Automotive Air Suspension Systems Market 2025 Poised for Dynamic Growth with 4.88% CAGR

Automotive Air Suspension Systems Market

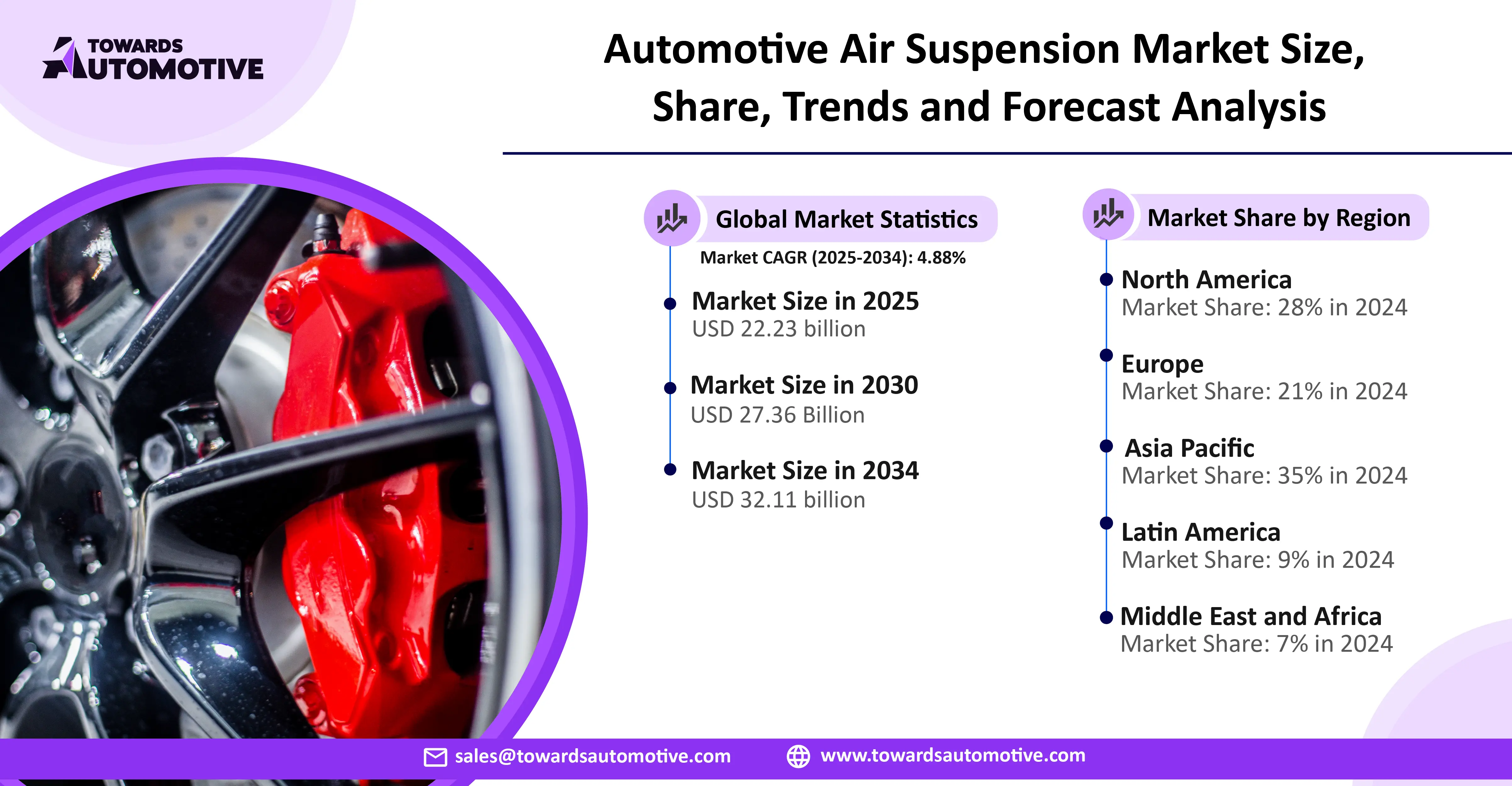

The global automotive air suspension systems market is anticipated to grow from USD 22.23 billion in 2025 to USD 32.11 billion by 2034, with a compound annual growth rate CAGR of 4.88% during the forecast period from 2025 to 2034. This market is rising due to growing demand for comfort, safety, efficiency, and advanced vehicle technologies.

Global Outlook

The global automotive air suspension systems market is experiencing steady growth and demand for improved driving comfort; vehicle stability and overall ride quality are some of the key influences. More luxury cars, heavy-duty trucks and buses are designed with multi-chamber suspension systems which will continuously lead growth across all automotive categories. Integration of intelligent vehicle systems positively impact vehicle performance & efficiency.

The rise of the electric vehicle (EV) and aftermarket autonomous vehicle (AV) market promotes further opportunities with manufacturers offering and utilizing modern lightweight materials and unique suspension solutions ensuring reliable service life and energy efficiency.

The advancement of urbanization, infrastructure, demands and logistics and construction interest will continue to elevate demand for better performing commercial vehicles with greater load carrying attributes than traditional heavyweights. The high initial costs of an air suspension system is suppressing market growth, but in the long-term it will lead to acceptance via lower maintenance costs and improved fuel efficiency of air suspension solutions globally.

Market Opportunity

Emerging Opportunities in the Global Automotive Air Suspension Systems Market

The automotive air suspension systems market brings a number of opportunistic possibilities driven by shifting consumer preferences, and transformation in the automotive industry. As demand for luxury and premium vehicles increases, especially in emerging economies, advanced suspension technologies have pioneering space within the growing market conditions. The shift to electric and autonomous vehicles also offers emerging market entry possibilities for air suspension systems that are unique, lightweight and energy efficient.

These innovations are supportive of battery performance and ride stability. Additionally, the growth of commercial transport and logistics worldwide is creating potential urgency for continued adoption of air suspensions in heavy-duty trucks and buses and larger commercial vehicles that assure durability and optimize loads. The recent focus on smart mobility, connected-vehicle capabilities and user comfort and convenience has created an environment whereby manufacturers are investing in electronically controlled intelligent suspension systems - encouraging competition and new advancements in automotive air suspension systems market space.

Key Growth Factors

- Growth of Luxury Car Demand – The shift in consumers towards premium vehicles offering greater ride comfort and stability is an important driver for growth.

- The Growing Commercial Transport – Both heavy-duty trucks and buses are moving to air suspension systems to increase load capacities and durability.

- New Technologies – Advances and developments in electronically controlled air suspension systems (ECAS) and smart systems for vehicles are increasing efficiency and performance.

- Development of Electric & Autonomous Vehicles – The lightweight properties of air suspension as well as advantageous energy consumption and driving characteristics provide a benefit to electric vehicles and self-driving cars.

- Urbanization & Infrastructure Development – Rapid growth and activity in logistics and passenger mobility will help spur overall adoption of automotive air suspension systems around the world.

- Longer-Term Value Offerings – Reduced maintenance practices and improved fuel economy will entice and promote automotive air suspension systems in the marketplace.

Restraint

Obstacles and Limitations in the Automotive Air Suspension Market

The automotive air suspension systems market shows promise for strong growth, but will continue to face limitations that can have an impact on growth. One of the key obstacles in the automotive air suspension systems market is the significant installation and manufacturing cost which limits adoption in cost-sensitive markets. The automotive air suspension system also requires more complex design and maintenance that makes ownership costs higher that discourage adoption in mid-range vehicles. The market continues to deal with limited after-market availability and dependence on specific service providers which can make repair or replacement expensive. In addition to fluctuating raw material costs, and supply chain disruptions with raw materials also continue to put pressure on manufacturing costs.

Segment Insights

Component insights

With its significant impact on ride comfort, load-carrying capacity, and stability, the air spring component currently has the highest market share in the global automotive air suspension systems market and is the leading component driving overall growth of the market. With increased popularity of air springs in nearly all luxury vehicles, buses, and heavy-duty trucks, air springs will continue to be a crucial component in the global automotive air suspension systems market.

The tank component has the highest growth rate in the automotive air suspension systems market, primarily driven by demand for enhanced pressure management as well as improved performance for air suspension systems. Increased inclusion of air tanks in both passenger vehicles and commercial trucks is giving consumers consistent airflow, durability, and responsiveness to pressure management. Therefore, air tanks are benefitting from a global increase in adoption and market growth.

Type insights

The electronically controlled air suspension (ECAS) segment accounts for the largest share of the global automotive air suspension systems market due to its ability to provide exact ride height adjustment, improved stability and superior ride comfort. The fact that it is offered as standard equipment in luxury vehicles, premium SUVs and commercial fleets of vehicles, illustrates it is leading the way in advancing smart mobility technologies around the globe.

The non-electronic air suspension segment is experiencing exponential growth as it is relatively inexpensive and has a more simplistic design and is a growing choice in developing markets for affordability. More vehicles are being production in mid-tier segments and commercial fleets are choosing non-electronical air suspension systems, which is why there is a broaden segment of demand, making it an opportunity that is fast growing in the market.

Geographical Outlook

North America

North America commands a sizeable share of the automotive air suspension systems market, supported by strong demand for luxury sedans, light-duty commercial fleets and advanced transportation solutions which demonstrate largely unconstrained growth rates. Consumers in North America are already spending a relatively high amount of money in the automotive space, while, the sector can continually push more levels of technology, driven by legacies who are well-placed to capture ongoing adoption of electronically controlled air suspension systems.

Asia-Pacific

The Asia-Pacific region has the second largest share of growth in the automotive air suspension systems market, as a result of rapid urbanization and development, increasing automotive production and increasing personal income. With demand for driver comfort rising, the logistics sector growing alongside recent options for commuting, the presence of air suspension systems will experience high levels of growth in most emerging market areas.

Strategic moves by key players

- On May 9, 2024, Exeed (Chery’s premium brand) officially launched the Sterra ET SUV equipped with an adaptive air suspension system by KHAT that uses LiDAR for real-time ride-height adjustment marking a notable leap in smart comfort technologies.

- On June 3, 2024, Nidec Motor (Dalian) unveiled a compact brushless motor for air suspension compressors, offering enhanced responsiveness, durability, and efficiency in pressure management systems.

Source: https://www.towardsautomotive.com/insights/automotive-air-suspension-systems-market-size