What is the Pet DNA Testing Market Size?

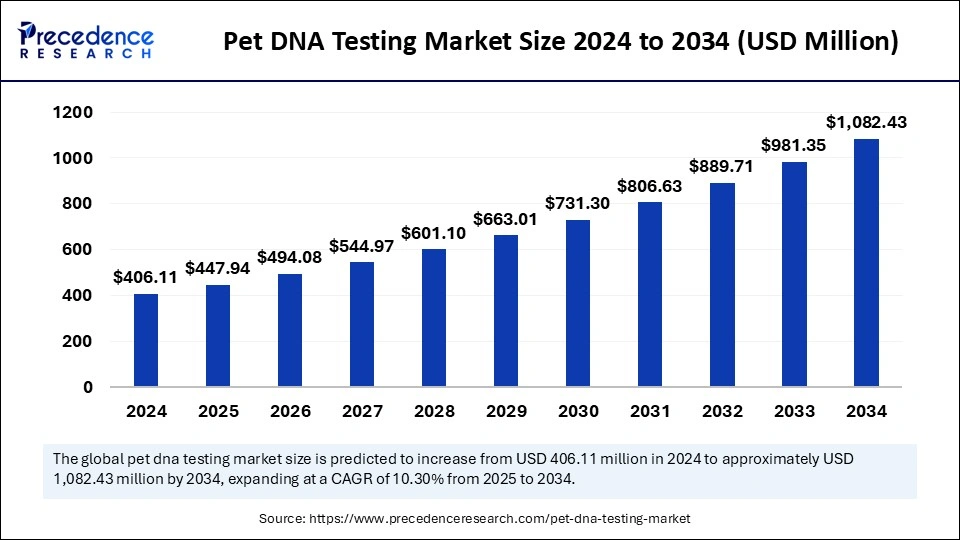

The global pet DNA testing market size is valued at USD 447.94 million in 2025 and is predicted to increase from USD 494.08 million in 2026 to approximately USD 1,082.43 million by 2034, expanding at a CAGR of 10.30% from 2025 to 2034. This market is growing due to increasing pet ownership and rising interest in genetic health.

Pet DNA Testing Market Key Takeaways

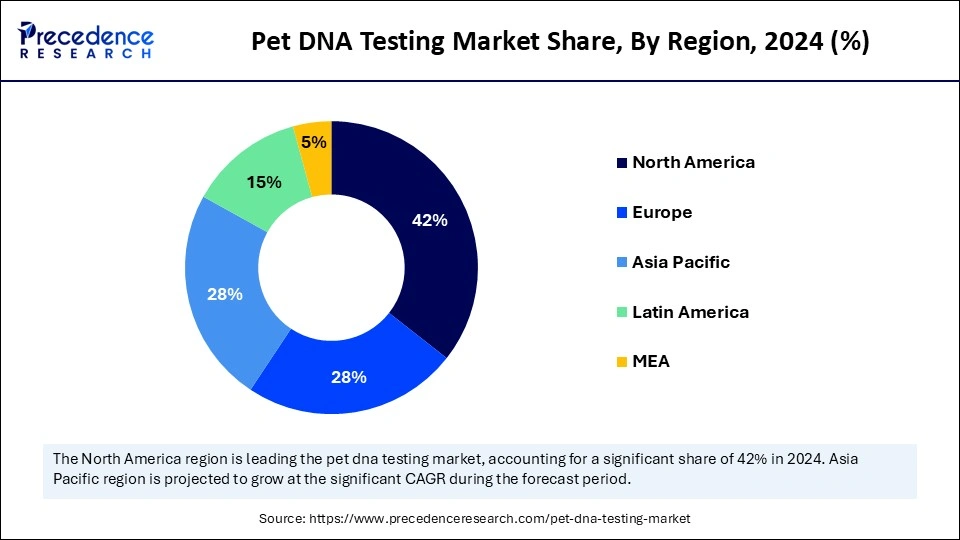

- North America dominated the market with the largest market share of 42% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 12.2% during the forecast period.

- By animal type, the dogs segment has held the highest market share of 53% in 2024.

- By animal type, the cat segment is expected to grow at a significant CAGR of 10.9% during the predicted timeframe.

- By sample type, the saliva segment contributed the highest market share of 55% in 2024.

- By sample type, the blood segment is expanding at a notable CAGR of 10.72% during the forecast period.

- By test type, the breed profile segment accounted for the biggest market share of 39% in 2024.

- By test type, the health and wellness segment is expected to grow at a CAGR of 10.52% in 2024.

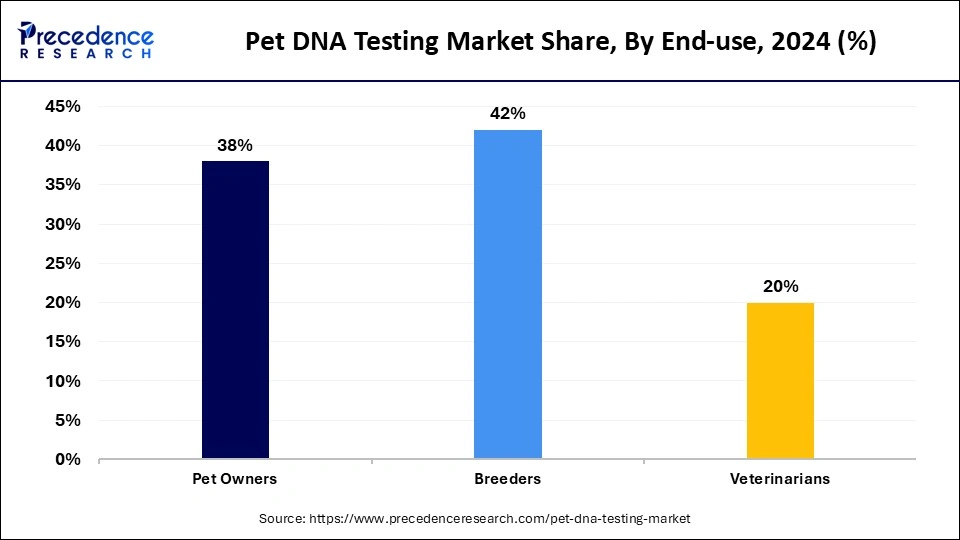

- By end use, the breeder's segment has held the highest market share of has held the highest market share of 42% in 2024.

- By end use, the pet owner's segment is growing at a notable CAGR of 10.6% forecast period.

How is AI revolutionizing the accuracy and efficiency of pet DNA testing?

Artificial Intelligence is transforming pet DNA testing's precision and effectiveness by using cutting-edge algorithms to analyze massive genetic data sets with previously unheard-of accuracy. Faster and more accurate breed identification, health screening, and trait prediction are made possible by these AI-powered systems' ability to process complex genetic markers quickly. To give pet owners a more thorough and trustworthy understanding of their pet's genetic composition Embark Veterinary, for example, uses AI-driven technology to improve breed identification accuracy and forecast genetic health risks. Compared to conventional approaches this AI integration ensures greater reliability and fewer errors by streamlining the testing process.

Furthermore, businesses like Wisdom Health and a division of Mars Petcare use AI to expedite testing while preserving a high degree of precision in identifying breed characteristics and genetic disorders. By employing machine learning models these businesses can continuously improve their testing procedures guaranteeing ongoing enhancements and more specialized genetic insights for animals. AI is revolutionizing the pet DNA testing market by decreasing human error, enhancing data processing, and lowering testing costs making it more affordable and advantageous for both professional and pet owners.

Why Are Pet Genomes Becoming a Household Conversation?

The pet DNA testing market is experiencing significant growth driven by increasing pet ownership and owners' desire to understand their pets' genetic backgrounds for better health management. Embark Veterinary Wisdom Health (a branch of Mars Petcare) DNA My Dog and Basepaws (acquired by Zoetis Inc.) are important participants in this expansion. Orivet Genetic Pet Care as well.

From breed identification to health screening, these businesses use cutting-edge technologies like microarray analysis and next-generation sequencing to provide a variety of services. Recent events like Orivet's improvement of their canine Breed Profiles and Mars Petcare's purchase of French veterinary diagnostics companies Cerba Vet and Antagene highlight how dynamic this sector is. The market keeps growing as consumer interest and technological advancements increase awareness of the risks to one's health posed by genetics.

Pet DNA Testing Market Growth Factors

- Increase Pet Ownership: As pet ownership continues to rise globally more pet owners are seeking ways to ensure their pets' health and wellbeing, driving the demand for genetic testing services.

- Health and Wellness Awareness: Pet owners are becoming increasingly aware of the importance of genetic health screening to identify potential hereditary diseases, allowing them to take preventative measures for their pet's health.

- Breed Identification and Legislation: With the rise of mixed breed pets and breed-specific legislation in various regions, pet DNA testing provides owners with accurate breed identification, helping in legal compliance and behavioral understanding.

- Veterinary Adoption: Veterinarians are increasingly recommending DNA testing to better manage health issues, contributing to the market's growth as more professionals adopt these services.

- Rising Disposable Incomes: As disposable incomes grow in many regions, pet owners are willing to invest more in the health and well-being of their pets, including genetic testing services.

Market Outlook

- Industry Outlook: The pet DNA testing market is poised for rapid growth from 2025 to 2034, driven by drivers like humanization of pets and premiumization of pet care as owners increasingly treat pets as family, demand for personalized health insights, longevity solutions, and tailored nutrition grows, directly expanding the market for genetic testing. And the second one is integration with veterinary care and digital platform collaborating between testing labs, veterinary clinics and pet health apps.

- Major Investment: Pet gen labs and companion health venture are the two majorly investing firms that are investing in high-throughput sequencing infrastructure and clinical partnerships to lower per-test cost and improve turnaround for veterinary grade.

- Sustainability Trend: Sustainability in pet DNA testing focuses on reducing lab waste, sourcing eco-friendly packaging for test kits, and promoting responsible breeding that mitigates hereditary diseases prevalence.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,082.43 Million |

| Market Size in 2025 | USD 447.94 Million |

| Market Size in 2026 | USD 494.08 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.30% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Animal Type, Sample Type, Test Type, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advancements in Genetic Research

Technological advancements in bioinformatics, AI-driven analytics, and DNA sequencing have increased the precision speed, and cost-effectiveness of pet DNA testing. Companies like Basepaws now owned by Zoetis, leverage machine learning algorithms to analyze feline DNA providing insights into breed and potential genetic diseases. Next-generation sequencing or NGS is used by Embark Veterinary to enhance disease screening and breed identification providing more accurate results. Because of these developments, testing has become now affordable for pet owners all over the world. Pet DNA testing is still a cutting-edge and growing industry thanks to the ongoing advancements in genetic science.

Expansion of Direct-to-Consumer Testing

Genetic testing has become easier to obtain and more convenient with the rise of direct-to-consumer pet DNA testing kits. The procedure is easy to use thanks to at-home test kits from businesses like DNA MY Dog and Embark Veterinary that only need a basic saliva sample. These kits do not require a visit to the veterinarian because they offer rapid results via online portals. The consumer base has grown thanks to the direct-to-consumer business model which now reaches pet owners who might not have previously thought about DNA testing. This expansion driven by convenience is changing the market and expanding its reach internationally.

Restraint

Accuracy and Reliability Concerns

The accuracy and dependability of some tests are still in doubt despite advancements in DNA testing technology. Some pet owners have expressed disbelief in the reliability of these services after receiving conflicting results from several testing providers. Due to variations in their genetic databases, for instance, breed identification results from various providers such as Wisdom Panel and DNA My Dog may differ. Potential customers may become less trusting of this inconsistency and be reluctant to spend money on DNA testing services. To solve these issues businesses must increase the uniformity and openness of their processes.

Opportunities

Personalized Pet Healthcare and Nutrition

Customized pet nutrition and care programs based on genetic insights are becoming more and more popular. To develop specialized diets that fit an animal's genetic profile companies like Purina and Royal Canin are looking into collaborating with pet DNA testing companies. Testing businesses can provide wellness and nutrition programs based on DNA going beyond breed identification and health screening. Opportunities for cooperation between DNA testing companies pet food procedures and veterinary clinics are created by the trend toward customized pet care.

Expansion into Exotic and Niche Pet DNA Testing

DNA testing is becoming more popular for exotic pets like birds, reptiles, and small mammals even though the pet DNA testing market is still primarily focused on dogs and cats. The first companies to use feline DNA testing were Basepaws and others which paved the way for future growth into other categories. In a competitive market creating genetic tests for exotic pets can help businesses stand out and draw specialized pet owners seeking ancestry and health information. This diversification can expand market reach and create new revenue streams.

Animal Type Insights

Dogs segment dominated the pet DNA testing market with the largest share in 2024, driven by ancestry analysis genetic health screening and breed identification are in high demand. To ensure responsible breeding practices optimize nutrition and comprehend possible hereditary diseases many dog owners seek DNA testing. Comprehensive canine genetic databases are provided by organizations like Embark Wisdom Panel and Orivet which improves the accuracy and dependability of tests.

The growing popularity of adopting mixed-breed dogs has increased the demand for DNA testing as pet owners seek to learn more about the ancestry and possible health hazards of their animals. DNA testing is becoming more common in clinical settings as a result of veterinary professional's recommendations for early disease detection.

Cat segment is expected to grow at the fastest rate in the forecast period driven by growing knowledge of breed-specific illnesses that can be identified by DNA testing such as polycystic kidney disease and hypertrophic cardiomyopathy. Cat breed identification, health risk assessments, and trait analysis are now included in the services offered by businesses such as Basepaws and Optimal Selection Feline. Because many domestic cats have mixed ancestry DNA testing is appealing to owners who are interested in their feline's genetic background, unlike a dog whose breeds are well documented. Further driving up demand for feline DNA testing is the increasing number of cat adoptions and the growing trend of customized pet care.

Sample Type Insights

The saliva segment dominated the market with the largest share in 2024, driven by its ease of use, non-invasiveness, and simplicity in sample collection. Saliva swab tests are preferred by pet owners because they are more accessible and reasonably priced, and they can be done at home without the help of a professional. Because they provide thorough breed identification ancestry mapping and health screenings using straightforward cheek swabs companies like Embark Wisdom Panel and Basepaws have helped to popularize saliva-based tests.

Improvements in genetic sequencing have increased the precision of saliva tests giving pet owners comprehensive information on the inherited characteristics and possible health hazards of their animal companion. As more pet parents choose at-home testing kits this market is still expanding.

Blood segment is expected to grow at the fastest rate in the forecast period, expanding quickly as a result of its improved accuracy and dependability. To identify specific breeds and identify genetic disorders and inherited diseases veterinary clinics and professional breeders are increasingly using blood samples.

Blood samples are perfect for sophisticated health screenings because they contain higher-quality DNA which lowers the risk of contamination and increases test precision. For veterinarians and research facilities companies such as Neogen and Orivet provide customized blood-based genetic tests. This pet DNA testing market is growing as a result of the growing need for specialized veterinary diagnostics and early disease detection, especially in clinical and breeding settings.

Test Type insights

Breed profile segment dominated the market with the largest share in 2024, driven by pet owners' interest in the origins of their animal's growth. Breed identification tests are in high demand since many adopt mixed-breed dogs and cats without knowing their genetic heritage. Organizations such as Embark Wisdom Panel and Basepaws provide comprehensive breed databases with incredibly precise genetic marker-based results. Breeders and animal lovers who wish to verify purebred ancestry or comprehend behavioral characteristics associated with breeds also frequently use breed testing. The breed profile segment continues to hold the largest market share as DNA testing becomes more widely available and more reasonably priced.

Health and Wellness segment is expected to grow at the fastest rate in the forecast period, these tests enable early intervention and customized care plans by screening for genetic predispositions to diseases like hip dysplasia heart disease, and hereditary cancers. More genetic health testing services are being offered by organizations like Orivet Neogen and Optimal Selection which assist veterinarians and pet owners in identifying possible hazards before symptoms manifest. The pet DNA testing market is expanding at the fastest rate due to the growing demand for health and wellness testing brought on by improvements in DNA-based diagnostics and growing awareness of pet healthcare.

End Use insights

Breeders segment dominated the market with the largest share because genetic testing is essential to maintaining breed standards and ensuring healthy bloodlines breeders control most of the pet DNA testing market. By choosing genetically robust partners professional breeders can improve breeding programs verify lineage and screen for hereditary diseases using DNA testing. Specialized tests designed for breeders are provided by companies such as Neogen Orivet and Optimal Selections. These tests offer information on genetic traits, coat colors, and possible health hazards. This market is the biggest service since DNA testing helps breeders preserve their reputation and enhance the general health of breeds.

Pet owners' segment is expected to grow at the fastest rate in the forecast period as more people get DNA testing for personal information and pet health care and to find out more about the ancestry of their pets. Pet owners are investing in high-end medical care such as genetic screening for hereditary disorders and breed identification as a result of the growing trend of pet humanization. At-home testing kits are now widely accessible thanks to companies like Embark Wisdom Panel and Basepaws. These kits enable pet parents to obtain comprehensive genetic reports by collecting saliva samples. DNA testing is the market segment with the fastest rate of growth as pet owner's awareness of the risks to their genetic health and their emphasis on individualized pet care are driving up demand for the service.

Regional Insights

U.S. Pet DNA Testing Market Size and Growth 2025 to 2034

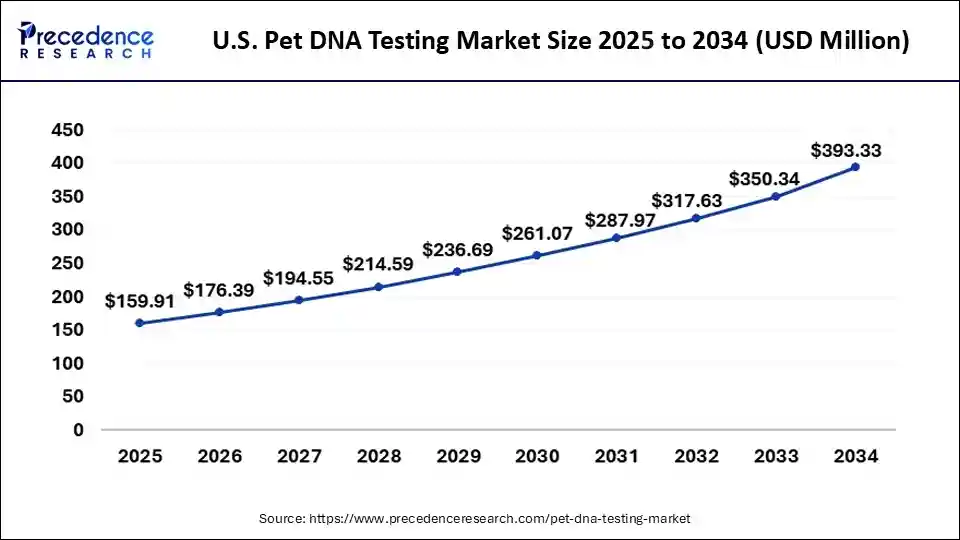

The U.S. pet DNA testing market size is exhibited at USD 159.91 million in 2025 and is projected to be worth around USD 393.33 million by 2034, growing at a CAGR of 10.49% from 2025 to 2034.

North America dominates the pet DNA testing market due to the high pet ownership rates, strong consumer awareness, and the presence of leading genetic testing companies. Veterinarians in the area are increasingly recommending genetic screening for breed identification and health risk assessments demonstrating the region's established pet healthcare infrastructure. The market is still growing due to the growing demand for individualized pet care and increased spending on pet wellness products. Additionally, pet owners in the area now have greater access to genetic testing thanks to developments in DNA sequencing technology and direct-to-consumer test kits.

Asia-Pacific is expected to grow at the fastest rate in the market during the forecast period due to rising pet adoption, rising disposable incomes, and growing awareness about pet health. As pet owners become more aware of the health risks and inherited conditions unique to their breed there is an increasing demand for genetic testing. Businesses are increasing their providing more reasonably priced test kits and localized services. Asia Pacific is currently the pet genetics market with the fastest rate of growth due to the proliferation of online pet care platforms and e-commerce distribution channels which have further stimulated the adoption of DNA testing.

Japan Pet DNA Testing Market Trends

In Japan, high pet-human affinity and advanced veterinary care create a receptive market for DNA-based health screening and breed identification. China shows rapid interest among urban millennials and Gen Z pet owners who value premium pet services and digital health platforms. Australia balances strong animal welfare norms with a proactive veterinary community that adopts genomic testing for hereditary disease screening. Across APAC, success depends on tying test results to local vet follow-up, accessible interpretation, and culturally relevant pet-care guidance.

Europe is currently experiencing the most rapid growth in the pet DNA testing market, due to the strong regulatory frameworks for animal welfare, high veterinary care standards, and a growing interest in pet genetics. DNA testing is becoming more and more popular in the area among pet owners who want to learn about inherited diseases and breed composition. By investing in cutting-edge testing techniques. European veterinary research institutes and pet genetic companies are bolstering the market. The market in Europe is also steadily expanding due to the popularity of high-end pet services like customized diets and wellness programs based on genetics.

The UK Pet DNA Testing Market Trends

The UK leads with a robust direct-to-consumer market and strong vet-clinic partnerships that convert genetic insights into action plans. Germany combines rigorous animal-health regulation with high pet-care expenditure, encouraging adoption for hereditary disease screening. Nordic countries prioritise data ethics and vet-led interpretation, integrating tests into broader animal-welfare initiatives. Across Europe, adoption gains steam where tests are seen as tools for welfare and prevention rather than mere novelty.

Will Middle East Africa Leap into Genomic Pet Care or Stay Niche?

Middle East & Africa present a dual landscape: affluent urban centres with premium pet services show growing interest in DNA testing, while many regions remain price-sensitive with limited veterinary genomics infrastructure. Luxury pet services and boutique clinics in metropolitan hubs are early adopters, offering breed and health insights to discerning owners. Outreach via mobile veterinary units and regional distributors is beginning to bridge access gaps in some African markets. For broader adoption, cheaper tests, local lab capacity, and educational campaigns that translate genetic data into clear care actions are essential.

The UAE Pet DNA Testing Market Trends

In the United Arab Emirates, premium pet clinics and affluent owners drive demand for ancestry and health-screen tests as part of personalised pet care packages. South Africa shows veterinarian-led adoption in urban centres, especially for working dogs and pedigree breeders concerned about hereditary conditions. Across the region, growth hinges on building local lab capabilities and integrating genetic counselling services into veterinary practice. Public awareness and affordable service tiers will determine whether genomics moves from boutique to mainstream.

Can Latin America Turn Passion for Pets into Genomic Momentum?

Latin America combines intense pet affection with growing middle-class spending on pet services, creating fertile ground for DNA testing uptake. Early adopters in urban centres use tests for breed ID, health screening, and to manage inherited conditions in pedigree lines. Distribution challenges, pricing sensitivity, and varied vet infrastructure temper rapid mass adoption, but partnerships with regional pet retailers and clinics show promise. Education campaigns that link test results to tangible care benefits nutrition, preventive screening, and training will accelerate mainstream acceptance.

Brazil Pet DNA Testing Market Trends

Brazil leads in sheer market potential with a large pet population and vibrant pet-care industry receptive to premium services. Argentina and Chile show rising interest among urban pet owners and pedigree breeders who prioritise genetic health screening. Across the region, localization of services and multilingual reporting strengthen consumer trust and comprehension. Scaling distribution through vet networks and retail channels is the key to unlocking wider market penetration.

Pet DNA Testing Market Value Chain Analysis

- Raw Material Sourcing: Raw material sourcing in the pet DNA testing market begins with high-quality biological sampling kits, stabilizing reagents and secure packaging materials that ensure sample integrity during transport.

Key players: Thermo Fisher Scientific, Qiagen and New England Biolabs - Retail Sales and Distribution: Retail distribution channels ensure that DNA testing kits reach consumers through online platforms, veterinary clinics and pet specialty plays a pivotal role by offering financing options such as buy now pay later for premium kits, also widen adoption among budget-conscious consumers.

Key players: Wisdom Panel, Embark Veterinary and DNA My Dog

Top Companies in the Pet DNA Testing Market & Their Offerings:

- Embark Veterinary, Inc.: A market leader known for its extensive breed database and advanced health screening capabilities, contributing significantly to pet health research.

- Mars Petcare: A major player, particularly in breed identification. Its integration with veterinary care makes it a key partner for vets.

- DNA MY DOG: Important for offering an affordable and straightforward option for basic breed identification, making DNA testing accessible to a wider range of pet owners.

- Zoetis Inc. large animal health company that has expanded its services into the pet DNA testing market through acquisitions, leveraging its existing infrastructure.

- Neogen Corporation: Another major player in the broader animal health and genetic testing industry, also known for introducing lower-cost options into the market.

- Orivet Genetic Pet Care: Stands out by offering specialized tests and genetic counselling services, providing tailored solutions for specific needs beyond basic screening.

Pet DNA Testing Market Companies

- Zoetis Inc. (Basepaws Inc.)

- Mars Petcare (Wisdom Panel)

- Orivet Genetic Pet Care Limited

- Embark Veterinary, Inc.

- Dognomics (public: Clinomics)

- DNA MY DOG (Canadian Dog Group Ltd.)

- Neogen Corporation

- EasyDNA (Genetic Technologies)

- CirclePaw (Prenetics Global Limited)

- Macrogen, Inc.

Latest Announcements

- On 16 March, Metatech Insights announced the publication of its latest research study on the pet DNA testing market. The report provides an in-depth evaluation of business strategies adopted by emerging industry players, geographical scope, market segments, product landscape, pricing, and cost structures. It highlights the increasing demand for DNA testing among pet owners seeking insights into their pets' breed, health risks, and ancestry. The chief analyst at Metatech Insights stated, "This growth is driven by increasing pet adoption rates and heightened awareness of pet health among owners.

Recent Developments

- In August 2024, the University of Cambridge and Wisdom Panel developed a DNA test aimed at eradicating progressive retinal atrophy in English shepherd dogs. The breakthrough test helps breeders make informed decisions to reduce the spread of hereditary eye diseases in this breed. Wisdom Panel continues to expand its genetic database, ensuring higher accuracy for bread and health screening.

- In July 2024,Mars Petcare completed the acquisition of two French veterinary diagnostics companies, Cerba Vet and Antagene. Cerba Vet operates six veterinary diagnostic labs, while Antagene specializes in DNA testing for animals and disease diagnostics. This acquisition strengthens Mars Petcare's position in the veterinary diagnostics sector and enhances its research capabilities in pet genomics. The company aims to integrate these services with its existing DNA testing solutions under Wisdom Panel.

Segments Covered in the Report

By Animal Type

- Dogs

- Cats

- Other Animals

By Sample Type

- Blood

- Saliva

- Fecal

- Others

By Test Type

- Breed Profile

- Genetic Diseases

- Health and Wellness

By End-use

- Pet Owners

- Breeders

- Veterinarians

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting