Embedded Systems Market To Attain Revenue USD 258.6 Bn By 2032

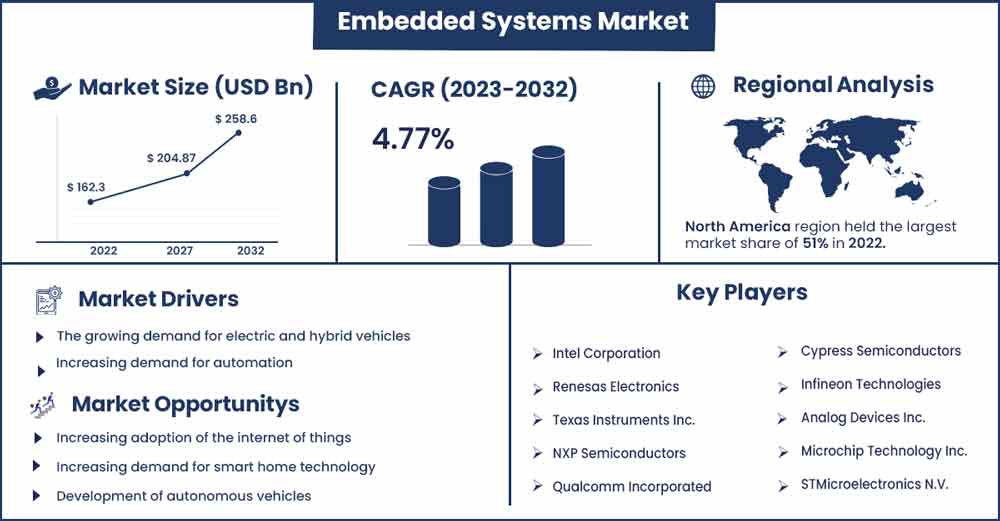

The global embedded systems market revenue was evaluated at USD 162.3 billion in 2022 and is expected to attain around USD 258.6 billion by 2032, growing at a CAGR of 4.77% from 2023 to 2032.

An embedded system is a computer integrated into a larger mechanical or electrical system to control, monitor, or operate it. These systems are designed to perform specific tasks, often in real-time, with high reliability and efficiency. They are used in various applications, from simple devices like calculators and digital watches to complex systems like automobiles, airplanes, and industrial machinery.

The continuous advancements in technology, such as the Internet of Things (IoT), artificial intelligence (AI), and 5G, have greatly increased the demand for embedded systems. Embedded systems are essential for enabling these technologies to function effectively. Also, the increasing use of connected devices, such as smartphones, smart homes, and wearable technology, has driven the demand for embedded systems. Embedded systems control and monitor these devices, making them essential for their functioning.

Regional Snapshots:

The embedded systems market is expected to experience the highest market share from the North America region during the forecast period. The U.S. dominates nearly all of the embedded systems market. The region has a high demand for connected devices, such as smartphones, tablets, and wearables, which have been on the rise in the U.S. Embedded systems are used to control and monitor these devices, making them essential for their functioning. Furthermore, the U.S. has been at the forefront of the Industry 4.0 revolution, focusing on automation, data exchange, and cyber-physical systems.

Embedded systems are a critical component of Industry 4.0, enabling the automation and monitoring of complex systems and processes. The automotive industry is a significant user of embedded systems in the U.S., focusing on infotainment systems, driver assistance systems, and electric and hybrid vehicles. Thus, the U.S. is a significant market for embedded systems, with a high degree of technological advancement and innovation in the field and several key growth and demand drivers.

Embedded Systems Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 170.04 Billion |

| Projected Forecast Revenue by 2032 | USD 258.6 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.77% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights:

- On the basis of application, it is divided into automotive, consumer electronics, industrial, aerospace and defense, and others. The automotive segment has gained a major share of the global market.

- On the basis of components, it is divided into hardware and software. The hardware segment has gained a major share of the global market.

- Based on geography the embedded systems market has been expected to experience the highest market share from the North America region during the forecast period.

- On the basis of geography, the Embedded Systems market, North America, is serving as the most dominating region among others. The dominance of the Embedded Systems market is largely due to the high degree of technological advancement and innovation in North America.

Market Dynamics:

Drivers:

The growing use of connected devices is one of the key drivers of the embedded system market. With the increasing demand for smartphones, smart homes, wearables, and other IoT devices, the need for embedded systems to control and monitor these devices has grown significantly. It is used in these devices to perform various functions such as data processing, communication, sensing, and control. For example, in a smart home, embedded systems are used to control lighting, temperature, security, and other functions.

The healthcare industry has also witnessed significant growth in connected devices, such as wearable health monitoring devices, pacemakers, and insulin pumps. Embedded systems are essential for the functioning of these devices, enabling data collection, monitoring, and processing. The automotive industry is also a significant user of embedded systems, with the growing demand for infotainment systems, driver assistance systems, and electric and hybrid vehicles. Embedded systems are used in these devices to enable features such as GPS navigation, music playback, and voice recognition.

Opportunities:

With the rapid advancement of Industry 4.0, there is a growing need for automation, data exchange, and cyber-physical systems to optimize and streamline manufacturing processes. Embedded systems play a critical role in automation by controlling and monitoring machines and processes in real-time. For instance, they are used in industrial robots to enable precision control of movements and speeds, as well as to monitor sensor data to ensure safety. The use of embedded systems in automation extends beyond just manufacturing. They are also used in home automation, smart buildings, and smart cities, enabling efficient management of systems and resources.

Moreover, the increasing demand for autonomous vehicles, drones, and other autonomous machines has also led to a surge in demand for embedded systems. These devices require a high degree of automation, and embedded systems are the key technology that enables this automation. Thus, the increasing demand for automation across various industries is a significant driver of the embedded system market, with the demand for embedded systems expected to grow significantly.

Recent Developments:

- In June 2020, Arm announced the launch of its new Cortex-A78AE processor, designed to deliver high-performance computing capabilities for advanced driver-assistance systems (ADAS) and autonomous vehicles.

- In July 2020, Cypress Semiconductor announced the launch of its new Traveo II family of automotive microcontrollers, designed to deliver high-performance computing capabilities for automotive applications.

- In November 2019, NXP Semiconductors acquired Marvell's Wi-Fi and Bluetooth connectivity assets to expand its product portfolio in the IoT market.

Key Market Players:

- Intel Corporation

- Renesas Electronics

- Texas Instruments Inc.

- NXP Semiconductors

- Qualcomm Incorporated

- Cypress Semiconductors

- Infineon Technologies

- Analog Devices Inc.

- Microchip Technology Inc.

- STMicroelectronics N.V.

Market Segmentation:

By Function

- Standalone System

- Real-Time System

- Network System

- Mobile System

By Application

- Automotive

- Consumer Electronics

- Manufacturing

- Retail

- Media & Entertainment

- Aerospace and Defense

- Telecom

- Others

By Components

- Hardware

- ASIC & ASSP

- Microcontroller

- Microprocessor

- Power Management Integrated Circuit (PMIC)

- Field Programmable Gate Array (FPGA)

- Digital Signal Processor (DSP)

- Memory

- Software

- OS

- Middleware

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2759

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333