Passenger Security Equipment Market Size and Growth 2025 to 2034

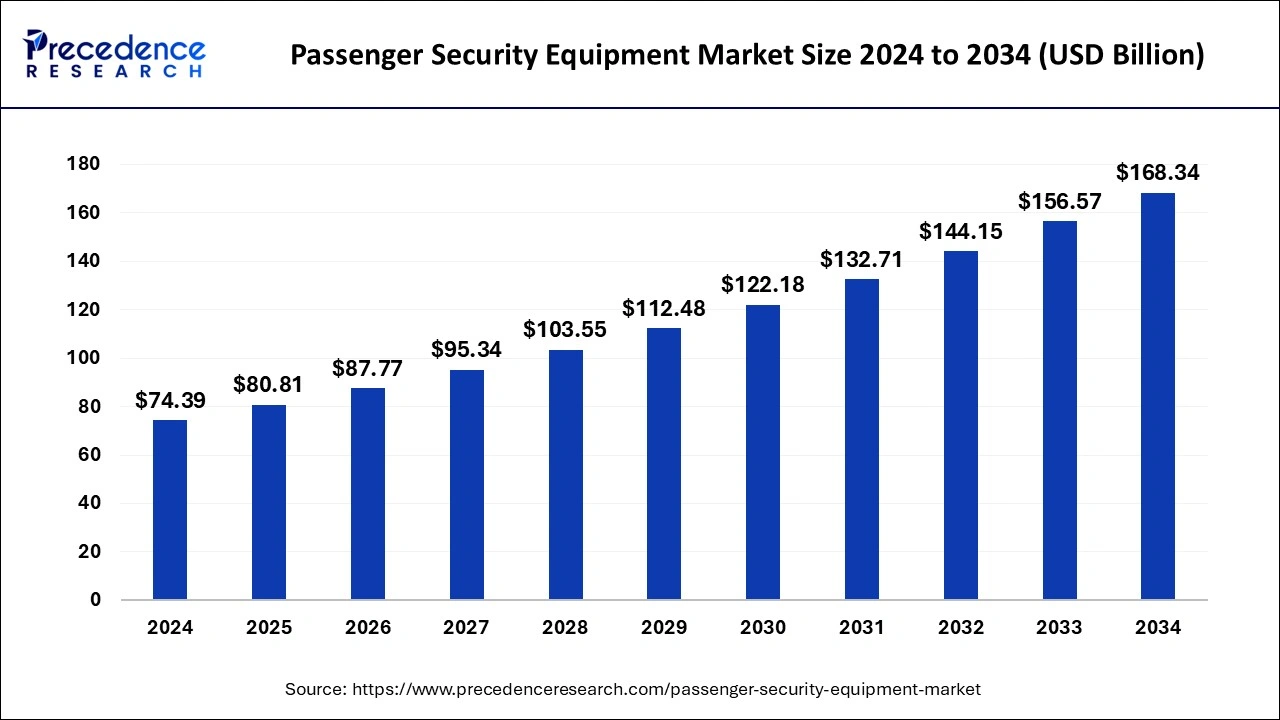

The global passenger security equipment market size was estimated at USD 74.39 billion in 2024 and is predicted to increase from USD 80.81 billion in 2025 to approximately USD 168.34 billion by 2034, expanding at a CAGR of 8.51% from 2025 to 2034. Due to the rapid expansion of urban areas, there is an increased dependence on buses and other public transit networks, so the rising security of passengers in urban areas can boost the demand for the passenger security equipment market.

Passenger Security Equipment Market Key Takeaways

- In terms of revenue, the global passenger security equipment market was valued at USD 74.39 billion in 2024.

- It is projected to reach USD 168.34 billion by 2034.

- The market is expected to grow at a CAGR of 8.51% from 2025 to 2034

- North America held a significant share of the passenger security equipment market in 2024.

- Europe is expected to grow at a higher pace in the market during the forecast period.

- By transport infrastructure, the airports segment dominated the market in 2024.

- By transport infrastructure, the bus stations segment is expected to grow rapidly in the market during the forecast period.

- By type, the baggage inspection system segment dominated the market in 2024.

- By type, the explosive detection system segment is expected to grow to the highest CAGR in the market during the forecast period.

Market Overview

The passenger security equipment market deals with products and services related to the passenger's safety and security in public transportation environments, such as airports, railway stations, and bus stops. This includes a variety of devices and systems together referred to as passenger security equipment. The purpose of this technology is to identify, stop, and deal with possible security risks. Some of the common kinds of security gear for passengers are fire safety and detection systems, baggage inspection systems, intrusion detection and prevention systems, explosive detection systems, people screening systems, and video surveillance.

The passenger security equipment market is fragmented with multiple small-scale and large-scale players, such as Honeywell International Inc., Axis Communications AB, SITA, L3Harris Technologies, Inc., Smiths Group plc, Rapiscan Systems, Autoclear, Simens AG, Bosch Sicherheitssysteme GmbH, Kapsch TrafficCom AG.

Passenger Security Equipment Market Growth Factors

- The development of newer technologies for scanning and screening is expected to create ample opportunities for the passenger security equipment market.

- The market is expected to be driven by increasing terrorism threats, rising safety and security concerns, growing demand for biometric technologies, and technological advancements.

- The increasing government investment in safety and security products and solutions is a major factor driving the growth of the passenger security equipment market.

Passenger Security Equipment Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 80.81 Billion |

| Market Size by 2034 | USD 168.34 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.51% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Transport Infrastructure, Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand from airport security

The rising demand for airport security grows the passenger security equipment market. The number of passengers using airports throughout the world is steadily rising, requiring more security measures to handle increased volumes effectively and safely. This immediately fuels the need for cutting-edge security gear to guarantee passenger security and efficient operations.

Airports in the Arabian Gulf are expected to handle 450 million passengers a year by 2020, a number which is expected to grow by 5.2 percent a year until 2030, according to the International Civil Aviation Organization (ICAO). This translates into an estimated 2.6 million aircraft movements through the region, equivalent to over 7,000 flights each day.

Government and private sector expenditures

The government and private sector investment in airport infrastructure may grow the passenger security equipment market. The market is growing as a result of significant expenditures made in airport infrastructure by both government and private sector organizations. The purpose of these expenditures is to strengthen security protocols in order to safeguard travelers and infrastructure.

- In July 2023, the Government and private sectors invested over USD12 billion in Indian airports. India's Minister of Civil Aviation, Jyotiraditya Scindia, indicates that Indian private and government sectors are planning to invest INR1 trillion in airports.

Restraint

Negatives and false positives

The false positive and negative identification of baggage screening may slow down the passenger security equipment market. The ability of X-ray machines to create false positives and negatives, identify innocent objects as threats, or overlook hazardous materials that are concealed or camouflaged is one of the primary drawbacks of utilizing them for baggage screening. While false negatives might jeopardize airport security and safety, false positives can result in needless delays, discomfort, and frustration for both passengers and workers.

Opportunity

Technological innovation for security

The technical innovation in security can be the opportunity to boost the passenger security equipment market. The capacity to identify threats more precisely and effectively is improved by security technology innovations like biometric screening, sophisticated imaging systems, and AI-powered surveillance. In order to keep ahead of security issues, airports are implementing this technology more often. Technical innovations for security, such as computer tomography, include CT technology that generates 3D, volumetric X-ray images, etc.

In the passenger security equipment market, security personnel are able to examine luggage from every perspective, from the perspective of an innovation to a CT scanner. The operators are helped in making prompt and accurate evolution by automated exclusive detection algorithms and automated object identification software, which can identify illegal objects like guns. This improves security outcomes as well as operational efficiency. The increasing global use of CT scanner technology is good news for travelers since it removes the need to remove liquid and electronic devices from bags, significantly reducing waiting times and improving the smoothness of the checkpoint experience.

In the U.S., the Transportation Security Administration (TSA) is working to implement CT technology, and recently, Miami International Airport unveiled seven Smiths Detection CTiX scanners installed at TSA checkpoints, allowing passengers to keep laptops and electronic devices in their carry-on bags to minimize touch points during the screening process.

Transport Infrastructure Insights

The airports segment dominated the passenger security equipment market in 2024. Due to the rapid expansion of urban areas, there is an increased dependence on buses and other public transit networks. In order to protect passenger safety, this expansion calls for more stringent security measures at bus terminals. The bus stops often feature more foot traffic than other transit hubs, especially in highly populated cities. More reliable security measures are needed to efficiently handle and monitor the heightened passenger flow.

To increase the security of public transit, several countries have imposed strict laws and policies. In order to anticipate and address such threats, these programs frequently involve the installation of cutting-edge security technology at bus terminals. The creation and use of new security technologies, such as automatic threat detection, biometric systems, and sophisticated surveillance cameras, have made it possible to deploy the development and uptake of new security technology, including automatic threat detection, biometric systems, and sophisticated surveillance cameras. By facilitating prompt incident reaction and real-time monitoring, these technologies improve passenger safety at bus stops.

The bus stations segment is expected to grow rapidly in the passenger security equipment market during the forecast period. National and international aviation agencies enforce strict security requirements at airports. These laws are always changing to deal with new dangers, which means that continuous expenditures on cutting-edge security gear are required. The airport passenger numbers are increasing as a result of the worldwide increase in air travel, which is being driven by factors including economic development, improved connectivity, and the advent of low-cost carriers. To handle growing crowds and guarantee passenger safety, this expansion necessitates the implementation of more thorough and effective security measures. When it comes to using cutting-edge security solutions, the aviation sector is leading the way. Airports are progressively using innovations to improve security and expedite passenger processing, such as automated border control systems, AI-based threat detection, biometric screening, and sophisticated imaging systems.

Type Insights

The baggage inspection system segment dominated the passenger security equipment market in 2024. Strong security measures are required since terrorism and contraband are constant threats. In order to protect passengers and personnel, baggage screening systems- such as CT scanners, X-ray machines, and bomb detection systems -are essential for spotting such threats. Technological development, including the incorporation of machine learning, artificial intelligence (AI), and better imaging methods, have greatly increased the effectiveness and precision of baggage screening systems. These developments strengthen the systems' position in the market by making it simpler to identify materials and objects that are forbidden.

The explosive detection system segment is expected to grow to the highest CAGR in the passenger security equipment market during the forecast period. In the passenger security equipment market, an explosive detection system is an advanced piece of machinery and technology used to find and identify hazardous substances on passengers, in luggage, and in containers. These technologies are essential for improving security to stop terrorist attacks and protect public safety at airports, transit hubs, and other high-risk public locations.

The explosive detection system uses a number of methods, including trace detection, computed tomography (CT), and X-ray diffraction. These technologies make it possible to thoroughly scan and examine items and luggage to check for the presence of explosive materials. Many explosive detection systems are completely automated, using artificial intelligence and complex algorithms to identify explosives with great accuracy and no need for human participation. The explosive detection systems frequently work in collaboration with other security tools, including biometric systems, body scanners, and metal detectors.

Regional Insights

North America held a significant share of the passenger security equipment market in 2024. Some of the strongest security laws for transportation, notably in aviation, are found in North America and, specifically, in the United States. The Transportation Security Administration (TSA) enforces strict security regulations, which call for sophisticated and all-encompassing security gear.

The area has continuously made significant investments in maintaining and modernizing its security systems. Modern security systems are frequently implemented by North American airports, railroads, and other transportation hubs to improve passenger safety and adhere to legal requirements. Companies in North America are pioneers in the creation and manufacturing of cutting-edge security technology. The market is being driven by the growing use of sophisticated imaging technology, explosive detection systems, and biometric screening innovations in the area.

- In December 2023, The U.S. Department of Homeland Security's Science and Technology Directorate (S&T) announced a new program to trial self-service security screening at airports through its Screening at Speed Program.

Europe is expected to grow at a higher pace in the passenger security equipment market during the forecast period. All of the member nations of the European Union have been subject to increasingly strict security measures. The demand for cutting-edge security technology is fueled by directives like the EU Aviation Security Strategy and other ones that strive to raise security standards.

Europe is making significant investments to update its transportation network. Modern security systems are being added to airports, train stations, and other transportation hubs through significant financing upgrades. Both domestic and international traveler traffic is steadily rising in Europe. Passenger security equipment is in greater demand as a result of this rise, which makes more security measures necessary to handle the increased number of travelers.

Passenger Security Equipment Market Companies

- Honeywell International Inc.

- Axis Communications AB

- SITA

- L3Harris Technologies, Inc.

- Smiths Group plc

- Rapiscan Systems

- Autoclear

- Siemens AG

- Bosch Sicherheitssysteme GmbH

- Kapsch TrafficCom AG

Recent Developments

- In November 2023, Huawei launched the Smart Airport Perimeter Security with Fiber Sensing solution, which can identify vibrations caused by wind and rain and is, therefore, able to detect perimeter intrusions in all weathers and cover long distances.

- In November 2023, Bangalore Metropolitan Transport Corporation (BMTC) installed an Advanced Driver Assistance System (ADAS) in 10 of its buses on a pilot basis to prevent and reduce road accidents.

- In July 2023, A new security system was launched at the airport as part of a £3m project to improve customer facilities and security technology. Ports of Jersey confirmed the equipment, which was installed in June, would allow passengers to carry any amount of individual liquid, aerosols, or gel containers of up to two liters in their hand luggage.

Segment Covered in the Report

By Transport Infrastructure

- Bus Stations

- Airports

- Seaports

- Train Station

By Type

- Fire Safety & Detection System

- Baggage Inspection System

- Intrusion Detection And Prevention System

- Explosive Detection System

- People Screening Systems

- Video Surveillance

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting