness of precision oncology and better access to biologic-based therapies are driving regional interest in new immunotherapy platforms. The government sector in Gulf Cooperation Council (GCC) countries is making increased translational research and global partnerships to accelerate delivery of innovative approaches to oncology.

UAE Oncolytic Virus Therapy Market Trend

The United Arab Emirates (UAE) is leading the regional development of oncolytic virus therapy changes via a sustained degree of health care innovation a biotechnologically geared spending. Precision medicine programs in the UAE, like the UAE Genomics Council initiatives, support genomic and immunologic research that are important for viral oncology. Working with international biopharma, and world-famous cancer centers, UAE is increasing the access to clinical trials for new oncolytic agents.

Value Chain Analysis for Oncolytic Virus Therapy Market

- Discovery & Design

This includes rapid identification of virus-based backbone and genetic payloads with tumour-selective characteristics to maximize tumour killing and immune activation.

Key Players: Oncolytics Biotech, Replimune, PsiOxus, academic laboratories at MD Anderson, NIH, Cambridge University - Preclinical Testing (In Vitro / In Vivo)

In vitro assays and in vivo animal models will test safety, distribution, and efficacy prior to human trials.

Key Players: WuXi (preclinical CDMO services), academic preclinical groups (Memorial Sloan Kettering, Parker Institute), small biotech companies. - Clinical Development & CRO Support

Clinical Phase I-III will evaluate dosing, safety, and efficacy - often developed in collaboration with specialized oncology CRO partners.

Key Players: Oncolytics, Replimune, Bristol-Myers Squibb (collaborative), IQVIA, Parexel, PPD/Thermo Fisher. - GMP Manufacturing & Scale-up (CMO/CDMO)

Process development, viral bank, and GMP manufacturing, enable clinical supply and commercial scale manufacture.

Key Players: Catalent Biologics, Thermo Fisher / Patheon, WuXi AppTec (Advanced Therapies), others specialized CDMO's. - Regulatory Approval, Commercialization & Post-Market Surveillance

Documenting regulatory filings, pricing and market access, distribution, and long-term safety monitoring adequately brings therapies to the patient's bedside.

Key Players: FDA, EMA; Amgen (IMLYGIC commercial example), pharmaceutical partners and specialty distributors.

Major Players in the Oncolytic Virus Therapy Market

Tier I

These are large biopharma / biotech firms with existing approvals or advanced clinical programs, strong global footprint, and resources to generate meaningful revenue from oncolytic virus therapies.

- Amgen Inc. (with Imlygic / T VEC)

- Replimune Group Inc.

- Oncolytics Biotech Inc.

Cumulative contribution of this tier is estimated at ~ 45 50% of total market revenue.

Tier II

These are mid sized biotech / specialized firms with significant pipeline activity, often in late phase or advanced clinical trials, partly licensed technologies, increasing revenues but not yet matching the Tier I giants.

- Sorrento Therapeutics, Inc.

- PsiOxus Therapeutics Ltd.

- Transgene SA

- SillaJen, Inc.

Estimated combined share ~ 25 35%.

Tier III

These are smaller biotech or early stage firms, often preclinical or early clinical, with potentially high upside but relatively low present revenue.

- Lokon Pharma AB

- CG Oncology Inc.

- DNAtrix

- Targovax

Other smaller players / academic spin outs or firms focusing on earlier stage assets.

Recent Developments

- In May 2025, Tilt Biotherapeutics raised US$25.6 million in a series B to advance its experimental oncolytic adenovirus therapy into a Phase II trial for platinum-resistant ovarian cancer (PROC). It is designed to give in combination with T cell–based therapies such as tumour-infiltrating lymphocytes (TILs) or checkpoint inhibitors to boost their efficacy. (Source: https://firstwordpharma.com)

- In February 2025, UroGen Acquired a Next-Generation Investigational Oncolytic Virus (ICVB-1042) and Announces Multiple Strategic Research Collaboration. ICVB-1042 is an oncolytic virus engineered to selectively destroy cancer cells while retaining potency and trigger a robust immune response.

(Source: https://www.businesswire.com)

Segments Covered in the Report

By Virus Type

- Adenovirus

- Herpes Simplex Virus

- Vaccinia Virus

- Reovirus

- Measles Virus

- Newcastle Disease Virus (NDV)

- Vesicular Stomatitis Virus (VSV)

- Other engineered/native viral platforms

By Modification / Engineering

- Unmodified / Wild-type oncolytic viruses

- Genetically engineered

- Armed oncolytics

- Retargeted / tumor-selective tropism engineering

- Combination vectors

By Mechanism of Action

- Direct oncolysis

- Immunogenic cell death / immune stimulation

- Virotherapy-mediated gene delivery

- Combination multimodal mechanisms

By Indication / Cancer Type

- Melanoma

- Head & Neck Cancers

- Lung Cancer (NSCLC, SCLC)

- Colorectal Cancer

- Hepatocellular Carcinoma (HCC)

- Pancreatic Cancer

- Ovarian & Gynecological Cancers

- Hematological Malignancies

- Other solid tumors

By End-User

- Large pharmaceutical companies / Big biotech

- Small & mid-sized biotech companies / startups

- Contract research organizations (CROs) / CDMOs

- Academic & research institutes / hospitals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting