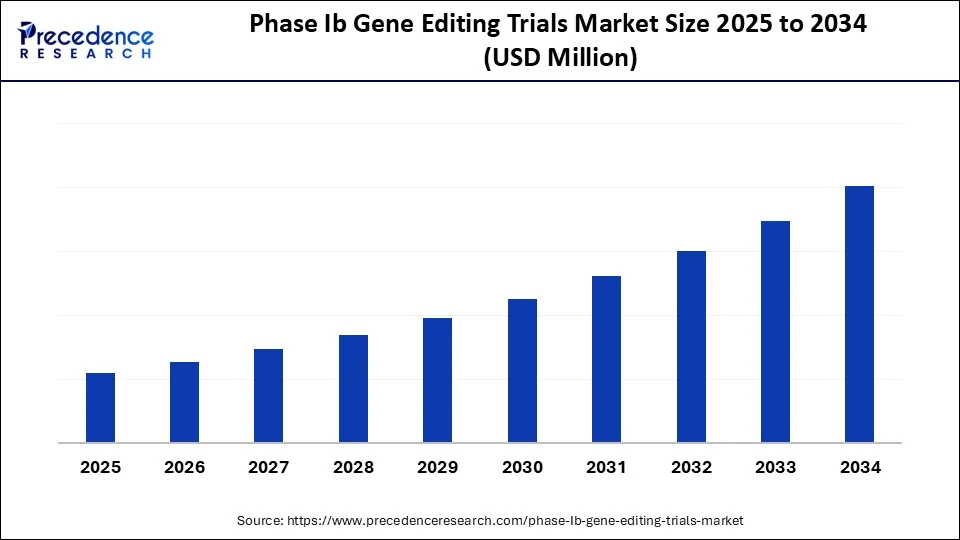

Phase Ib Gene Editing Trials Market Size and Forecast 2025 to 2034

Phase Ib gene editing trials market growth driven by in vivo CRISPR base editing, lipid nanoparticle delivery & early cardiovascular and rare disease therapies. The market growth is attributed to the increasing prevalence of genetic disorders and rapid advancements in CRISPR and precision gene-editing technologies.

Phase Ib Gene Editing Trials MarketKey Takeaways

- North America dominated the global phase Ib gene editing trials market with the largest share of 61% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By gene editing platform, the CRISPR/Cas systems segment held the biggest market share of 62% in 2024.

- By gene editing platform, the base and prime editors segment is projected to grow at a significant CAGR between 2025 and 2034.

- By therapy type, the in vivo gene editing therapies segment captured the biggest market share of 55% in 2024.

- By therapy type, the ex vivo gene editing therapies segment is likely to expand at a significant CAGR between 2025 and 2034.

- By disease area, the oncology segment contributed the highest market share of 38% in 2024.

- By disease area, the neurology segment is expected to grow at a significant CAGR over the projected period.

- By delivery method, the electroporation segment led the market in 2024.

- By delivery method, the non-viral vectors segment is expected to grow at a notable CAGR from 2025 to 2034.

- By trial sponsor type, the biotech/pharma companies segment contributed the highest market share of 73% in 2024.

- By trial sponsor type, the academic institutions segment is expected to grow at a notable CAGR from 2025 to 2034.

Impact of Artificial Intelligence on the Phase Ib Gene Editing Trials Market

The artificial intelligence (AI) is critical in the improvement of phase Ib trials of gene editing as it helps simplify complicated procedures and allows making precise decisions. AI algorithms can rapidly process preclinical and Phase I data, forecast dose-response patterns, and help exclude off-target risks, informing real-time adjustments to trial protocols. Moreover, AI has a big positive impact on the development trajectory of Phase Ib gene editing trials and their success rates.

Market Overview

The Phase Ib gene editing trials market refers to the segment of clinical research activity where gene editing-based therapeutics (e.g., CRISPR, TALENs, ZFNs) are being evaluated in Phase Ib clinical trials a subphase of Phase I that primarily focuses on early proof-of-concept, initial efficacy signals, and dose optimization, often in patients with the target disease rather than healthy volunteers. This market specifically encompasses therapeutic candidates that have passed initial safety evaluation (Phase Ia) and are now being studied for their preliminary biological effect, optimal dosing regimen, and extended safety/tolerability in a small patient population.

The rise in the prevalence of genetic disorders is also triggering the growth of Phase Ib gene editing trials, as health systems across the globe push to adopt early interventions for rare and inherited conditions. It is possible to fix flawed DNA code with high precision with the help of new technologies in gene editing, such as CRISPR, base editing, and prime editing. According to the Gene, Cell, & RNA Therapy Landscape Report, over 4,000 gene, cell, and RNA-based therapies are currently in development globally. Furthermore, the further infiltration of venture capital into genome editing start-ups and an increase in the need for precision therapeutics are expected to lead to a rise in early-stage trial activity across a vast number of therapeutic areas.(Source: https://www.asgct.org)

Phase Ib Gene Editing Trials Market Growth Factors

- Rising Demand for Rare Disease Therapies: Growing unmet clinical needs in treating rare monogenic disorders are fuelling the development of early-stage gene editing programs.

- Boosting Integration of AI in Trial Design: Integration of artificial intelligence tools is accelerating trial optimization, data analysis, and patient matching in Phase Ib studies.

- Expanding CRISPR Toolkits Beyond Cas9: The development of novel systems, such as Cas12, Cas13, and Cas14, is driving more versatile gene editing approaches for Phase Ib pipelines.

- Growing Academic: Industry Collaborations: Strategic alliances between research institutions and biotech firms are propelling translational research into early human trials.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Gene Editing Platform, Therapy Type, Disease Area, Delivery Method, Trial Sponsor Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Increasing Prevalence of Genetic Disorders Driving the Growth of the Phase Ib Gene Editing Trials Market?

Increasing prevalence of genetic disorders is expected to drive market growth. The recently increasing prevalence of hereditary diseases, including sickle cell disease, thalassemia, and Duchenne muscular dystrophy, keeps fueling the demand for innovative gene editing treatments. Phase Ib trials are another essential stage of analyzing the safety of such interventions and their preliminary effectiveness in small, specific groups of people.

The data from ClinicalTrials.gov indicates that by 2025, more than 61,215 Phase I clinical trials are expected to register globally, along with an additional 5,744 trials classified specifically as Early Phase 1 studies.Healthcare providers are diagnosing the existence of these disorders earlier, with more advanced technology in diagnostics. Intellia Therapeutics and CRISPR Therapeutics companies reported advancements in their trials for transthyretin amyloidosis and beta-thalassemia, respectively, indicating increased clinical efforts. Furthermore, the rising focus on personalized medicine approaches is projected to influence early-phase trial designs.

Restraint

Regulatory Complexities

Regulatory complexities are expected to slow the progression of Phase Ib gene editing trials, hindering market growth. Such regulatory bodies as the FDA, EMA, and PMDA establish strict regulations regarding the safety of gene editing therapies. Issues of off-target effect, long-term safety, and difficulty in preventing germline transmission challenge the developers, extending both trial preparation and approval processes. Furthermore, companies lacking long-term financial backing often struggle to maintain trial continuity, which reduces overall innovation at the Phase Ib stage and hampers market growth.

Opportunity

How Does Growing Investments by Biotech Firms Accelerate the Phase Ib Gene Editing Pipeline?

Increasing investment in gene-editing by biotech companies is expected to fuel the growth of the Phase Ib pipeline market and create numerous opportunities. Venture capital firms, strategic pharmaceutical partnerships, and government funding are increasingly financing companies that develop next-generation gene-editing technology. These investments are happening through the direct contribution of advancing therapeutic candidates into early clinical stages.

In May 2025, Finnish biotechnology firm TILT Biotherapeutics (Tiltbio) secured $25.6 million (€22.6 million) in Series B financing to advance its clinical development programs. The funding is set to support a Phase II trial of its lead oncolytic immunotherapy candidate, TILT-123, in patients with platinum-resistant epithelial ovarian cancer. Additionally, the investment will back a Phase Ib trial in melanoma using TIL (tumor-infiltrating lymphocyte) combination therapy, as well as other Phase Ib trials evaluating TILT-123 in various solid tumor indications.

Other companies, such as CRISPR Therapeutics, Editas Medicine, or Beam Therapeutics, allocate this money to well-developed Phase Ib research to test the approaches of genome modifications in translational conditions. The additional resources that accompany the influx of capital support complex R&D activities, thereby further increasing the number of trials. Furthermore, the surging technological advancements in CRISPR and base editing platforms are estimated to boost trial initiation.

(Source: https://www.asgct.org)

Gene Editing Platform Insights

Why Did the CRISPR/Cas Systems Segment Dominate the Phase Ib Gene Editing Trials Market?

The CRISPR/Cas systems segment dominated the market, accounting for an estimated 62% share in 2024. The dominance of the segment stems from the effectiveness, versatility, and high adoption of CRISPR/Cas systems in research. CRISPR-based therapies represented the majority of early-phase clinical trials, particularly in trials for monogenic conditions, such as sickle cell disease, beta-thalassemia, or hereditary angioedema.

- As of December 2022, the National Institutes of Health (NIH) reported a total of 71 clinical trials involving CRISPR-Cas systems, with 45 specifically targeting human therapeutic development.

Research studies applying CRISPR-based technologies in early-stage drug development worldwide, encompassing all gene editing-related studies using the I and Ib phases of gene editing. The number of programs utilizing CRISPR in clinical pipelines continues to rise steadily. Leading companies, including CRISPR Therapeutics, Intellia Therapeutics, and Editas Medicine, were furthering in vivo and ex vivo trials, which have been for hematologic, hepatic, and immunologic indications. Furthermore, the comparatively simple design and wide applicability of the disease played a key role in fueling the segment.(Source: https://pmc.ncbi.nlm.nih.gov)

The base & prime editors segment is expected to grow at the fastest CAGR in the coming years, owing to their overall precision and lower chances of an off-target effect during the process than regular CRISPR/Cas systems. This type of platform has the ability to directly correct point mutations irreversibly, as they not generate breaks in the two strands of DNA. This further offers a high level of applicability to inherited diseases due to SNVs. Moreover, the increasing regulatory acceptance of this type of gene editing platform is expected to further boost the segment in the coming years.

Therapy Type Insights

How Does the In Vivo Gene Editing Therapies Segment Lead the Phase Ib Gene Editing Trials Market in 2024?

The in vivo gene editing therapies segment led the market with a 55% share in 2024. This is mainly due to their streamlined administration and increased success in systemic indications. Various regulatory bodies, such as the FDA in the U.S. and the EMA, have promoted these efforts by granting numerous in vivo candidates expedited designations, including the FDA's Fast Track designation and the Orphan Drug designation. Furthermore, the fact that its technical background is comparatively simpler to manufacture, combined with the ability to customize it per patient, further propels the segment.

The ex vivo gene editing therapies segment is expected to grow at the fastest rate in the coming years, owing to the development of cell engineering, process optimization, and immune cell therapies. In contrast to the in vivo therapies, the ex vivo gene editing therapies undergo strict quality control and reinfuse the purified cells. Additionally, the adoption of automation and universal donor cell platforms by manufacturers is expected to enhance the scalability of Ex vivo therapies and increase their demand in the coming years.

Disease Area Insights

What Made Oncology the Dominant Segment in the Phase Ib Gene Editing Trials Market in 2024?

The oncology segment dominated the phase Ib gene editing trials market, holding a 38% share in 2024. This is primarily due to the growing need to develop new methods of cancer treatment and the potential of gene-edited immune cell therapy. There were multiple trials, including hematologic malignancies and solid tumors, at Phase Ib, guided by positive initial safety and efficacy data. Companies like CRISPR Therapeutics, Caribou Biosciences, and Precision BioSciences have developed engineered CAR-T and CAR-NK therapies with further CRISPR-based improvements, allowing for higher cytotoxicity and lower immune evasion.

The American Society of Gene & Cell Therapy (ASGCT) and ClinicalTrials.gov reported that the majority of Phase Ib gene editing trials in 2024 were conducted in oncology investigations. The majority of that oncology work concentrated on leukemia, lymphoma, and glioblastoma. RMAT and PRIME schemes were maintained by regulatory organizations, such as the FDA and the EMA, to continue supporting such programs. Furthermore, all these innovative developments are bolstering trial preparedness and assisting in the diversification of therapeutic pipelines within large biotech and pharmaceutical players.(Source: https://www.asgct.org)

The neurology segment is expected to grow at the fastest CAGR in the upcoming period, supported by advancements in delivery mechanisms that enable passage across the blood-brain barrier and enhance therapeutic precision. Gene editing therapy used against monogenic neurological disorders, such as Huntington disease, amyotrophic lateral sclerosis (ALS), and Rett syndrome, further gained pace in 2024. Additionally, the technological advancements and translation-related partnerships are expected to propel an increase in the number of Phase Ib studies focused on neurology in the coming years.

Delivery Method Insights

Why Did the Electroporation Segment Dominate the Phase Ib Gene Editing Trials Market in 2024?

The electroporation segment dominated the market while holding the largest revenue share in 2024. This is primarily due to its high transfection rate and lower cost compared to other methods. The physical approach enables temporary permeability in the membrane, allowing for the rapid introduction of CRISPR components, base editors, or plasmids into immune cells, particularly T cells and Hematopoietic Stem Cells (HSCs). Furthermore, the favourable safety profile of electroporation in INDs for hematologic malignancies further boosts segment growth.

The non-viral vectors segment is expected to grow at the fastest CAGR over the projection period, owing to their continually rising modularity in genetic cargo engineering. The NIH and Nature biotechnology highlighted the increased promise of lipid nanoparticles (LNPs), polymeric nanoparticles, and gold nanoparticle delivery platforms to deliver CRISPR components in vivo. Additionally, the pursuit of non-viral gene editing technologies to treat chronic and complex diseases is expected to fuel the market.

Trial Sponsor Type Insights

How Does the Biotech/Pharma Companies Segment Dominate the Phase Ib Gene Editing Trials Market?

The biotech/pharma companies segment dominated the Phase Ib gene editing trials market with a 73% share in 2024, driven by the continuous flow of capital, the development of research and development pipelines, and their own delivery and editing systems. Industry sponsors supported by strong preclinical data and fast-track regulatory approval paths, such as RMAT or Fast Track designation by the FDA, are expected to facilitate Phase Ib trials in gene editing.

An earlier 2024 report by the American Society of Gene & Cell Therapy noted that industry-sponsored trials were more likely to advance through early-stage development with a combination of in-house capability and more modular GMP manufacture. Furthermore, the major pharmaceutical companies are focusing on gene editing platforms are contributing to the de-risking of clinical programs, which further strengthens the market in the coming years.(Source:https://www.asgct.org)

The academic institutions segment is expected to grow at the fastest CAGR in the coming years, supported by genome engineering breakthrough research findings, grant applications, and translational collaborations with clinical facilities. Additionally, grants on translationalgene therapy research increased dramatically in this type of medical setting, further driving the segment.

Regional Insights

What Made North America the Dominant Region in the Phase Ib Gene Editing Trials Market?

North America led the Phase Ib gene editing trials market, capturing the largest share of 61% in 2024, as the region has concentrated on advanced research infrastructure, a favorable regulatory ecosystem, and a robust funding ecosystem for biotechnology. Top players, including Editas Medicine, Intellia Therapeutics, and Verve Therapeutics, have initiated pilot trials in various therapeutic lines.

The NIH and DARPA continued to invest in genome engineering programs, while the FDA accelerated clinical development activities. Academic institutions, such as Harvard Medical School, the Massachusetts Institute of Technology, and Stanford University School of Medicine, have partnered with industry to develop translational programs that progress to clinical stages. The rates used in patient enrollment, dedicated gene therapy centers, and fast regulatory feedback mechanisms also boosted the dominance held by North America in early-stage studies of gene editing. Furthermore, the growing investment in biomedical innovation further facilitates the market in this region.

- NIH-funded research serves as a critical foundation for the U.S. biomedical industry, which contributes more than $69 billion to the nation's GDP annually and supports over 7 million jobs across the healthcare and life sciences sectors.(Source: https://www.nih.gov)

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period, driven by the rapidly increasing rate of biomedical investment, high rates of regulatory modernization, and an overall increase in academic-industry collaboration. China, South Korea, Japan, and Singapore relied on national programs, including China's 14th Five-Year Plan on Biotechnology Development and Japan's Government AMED funding schemes, to increase their presence in clinical trials. Additionally, the growing number of Early-Phase Gene Editing Trials in the region is expected to fuel the market in the coming years.

Phase Ib Gene Editing Trials Market Companies

- Allogene Therapeutics

- Beam Therapeutics

- Caribou Biosciences

- Cellectis

- CRISPR Therapeutics

- EdiGene

- Editas Medicine

- Excision BioTherapeutics

- Graphite Bio

- iECURE

- Intellia Therapeutics

- LogicBio Therapeutics

- Metagenomi

- Poseida Therapeutics

- Precision BioSciences

- Regenxbio

- Sana Biotechnology

- Sangamo Therapeutics

- Tessera Therapeutics

- Verve Therapeutics

Recent Developments

- In June 2025, SNIPR Biome announced the initiation of its Phase 1b trial for SNIPR001, building on encouraging results from its Phase 1a trial in healthy volunteers. The earlier study, funded by CARB-X, demonstrated a favorable safety profile and effective target engagement. "This milestone builds upon the highly encouraging data from our Phase 1a trial, where SNIPR001 demonstrated promising safety and target engagement," said Dr. Christian Grøndahl, Co-founder and CEO of SNIPR Biome.(Source:https://crisprmedicinenews.com)

- In January 2025, AskBio, a gene therapy firm under Bayer AG, announced the randomization of the first participants in its Phase II REGENERATE-PD clinical trial targeting Parkinson's disease. Dr. Rajesh Pahwa, Director of the Parkinson's Disease and Movement Disorder Center at the University of Kansas Medical Center and Principal Investigator of the study, noted, “The advancement of this important investigational gene therapy gives hope to patients and the medical community, especially given the critical need for neurorestorative therapies in Parkinson's.” (Source: https://www.askbio.com)

- In May 2025, The Danforth Technology Company (DTC) unveiled the launch of Spearhead Bio, a startup dedicated to advancing plant genome engineering. The company's proprietary Transposase Assisted Homology Independent Targeted Insertion (TAHITI) technology enables efficient and seamless gene integration in both transgenic and non-transgenic crops, aiming to enhance precision and efficiency in agricultural biotechnology.(Source:https://www.danforthcenter.org)

(Source: https://www.askbio.com)

(Source: https://regenxbio.gcs-web.com)

Latest Announcement by Industry Leader

- April 2025, Verve Therapeutics, a clinical-stage biotechnology company focused on genetic medicines for cardiovascular disease, announced encouraging initial results from its Phase 1b HEART-2 clinical trial evaluating VERVE-102. The trial is enrolling patients diagnosed with heterozygous familial hypercholesterolemia (HeFH) and/or premature coronary artery disease (CAD). Dr. Eugene Braunwald, Distinguished Hersey Professor of Medicine at Harvard Medical School and Founding Chairman of the TIMI Study Group at Brigham and Women's Hospital, commented, “These initial HEART-2 data are promising concerning both safety and efficacy and suggest the potential for a new era of cardiovascular disease treatment where a single dose might lead to lifelong control of LDL-C.” Dr. Braunwald also emphasized the urgent need for innovative therapies, stating that atherosclerotic cardiovascular disease (ASCVD) remains the leading cause of death globally, and that existing lipid-lowering treatments often fail in practice. “With current therapies, nearly half of patients stop treatment within a year, resulting in poor LDL-C control in real-world settings,” he noted. “VERVE-102 offers the potential to transform ASCVD management by replacing daily pills or periodic injections with a single, long-lasting therapeutic solution.” (Source:https://ir.vervetx.com)

Segments Covered in the Report

By Gene Editing Platform

- CRISPR/Cas Systems (e.g., Cas9, Cas12, Cas13)

- Zinc Finger Nucleases (ZFNs)

- TALENs (Transcription Activator-Like Effector Nucleases)

- Meganucleases

- Base & Prime Editors

By Therapy Type

- In Vivo Gene Editing Therapies

- Ex Vivo Gene Editing Therapies

By Disease Area

- Oncology (e.g., gene-edited T-cell therapies)

- Rare Genetic Disorders

- Hematological Disorders (e.g., sickle cell, beta-thalassemia)

- Ophthalmology

- Infectious Diseases

- Neurology

- Cardiovascular Disorders

By Delivery Method

- Lipid Nanoparticles (LNPs)

- Electroporation

- Viral Vectors

- AAV

- Lentivirus

- Non-Viral Vectors

By Trial Sponsor Type

- Biotech/Pharma Companies

- Academic Institutions

- Non-Profit Research Organizations

- Public-Private Collaborations

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content