What is the Ovine And Caprine Artificial Insemination Market Size?

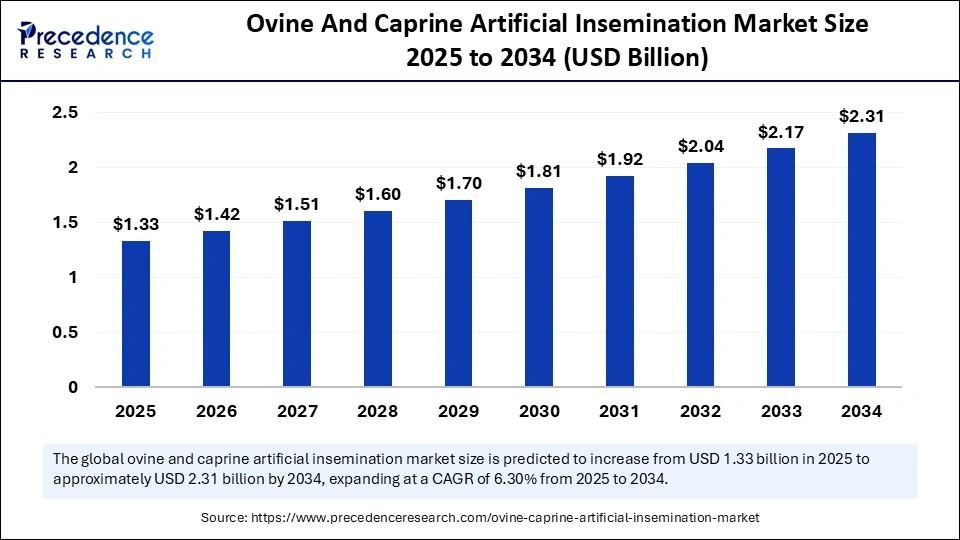

The global ovine and caprine artificial insemination market size is valued at USD 1.33 billion in 2025 and is predicted to increase from USD 1.42 billion in 2026 to approximately USD 2.31 billion by 2034, expanding at a CAGR of 6.30% from 2025 to 2034. The market for artificial insemination in ovine and caprine (sheep and goats) is experiencing substantial growth, driven by increasing demand for genetic improvement. This growth is further supported by the adoption of advanced breeding techniques aimed at enhancing productivity and disease resistance. Additionally, expanding applications in livestock management and dairy production are expected to fuel market expansion.

Ovine And Caprine Artificial Insemination Market Key Takeaways

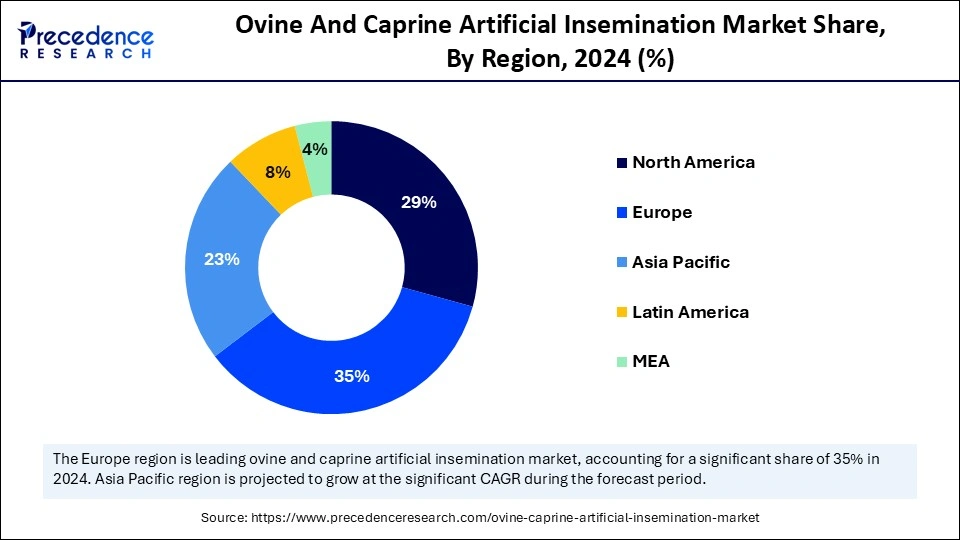

- Europe dominated the global ovine and caprine artificial insemination market with the largest share of 35% in 2024.

- Asia Pacific is anticipated to grow at a significant CAGR from 2025 to 2034.

- By insemination type, the cervical insemination segment captured the biggest market share of 45% in 2024.

- By insemination type, the laparoscopic insemination segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By semen type, the frozen semen segment contributed the highest market share of 50% share in 2024.

- By semen type, the chilled semen segment is expected to witness the fastest CAGR during the foreseeable period.

- By technique, the hormone-assisted insemination segment held the largest market share, 40%, in 2024.

- By technique, the synchronization protocols segment is projected to grow at a CAGR between 2025 and 2034.

- By equipment & consumables, the semen collection and storage equipment segment captured the largest market share of 35% in 2024.

- By equipment & consumables, the cryogenic tanks segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By application, the dairy production segment held the maximum market share of 50% in 2024.

- By application, the meat production segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By end user, the livestock farms segment generated the major market share of 55% in 2024.

- By end user, the artificial insemination centers and cooperatives segment is expected to witness the fastest CAGR during the foreseeable period.

What is Ovine And Caprine Artificial Insemination?

The global market for ovine and caprine artificial insemination involves the use of reproductive biotechnology aimed at improving genetic traits, enhancing productivity, and promoting sustainable livestock breeding. Artificial insemination includes the collection, preservation, and insertion of semen (fresh, chilled, or frozen) into the reproductive tracts of ewes and does. This method enables selective breeding without the necessity of natural mating. The market is primarily driven by the increasing demand for high-quality meat, dairy, and wool products, the growing adoption of advanced breeding programs, government initiatives to enhance livestock productivity, and advancements in cryopreservation and synchronization technologies.

How Can AI Impact the Ovine and Caprine Artificial Insemination Market?

Artificial intelligence (AI) is also transforming the market by improving genetic selection, increasing efficiency, and managing reproduction through advanced technologies like machine learning, robotics, and data analytics. AI algorithms can analyze large volumes of data from sensors and individual animals to identify high-performing traits, allowing for more precise genetic selection and improvement. By accelerating genetic progress and facilitating out-of-season breeding, AI enhances the productivity of flocks and herds, leading to better distribution of market outputs. Furthermore, AI enables the widespread dissemination of semen from superior sires, even from deceased or geographically distant animals, thereby expanding genetic options for breeders.

Market Outlook

- Industry Growth Overview:

The ovine and caprine artificial insemination market is growing, driven by growing demand for larger genetics and enhanced livestock productivity, improved government support, and an increasing understanding of herd management efficiency. - Global Expansion:

Farmers and breeders apply AI-driven methods to access high-quality genetics from greater males, introducing wanted traits such as enhanced meat quality, disease resistance, and milk production into their flocks and herds. North America is dominant in the market due to its progressive animal husbandry infrastructure and high adoption of AI-driven technologies. - Major investors:

Major investors are typically involved in specialized companies that manufacture and supply the necessary equipment, consumables, and genetic materials, rather than large venture capital firms in the traditional sense. It includes IMV Technologies, Zoetis, Neogen Corporation, MINITÜB GMBH, and others.

What are the Key Trends in the Ovine and Caprine Artificial Insemination Market?

- Improved Reproductive Efficiency: Artificial insemination allows for better breeding management by enabling a superior male to sire offspring with multiple females, ultimately improving overall herd productivity. By avoiding natural mating, the risk of sexually transmitted diseases spreading within a flock or herd is minimized.

- Demand for High-Quality Genetics: Farmers and breeders are increasingly seeking to introduce desirable traits into their herds, such as enhanced meat quality, higher milk production, and greater disease resistance. Artificial insemination facilitates this by providing access to elite male genetics.

- Disease Control and Biosecurity: This method significantly reduces the risk of transmitting venereal or other infectious diseases that can occur during natural mating. Using carefully screened semen in a controlled process promotes overall herd health and biosecurity, which is becoming increasingly important for livestock producers.

- Advancements in Artificial Insemination Technology: Improvements in semen processing techniques, such as sexing, density gradient centrifugation, and cryopreservation methods like vitrification, along with the availability of more sophisticated equipment like insemination guns and catheters, enhance the effectiveness of artificial insemination.

- Genetic Improvement and Efficiency: Artificial insemination enables farmers to access genetic material from high-merit male animals located in different geographic areas, overcoming previous challenges related to costs and logistics. This accelerates the selection process for desirable traits.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.31 Billion |

| Market Size in 2026 | USD 1.42 Billion |

| Market Size in 2025 | USD 1.33 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.30% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Insemination Type, Semen Type, Technique, Equipment & Consumables, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Global Demand for Top-Quality Meat and Dairy Products

A key driver of the ovine and caprine artificial insemination market is the rising global demand for top-quality meat and dairy products. This demand fuels the need for genetic improvement and enhanced productivity in sheep and goat farming. Artificial insemination provides access to superior genetics from high-quality rams and bucks, enabling farmers to introduce desirable traits such as better meat quality, increased milk production, and improved disease resistance into their herds. Innovations like sexed semen, enhanced semen storage and transportation methods, and reproductive management software have further increased the efficiency and effectiveness of the artificial insemination process.

Restraint

Difficulty of Effective Semen Application

However, one of the main restraints within the ovine and caprine artificial insemination market is the difficulty of effective semen application, particularly with frozen semen, due to the complex cervical anatomy of ewes. This anatomical barrier complicates the procedure for technicians, often resulting in variable and low conception rates. The inconsistent success rate of transcervical artificial insemination using frozen semen diminishes the procedure's cost-effectiveness, making it less appealing to many farmers. Consequently, laparoscopic artificial insemination (LAI), which is a more invasive and expensive surgical procedure, is frequently necessary to achieve satisfactory pregnancy rates.

Opportunity

Advancements In Genetic Improvement Technologies

A significant opportunity in the ovine and caprine artificial insemination market lies in advancements in genetic improvement technologies, particularly sexed semen and genomic selection. Integrating these technologies with artificial insemination enables breeders to maximize productivity, create superior breeds, and drive significant economic growth in the livestock sector. The rising global demand for high-quality meat and milk from sheep and goats further emphasizes the need for more efficient breeding methods. By reducing the costs associated with maintaining breeding bucks and minimizing the risk of disease transmission, and more accessible to small and medium-sized farms.

Insemination Type Insights

What Made the Cervical Insemination Segment Lead the Ovine and Caprine Artificial Insemination Market in 2024?

The cervical insemination segment is expected to dominate the market in 2024, due to its accessibility and lower cost compared to LAI. Cervical insemination is a non-invasive procedure, meaning it does not require surgical expertise, anesthesia, or specialized laparoscopic equipment. This makes it a more practical and cost-effective option for many producers. Additionally, it is most effective when using fresh or chilled semen, achieving acceptable conception rates of up to 60%. The caprine cervix is less complex and easier to navigate than the ovine cervix, making cervical insemination a common and effective practice in goat breeding.

On the other hand, the laparoscopic insemination segment is anticipated to be the fastest-growing segment in the market. This approach offers the highest conception rates by placing semen directly into the uterus, effectively bypassing the challenging cervix of small ruminants. The segment's growth is also supported by advancements in equipment, such as double-lumen needles and specialized sheaths, along with sophisticated estrus synchronization protocols, which enhance efficiency and success rates. These developments can lead to greater genetic improvement and profitability for producers.

Semen Type Insights

How Did the Frozen Semen Segment Lead the Ovine and Caprine Artificial Insemination Market in 2024?

The frozen semen segment led the market in 2024, primarily because it enables long-term storage and global distribution of elite genetics. This allows producers to widely disseminate superior traits and maintain genetic resources regardless of the sire's location or lifespan. Producers can transport frozen semen both nationally and internationally, which facilitates the rapid and widespread distribution of superior genotypes without the physical presence of the male. Additionally, frozen semen significantly increases the number of offspring from a single valuable sire, enhancing genetic selection schemes without the risk of disease transmission.

The chilled semen segment is experiencing the fastest growth in the market, mainly due to its lower operational costs, extended shelf life compared to fresh semen, ease of transport for regional use, and reduced complexity and time commitment when compared to frozen semen. Chilled semen strikes a balance between the immediate availability of fresh semen and the extensive processing and storage requirements, making it ideal for local areas where timely access is crucial for improving herd quality. Furthermore, artificial insemination with chilled semen allows for widespread genetic improvement, resulting in higher meat yields and better disease resistance.

Technique Insights

How Did Hormone-Assisted Insemination Dominate the Ovine and Caprine Artificial Insemination Market in 2024?

The hormone-assisted insemination segment dominated the market in 2024, largely because it enhances fertility and breeding efficiency by controlling the estrus cycle and synchronizing insemination. Hormonal protocols, such as those that use progesterone or prostaglandins, allow for synchronized ovulation in ewes and does. This means that insemination can occur at an optimal and predictable time, leading to higher conception rates. This hormonally guided approach maximizes the use of genetically superior males, increases conception rates, and facilitates targeted genetic improvement in herds, thus maximizing productivity and profitability in livestock farming.

The synchronization protocols segment is expected to experience the fastest growth in the market. This growth is driven by improvements in genetic quality, increased breeding efficiency, and the ability to standardize offspring by allowing large groups of animals to be bred at the same predetermined time. Synchronization enables breeders to inseminate many females using semen from high-quality, proven sires, thereby accelerating the propagation of desirable genes and traits within the herd or flock. By synchronizing estrus and ovulation, large groups of females can be inseminated on a predetermined schedule, significantly shortening the breeding and calving seasons and improving pregnancy rates.

Equipment Insights

What Made the Semen Collection and Storage Equipment Segment Lead the Market in 2024?

The semen collection and storage equipment segment led the market in 2024, as it is fundamental to the entire artificial insemination process, enabling the acquisition, processing, and preservation of semen for genetic improvement and herd management. Semen collection and storage are foundational steps in artificial insemination, providing the genetic advantages of superior animals that are efficiently distributed. The primary goal of ovine and caprine artificial insemination is to enhance genetic traits in herds and improve productivity. Advances in storage equipment and techniques, such as cryopreservation, allow semen to be stored for longer periods, making it available when needed and facilitating global shipment.

The cryogenic tanks segment is growing rapidly in the market, mainly due to the increasing demand for frozen semen for breeding, advancements in cryopreservation, and greater awareness of the benefits of artificial insemination in developing countries looking to enhance meat and milk production. Continuous development in semen freezing and thawing techniques, including improved cryoprotective agents, has enhanced the viability of frozen semen. This increased success rate in preserving sperm quality makes frozen semen a more viable option, driving demand for storage to improve breeding efficiency and genetic selection.

Application Insights

Which Application Dominates the Ovine and Caprine Artificial Insemination Market?

The dairy production segment dominated the market in 2024. This growth is attributed to the significant increase in dairy farming, which improves herd quality and productivity through artificial insemination, ultimately leading to higher milk yields and more milk-derived products. It enables farmers to select for superior genetic traits in their sheep and goats, enhancing overall efficiency, reducing the costs associated with maintaining large numbers of breeding animals, and providing better control over disease spread. Moreover, it helps mitigate the transmission of diseases that can occur during natural mating, improving the overall health of the flock.

The meat production segment is expected to grow the fastest in the market. This growth is primarily driven by the increasing global demand for high-quality protein, the desire to improve the productivity of native sheep and goat breeds through selective breeding, and supportive government initiatives combined with advanced agricultural practices that promote the adoption of artificial insemination. Farmers are increasingly leveraging artificial insemination to enhance genetic traits, leading to improved herd quality and productivity, with superior products and efficient breeding methods.

End User Insights

Why Did Livestock Farms Lead the Ovine and Caprine Artificial Insemination Market in 2024?

The livestock farms segment led the market in 2024 because these farms are the direct users of artificial insemination technologies. This segment is driven by the demand to enhance herd genetics, improve productivity for both meat and milk, increase disease control, and lower overall breeding costs. Livestock farmers benefit directly from AI by improving the genetic traits of their sheep and goat herds, which leads to better production of milk, meat, and fiber. It also aids in controlling the spread of diseases, as it reduces the need for natural mating, thereby minimizing potential health risks and economic losses for farms. Enhancing breeding outcomes and herd health contributes to more cost-effective operations for livestock farms.

The artificial insemination centers and cooperatives segment is the fastest-growing in the market. This growth is mainly due to the accessible, community-based, and cost-effective artificial insemination services offered, particularly for small-scale farmers in developing regions. These segments are often supported by government and NGOs, which extend artificial insemination services and technology to remote or small-scale farmers who may lack direct access to private services. These entities are crucial for disseminating this technology, genetic materials, and expert support to a broader rural base, thereby increasing access to improved breeding practices that boost productivity and profitability for individual farmers and the agricultural community at large.

Regional Insights

Europe Ovine And Caprine Artificial Insemination Market Size and Growth 2025 to 2034

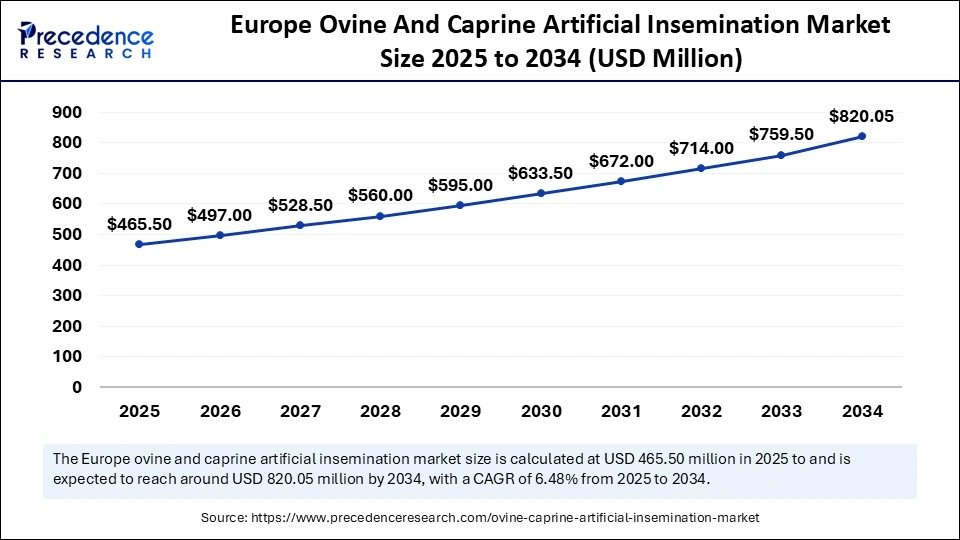

The Europe ovine and caprine artificial insemination market size is exhibited at USD 465.50 million in 2025 and is projected to be worth around USD 820.05 million by 2034, growing at a CAGR of 6.48% from 2025 to 2034.

How Did Europe Dominate the Ovine and Caprine Artificial Insemination Market in 2024?

Europe dominated the ovine and caprine artificial insemination market in 2024, primarily due to well-developed animal breeding programs, advanced infrastructure, and strong governmental support. Europe has a long history of intensive breeding programs for sheep and goats, leading to the selection and development of superior genetic traits for milk yield, meat quality, and disease resistance. European governments and the EU provide significant backing through policies, subsidies, and funding for modern agricultural practices. Companies like IMV Technologies and Minitüb GmbH are major players in the global veterinary artificial insemination market, offering advanced equipment and services.

The UK Ovine and Caprine Artificial Insemination Market Trends

The UK plays a dominant role in the global market, characterized by government support, a diverse genetic pool, and a growing domestic market. The UK has developed numerous native sheep breeds with unique traits, such as improved productivity and disease resistance. The UK's advanced breeding and genetic technologies contribute significantly to the global sheep gene pool. Genomic applications are employed to study British breeds, facilitate conservation, and enhance production worldwide to meet specific health and certification requirements.

Germany Ovine and Caprine Artificial Insemination Market Trends

Germany plays a significant role in the European global market, leading in revenue generation. Its position is driven by a technologically advanced agricultural sector focused on genetic improvement for sheep and goats, enhancing traits like productivity and disease resistance. Ongoing advancements in reproductive technologies, including improved cryopreservation and data-driven management systems, have contributed to more reliable and efficient breeding outcomes.

Why is Asia Pacific Considered the Fastest-Growing Region in the Ovine and Caprine Artificial Insemination Market in 2024?

Asia-Pacific is the fastest-growing market for ovine and caprine artificial insemination, driven by large and growing populations, increased urbanization, rising incomes, and a strong cultural preference for meat and dairy products in countries such as India and China. As economies expand, incomes rise, and populations shift towards urban areas, there is an increase in the consumption of processed and packaged food, including meat and dairy. There is also a growing awareness of the importance of nutrition and the health benefits associated with animal products, further increasing the demand for higher-quality and more diverse food sources. The region's high population density relative to its agricultural land creates pressure to enhance productivity and efficiency.

India: Increasing economic importance of sheep and goats

In India, the growing demand for ovine and caprine artificial insemination (AI) is due to the requirement for genetic development and cross-breeding, the scarcity of superior male animals, government support, and the economic benefits for small-scale farmers. AI-driven technology is an important method for presenting superior genetics to local breeds, which supports in development of cross-breeds with healthier economic traits such as higher milk and meat production.

North America: Presence of advanced veterinary healthcare infrastructure

North America is significantly growing the market with a modern veterinary medical care infrastructure, robust research, and advancement. Growing demand for advanced-quality meat and dairy products. Increasing awareness of AI and the requirement to meet increasing animal protein demands predominantly. Major organizations, such as STgenetics, are based in North America and have a significant role in the market.

U.S.: Technological leadership

The U.S. leverages advanced breeding technologies for genetic enhancement, predictive modeling, and more efficient breeding processes. Strong research foundation, maintained by institutions such as universities and organizations such as the USDA, drives invention in AI techniques for both commercial and smaller farms.

Ovine and Caprine Artificial Insemination Market- Value Chain Analysis

R&D:

R&D process for an ovine and caprine artificial insemination focuses on semen technology and cryopreservation, female reproductive management, insemination technology, equipment, and advanced genetic and reproductive skills.

- Key Players: IMV Technologies and Zoetis

Clinical Trials:

Clinical trials and research in ovine and caprine artificial insemination (AI) focus on optimizing techniques to enhance success rates, genetic gain, and animal welfare.

- Key Players: Agtech, Inc., and B&D Genetics

Patient Services:

It involves pre-insemination services, insemination services, post-insemination services, breeding consultancy, and recovery monitoring

- Key Players: SEK Genetics

Top Vendors in the Ovine and Caprine Artificial Insemination Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

United States |

Strong brand reputation, robust financial performance |

Zoetis is the largest worldwide animal health organization committed to nurturing the world and humankind by advancing care for animals. |

|

|

United States |

Global presence with a robust distribution network |

It offers better across-breed comparisons, allowing breeders to benchmark animals more efficiently. |

|

|

STgenetics |

United States |

It provides advanced genomic testing |

It is well known as the pioneer of sex-sorting technology, specifically SexedULTRA and SexedULTRA High Purity, used to produce gender-sorted bovine semen for the beef and dairy industries. |

|

Ceva Sante Animale |

France |

Pioneering sex-sorted semen technology |

Ceva maintains a commitment to offering effective equipment for veterinarians and farmers to improve animal well-being and farm sustainability. |

|

Minitube International |

Tiefenbach, Germany |

Strong emphasis on research and development |

Minitube is the global leading supplier of systems for the field of assisted animal reproduction. |

Other Major Companies

- URUS Group LP

- CRV

- Viking Genetics

- IMV Technologies

- Genus plc (ABS Global)

- Select Sires Inc.

Leaders' Announcements

- In January 2025, IMV Technologies announced its acquisition of Conception Ro-Main Inc., a Quebec-based leader in swine technology. This partnership is anticipated to enhance product offerings and sustainable production solutions for pig producers globally. IMV's CEO emphasized Ro-Main's strong reputation and innovative product portfolio, which includes AI-powered software and advanced breeding tools.

(Source: https://www.imv-technologies.com)

Recent Developments

- In June 2024, Mali launched its first community-based breeding scheme for goats, aimed at enhancing the genetic potential of local herds through collaboration among livestock keepers. This initiative, supported by ICARDA and ILRI, reflects Mali's rich agropastoral tradition and the significant role of small ruminants in the economy, with over 29 million goats contributing to rural livelihoods and export earnings.

(Source: https://www.global-agriculture.com) - In August 2023, URUS Group LP (URUS) acquired a majority interest in Leachman Cattle of Colorado, which enhances its position in global cattle genetics. Leachman's innovative genetic selection tools and extensive database are expected to enable significant improvements in beef and dairy programs, benefiting both producers and consumers.

(Source: https://www.dairyherd.com)

Segments Covered in the Report

By Insemination Type

- Cervical Insemination

- Transcervical Insemination

- Laparoscopic Insemination

By Semen Type

- Fresh Semen

- Chilled Semen

- Frozen Semen

By Technique

- Hormone-Assisted Insemination

- Synchronization Protocols

- Embryo Transfer Support

- Others

By Equipment & Consumables

- AI Guns & Catheters

- Speculums

- Semen Collection & Storage Equipment

- Cryogenic Tanks

- Others

By Application

- Dairy Production (milk yield improvement)

- Meat Production (genetic improvement of breeds)

- Wool & Fiber Production

- Research & Breeding Programs

By End User

- Veterinary Clinics & Hospitals

- Livestock Farms

- Artificial Insemination Centers & Cooperatives

- Research Institutes & Universities

- Government & NGOs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting