Patient Monitoring and Ultrasound Devices Display Market Size and Forecast 2025 to 2034

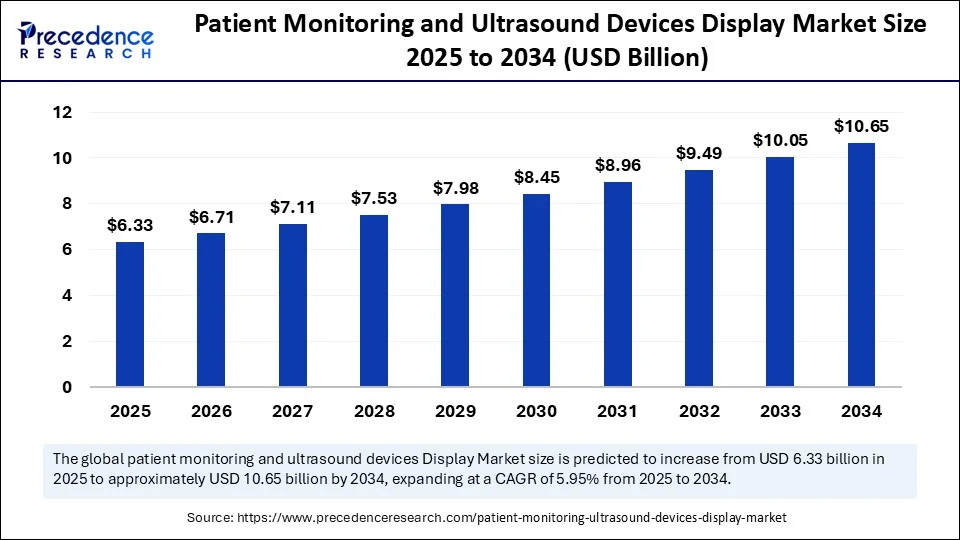

The global patient monitoring and ultrasound devices display market size accounted for USD 5.98 billion in 2024 and is predicted to increase from USD 6.33 billion in 2025 to approximately USD 10.65 billion by 2034, expanding at a CAGR of 5.95% from 2025 to 2034.The rising demand for advanced imaging technologies and real-time data is boosting the growth of the market. Moreover, advancements in display technology support market expansion.

Patient Monitoring and Ultrasound Devices Display MarketKey Takeaways

- In terms of revenue, the global patient monitoring and ultrasound devices display market was valued at USD 5.98 billion in 2024.

- It is projected to reach USD 10.65 billion by 2034.

- The market is expected to grow at a CAGR of 5.95% from 2025 to 2034.

- North America dominated the global patient monitoring and ultrasound devices display market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By device type, the patient monitoring devices segment held the major market share in 2024.

- By device type, the ultrasound devices segment will grow at the fastest CAGR between 2025 and 2034.

- By display type, the non-interactive segment captured the biggest market share in 2024.

- By size, the 11–20” segment contributed the significant market share in 2024.

- By display technology, the LCD segment led the global market in 2024.

- By display technology, the LED segment is expected to expand at a significant CAGR between 2025 and 2034.

- By end-user, the hospitals segment accounted for significant market share in 2024.

- By end-user, the diagnostic centers segment will expand at a significant CAGR between 2025 and 2034.

How is AI Revolutionizing the Patient Monitoring and Ultrasound Devices Display Market?

Artificial intelligence is playing a crucial role in enhancing the accuracy, safety, and efficiency of medical devices, including patient monitoring and ultrasound devices. AI is a significant tool that enables rapid and accurate analysis of medical images. AI is being rapidly utilized to identify subtle patterns and provide real-time monitoring, tracking, and feedback to healthcare providers, enabling high-speed, high-quality, and accurate disease detection and prevention. The growing trends like remote patient monitoring and demand for personalized patient care are offering robust growth opportunities for AI to incorporate into medical devices. Additionally, government initiatives to promote AI-enabled medical device adoption are likely to contribute to the rapid shift of the healthcare industry toward AI-driven patient monitoring and ultrasound devices.

- In April 2025, a global leader in health technology, Royal Philips, launched its novel AI-enabled Elevate Platform upgrade release on the EPIQ Elite ultrasound imaging platform at UltraFest 2025 in India.

(Source: https://www.philips.co.in)

Market Overview

The global patient monitoring and ultrasound devices display market has been witnessing transformative growth, driven by factors like rising demand for remote patient monitoring, expanding healthcare expenditure, and growing technological advancements. The rising demand for higher resolution and energy-efficient displays like OLED, micro-LED, and AMOLED is boosting market growth. Governments around the world are promoting digital health integration and supporting market expansion.

The demand for high-resolution displays, portable and compact devices, and wireless connectivity has been rising, driven by the increased burden of chronic diseases and an aging population. There is a high demand for home-based treatment plans, creating the need for remote patient monitoring devices. The rapid digitalization of the healthcare industry is also driving the need for cutting-edge ultrasound devices. Market players are focusing on developing innovative medical devices, including those for patient monitoring and diagnostics, which contributes to market growth.

What are the Key Factors Fueling the Growth of the Patient Monitoring and Ultrasound Devices Display Market?

- Chronic Disease Prevalence: The growing prevalence of chronic diseases, such as cardiovascular disease, cancer, diabetes, and hypertension, is driving demand for patient monitoring and ultrasound devices to facilitate ongoing monitoring, early diagnosis, and improved patient outcomes.

- Growing Need for Early Disease Detection: The adoption of patient monitoring and ultrasound device displays has increased due to the rising need for early disease detection and prevention, particularly in areas such as cancer and cardiovascular care.

- Growing Demand for Remote Patient Monitoring: The demand for remote patient monitoring has increased, driven by the growth of home care settings and remote patient care settings, creating a need for cutting-edge patient monitoring devices.

- Increased Awareness of Prenatal Screening and Diagnosis: The growing awareness of prenatal screening and diagnosis is driving demand for advanced ultrasound devices.

- Cardiovascular Ultrasound System: The adoption of cardiovascular ultrasound systems is increasing, driven by the rising incidence of cardiovascular diseases and the growing demand for minimally invasive imaging techniques.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.65 Billion |

| Market Size in 2025 | USD 6.33 Billion |

| Market Size in 2024 | USD 5.98 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.95% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, Display Type, Size, Display Technology, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Point-of-Care Diagnostic Devices

The demand for point-of-care (PoC) diagnostic devices is rising worldwide, driven by the increased prevalence of chronic diseases like CVDs, respiratory illness, cancer, hypertension, and diabetes. These diseases often require regular monitoring to manage symptoms and conditions. An aging population also contributes to market growth, as elderly people are more susceptible to chronic diseases, requiring continuous monitoring. Patient monitoring devices provide continuous tracking of the health matrix, enabling early detection of illness and providing timely interventions. Ultrasound devices help to diagnose and monitor chronic disease conditions. The increased awareness among people about the early detection and prevention of disease is also driving the demand for advanced patient monitoring and ultrasound devices.

Restraint

Data Security Concerns and High Cost

Patient monitoring and ultrasound devices store vital patient data, making them susceptible to data breaches. This raises concerns regarding patient safety and data security. Thus, healthcare organizations must implement cybersecurity measures to address these challenges. Moreover, Patient monitoring and ultrasound devices are costlier, creating barriers for small healthcare organizations, especially those operating on constrained budgets. The market is witnessing a delay in product launch due to stringent regulatory requirements and lengthy approval processes. Moreover, patients have become more aware of cybersecurity. All these factors limit the adoption of these devices, ultimately restraining the growth of the patient monitoring and ultrasound devices display market.

In January 2025, the U.S. Food and Drug Administration (FDA) raised awareness among healthcare providers, healthcare facilities, patients, and caregivers that cybersecurity vulnerabilities in Contec CMS8000 patient monitors and Epsimed MN-120 patient monitors (which are Contec CMS8000 patient monitors relabeled as MN-120) may put patients at risk after being connected to the internet.

(Source: https://www.fda.gov)

Opportunity

Growing Adoption of Minimally Invasive Techniques

The demand for minimally invasive techniques is increasing due to the rising prevalence of chronic diseases. The minimally invasive procedures require cutting-edge imaging and real-time monitoring, driving the adoption of advanced patient monitoring and ultrasound devices. High-resolution displays enable high-resolution ultrasound and provide high-quality visualizations of images, as well as real-time data analytics. The increasing adoption of laparoscopic and robotic surgeries is a major factor contributing to the growth of patient monitoring and ultrasound devices. Major manufacturing companies are focusing on providing 3D/4D imaging and AI-integrated diagnostic ultrasound technologies to enhance the capabilities of these devices. The growing medical tourism industry is further creating a need for these devices to offer cutting-edge capabilities for minimally invasive techniques.

In May 2025, the BeneVision V Series patient monitoring solution was introduced by Mindray at Euroanaesthesia 2025 in Lisbon. This next-generation solution is designed to offer industry-first innovations in ultrasound-integrated hemodynamic assessments and cable-lite patient monitoring workflows. (Source: https://www.mindray.com)

Device Type Insights

Why Did the Patient Monitoring Devices Segment Dominate the Market in 2024?

The patient monitoring devices segment dominated the patient monitoring and ultrasound devices display market with the largest revenue share in 2024. This is mainly due to the increased demand for remote monitoring solutions, driven by increased prevalence of chronic disease and an aging population. As the burden of chronic diseases increases, so does the need for patient monitoring devices to track vital signs and health metrics. Chronic diseases require regular monitoring of vital signs to manage conditions and reduce the risk of complications. Technological advancements in display technologies like high-resolution screening and 3D/4D imaging are improving diagnostic accuracy, making monitoring devices more essential in healthcare settings.

The ultrasound devices segment is expected to grow at the fastest rate in the coming years, driven by the increased demand for diagnostic imaging in various medical specialties like radiology, cardiology, and oncology. Technological advancements in ultrasound technology, like 3D/4D ultrasound and contrast-improved ultrasound, are contributing to the growth of the segment. There is a high demand for portable ultrasound devices for early disease detection, boosting the need for high-resolution, compact displays. The demand for point-of-care ultrasound devices is also rising, contributing to segmental growth.

Display Type Insights

How Does the Non-interactive Segment Dominate the Patient Monitoring and Ultrasound Devices Display Market in 2024?

The non-interactive segment dominated the market with a major revenue share in 2024 and is expected to continue its upward trajectory in the near future. The simplicity and cost-effectiveness of non-interactive displays are key factors boosting their adoption. These displays are widely used in basic patient monitoring and ultrasound imaging due to their user-friendly nature. The affordability of non-interactive displays makes them ideal for budget-conscious healthcare facilities. The use of non-interactive displays is widespread in critical applications, like displaying vital signs and providing basic ultrasound imaging for quick assistance in critical care units. The need for advanced user interactions is rising in specific applications, making non-interactive displays essential.

Size Insights

What Made the 11–20” the Dominant Segment in the Market?

The 11–20” segment dominated the patient monitoring and ultrasound devices display market in 2024. This is mainly due to the increased demand for high-quality and wide displays in patient monitoring and ultrasound devices. The adoption of 11–20” displays has increased due to technological advancements in display technology like OLED, micro-LED, and AMOLED, improving energy efficiency and image quality. The 11–20” size of the display is ideal for the ongoing demand for high-resolution, energy-efficient, and portable patient monitoring and ultrasound devices.

Display Technology Insights

How Does the LCD Segment Dominate the Patient Monitoring and Ultrasound Devices Display Market in 2024?

The LCD (Liquid Crystal Display) segment dominated the market with the biggest share in 2024 due to its high portability, efficiency, and improved image quality. The increased demand for portable ultrasound image devices and advanced patient monitoring solutions is driving the need for LCDs. This technology enhances diagnostic capabilities due to high resolution and luminance, which provide clear and sharper images. The LCD technology has enabled the development of small, light, and portable monitoring devices, making them more accessible to all patient care areas, like remote areas, home-based patient care, and emergency settings. The energy-efficient and cost-effective nature of LCD technology contributes to the segment's growth.

The LED segment is the second-largest segment in the market. The growth of the segment is driven by its high adoption in healthcare settings due to its superior performance and high image quality. Advancements in display technology led to improvements in brightness and higher resolutions of LEDs, contributing to the rising adoption rate for medical imaging applications. LED display technology, particularly OLED and micro-LED, is gaining traction due to its energy efficiency, high contrast ratio, and clear visualization of images. Additionally, the ability of LED display technology to offer high-quality medical images contributes to segmental growth.

End-User Insights

Which End-user Segment Led the Patient Monitoring and Ultrasound Devices Display Market in 2024?

The hospitals segment led the market in 2024 due to the increased adoption of real-time monitoring and advanced imaging technologies in hospitals. The increased prevalence of chronic disease and hospitalization rates boosted the adoption of advanced patient monitoring devices in hospitals. There is a heightened need for high-quality displays to provide enhanced diagnostic accuracy and patient care. The trend of digital health technologies in hospitals is fostering the adoption of advanced patient monitoring and ultrasound devices. Additionally, government support and funding for improving hospital infrastructure contributes to the segment's growth.

The diagnostic centers segment is expected to grow at the fastest rate over the forecast period, owing to the increased focus on value-based care models. There is a high demand for high-quality displays and advanced ultrasound devices, driven by demand for precision diagnostics. The reliance on high-quality imaging for accurate diagnosis and monitoring is driving the adoption of advanced and high-resolution ultrasound devices. Moreover, the growing awareness about early diagnosis and rising patient volumes undergoing diagnosis are likely to support segmental growth.

Regional Analysis

What Made North America the Dominant Region in the Patient Monitoring and Ultrasound Devices Display Market?

North America dominated the global market by capturing the largest share in 2024, driven by the high prevalence of chronic diseases and the demand for remote patient monitoring. North America is well known for the early adoption of advanced technologies, including high-resolution medical displays and portable imaging devices. Robust healthcare infrastructure and the existence of strict regulations for patient health and safety are contributing to the market growth. The U.S. FDA has been encouraging manufacturers to develop innovative, effective, and safe medical devices, creating the need for innovative displays. Moreover, increased healthcare spending bolstered the growth of the market in the region.

In May 2025, the U.S. Food and Drug Administration (FDA) approved GE HealthCare's Optison (Perflutren Protein-Type A Microspheres Injectable Suspension, USP) ultrasound enhancing agent (UEA). This approval will help improve the clarity and diagnostic accuracy of echocardiograms in pediatric patients, giving cardiologists a fuller picture of ventricular function when assessing possible heart abnormalities or disease.

(Source: https://investor.gehealthcare.com)

The U.S. is a major player in the North American patient monitoring and ultrasound devices display market, driven by the rising demand for remote and point-of-care diagnostics. The robust healthcare infrastructure and increased chronic disease prevalence are driving the need for high-resolution displays, including OLED, micro-LED, and AMOLED. Growing awareness about early disease detection and prevention also contributes to market growth.

Asia Pacific Patient Monitoring and Ultrasound Devices Display Market Trends

Asia Pacific is the fastest-growing region in the market, driven by a growing aging population, medical tourism, and government initiatives to promote digital health technologies. Governments of various Asian countries are providing funding to boost the domestic production of medical devices, supporting regional market growth. The rising focus on patient-centric care is fostering the adoption of innovative and advanced patient monitoring and ultrasound devices in the region.

China is a major player in the market. The growth of the market in China is driven by a large aging population, increasing prevalence of chronic diseases, and increased manufacturing capabilities. Rising government investments in expanding healthcare infrastructure and research and development capabilities further contribute to market growth. Additionally, the “Make in China” initiative, which aims to boost the manufacturing capabilities of electronic devices like medical devices, is supporting market expansion.

India is rapidly growing in the regional market, driven by factors like growing medical tourism and rising healthcare expenditure. Rising government initiatives to improve healthcare infrastructure further support market growth. Moreover, the growing aging population and rising digitalization of the healthcare industry contribute to market expansion.

European Patient Monitoring and Ultrasound Devices Display Market Trends

Europe is considered to be a significantly growing area. The growth of the market in the region is driven by its well-established healthcare sector and the rising prevalence of chronic disease. There is a strong emphasis on value-based and patient-centric care models, boosting the adoption of cutting-edge diagnostic tools. In addition, the rising demand for early disease diagnosis and the focus on improving patient outcomes are boosting the demand for patient monitoring and ultrasound devices. Germany and the UK are leading the market, driven by strong government support to optimize healthcare standards, growing adoption of telemedicine, and increasing demand for PoC diagnostics.

Patient Monitoring and Ultrasound Devices Display Market Companies

- Becton, Dickinson and Company

- Abbott Laboratories

- GE Healthcare Technologies Inc.

- Hitachi Medical Corporation

- Biotronik SE & Co. KG

- Cook Medical

- Hologic, Inc.

- Masimo Corporation

- Samsung Medison Co., Ltd.

- Nihon Kohden Corporation

- Shimadzu Corporation

- Olympus Corporation

Recent Developments

- In May 2025, Tenovi launched its new cellular-connected blood pressure monitor with irregular heartbeat detections. The devices are created to enable clinicians to intervene early with patients at stroke and other cardiovascular complications.

(Source:https://www.medicaleconomics.com)

- In March 2025, Hunteight Healthcare received the U.S. FDA approval for the world-renowned Dawes-Redman CTG Analysis, a novel milestone in electronic fetal monitoring devices. The system is designed to assist healthcare providers in enhancing target interpretation and preventing poor results for babies and families.

(Source: https://www.huntleigh-diagnostics.com)

- In January 2025, Novosound unveiled its ultrasound blood pressure monitoring at CES 2025 in Las Vegas. The system is designed to achieve a higher accuracy level than traditional electronic cuff devices through the miniaturization of wearable devices.

(Source:https://finance.yahoo.com)

Segments Covered in the Report

By Device Type

- Patient Monitoring Devices

- Hemodynamic Monitoring Devices

- Fetal Monitoring Devices

- Cardiac Monitoring Devices

- Respiratory Monitoring Devices

- Remote Patient Monitoring Devices

- Others

- Ultrasound Devices

- 2D Ultrasound

- 3D Ultrasound

- 4D Ultrasound

- Doppler Ultrasound

By Display Type

- Interactive

- Non-interactive

By Size

- <10”

- 11-20”

- 20” and Above

By Display Technology

- LCD

- LED

- OLED

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Diagnostic Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting