What is the Precision Genomic Testing Market Size?

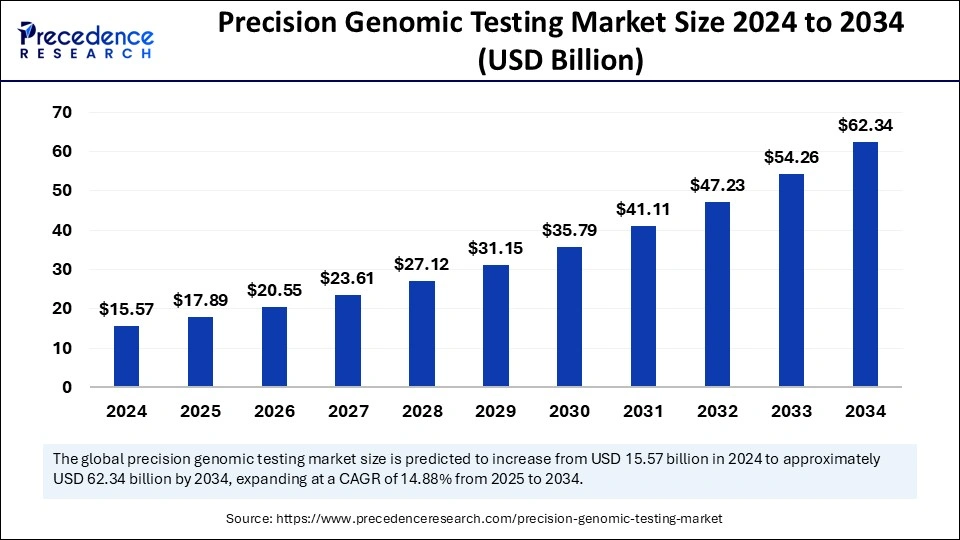

The global precision genomic testingmarket size is calculated at USD 17.89 billion in 2025 and is predicted to increase from USD 20.55 billion in 2026 to approximately USD 62.34 billion by 2034, expanding at a CAGR of 14.88% from 2025 to 2034. Advancements in genomic technologies are the key factor driving market growth. Also, the growing focus on personalized medicine coupled with the growing demand for precision genomic testing can fuel market growth further.

Precision Genomic Testing Market Key Takeaways

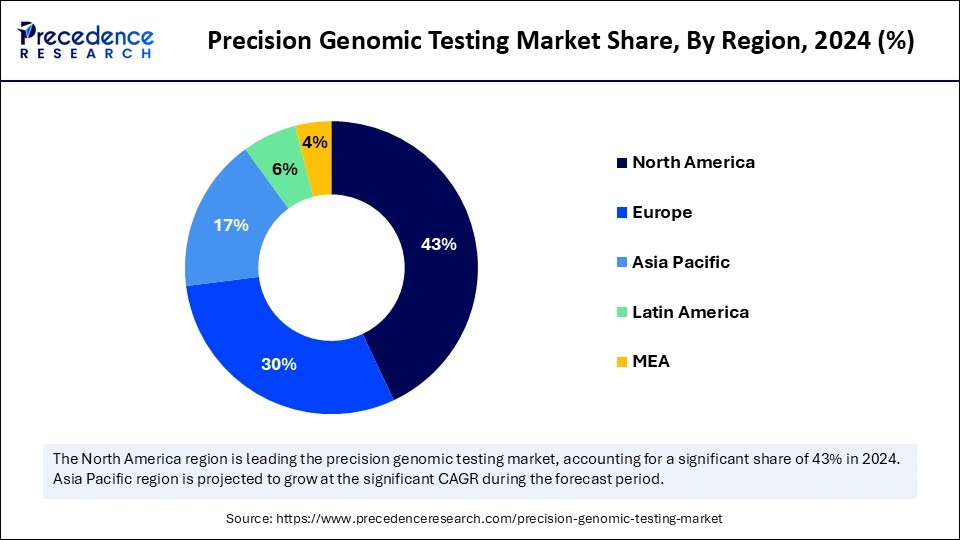

- North America dominated the market by holding more than 43% of market share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR 20.63% over the forecast period.

- By product and services, the consumables segment held the biggest market share of 46% in 2024.

- By product and services, the services segment is projected to grow at a solid CAGR of 15.41% over the forecast period.

- By technology, the next-generation sequencing segment accounted for the major market share of 33% in 2024.

- By technology, the microarray technology segment is expanding at a notable CAGR of 15.80% during the projected period.

- By application, the oncology segment contributed the highest market share of 33% in 2024.

- By application, the neurological disorders segment is poised to grow at a double digit CAGR of 16% over the forecast period.

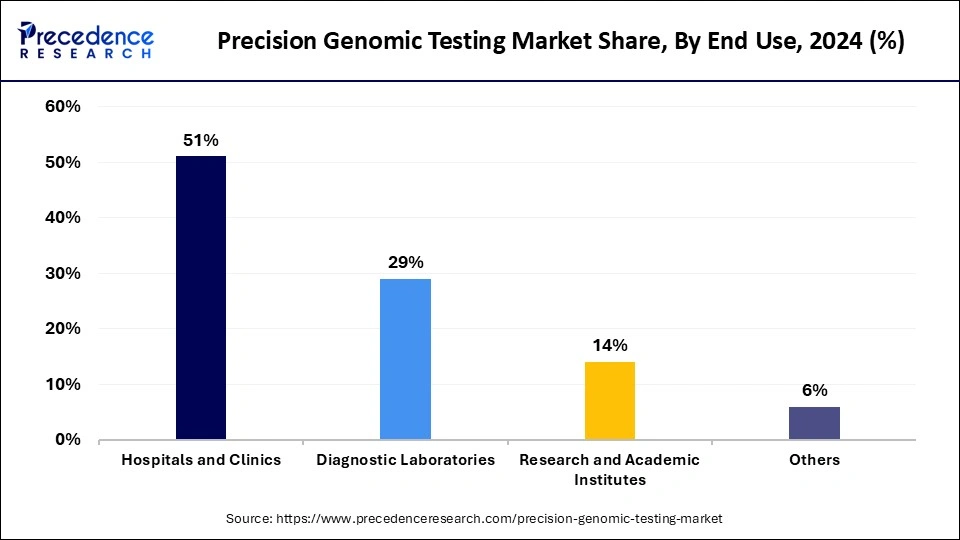

- By end use, the hospitals and clinics segment held the major market share of 51% in 2024.

- By end use, the diagnostic laboratories segment is projected to grow at the fastest rate during the forecast period.

Market Overview

Precision genomic testing is the process of analyzing a person's DNA to offer insights into disease conditions and provide treatment decisions that cater to genetic profile-based medical interventions. As medical systems across the globe are shifting towards precision medicine, the precision genomic testing market is becoming more crucial in medicine. The rapid evolution of f next-generation sequencing (NGS)has enhanced the process of genomic testing and also lowered its overall costs.

Role of Artificial Intelligence (AI) in Genomics

Artificial intelligence is significantly transforming the field of genomics. By using machine learning algorithms in the precision genomic testing market, AI systems can detect patterns and correlations within large amounts of genetic information. Furthermore, Artificial Intelligence in genomics has the ability to revolutionize medical care by offering more precise diagnoses, novel therapeutic targets, and individualized treatment plans.

- In January 2025, Nvidia announced the partnership with Illumina to apply genomics and AI technologies to analyze and interpret multi-omic data in drug discovery, clinical research, and human health, the companies said in a collaboration of technology leaders announced early during the 43rd Annual J.P. Morgan Healthcare Conference.

Market Outlook

- Industry Growth Overview: The precision genomic testing market is growing rapidly due to rising demand for personalized medicine, increased adoption of next-generation sequencing, expanding applications in oncology, improved diagnostic accuracy, and greater healthcare investments worldwide.

- Global Expansion: The market is expanding globally due to advancements in DNA sequencing technologies, increasing adoption of personalized medicine, and growing awareness of the benefits of genomics in diagnosing and treating diseases. Emerging regions, particularly in Asia-Pacific, Latin America, and the Middle East, present significant opportunities as healthcare systems improve, disposable incomes rise, and demand for advanced diagnostic tools grows.

- Major Investors: Major investors in the market include venture capital firms such as ARCH Venture Partners and Flagship Pioneering, healthcare specialist funds such as OrbiMed, and corporate venture arms such as Illumina Ventures. Their backing spans early-stage platforms to clinical-scale diagnostic companies, supporting innovation across sequencing, bioinformatics, and genomic testing technologies.

- Startup Ecosystem: The precision genomic testing market's startup ecosystem is driven by emerging companies focused on AI-driven sequencing, personalized medicine, cloud bioinformatics, rapid diagnostics, and cancer risk prediction, supported by strong VC funding and research-industry collaborations.

Precision Genomic Testing Market Growth Factors

- The increasing incidence of genetic disorders and cancers is expected to boost precision genomic testing market growth soon.

- Pharmaceutical companies are heavily investing in companion diagnostics, which can propel market growth shortly.

- The integration of genomic testing in daily clinical practice will likely contribute to the market expansion further.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 62.34 Billion |

| Market Size in 2025 | USD 17.89 Billion |

| Market Size in 2026 | USD 20.55 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.88% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing demand for personalized medicine

The increase in demand for personalized medicine is a major driver fuelling the precision genomic testing market growth. As the medical industry evolves, there is an increasing focus on treatments specific to personalized genetic profiles. In addition, Personalized medicine enables effective treatment plans and precise diagnosis and decreases the risk of potential side effects. This shift is backed by innovations in genomic technologies.

- In January 2025, Agilus Diagnostics announced a ground-breaking achievement in genomic testing with its industry-leading 3-day turnaround time (TAT) for test results in myeloid malignancies. Agilus Diagnostics has announced a ground-breaking achievement in genomic testing with its industry-leading 3-day turnaround time (TAT) for test results in myeloid malignancies.

Restraint

Ethical and regulatory complexities

The regulatory scenario for precision genomic testing changes extensively across various regions, generating hurdles for market growth. Many nations have strict guidelines regarding the utilization, storage, and collection of genetic data. Moreover, ethical concerns associated with the misuse and privacy of genetic data information and implementation can hinder market growth further.

Opportunity

Growing application in oncology

The increasing incidence of cancer and rising prevalence of neurological diseases create future opportunities in the market. Various healthcare organizations are collaborating to develop drugs created to treat a specific group of patients in accordance with their tailored requirements, hence growing the number of clinical trials, which can lead to a surge in disease diagnostics.

- In September 2024, Variantyx, a leading molecular diagnostics lab, announced the launch of Genomic Unity 2.0, a novel whole genome-based diagnostic test. This advanced test integrates traditional short-read genome sequencing with third-generation long-read genome sequencing, detecting genetic variants that are missed by other methodologies and improving diagnostic yield.

Segment Insights

Product and Services Insights

The consumables segment held the largest precision genomic testing market share in 2024. The dominance of the segment can be attributed to the ongoing advancements in genomic technology and new product launches. Additionally, major market players are bringing advanced consumables like kits, reagents, and assay components to cater to genomic sequencing and analysis.

The services segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the increasing demand for analysis services and specialized testing. Companies providing clinical trial support, genetic counseling, and interpretation of genomic data are increasing their service offerings, impacting the segment's growth positively.

Technology Insights

The next-generation sequencing segment dominated the precision genomic testing market in 2024. The dominance of the segment is owning to the ongoing strategic partnerships among market players along with the continuous advancements in NGS technologies. Furthermore, these collaborations among key players will optimize the translation of advanced research into clinical applications.

The microarray technology segment is anticipated to grow at the fastest rate during the projected period. The growth of the segment is due to the technological developments in microarray technology. Improved microarray platforms provide greater accuracy and high resolution, facilitating comprehensive analysis of gene expression and genetic variations.

- In August 2023, Thermo Fisher Scientific announced the launch of a new chromosomal microarray designed to improve cytogenetic research lab productivity, efficiency, and profitability with an industry-leading two-day turnaround time. Providing insights on chromosomal variants for a wide range of prenatal, postnatal, and oncology research applications.

Application Insights

The oncology segment led the precision genomic testing market in 2024. The dominance of the segment can be linked to advancements in cancer genomics, such as comprehensive genomic profiling, liquid biopsy techniques, and targeted therapy developments. These innovations are improving disease detection, diagnosis, and individualized treatment of cancers, driving the segment's growth further.

The neurological disorders segment is expected to show the fastest growth over the forecast period. The growth of the segment can be driven by increased investment in the genomics sector and ongoing innovations in genomic technologies. Moreover, technologies such as CRISPR and next-generation sequencing (NGS) are facilitating more accurate detection of genetic mutations related to neurological conditions like epilepsy and Alzheimer's.

End Use Insights

In 2024, the hospitals and clinics companies segment led the precision genomic testing market by holding the largest market share. The dominance of the segment can be linked to the increasing incidence of genetic disorders and growing funding in hospitals and clinics. In addition, financial support from private investments and government initiatives are improving the capabilities of healthcare infrastructure.

The diagnostic laboratories segment is projected to grow at the fastest rate during the forecast period. The growth of the segment is because of the growing demand for clinical testing of various diseases, ongoing research, and innovations in technology. These labs are deploying advanced genomic technologies to improve the genomic process, impacting positive segment growth shortly.

Regional Analysis

Which Factors Contribute to North America's Dominance in the Precision Genomic Testing Market?

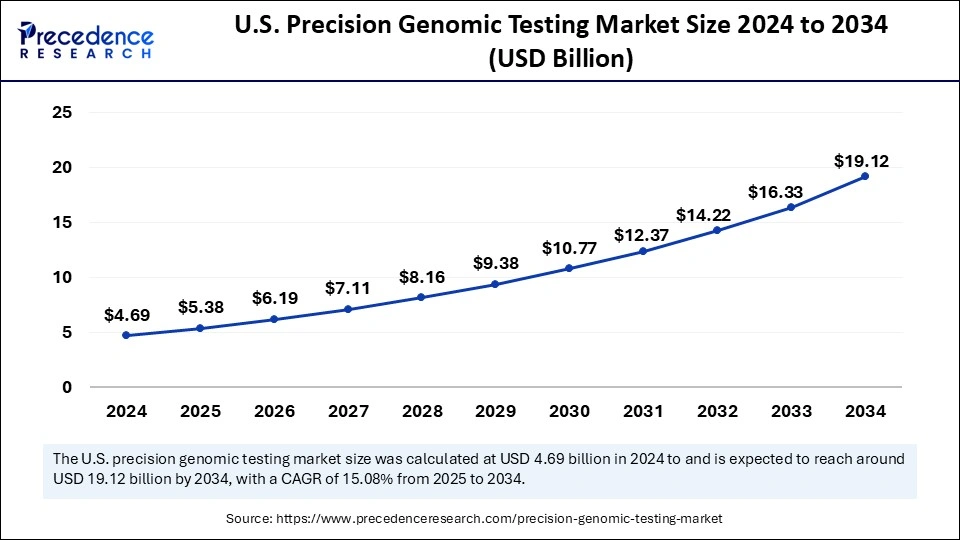

North America dominated the precision genomic testing market in 2024. The dominance of the region can be attributed to the advancements in bioinformatics and next-generation sequencing (NGS) is boosting the market growth, enabling improved genomic analysis and individualized medicine applications.

U.S. Precision Genomic Testing Market Trends

The U.S. precision genomic testing market size is exhibited at USD 5.38 billion in 2025 and is projected to be worth around USD 19.12 billion by 2034, growing at a CAGR of 15.08% from 2025 to 2034.

In North America, the U.S. led the market owing to the increasing collaboration between research institutions and market leaders. These partnerships propel innovations and boost the development of innovative genomic technologies, improving overall diagnostic capabilities.

Asia Pacific is expected to grow at the fastest rate over the forecast period. The growth of the region can be credited to the substantial investments in research and development. These high investments are fuelling technological advancements in genomic sequencing and diagnostics, improving the region's abilities in individualized healthcare solutions.

What Makes Asia Pacific the Fastest-Growing Region in the Precision Genomic Testing Market?

In Asia Pacific, China is expected to grow at the fastest rate, due to the strategic partnerships with international players coupled with the global expansion efforts in genomic testing. These partnerships improve access to innovative genomic technologies and expertise, supporting the market's expansion in the region.

- In January 2025, Taiwan-based Advanced Genomics APAC Co. announced the signing of an exclusive service provider agreement with Cancer Precision Medicine Inc. (CPM) for the bladder cancer screening test GALEAS Bladder in Japan. Additionally, the agreement includes other cancer genetic testing services in the Japanese market.

Why is Europe Considered a Notably Growing Area?

Europe is expected to show notable growth in upcoming years. This growth is owing to the ongoing investments in research and development. This surge in funding supports innovations in genomic technologies, boosting market growth in the region further.

UK Precision Genomic Testing Market Trends

In Europe, the UK is witnessing substantial growth in the foreseeable future. The growth of this country can be attributed to the growing adoption of precision medicine, innovative healthcare infrastructure, and a well-established genomics sector backed by major pharmaceutical and biotechnology companies.

How Crucial is the Role of Latin America in the Precision Genomic Testing Market?

Latin America is growing rapidly in the precision genomic testing market due to rising investments in healthcare modernization, increased government focus on cancer and rare disease diagnosis, and expanding adoption of next-generation sequencing in hospitals. Growing awareness of personalized medicine, improved access to genetic counseling services, and cross-border research collaborations with U.S. and European institutions further accelerate the market's regional momentum.

What are the Latest Trends in Brazil?

Brazil leads the Latin America precision genomic testing market due to its strong healthcare research infrastructure, rapid adoption of advanced sequencing technologies, and increasing government support for precision medicine initiatives. Growing cancer and rare disease screening programs, partnerships with global genomic companies, and high investment in biotechnology further strengthen Brazil's dominant regional position.

What Opportunities Exist in the Middle East and Africa for the Precision Genomic Testing Market?

The Middle East and Africa (MEA) offers significant growth opportunities for the market due to rapidly improving healthcare infrastructure, increased government focus on personalized medicine, and the rising prevalence of genetic and chronic diseases. Expansion of genomics research centers, growing medical tourism, and collaborations with international biotech companies further boost adoption. Supportive funding for early disease detection and newborn screening programs enhances long-term market potential in the region.

What are the Ongoing Trends in the UAE Market?

The UAE remains the leading country in the Middle East and Africa's precision genomic testing market due to strong government investment in advanced healthcare, early adoption of personalized medicine, and nationwide genomics initiatives. Growing partnerships with global biotech companies, expanding genetic screening programs, and high patient awareness continue to drive rapid innovation and market leadership in the country.

Value Chain Analysis

- R&D

Research focuses on discovering disease-linked genetic biomarkers and developing diagnostic sequencing panels and AI-based interpretation algorithms. Validation studies optimize bioinformatics pipelines to ensure accuracy and clinical usefulness.

Key Players: Illumina, Thermo Fisher Scientific, Roche, Qiagen, Agilent Technologies, BGI Genomics, Invitae. - Clinical Trials and Regulatory Approvals

Clinical evaluations assess the diagnostic safety and reliability of genomic tests across diverse patient groups. Regulatory bodies review validation results and authorize commercial use with post-market compliance monitoring.

Key Players: U.S. FDA, EMA, MHRA, TGA, CDSCO, Health Canada, Saudi FDA. - Patient Support and Services

Patients receive genetic counseling and personalized reports explaining their results and potential treatment implications. Telehealth and digital platforms support long-term disease risk monitoring and medical guidance.

Key Players: 23andMe, GeneDx, Color Genomics, Myriad Genetics, Natera, Fulgent Genetics.

Precision Genomic Testing Market Companies

- Illumina, Inc.: A global leader in DNA sequencing and genotyping technologies, Illumina provides high-throughput sequencing systems (e.g., NovaSeq, MiniSeq) and associated reagents and software used widely in precision genomic testing and research.

- Qiagen N.V.:Provides molecular diagnostics platforms, sample & assay technologies and bioinformatics solutions that support genomic testing workflows in clinical and research settings.

- Danaher:Provides genomic sequencing instruments, molecular diagnostic platforms, reagents, and workflow automation solutions used in precision genomic testing laboratories.

- Merck (Merck KGaA / MilliporeSigma):Supplies genomic reagents, nucleic acid extraction kits, PCR materials, sequencing chemicals, and laboratory tools that support precision genomic diagnostic workflows.

- Revvity, Inc.:Offers genomic sample-prep systems, sequencing reagents, and assay development solutions used in precision oncology and hereditary disease genomic testing.

- Maravai LifeSciences: Provides nucleic-acid-based reagents, mRNA and oligo production services, and labeling chemistry used in diagnostic genomic assay development and testing.

- GenScript:Offers gene synthesis, CRISPR tools, DNA/RNA reagents, and custom assay components used for developing and running precision genomic diagnostics.

- PacBio: It contributes to the precision genomic testing market with its long-read sequencing technology, providing highly accurate and comprehensive genomic data for complex genetic analysis and clinical diagnostics.

- Oxford Nanopore Technologies plc.: It advances precision genomic testing by offering portable, real-time sequencing devices that enable rapid, scalable genetic testing across clinical, research, and field settings.

- 10x Genomics, Inc.: It enhances precision genomic testing with its single-cell and spatial genomics platforms, enabling detailed analysis of gene expression and genetic variations at a single-cell level for personalized medicine.

Latest Announcement by Market Leaders

- In June 2024, Merck, a leading science and technology company, announced an investment of € 62 million at its Darmstadt headquarters in a new quality control building for its Life Science business. The facility will bring together approximately 135 employees across several departments into one collaborative state-of-the-art space.

- In February 2025, QIAGEN announced the official opening of a new data center in Melbourne, Australia, designed to strengthen its global bioinformatics leadership position in this region of the world. This latest addition reflects QIAGEN's ongoing commitment to enhance its bioinformatics data infrastructure.

Recent Developments

- In July 2024, Phenomix Sciences partnered with Hello Alpha to introduce personalized genetic testing for obesity, specifically targeting women. Hello Alpha, a virtual primary care platform, seeks to enhance women's healthcare by offering accessible, affordable, and confidential online medical services.

- In July 2024, Thermo Fisher Scientific Inc. partnered with the National Cancer Institute (NCI), a division of the National Institutes of Health, to advance research on new treatments for Acute Myeloid Leukemia (AML) and Myelodysplastic Syndrome (MDS). As part of the myeloMATCH (Molecular Analysis for Therapy Choice) precision medicine umbrella trial, the collaboration aimed to expedite patient matching for clinical trials.

- In February 2024, Exact Sciences Corp., a provider of cancer screening and diagnostic tests, launched the Riskguard cancer test in the U.S. The Riskguard test offers individualized patient reports that detail gene-specific and familial risks for 10 common cancers.

Segments Covered in the Report

By Product & Service

- Consumables

- Kits

- Reagents

- Equipment

- Services

By Technology

- Next-Generation Sequencing

- Polymerase Chain Reaction

- Microarray Technology

- Sanger Sequencing

- CRISPR/Cas Systems

- Others

By Application

- Oncology

- Cardiovascular Diseases

- Neurological Disorders

- Reproductive Health

- Rare Diseases

- Others

By End Use

- Hospitals and Clinics

- Diagnostic Laboratories

- Research and Academic Institutes

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting