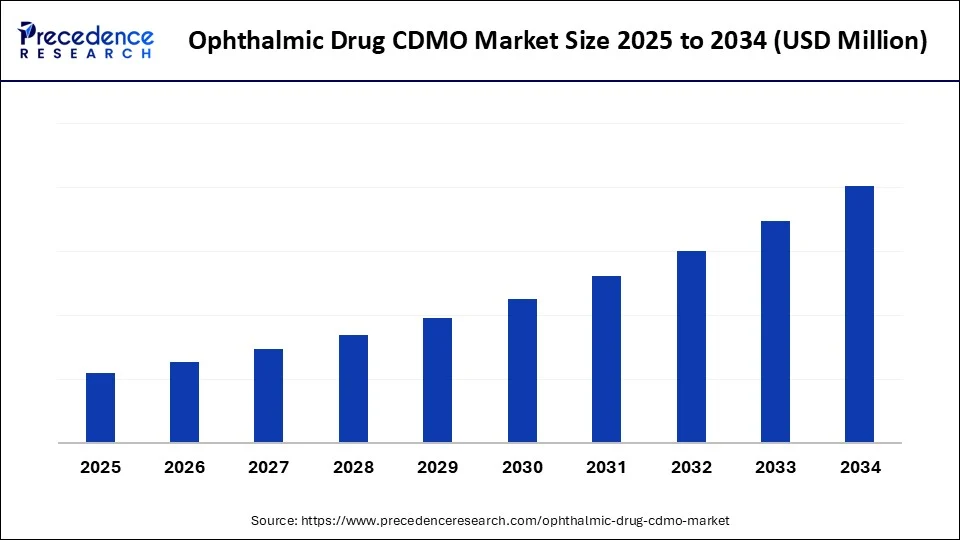

Ophthalmic Drug CDMO Market Size and Forecast 2025 to 2034

The global ophthalmic drug CDMO market is driven by innovation, outsourcing strategies, and the need for scalable solutions in ophthalmic drug development. The market is experiencing significant growth due to the rising demand for specialized ophthalmic formulations and outsourcing services. This growth is further supported by advancements in sterile manufacturing and the increasing development of complex drug delivery systems. Additionally, the rising prevalence of eye disorders and the need for cost-effective production are expected to drive market expansion.

Ophthalmic Drug CDMO MarketKey Takeaways

- North America dominated ophthalmic drug CDMO market share in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By service type, the drug product manufacturing (formulation & fill-finish) segment held the largest market share in 2024.

- By service type, the analytical & regulatory services segment is expected to witness the fastest CAGR during the foreseeable period.

- By dosage form, the eye drops & solutions segment led the market in 2024.

- By dosage form, the inserts & implants segment is anticipated to grow at the fastest CAGR during the foreseeable period.

- By molecule type, the small molecules segment held the biggest market share in 2024.

- By molecule type, the biologics segment is expected to witness the fastest CAGR during the foreseeable period.

- By therapeutic area, the glaucoma segment contributed the highest market share in 2024.

- By therapeutic area, the retinal disorders (AMD, DME, etc.) segment is expected to witness the fastest CAGR during the foreseeable period.

- By end user, the large pharmaceutical companies segment generated the major market share in 2024.

- By end user, the biotechnology firms segment is expected to witness the fastest CAGR during the foreseeable period.

How Can AI Impact the Ophthalmic Drug CDMO Market?

Artificial intelligence (AI) is enhancing the ophthalmic drug CDMO market by accelerating drug discovery, optimizing manufacturing processes, improving quality control, and enabling personalized medicine through data analysis and predictive modeling. AI algorithms can analyze vast datasets to identify potential drug targets, predict drug efficacy and toxicity, and screen compounds more efficiently, thus speeding up the overall discovery process for ophthalmic therapies. AI can also help design and streamline clinical trials by identifying ideal patient populations and predicting outcomes, thereby reducing the cost and time required to bring new drugs to market.

Market Overview

The ophthalmic drug CDMO market consists of specialized service providers that offer formulation development, manufacturing, packaging, and regulatory support for ophthalmic drugs. Pharmaceutical companies increasingly outsource to CDMOs (Contract Development and Manufacturing Organization) to focus on their core activities, such as research and development (R&D) and marketing. This outsourcing allows them to access specialized expertise, ensure high-quality production, and accelerate the drug development process for new eye treatments. This involves various forms such as solutions, suspensions, ointments, gels, and advanced delivery systems, all aimed at treating eye disorders like glaucoma, dry eye disease, infections, and retinal diseases.

What Are the Key Trends in the Ophthalmic Drug CDMO Market?

- Increasing Aging Global Population: The growing elderly population is more prone to age-related eye disorders, which is anticipated to significantly increase the demand for both ophthalmic drugs and their contract manufacturing.

- Outsourcing by Pharmaceutical Companies:Pharmaceutical companies are increasingly outsourcing their manufacturing processes to CDMOs to reduce costs, improve efficiency, and allow their internal teams to focus on research, development, and marketing.

- Technological Advancements:The integration of advanced technologies, such as automation, artificial intelligence (AI), and data analytics into CDMO services, enhances manufacturing efficiency, product quality, and regulatory compliance, further stimulating market growth.

- Emphasis on Innovation and Efficacy:There is a continuous demand for more effective, safer, and innovative ophthalmic drugs and delivery systems to address the challenges of existing treatments. CDMOs with specialized capabilities and strong research and development (R&D) support play a crucial role in meeting this demand.

- Streamlined Time-to-Market:Partnering with specialized CDMOs enables pharmaceutical companies to bring new ophthalmic drugs to market more quickly by leveraging the CDMO's expertise in development and manufacturing.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Authentication, Component,Deployment, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of Age-Related Ophthalmic Diseases

A primary driver for the growth of the ophthalmic drug CDMO market is the increasing prevalence of age-related ophthalmic diseases, such as cataracts and glaucoma, along with the rising demand for specialized treatments and new drug formulations. This scenario necessitates the specialized expertise and cost-effective manufacturing solutions that CDMOs offer. The global increase in conditions like age-related macular degeneration, glaucoma, and dry eye disease drives the demand for both new and existing treatments, thereby fueling the need for CDMO services, which require specialized formulation and manufacturing capabilities.

Restraint

Stringent And Complex Regulatory Environment

The primary restraint in this market is the stringent and complex regulatory environment. Compliance with strict quality, safety, and clinical trial standards varies by region, and ophthalmic drug manufacturing must adhere to guidelines set by regulatory bodies such as the FDA and EMA. These regulations are frequently updated and can significantly vary across global markets. Consequently, CDMOs must invest heavily in maintaining facilities and equipment that meet these high-quality standards, as well as in analytical validation and dossier preparation necessary for gaining approval, which increases operational costs.

Opportunity

Provision of Comprehensive and End-to-End Services

Looking ahead, a key opportunity in the ophthalmic drug CDMO market is the provision of comprehensive, end-to-end services for gene therapies and other advanced modalities, which represent a high-growth area addressing unmet needs in ocular diseases. CDMOs that can offer expertise in these specialized and complex manufacturing processes, including clinical trial material preparation and regulatory support, stand to benefit significantly. The development of novel genetic medicines and gene therapies for ocular diseases offers considerable potential to address conditions with high unmet needs, though it poses complex manufacturing challenges.

Service Type

What Made the Drug Product Manufacturing Segment Lead the Ophthalmic Drug CDMO Market in 2024?

The drug product manufacturing (formulation & fill-finish) segment dominated the market in 2024. This is mainly because ophthalmic drugs, including eye drops, ointments, and implants, often require specialized manufacturing processes such as sterile filling, advanced formulations, and specific packaging to maintain drug stability and efficacy. CDMOs can provide these processes cost-effectively and efficiently to accelerate time-to-market and reduce risks for pharmaceutical companies. They offer scalable manufacturing infrastructure and a global supply chain to shorten development timelines and speed up their ophthalmic drugs' entry into the competitive market.

The analytical & regulatory services segment is expected to experience the fastest growth in the market. This growth is mainly due to the increasing complexity of ophthalmic drug development, stringent global regulatory standards, and the critical need for precise testing of advanced drug delivery systems. CDMOs provide specialized expertise and state-of-the-art technology to navigate these challenges, enabling faster market approval and ensuring product quality. It is essential at every stage of drug development, from early formulation and clinical trials to final regulatory submissions and post-market surveillance, to provide the necessary data to confirm product integrity and safety.

Dosage Form Insights

How Did the Eye Drops and Solutions Segment Lead the Ophthalmic Drug CDMO Market in 2024?

The eye drops & solutions segment captured the dominant position in the market in 2024. This is mainly due to a strong combination of patient preference, manufacturing cost-efficiency, and technological innovation. Traditional eye drops are a non-invasive, easy-to-use delivery method favored for treating common anterior eye diseases, ensuring high patient compliance. Although conventional drops have low bioavailability, CDMOs drive advancements in formulation technology, such as preservative-free and nanoparticle-based drops, which improve drug retention and efficacy, overcoming previous limitations.

The inserts & implants segment is expected to be the fastest-growing in the market. This growth is primarily due to a shift from traditional, low-bioavailability eye drops toward advanced, long-acting delivery systems that improve treatment outcomes and patient compliance for chronic eye diseases. These implants and inserts provide sustained and targeted drug release directly to the eye, overcoming issues like frequent dosing and poor absorption, especially for posterior segment diseases like age-related macular degeneration and glaucoma. This growth is further fueled by rapid technological advancements and controlled-release mechanisms.

Molecule Type Insights

How Will the Small Molecules Segment Dominate the Ophthalmic Drug CDMO Market in 2024?

The small molecules segment led the market in 2024. This is mainly because small molecules, which make up many current drugs, are easier for CDMOs to synthesize and manufacture, offering cost-effectiveness and wider therapeutic applications such as glaucoma or macular degeneration. There is also consistent demand from drug developers who outsource to leverage expertise and reduce capital costs. Small-molecule drugs can be formulated into topical solutions, enabling targeted and sustained drug release directly into the eye. This is highly effective for treating serious ophthalmic conditions, ensuring broad and steady market demand.

The biologics segment is expected to experience the fastest growth during the forecast period. This growth is driven primarily by increasing demand for targeted, precision therapies for complex eye conditions like retinal diseases and autoimmune disorders. Biologics such as monoclonal antibodies are particularly well-suited for these treatments. Because biologics offer highly specific mechanisms of action, they are ideal for managing chronic and complex conditions like autoimmune diseases and hereditary eye disorders. The pipeline for biologics is expanding with innovations in monoclonal antibodies, cell and gene therapies, and other complex biologics.

Therapeutic Area Insights

Why Did the Glaucoma Segment Lead the Ophthalmic Drug CDMO Market in 2024?

The glaucoma segment led the market in 2024. This is mainly due to the rising global prevalence of the disease, especially among the growing elderly population, creating a large and expanding patient base. Continuous advancements in diagnostic tools and the development of novel therapies, such as sustained-release drug delivery systems and gene therapies, demand specialized manufacturing capabilities from CDMOs. The need for more effective and patient-friendly drug delivery options, like sustained-release formulations, punctual plugs, implants, and nanotechnology-based carriers, adds to the complexity of manufacturing.

The retinal disorders (AMD, DME, etc.) segment is projected to experience the fastest growth in the market. This growth is further driven by the aging population worldwide, increasing rates of diabetes leading to conditions like diabetic retinopathy, and significant advances in treatments like anti-VEGF therapies, gene therapies, and sophisticated drug delivery systems. These innovations, which improve efficacy and reduce treatment burden, are often complex to manufacture, prompting pharmaceutical and biotech companies to outsource development and production to specialized ophthalmic CDMOs.

End User insights

What Made the Large Pharmaceutical Companies Segment Dominate the Ophthalmic Drug CDMO Market in 2024?

The large pharmaceutical companies segment maintained a dominant market position in 2024. This is because they require high-tech manufacturing and specialized expertise, which CDMOs can provide at a lower cost, faster time-to-market, and without the burden of extensive capital investment or regulatory risk. CDMOs help large pharmaceutical companies meet stringent quality and legal standards for ophthalmic products, minimizing legal and compliance risks. Additionally, outsourcing manufacturing and development allows large pharma firms to stay asset-light and focus resources on core activities like research, drug discovery, and marketing.

The biotechnology firms segment is the fastest-growing segment during the forecast period. This growth is mainly due to the increasing complexity of ophthalmic treatments, rising demand for advanced drug delivery systems like intraocular lenses and sustained-release implants, and the need for specialized expertise and cutting-edge technology. Smaller, more innovation-focused biotech companies outsource their drug development and manufacturing to CDMOs to access these capabilities and infrastructure, enabling quicker development of new therapies for eye conditions that require advanced technologies for precise manufacturing, stability, bioavailability enhancement, and specialized formulations.

Regional Insights

How did North America Lead the Ophthalmic Drug CDMO Market in 2024?

North America dominated the ophthalmic drug CDMO market in 2024. This dominance is attributed to high healthcare expenditure, a robust pharmaceutical infrastructure, significant investment in research and development, a high prevalence of eye diseases such as retinal disorders and dry eye conditions, and strong regulatory frameworks from the FDA. Ongoing developments in advanced drug delivery technologies, including sustained-release formulations and preservative-free systems, are leading to more effective and patient-friendly products. The presence of regulatory bodies like the FDA ensures strict quality standards and operational capabilities, requiring CDMOs to maintain robust compliance, which benefits the market.

In April 2024, Viatris Inc. launched RYZUMVI™ (phentolamine ophthalmic solution) 0.75%, the only FDA-approved eye drop for reversing pharmacologically-induced mydriasis in the U.S. Approved by the FDA in September 2023, RYZUMVI was tested in two clinical trials involving 553 patients, demonstrating its effectiveness in managing dilation caused by common mydriatic agents.(Source: https://investor.viatris.com)

The U.S. Ophthalmic Drug CDMO Market Trends

The U.S. plays an evolving role in the global market. This is mainly driven by an aging population and a high prevalence of chronic eye diseases. U.S. CDMOs offer crucial specialized services for the complex sterile manufacturing required for ophthalmic products. Their expertise in navigating the strict regulatory landscape of the FDA and managing the development of innovative, high-growth therapies like biologics and gene therapies solidifies the U.S.'s pivotal role in the market.

Canada Ophthalmic Drug CDMO Market Trends

Canada serves as a key hub for ophthalmic drug CDMOs, leveraging a growing domestic market driven by its aging population and increasing prevalence of eye diseases. The country's robust healthcare infrastructure, supportive regulatory environment managed by Health Canada, and strong research and development ecosystem attract investment and innovation in advanced therapies, including biologics, gene therapies, and novel drug delivery systems. Canadian CDMOs benefit from a skilled workforce and offer specialized services that help pharmaceutical clients, including major players like Bausch Health, navigate regulatory pathways and bring complex ophthalmic drugs to market.

Why is Asia Pacific Considered the Fastest-Growing Region in the Ophthalmic Drug CDMO Market?

Asia Pacific is the fastest-growing region in the ophthalmic drug CDMO market. This growth is attributed to its large population, rising burden of ophthalmic disorders, increasing healthcare spending, supportive government policies, and cost-effective manufacturing capabilities. Supportive government policies, tax breaks, and incentives attract foreign investment and foster local CDMO growth, particularly in countries like China and India. Government support includes incentives and programs aimed at attracting foreign direct investment (FDI) and developing domestic pharmaceutical sectors, as seen with China and India's efforts to become innovation and manufacturing hubs, respectively.

Value Chain Analysis

- R&D

The R&D outsources the development and manufacturing of eye-related drugs to specialized contract organizations. This allows drugmakers to reduce costs and leverage expert resources for complex, sterile products like eye drops and injections, accelerating the time to market.

Key Players: Catalent, Inc., Lonza Group AG, Siegfried Holding AG, Laboratorios Salvat, S.A., Bora Pharmaceuticals

- Clinical Trials and Regulatory Approvals

These services span the entire drug development lifecycle, from early-stage research and clinical trial manufacturing to navigating complex regulatory pathways for market approval. The market is growing due to the rising prevalence of eye disorders, the need for specialized manufacturing, and the desire for cost-efficient development.

Key Players: Lonza Group, Recipharm, Thermo Fisher Scientific, MedPharm, AbbVie Inc.

- Formulation and Final Dosage Preparation

This stage involves converting the active pharmaceutical ingredient into a stable and effective drug product suitable for the eye. Once the formulation is finalized, like eyedrops, ointment, gels, injections, and inserts, the CDMO handles large-scale production, adhering to strict regulatory standards like Good Manufacturing Practices.

Key Players: Catalent, Inc., Piramal Pharma Solutions, Siegfried Holding AG, Laboratorios Salvat, S.A., Altasciences

- Packaging and Serialization

The packaging and serialization manufacturer packages and uniquely identifies sterile eye-care drugs for pharmaceutical firms. This is driven by strict regulatory demands for sterility and anti-counterfeiting, to outsource complex manufacturing processes like producing eye drops, gels, and injectables, as well as providing specialized bottles and implementing serialization to track drugs throughout the supply chain.

Key Players: Thermo Fisher Scientific Inc., Lonza, Recipharm, Catalent, Inc., Unither Pharmaceuticals

- Distribution to Hospitals, Pharmacies

Ophthalmic drugs are distributed through various channels, predominantly through hospital pharmacies for acute conditions and specialized care, which constitute the largest market segment. This is further served by retail and online pharmacies, providing convenience and expanding access, especially for over-the-counter and recurring medication needs like dry eye treatments.

Key Players: AbbVie Inc., Alcon, Regeneron Pharmaceuticals Inc., Lonza Group AG, Bausch + Lomb

- Patient Support and Services

The Patient Support and Services refers to the specialized sector to not only produces eye-related medications, but also provides integrated patient support programs. These programs offer services like patient education, financial assistance, and adherence reminders to improve treatment outcomes for patients.

Key Players: Thermo Fisher Scientific, Bora Pharmaceuticals, Laboratorios Salvat, S.A., ProPharma Group, Recipharm

Ophthalmic Drug CDMO Market Companies

- Catalent, Inc.

- Lonza Group,

- WuXi AppTec,

- Piramal Pharma Solutions,

- Siegfried Holding AG,

- Recipharm AB,

- Ajinomoto Bio-Pharma Services,

- Jubilant Pharmova Ltd.,

- Samsung Biologics,

- AMRI (Curia Global),

- Vetter Pharma International,

- Baxter BioPharma Solutions,

- Alcami Corporation,

- BioPharma Solutions, and

- Thermo Fisher Scientific

Leaders' Announcements

- In July 2025, Alcon announced its intent to acquire LumiThera, Inc., known for its light-based treatment for early and intermediate stages of dry age-related macular degeneration (AMD). LumiThera's photobiomodulation (PBM) device is the only one proven to improve vision for these patients, addressing a significant unmet need in this progressive disease. Enhancing the therapy's availability and clinical evidence, offering a non-invasive treatment in clinical settings.(Source: https://investor.alcon.com)

- In August 2025, Alcon entered into a definitive merger agreement to acquire STAAR Surgical Company, the maker of the EVO ICL™ for vision correction in patients with moderate to high myopia. Alcon will purchase STAAR for USD 28 per share, totaling approximately USD 1.5 billion. This acquisition aims to expand Alcon's surgical vision correction options in response to the growing demand for myopia treatment.(Source: https://investors.staar.com)

Recent Developments

- In February 2025, Glenmark Pharmaceuticals Inc. announced the launch of Latanoprost Ophthalmic Solution, 0.005%, which is bioequivalent to Upjohn's Xalatan Ophthalmic Solution. According to IQVIA™ data, Xalatan had annual sales of approximately USD 113.5 million by December 2024. Marc Kikuchi, President and Business Head of North America, expressed excitement about the expansion of their ophthalmic product portfolio.

(Source: https://www.prnewswire.com) - In June 2024, Bausch + Lomb introduced INFUSE for Astigmatism daily disposable contact lenses. These lenses, designed with ProBalance Technology™ and OpticAlign design, aim to provide comfort and clear vision while addressing common issues such as dryness and blurred vision.

(Source: https://www.businesswire.com)

Segments Covered in the Report

By Service Type

- Drug Substance Development & Manufacturing

- Drug Product Manufacturing (Formulation & Fill-Finish)

- Packaging & Labelling

- Analytical & Regulatory Services

By Dosage Form

- Eye Drops & Solutions

- Ointments & Gels

- Emulsions & Suspensions

- Inserts & Implants

By Molecule Type

- Small Molecules

- Biologics

By Therapeutic Area

- Glaucoma

- Dry Eye Disease

- Retinal Disorders (AMD, DME, etc.)

- Eye Infections & Allergies

- Others

By End User

- Large Pharmaceutical Companies

- Biotechnology Firms

- Specialty Ophthalmic Companies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting