Physical Therapy Software Market Size and Forecast 2025 to 2034

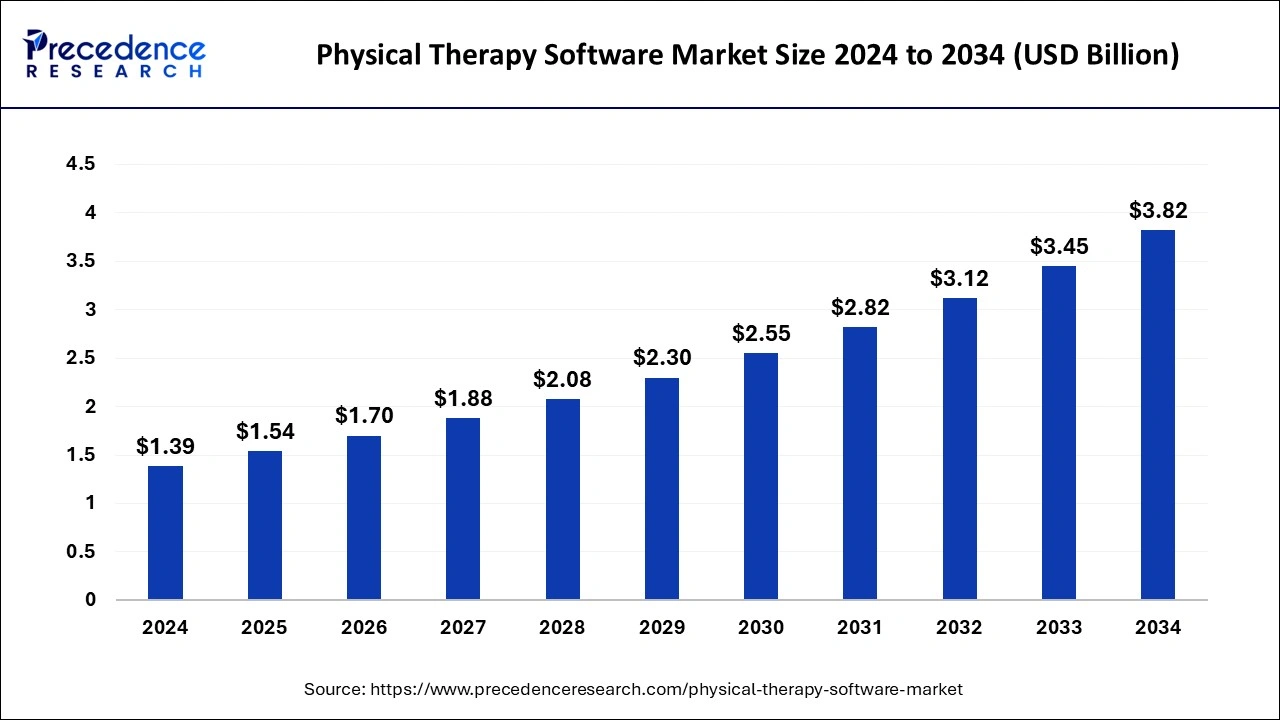

The global physical therapy software market size accounted for USD 1.39 billion in 2024 and is expected to exceed around USD 3.82 billion by 2034, growing at a CAGR of 10.63% from 2025 to 2034. The physical therapy software market growth is attributed to the increasing adoption of digital health solutions and the rising demand for personalized, remote rehabilitation services.

Physical Therapy Software Market Key Takeaways

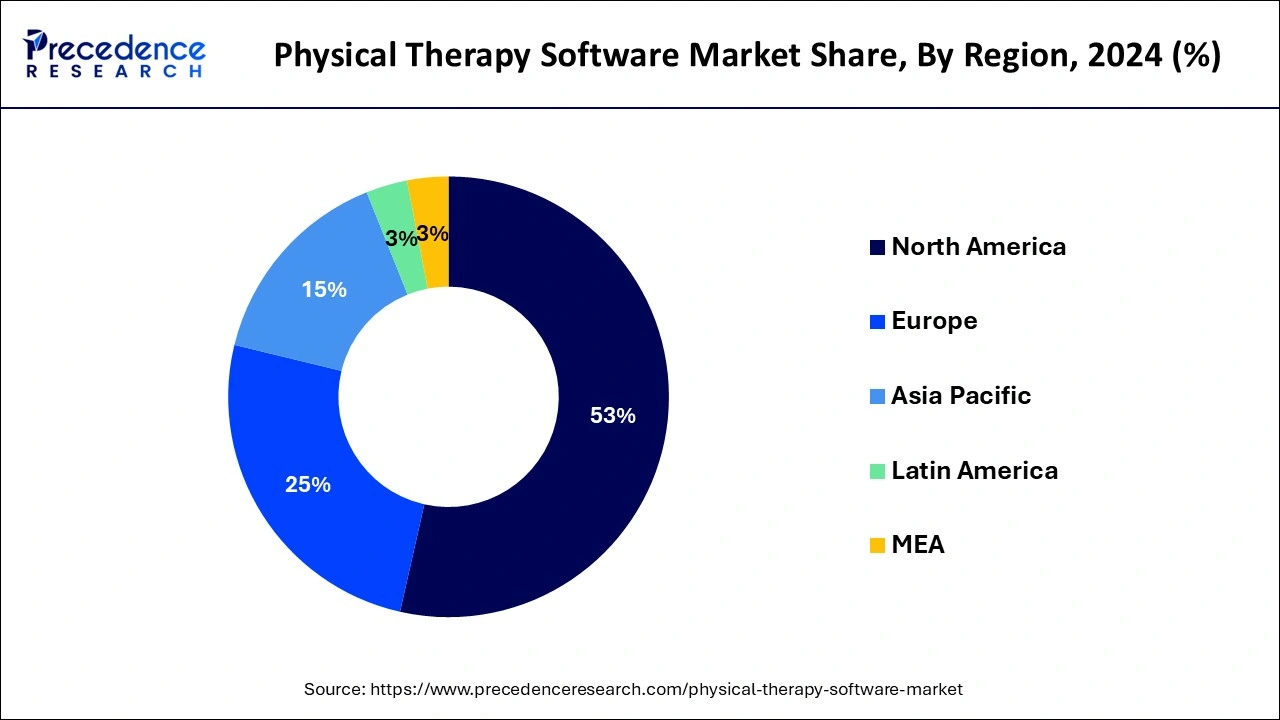

- North America dominated the global physical therapy software market with the highest market share of 53% in 2024.

- Asia Pacific is projected to grow at the fastest CAGR of 11.12% in the coming years.

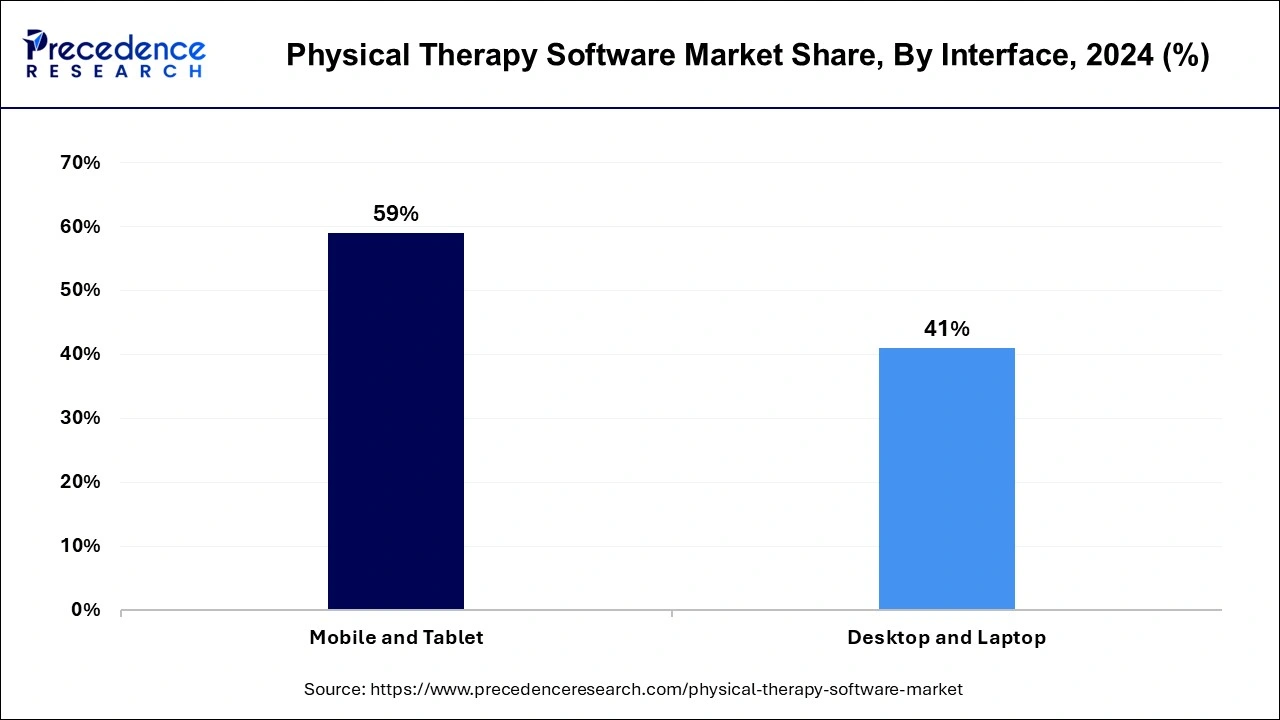

- By interface, the mobile and tablet segment contributed the biggest market share of 59% in 2024.

- By interface, the desktop and laptop segment are expected to grow at the fastest CAGR during the forecast period.

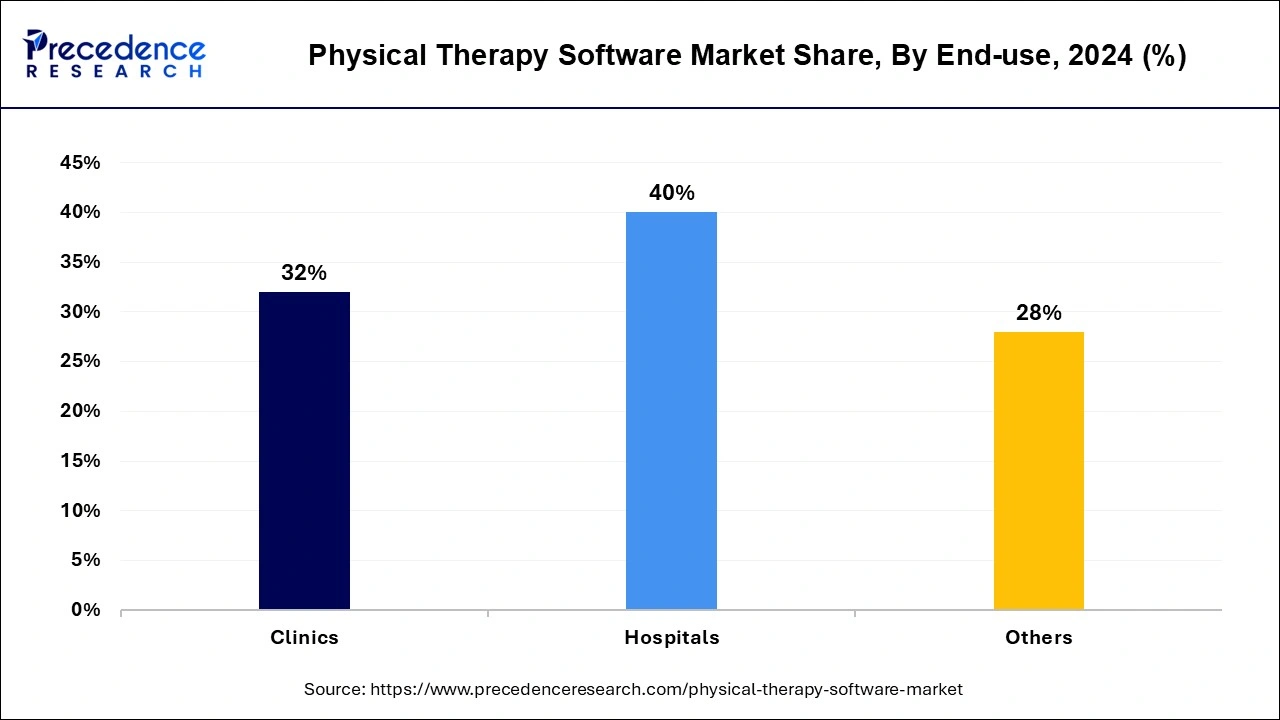

- By end-user, the hospitals segment recorded more than 40% of market share in 2024.

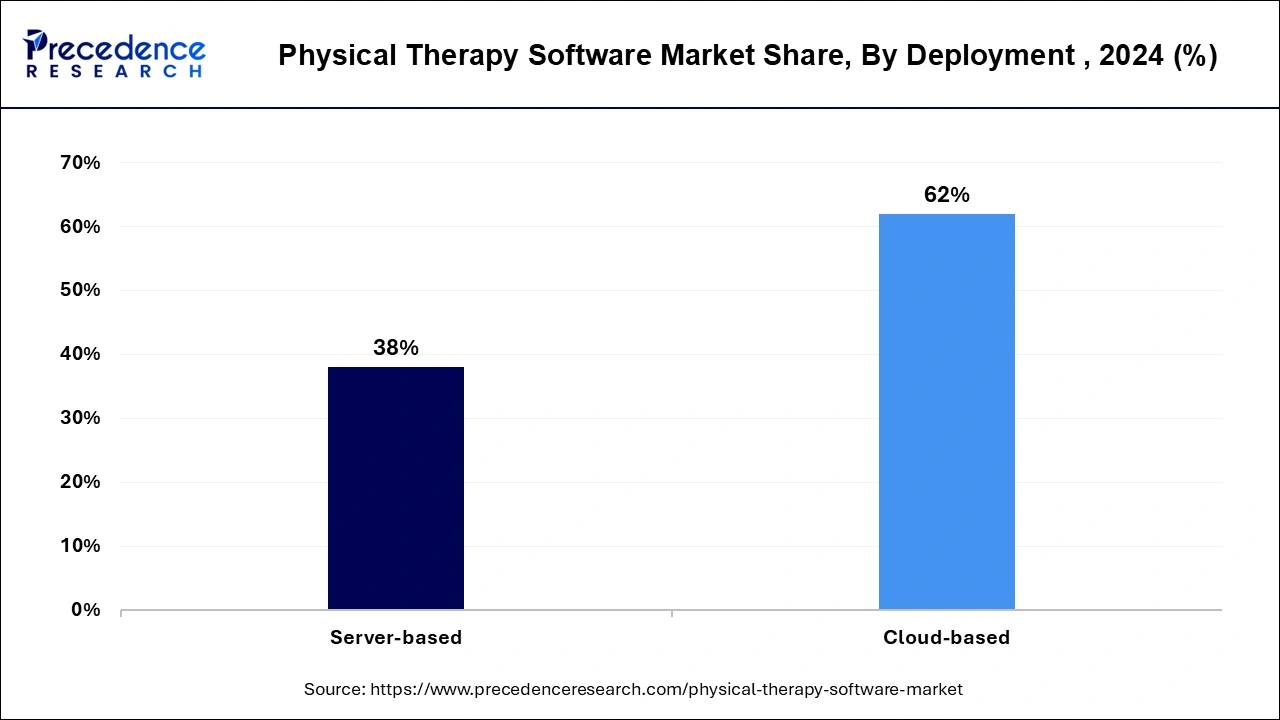

- By deployment, the cloud-based segment has held a major market share of 62% in 2024.

- By deployment, the server-based segment is anticipated to grow with the highest CAGR in the market during the studied years.

Impact of Artificial Intelligence (AI) on the Physical Therapy Software Market

Artificial intelligence optimizes the potential patient outcomes in the physical therapy software market by analysing data as related to particular patients and individualized rehabilitation programs. It also reduces administrative workload; hence, the therapists spend more time with the patients. Automated algorithms help monitor patient progression and modify therapy plans in real time to enhance patient activation and compliance. Additionally, as part of digital solutions, there are self-learning virtual assistants/Chatbots available for patients' queries and support between sessions. These improvements lower costs, remove barriers, and create the conditions for further technological enhancements of rehabilitation provisions, defining their subsequent evolution.

U.S. Physical Therapy Software Market Size and Growth 2025 to 2034

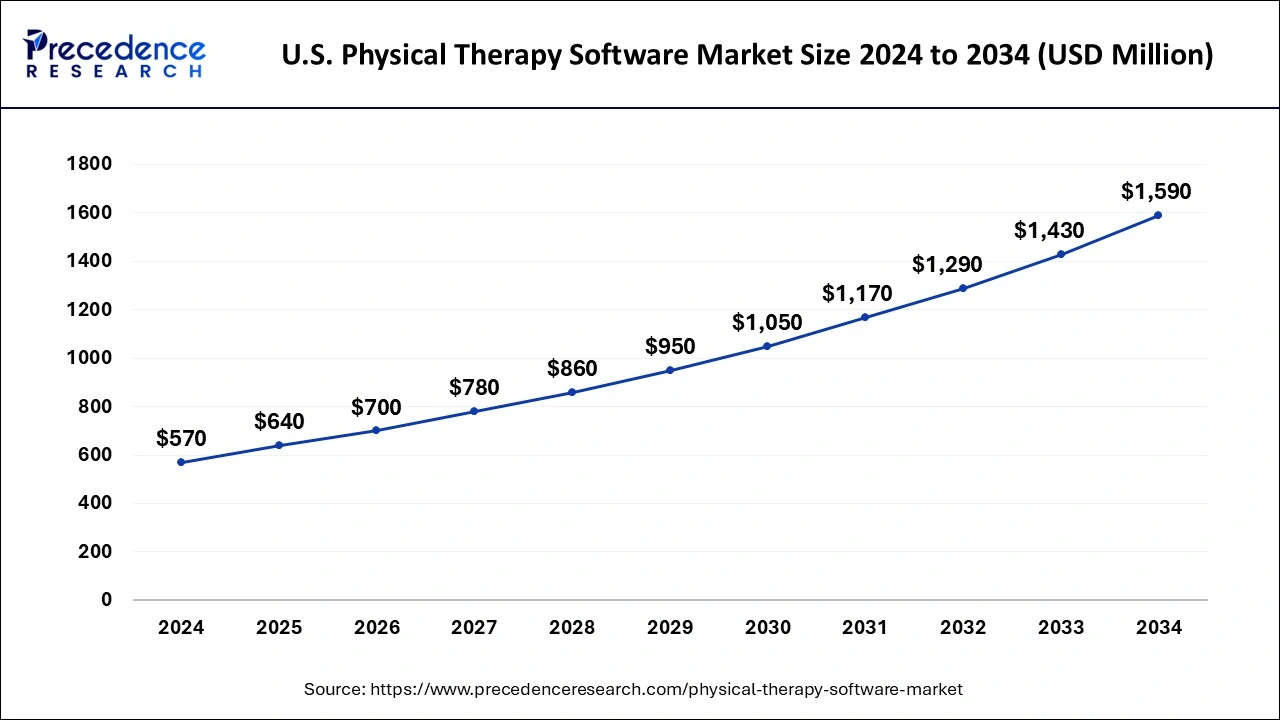

The U.S. physical therapy software market size was exhibited at USD 570 million in 2024 and is projected to be worth around USD 1.59 billion by 2034, growing at a notable CAGR of 10.80% from 2025 to 2034.

North America dominated the global physical therapy software market in 2024 due to the rising healthcare industry, the increased number of telemedicine applications, and growing patient needs management. The applications of physical therapy software in the U.S., as the country's overall healthcare expenditure has been on the rise and the necessity to increase the efficacy of clinical practices.

- According to the HHS, telehealth usage rates fluctuated between 20.5% and 24.2% during the study period, with an average of 22.0% of adults reporting telehealth use in 2024.

Asia Pacific is projected to host the fastest-growing physical therapy software market in the coming years, as the adoption of physical therapy software solutions includes China, India, and Japan, which are undergoing a revolution in the adoption of digital healthcare solutions. This is attributable to the increasing healthcare system, in addition to government endorsement and support towards increasing health standards throughout the globe. Chronic illness and an aging population in Asia, which includes Japan and China, is increasing the physical therapy demand. Moreover, the increasing healthcare spending is anticipated to result in the region.

- As stated by the World Health Organization (WHO), Japan's elderly population is projected to rise to 35% by 2035, which demands even more efficient rehabilitation technologies.

Market Overview

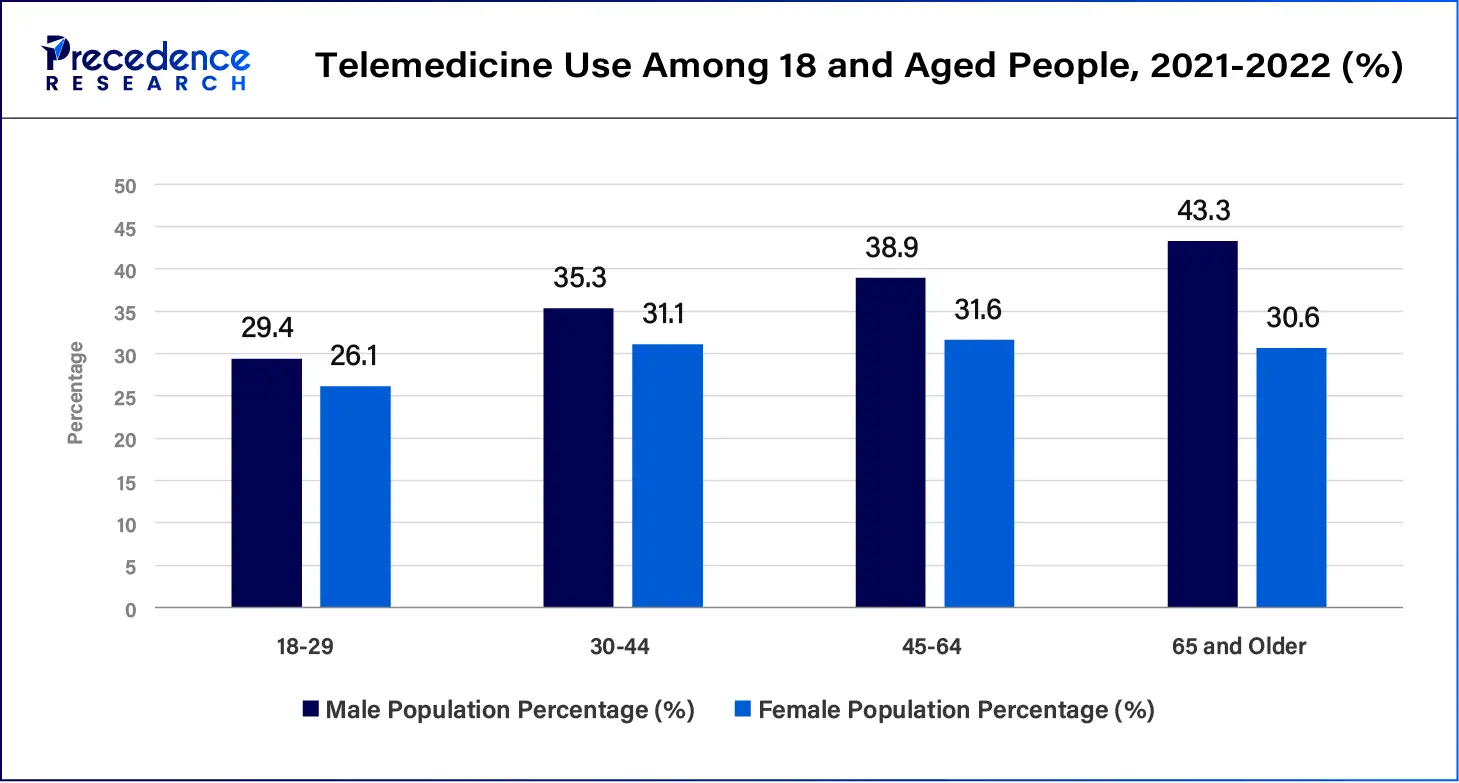

The strong need for remote care and telehealth services will facilitate the physical therapy software market in the coming years. The move to digital-oriented solutions helps physical therapists to be able to monitor their patients in an efficient way to improve their treatment. Implemented in these software solutions, cloud technologies enable healthcare providers to provide versatile and scalable solutions that can adapt to accommodate process aspects such as remote therapy sessions. This is a trend that has increasingly made physical therapy software more popular, as it provides for remote consultations, appointment making, tracking of patients, and administration of therapy sessions.

- The HHS has forecasted that telehealth visits will grow by over 50% by 2025, which will only serve to drive the need for technologies in physical therapy. Long-term factors such as the shift towards technology and remote home-based care shall continue to shape the market.

Physical Therapy Software Market Growth Factors

- Increasing adoption of artificial intelligence to personalize rehabilitation plans and improve treatment outcomes.

- Rising demand for mobile applications to support on-the-go monitoring and therapy progress tracking.

- Expansion of reimbursement policies for telehealth services, encouraging the adoption of physical therapy software.

- Growing awareness of musculoskeletal health and the need for preventive physical therapy among the aging population.

- Enhanced focus on data security and compliance with regulations like HIPAA to drive confidence in software adoption.

- Increase in the number of outpatient clinics and small healthcare practices seeking efficient management solutions.

- Advancements in wearable technology integrate with physical therapy software to track patient movement and provide real-time feedback.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 1.39 Billion |

| Market Size in 2025 | USD 1.54 Billion |

| Market Size in 2034 | USD 3.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Interface, End-use, Deployment, and Regions. |

| Regions Covered | America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Growing awareness and adoption

The increasing adoption of digital health solutions is expected to fuel the physical therapy software market growth. Healthcare providers are leveraging digital platforms to streamline therapy management, improve patient engagement, and optimize treatment outcomes. The PRs recommended for PTs incorporated the following features: Electronic Health Records (EHR), patient engagement modules, and real-time monitoring systems. This improves the operations of physical therapy service providers. Furthermore, the escalating implementation of physical therapy software in wearable devices fills the gap between face-to-face and telemedicine.

- The Rock Health survey for the usage of virtual care done in 2023 showed that 76% of the respondents were using virtual care, which is the third straight year of using virtual care above 70%.

- In its report on digital health innovation published in 2023, WHO pointed out that telemedicine approaches have presented themselves as indispensable solutions in the provision of care in care-deficit areas.

Restraint

High initial costs

Hamper adoption due to high implementation costs is expected to limit physical therapy software market penetration. The introduction of physical therapy software comes with a high-cost implication for licensing, hardware acquisition, and staff education. These costs are difficult to handle, especially for small and medium-sized clinics which operate on a small budget. Other costs in this area are related to the customization of software, periodic updates or acquisitions, and expenses for technical support services, and these exert demands on the available financial resources. Such financial realities and profitability of superior digital tools thus restrict the market's growth in lower-resourced healthcare domains.

Opportunity

Growing demand for advanced telehealth solutions and services

High demand for remote and telehealth services is likely to boost the adoption of this technology and is expected to create immense opportunities for the physical therapy software market. The shift toward remote care, particularly following the COVID-19 pandemic, has highlighted the importance of accessible therapy options. Physical therapy software supports virtual consultations, remote monitoring, and home-based exercise programs, catering to patients unable to attend in-person sessions. This approach increases convenience for users and also expands the reach of healthcare providers, enabling them to serve a broader population and address geographical barriers. Furthermore, the growing role of telehealth services globally presents substantial opportunities for physical therapy software solutions to meet the increasing demand for remote care in the coming years.

- According to the National Health Institute (NHI) 2024 report, telehealth usage among adults in the United States has remained above pre-pandemic levels, with an average of 38.78% reporting telehealth use in the past year.

Interface Insights

The mobile and tablet segment held a dominant presence in the physical therapy software market in 2024, owing to the population's need for increased and flexible accessibility of healthcare services and technologies. They let the physical therapists view patient details, record various aspects about the patient, and even offer home-based therapy classes, thus increasing patients' interactions and better results. Telemedicine adoption has driven consumer mobility further toward the use of mobile and tablet modes.

- A 2024 forecast from the National Health Service (NHS) further indicates a rising demand for mobile health solutions, as more than 50% of the population is expected to use mobile health tools for rehabilitation by 2025.

The desktop and laptop segment is expected to grow at the fastest rate in the physical therapy software market during the forecast period of 2025 to 2034 due to the higher processing and display capabilities required for tasks, including documentation and analytical patient data processing of physical therapy software. Desktops and laptops are parts of the healthcare processes since physicians use them for patient management, therapy development, and commonplace work. Moreover, the telehealth consultations being carried out using desktops and laptops continue to be a critical driver for care extension.

End-use Insights

In 2024, the hospital's segment led the global physical therapy software market due to the growing demand for versatile and dynamic patient tracking and therapy solutions. Such institutions need better software solutions in order to address the volume of patient information, monitor the status of ongoing treatment, and interface physical therapy with other operational systems in the hospital. Furthermore, the telemedicine services that are used widely in the infrastructure of hospitals also inquire into these software solutions to provide remote consultation and patient dependency.

- According to the NIH 2022 report, hospitals across the United States have rapidly integrated telehealth services post-COVID-19, with a 63-fold increase in telehealth visits from 2019 to 2021.

The clinics segment is projected to expand rapidly in the physical therapy software market in the coming years. Clinics are usually smaller than hospitals and thus tend to focus on software that simplifies new visits, therapy progress, and payment. The ever-raising number of outpatient clinics and the customers' expectations of personalized care. This creates a demand for high-level software tools to optimize the process and improve patients' satisfaction. Exercises and physical therapy software solutions provide clinics with the likelihood of expansion, patient interaction through the application interface, and virtual evaluations. This trend, combined with increasing healthcare accessibility and affordability.

Deployment Insights

The cloud-based segment accounted for a considerable share of the physical therapy software market in 2024, as they provide higher flexibility, scalability, and cost-effectiveness than traditional IT solutions, which are very beneficial for healthcare providers. It makes the possibility to use multiple located facilities and get an access to the patient's data while offering remote consultations and using telemedicine. Furthermore, the use of EHR systems and customers opting for data-driven and remote solutions has led to the demand for cloud systems.

The server-based segment is anticipated to grow with the highest CAGR in the physical therapy software market during the studied years, owing to the relative strength of the system's security and structure. This model puts all the patient data and software on the organization's internal servers, which some view as being more secure than cloud solutions. Server-based solutions are realized in companies that already have their physical IT infrastructure and have enough employees to manage the server. Furthermore, with the growing trend toward cloud-based deployments, server-based models are expected to boost, especially in larger organizations with specific security or compliance needs.

Physical Therapy Software Market Companies

- Axxess

- BioEx Systems, Inc.

- DrChrono Inc. (EverHealth Solutions Inc.)

- Kareo, Inc.

- Meditab

- MICA Information Systems, Inc.

- NXGN Management, LLC

- OptimisCorp

- Oracle

- Power Diary Pty Ltd.

- Practice Fusion, Inc.

- Systems 4PT

- WebPT

Latest Announcements by Industry Leaders

- July 2024 – WebPT

- President – Andrea Facini

- Announcement - WebPT, the leading rehab therapy platform for Practice Experience Management (PXM), has announced new advanced capabilities through a partnership with PredictionHealth. "We are thrilled to partner with PredictionHealth to deliver cutting-edge AI capabilities to our members," said Andrea Facini, President of Go-To-Market at WebPT. "This integration provides our users with tools that streamline documentation processes, boost compliance, and optimize revenue. By utilizing advanced AI technology, clinicians can reduce documentation time by up to 50%, enabling them to focus more on patient care and less on administrative tasks."

Recent Developments

- In May 2024, SPRY Therapeutics (“SPRY”), the developer of rehab therapy's first fully integrated, AI-powered EMR, unveiled SPRY Ally, a suite of AI-driven tools designed for rehab therapy. These tools harness AI's continuous learning capabilities to significantly enhance the efficiency and accuracy of clinical documentation, patient intake, and billing processes.

- In October 2024, Enlyte launched Apricus Physical Medicine, an end-to-end specialty service solution for the industry. As the specialty network brand of Enlyte, Apricus provides injured employees and payers with comprehensive physical medicine services through a multidisciplinary specialty network. The program integrates with bill review and data analytics systems, offering insights into medical spending trends and supporting vertical integration across utilization review (UR) and case management.

Segments Covered in the Report

By Interface

- Mobile and Tablet

- Desktop and Laptop

By End-use

- Clinics

- Hospitals

- Others

By Deployment

- Server-based

- Cloud-based

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting