What is the Oral Protein and Peptides Market Size?

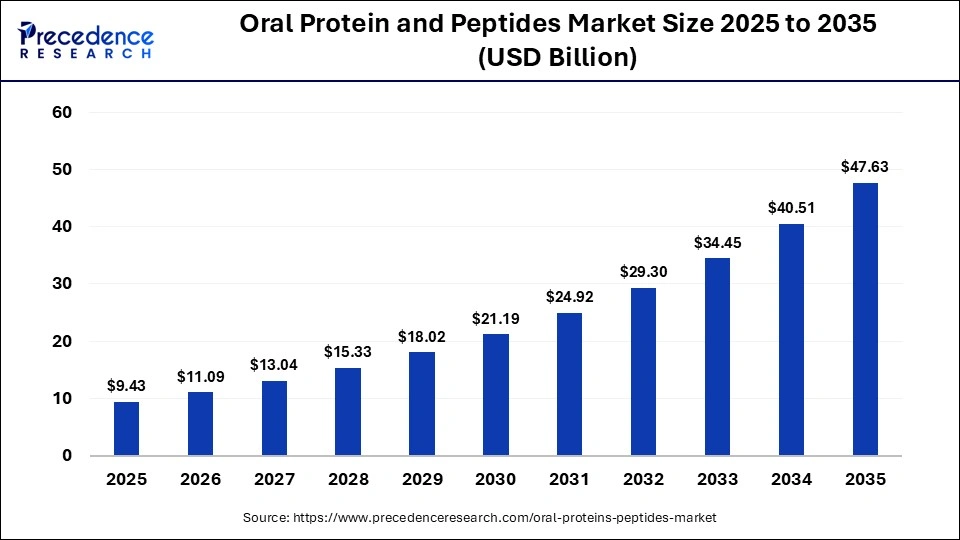

The global oral protein and peptide market size was calculated at USD 9.43 billion in 2025 and is predicted to increase from USD 11.09 billion in 2026 to approximately USD 47.63 billion by 2035, expanding at a CAGR of 17.58% from 2026 to 2035.The market is witnessing substantial growth driven by the increasing burden of chronic diseases and higher demand for convenient, non-invasive oral medications over traditional injections, which improves patient adherence and quality of life. This expansion is further supported by rapid advancements in novel drug delivery technologies, spurring significant R&D investments and expanding clinical pipelines across various therapeutic areas, including oncology, bone diseases, and autoimmune disorders.

Market Highlight

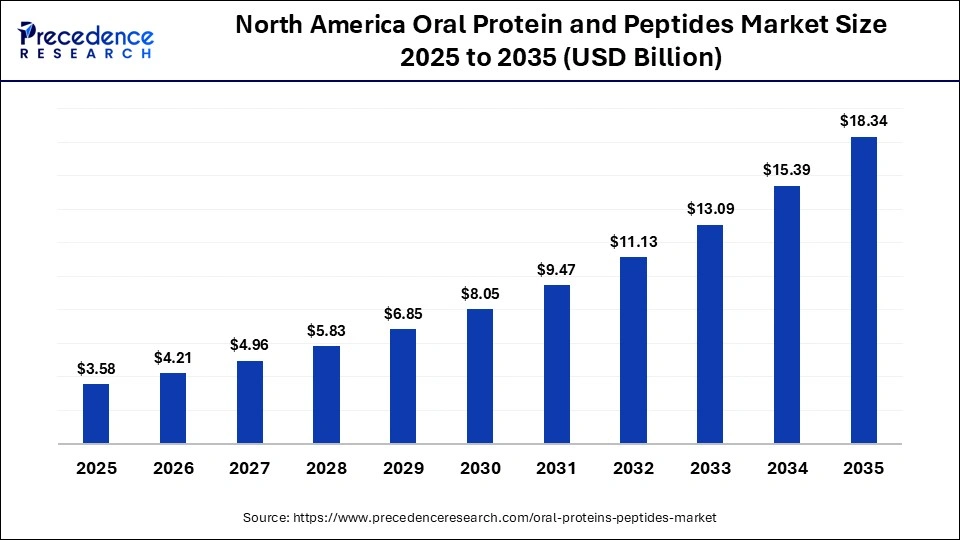

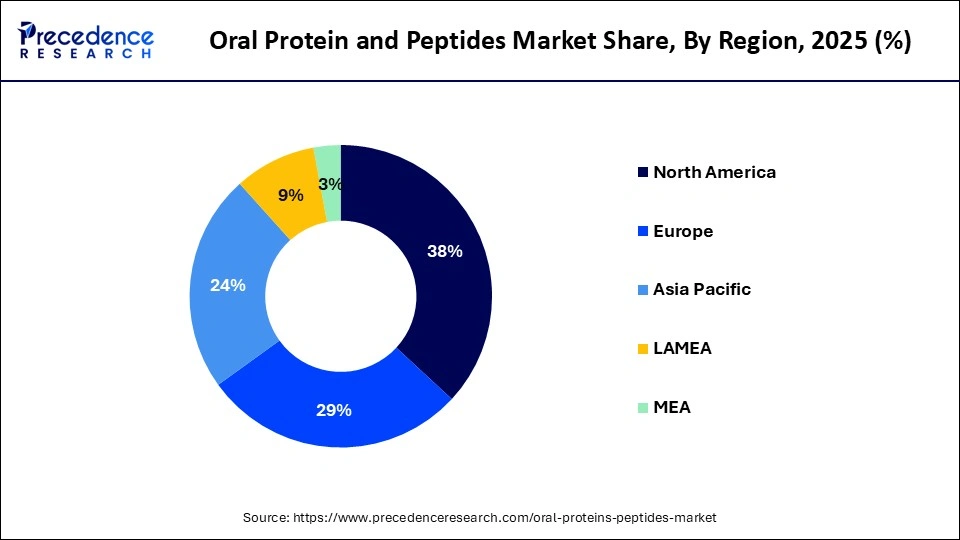

- North America dominated the market with around 38% of the market share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 18% between 2026 and 2035.

- By product type, the nutritional proteins segment captured the highest market share of around 47% in 2025.

- By product type, the therapeutic oral peptides segment is poised to grow at a healthy CAGR of about 18% between 2026 and 2035.

- By source, the animal-derived proteins segment generated the biggest market share of around 42% in 2025.

- By source, the plant-derived proteins segment is expanding at the fastest CAGR of around 16% between 2026 and 2035.

- By application, the sports & performance nutrition segment accounted for the largest market share of about 40% in 2025.

- By application, the immune health support segment is projected to grow at a solid CAGR of around 17% between 2026 and 2035.

- By end-user, the sports & fitness enthusiasts segment held a major market share of around 43% in 2025.

- By end-user, the aging population segment is expected to expand at a notable CAGR of around 17.50% from 2026 to 2035.

What is the Oral Protein and Peptides Market?

The global oral protein and peptide market comprises orally administered protein- and peptide-based products, including nutritional proteins, bioactive peptides, therapeutic peptide drugs, and fortified functional foods and beverages that deliver health, nutritional, or therapeutic benefits through the digestive tract. Key components include whey, soy, plant proteins, collagen peptides, and bioactive peptide formulations targeting gut health, immune support, weight management, muscle synthesis, metabolic function, and specific therapeutic applications. Growth is driven by rising health and wellness awareness, increasing demand for protein-fortified foods, advances in oral peptide delivery technologies, aging populations seeking nutrition and therapeutics, and expanding clinical applications of peptides.

This expansion is further supported by innovation in encapsulation, enzyme protection, and absorption-enhancing technologies that improve peptide bioavailability. Increasing crossover between nutrition and pharmaceuticals is broadening use cases for oral peptides beyond supplements into preventive and adjunct therapies. Growth of personalized nutrition and sports nutrition is increasing demand for targeted peptide formulations. Regulatory acceptance of functional ingredients is also supporting wider commercialization across food, beverage, and healthcare channels.

How will AI Transform the Oral Protein and Peptides Market?

Artificial intelligence (AI) is transforming the global market by accelerating discovery, optimizing structures for better stability and efficacy, predicting interactions, and streamlining manufacturing. It also identifies bioactive sequences, designs novel peptides, and optimizes them for target specificity and potency, reducing trial-and-error. It not only predicts how peptides bind to targets and designs structures with improved stability, absorption, and half-life, overcoming degradation in the gut, but also forecasts peptide-protein interactions, physicochemical properties, toxicity, and pharmacokinetics, enhancing success rates.

Oral Protein and Peptides Market Outlook

- Industry Growth Overview: The market is set for robust growth from 2026 to 2035, primarily driven by increasing protein demand for health, along with growing awareness of protein's role in muscle health, weight management, and anti-aging, particularly among an aging global population, that seeks enhanced efficacy and a better patient experience.

- Shift from Injectable Therapies to Convenient Oral Forms: This trend is driven by advancements in drug delivery technologies like nanoparticles and enteric coatings that overcome gastric degradation and improve bioavailability, coupled with the rising global burden of chronic diseases, significantly boosting market growth and patient-centric solutions.

- Global Expansion: The global market is experiencing significant expansion, with North America driven by rising chronic diseases, demand for non-invasive therapies, and major tech advancements. Asia pacific and Europe also drive the market expansion by boosting patient compliance and making injectable alternatives viable. Latin America, the Middle East, and Africa also surge with rapid growth in the market.

- Major Investors: Many large pharmaceutical companies, like Novozymes, DSM, Danone, and Nestle, and nutraceutical companies invest heavily in R&D along with funding innovation in precision fermentation, synthetic biology, and novel peptide therapeutics.

- Startup Ecosystems: Focus on bioactive peptides, sustainable protein sources, and personalized nutrition to overcome inherent challenges like low bioavailability and enzymatic degradation, making them attractive targets for partnerships and investments from larger pharmaceutical companies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.43 Billion |

| Market Size in 2026 | USD 11.09 Billion |

| Market Size by 2035 | USD 47.63 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 17.58% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Source, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

How did the Nutritional Proteins Segment Dominate the Oral Protein and Peptides Market in 2025?

The nutritional proteins segment is dominated, with around 47% market share in 2025. This is mainly due to technological advancements in oral delivery systems, such as enteric coatings and nanoparticles, which make these products more stable and absorbable in the GI tract. Peptides offer diverse biological activities, making them ideal for treating metabolic disorders and gastrointestinal issues. This dominance is further fostered by increasing demand for oral treatments for chronic diseases like diabetes, better patient compliance, and faster development cycles than for larger proteins, all of which drive market expansion.

The therapeutic oral peptides segment is anticipated to have the fastest growth, with a CAGR of around 18% in the global market. This is because of breakthroughs in advanced delivery systems, such as nanoparticles and mucoadhesive systems, which overcome major hurdles like enzymatic breakdown, combined with the rising demand for convenient, needle-free options for chronic diseases. Patients prefer oral medications over injections for long-term management of chronic conditions, boosting the appeal and adoption of oral peptide therapies and driving demand for effective, accessible peptide treatments.

Source Insights

What Made the Animal-Derived Proteins Segment Lead the Oral Protein and Peptides Market in 2025?

The animal-derived proteins segment led with around 42% market share in 2025. This is mainly because these proteins are considered complete, containing all essential amino acids, with superior bioavailability, strong scientific backing for health benefits, and established industry processing. A strong global dairy industry and increasing meat consumption provide a robust foundation for these protein sources in various protein products. Animal sources also yield numerous bioactive peptides with potential health effects, expanding their pharmaceutical and nutraceutical applications and improving healthcare outcomes.

The plant-derived proteins segment is expected to grow the fastest, with a CAGR of 16%. This is mainly due to increasing consumer demand for vegetarian and vegan options, environmental concerns, lower costs than animal proteins, and their functional properties. Plant proteins offer a sustainable alternative to meet global protein needs as populations grow. They yield bioactive peptides with potential health benefits, including antioxidant and anti-inflammatory effects, making them valuable in nutraceuticals and functional foods and offering diverse amino acid profiles.

Application Insights

Why did the Sports & Performance Nutrition Segment Dominate the Oral Protein and Peptides Market in 2025?

The sports & performance nutrition segment dominated with 40% of market share in 2025. This is because proteins and peptides are crucial for muscle repair, growth, and enhanced endurance, with athletes seeking supplements. Protein powders, bars, and functional beverages are heavily marketed for their ability to speed recovery after workouts, reduce soreness, and allow athletes to train more consistently. These supplements also improve endurance, increase muscle strength, boost glycogen uptake, and help maintain lean muscle mass, directly impacting athletic performance.

The immune health support segment is anticipated to experience the fastest growth, with a CAGR of 17%. This is mainly due to increasing health awareness, consumer demand for non-invasive immune boosters, rising chronic diseases, and advancements in oral delivery tech. Consumers actively seeking ways to strengthen immunity, especially post-pandemic, prefer oral protein and peptide supplements for general wellness. Peptides like Thymosin Alpha-1 (TA1) and LL-37 directly interact with immune pathways, offering targeted support and making oral delivery effective.

End-User Insights

What made the Sports & Fitness Enthusiasts Segment Lead the Oral Protein and Peptides Market in 2025?

The sports & fitness enthusiasts segment led with 43% market share in 2025. This is mainly due to increasing demand for muscle building, recovery, and performance, along with rising health awareness, easy online access to products like protein powders, and growth in fitness culture. Athletes rely on these supplements for increased energy, endurance, and faster recovery from intense training, creating significant demand. Additionally, online retail and easy availability of products like protein powders and bars make them accessible to a broad base of fitness enthusiasts.

The aging population segment is expected to have the fastest growth, with a CAGR of 17.50%. This is mainly because older adults have higher rates of chronic diseases, prefer less invasive treatments, and demand a better quality of life, all of which oral peptides, with improved delivery tech, provide. This demographic shift creates a huge, continuous need for convenient, effective therapies for conditions requiring daily management, boosting adoption of oral biologics. Beyond disease, peptides are gaining traction for anti-aging and muscle health, appealing to an aging demographic seeking vitality.

Regional Insights

How Big is the North America Oral Protein and Peptides Market Size?

The North America oral protein and peptide market size is estimated at USD 3.58 billion in 2025 and is projected to reach approximately USD 18.34 billion by 2035, with a 17.75% CAGR from 2026 to 2035.

How Did North America Dominate the Oral Protein and Peptides Market in 2025?

North America dominated with 38% market share in 2025. This is mainly due to its robust R&D infrastructure, the significant presence of key pharmaceutical companies, a supportive regulatory environment, and the high prevalence of chronic diseases. The market is home to numerous major pharmaceutical and biotechnology companies, such as AbbVie, Pfizer, and Johnson & Johnson, which are at the forefront of oral peptide innovation and commercialization. Regulatory bodies like the U.S. FDA have implemented initiatives to streamline the approval process for innovative drug delivery technologies, providing a favorable environment that accelerates product development and market entry.

What is the Size of the U.S. Oral Protein and Peptides Market?

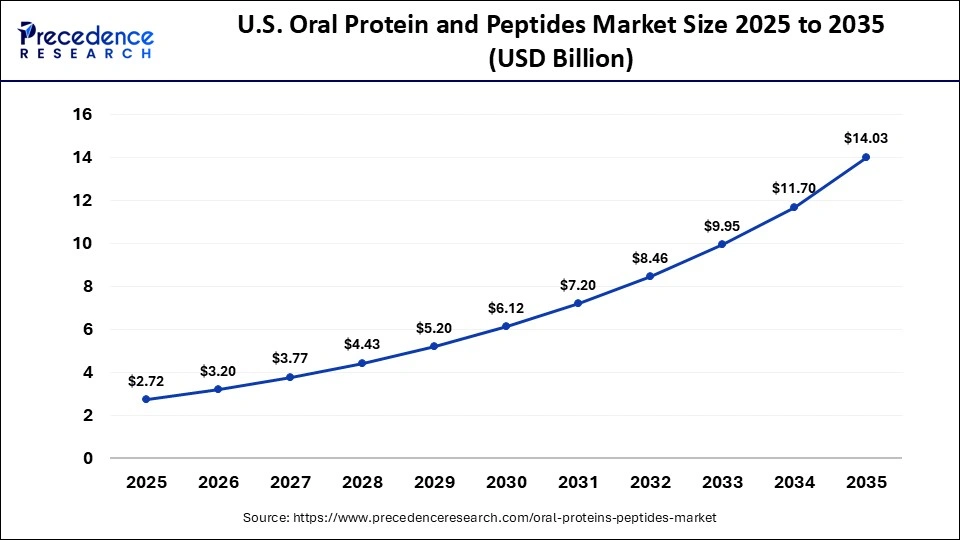

The U.S. oral protein and peptide market size is calculated at USD 2.72 billion in 2025 and is expected to reach nearly USD 14.03 billion in 2035, accelerating at a strong CAGR of 17.83% between 2026 and 2035.

U.S. Oral Protein and Peptides Market Trends

The U.S. holds the largest market share within North America, primarily due to significant investments in research and a robust pipeline of novel oral peptide therapies with a strong emphasis on patient-centric options. Prominent companies such as AbbVie Inc., Pfizer Inc., and Johnson & Johnson Services, Inc. are at the forefront of developing new oral formulations. The U.S. FDA has approved several oral protein- and peptide-based therapies, and its regulatory pathways encourage rapid clinical development.

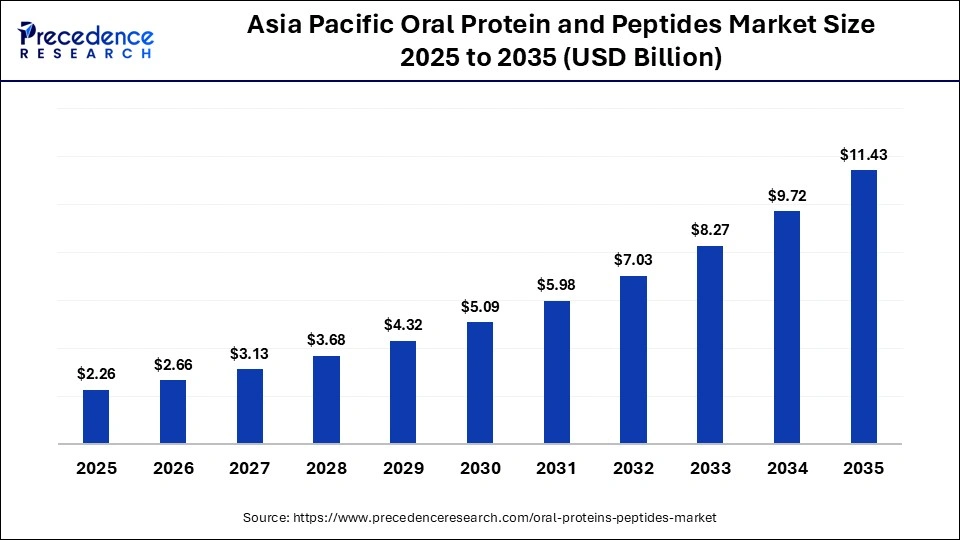

What is the Asia Pacific Oral Protein and Peptides Market Size?

The Asia Pacific oral protein and peptide market size is expected to be worth USD 11.43 billion by 2035, increasing from USD 2.26 billion by 2025, growing at a CAGR of 17.6% from 2026 to 2035.

Why Will Asia Pacific Be the Fastest-Growing Region in the Oral Protein and Peptides Market During the Coming Years?

Asia Pacific is anticipated to have the fastest growth with a CAGR of around 18%. This is mainly due to increasing health consciousness, the high prevalence of chronic diseases like diabetes, and significant advancements in drug delivery technologies and local manufacturing capabilities. Countries like India and China are emerging as major hubs for cost-effective pharmaceutical manufacturing and contract manufacturing organizations, attracting global players seeking to reduce production expenses. There is an increasing patient preference for oral medications over traditional injections due to convenience, improved quality of life, and better treatment adherence.

India Oral Protein and Peptides Market Trends

India plays a unique role in the region, characterized by its technical expertise and infrastructure for the large-scale production of generic peptide drugs and APIs. Indian companies and research institutions are developing innovative formulations, including nanoparticle-based and oral delivery systems, to enhance existing generic peptides and improve patient compliance. The government is focused on strengthening the generics and biosimilars market to achieve self-reliance in peptide-based medicines.

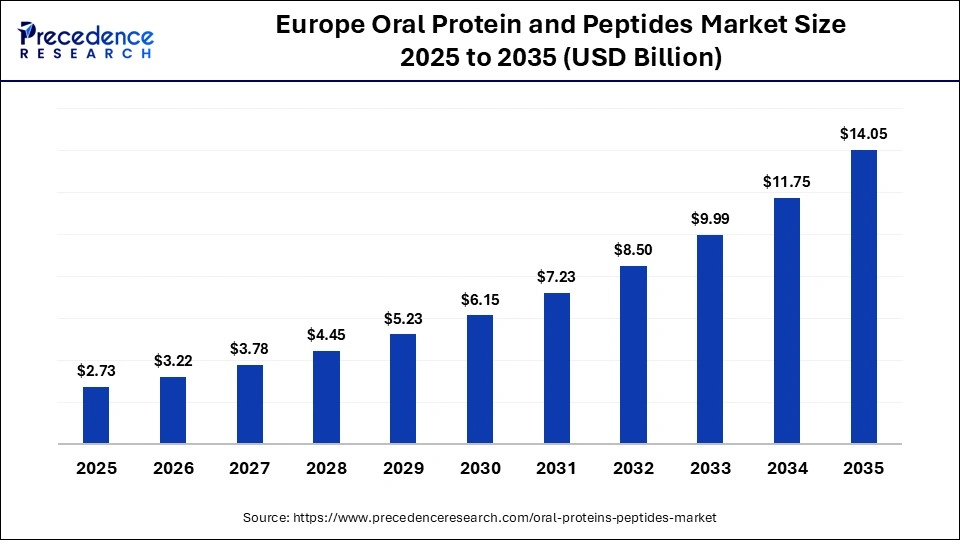

What is the Europe Oral Protein and Peptides Market Size and Growth Rate?

The Europe oral protein and peptide market size has grown strongly in recent years. It will grow from USD 2.73 billion in 2025 to USD 14.05 billion in 2035, expanding at a compound annual growth rate (CAGR) of 17.8% between 2026 and 2035.

How Will Europe Consider the Prominent Region in the Oral Protein and Peptides Market in 2025?

Europe is a prominent region in the global market due to its strong research infrastructure, increasing investments in research and development (R&D), and a progressive regulatory environment. Additionally, the rising incidence of chronic conditions such as diabetes, osteoporosis, and gastrointestinal disorders among the aging population creates significant demand for effective and convenient treatment options. Major pharmaceutical and biotech companies, including Novo Nordisk, Sanofi, AstraZeneca, and Novartis, are leading innovation in this market.

Germany Oral Protein and Peptides Market Trends

Germany is a leading hub for pharmaceutical innovation and production in Europe. German pharmaceutical companies are heavily investing in R&D and patent applications, making the country a top location for clinical trials and biopharmaceutical production. The aging population and increasing rates of chronic illnesses drive demand for non-invasive and easily administered therapies, supporting the adoption of oral peptides.

How Will Latin America Surge in the Oral Protein and Peptides Market in 2025?

Latin America is a rapidly growing region in the global healthcare market. This growth is primarily driven by increased healthcare expenditure, a rising prevalence of chronic diseases, a growing preference for non-invasive therapies, and expanding healthcare infrastructure. With a population experiencing high rates of chronic and metabolic conditions, there is substantial demand for effective and convenient treatment options such as oral peptides. As the region's economies grow, so does investment in healthcare infrastructure and public health programs.

Brazil Oral Protein and Peptides Market Trends

Brazil represents a significant market in Latin America, characterized by increasing local demand and international investment. The rising prevalence of chronic diseases and growing interest in non-invasive delivery methods highlight the market's potential. Moreover, Brazil has a substantial protein ingredients market for food, beverages, and nutrition, with investments being made in innovative sources such as precision fermentation proteins.

How Will the Middle East and Africa Contribute to the Oral Protein and Peptides Market in 2025?

The Middle East and Africa are key contributors to the global market due to the increasing prevalence of chronic and lifestyle-related diseases, heightened health awareness, and a growing demand for nutritional supplements. There is also a notable preference for non-invasive oral drug delivery methods. Increased investments in digital infrastructure and the pharmaceutical industry are supporting the adoption of advanced drug delivery technologies. Expanding healthcare infrastructure, particularly in countries like the UAE and Saudi Arabia, enables greater spending on innovative and premium health products.

Saudi Arabia Oral Protein and Peptides Market Trends

Saudi Arabia is emerging as a key player in the region, primarily as a consumer market. The increasing prevalence of diabetes and a growing emphasis on patient-centric therapies are expected to drive the adoption of oral peptide drugs. The nation's healthcare modernization programs and rising health awareness contribute to its role as a key regional market for the consumption and adoption of advanced therapeutic solutions.

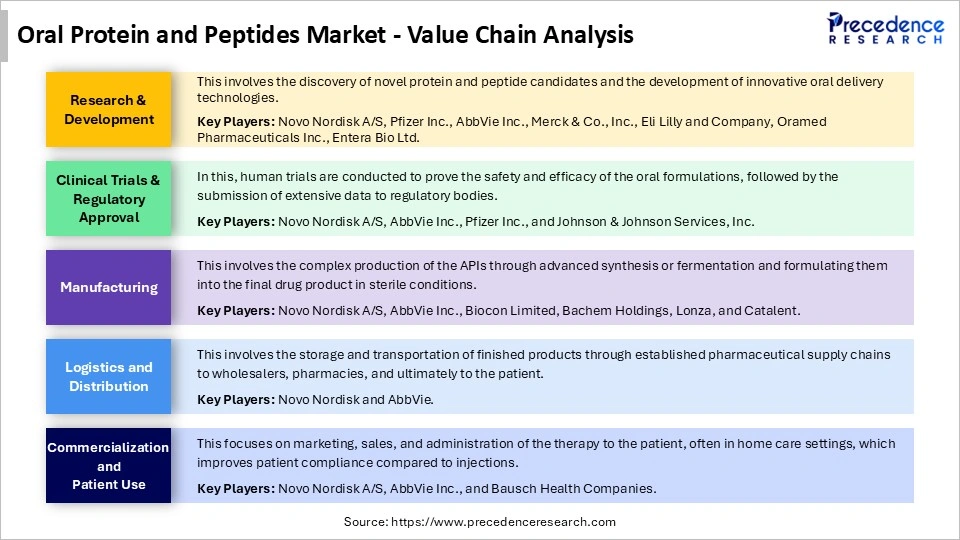

Oral Protein and Peptides Market Value Chain Analysis

Who are the Major Players in the Global Oral Protein and Peptide Market?

The major players in the oral protein and peptide market include Novo Nordisk, Eli Lilly, Pfizer, AbbVie, Zealand Pharma, Oramed Pharmaceuticals, Entera Bio, Bachem, za, Catalent, Evonik Health Care, and Adare Pharma Solutions.

Recent Developments

- In May 2025, Eli Lilly announced results from SURMOUNT-5, a Phase 3b trial comparing the efficacy of Zepbound (tirzepatide), a dual GIP and GLP-1 receptor agonist, to Wegovy (semaglutide) in adults with obesity. At 72 weeks, Zepbound outperformed Wegovy, with 64.6% of participants achieving at least 15% weight loss compared to 40.1% with Wegovy, and a superior waist circumference reduction. Results were presented at the 32nd European Congress on Obesity and published in The New England Journal of Medicine.(Source: https://investor.lilly.com)

- In April 2025, Cyprumed and MSD signed a nonexclusive license agreement for Cyprumed's oral peptide delivery technology, allowing MSD to develop oral formulations of peptides. Cyprumed could receive up to USD 493 million in milestones, while MSD will handle the development and commercialization of products using this technology.(Source: https://www.genengnews.com)

Segments Covered in the Report

By Product Type

- Nutritional Proteins

- Bioactive Peptides

- Therapeutic Peptides

By Source

- Animal-Derived Proteins

- Plant-Derived Proteins

- Synthetic/Fermentation-Derived Peptides

- Collagen-Derived Peptides

By Application

- Sports & Performance Nutrition

- Weight Management

- Immune Health Support

- Digestive & Gut Health

- Bone & Joint Health

- Metabolic Health

- Therapeutic/Clinical Nutrition

- Other Functional Applications

By End-User

- Sports & Fitness Enthusiasts

- Health & Wellness Consumers

- Medical & Clinical Nutrition Patients

- Aging Population / Elderly

- Lifestyle / Weight Management Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting