What is Penicillin G Sodium Market Size?

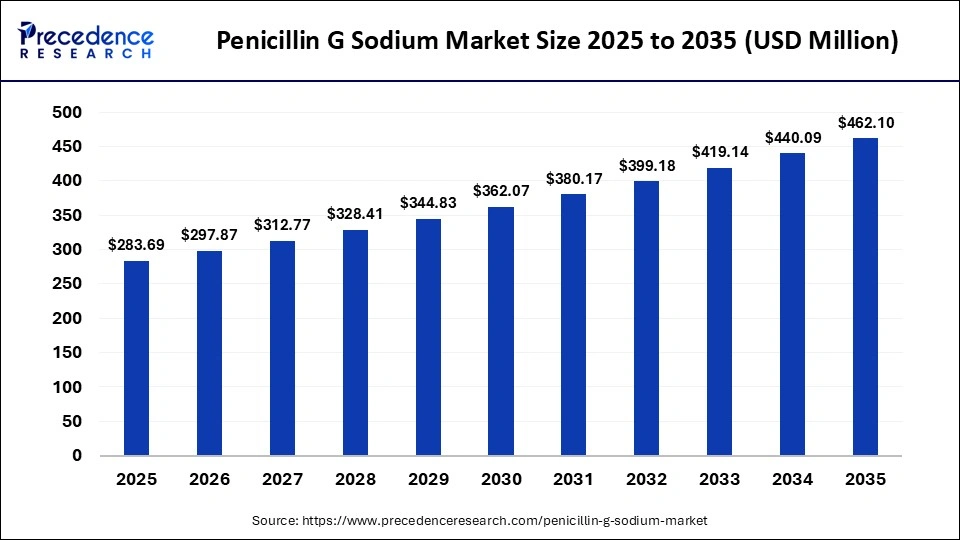

The global penicillin G sodium market size was calculated at USD 283.69 million in 2025 and is predicted to increase from USD 297.87 million in 2026 to approximately USD 462.1 million by 2035, expanding at a CAGR of 5.00% from 2026 to 2035. The market is driven by the growing prevalence of congenital syphilis, along with technological advancements in the pharmaceutical sector.

Market Highlights

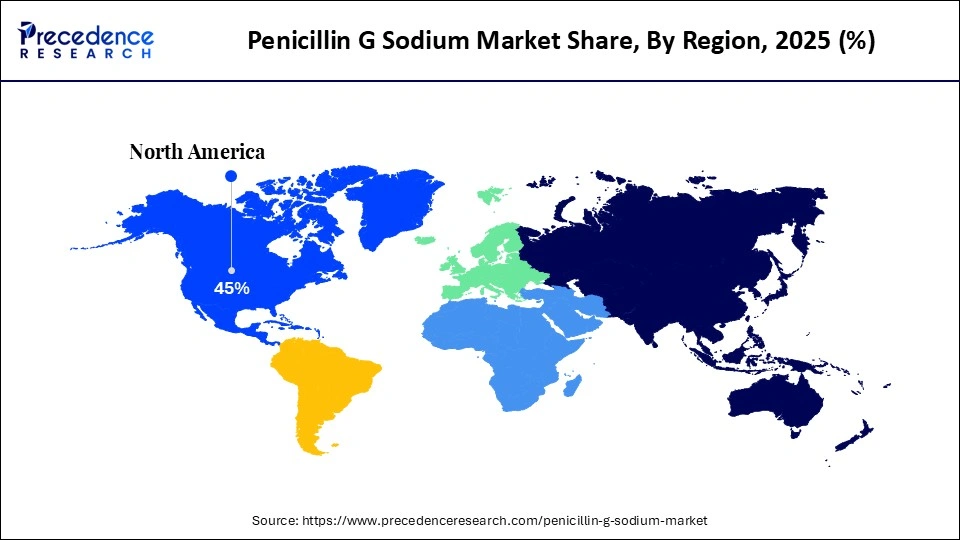

- Asia Pacific led the market with a major share of 45% in 2025.

- North America is expected to grow at the fastest CAGR of 5.2% during the forecast period.

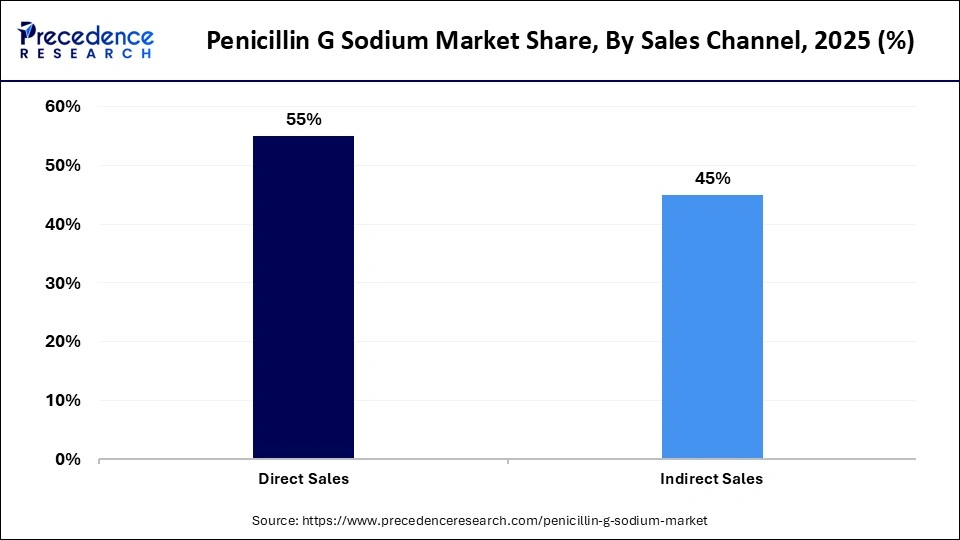

- By sales channel, the direct sales segment held the largest market share of around 55% in 2025.

- By sales channel, the indirect sales segment is expected to expand at a CAGR of 4.4% during the forecast period.

- By end-use/ application, the bacterial infections segment held the largest market share of about 40% in 2025.

- By end-use/application, the meningitis treatment segment is expected to grow at the highest CAGR of 4.5% between 2026 and 2035.

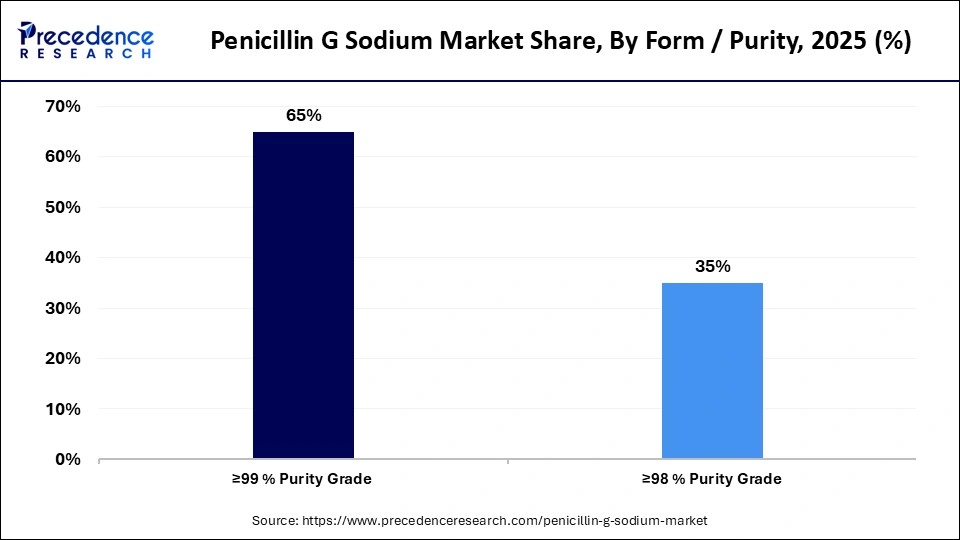

- By form/purity, the ≥99% purity grade segment held the highest market share of 65% in 2025.

- By form/purity, the ≥98% purity grade segment is expected to grow at a healthy CAGR of 4.1% during the forecast period.

- By end-user industry, the hospitals & clinics segment dominated the market with a share of 60% in 2025.

- By end-user industry, the veterinary medicine/animal health segment is expected to expand at the highest CAGR of 4.3% during the forecast period.

Market Overview

The penicillin G sodium market is a crucial branch of the pharmaceutical sector. This market deals with the production and distribution of narrow-spectrum β-lactam antibiotics across the world. Penicillin G Sodium is a natural antibiotic used to treat severe infections caused by gram-positive bacteria. Its steady demand stems from clinical efficacy, affordability, essential drug status, and rising infectious disease prevalence.

The surging cases of gonorrhea and anthrax, along with the rapid investment by the market players for opening new manufacturing plants, are driving the market growth. Moreover, expanding healthcare infrastructure and antibiotic access, despite challenges from supply chain variability and antimicrobial resistance concerns, is expected to contribute to the market growth.

Penicillin G Sodium Market Trends

- Business Expansions: Various pharma companies are constantly engaged in opening new production centers to increase the manufacturing of penicillin-based products. For instance, in November 2025, Boryung Corporation announced to open a new manufacturing plant in Ansan, South Korea. This new production unit is inaugurated to increase the production of oral penicillin antibiotics in this country.

- Increasing Prevalence of Meningitis: The surging cases of meningitis are increasing the demand for penicillin G sodium. According to the Meningitis Research Foundation, around 421,775 cases of meningitis occurred in India during 2024.

- Government Investments: Governments of numerous countries, such as the U.S., China, the UAE, India, and France, are investing rapidly in developing the pharmaceutical sector. For instance, in February 2026, the government of India announced an investment of Rs. 10,000 crores. Through this investment, the government aims to strengthen the pharma industry across India.

- Regulatory and Quality Compliance: Stringent regulatory standards from agencies like the FDA, EMA, and WHO are shaping how Penicillin G Sodium is manufactured and marketed. Focus on Good Manufacturing Practices (GMP) and quality control ensures product safety and consistency but also increases compliance costs.

How is AI Revolutionizing the Penicillin G Sodium Market?

Ongoing advancements in Artificial intelligence are crucial for the development of the overall pharmaceutical industry. AI helps optimize manufacturing, accelerate drug discovery, enhance clinical trial efficiency, and predict drug safety. In recent times, penicillin G sodium manufacturers have been deploying AI in their production units to enhance real-time monitoring, optimize fermentation processes, improve strains, and implement advanced control strategies. Additionally, AI-driven quality control and predictive analytics enhance product consistency, regulatory compliance, and operational decision-making, supporting safer and more reliable antibiotic production.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 283.69 Million |

| Market Size in 2026 | USD 297.87 Million |

| Market Size by 2035 | USD 462.1 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Sales Channel,End-Use/ Application,Form/Purity,End-User Industry, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Analysis

Sales Channel Insights

Why Did the Direct Sales Segment Dominate the Penicillin G Sodium Market?

The direct sales segment dominated the market with a major share of 55% in 2025. This is due to the increased investment by pharma companies in opening warehouses for delivering penicillin-based products to the 3rd party vendors to make them available for the consumers. Partnerships among medicine manufacturers and hospitals to improve the supply chain capabilities are adding to the segmental dominance.

Direct sales also help ensure product quality and regulatory compliance by reducing intermediaries in the supply chain. Additionally, this approach enables manufacturers to provide technical support, guidance on proper storage and handling, and tailored solutions, which are critical for antibiotics like Penicillin G Sodium that require precise dosing and handling.

The indirect sales segment is expected to grow at a CAGR of 4.4% during the forecast period. This is because of the growing emphasis of pharmaceutical distributors, wholesalers, and third-party suppliers to expand their reach into emerging markets and smaller healthcare facilities that manufacturers may not serve directly. Additionally, the availability of a wide range of penicillin-based products in online pharmacies, along with collaborations among penicillin manufacturers and distributors, is playing a prominent role in boosting segmental growth. Moreover, numerous benefits of indirect sales, such as cost efficiency, enhanced scalability, expanded market reach, and risk mitigation, are expected to contribute to the growth of this segment.

End-Use/ Application Insights

What Made Bacterial Infections the Leading Segment in the Penicillin G Sodium Market?

The bacterial infections segment led the market with a share of around 40% in 2025. This is due to the increased prevalence of UTIs in several nations, such as India, Japan, Canada, and the U.S., which has boosted the demand for penicillin G sodium in both hospitals and outpatient settings. The segment's leadership is also reinforced by the rapid investment by healthcare providers in opening new hospitals to treat bacterial diseases. Moreover, partnerships among pharma brands and healthcare companies for developing high-quality antibiotics are expected to foster the growth of this segment.

The meningitis treatment segment is expected to expand at the highest CAGR of 4.5% between 2026 and 2035. This is primarily due to the surging cases of meningitis in numerous countries, including Germany, the UK, China, and the UAE. Also, numerous government initiatives are aimed at opening new healthcare centers to enhance meningitis treatment capabilities, thereby boosting segmental expansion. Moreover, the growing use of penicillin for treating meningitis is expected to bolster the growth of this segment.

Form/Purity Insights

Why Did the ≥99% Purity Grade Segment Dominate the Penicillin G Sodium Market?

The ≥99% purity grade segment dominated the penicillin G sodium market with a share of 65 % in 2025, owing to the increasing use of ≥99% purity grade penicillin for treating a wide range of bacterial infections. Moreover, the surging preference of pharma companies in using ≥99% purity grade penicillin for manufacturing high-quality antibiotics is expected to accelerate the segmental expansion.

The ≥98% purity grade segment is expected to grow at the fastest CAGR of 4.1% during the forecast period. This is due to the growing adoption of the ≥98% purity grade penicillin by research centers for accelerating drug discovery. Additionally, the surging application of ≥98% purity grade penicillin for treating meningitis is expected to drive the growth of this segment.

End-User Industry Insights

Why Did the Hospitals & Clinics Segment Dominate the Penicillin G Sodium Market?

The hospitals & clinics segment dominated the penicillin G sodium market with the largest share of 60% in 2025. This is due to the rise in the number of public hospitals in several nations, including the U.S., China, Saudi Arabia, and the UK, which has boosted the demand for penicillin G sodium for treating bacterial infections. Additionally, the rapid investment by the government to integrate advanced technologies in hospitals, as well as the surging preference of patients to visit healthcare clinics on a regular basis, is playing a vital role in shaping the segment. Moreover, the increasing emphasis of healthcare providers to open new hospitals in isolated areas is expected to sustain the long-term dominance of this segment.

The veterinary medicine/animal health segment is expected to grow at the highest CAGR of 4.3% during the forecast period. This is due to the surging prevalence of animal diseases, especially in Asia Pacific, which is increasing the demand for penicillin. Also, the increasing investment by the government for strengthening the veterinary sector, along with the rapid expansion of the veterinary industry globally, is positively contributing to the segmental growth. Moreover, the growing focus of the pharma companies to advance research and development of veterinary items is expected to boost the growth of this segment.

Regional Insights

How Big is the North America Penicillin G Sodium Market Size?

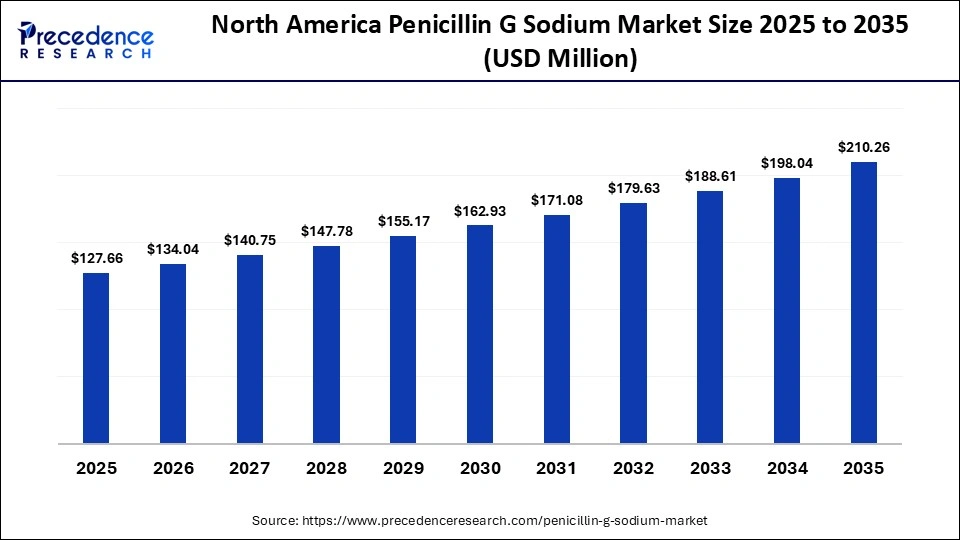

The North America penicillin G sodium market size is estimated at USD 127.66 million in 2025 and is projected to reach approximately USD 210.26 million by 2035, with a 5.12% CAGR from 2026 to 2035.

Why is North America Expanding with the Fastest CAGR in the Market?

North America is expected to expand at the fastest CAGR of 5.2% during the forecast period. The increasing prevalence of meningitis in several countries, including the U.S., Canada, and Mexico, is increasing the demand for penicillin, thereby driving the market in the region. Also, numerous government initiatives aimed at developing the public hospitals, as well as the rise in the number of pharma startups, are positively contributing to the industry. Moreover, the presence of various market players such as Pfizer, AbbVie Inc., and Viatris Inc is expected to foster the growth of the penicillin G sodium market in this region.

- In August 2025, AbbVie invested around US$ 195 million. This investment is made to expand the manufacturing of Active Pharmaceutical Ingredients in the U.S. region.

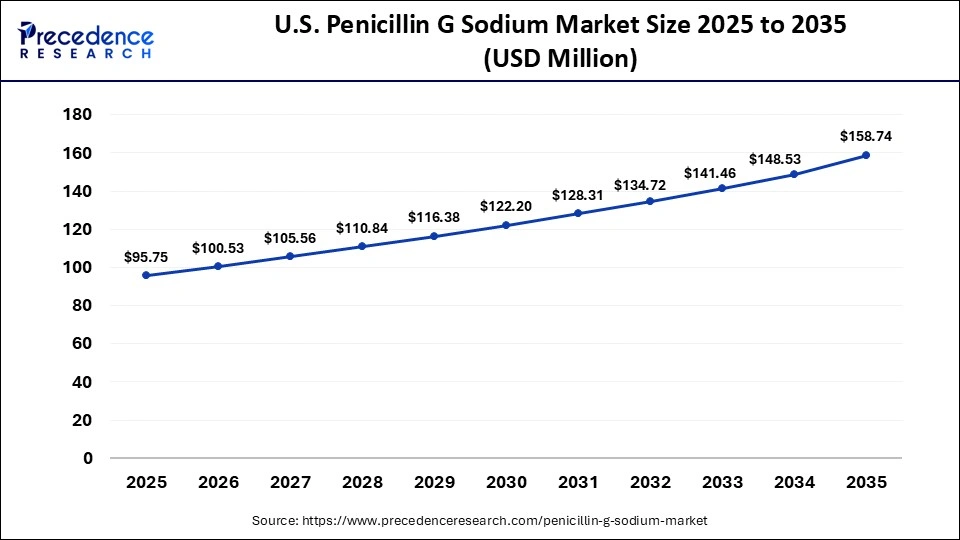

What is the Size of the U.S. Penicillin G Sodium Market?

The U.S. penicillin G sodium market size is calculated at USD 95.75 million in 2025 and is expected to reach nearly USD 158.74 million in 2035, accelerating at a strong CAGR of 5.19% between 2026 to 2035.

U.S. Penicillin G Sodium Market Analysis

The U.S. isconsidered the major contributor to the North American market due to the increasing prevalence of bacterial infections and a rising demand for effective, broad-spectrum antibiotics in both hospital and outpatient settings. Ongoing government initiatives to improve infectious disease management and the continuous adoption of advanced formulations that enhance drug stability and administration efficiency also contribute to the market. Additionally, the expansion of the healthcare infrastructure and rising awareness among healthcare providers are driving higher usage of Penicillin G Sodium across the country.

What Made Asia Pacific the Dominant Region in the Penicillin G Sodium Market?

Asia Pacific dominated the penicillin G sodium market, accounting for a 45% share in 2025. This is due to the surging prevalence of syphilis and prophylaxis in several nations, including China, India, South Korea, and Japan. The rapid investment by the government in developing the pharma industry and the opening of new production centers are playing a prominent role in shaping the landscape of the market. Moreover, the presence of several market players, including Asia Pioneer Pharmaceuticals, Aurobindo Pharma Ltd., CSPC Zhongnuo Pharmaceutical (Shijiazhuang) Co., Ltd, and Kangyuan Pharmaceutical Group, is expected to drive the long-term growth of the market in this region.

- In August 2024, Aurobindo Pharma announced to open a production unit in China during the 3rd quarter of 2025. This new manufacturing center has been inaugurated to increase the production of Penicillin-G for the consumers of this nation.

China Penicillin G Sodium Market Trends

China is a major contributor to the market within Asia Pacific. The growing cases of endocarditis, along with technological advancements in the biopharma sector, are boosting the market in China. Additionally, the rise in the number of veterinary centers and the availability of raw materials at reasonable prices are playing a prominent role in shaping the industrial landscape.

Canada Penicillin G Sodium Market Analysis

The market in Canada is growing due to the surging emphasis of consumers to purchase medicinal items from e-commerce platforms. Additionally, the surging investment by the market players in opening new research and development centers for accelerating drug discovery, along with the numerous government initiatives aimed at modernizing public hospitals, is positively contributing to the industry.

Who are the Major Players in the Global Penicillin G Sodium Market?

The major players in the penicillin G sodium market include Henan Xinxiang Huaxing Pharmaceutical, CSPC Zhongnuo Pharmaceutical (Shijiazhuang) Co., Ltd., Shandong Lukang Pharmaceutical Group Co., Ltd., Kangyuan Pharmaceutical Group, Sinopharm Weiqida Pharmaceutical Co., Ltd., Pfizer Inc., Cipla Ltd., Fresenius Kabi AG, Sandoz (Novartis Division), Panpharma, Biocon Ltd., Harbin Pharmaceutical Group, Xi'an Harmonious Natural Biotechnology Co., Ltd., and Rajasthan Antibiotic Limited

Recent Developments

- In November 2025, Dechra launched Solovecin in the U.S. Solovecin is an antibiotic designed for treating skin infections in cats and dogs.

(Source: https://www.businesswire.com) - In November 2025, Meitheal Pharmaceuticals announced that the FDA had approved CONTEPO. CONTEPO is an antibacterial antibiotic designed for the treatment of Acute Pyelonephritis (AP) in the U.S.(Source: https://www.businesswire.com)

- In June 2025, Lyfius Pharma announced to resume Penicillin-G production in the Kakinada plant, Andhra Pradesh. This new manufacturing unit is expected to increase the production of Penicillin-G for the consumers of India.(Source: https://www.thehindu.com)

Segments Covered in the Report

By Sales Channel

- Direct Sales

- Indirect Sales

By Form/Purity

- ≥99 % Purity Grade

- ≥98 % Purity Grade

By End-Use/Application

- Bacterial Infections (General)

- Syphilis Treatment

- Prophylaxis

- Meningitis Treatment

- Combination Therapies & Others

By End-User Industry

- Hospitals & Clinics

- Pharmaceutical Manufacturers (API / Finished Dosage)

- Veterinary Medicine / Animal Health

- Research & Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting