What is Precipitated Calcium Carbonate (PCC) Market Size?

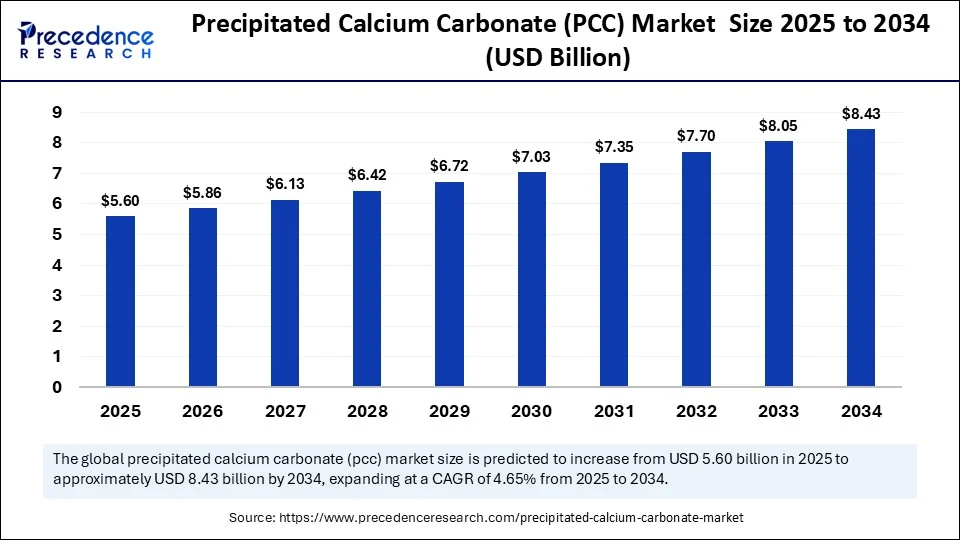

The global precipitated calcium carbonate (PCC) market size accounted for USD 5.60 billion in 2025 and is predicted to increase from USD 5.86 billion in 2026 to approximately USD 8.43 billion by 2034, expanding at a CAGR of 4.65% from 2025 to 2034. The growth of the market is attributed to the rising adoption of PPC in industries like paper, pharmaceuticals, plastics, and paints, which offer superior properties like whiteness, purity, and practical control compared to naturally occurring calcium carbonate.

Market Highlights

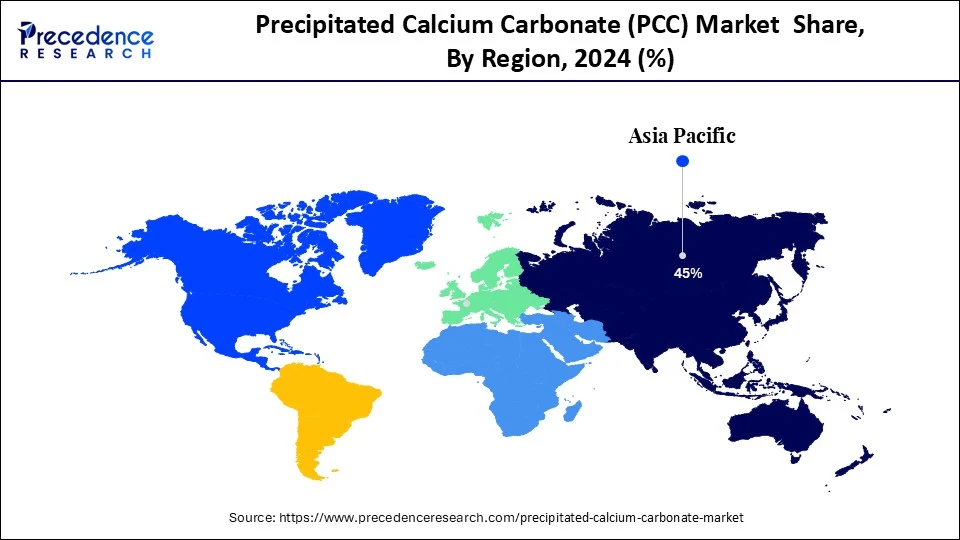

- Asia Pacific dominated the precipitated calcium carbonate (PCC) market, holding a 45% share in 2024.

- North America is expected to expand at the fastest CAGR between 2025 and 2034.

- By application type, the paper segment led the market in 2024.

- By application type, the plastics segment is the fastest-growing during the forecast period.

- By production process, the carbonation process segment held the largest market share of 70% in 2024.

- By production process, the hydrochloric acid method segment is expected to grow at a significant CAGR between 2025 and 2034.

- By form, the powder segment captured the biggest market share of 55% in 2024.

- By form, the slurry segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By grade, the industrial grade segment contributed the major market share of 60% in 2024.

- By grade, the pharmaceutical grade segment is expected to grow at a remarkable CAGR between 2025 and 2034.

What is the Precipitated Calcium Carbonate (PCC) Market?

Precipitated calcium carbonate (PCC) is a synthetic calcium carbonate produced through a chemical precipitation process involving the reaction of quicklime (calcium oxide) with water to form hydrated lime (calcium hydroxide), which is then carbonated with carbon dioxide to form PCC. Compared to ground calcium carbonate (GCC), PCC controlled particle sizes, shapes, and distribution, which allows it to be tailored for specific applications in industries such as paper, plastics, paints, adhesives, pharmaceuticals, and personal care.

The global market for precipitated calcium carbonate is evolving into a high-value arena, driven by technological innovation and sustainability pressures. Once considered a basic filler material, PCC is now seen as a performance enhancer across several high-growth industries. The paper industry remains the dominant consumer of PCC, particularly in Asia-Pacific, where economic development fuels the demand for high-quality printing and packaging. PCC not only enhances the brightness and opacity of paper but also reduces the amount of wood pulp required, aligning with green manufacturing goals.

In the plastic industry, PCC is gaining traction for improving rigidity and surface finish while reducing polymer costs. Demand from the automotive and consumer goods industries is expanding due to the increasing requirement for lightweight yet strong components. PCC's ability to be tailored at a nano level enhances its suitability in these applications. The pharmaceutical and food sectors are also becoming significant growth contributors. PCC's high purity and controlled particle size make it ideal for tablets, toothpaste, and calcium supplements. Regulatory approvals and rising health awareness are further amplifying its usage.

How is AI contributing to the Precipitated Calcium Carbonate (PCC) Market?

Artificial Intelligence is no longer confined to software, analytics, or automation; it is now creating ripples even in sectors like the precipitated calcium carbonate (PCC) market. As industries strive for precision, efficiency, and innovation, AI is becoming an enabler of smarter processes and deeper insights across the PCC value chain. AI is optimizing the production process. Traditionally, PCC production involved trial-and-error methods to achieve the desired particle size and morphology. Today, AI algorithms analyze real-time data from sensors in the reactor to fine-tune parameters such as temperature, pH, and flow rates, resulting in enhanced consistency and reduced material waste.

AI-powered quality control systems are revolutionizing the way manufacturers maintain standards. High-speed imaging and machine learning are being employed to detect even minute variations in texture, color, or particle size. This eliminates human error and ensures batches meet exact customer requirements, which is especially crucial in pharmaceutical or food-grade applications. Furthermore, AI is contributing to the predictive maintenance of PCC manufacturing equipment.

Through data collected from machinery over time, AI models predict wear and tear, identify signs of potential failure, and allow proactive servicing. This reduces downtime, increases operational efficiency, and cuts costs significantly. In marketing and logistics, AI tools are helping companies better understand customer demand patterns, regional consumption trends, and inventory needs. Smart forecasting systems allow just-in-time production and delivery, thereby lowering overheads and improving customer satisfaction.

Key Market Trends

- Rising demand for nano-grade PCC: A notable trend is the growing preference for nano-precipitated calcium carbonate (NPCC), particularly in high-performance applications. NPCC offers superior surface area, dispersion, and reinforcement properties.

- Green manufacturing and carbon capture integration: With global attention shifting towards climate-conscious manufacturing, PCC producers are increasingly integrating carbon capture technologies.

- Technological modernization of production: Automation, artificial intelligence, and advanced sensors are being deployed in PCC plants to ensure quality control, predictive maintenance, and process optimization.

- Expanding application scope: PCC is finding new utility beyond traditional strongholds. In the food and beverage sector, it is used as a dietary calcium fortifier.

Market Outlook

- Industry Growth Overview: The market growth that has been going on for quite some time is still supported by construction paper pharmaceutical applications that are gradually getting bigger and changing their running characteristics, etc., resulting in smoother operations and unvarying demand for PCC.

- Sustainability Trends: The adoption of recyclable PCC innovations and the establishment of resource-efficient processes, combined with the industry's shift to sustainable production methods that also feature minimal carbon footprints, the use of eco-friendly materials, and eco-friendly manufacturing practices.

- Global Expansion:The global market is still growing at a rapid pace, with Asia-Pacific taking the lead in the expansion due to the availability of good factories, the rise of the paper industry, and the diversification of PCC applications that are getting more and more varied.

- Major Investors: There is no indication of specific venture capital firms or individual PCC investors, which suggests that the public data on investments in the broader industrial materials research is very limited.

- Startup Ecosystem: The technology-focused green startups are the ones that primarily highlight innovations, but the PCC startup ecosystem, which is dedicated to collaboration and innovation initiatives, is still very much less defined.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.60 Billion |

| Market Size in 2026 | USD 5.86 Billion |

| Market Size by 2034 | USD 8.43 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.65% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Production Process, Form, Grade, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for PCC from the Paper & Pulp Industry

The escalating demand for the PCC from the paper and pulp industry is driving the growth of the market. As the global population continues to grow, the consumption of paper-based products, ranging from packaging and printing paper to hygiene and specialty papers, remains high. PCC plays a pivotal role in improving the printability, brightness, opacity, and smoothness of paper. Unlike ground calcium carbonate (GCC), PCC allows for better control over particle size and surface characteristics, enhancing the paper's aesthetic and functional performance. This makes it indispensable for premium paper products and eco-friendly printing solutions. Moreover, the use of PCC in paper manufacturing reduces the need for wood pulp, thereby supporting sustainable forestry practices. As environmental awareness and regulatory pressures mount, manufacturers are shifting towards paper grades that incorporate more fillers like PCC to reduce energy and water consumption.

Rising Demand from the Healthcare Industry

The rising demand for PCC from the healthcare industry also drives the growth of the market. PCC is widely used in antacids, tablets, and fortified food products owing to its high bioavailability and purity. With a growing elderly population and the global surge in lifestyle-related disorders, calcium intake is becoming increasingly critical. PCC offers an ideal solution due to its controlled particle size, low toxicity, and ease of formulation in consumables. The pharmaceutical industry is investing heavily in solid oral dosage forms, where PCC is used not just as a supplement but also as a bulking agent and pH stabilizer. Its inert nature and compatibility with active ingredients make it a preferred excipient.

Restraint

Fluctuations in Raw Material Prices and High Production Costs

Despite its growing prominence, the precipitated calcium carbonate (PCC) market faces several challenges. The most pressing challenge is the volatility in raw material supply, particularly high-purity limestone, which is essential for producing quality PCC. Volatility in raw materials availability can affect the production costs. Limestone reserves are geographically concentrated and often subject to strict environmental and mining regulations. Disruptions in mining activities or transportation can lead to fluctuations in supply, thereby affecting the stability of production costs and availability.

Moreover, the high capital expenditure required for setting up PCC manufacturing plants, especially those integrated with CO? capture technologies or nano-grade capabilities, poses a significant entry barrier. Small and mid-sized players often struggle with financing and technological expertise, restricting market competition. The market also faces resistance from industries that are cost-sensitive and continue to rely on natural or ground calcium carbonate, especially in developing regions. The perception of PCC as a premium material may slow its adoption in sectors where price outweighs performance considerations.

Opportunity

The precipitated calcium carbonate (PCC) market is ripe with opportunities beyond its conventional applications. As industries seek materials that offer multifunctionality and cost efficiency, PCC is being reimagined as a high-value additive across multiple emerging sectors. One of the most promising opportunities lies in the pharmaceutical and nutraceutical industries. PCC's biocompatibility, purity, and ability to act as a calcium supplement position it well in the growing health-conscious consumer base. Tablets, antacids, and fortified food products increasingly incorporate PCC, offering significant room for expansion. Another fertile ground is the polymers and plastics sector, where PCC enhances stiffness, dimensional stability, and surface finish in products such as cables, films, and packaging. The lightweight nature of PCC-infused plastics aligns with the automotive and electronics industry's needs for reduced material usage and improved fuel efficiency.

Segment Insights

Application Insights

Why Does the Paper Segment Dominate the Market in 2024?

The paper segment dominated the precipitated calcium carbonate (PCC) market, under which the coating sub-segment held the largest share in 2024. This is mainly due to its pivotal role in enhancing paper quality and printability. The use of PCC in paper coating improves opacity, smoothness, brightness, and ink absorbency, critical features in packaging, printing, and publication papers. Moreover, PCC enables manufacturers to reduce reliance on expensive pulp fibers. By acting as a functional filler, it cuts production costs and energy usage while offering superior print results. This cost-effectiveness aligns perfectly with the industry's pursuit of sustainability and resource efficiency. The rise of e-commerce and the demand for high-quality packaging have further amplified the need for coated paper products. Whether it is folding cartons or luxury packaging, PCC's ability to provide a smooth surface and enhance visual appeal makes it the material of choice.

On the other hand, the plastics, especially the PVC, segment is expected to grow at the fastest rate in the upcoming period, driven by the surge in demand for lightweight, cost-effective, and high-performance plastic components. PCC serves as a reinforcing filler in PVC formulations, improving rigidity, thermal conductivity, and dimensional stability. One key driver is the construction industry's growing requirement for durable, affordable materials. PCC-infused PVC is widely used in pipes, conduits, profiles, and window frames. It helps in improving mechanical strength while reducing polymer content.

In the automotive sector, weight reduction is crucial for energy efficiency and compliance with emission norms. PCC helps reduce the overall density of PVC parts without compromising durability, supporting the shift toward greener vehicles. Consumer electronics and appliances also benefit from PCC-enhanced plastics. It enhances flame retardancy and surface finish, contributing to product safety and aesthetics, particularly in cables and casings.

Production Process Insights

Why Did the Carbonation Process Segment Dominate the Precipitated Calcium Carbonate (PCC) Market in 2024?

The carbonation process segment dominated the market, holding a 70% share in 2024. This is mainly due to its simplicity, scalability, and economic feasibility. This method involves reacting calcium hydroxide with carbon dioxide to yield highly pure and uniform PCC particles. Carbonation offers excellent control over particle size, shape, and surface area, making it ideal for high-performance applications in paper, paints, and pharmaceuticals. This process is also energy-efficient and can be integrated with CO? capture technologies, addressing environmental concerns. Its adaptability across multiple PCC grades, from coarse to nano-sized, makes it a go-to method for manufacturers seeking flexibility. This is especially valuable in customizing PCC for diverse industries like rubber, plastics, and food.

Meanwhile, the hydrochloric acid method is expected to grow at the fastest rate during the forecast period. This method is gaining traction for its ability to produce ultra-pure PCC with specialized properties suited to niche applications. Unlike carbonation, this method offers higher chemical control and greater flexibility in adjusting the chemical structure of PCC. This is particularly useful in pharmaceutical, cosmetic, and food-grade formulations where ultra-fine, contaminant-free calcium carbonate is required. The HCl process is also being adopted for recycling calcium-containing industrial waste into PCC, contributing to the circular economy. This method aligns well with zero-waste manufacturing practices and green chemistry principles.

Form Insights

What Made Powder the Dominant Segment in the Market in 2024?

The powder segment dominated the precipitated calcium carbonate (PCC) market by holding a 55% share in 2024, owing to its superior handling characteristics, easy blending, and broad applicability across key industries like paper, plastics, and pharmaceuticals. In paper production, powdered PCC allows for consistent mixing into slurry systems, enhancing uniformity and surface finish. Its compatibility with other additives and controlled dispersion make it a versatile choice for manufacturers. For plastics and paints, powdered PCC is valued for its bulk density, ease of transport, and ability to reinforce structures. It can be customized to varying particle sizes and coating needs, enabling performance enhancement without compromising formulation stability.

On the other hand, the slurry segment is expected to grow at the fastest rate during the projection period, primarily because of its convenience in continuous, large-scale manufacturing processes and its compatibility with real-time applications. In the paper and coatings industry, slurry allows for direct application without the need for additional mixing or hydration steps. This reduces preparation time and ensures consistency in coating and filler performance. Slurry PCC is particularly beneficial in modern high-speed paper machines, where flowability and stability are crucial. It reduces dusting, minimizes material loss, and ensures homogeneity, key factors for efficiency and quality.

Grade Insights

Why Does the Industrial Grade Segment Dominate the Precipitated Calcium Carbonate (PCC) Market in 2024?

The industrial-grade segment dominated the market with a 60% share in 2024, driven by its extensive use in the paper, plastic, rubber, construction, and coatings industries. This grade offers optimal performance at a lower cost, making it ideal for bulk applications. It provides whiteness, opacity, and reinforcement properties while maintaining affordability, which is crucial for industries that operate on thin margins and high volumes. Its versatility across formulations further enhances its industrial appeal.

On the other hand, the pharmaceutical-grade segment is likely to grow at the fastest rate in the upcoming period. Pharmaceutical-grade PCC is gaining prominence due to its high purity, safety, and compatibility with ingestible and topical products. It is extensively used in tablets, antacids, and oral suspensions. This grade undergoes stringent quality checks and conforms to pharmacopeial standards, making it suitable for regulated markets in Europe, North America, and Japan. Its role as a calcium supplement and excipient is expanding with rising health awareness.

Regional Insights

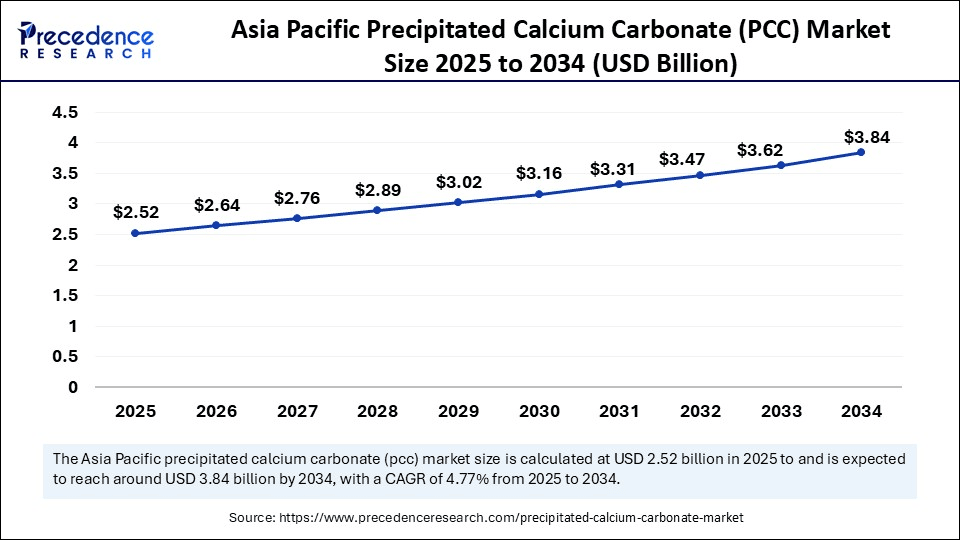

Asia Pacific precipitated calcium carbonate (PCC) Market Size and Growth 2025 to 2034

Asia Pacific precipitated calcium carbonate (PCC) market size is exhibited at USD 2.52 billion in 2025 and is projected to be worth around USD 3.84 billion by 2034, growing at a CAGR of 4.77% from 2025 to 2034.

What Made Asia Pacific the Leading Region in the Precipitated Calcium Carbonate (PCC) Market in 2024?

Asia Pacific registered dominance in the market, capturing a 45% share in 2024, thanks to its robust manufacturing infrastructure, rapid industrialization, and expanding consumer base. This region serves as the epicenter for paper production, plastics, and construction activities, all major end-users of Precipitated Calcium Carbonate. China remains a powerhouse in the PCC market due to its vast paper manufacturing sector and high consumption of packaging materials. With government policies encouraging domestic production and recycling, the demand for PCC as a sustainable filler in paper is surging.

Additionally, the presence of abundant limestone reserves supports local sourcing, reducing costs and dependency on imports. India is emerging as another key contributor, with rapid urbanization, growth in FMCG packaging, and infrastructural development driving PCC consumption. The rising demand for cost-effective construction materials, paints, and sealants is fueling adoption. Furthermore, India's strong pharmaceutical and food processing industries are creating new pathways for PCC in health and nutrition segments. South-east Asian nations, such as Vietnam, Indonesia, and Thailand, are becoming increasingly favorable manufacturing hubs due to low production costs and rising foreign investment. These economies are also witnessing a rise in plastic processing, footwear manufacturing, and personal care sectors, further enhancing PCC demand.

What Factors Support the Growth of the Precipitated Calcium Carbonate (PCC) Market Within North America?

North America is emerging as the fastest-growing region in the market, driven by innovation, sustainability mandates, and the demand for high-performance materials across various sectors. Although the region holds a smaller share compared to Asia Pacific, its growth rate is accelerating at an impressive pace. The U.S. leads the regional charge, with rising consumption of PCC in pharmaceuticals, personal care products, and food additives. The growing elderly population and increasing focus on preventive healthcare have led to a spike in demand for calcium-enriched supplements, where PCC plays a pivotal role.

North America is witnessing a high demand for lightweight, eco-friendly materials, particularly in the plastics and automotive industries. PCC is being integrated into polymer matrices to reduce weight and improve mechanical properties, particularly in electric vehicle components and sustainable packaging solutions. The construction sector in the U.S. and Canada is also transforming, with eco-conscious building practices and regulations promoting the use of recyclable and non-toxic additives. PCC is increasingly used in paints, putties, and adhesives, enhancing both performance and sustainability.

What are the Driving Factors of the Precipitated Calcium Carbonate (PCC) Market in Europe?

Europe's market for precipitated calcium carbonate is under severe regulatory constraints that require the production of sustainable and high-performing materials, the innovation of specialty paper, paints automotive applications, and the support of industrial capabilities, research priorities, and environmental stewardship. However, the high energy cost has been a continuous challenge.

Germany Precipitated Calcium Carbonate (PCC) Market Trends:

Germany is at the forefront of Europe's market for precipitated calcium carbonate due to a strong automotive construction and advanced paper industry that encompasses the adoption of innovations such as sustainable manufacturing that integrate CO2 capture. This is happening because of the combination of research expertise, industrial infrastructure, environmental responsibility, and strong market demand.

Value Chain Analysis

- Feedstock procurement: obtaining limestone, water, and energy from suppliers that are in line with the production requirements of PCC.

Key Players: Omya AG, Imerys S.A., Minerals Technologies Inc., Sibelco Group NV, Carmeuse Group - Chemical synthesis processing: the process that involves the transformation of the raw materials into crude PCC slurry using calcination and carbonation reactions.

Key Players: Minerals Technologies Inc. (SMI), Omya AG, Imerys S.A. - Compound formulation blending: the process of mixing the synthesized PCC with the additives to get the required material performance properties for a specific application.

Key Players: Minerals Technologies Inc., Imerys, Omya) - Quality testing certification: quality control checks are performed, and certifications are obtained to ensure that the PCC meets the required specifications.

Key Players: Sudarshan Group, Kunal Calcium) - Packaging labeling PCC: finished PCC packaging is prepared with safety labels that are for transport, storage, and distribution.

Key Players: Kunal Calcium Limited, Sudarshan Group

Precipitated Calcium Carbonate Market Companies

- Imerys S.A.

- Omya AG

- Minerals Technologies Inc.

- Huber Engineered Materials (J.M. Huber Corporation)

- Mississippi Lime Company

- Schaefer Kalk GmbH & Co. KG

- Calcium Carbonate Co. Ltd. (Malaysia)

- Carmeuse

- Gulshan Polyols Ltd.

- Nordkalk Corporation

- Lhoist Group

Recent Developments

- In June 2025, outside Amalgamated Sugar's Nampa factory, piles of a pale, chalky substance rise like flat-topped hills. The company said that for over a century, since its first Idaho factory opened, its workers have been stockpiling the waste product created from turning beets into sugar, waiting for someone to find a use for it. Now, it's on the verge of becoming a key part of state infrastructure. Idaho State University has partnered with the Idaho Transportation Department to test a new concrete made from the powdery substance, known as precipitated calcium carbonate (PCC).

(source: https://www.yahoo.com) - In March 2025, Domtar's Nekoosa mill has launched a new on-site precipitated calcium carbonate (PCC) plant in collaboration with Omya, addressing supply chain challenges caused by a 2020 regional PCC plant closure. The plant ensures a stable, cost-effective, and sustainable supply of PCC, reducing transportation emissions and increasing operational efficiency.

(Source: https://india.paperex-expo.com)

Segments Covered in the Report

By Application

- Paper

- Coating

- Filling

- Plastics

- PVC

- Polypropylene (PP)

- Polyethylene (PE)

- Others

- Paints & Coatings

- Architectural

- Industrial

- Adhesives & Sealants

- Personal Care

- Toothpaste

- Skincare

- Pharmaceuticals

- Rubber

- Food & Beverages

- Anticaking Agent

- Fortification Agent

- Others

- Detergents

- Agriculture

By Production Process

- Carbonation Process

- Hydrochloric Acid Method

- Others

By Form

- Powder

- Slurry

- Granule

- Others

By Grade

- Industrial Grade

- Pharmaceutical Grade

- Food Grade

- Cosmetic Grade

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting