Packaging Testing Market Size and Forecast 2025 to 2034

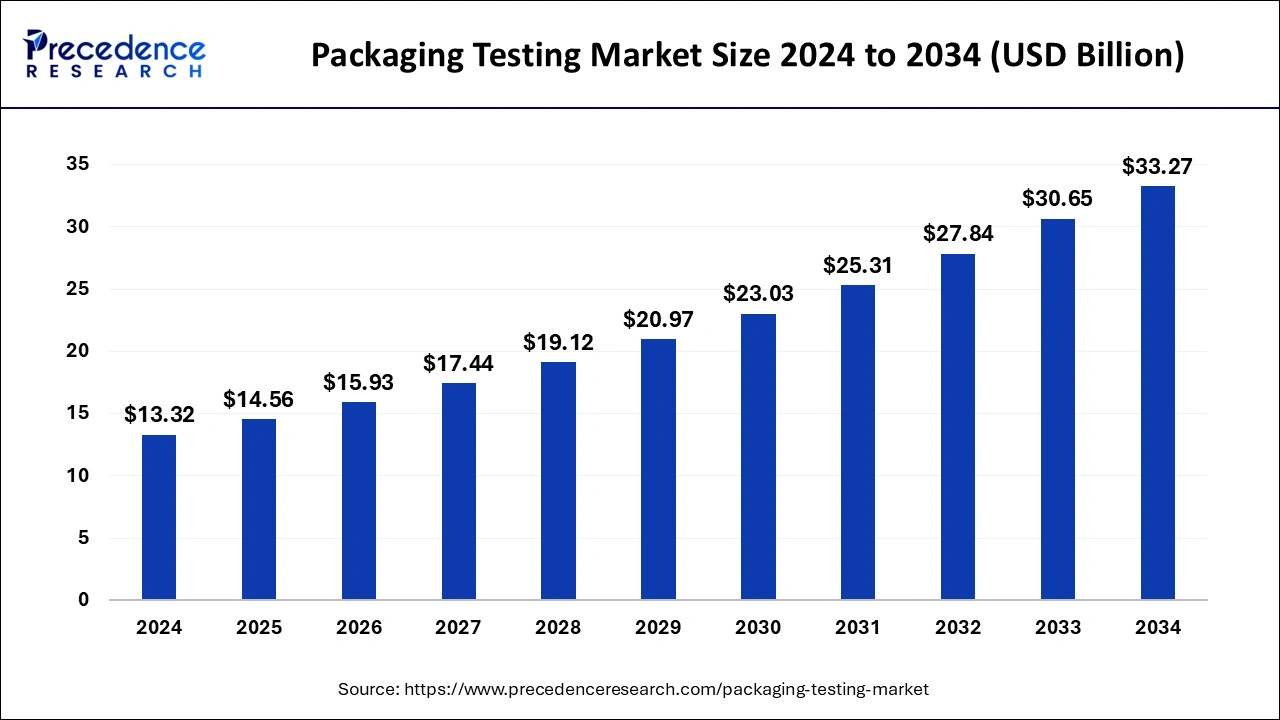

The packaging testing market size was estimated at USD 13.32 billion in 2024 and is predicted to increase from USD 14.56 billion in 2025 to approximately USD 33.27 billion by 2034, expanding at a CAGR of 9.59% from 2025 to 2034.

Packaging Testing MarketKey Takeaways

- In terms of revenue, the global packaging testing market was valued at USD 13.32 billion in 2024.

- It is projected to reach USD 33.27 billion by 2034.

- The market is expected to grow at a CAGR of 9.59% from 2025 to 2034.

- North America held the dominant share of the market in 2024. The region is observed to witness prolific growth during the forecast period.

- Europe is observed to expand at a rapid pace during the forecast period.

- By type, the chemical segment captured the biggest market share in 2024.

- By type, the physical segment is observed to witness a significant share during the forecast period.

- By material type, the plastic segment held the largest market share in 2024.

- By material type, the paper and paperboard segment is expected to grow at the fastest rate during the forecast period.

- By end-user, the food & beverages segment held the major market share in 2024.

- By end-user, the chemical and fertilizers segment is expected to grow at a notable rate.

Market Overview

The packaging testing market offers essential solutions across various sectors. Packaging testing ensures the safety of products for consumption or use and aligns with regulatory standards. Packaging testing ensures that meet meets the specifications of the business's packaging and avoids any product damage. Packaging testing identifies several opportunities across different areas including enhanced performance of packaging materials in realistic environmental conditions, cost savings on packaging, scalability of packaging, reliability during transportation scenarios, and quality control. It includes compliance issues such as specifications, certifications, and regulations.

In recent years, the packaging testing market has witnessed significant growth and is projected to grow considerably in the coming years. The packaging test is the essential step that is carried out before the product is shipped to its destination. Several tests are carried out on packaging material such as pressure loads, vibrations, shocks, temperature changes, changes in humidity, and others to test packaging.

Packaging Testing Market Growth Factors

- The growing focus on sustainability and eco-friendly packaging materials is observed to promote the market's growth in the upcoming years.

- The rapid growth of e-commerce and direct-to-consumer channels creates demand for packaging solutions that can withstand the rigors of online shipping and handling.

- Growing awareness among consumers about product safety, hygiene, and environmental sustainability fuels the demand for packaging testing services.

- Innovations in packaging materials and technologies, such as active and intelligent packaging, biodegradable materials, and nanotechnology-based coatings, create the need for specialized testing methods.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 13.32 Billion |

| Market Size by 2034 | USD 33.27 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.59% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Marerial type, By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing emphasis on sustainable packaging

The increasing emphasis on sustainable packaging is expected to boost the growth of the packaging testing market during the forecast period. The introduction of sustainable and eco-friendly packaging materials to cater to the ongoing consumer demand for eco-friendly products. Sustainable packaging is gaining momentum driven by eco-conscious consumers and stringent government regulations. Testing of bio-based, recyclable, and other sustainable packaging requires specialized capabilities. In recent decades, the demand for safe and secure packaging solutions has increased due to the emerging trend of advanced packaging testing solutions.

Sustainable packaging led to the rising use of multiple grades of plastic across various industries. Sustainable packaging protects the packaged product from damage caused by bad weather conditions, insects, microbes, and many other factors during transportation. The rapidly rising environmental concerns have compelled several companies to adopt sustainable packaging materials. The appropriate testing ensures that packaging materials are eco-friendly and meet all the required quality standards.

Moreover, renowned government authorities are implementing stringent regulations on the quality and safety of packaging used across various end-use industries. For instance, the U.S. FDA has established strict norms for packaging materials used in healthcare and pharmaceutical applications. Such stringent regulations by government bodies ensure compliance through packaging testing. Thereby, driving the market's growth.

Restraint

High cost

The high cost associated with advanced packaging testing methods is anticipated to hamper the growth of the market. Setting up a laboratory for packaging testing requires significant investment in facilities, tools, equipment, and skilled professionals. The need to meet advancing test methodologies often gets impacted due to budget constraints, which may limit the adoption and restrict expansion of the global packaging testing market.

Opportunity

Robust growth of the e-commerce sector

The robust growth of the e-commerce industry is projected to offer a lucrative opportunity for the growth of the packaging testing market during the forecast period. The rapid rise of e-commerce, coupled with technological advancements in packaging material solutions is positively affecting the growth of the market. The changing trend of online shopping relies on packaging material to ship their products safely to customers. Packaging testing is crucial to ensure the packaging used for shipping the desired product to the customer must withstand transit-related risks such as vibrations, shocks, and compression. E-commerce companies conduct various packaging tests to deliver goods safely, reduce returns, avoid damages during transportation, and enhance customer satisfaction. E-commerce companies and online retail emphasize designing packaging that is suitable to handle harsh shipping environments.

Type Insights

Based on type, the chemical segment dominated the packaging testing market in 2024. the segment is observed to grow at a significant rate during the forecast period. Chemical packaging plays a crucial role in assuring the safety and quality of chemical products during their storage and transportation. The chemical industry has witnessed significant growth due to ongoing demand for chemicals in several industries such as construction, automotive, healthcare, consumer goods, and others.

On the other hand, the physical segment is observed to grow significantly during the forecast period. Physical packaging testing solutions are generally being preferred for evaluating structural and mechanical aspects of packaging. Physical testing plays a crucial role in assessing the structural integrity and durability of packaging materials and designs. This includes evaluating factors such as tensile strength, compression resistance, puncture resistance, tear resistance, and burst strength to ensure that packaging can withstand the rigors of transportation, handling, and storage.

Material Type Insights

The plastic segment held the dominating share of the packaging testing market in 2024. Plastic packaging is lightweight, cost-effective, and resistant to chemicals as well as heat. Plastic remains the most often utilized material for packaging as polypropylene can provide a strong barrier against contamination and temperature, preventing harm to the packaged goods. The market has experienced the increasing use of sustainable and biodegradable plastic packaging across various end-use industries. Plastic packaging protects the packaged product from damage during transportation. Therefore, the rising use of plastic materials in packaging is anticipated to spur the demand for plastic packaging testing solutions.

The paper and paperboard segment is observed to grow at the fastest rate during the forecast period of 2025-2034. Paper and paperboard are among the most commonly used materials for packaging across various industries, including food and beverage, pharmaceuticals, cosmetics, and consumer goods. Their versatility, affordability, and eco-friendliness make them preferred choices for packaging applications, leading to a high demand for testing services specific to these materials.

End-user Insights

The food & beverage segment held the dominating share of the packaging testing market in 2024. Nowadays, packed food and beverages are becoming more prevalent around the world as processed food consumption is increasing steadily. Market players in the food and beverages industry are increasing their global presence and service offerings. The rapidly rising demand for packaged food and beverages is fueling the market's growth. Packaged foods are in high demand globally such as ready-to-eat meals, confectionery, dairy products, snacks, and bakery items that require the best packaging material to preserve the taste, quality, and freshness of products.

Proper testing ensures that the packaging used for packing the food products maintains appropriate properties till the shelf life. Gradually, consumers are preferring packaged beverages including juices, carbonated drinks, and health drinks to stay hydrated in their daily lives. Customers also pay more attention to the reliability and security of the product before they purchase. Some advanced packaging methods are gaining attention including active, smart packaging, intelligent packaging, and modified atmosphere packaging. Therefore, packaging testing assures consumers that the products they are buying are safe and meet all the quality standards of government bodies.

The chemicals and fertilizers segment is observed to grow at the fastest rate during the forecast period. The chemicals and fertilizers industry faces significant risks associated with product handling, transportation, and storage. Any failure or breach in packaging integrity can result in costly product recalls, environmental damage, and legal liabilities. To mitigate these risks and ensure compliance with industry regulations, companies invest in thorough packaging testing to assess the strength, compatibility, and suitability of packaging materials for their specific products and applications.

Region Insights

North America held the dominating share of the packaging testing market in 2024. The dominance of the region is attributed to the presence of an established packaging industry, rapid adoption of advanced technology in packaging testing, robust growth of the e-commerce industry, rising research and development activities, increasing awareness about product quality and safety, stringent regulatory policies of the government, and increasing use of smart packaging which results in spurring demand for packaging testing solutions in the region.

The rapidly increasing food demand for packed food & beverages is due to changing lifestyles in countries such as the United States and Canada. Moreover, technological innovation is associated with sustainable packaging, accelerating the expansion of the packaging testing market in the coming years.

- In June 2022, Bureau Veritas announced the acquisition of Advanced Testing Laboratory (ATL), a pioneer in scientific sourcing services for the North American Consumer Healthcare Products, Cosmetics & Personal Care, and Medical Device markets. Through the acquisition, Bureau Veritas will expand its footprint in Consumer Products and Consumer Healthcare markets.

- According to the US Census Bureau, the monthly sales of food services and drinking places increased in July 2022, accounting for USD 86.1 billion, which is 12 percent high compared to July 2021.

Europe is expected to grow at a significant CAGR in the coming years for the packaging testing market due to several factors including rising eco-conscious consumers for sustainable packaging, robust growth of the e-commerce industry, rising disposable incomes, stringent government policy, growth in theindustrial packagingsector, advancements in testing technologies. European countries such as Spain, the U.K., France, and Germany witnessed the rising consumer demand for packed food & beverages which has increased emphasis on quality packaging, contributing to the market's revenue in the region.

- In November 2023, SIG started a new Packaging Development Center in Linnich, Germany. The facility features extrusion and finishing technology, coupled with quality measurement systems and testing equipment. The facility also expands SIG's position in the sustainable packaging industry.

Packaging Testing Market Companies

- Intertek Group PLC

- Eurofins Scientific SE

- SGS SA

- Bureau Veritas SA

- TUV SUD AG

- Campden BRI

- IFP Institute for Product Quality GmbH

- DDL Inc. (Integreon Global)

- Turner Packaging Limited

- Nefab Group

- ALS Limited

- TUV SUD AG

- Microbac Laboratories Inc.

- National Technical Systems Inc.

- EMSL Analytical Inc

- Krones AG

- Qualitest International Inc.

- L.A.B. Equipment Inc.

- Marchesini Group S.p.A.

- Coesia S.p.A.

- AMETEK Inc.

- PackTest Machines Inc.

Recent Developments

- In March 2022, Intertek acquired QIMA, a leading provider of quality, safety, and compliance solutions including packaging testing. The acquisition expands Intertek's TIC capabilities.

- In March 2022, Intertek launched Protek healthcare packaging testing to ensure medical packaging quality and safety. The new testing helps improve patient safety and drug efficacy. Intertek Group plc is a U.K.-based multinational assurance, inspection, product testing, and certification company headquartered in London, England. It is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index.

- Eurofins Medical Device Testing opened a new Package Testing Lab in July 2022. The clients receive vital testing support for the packaging's protective qualities and the longevity of their labelling from the new lab. Additionally, it is anticipated that the company's Chemical Characterization, Sterility/Microbiology, and Biocompatibility service offerings to clients will be improved by the new Package Testing expansion at the Lancaster, PA campus.

Segments Covered in the Report

By Type

- Physical

- Chemical

- Microbiological

By Material Type

- Plastic

- Paper and Paperboard

- Glass

- Metal

- Wood

- Others

By End-user Industry

- Food & Beverage

- Industrial

- Automotive

- Healthcare

- Chemical and Fertilizers

- Personal Care and Cosmetic

- Electrical and Electronics

- Other end-user industries

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content