Pill Timer Market Size and Forecast 2025 to 2034

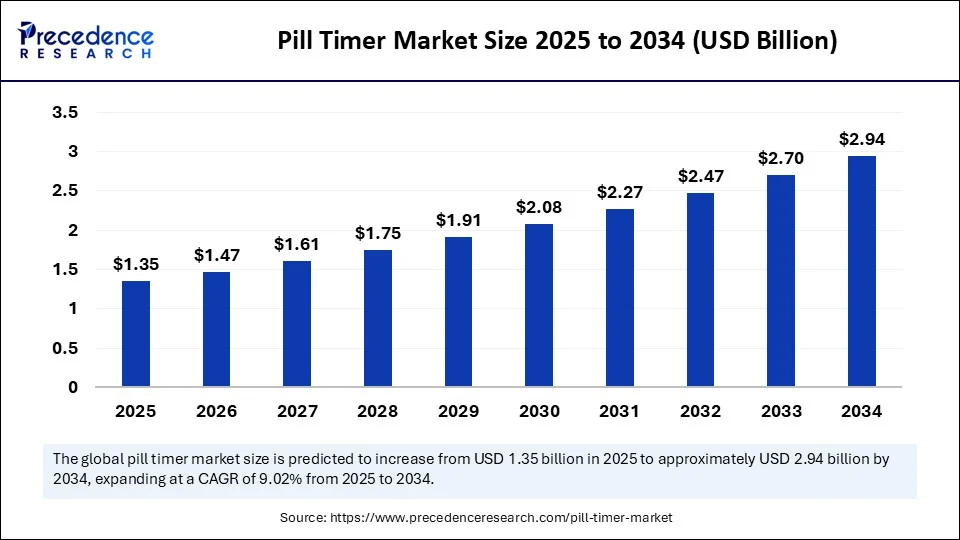

The global pill timer market size accounted for USD 1.24 billion in 2024 and is predicted to increase from USD 1.35 billion in 2025 to approximately USD 2.94 billion by 2034, expanding at a CAGR of 9.02% from 2025 to 2034. The pill timer market is growing with an aging population, increasing chronic disease prevalence, and rising medication adherence awareness. Technological innovations like smart, IoT-enabled devices and app integration further strengthen the market growth.

Pill Timer MarketKey Takeaways

- In terms of revenue, the global pill timer market was valued at USD 1.24 billion in 2024.

- It is projected to reach USD 2.94 billion by 2034.

- The market is expected to grow at a CAGR of 9.02% from 2025 to 2034.

- North America held the dominant share of the pill timer market in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR in the market between 2025 and 2034.

- By product type, the digital pill timers segment held the largest market share in 2024.

- By product type, the smart pill timers segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By technology, the standalone timers segment captured the biggest market share in 2024.

- By technology, the IoT-enabled pill timers segment is expected to expand at a notable CAGR over the projected period.

- By functionality, the reminder only segment captured the highest pill timer market share in 2024.

- By functionality, the reminder + caregiver notification segment is expected to expand at a notable CAGR over the projected period.

- By age group, the geriatric patients segment held the largest market share in 2024.

- By age group, the pediatric patients segment is expected to expand at a notable CAGR over the projected period.

- By end user, the individual patients segment held the largest pill timer market share in 2024.

- By end user, the home healthcare providers segment is expected to expand at a notable CAGR over the projected period.

- By distribution channel, the online retail segment held a dominant market share in 2024.

- By distribution channel, the direct-to-consumer company portals segment is expected to expand at a notable CAGR over the projected period.

AI Updates Pill Timers: Smarter Medication Adherence for Better Health

Artificial intelligence has taken pill timers a step beyond, reinventing them as proactive, predictive health assistants. In January 2025, at CES 2025, Smart Pillbox launched its HealthBuddy app and next-generation AI-based smart pillbox that allows not only for real-time tracking and smart reminders, but automatic caregiver alerts and remote adherence monitoring to reduce missed doses and improve outcomes. (Source:https://www.cbs42.com)

Elsewhere, in March 2025, MIT-WPU in Pune introduced an IoT-enabled smart pill dispenser powered by AI scheduling and remote oversight to ensure complex regimens are completed on time and accurately, in home and care environments.Together, this novel integration of AI features is another significant step toward personalized, reliable, and caregiver-mediated medication management. (Source: https://www.biospectrumindia.com)

Market Overview

The pill timer market refers to the demand for electronic or mechanical devices integrated into pillboxes, caps, or standalone timers that help patients adhere to prescribed medication schedules. These devices alert users via alarms, lights, vibrations, or app notifications to take their medications at specific times. Pill timers are widely used by elderly populations, chronic disease patients, caregivers, and healthcare institutions to reduce missed doses, improve treatment outcomes, and prevent overdoses. The growing aging population, rising prevalence of chronic conditions, and demand for home healthcare solutions are major drivers of this market.

Pill Timer Market Growth Factors

- Aging Population Needs- The growing elderly population often manages multiple medications and needs reliable reminders. Pill timers help prevent missed doses and improve safety, especially for those with memory issues or complicated prescriptions.

- Chronic Disease Management- As cases of diabetes, hypertension, and other long-term illnesses rise, pill timers support strict medication adherence. This reduces complications, cuts hospital visits, and improves overall patient outcomes.

- Smart Device Integration- Modern pill timers now offer app syncing, dose tracking, alarms, and notifications. These tech features attract users looking for convenient and personalized health management tools.

- Rise in Home Healthcare- Trends in self-medication and at-home treatment increase the demand for user-friendly devices like pill timers. These devices allow patients and caregivers to manage medications efficiently without relying on clinical settings.

- E-Commerce Accessibility- Online platforms and pharmacies make it easy to access a wide range of pill timers. This convenience, along with affordable pricing and home delivery, encourages consumer adoption worldwide.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.94 Billion |

| Market Size in 2025 | USD 1.35 Billion |

| Market Size in 2024 | USD 1.24 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.02% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology, Functionality, Age Group, End-user, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Medication non-adherence epidemic spurs demand for pill timers

A key factor driving the pill timer market is the widespread issue of medication non-adherence, particularly among patients with chronic conditions. According to the reports, about 50% of patients with chronic diseases in developed countries do not take their medications correctly, which results in 30% to 50% of treatment failures. This also contributes to over 125,000 preventable deaths in the U.S. each year. (Source: https://www.uspharmacist.com)

Amnesia, complicated regimens, and the challenges of managing multiple medications, especially for older adults, raise the risk of missed doses. A large randomized study that looked at digital timer caps and smart pill dispensers showed modest improvements in adherence. Some devices improved the chances of proper adherence by around 10% compared to standard pillboxes. Pill timers give patients auditory and visual reminders to take their medications on time. This helps make pill management easier, reduces dosing errors, and supports better health outcomes.

Restraint

Usability and design limitations undermine pill timer effectiveness

A major factor limiting the pill timer market is the complicated design and poor usability for older adults, who need support to stick to their medication schedules. Around 830 million people aged 65 and older live in the world. Studies funded by the government and health literature highlight that nearly 50% of patients with chronic conditions in developed countries do not follow their medication plans correctly.

Technology solutions like pill timers and smart dispensers can help, but usability tests reveal significant challenges. In one study of electronic medication adherence products with older adults, only 55.3% of tasks were completed without help. The setup often required about 12.7 steps, and the average usability score was low, with a System Usability Scale (SUS) score of 52.8 on a scale from 0 to 100, indicating a substantial workload burden. These results show that usability issues and complex interfaces hinder the adoption and long-term use of pill timers, especially among older users. (Source: https://www.researchgate.net)

Opportunity

How is the expanding role of telemedicine and remote healthcare creating new opportunities for the pill timer market?

The growing use of telemedicine and remote healthcare services is opening up significant opportunities for the pill timer market worldwide. As virtual consultations become more common, especially after the COVID-19 pandemic, doctors increasingly depend on patients to manage their medications on their own and accurately. According to the American Medical Association (AMA), more than 80% of physicians in the U.S. used telehealth in some form. This shift has increased the demand for smart, connected tools like digital pill timers. These devices help track dosage timing, reduce missed medications, and allow for better remote monitoring. (Source: https://www.ama-assn.org).

These devices can sync with mobile apps or cloud systems, enabling healthcare providers to check medication adherence in real time. This is crucial for managing chronic diseases, caring for the elderly, and following up after discharge. As remote care evolves into a long-term healthcare model, pill timers are becoming essential tools for improving patient compliance and clinical outcomes outside of traditional hospital settings.

Product Type Insights

Which Product Type Dominated the Pill Timer Market in 2024?

The digital pill timers segment held the dominant share of the market in 2024, position because of its wide accessibility, low cost, and easy-to-use design. These devices are especially popular with elderly users and those who want simple medication reminders without needing internet access or complicated setups.

The smart pill timers segment is expected to grow at the fastest CAGR during the forecasted period. More people are using connected health solutions, integrating mobile apps, and wanting real-time medication tracking features. These smart devices are becoming more popular among tech-savvy users, caregivers, and patients with chronic conditions because they help improve adherence and allow for remote monitoring.

Technology Insights

What Was the Leading Technology in the Market?

The standalone timers segment had the largest pill timer market share in 2024. This was mainly due to their ease of use, low cost, and ability to function without smartphones or the internet. These devices work well for elderly patients, people in remote areas, and those who prefer non-digital options. Their battery-powered design is reliable and provides consistent performance without needing technical setup or updates. This makes them a practical choice for daily medication reminders.

On the other hand, the IoT-enabled pill timers segment is expected to grow quickly during the forecast period. This growth is driven by the rising use ofsmart healthcare solutions, increased awareness of medication adherence, and a growing need for real-time connectivity. These devices let caregivers and healthcare providers remotely track and manage patient compliance.

Functionality Insights

Which Functionality Drove the Market in 2024?

The reminder only pill segment accounted for the largest pill timer market share in 2024. This is mainly because of their important features, low cost, and ease of use. These timers are particularly popular among older adults and people with limited tech skills who need a simple way to avoid missed doses. Their widespread availability and straightforward design have made them a go-to option for basic medication reminders.

The reminder + caregiver notification segment is expected to see significant growth during the forecast period. This increase is due to the rising demand for remote health monitoring, especially among older populations and those managing chronic illnesses. These timers notify both users and caregivers, which helps ensure timely support and enhances patient safety.

Age Group Insights

Which Age Segment Represented the Highest Market Share for Pill Timers?

As of 2024, the geriatric patients segment held a substantial share of the pill timer market. This is primarily due to the increasing prevalence of chronic diseases and strict adherence to medications among elderly patients. Elderly patients who take several medications per day and are living longer are increasingly relying on pill timers to support their health routines, as continued aging populations globally have made pill timers essential in helping older adults cope with their different medications. The elderly segment is consequently going to be the big market driver.

The pediatric patients segment will grow at a faster rate during the forecast period. Another driver of the market growth is the increasing awareness of parents for their children regarding timely medication, in addition to the increasing availability of colourful and child-friendly pill timers with fun alerts in technology/digital pill timers, helping these parents for their young patients with their particular treatment schedules.

End User Insights

Which End User Drove the Demand in 2024?

The individual patients segment held the largest pill timer market share in 2024, due to the increased proliferation of pill timers for personal medication management, including greater numbers of patients, and more age categories. Pill timers have been well adopted by patients with chronic disease, older individuals, and patients on long-term therapy. These patients are adopting pill timers to ensure on-time dosing and avoid complications from missed medication. Individual patients also appear to be leveraging the high availability, ease of access, and diverse types of pill timers in enough variety to increase their numbers among self-managing patient use base.

The home healthcare providers segment is poised for rapid growth during the forecast period. The use of home-based care services continues to ramp up, and as such, there is a larger volume of caregivers using these advanced pill timers for remote medication schedule monitoring and management to remedy medication adherence, compliance, and error prevention.

Distribution Channel Insights

Which Distribution Channel Dominates the Market in 2024?

In 2024, the online retail segment led the pill timer market due to the convenience, variety, and competitive pricing provided by e-commerce platforms. Consumers prefer online channels because they are easily accessible, especially in remote or underserved areas. Shoppers appreciate the ability to compare different brands, features, and customer reviews before making a purchase. Discounts, fast delivery, and growing digital skills have also pushed the trend toward online shopping.

The direct-to-consumer company portals segment is expected to grow quickly in the coming years. Manufacturers are using their own websites and platforms more often to provide exclusive products, personalized customer support, subscription models, and additional services. This strategy helps improve customer engagement, build brand loyalty, and increase profits while offering shoppers a more personalized experience both during and after their purchases.

Regional Insights

Why is North America at the Forefront of the Pill Timer Market?

North America led the market in 2024 due to its strong digital healthcare system and the growing use of connected tools for medication adherence. The increasing number of chronic illnesses, an aging population, and structured healthcare payment systems have sped up the use of smart pill dispensers and timer-enabled pillboxes. More awareness about medication adherence, particularly among older adults, along with helpful regulations, has also boosted market growth. Innovations from U.S.-based med-tech companies and retail pharmacies that provide medication management solutions have shaped consumer habits and maintained steady product demand in the region.

The U.S. is the top contributor in North America, driven by efforts to lower medication non-adherence, costing its healthcare system billions every year. According to the CDC, nearly 50% of patients with chronic conditions in the U.S. do not take their medications as prescribed. This has led to an increase in reminder-based tools. The growth of home healthcare, along with the availability of digital pill timers through online pharmacies and insurance-covered programs, has made these devices more accessible. Additionally, collaborations between healthcare providers and tech companies are speeding up the introduction of smart, app-connected pill organizers for patients.

Why Is Asia Pacific Emerging as the Growing Pill Timer Market?

Asia Pacific is experiencing fast growth in the market. This is driven by the rise of digital healthcare, an increasing elderly population, and greater awareness about taking medications correctly. Countries like India, China, and Japan are promoting digital health solutions, including smart pill timers, to tackle issues with multiple medications and managing chronic diseases. The growing use of smartphones, the rise of e-pharmacies, and government support for elderly care are helping this growth. Moreover, the expanding urban middle class wants affordable, tech-based health products, which is accelerating the adoption of pill timer technology in the region.

India is crucial to the region's growth due to its improving healthcare system and digital initiatives like the Ayushman Bharat Digital Mission. The country's quickly aging population and the rise of chronic diseases such as diabetes and hypertension have increased the demand for tools that help with medication adherence, like pill timers. Local startups and health tech companies are creating affordable smart pill dispensers that work with mobile apps and SMS alerts. With more tech-savvy consumers and greater smartphone use, India is becoming an important center for innovation and the adoption of tools for managing medications in the Asia Pacific region.

Pill Timer Market Companies

- Med-E-Lert

- e-pill Medication Reminders

- Tricella Inc.

- TabTime Ltd

- MedReady Inc.

- Philips Medication Dispensing Service

- LiveFine

- MedMinder Systems Inc.

- TimerCap LLC

- Apothecary Products, LLC

- Hero Health

- Vigilant LLC

- EllieGrid

- GMS Group Medical Supply

- Careousel (Pivotell Ltd)

- iCap (Information Mediary Corp)

- PillDrill Inc.

- AdhereTech

- Maya Health

- Tunstall Healthcare

Latest statements and investments by major players

- In July 2025, Medication non-adherence remains a significant challenge in managing chronic conditions. With the Smart Pillbox, we're giving patients a tool that not only provides reminders but also tracks and reports their adherence to our providers in real time, said Dr. David Howard, Chief Medical Officer and Founder of My Virtual Physician. "This technology bridges the gap between prescribing medication and ensuring it's actually taken, enhancing the accountability and effectiveness of virtual care.

(Source:https://www.fox44news.com) - In July 2025, Pillbox Health launched PillPal, a remote therapeutic monitoring application tied to a smart pill timer. PillPal offers real-time reminders, adherence reminders, adherence data insights, and sharing of information with providers, providing a convenient avenue for chronic care of medications and overall improved outcomes.

(Source: https://www.cbs42.com) - In June 2024, Crown Aesthetics, a division of Crown Laboratories, announced the U.S. launch of SkinPen Precision Elite, an FDA-cleared microneedling device featuring ActiSine™ retraction technology, digital interface, ergonomic design, and inductive charging for enhanced safety and performance. (Source: https://www.prnewswire.com)

Segments Covered in the Report

By Product Type

- Smart Pill Timers (with Bluetooth/Wi-Fi/app sync)

- Digital Pill Timers (Alarm Clocks, LCD Displays)

- Mechanical Pill Timers (Manual Timers, Dials)

- Pill Timer Caps (integrated in bottle lids)

- Pill Timer Boxes (built-in compartments + timers)

By Technology

- Standalone Timers

- IoT-enabled Pill Timers

- App-integrated Timers (via mobile applications)

- Voice-activated/Smart Home Compatible Timers

By Functionality

- Reminder Only

- Reminder + Dose Logging

- Reminder + Caregiver Notification

- Multi-dose Scheduling (multiple alarms per day)

By Age Group

- Pediatric Patients

- Adults

- Geriatric Patients

By End-user

- Individual Patients

- Home Healthcare Providers

- Hospitals & Clinics

- Assisted Living Facilities

- Pharmacies (value-added packaging)

By Distribution Channel

- Online Retail (e-commerce platforms)

- Pharmacies & Drug Stores

- Medical Supply Stores

- Direct-to-Consumer (D2C) Company Portals

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting