Electric And Fuel Cell Truck Market Size To Hit 43.7 Bn By 2030

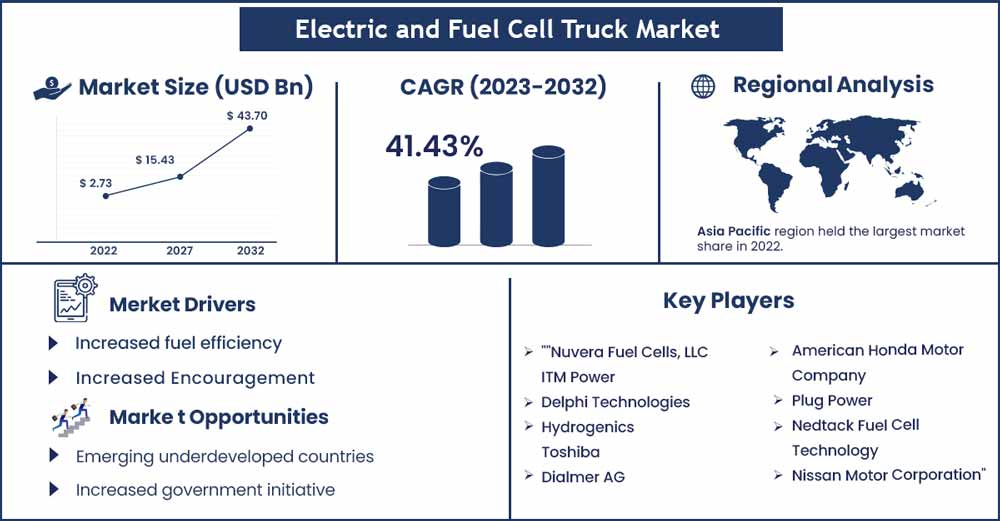

The global electric and fuel cell truck market size surpassed USD 1.93 billion in 2022 and is predicted to hit around USD 43.7 billion by 2030, expanding at a CAGR of 41.43% during the forecast period 2022 to 2030. Increased demands for the developed technologies in the electric and fuel cell truck market.

The rapid acceptance of the newly developed technologies in the electric and fuel cell truck with increased transportation of goods and increased research and development for improving more technologies have enhanced the electric and fuel cell market rate. Increased energy underdeveloped countries with wide applications of fuel cells in trucks, buses, commercial vehicles, and passenger vehicles have increased the market size to a larger extent.

Increased government initiatives to increase the electric and fuel cell market with an increased focus on zero-emission and less noise pollution have gained more attention to enhance the market during the forecast period. The key market players involved in introducing the new technologies in electric and fuel cell trucks with increased investments have extended the market growth to a larger extent.

Report Highlights:

- By type, PEMFC accounts for the increased market in fuels cells. Phosphoric acid fuel cells also widely used in the automotive sector with increased demands from the customer and enhanced market rate.

- By power rating, the 200kW having considerable growth in the electric and fuel cell trucks.

- By vehicles, the passenger vehicle to hold the largest position, bus with the second highest position, followed by light commercial vehicles and trucks.

- By geography, Asia Pacific region to hold the top position in the electric and fuel cell truck market with increased transportation and increasing demands have enhanced the market growth. North America also with significant contribution with the increased market rate. Other regions such as Europe, Latin America, the Middle East and Africa contributed to increase the electric and fuel cell truck market to grow.

Regional Snapshots:

Electric and fuel cell truck based on the geographical sector. Asia Pacific region to hold the largest position on the electric and fuel cell truck with increased transportation and developed infrastructures along with zero emission of carbon and less noise pollution have gained the attention led to increased market growth of electric and fuel cell trucks. Other regions such as North America also the leading region to increase the market due to increased research and development for developing newer technologies and increased government initiatives to increase the developments with the focus of zero-emission and less noise contributes to increasing the growth. Latin America, Europe, the Middle East and Africa are included in enhancing the electric and fuel cell truck market.

Electric And Fuel Cell Truck Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 3.86 Billion |

| Projected Forecast Revenue in 2030 | USD 43.7 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 41.43% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2022 to 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics:

Drivers:

Increased fuel efficiency in the electric and fuel cell trucks as compared to the other convenient trucks with increased demand from the market for fuel-efficient trucks. Which enhanced the market of electric and fuel cell truck at a larger extent. Increased government interest in developing electric and fuel cell truck due to less emission of carbon and noise pollution with increased focus on environment with maintaining global system with rising investments from the market players in the automobile industry and develop more technologies in electric and fuel cell trucks with more research and development. Striving growth of the electric and fuel cell trucks with continuous development and manufacturing of the new developments with increased research and development enhanced the market growth.

Restraints:

The major factor that could affect the market rate is the increased cost of the electric and fuel cell truck with increased demand from the market fore new technologies and development led to high costing of the materials required for manufacturing. Hydrogen and oxygen is used in fuel cells through the chemical reaction electricity is produced and stored in the batteries. Hydrogen need to be handled carefully because hydrogen is highly flammable and can cause fire. If in the vehicle hydrogen gas in placed and if the spark of electric power gets in contact with the hydrogen gas it can explode with fire. Due to highly flammable properties of hydrogen gas can led to hamper thr electric and fuel cell truck market rate.

Opportunities:

Increased demands from the market for newly developed technologies with new features installed in the vehicles. Driving the market of electric and fuel cell truck with less emission of carbon from the vehicles and decreased noise from the trucks. Which contributes to maintaining the environment with green ecosystem. Fuel cells are utilized widely in the automotive industry such as buses, trains, passenger vehicles, light commercial vehicles and many more. It can be used as power bank with stored electric power in the battery and can be utilized whenever required. Increased government support to develop the trucks with rising transportation with the increased focus on maintaining the green ecosystem and increasing the market rate with research and developments.

Challenges:

The high cost of the newly developed technologies in electric and fuel cell truck enhanced the prices of the material used in fuel cells could act as challenge to increase the market rate and hamper the growth rate. Utilization of hydrogen in the cell which is highly flammable can cause fire contact of electric power and hydrogen gas can explode which hinder the market of electric and fuel cell truck. Increased availability of options alternative to the electric and fuel cell trucks with low cost of the alternatives can affect the market and declines the growth of the electric and fuel cell truck.

Recent Developments:

- The Turnkey hydrogen solution provided by the Plug Power Inc, in the year 2021 October with increased benefits such as global environment and a clean and green ecosystem. Lunching of HYVIA hydrogen 'Renault Master Van H2- Tech protype in 2021. Manufacturing of van powered with hydrogen fuel cell in North America.

- Launching of Arcola Energy an engineering industry with UK based specialization in train and other vehicles with fuel cell powered with hydrogen with new integrated system from the Ballard Power System in the year 2021 November.

- Introduction of manufacturing the H20z buz designed with the project in the year 2020 May, hydrogen energy manufactured by ITM power. It includes system of transits collaboration of partners such as Ballard Power System, ITM Power, Sea-link Travel Group, Palisade investment partners. In Australia increased electric buses for public transportation with increased evaluation and higher performance.

Major Key Players:

- Nuvera Fuel Cells, LLC

- ITM Power

- Delphi Technologies

- Hydrogenics

- Toshiba

- Dialmer AG

- American Honda Motor Company

- Plug Power

- Nedtack Fuel Cell Technology

- Nissan Motor Corporation

- Toyota Motor Company

- Hyundai Motor Company

- Ballard Power Systems

- W.L. Gore and Associates

- Bing Energy

- Hauzer Techno Coating B.V.

- Sinocat Environmental Technology Co, Ltd

- Wuhan Tiger FCV

- Valmet Automotive

- Symbio

- StreetScooter

- Ceres Power

- AVL

- Bosch

- ElringKlinger

- Faurecia

- FEV Group GmbH

- Inteligent Energy

- Continental Industries

- Wystrach

- Wind2Gas Energy GmbH & Co KG

- UQM Technologies

- Umicore

Market Segmentation:

By Type

- Phosphoric Acid Fuel Cell

- Proton Exchange Menbrance Fuel Cell

- Others

By Power Rating

- Below 100 kW

- 100 - 200 kW

- Above 200kW

By Vehicles

- Light Commercial Vehicles

- Passenger Vehicles

- Bus

- Trucks

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2134

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333