What is Pharmaceutical Grade Sodium Chloride Market Size?

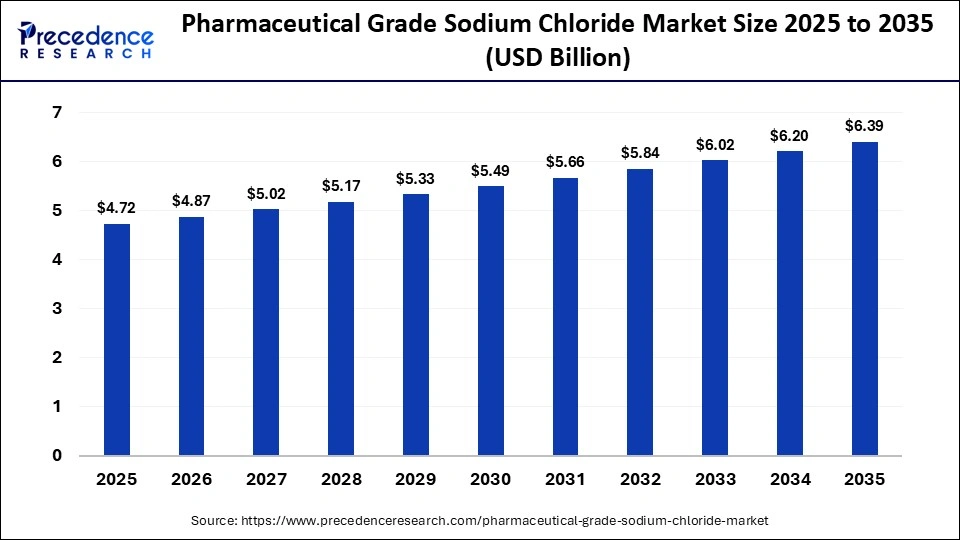

The global pharmaceutical grade sodium chloride market size was calculated at USD 4.72 billion in 2025 and is predicted to increase from USD 4.87 billion in 2026 to approximately USD 6.39 billion by 2035, expanding at a CAGR of 3.08% from 2026 to 2035. The market growth is attributed to rising demand for high-purity sodium chloride in dialysis, injectable therapies, and expanding healthcare infrastructure worldwide.

Market Highlights

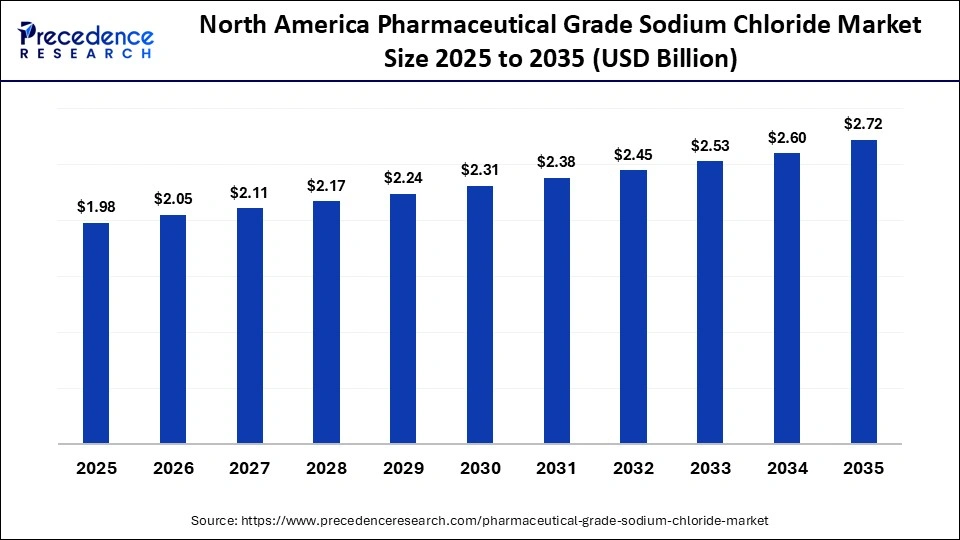

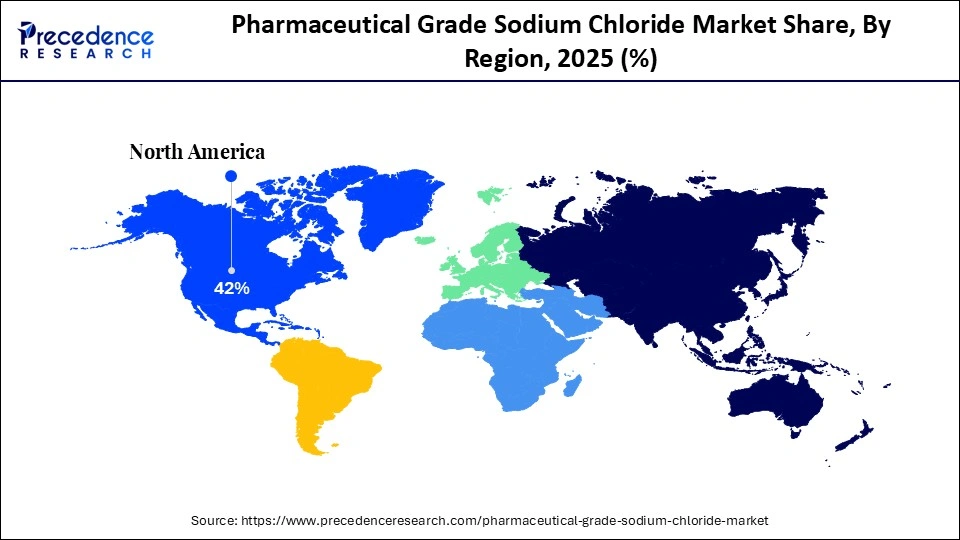

- North America dominated the market with the largest market share of 42% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By grade, the API-NaCl segment contributed the highest pharmaceutical grade sodium chloride market share in 2025.

- By grade, the HD-NaCl segment is expected to expand rapidly in the market in the coming years.

- By application, the dialysis segment captured the highest market share in 2025.

- By application, the injectables/intravenous solutions segment is expected to expand at a notable CAGR from 2026 to 2035.

Market Overview

The pharmaceutical grade sodium chloride market is fundamentally driven by increasing demand for sterile IV saline solutions in critical care and emergency medicine. The saline 0.9% is needed for hydration, resuscitation, and the delivery of injectable drugs in healthcare systems. The pharmaceutical-grade sodium chloride (NaCl) must adhere to stringent Pharmacopoeia standards (UP/BP/IP).

This demand was highlighted by the U.S. Food and Drug Administration (FDA)'s official announcement of the end of a multi-year nationwide shortage of NaCl 0.9% injectable saline. Furthermore, the market's growth is further supported by expansion in hospital infrastructure, rising surgical and chronic care demands, and global initiatives to strengthen medical supply chains following public health challenges.

Impact of AI on the Pharmaceutical Grade Sodium Chloride Market

The market is evolving due to the role of artificial intelligence (AI) in enhancing efficiency, quality management, and supply chain management. AI-driven process monitoring allows manufacturers to monitor crystallization, purity, and even sterility on-the-fly, with every batch being standard quality. The process control with AI support makes it possible to adjust the process by adjusting filtration, depyrogenation, and sterilization cycles. Furthermore, hospitals also use AI in pharmacy and ordering to forecast the use of IV saline to prevent wastages and to make it available when needed to save lives.

Growth Factors

- Rising Prevalence of Chronic Diseases: Increasing rates of kidney disease, hypertension, and diabetes are fuelling demand for dialysis and parenteral solutions requiring high-purity NaCl.

- Growth of Biologics and Injectable Therapies: Expanding use of complex injectable drugs is fuelling the need for ultra-pure NaCl as a critical excipient in formulation workflows.

- Rising Demand for Home Healthcare Solutions: Expansion of home dialysis and outpatient infusion services is boosting the consumption of ready-to-use high-purity saline solutions.

- Strategic Manufacturing Partnerships: Collaborations between pharmaceutical excipient suppliers and contract manufacturers are driving supply chain efficiency and broader market access.

Structural Demand Intensity and Cross-Border Supply Interdependencies Shaping the Pharmaceutical Grade Sodium Chloride Market

- In the U.S., one major sterile saline manufacturing facility, including Baxter's plant in North Carolina, was responsible for about 60% of the nation's IV fluid and injectable saline supply, highlighting the scale of demand for injectable NaCl solutions in clinical care

- Estimates suggest that 3.57 million people worldwide were receiving dialysis treatments in 2023, underscoring a significant and growing global demand for high-purity NaCl used in dialysis fluids.

- Chile's sodium chloride imports under HS 25010090 totaled ~62,000 kg in 2023, indicating reliance on imported high-grade NaCl for local pharmaceutical formulating and injectable fluid demand.

- Vietnam imported USD 48,002.41K of high-purity NaCl (HS 25010090) in 2023, which supports the country's burgeoning pharmaceutical manufacturing sector and expanding demand for sterile solution production inputs.

- India sent 657.25 million kg of pure NaCl (HS 250100) to Qatar and 611.88 million kg to Bangladesh in 2023, indicating an underlying total salt export capacity that can feed GMP supply chains.

Pharmaceutical Grade Sodium Chloride Market Trends

- Localized Sterile Packaging Innovations for Home Care: Manufacturers are introducing new sterile formats of packaging that can be used at home for infusion and dialysis processes. The use of smaller, easy-to-carry sachets, pre-filled vials, and unit-dose bag systems is gaining popularity with patients and caregivers in 2026. This development justifies the extension of the use of outpatient and in-home therapeutic services and minimizes handling errors.

- Green Manufacturing and Low-Carbon Salt Purification: Pharmaceutical excipient producers are investing in energy-efficient purification technologies to cut carbon emissions during NaCl refinement. Green chemistry strategies and integration of renewable energy are taking their place in the list of priority investments in Europe and North America. The sustainability criterion among suppliers is gaining popularity among buyers, and the trend of eco-driven production is an increasingly popular choice.

- Advanced Depyrogenation Technologies for Ultra Low Endotoxin Grades: Manufacturing plants are incorporating the latest depyogenation technologies, which always provide low endotoxin concentrations. These technologies enable manufacturers to surmount such emergent pharmacopoeial expectations and assist sensitive therapies (biologics) and other such emergent ones. GMI regulatory auditors are putting increased focus on depyrogenation controls documentation during GMI inspections.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.72 Billion |

| Market Size in 2026 | USD 4.87 Billion |

| Market Size by 2035 | USD 6.39 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.08% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Grade, Application and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Grade Insights

Why Did the API-NaCl Segment Dominate the Market?

The API-NaCl segment dominated the pharmaceutical grade sodium chloride market in 2025 due to its ultra-high purity and ultra-low endotoxin levels make it ideal for intravenous fluids, vaccines, parenteral nutrition, and sensitive pharmaceutical compounding.

API-NaCl supports multi-compendial compliance, enabling manufacturers to supply global markets with a single certified source. This enhances regulatory acceptance and reduces validation complexity. Furthermore, the API-NaCl's demand remains foundational to modern sterile drug production for its essential role in injectable and biologics portfolios, facilitating the segment's growth.

The HD-NaCl segment is expected to grow at the fastest CAGR in the coming years, owing to the rising incidence of chronic kidney disease and the expansion of dialysis infrastructure worldwide. Hospitals and dialysis centers turn to HD-NaCl as a more normal routine in managing electrolytes in hemodialysis and peritoneal dialysis care.

HD-NaCl purity is an important factor in effective treatment without needing ultra-low endotoxin levels. Additionally, the continued growth of healthcare capacities in emerging economies is likely to raise the demand for HD-NaCl, particularly in cases where renal care services to the population are extended by the state health systems.

Application Insights

How the Dialysis Segment Led the Market?

The dialysis segment led the pharmaceutical grade sodium chloride market in 2025, due to the rising global prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD). Healthcare systems were relying largely on high-purity dialysate salts for dialysis treatment. It has been noted by several national health agencies that patients on long-term haemodialysis need accurate electrolyte levels in dialysis fluids.

This demand has led to continuous purchases of pharmaceutical and ISO-certified NaCl concentrates of electrolytes. In 2024-2025, national renal care programs in developed and emerging economies increased their capacity, enhancing reliance on certified NaCl inputs to renal replacement therapies. Furthermore, regulators continue to underscore proper medical device classification and approval for dialysis concentrates, reinforcing adherence to quality standards and solidifying the prominence of this segment.

The injectables/intravenous solutions segment is expected to witness the fastest growth in the market over the forecast period, owing to its critical role of sterile intravenous (IV) saline in emergency care, surgery, and routine clinical therapies. The 0.9% NaCl is widely preferred as a fluid resuscitation, medication delivery, and hydration agent and is clinically adopted in acute care units.

This amplification of its daily use is due to population aging and increased volume of surgeries. Moreover, the broader hospital infrastructure development, especially in emerging regions, boosted the demand for sterile IV solutions to ensure access to basic and advanced medical services.

Regional Insights

How Big is the North America Pharmaceutical Grade Sodium Chloride Market Size?

The North America pharmaceutical grade sodium chloride market size is estimated at USD 1.98 million in 2025 and is projected to reach approximately USD 2.72 million by 2035, with a 3.23% CAGR from 2026 to 2035.

Why North America Dominated the Pharmaceutical Grade Sodium Chloride Market?

North America held a major revenue share of the market in 2025, due to the presence of advanced healthcare systems and high utilization of sterile NaCl in clinical therapies. The region's prevalence of chronic diseases maintained an unending demand for high-quality clinical fluids. Strict quality and GMP standards are imposed on hospital products of 0.9% NaCl injection products to provide resuscitation and supportive care by regulators like the U.S. FDA.

The use of NaCl in emergency rooms, operating rooms, and long-term care units remained the priorities of clinical teams, which opened the way to continued high demand. Furthermore, the strong manufacturer presence and strategic production capacities positioned in North America support consistent delivery of regulated sodium chloride products across acute and chronic care settings.

What is the Size of the U.S. Pharmaceutical Grade Sodium Chloride Market?

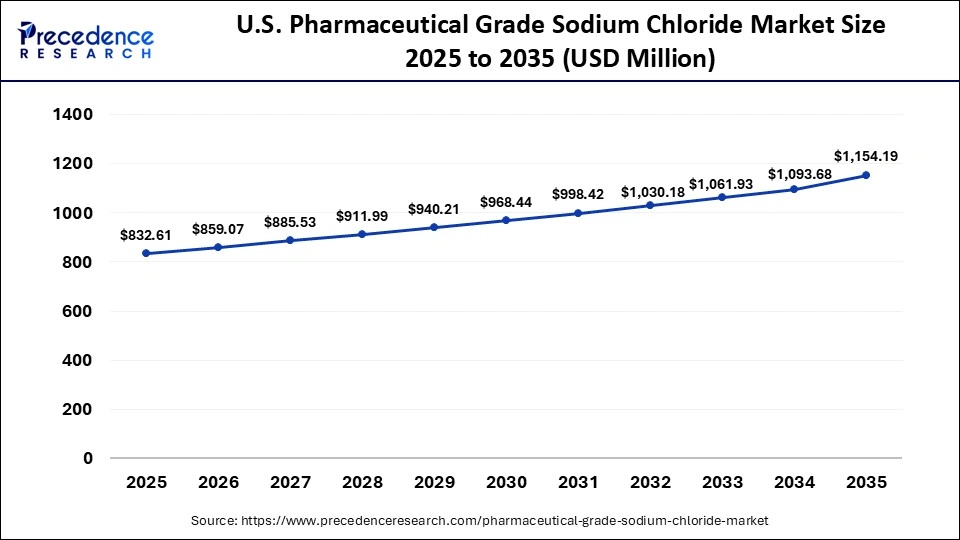

The U.S. pharmaceutical grade sodium chloride market size is calculated at USD 832.61 million in 2025 and is expected to reach nearly USD 1154.19 million in 2035, accelerating at a strong CAGR of 3.32% between 2026 to 2035.

U.S.: North America's Leading Market

The U.S. leads the market, as it has highly developed healthcare facilities, and sterile IV saline is largely used in the practice. Hospital and infusion centers in the U.S. use 0.9% NaCl as a source of fluid resuscitation, electrolyte balance, and injectable drug delivery.

The growth of biologics, injectable medications, and critical care guidelines in major health care systems further boosts the application of medically certified NaCl. Furthermore, the continued recommendation of 0.9% saline as a primary crystalloid in the management of shock and sepsis by national guidelines is expected to fuel the market in the U.S.

How is Asia-Pacific Growing in the Market?

Asia Pacific is expected to grow at the fastest CAGR in the pharmaceutical grade sodium chloride market during the forecast period, owing to the rapid growth of healthcare infrastructure, pharmaceutical production, and dialysis. Growing numbers of dialysis centers in China, India, and Southeast Asian economies reflect public health efforts to address chronic kidney disease. High-purity NaCl is a major component of the dialysate and clinical solution. Additionally, the sustained chronic disease burdens combined with expanding pharmaceutical clusters in cities, such as Shanghai, Mumbai, and Seoul, likely propel the Asia Pacific region in the market.

China Driving Asia Pacific's Growth

China is leading the charge in the Asia-Pacific market, due to the rapid scaling of healthcare capacity, local pharmaceutical manufacturing, and the expansion of renal care services. The Chinese medical manufacturing centers in provinces like Jiangsu, Shandong, and Zhejiang have intensified the manufacture of quality saline and dialysis concentrates, facilitating the demands of the international pharmacopeial quality standards. Moreover, the growth of dialysis facilities in China was in reaction to the increase in cases of chronic kidney disease that led to the acquisition of medically approved NaCl to use as dialysate solution.

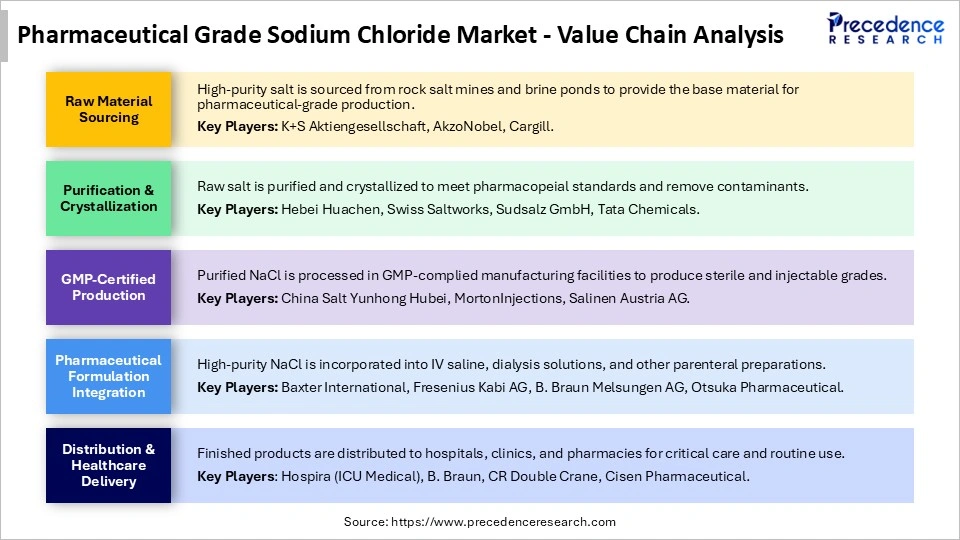

Pharmaceutical Grade Sodium Chloride Market Value Chain Analysis

Who are the major players in the global pharmaceutical grade sodium chloride market?

The major players in the pharmaceutical grade sodium chloride market include Akzo Nobel N.V., Cargill (Salt Business), Cheetham Salt, Compass Minerals, Dominion Salt Ltd., Hubei Xingfa Chemicals Group, K+S Aktiengesellschaft, Merck KGaA, Nouryon, Salinen Austria AG, Spectrum Chemical, Sudsalz GmbH, Swiss Saltworks, and Tata Chemicals Ltd.

Recent Developments in the Pharmaceutical Grade Sodium Chloride Market

- In January 2026, Miamed Pharmaceutical Industries inaugurated Syria's first pharmaceutical salt production line, producing 900–1,000 tons annually of pharmaceutical-grade NaCl and injectable-grade NaCl. The facility, located in rural Damascus, meets the highest international quality standards, marking a significant milestone in local healthcare manufacturing. (Source: https://levant24.com)

- In October 2025, B. Braun Medical Inc. introduced Midazolam in 0.8% Sodium Chloride Injection to the U.S. market. Offered in 50 mg/50 mL and 100 mg/100 mL IV bags, these preservative-free injections avoid DEHP, PVC, and natural rubber latex, reflecting a commitment to both patient safety and environmental responsibility. B. Braun continues to lead in infusion therapy and pharmaceutical innovation. (Source:https://www.prnewswire.com)

- In December 2024, Baxter International Inc. announced the launch of five new injectable pharmaceutical products in the U.S. The products included ready-to-use formats of standard concentrations of commonly prescribed drugs to offer operational efficiencies for healthcare providers, reducing the risk of contamination and avoiding potential compounding errors. (Source:https://www.businesswire.com)

Segments Covered in the Report

By Grade

- HD-NaCl

- API-NaCl

By Application

- Dialysis

- Hemofiltration Solutions

- Injectables/Intravenous Solutions

- Mechanical Cleansing Solutions

- Oral Rehydration Salts

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting