Automated and Closed Cell Therapy Market Size and Forecast 2025 to 2034

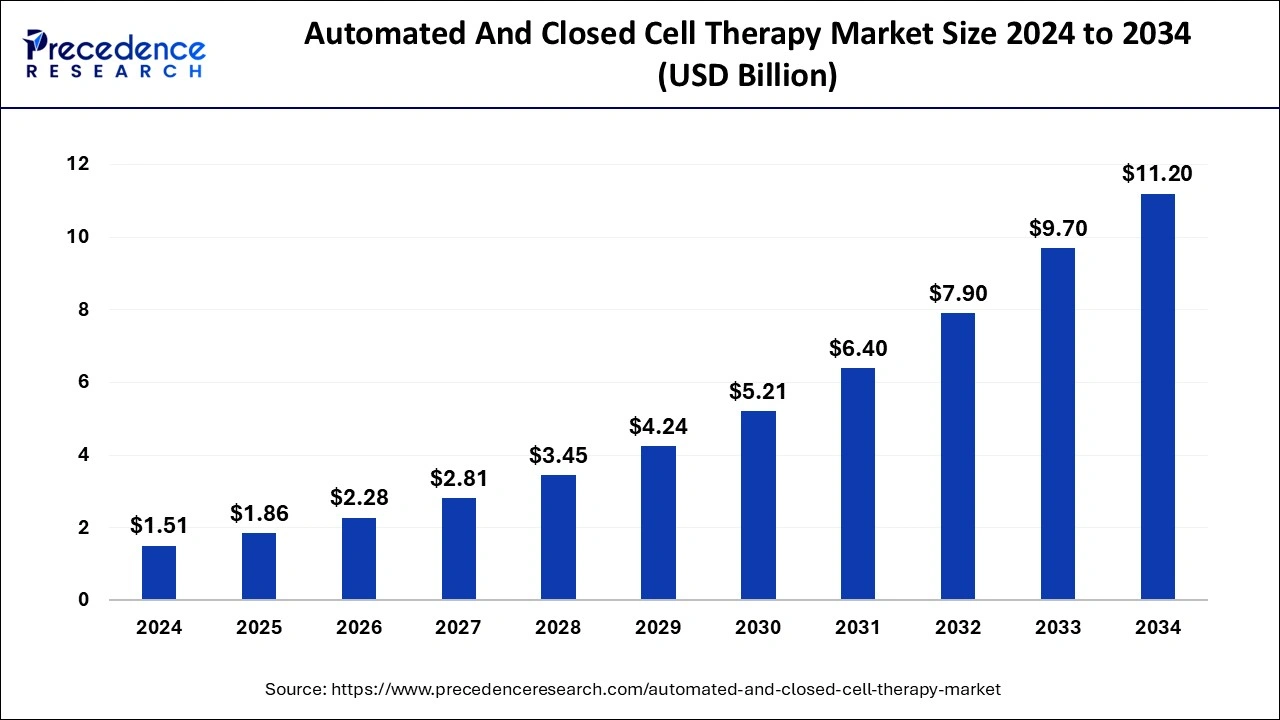

The global automated and closed cell therapy market size was calculated at USD 1.51 billion in 2024 and is predicted to reach around USD 11.20 billion by 2034, expanding at a CAGR of 22.19% from 2025 to 2034.

Automated and Closed Cell Therapy Market Key Takeaways

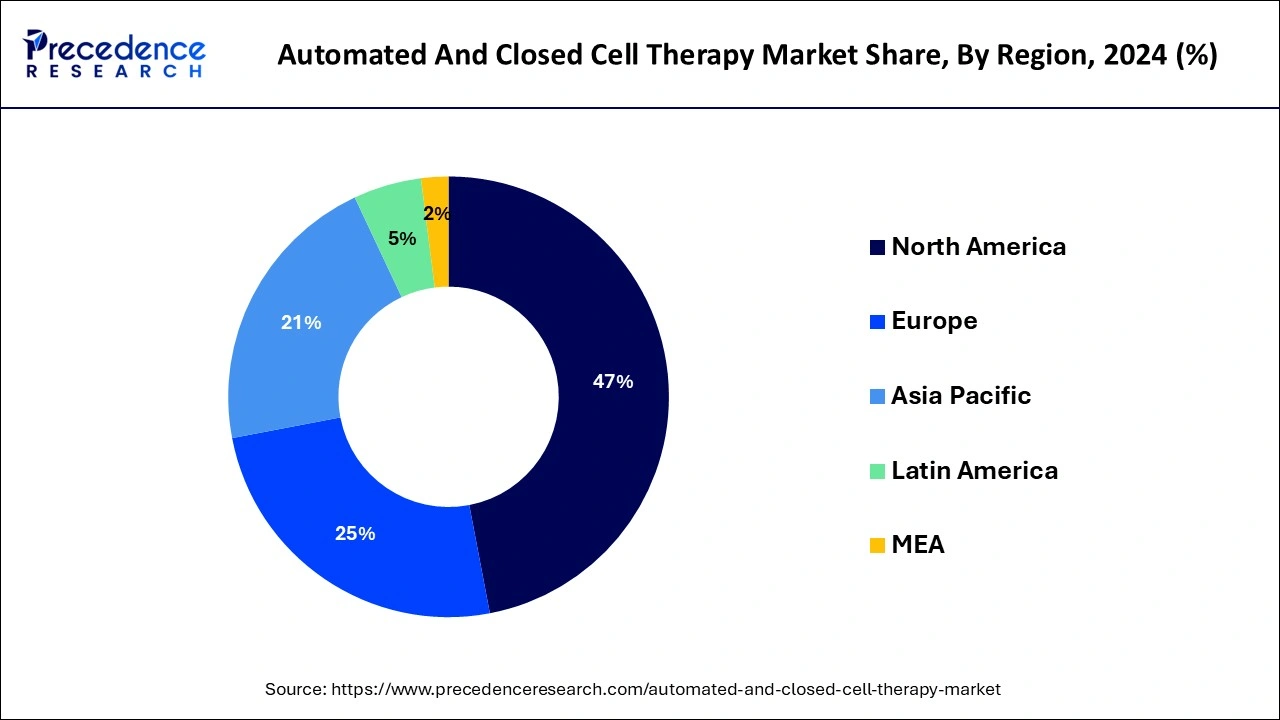

- North America led the market and captured the maximum market share of 46.24% in 2024.

- By Workflow, the expansion segment generated the largest market share in 2024.

- By Type, thestem cell therapy segment contributed to a maximum market share in 2024.

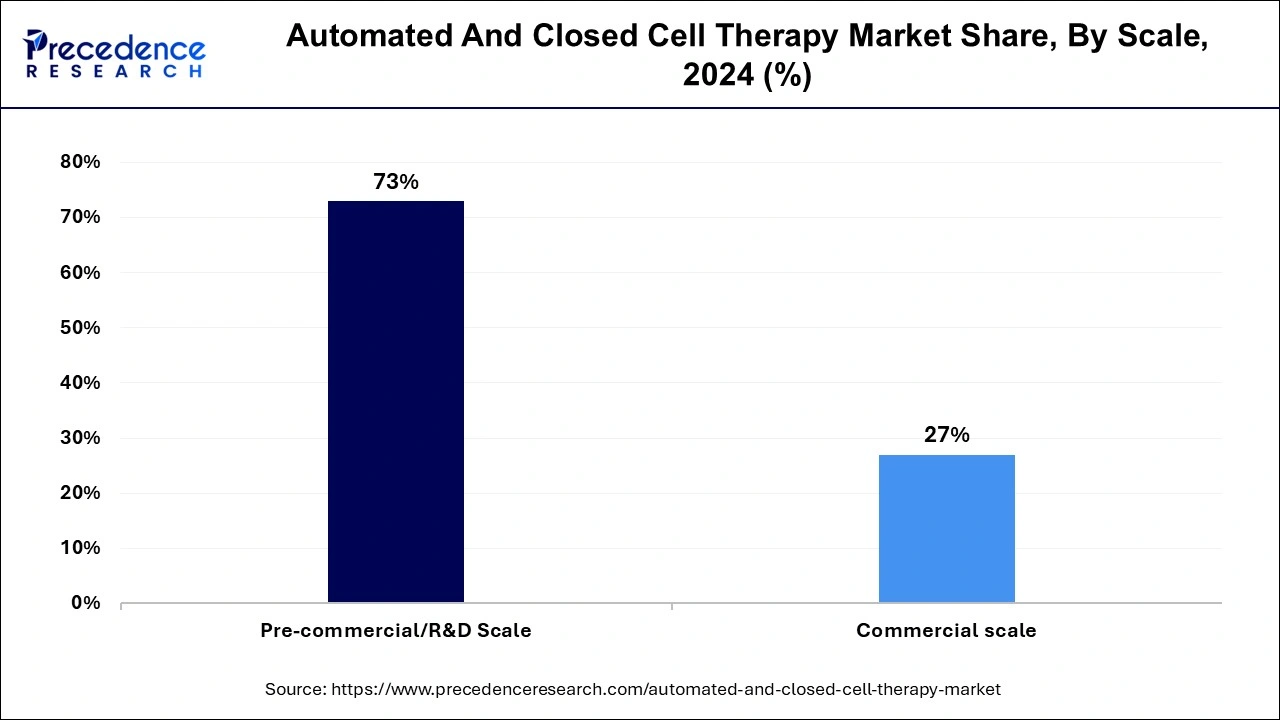

- By Scale, the pre-commercial/R&D scale generated the largest market share of 73% in 2024.

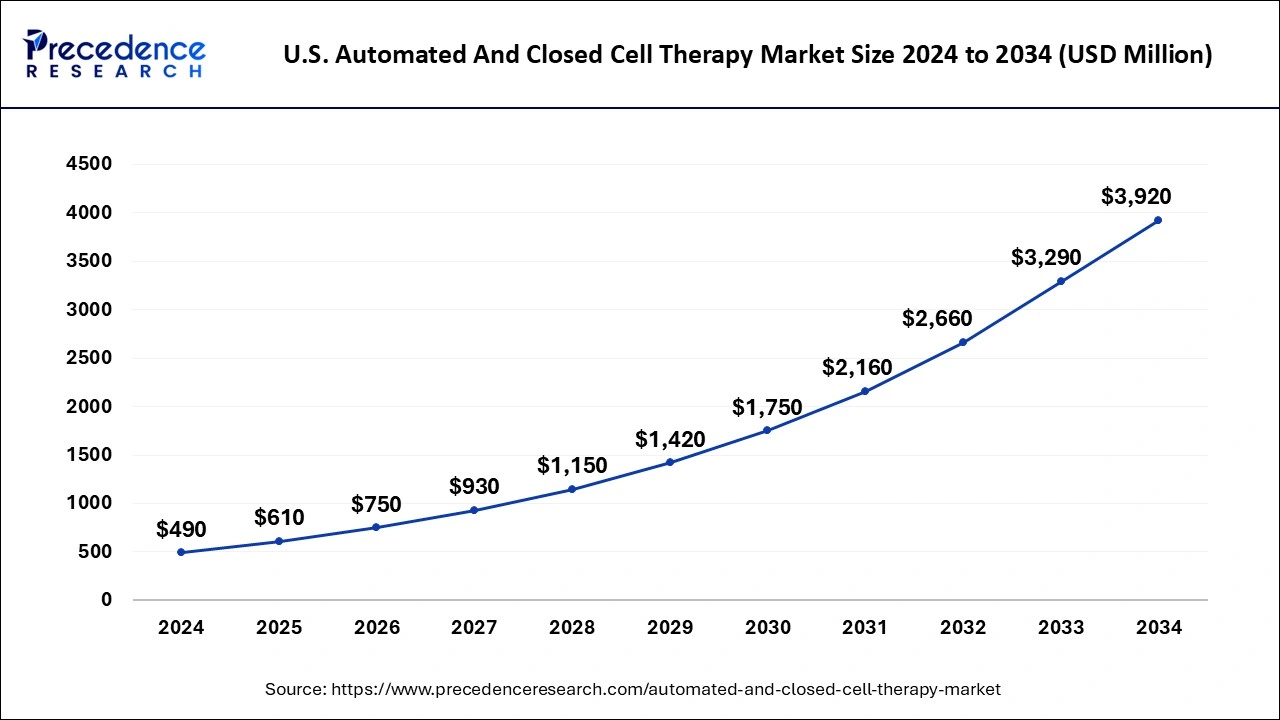

U.S. Automated and Closed Cell Therapy Market Size and Growth 2025 to 2034

The U.S. automated and closed cell therapy market size was evaluated at USD 490 million in 2024 and is projected to be worth around USD 3,920 million by 2034, growing at a CAGR of 23.11% from 2025 to 2034.

In 2024, North America dominated the market accounting highest market share. This is due to significant market players, favourable government initiatives, and increased research and development activities. The market is expected to grow significantly in the coming years due to the increasing demand for personalized medicineand the rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases. The US market is expected to grow significantly due to the favourable regulatory environment, increasing research and development investments, and a large patient population.

The US Food and Drug Administration (FDA) has provided guidelines for developing and manufacturing automated and closed-cell therapies, which has helped boost research and development activities in the country. Canada is also expected to grow significantly due to the increasing adoption of automated and closed-cell therapies, rising healthcare expenditure, and a well-developed healthcare infrastructure.

The Canadian government has also introduced various initiatives to support the development and adoption of personalized medicine, which is expected to drive market growth. Therefore, North America is a crucial region for the automated and closed cell therapy market, with the US and Canada significant contributors to the market's growth. The region is expected to grow substantially in the coming years due to the favourable regulatory environment, increasing adoption of personalized medicine, and a large patient population.

Market Overview

The automated and closed cell therapy market refers to the market for medical devices and equipment designed to automate and streamline the manufacturing and delivery of cell-based therapies, such as CAR-T, stem cell, and regenerative therapies medicine. These systems are typically closed and designed to minimize the risk of contamination and maintain sterility during the cell culture and manufacturing process.

It includes various products and services, such as automated bioreactors, cell sorters, and other equipment, as well as software and analytics tools to help manage and monitor the manufacturing process. The goal of these systems is to improve the safety, efficacy, and scalability of cell-based therapies, which have the potential to revolutionize the treatment of a wide range of diseases and conditions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.86 Billion |

| Market Size by 2034 | USD 11.20 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 22.19% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Workflow, Type, and Scale |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing prevalence of chronic and degenerative diseases

The increasing prevalence of chronic and degenerative diseases, such as cancer, diabetes, and cardiovascular diseases, is driving the market's growth. These diseases require long-term and often expensive treatment options, which have led to an increased demand for effective and affordable therapies. Cell therapy, which involves using living cells to treat or cure a disease, has shown promising results in treating various chronic and degenerative diseases. However, the traditional manual cell therapy process is time-consuming, labour-intensive, and has a high risk of contamination, limiting its scalability and adoption.

Automated and closed cell therapy systems address these limitations by providing a closed and controlled cell manipulation and processing environment. These systems also minimize the risk of contamination and variability, enhance cell viability and yield, and increase the efficiency and reproducibility of the cell therapy process. As a result, the automated and closed-cell therapy market is driven by the increasing demand for effective and affordable cell therapies for chronic and degenerative diseases.

Restraint

High cost

The high costs of developing, manufacturing, and administering automated and closed-cell therapies significantly restrain the market's growth. These therapies involve highly specialized equipment, materials, and processes, which can be expensive to acquire and maintain. Additionally, the high cost of research and development, clinical trials, and regulatory approval can increase costs to the overall development process. One of the significant factors contributing to the high costs of automated and closed-cell therapy is the need for specialized equipment and facilities. These therapies often require specialized manufacturing facilities, such as clean rooms and sterile environments, which can be costly to build and maintain.

The equipment needed to manufacture and administer these therapies, such as bioreactors and closed-cell culture systems, can also be expensive. Furthermore, these therapies often involve advanced technologies, such as gene editing and cell engineering, which require highly specialized knowledge and expertise. Additionally, the regulatory requirements for developing and approving these therapies can be lengthy and expensive, adding high costs to the overall development process.

Opportunity

Increasing demand for the regenerative medicine

Regenerative medicine is a field of medicine that aims to repair, replace, or regenerate damaged tissues and organs. This approach can potentially treat various conditions, from chronic diseases like diabetes and heart disease to acute injuries like spinal cord injuries and burns. Automated and closed-cell therapies are a vital part of the regenerative medicine field. These therapies involve specialized cells, often derived from the patient's body, to repair or regenerate damaged tissue. They can be used in various applications, from bone and cartilage regeneration to tissue engineering and wound healing. Several factors, including the ageing population, rising healthcare costs, and increasing patient awareness, drive the demand for regenerative medicine.

The ageing population is driving demand for new therapies to treat age-related conditions like osteoarthritis and macular degeneration. Automated and closed-cell therapies offer the potential to address these conditions in a more targeted and effective manner than traditional therapies. Moreover, Healthcare costs are on the rise, and regenerative medicine has the potential to reduce these costs by providing more effective and efficient treatments. Automated and closed-cell therapies have the potential to reduce hospital stays and minimize the need for additional surgeries.

Furthermore, Patients are becoming more aware of regenerative medicine and are seeking these treatments as alternatives to traditional therapies. This trend is driving demand for new and innovative regenerative medicine therapies. Thus, the demand for regenerative medicine presents a significant opportunity for the automated and closed-cell therapy market. Companies that are able to develop safe and effective therapies to meet this demand have the potential to capture a share of this growing market and improve patient outcomes.

COVID-19 Impact:

The COVID-19 pandemic has had a mixed impact on the Automated and Closed Cell Therapy market. While the pandemic has disrupted supply chains and slowed clinical trials, it has also created opportunities for companies operating in the cell therapy space. One of the significant impacts of the COVID-19 pandemic on the automated and closed cell therapy market has been the disruption of supply chains. With lockdowns and travel restrictions in place, it has become more challenging to transport raw materials and finished products. This has led to delays in the production and delivery of cell-based therapies.

Additionally, the closure of manufacturing facilities has also contributed to the slowdown in the market. The COVID-19 pandemic has also impacted clinical trials for cell-based therapies. Many hospitals and clinics focused on treating COVID-19 patients have delayed or suspended clinical trials for other conditions. This has resulted in a slowdown in the development and commercialization of cell-based therapies.

Workflow Insights

Based on workflow, the automated and closed cell therapy market is segmented into separation, expansion, apheresis, fill–finish, cryopreservation and Others. In 2024, the expansion segment accounted for the highest market share. This is due to the increasing demand for cell therapies and the need to generate sufficient cells for therapeutic use. Furthermore, cell culture technologies and automation advancements have made the expansion process more efficient and scalable, contributing to this segment's growth. However, it's important to note that the dominance of any particular segment can vary based on several factors, such as market dynamics, technological advancements, and regulatory changes.

Type Insights

Based on type, the market is segmented into stem cell therapy and non-stem cell therapy. In 2024, the stem cell therapy segment accounted for a high market share. Stem cell therapy involves using stem cells to repair or replace damaged or diseased cells and tissues. Stem cells can differentiate into different types of cells and have the potential to regenerate damaged tissue, making them a promising area of research for a variety of medical conditions. Several types of stem cells are used in therapy, including embryonic stem cells, adult stem cells, and induced pluripotent stem cells (iPSCs). Embryonic stem cells are derived from embryos and have the potential to differentiate into any cell type in the body.

Adult stem cells are found in various tissues throughout the body and can differentiate into a limited number of cell types. iPSCs are generated by reprogramming adult cells to an embryonic-like state, allowing them to differentiate into many different cell types. Stem cell therapy has shown promising results in various treatments such as Neurological disorders such as Parkinson's disease, multiple sclerosis, spinal cord injuries, and cancer, particularly blood cancers such as leukaemia and lymphoma. While stem cell therapy is still relatively emerging, it has shown great potential for treating many conditions. However, more research and clinical trials are needed to fully understand the safety and efficacy of stem cell therapy for different indications.

Scale Insights

Based on the scale, the market is segmented into Pre-commercial/R&D Scale and commercial scale. In 2024, the pre-commercial/R&D scale accounted for the highest market share during the forecast period. The pre-commercial/R&D scale segment of the automated and closed cell therapy market includes companies still in their products' research and development phase and have not yet scaled up for commercial production. At this stage, companies are typically focused on conducting small-scale experiments, laboratory testing, and pilot projects to refine and prove the viability of their technology.

In this segment, companies focus on developing and testing new technologies, processes, and techniques for automating and closing the manufacturing process of cell therapies. They are conducting clinical trials to test the safety and efficacy of their products and working to refine their manufacturing and quality control processes. Therefore, the pre-commercial/R&D scale segment is essential in developing new automated and closed-cell therapy products. It lays the groundwork for their eventual commercialization and establishes their potential to improve patient outcomes.

Recent Developments

- In October 2021, Miltenyi Biotec launched the CliniMACS Prodigy X, a fully automated cell and gene therapy manufacturing platform.

- In August 2021, Thermo Fisher Scientific acquired PPD, a leading global contract research organization (CRO) providing discovery, development, and post-approval services.

- In June 2021, Lonza announced the launch of the Cocoon Platform, an automated system to produce personalized cell and gene therapies.

- In May 2021, Terumo BCT announced the acquisition of GID Group, a leading provider of closed-system cell and gene therapy manufacturing solutions.

- In March 2021, Sartorius Stedim Biotech acquired the majority stake in Israeli start-up Novasep Holding SAS, a chromatography and membrane filtration technologies provider for biopharmaceutical manufacturing.

Automated and Closed Cell Therapy Market Companies

- Thermo Fisher Scientific Inc.

- Miltenyi Biotec GmbH

- Sartorius AG

- Lonza Group AG

- Terumo BCT, Inc.

- Fresenius SE & Co. KGaA

- GE Healthcare

- Pall Corporation

- Asahi Kasei Corporation

- Merck KGaA

Segments Covered in the Report

By Workflow

- Separation

- Expansion

- Apheresis

- Fill – Finish

- Cryopreservation

- Others

By Type

- Stem Cell Therapy

- Non- Stem Cell Therapy

By Scale

- Pre-commercial/R&D Scale

- Commercial scale

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting