What is the Oncolytic Virus-Based Gene Therapy Market Size?

The global oncolytic virus-based gene therapy market is advancing as engineered viruses emerge as a powerful approach to target, infect, and kill tumor cells while stimulating immune response.The market is experiencing significant growth, primarily due to the rising incidence of cancer, the increasing demand for innovative cancer treatments, and the unique dual mechanism of action of the oncolytic virus that both destroys tumors and stimulastes the immune system. This growth is further accelerated by advancements in genetic engineering, viral vector technology, and the development of effective combination therapies, especially with immune checkpoint inhibitors.

Oncolytic Virus-Based Gene Therapy Market Key Takeaways

- North America dominated the market, capturing approximately 45% of the share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 15% from 2025 to 2034.

- By virus type, the herpes simplex virus (HSV) segment held the largest market share of 30%, in 2024.

- By virus type, the reovirus segment is expected to register the fastest CAGR of about 30% from 2025 to 2034.

- By delivery route, the intravenous segment dominated the market with around 40% share in 2024.

- By delivery route, the intratumoral segment is anticipated to grow at approximately 35% CAGR from 2025 to 2034.

- By cancer type, the melanoma segment led the market with a 25% share in 2024.

- By cancer type, the glioblastoma segment is expected to expand at a 28% CAGR from 2025 to 2034.

- By end-user, the pharmaceutical & biotechnology companies segment held the major market share of about 50% in 2024.

- By end-user, the academic & research institutes segment is expected to witness the fastest CAGR of around 20% during the foreseeable period.

What is Oncolytic Virus-Based Gene Therapy?

Oncolytic virus-based gene therapy is a type of cancer treatment that uses genetically modified viruses to selectively infect, replicate within, and destroy cancer cells while sparing healthy cells. The oncolytic virus-based gene therapy market focuses on the development and application of genetically engineered viruses to selectively infect and destroy cancer cells. These oncolytic viruses are designed to replicate within tumor cells, resulting in cell lysis and the release of tumor antigens, which stimulates the immune system to target residual cancer cells. This approach offers a dual mechanism of action, direct oncolysis and immune system activation, making it a promising avenue in cancer immunotherapy.

How Can AI Impact the Oncolytic Virus-Based Gene Therapy Market?

Artificial intelligence (AI) is revolutionizing the oncolytic virus-based gene therapy market by streamlining the design, optimization, and personalization of treatments. Instead of relying on lengthy traditional laboratory methods, AI utilizes large datasets to predict treatment outcomes, enhance viral vector efficacy, and develop more targeted therapies with improved safety profiles. By analyzing genomics and molecular data, AI can identify patterns and potential biomarkers, enabling more effective monitoring of treatment progress. This accelerates the development of new cancer treatments.

Researchers have developed an AI-powered computational model combining time-delayed Generalized Lotka-Volterra equations with advanced optimization algorithms to predict oncolytic viral therapy dynamics. This model aims to enhance personalized treatment regimens by identifying key biomarkers and optimizing therapeutic efficacy. (Source: https://arxiv.org)

Oncolytic Virus-Based Gene Therapy Market Outlook

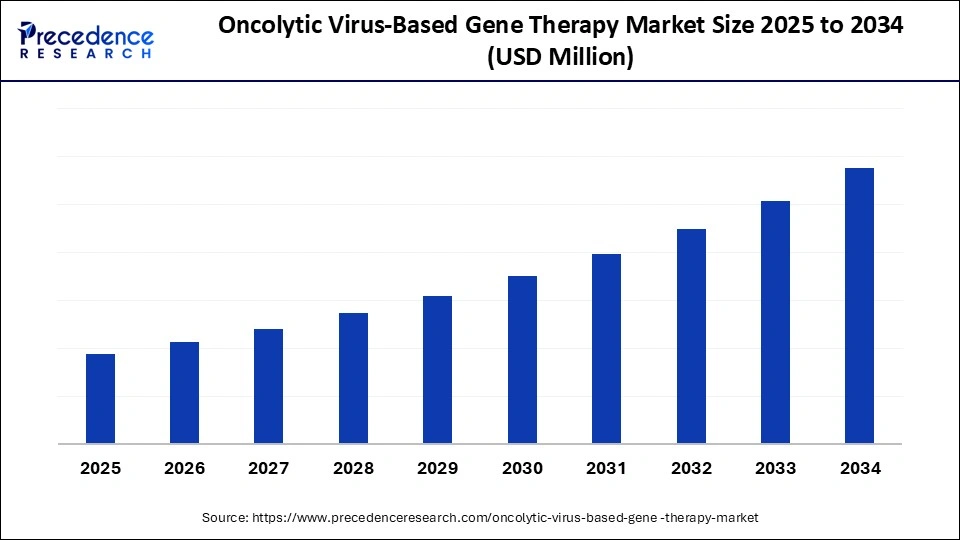

- Market Growth Overview: The market for oncolytic virus-based gene therapy is poised for significant growth between 2025 and 2034, driven by the rising global incidence of cancer, advancements in viral engineering, and the demand for more targeted and personalized cancer treatments for solid tumors and melanoma, aiming to enhance tumor-targeting and safety.

- Combination Therapy Trends: A significant trend in the market is the development and adoption of combination therapies, where oncolytic viruses are used in conjunction with other treatments, such as immune checkpoint inhibitors (ICIs), chemotherapy, and other immunotherapies. This approach leverages the synergistic effects of different modalities, enhancing efficacy and patient outcomes.

- Global Expansion: There is strong potential for market growth in emerging regions such as Asia Pacific and Latin America, fueled by rising healthcare investments, large patient populations, and increasing government support for oncology innovation. In particular, the expansion of biotech ecosystems and substantial R&D investments in countries like China and Japan are further driving regional market development.

- Major Investors: Significant investment from large pharmaceutical companies (e.g., Amgen, Pfizer, Merck) and venture capital firms is driving market growth through strategic partnerships and acquisitions. Investors are drawn to the potential for high margins, the unmet clinical need, and the alignment with precision medicine objectives.

- Startup Ecosystem: The startup landscape is rapidly maturing, with firms focusing on innovation in viral vector design, enhanced delivery mechanisms, and combination therapies. Emerging companies are attracting substantial venture capital funding by offering novel, targeted, and effective alternatives to conventional cancer treatments.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Virus Type, Delivery Route, Cancer Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Combination Therapies

The main driver of the oncolytic virus-based gene therapy market is the increasing combination of oncolytic viruses with other types of cancer immunotherapy, such as checkpoint inhibitors. This approach significantly enhances the overall anti-tumor immune response and helps overcome the limitations of using single therapies alone. Combining an oncolytic virus with other immunotherapies boosts this effect. These therapies are designed to selectively infect and destroy cancer cells while sparing healthy tissue and preparing the tumor for a stronger response

Restraint

Challenge of Effective Systemic Delivery

The primary restraint in the oncolytic virus-based gene therapy market is the challenge of achieving effective systemic delivery, particularly in overcoming the body's natural antiviral immune response. This is caused by pre-existing antibodies and the complement system, which can rapidly clear viral particles. This process drastically reduces the viral load, rendering the therapy ineffective. Once administered through IV, the viruses are often eliminated by the immune system before they reach and infiltrate solid tumors.

Opportunity

Technological Innovations in Delivery and Targeting

Technological innovations in delivery and targeting are significantly creating opportunities in the oncolytic virus-based gene therapy market by improving specificity, safety, and therapeutic efficacy. Advanced genetic engineering allows viruses to be programmed with tumor-specific promoters or microRNA-responsive elements, ensuring that viral replication and gene expression occur only within cancer cells, minimizing damage to healthy tissues. Innovations like capsid modification, nanoparticle delivery, and exosome-mediated transport enhance virus stability, reduce immune clearance, and enable deeper tumor penetration. These breakthroughs help overcome key challenges such as immune neutralization and off-target toxicity, making oncolytic therapies more viable for a broader range of solid tumors.

Segment Insights

Virus Type Insights

What Made Herpes Simplex Virus (HSV) the Leading Segment in the Market?

The herpes simplex virus (HSV) segment led the oncolytic virus-based gene therapy market, accounting for approximately 30% share in 2024. This is due to its large, easily modified genome, proven safety record, and successful use in the first FDA-approved oncolytic viral therapy. These features make HSV a versatile and clinically advanced platform for delivering therapeutic payloads and selectively destroying cancer cells. Decades of research into the HSV genome and its replication have created extensive knowledge that simplifies genetic engineering.

The reovirus segment is expected to grow at a 30% CAGR during the forecast period. This is due to its natural ability to selectively replicate in tumor cells, low toxicity, and capacity to stimulate both direct tumor cell killing (oncolysis) and systemic anti-tumor immunity. It also shows great promise when combined with other cancer therapies. Reovirus naturally exploits defects in many cancer cells. In normal cells, the antiviral protein PKR activates to halt viral replication, making reovirus a safe candidate for therapy.

Delivery Route Insights

How Did the Intravenous Segment Dominate the Oncolytic Virus-Based Gene Therapy Market?

The intravenous (IV) segment dominated the market with a 40% share in 2024. This is mainly because IV delivery allows systemic treatment of widespread metastatic and hard-to-access tumors that have spread from the primary site to other parts of the body. IV administration enables the oncolytic virus to circulate throughout the body via the bloodstream. This is crucial for treating metastatic cancers, where tumors have spread beyond the primary site and cannot be reached by direct injection.

The intratumoral segment is expected to grow at a CAGR of 35% in the upcoming period because it offers a direct, highly concentrated, and targeted approach with less systemic toxicity compared to other methods. Intratumoral delivery allows for combining oncolytic viruses with other immunotherapies, such as immune checkpoint inhibitors, at higher local concentrations that would be unsafe systemically. This method is especially effective in activating the immune system against cancer and enables potent combination therapies.

Cancer Type Insights

How Does the Melanoma Segment Lead the Oncolytic Virus-Based Gene Therapy Market?

The melanoma segment led the market with about 25% share in 2024. This is largely due to the mechanism of action of oncolytic viruses, which infect and lyse cancer cells while releasing tumor antigens that activate a systemic immune response. This approach has proven particularly effective in melanoma, where immune activation can lead to widespread tumor clearance. The landmark regulatory approval of oncolytic virus therapy for melanoma validated virotherapy as a legitimate cancer treatment and spurred increased investment, research, and clinical development in this area.

The glioblastoma segment is expected to grow at nearly 28% CAGR over the projection period. This is mainly because glioblastoma is an aggressive and treatment-resistant brain cancer with a poor prognosis, representing a critical unmet medical need. Oncolytic virotherapy offers a promising solution, as glioblastoma rarely spreads outside the brain, making it suitable for localized treatment. Direct delivery of oncolytic viruses into brain tissue enables targeted action and minimizes systemic side effects.

End-User Insights

Why Did the Pharmaceutical & Biotechnology Companies Segment Dominate the Market in 2024?

The pharmaceutical & biotechnology companies segment dominated the oncolytic virus-based gene therapy market with a 50% share in 2024. This is due to their substantial financial resources, extensive expertise, and advanced infrastructure. Developing oncolytic virus therapies is complex and costly, requiring significant investment, specialized manufacturing, and sophisticated clinical trial capabilities, areas where major pharmaceutical firms have a clear advantage. Their facilities are equipped for large-scale production, which is essential for widespread clinical use.

The academic & research institutes segment is expected to grow at around 20% CAGR in the coming years. This growth is driven by a focus on fundamental discovery, increased investment, genetic engineering capabilities, and key collaborations. These factors are crucial for developing next-generation, highly potent, and targeted viral therapies. Academic and research institutions often receive substantial funding from government agencies, private foundations, and venture capitalists, accelerating innovation in gene therapy and novel cancer treatments.

Regional Insights

Why Did North America Dominate the Oncolytic Virus-Based Gene Therapy Market?

North America dominated the oncolytic virus-based gene therapy market in 2024, holding approximately 45% market share. This leadership is driven by its robust healthcare infrastructure, substantial R&D investments, and a favorable regulatory environment that supports commercialization. The region, particularly the U.S. hosts a high concentration of leading biotechnology and pharmaceutical companies, as well as top-tier research institutions that propel innovation in gene therapy. The U.S. FDA has established clear regulatory pathways for cell and gene therapies, offering mechanisms such as Fast Track designation, Breakthrough Therapy designation, and priority reviews to expedite approvals for therapies addressing unmet medical needs.

The U.S. Oncolytic Virus-Based Gene Therapy Market Trends

The U.S. plays a critical role in advancing the global oncolytic virus-based gene therapy landscape. It benefits from an extensive research ecosystem, strong biotech and pharma sectors, and consistent public and private investment. The FDA's 2015 approval of T-VEC, the first oncolytic virus therapy, marked a turning point for the field, validating the clinical potential of virotherapy. Since then, U.S.-based companies and academic institutions have continued to lead in clinical trials, technology development, and commercialization.

Canada Oncolytic Virus-Based Gene Therapy Market Trends

Canada is also emerging as a key player in the oncolytic virus gene therapy space, recognized for its pioneering research and collaborative initiatives. The Canadian Oncolytic Virus Consortium (COVCo), led by prominent scientists such as Dr. John Bell, has been instrumental in advancing viral gene therapy research. Organizations like BioCanRx and government-supported programs have contributed significant funding toward clinical trials, including the world's first trial combining an oncolytic vaccine with checkpoint inhibitors. This positions Canada as a center for innovation and translational research in the field.

Why is Asia-Pacific Considered the Fastest-Growing Region?

Asia Pacific is projected to be the fastest-growing market for oncolytic virus-based gene therapies, with an expected CAGR of 15%. This growth is fueled by a large and aging population, rising healthcare expenditures, and an increasingly supportive landscape for biotech innovation. Government initiatives and strategic collaborations are advancing research and clinical trial activity, particularly in countries like China, Japan, and South Korea. Additionally, significant investments from both public and private sectors are creating a fertile environment for biotech startups and R&D, accelerating the development and commercialization of novel oncolytic virus therapies.

- For instance, the Chinese government has been actively investing in biotechnology, fostering a supportive environment for oncolytic virus-based gene therapies. Initiatives include funding for clinical trials and support for biotech startups, accelerating the development and commercialization of new oncolytic viruses.

Country-level Investments & Funding Trends for Oncolytic Virus-Based Gene Therapy Market

- U.S.: Robust public and private funding supports oncolytic virus research. The National Institutes of Health awarded a $1.8 million grant in 2022 for oncolytic virotherapy research. Through the Advanced Research Projects Agency for Health, the federal government committed almost $115 million in 2023.

- China: The country leads the Asia Pacific region in market share and the number of oncolytic virus therapy clinical trials, with prominent institutions such as Shanghai Jiaotong University receiving tens of millions of Chinese yuan for lung cancer research, and the overall oncology informatics sector raising $656 million.

- Japan: Demonstrates strong government support and was the first country to approve an oncolytic virus for malignant glioma. Japan's health ministry estimated the newly approved oncolytic virus therapy would accrue 7.2 billion yen per year under its national health insurance.

- Australia: Active in clinical trials, with government funding initiatives like the Medical Research Future Fund supporting cancer research. The Australian government committed $105 million to the Brain Cancer Mission, with $55 million from the MRFF, to which OV research is applicable.

- Germany: The broader cancer immunotherapy sector in Germany has attracted over $1.98 billion in funding over the past decade. Individual projects receive substantial support, such as a €2.6 million grant from the German Cancer Aid for a CAR T-cell therapy study.

Oncolytic Virus-Based Gene Therapy Regulatory Landscape: Global Regulations

| Country/Region | Regulatory Body | Key Initiatives & Regulations |

| U.S. | Food and Drug Administration (FDA) |

|

| EU | European Medicines Agency (EMA) |

|

| Japan | PMDA / MHLW |

|

| UK | Medicines and Healthcare products Regulatory Agency (MHRA) |

|

| India | CDSCO / ICMR |

|

Value Chain Analysis of Oncolytic Virus-Based Gene Therapy Market

- Research & Discovery: This initial stage involves identifying and engineering viruses capable of selectively infecting and destroying cancer cells while sparing healthy tissue. Researchers focus on modifying viral genomes to enhance tumor targeting, improve safety profiles, and incorporate therapeutic genes that stimulate the immune response. This foundational work sets the stage for subsequent development and clinical evaluation.

- Preclinical Development: In this phase, engineered oncolytic viruses undergo rigorous laboratory and animal testing to assess their efficacy, safety, biodistribution, and pharmacodynamics. Preclinical studies are essential to determine the optimal viral dose, delivery methods, and therapeutic potential before moving into human clinical trials. Positive outcomes here validate the candidate's potential for clinical success.

- Clinical Trials: Clinical development spans multiple phases (I to III), focusing on evaluating safety, dosing, efficacy, and overall therapeutic benefit in patients. This stage is critical for regulatory approval, as it generates evidence on how the therapy performs in diverse patient populations and in combination with other cancer treatments. Successful trials lead to market authorization and commercialization.

- Manufacturing & Scale-Up: Production of oncolytic viruses under stringent Good Manufacturing Practice (GMP) conditions involves scaling up viral vector synthesis, purification, and formulation to ensure consistent quality, potency, and safety. Manufacturing also includes developing stable delivery formats and meeting regulatory standards for clinical and commercial supply. Efficient manufacturing is crucial to meet growing demand while maintaining cost-effectiveness.

- Regulatory Approval & Compliance: Companies engage with regulatory bodies (FDA, EMA, PMDA, etc.) to obtain necessary approvals through submission of comprehensive clinical data and manufacturing information. This stage includes securing designations such as Orphan Drug or Fast Track to expedite review and address unmet medical needs. Compliance with safety, efficacy, and quality standards is essential for market entry.

- Commercialization & Post-Market Surveillance: Following approval, therapies are marketed and distributed to healthcare providers, with ongoing monitoring for safety and long-term effectiveness. Real-world evidence collected during this stage informs potential label expansions and improves treatment protocols. Strong commercialization strategies, including physician engagement and reimbursement support, are vital to drive adoption and maximize patient access.

Top Companies in the Oncolytic Virus-Based Gene Therapy Market and their Offerings

Tier I: Major Market Leaders

These are companies with approved oncolytic therapies or large, advanced clinical programs, strong global presence, and relatively higher revenue/market influence.

| Company | Key Assets / Contributions |

| Amgen, Inc | Markets Imlygic (T VEC), an approved oncolytic herpes simplex virus therapy for melanoma. |

| Replimune Group, Inc | Developing next generation HSV based oncolytic viruses (RP1, RP2, RP3) for solid tumors. |

| Oncolytics Biotech, Inc. |

Known for pelareorep (a reovirus based candidate), multiple ongoing clinical trials. |

Tier II: Significant / Mid Size Players

These companies are growing, often with promising clinical pipelines, but don't (yet) hold quite the same level of market dominance as Tier I.

| Company | Key Assets / Contributions |

| Sorrento Therapeutics, Inc | HSV based oncolytic candidates; active pipeline in solid tumors and brain cancers. |

| PsiOxus Therapeutics Ltd. | Develops tumor selective adenovirus vectors (e.g. Enadenotucirev); trials in colorectal, ovarian cancers etc. |

| Transgene SA | French biotech specializing in viral based immunotherapies, including oncolytic viruses. |

| SillaJen, Inc |

Pexa Vec (JX 594) vaccinia virus candidate; oncology focus. |

Tier III: Emerging / Early Stage Players

These are smaller or earlier stage firms, or companies whose oncolytic virus programs are still developing. Their individual revenue contributions currently are smaller, but they have potential for growth.

| Company | Key Assets / Pipeline Highlights |

| Genelux Corporation | Developing Olvi Vec (vaccinia virus platform) for solid tumors; pipeline includes challenging cancers. |

| Shanghai Sunway Biotech Co. Ltd. | Manufactures Oncorine and active in local/regional markets; working on expanding applications |

| Takara Bio, Inc | Broad vector research; investment in clinical pipelines and exploratory oncolytic virus programs. |

| Others | Includes smaller biotechs: Lokon Pharma, Vyriad, Oncorus, Viralytics (Merck acquired), etc. Many are in clinical or late preclinical stages. |

Industry Leaders Announcement

- In February 2025, UroGen Pharma Ltd. expanded its oncology portfolio by acquiring the next-generation oncolytic virus ICVB-1042 from IconOVir Bio, Inc. UroGen is also entering strategic collaborations to enhance its proprietary RTGel technology for better immunotherapy outcomes. CEO Liz Barrett emphasized the acquisition as a significant step in developing innovative therapies for bladder cancer and addressing unmet needs in oncology.(Source: https://investors.urogen.com)

Recent Developments

- In July 2025, Calidi Biotherapeutics, Inc. received Fast Track designation from the FDA for CLD-201 (SuperNova), its allogeneic adipose stem-cell loaded oncolytic virus targeting soft tissue sarcoma. Calidi's Chief Medical Officer, Dr. Guy Travis Clifton, highlighted the significance of this milestone, emphasizing the potential of CLD-201 to provide transformational treatment for patients with sarcoma and other advanced tumors.(Source: https://www.calidibio.com)

- In July 2025, Oncolytics Biotech presented aggregated data supporting pelareorep's effectiveness across various tumor types, highlighting its ability to activate immune pathways, replicate in cancer cells, and enhance T cell activity in immunotherapy-resistant cancers. The research incorporated patient samples from clinical studies, revealing consistent immune activation signatures associated with tumor size reduction.(Source: https://www.prnewswire.com)

Exclusive Expert Analysis on the Oncolytic Virus-Based Gene Therapy Market

The global oncolytic virus-based gene therapy market is positioned at a strategic inflection point, driven by converging scientific validation, regulatory tailwinds, and robust capital inflows. The sector is witnessing accelerated maturation, propelled by clinical breakthroughs in tumor-selective virotherapy, and its synergistic potential when combined with immune checkpoint inhibitors and personalized cell-based platforms.

From a research analyst's lens, OVGT occupies a compelling white space in oncology therapeutics, addressing the high unmet need in resistant solid tumors where conventional therapies underperform. The market's asymmetric upside lies in its dual-modality mechanism, direct oncolysis and immune priming, which positions it uniquely within the broader immuno-oncology continuum.

With first-in-class approvals (e.g., T-VEC) having de-risked the regulatory pathway, and over 100+ assets in various stages of development globally, the competitive landscape is expanding from mono-agent virotherapies toward engineered, next-generation vectors with enhanced tumor tropism, immune evasion, and payload delivery capabilities. These dynamics signal an impending surge in licensing activity, strategic alliances, and platform-level acquisitions.

Regionally, North America dominates due to FDA's progressive stance and R&D intensity, but Asia Pacific is emerging as the fastest-growing opportunity hub, catalyzed by government-backed biotech clusters, cross-border VC interest, and a rising clinical trial density in China, Japan, and South Korea.

Segments Covered in the Report

By Virus Type

- Herpes Simplex Virus (HSV)

- Adenovirus

- Vaccinia Virus

- Newcastle Disease Virus (NDV)

- Reovirus

- Measles Virus

By Delivery Route

- Intratumoral

- Intravenous

- Intraperitoneal

- Intrathecal

- Subcutaneous

By Cancer Type

- Melanoma

- Glioblastoma

- Head and Neck Cancer

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Pancreatic Cancer

- Liver Cancer

- Bladder Cancer

By End-User

- Pharmaceutical & Biotechnology Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Academic & Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting