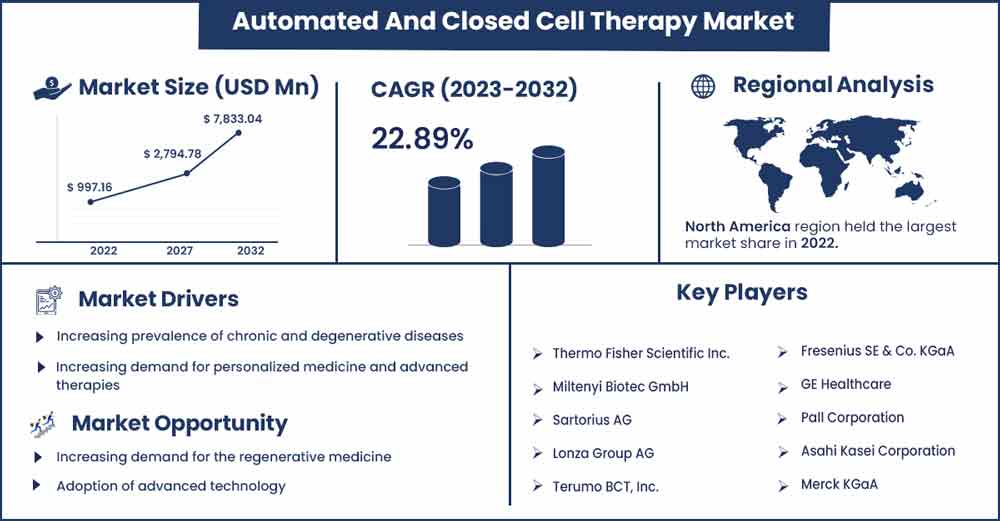

Automated And Closed Cell Therapy Market Will Grow at CAGR of 22.89% By 2032

The global automated and closed cell therapy market size is anticipated to reach around USD 7,833.04 million by 2032 up from USD 997.16 million in 2022 with a CAGR of 22.89% between 2023 and 2032.

Automated and closed cell therapy is a rapidly growing market that uses advanced technologies to manufacture and deliver personalized cell and gene therapies. The market is driven by the increasing demand for effective and safe cell therapies for treating various diseases, such as cancer, autoimmune disorders, and genetic disorders. The market is also driven by the growing number of partnerships and collaborations among biopharmaceutical companies, contract manufacturing organizations (CMOs), and academic institutions to develop and commercialize cell therapies.

Regional Landscape:

The Asia Pacific automated and closed cell therapy market is expected to grow significantly over the forecast period. One of the key drivers of the Asia Pacific automated and closed cell therapy market is the increasing prevalence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders. This has increased the demand for cell-based therapies that effectively treat these conditions.

The rising ageing population also contributes to the market’s growth, as older individuals are more susceptible to chronic diseases. Advancements in automation technology are also contributing to the development the Asia Pacific automated and closed cell therapy market. Automated systems are increasingly used in cell therapy manufacturing processes to reduce the risk of contamination and human error. Closed systems, designed to prevent contamination, are also becoming more popular in the region. These advancements are helping improve the safety and efficacy of cell-based therapies, driving the market's growth.

Automated And Closed Cell Therapy Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 1,225.41 Million |

| Projected Forecast Revenue by 2032 | USD 7,833.04 Million |

| Growth Rate from 2023 to 2032 | CAGR of 22.89% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics:

Driver:

Rising demand for personalized medicine

Increasing demand for personalized medicine and advanced therapies drives the automated and closed-cell therapy market. As the understanding of human biology and diseases improves, there is a growing emphasis on developing therapies that can target specific disease pathways and address the unique characteristics of individual patients. This has led to the development of advanced cell therapies that utilize a patient's cells to treat various diseases, such as cancer, autoimmune disorders, and genetic disorders.

Automated and closed-cell therapy manufacturing systems have emerged as a critical tool in developing and commercializing these therapies. These systems allow for the efficient and consistent production of high-quality cell therapies while minimizing the risk of contamination and maintaining strict control over the manufacturing process. The use of automated and closed systems can also help to reduce the overall cost of cell therapies, making them more accessible to patients and healthcare providers.

Restraint:

Regulatory hurdles

The market is highly regulated, with strict guidelines and requirements for approval and commercialization. The regulatory approval process can be time-consuming, expensive, and unpredictable, creating significant barriers to entry for companies looking to develop and bring new automated and closed-cell therapies to market. The regulatory approval process can be lengthy and expensive, delaying the commercialization of new therapies.

This can be particularly challenging for small and emerging companies, which may not have the resources to navigate the complex regulatory landscape. Additionally, the regulatory requirements for approval and commercialization can be unpredictable, with changing guidelines and requirements over time. This can create uncertainty for companies and investors, impacting investment decisions and the market’s growth.

Furthermore, the regulatory landscape for automated and closed-cell therapies can vary significantly by region and country. This can create challenges for companies looking to develop and commercialize their therapies globally, as they may need to navigate multiple regulatory systems and requirements. Thus, regulatory hurdles obstruct the market.

Opportunity:

Adoption of advanced technology

As cell therapy advances, there is an increasing need for automated and closed systems to ensure cell-based products' reproducibility, scalability, and consistency. One way to achieve these goals is by leveraging advanced technologies such as artificial intelligence, robotics, and automation. Artificial intelligence (AI) can potentially revolutionize cell therapy products' development and manufacture. By analyzing large datasets, AI algorithms can identify patterns and insights that may not be apparent to human researchers.

This can lead to the discovery of new therapeutic targets and the development of more effective cell-based therapies. Robotics and automation can also play a key role in developing and manufacturing cell-based products. By automating repetitive tasks, such as cell culture and harvesting, companies can improve efficiency, reduce errors, and increase throughput. Robotic systems can also provide greater precision and accuracy, which can be particularly important when working with fragile cells.

In addition to improving efficiency and consistency, using advanced technologies can also help reduce costs. By automating certain tasks, companies can reduce the need for manual labor, which can be a significant cost driver. Furthermore, using AI and other advanced technologies can help optimize processes and reduce waste, reducing costs. However, some challenges are associated with using advanced technologies in the cell therapy industry. For instance, implementing these technologies can require significant investment in infrastructure and training.

Additionally, regulatory agencies may be hesitant to approve products developed using novel technologies that have not yet been fully validated. Despite these challenges, advanced technologies in the automated and closed cell therapy market present a significant opportunity for companies that can successfully integrate these technologies into their processes. By doing so, they can improve efficiency, consistency, and scalability, reducing costs and driving innovation in the field.

COVID-19 Impact:

The COVID-19 pandemic has also created opportunities for companies operating in the automated and closed cell therapy market. For instance, there has been a growing interest in using cell-based therapies to treat COVID-19 patients. Researchers are exploring using mesenchymal stem cells (MSCs) to reduce the severity of COVID-19 symptoms and improve patient outcomes. Additionally, there has been a growing demand for cell-based therapies to treat other conditions exacerbating the pandemic, such as cardiovascular disease and neurological disorders.

Furthermore, the pandemic has accelerated the adoption of automation technologies in cell therapy. With social distancing measures in place, companies are increasingly turning to automated and closed systems to minimize the risk of contamination and ensure the safety of workers. This has increased the demand for automated and closed-cell therapy systems.

Workflow Landscape:

The fill-finish segment is estimated to grow faster during the forecast period. This is due to the fill-finish process is critical to the final preparation of the cell therapy product and is essential to ensure the final product's safety, efficacy, and stability. The increasing demand for cell therapies and the growing number of clinical trials involving cell-based products have contributed to the growth of this segment. Additionally, automation and aseptic processing technologies have made the fill-finish process more efficient, reliable, and cost-effective, further fueling this segment’s growth. With the increasing adoption of closed systems and single-use technologies, the fill-finish segment is expected to grow in the coming years.

Type Landscape:

Non-stem cell therapy segment is expected to grow faster during the forecast period. Non-stem cell therapy involves using different types of cells, such as immune cells, progenitor cells, and mesenchymal cells, to treat various medical conditions. Unlike stem cell therapy, which uses undifferentiated cells with the potential to develop into many different cell types, non-stem cell therapy involves using cells already differentiated into specific cell types. For instance, CAR-T cell therapy is a type of non-stem cell therapy that involves modifying a patient's T cells to recognize and attack cancer cells.

Additionally, Dendritic cells are immune cells that play a crucial role in activating the immune response to foreign substances, such as viruses and bacteria. In dendritic cell therapy, dendritic cells are isolated from a patient's blood, modified to express tumour-specific antigens, and then infused into the patient's body to activate an immune response against cancer cells. Therefore, Non-stem cell therapy is a rapidly evolving field with many potential applications in treating cancer and other diseases. However, more research is needed to fully understand the safety and efficacy of these therapies for different indications.

Scale Landscape:

The commercial scale segment is estimated to be the fastest growing during the forecast period. The commercial scale segment of the automated and closed cell therapy market includes companies that have successfully developed and scaled up their products for commercial production and are now focused on manufacturing, distribution, and marketing their products to a wider audience. Companies typically optimise their manufacturing processes in this segment to increase production efficiency, reduce costs, and maintain high product quality standards. They are investing in marketing and sales efforts to expand their customer base and increase awareness of their products.

In addition, companies in the commercial scale segment are working to obtain regulatory approvals in different markets and expand their product lines to include new therapies or applications. They collaborate with healthcare providers and insurers to establish reimbursement strategies and ensure broad patient access to their products. Thus, the commercial scale segment represents the automated and closed cell therapy market's growth phase. Companies must generate revenue and profitability and drive broader adoption of their technologies.

Recent Developments:

- In February 2021, GE Healthcare launched the KUBio box, a modular biomanufacturing platform that combines automation and digitalization to accelerate the production of cell and gene therapies.

- In January 2021, Pall Corporation launched the AcroPrep Advance Filter Plates, a range of closed-system filter plates designed to improve the efficiency and reliability of cell and gene therapy manufacturing.

Major Key Players:

- Thermo Fisher Scientific Inc.

- Miltenyi Biotec GmbH

- Sartorius AG

- Lonza Group AG

- Terumo BCT, Inc.

- Fresenius SE & Co. KGaA

- GE Healthcare

- Pall Corporation

- Asahi Kasei Corporation

- Merck KGaA

Market Segmentation:

By Workflow

- Separation

- Expansion

- Apheresis

- Fill – Finish

- Cryopreservation

- Others

By Type

- Stem Cell Therapy

- Non- Stem Cell Therapy

By Scale

- Pre-commercial/R&D Scale

- Commercial scale

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2758

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333