Oral Transmucosal Drugs Market Size and Forecast 2025 to 2034

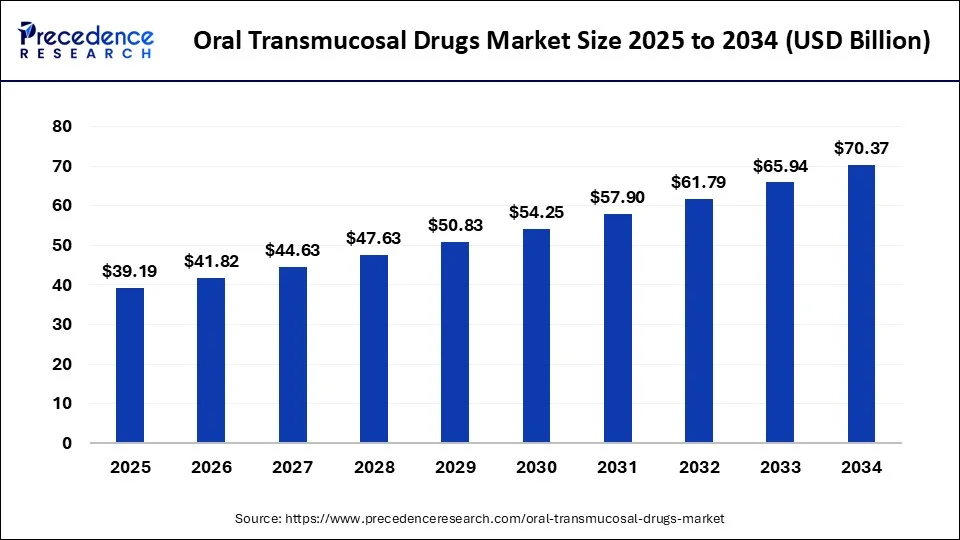

The global oral transmucosal drugs market size was calculated at USD 36.72 billion in 2024 and is expected to reach around USD 70.37 billion by 2034, expanding at a CAGR of 6.72% from 2025 to 2034. The North America oral transmucosal drugs market size reached USD 13.76 billion in 2023. The growth of the oral transmucosal drugs market is attributed to the increasing demand for efficient and rapid drug delivery systems, particularly for medications that require swift absorption into the bloodstream.

Oral Transmucosal Drugs Market Key Takeaways

- The global oral transmucosal drugs market was valued at USD 36.72 billion in 2024.

- It is projected to reach USD 70.37 billion by 2034.

- The oral transmucosal drugs market is expected to grow at a CAGR of 6.72% from 2025 to 2034.

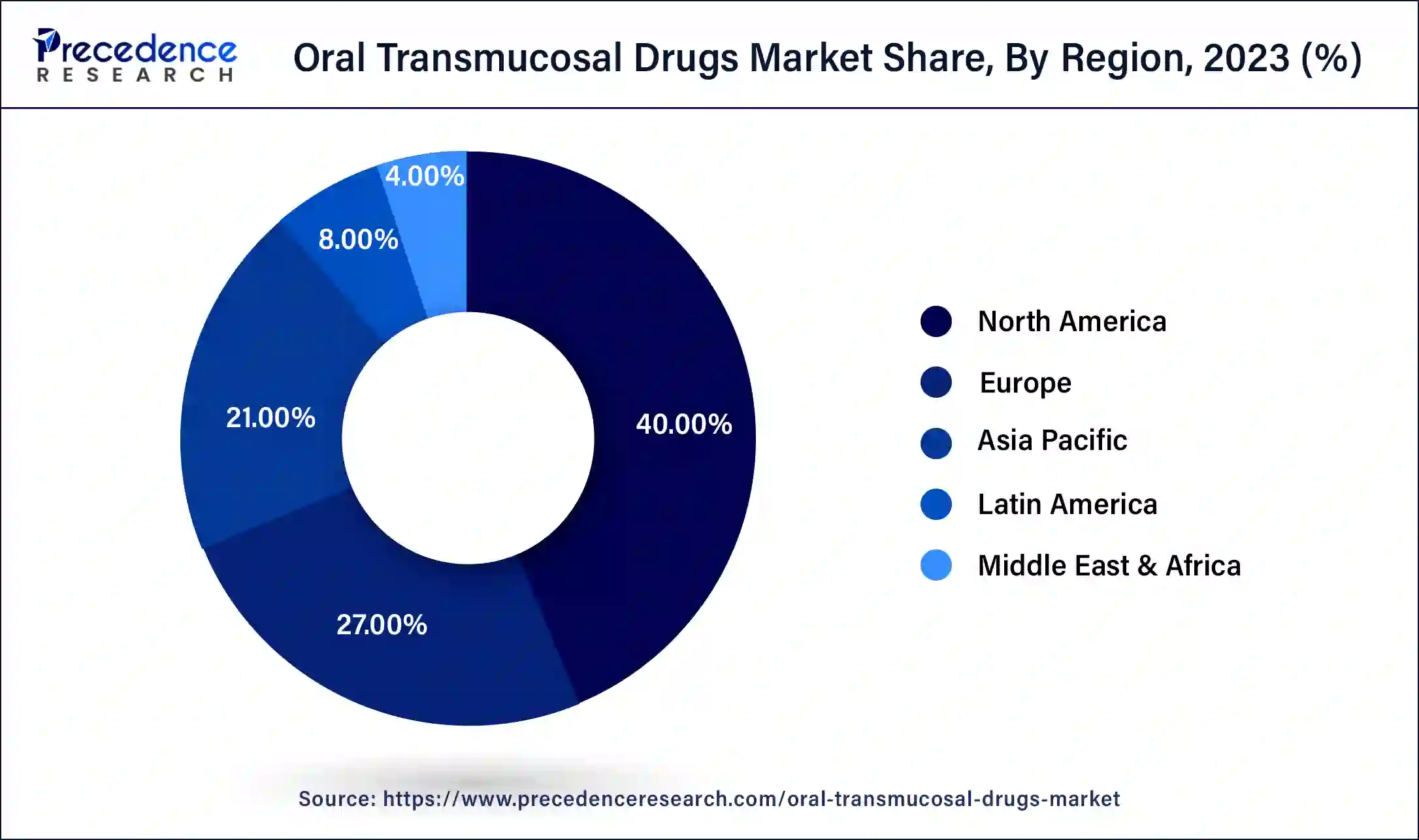

- North America dominated the oral transmucosal drugs market with the largest revenue share of 40% in 2024.

- Asia Pacific is expected to host the fastest-growing market in the upcoming years.

- By product type, the tablets segment accounted for the largest share of the market in 2024.

- By product type, the film segment is expected to grow at the fastest rate in the market over the forecast period.

- By route of administration, the sublingual mucosa segment has contributed more than 46% of revenue share in 2024.

- By route of administration, the buccal mucosa segment is expected to show the fastest growth in the market over the forecast period.

- By indication, the opioid dependence segment has generated more than 36% of revenue share in 2024.

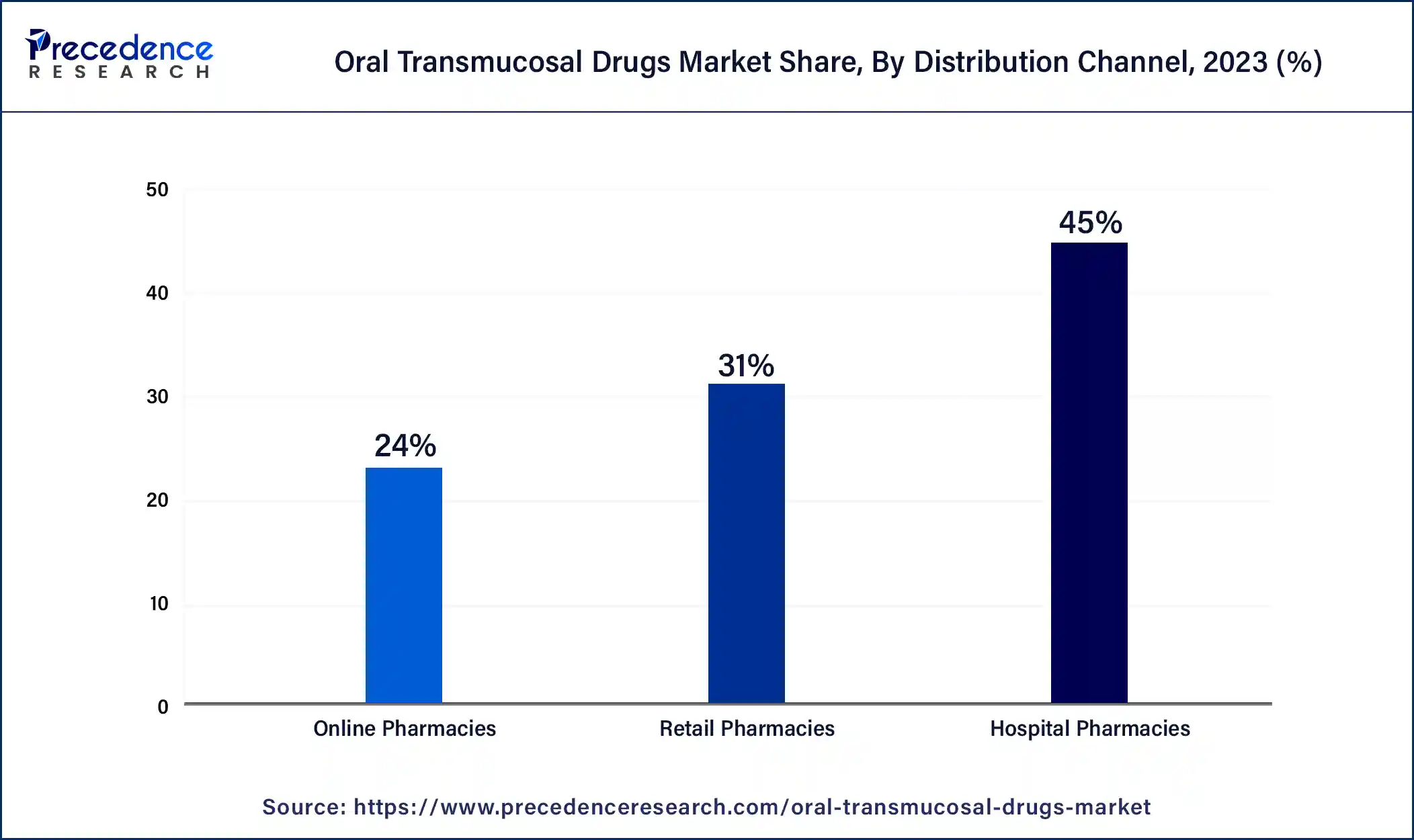

- By distribution channel, the hospital pharmacies segment accounted for the largest revenue share of 45% in 2024.

- By distribution channel, the retail pharmacy segment is expected to grow at the fastest rate in the market over the projected period.

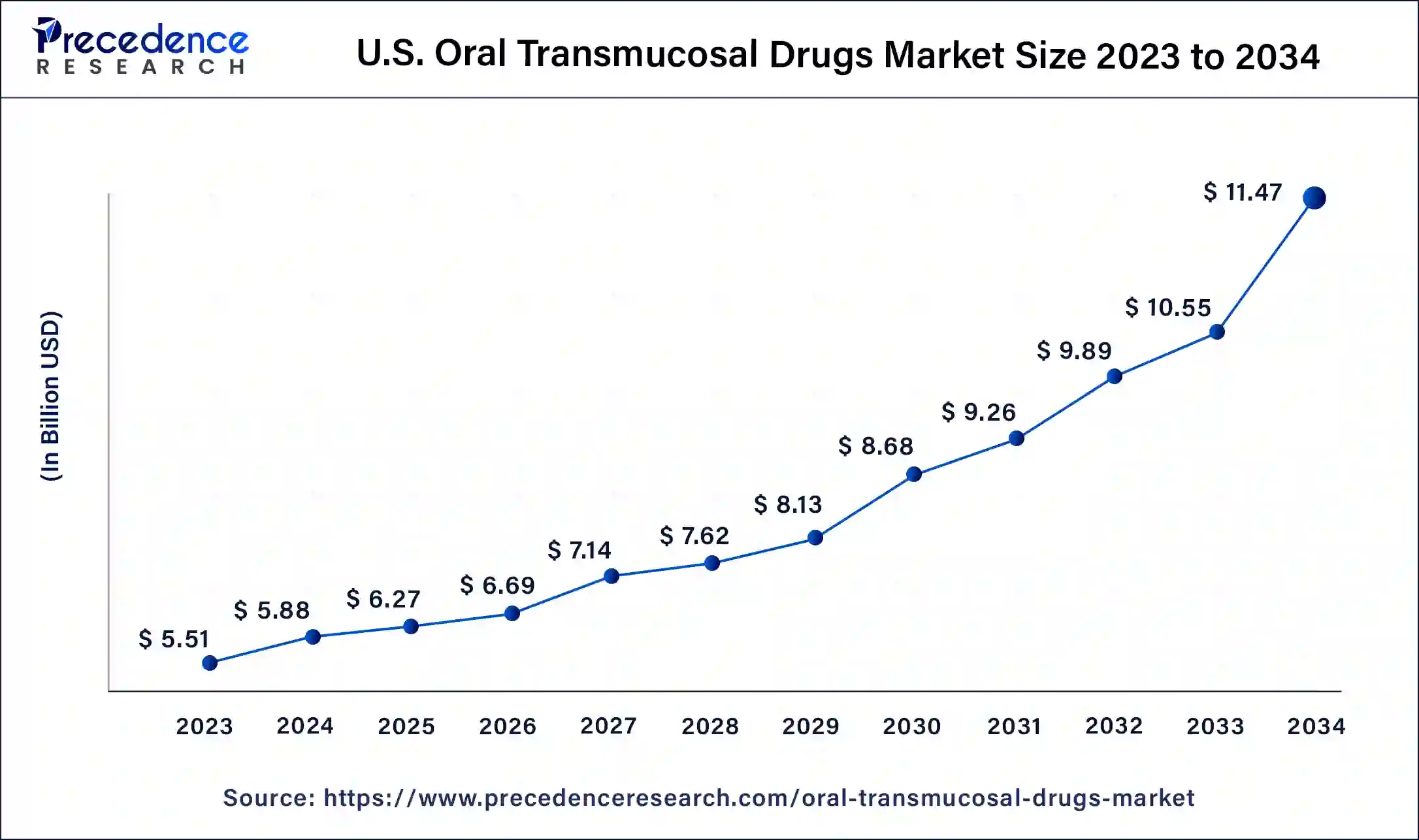

U.S. Oral Transmucosal Drugs Market Size and Growth 2025 to 2034

The U.S. oral transmucosal drugs market size was exhibited at USD 5.88 billion in 2024 and is projected to be worth around USD 11.47 billion by 2034, poised to grow at a CAGR of 6.91% from 2025 to 2034.

North America dominated the oral transmucosal drugs market in 2024. The widespread prevalence of Parkinson's, Alzheimer's, and dysphagia among target populations is driving market growth in the region. Additionally, the increasing geriatric population and a strong willingness to adopt new oral transmucosal medications are beneficial to the market. The region's expansion is further supported by the proactive efforts of local pharmaceutical companies and the availability of drugs designed to address opioid use disorders. This region has been particularly responsive to the ongoing global crisis of opioid use disorder and addiction, focusing on developing and providing effective treatment solutions.

- In January 2023, ALK, a global, research-driven pharmaceutical company, announced that the U.S. Food and Drug Administration (FDA) approved ODACTRA Tablet for Sublingual Use for the treatment of house dust mite-induced allergic rhinitis in persons ages 12 through 17. ODACTRA was first launched for adults, ages 18 through 65, in the U.S. in 2017, and the expanded indication builds on ALK's treatment offerings for those suffering from allergies.

Asia Pacific is expected to host the fastest-growing oral transmucosal drugs market in the upcoming years, with China, India, and Japan being the primary contributors. The region's drug delivery market is propelled by increased awareness of chronic disorders among the population, and a rising number of pharmaceutical and biotechnology companies aim to expand geographically and implement other strategies in Asia Pacific countries. Furthermore, the growth of research centers and increased government funding contribute to market expansion. The rising demand for therapeutics and the growth of medical tourism in Thailand, Singapore, and Malaysia also drive the market in this region.

The European oral transmucosal drugs market is set to grow significantly, driven by the aforementioned factors and trends. The market is expected to continue evolving with advancements in technology and increased focus on patient-centric drug delivery solutions. In Europe, the market is particularly robust in countries such as Germany, the UK, France, Italy, and Spain. Factors such as the increasing geriatric population, high prevalence of target diseases, and the presence of key market players contribute to the market's growth in these regions. The market is expanding due to the increasing demand for efficient and rapid drug delivery systems that offer quick absorption into the bloodstream, bypassing the gastrointestinal tract and avoiding first-pass metabolism in the liver. This is particularly advantageous for medications needed for pain management and other medical conditions requiring swift therapeutic effects​.

Market Overview

Transmucosal drug delivery devices, which administer medications through the mucous membrane for therapeutic purposes, provide an efficient alternative to oral, intravascular, subcutaneous, and transmucosal routes. As the demand for regular drug delivery devices for diagnosis and treatment increases among a wide audience, the oral transmucosal drugs market is expected to expand during the forecast period. One critical advantage of transmucosal drug administration is its ability to bypass the body's natural defense mechanisms. Transmucosal drug delivery offers numerous advantages over traditional administration methods, making it a lucrative market for companies in the value chain.

Oral Transmucosal Drugs Market Growth Factors

- Advancements in pharmaceutical formulations and technology are expected to fuel the growth of the oral transmucosal drugs market.

- The rising incidence of autoimmune diseases, like Parkinson's disease and cancer, can drive market growth shortly.

- Rising demand for oral transmucosal medications will likely boost the oral transmucosal drugs market growth further.

- The substantial rise in the diabetic population can propel the growth of oral transmucosal drugs market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 70.37 Billion |

| Market Size in 2025 | USD 39.19 Billion |

| Market Size in 2024 | USD 36.72 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.72% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Route of Administration, Indication, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The need for rapid drug delivery systems

In the oral transmucosal drugs market, the demand for efficient and smooth drug delivery systems is on the rise, driven by the need for medications that are quickly absorbed into the bloodstream. These drugs provide a more effective administration route, which makes them particularly valuable for pain management and specific medical conditions. Moreover, breakthroughs in pharmaceutical formulations and technology have led to the creation of innovative drug products and broadened their use across various therapeutic areas. This expansion mirrors the ongoing efforts within the pharmaceutical industry to improve drug delivery methods by offering patients more effective and convenient treatment options.

- In October 2023, Atai Life Sciences successfully concluded a Phase 1 study on VLS-01, an innovative oral trans-mucosal film (OTF) containing DMT. The study demonstrated that VLS-01 is well-tolerated and has a favorable safety profile in healthy participants.

Restraint

Potential Side Effects

The growth of the oral transmucosal drugs market is anticipated to be constrained by several disadvantages. Regulatory challenges and lengthy approval processes contribute to delays, while limited awareness among healthcare professionals and patients may also impede market expansion during the forecast period. Additionally, potential side effects or adverse reactions are factors that hinder market growth.

Opportunity

Rising R&D activities

The rising prevalence of diseases is driving increased research and development efforts to create new drugs with improved efficacy, leading to a surge in product launches for various conditions. This trend is expected to bolster market growth throughout the forecast period. Furthermore, the growing burden of diseases such as Parkinson's and migraines, along with the increasing geriatric population requiring oral medications, is likely to propel the expansion of the oral transmucosal drugs market in the coming years.

- In September 2023, Italian researchers developed a graphene-based smart transmucosal drug delivery device for the targeted mucosal and transmucosal delivery and controlled release of active pharmaceutical ingredients (APIs) for various therapeutic applications when on-demand drug administration is needed.

Product Type Insights

The tablets segment accounted for the largest share of the oral transmucosal drugs market in 2024. Their solid form and versatility in accommodating various drug formulations have made tablets popular among both drug manufacturers and healthcare providers, which can contribute to their market dominance. Tablets are a preferred method for administering medication due to their ease of use and patient familiarity. Also, the rising number of approvals for oral transmucosal tablets is expected to drive segment growth. Innovations such as rapidly dissolving tablets have enhanced the convenience and efficiency of drug absorption. Tablets are extensively used to treat a range of medical conditions, including pain, and are prescribed by doctors for both clinical and at-home use.

The film segment is expected to grow at the fastest rate in the oral transmucosal drugs market over the forecast period. Pharmaceutical films are polymeric formulations that serve as delivery platforms for administering small and large-molecule drugs for both local and systemic effects. They can be produced using synthetic, semi-synthetic, or natural polymers through methods such as hot melt extrusion, solvent casting, electrospinning, and 3D printing. The choice of components and manufacturing techniques modulate drug release. Additionally, these films offer advantages that have sparked interest in their development and evaluation for applications on buccal, nasal, vaginal, and ocular mucosa.

- In January 2022, IntelGenx Corp. dosed the first patient in a resumed Phase 2a clinical trial involving an oral film of montelukast for Alzheimer's disease (AD). The company says the leukotriene receptor antagonist montelukast could be the first disease-modifying therapy for Alzheimer's disease.

Route of Administration Insights

The sublingual mucosa segment led the oral transmucosal drugs market in 2024. This is because Sublingual drugs provide faster and more efficient medication delivery compared to other methods. These drugs are absorbed through blood vessels that have a substantial blood supply and a thin mucosa and enable quicker entry into the bloodstream. This characteristic makes sublingual medications particularly beneficial for acute conditions such as pain, where rapid relief is essential. Continuous advancements in research and technology are expected to keep the sublingual mucosa segment at the forefront of the oral transmucosal medicines market.

- In January 2024, Tata 1mg, a digital healthcare platform, announced that it has entered an exclusive partnership with Vitonnix UK to bring offerings to India. According to the company's press statement, they recently introduced a range of Vitamin Sublingual Sprays. This sublingual spray is applied directly under the tongue, thereby enabling the vitamins and supplements to be absorbed directly through the mucosal lining of the mouth, which has a rich blood supply.

The buccal mucosa segment is expected to show the fastest growth in the oral transmucosal drugs market over the forecast period. The buccal mucosa, which is richly supplied with blood vessels, offers greater permeability than the skin. This results in less frequent dosing, shorter treatment periods, and improved drug absorption. This site avoids first-pass metabolism, and its non-keratinized epithelium is relatively permeable to drugs. However, due to the flow of saliva and swallowing, substances in the buccal cavity have a short residence time. Therefore, this area is highly suitable for the development of bio-adhesive devices that adhere to the buccal mucosa and remain in place for an extended period.

Indication Insights

The opioid dependence segment dominated the oral transmucosal drugs market in 2024. This can be attributed to the rise in opioid addiction, and the demand for more advanced and effective treatments is driving this segment. Oral transmucosal drugs, such as sublingual medications, have proven effective in delivering medication to individuals struggling with opioid dependence. Moreover, these drugs ensure rapid absorption through the mucosa under the tongue and provide smooth relief from withdrawal symptoms by decreasing the risk of relapse.

Distribution Channel Insights

The hospital pharmacies segment accounted for the largest share of the oral transmucosal drugs market in 2024. Hospital pharmacies play an important role in distributing medications, including oral transmucosal drugs and providing pharmaceutical services. Healthcare professionals rely on these pharmacies to dispense medications in a controlled and well-monitored environment. Serving a diverse patient population, including those with acute medical conditions, hospital pharmacies are essential in managing patients' medication needs. This key role establishes hospital pharmacies as leaders in the distribution of oral transmucosal drugs.

The retail pharmacy segment is expected to grow at the fastest rate in the oral transmucosal drugs market over the projected period. Retail pharmacy is a platform where customers can physically see and evaluate their purchases, unlike online stores. This setup allows customers to experience instant gratification as they leave with them items immediately. In today's changing environment, retail pharmacies can strive to understand and meet consumers' needs to become a preferred shopping destination.

Oral Transmucosal Drugs Market Companies

- Aquestive Therapeutics, Inc.

- C.L.Pharm Co., Ltd.

- GW Pharmaceuticals plc.

- IntelGenx Corp

- Novartis AG

- Pfizer Inc.

- Seoul Pharmaceuticals

- Shilpa Therapeutics

- Sunovion Pharmaceuticals, Inc.

- ZIM Laboratories Limited

Recent Developments

- In April 2023, Eli Lilly and Company announced the launch of its new bilayer tablet formulation of Trulicity (dulaglutide) for the treatment of type 2 diabetes.

- In May 2023, AstraZeneca plc announced the launch of its new once-daily oral tablet formulation of Farxiga (dapagliflozin) for the treatment of type 2 diabetes and heart failure with preserved ejection fraction.

- In May 2022, the European subsidiary of ZIM Laboratories Limited, SIA ZIM Laboratories Limited, obtained marketing authorization from AEPMS for 'Sildenafil 50 mg' ODS in Spain.

Segments Covered in the Report

By Product Type

- Tablets

- Films

By Route of Administration

- Sublingual Mucosa

- Buccal Mucosa

- Others

By Indication

- Opioid Dependence

- Nausea & Vomiting

- Erectile Dysfunction

- Neurological Disorders

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting