Aquaculture Market Revenue to Attain USD 355.66 Bn by 2033

Aquaculture Market Revenue and Trends 2025 to 2033

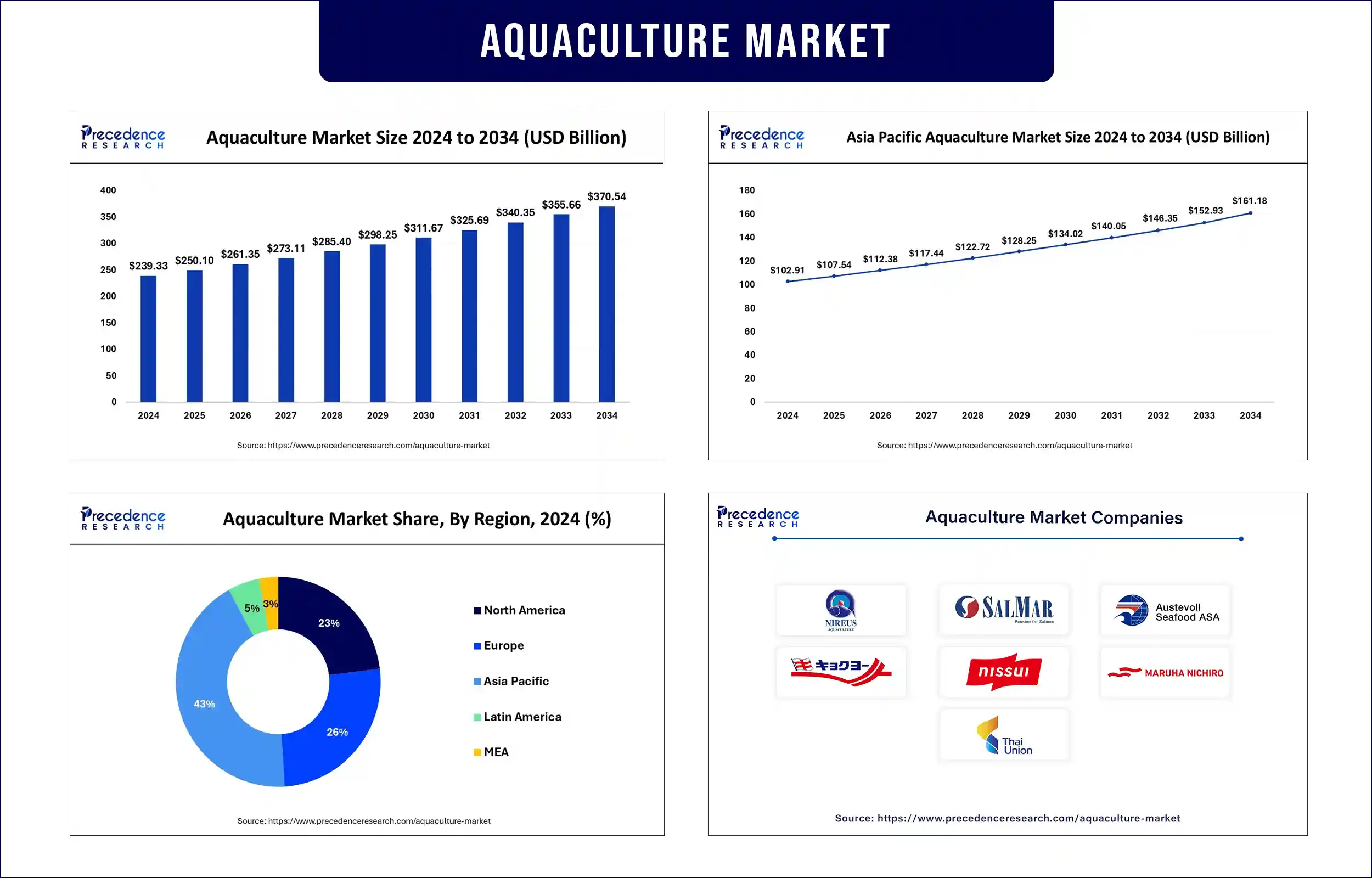

The global aquaculture market revenue is reached USD 250.10 billion in 2025 and is predicted to attain around USD 355.66 billion by 2033 with a CAGR of 4.47%. The growth of the market is driven by the increasing demand for seafood and advancements in aquaculture technology.

Market Overview

Raising the yield of fish, crustaceans, mollusks, and aquatic plants for food is becoming increasingly important to overcome global food challenges. Growing demand for seafood has forced people to rely on aquaculture since natural fish populations are shrinking. Improvements in breeding methods and advanced digital tools are enhancing the efficiency of aquaculture. Furthermore, government measures for responsible fish farming are supporting the growth of the market.

Aquaculture Market Trends

Technological Innovation in Aquaculture Systems

There is a major shift toward digitalization in the field of aquaculture. IoT and AI tools are enabling precision farming, boosting productivity and sustainability. In 2024, Horizon Europe in the European Union dedicated over EUR 150 million to developing smart fish farming strategies. These inventions decrease energy requirements and risk of death and promote clear and open procedures in the seafood sector. According to FAO data, more than 60% of fish production in 2024 depended on digital monitoring, showing that digital tools are widely adopted. The Aquaculture Stewardship Council (ASC) made an update to its certification standards to include rules for digital traceability.

(Source- https://www.fao.org)

(Source https://www.fao.org)

Sustainable and Alternative Feed Solutions

Growing emphasis on sustainability is leading the food industry to use insect meal, algae, and microbial proteins as substitutes. In a 2024 survey, the Global Aquaculture Alliance reported that more than one-third, that is 38% of commercial feed manufacturers, are using alternative proteins. These alternatives decrease reliance on wild fish stocks, lower emissions, and enhance the way feed is used. It was reported by the FAO in 2024 that substituting fishmeal in aquafeeds with algae resulted in a 25% reduction in greenhouse gas emissions. The European Commission – DG MARE began a new project called Coastal EU Insects for Aquafeed Initiative, supporting the circular economy.

(Source- https://www.ieabioenergy.com)

(Source- https://www.fao.org)

Offshore Aquaculture and Blue Economy Integration

To address farming issues near the shore, many countries are now investigating offshore aquaculture to operate in deeper waters. In 2024, the U.S. NOAA piloted various projects to see if farms could succeed in the ocean. Digital systems are helping coastal areas thrive by combining aquaculture and renewable energy, aiming to preserve water resources and save marine habitats. The World Bank highlighted in its 2024 Blue Economy report that offshore operations support economic growth and reduce negative impacts on nature.

(Source- https://www.noaa.gov)

(Source- https://www.worldbank.org)

Health and Biosecurity Management

Continued disease outbreaks risk the health of aquaculture, which is why more funding is going toward developing vaccines and water treatments. Health management technologies, such as real-time pathogen checks and automatic treatment, are bringing advancements in aquaculture. As early disease detection technologies have been adopted, outbreak responses are happening faster, limiting the extent of losses. Recently, the Norwegian Directorate of Fisheries reported a significant drop in bacterial infections after vaccinating fish in Norway’s salmon farms. Furthermore, the Department of Fisheries also improved water treatment in inland farms, reducing chemical usage by 30%.

(Source- https://www.pib.gov.in)

Report Highlights of the Aquaculture Market

By environment, the freshwater segment held the largest share of the market in 2024 and is expected to grow at a significant CAGR in the coming years. This segment benefits from lower operational costs and simpler regulatory environments compared to marine farming. Increasing adoption of recirculating aquaculture systems (RAS) and integrated multi-trophic aquaculture (IMTA) in freshwater setups is improving water efficiency and environmental sustainability.

By type, the fish segment led the market by capturing the largest share in 2024. This is mainly due to the increased production of species such as salmon, tilapia, and catfish, which are widely consumed across the world. Meanwhile, the aquatic plant segment is expected to grow at the fastest CAGR in the coming years. Seaweed farming is gaining momentum as a sustainable practice, with applications ranging from food ingredients and animal feed to biofertilizers and cosmetics.

By end-use, the seafood industry segment dominated the global market in 2024. This is mainly due to the increased demand for seafood, driven by increasing health consciousness among consumers and the expanding middle-class population worldwide. Enhanced cold chain logistics and processing technologies are improving seafood shelf life and quality, expanding access to distant markets. On the other hand, the pharmaceuticals segment is expected to expand at the fastest rate during the forecast period. Marine organisms are a rich source of novel bioactive compounds used in drug discovery, particularly for anti-inflammatory, antimicrobial, and anticancer therapies.

Regional Outlook

Asia Pacific registered dominance in the aquaculture market in 2024 due to the increased production and consumption of seafood. China, India, Vietnam, and Indonesia lead global production, supported by strong domestic demand and export potential. China launched a plan in 2024 to enhance aquatic health and security nationwide, and India’s PMMSY was expanded in coastal states to aid marine and inland aquaculture. In order to increase environmental compliance, Vietnam started using 2024 ASC standards for sustainable shrimp farming. Indonesia initiated a coastal aquaculture resilience program in 2024, designed to strengthen adaptation to climate change and better manage resources. Furthermore, such strategies are helping Asia-Pacific take the lead in developing aquaculture in a sustainable way.

(Source- https://www.pib.gov.in)

North America is expected to witness significant growth during the projection period. This is mainly due to the rising demand for seafood in the U.S. and Canada. There is heightened adoption of advanced technologies, boosting the efficiency of aquaculture. In 2024, NOAA in the U.S. launched expanded offshore aquaculture pilot efforts to investigate large-scale farming at sea. FAO reported in 2024 that the growth in aquaculture productivity in North America was mainly due to the adoption of advanced farming technologies.

(Source- https://civileats.com)

(Source- https://www.fao.org)

Aquaculture Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 250.10 Billion |

| Market Revenue by 2033 | USD 355.66 Billion |

| CAGR from 2025 to 2033 | 4.47% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Aquaculture Market News

- In April 2025, Christian Sørensen, the founder of the now-defunct Billund Aquaculture, has announced the launch of a new company, Globag Solutions, aimed at advancing recirculating aquaculture systems (RAS) and promoting sustainable fish farming practices. The new venture follows the bankruptcy of Billund Aquaculture in 2024 and the brief formation of Billund Aquatech, which has since transitioned into Globag Solutions. With a renewed focus on innovation and sustainability, the company seeks to provide advanced aquaculture solutions to meet the rising global demand for responsibly farmed seafood.

- In April, 2025, Kawasaki Heavy Industries, Ltd. has announced the development of a new sustainable aquaculture system designed to enhance food security and promote eco-friendly marine farming in Japan. Leveraging Kawasaki’s expertise in industrial water treatment and fluid control technologies—originally developed for marine vessels, industrial plants, and rail systems—the system incorporates advanced filtration and sterilization methods to protect aquaculture farms from viruses and parasites. The innovation also allows fish farming to take place near ports and coastal regions, ensuring proximity to consumers and distribution centers. By increasing accessibility and biosecurity, Kawasaki’s solution aims to help marine farmers deliver safe, traceable, and sustainable seafood to the Japanese market.

- In March 2025, EU Commissioner for Fisheries and Oceans Costas Kadis officially launched a new EU-wide campaign to raise awareness and public support for sustainable aquaculture. Titled “EU aquaculture. We work for you with passion,” the campaign is a collaborative effort between the European Commission, Member States, and the Aquaculture Advisory Council. Over the course of three months, the initiative will highlight the commitment of EU aquaculture producers to sustainability, food quality, and environmental stewardship. The campaign also aims to educate the public about the benefits of developing aquaculture within the EU, including enhanced food security, reduced reliance on imports, and stronger local economies.

Source: https://www.aquafeed.co.uk/billund-aquaculture-founder-launches-new-company-globaq-solutions/

https://global.kawasaki.com/en/corp/newsroom/news/detail/?f=20250414_3033

Aquaculture Market Key Players

- Nireus SA Ltd

- Dainichi Corporation

- SalMar ASA

- Austevoll Seafood

- Kyokuyo Co Ltd

- Surapon Foods Public Company Ltd

- Nippon Suisan Kaisha Ltd

- Maruha Nichiro Corporation

- Thai Union Group Plc

- Leroy Seafood Group ASA

- Eastern Fish Co.

- Shandong Homey Aquatic Development Co Ltd

Market Segmentation

By Environment

- Fresh water

- Marine water

- Brackish water

By Type

- Fish

- Crustaceans

- Aquatic plant

By End-User

- Seafood Industry

- Pharmaceuticals

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @https://www.precedenceresearch.com/sample/2779

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344