What is the Embedded Systems Market Size?

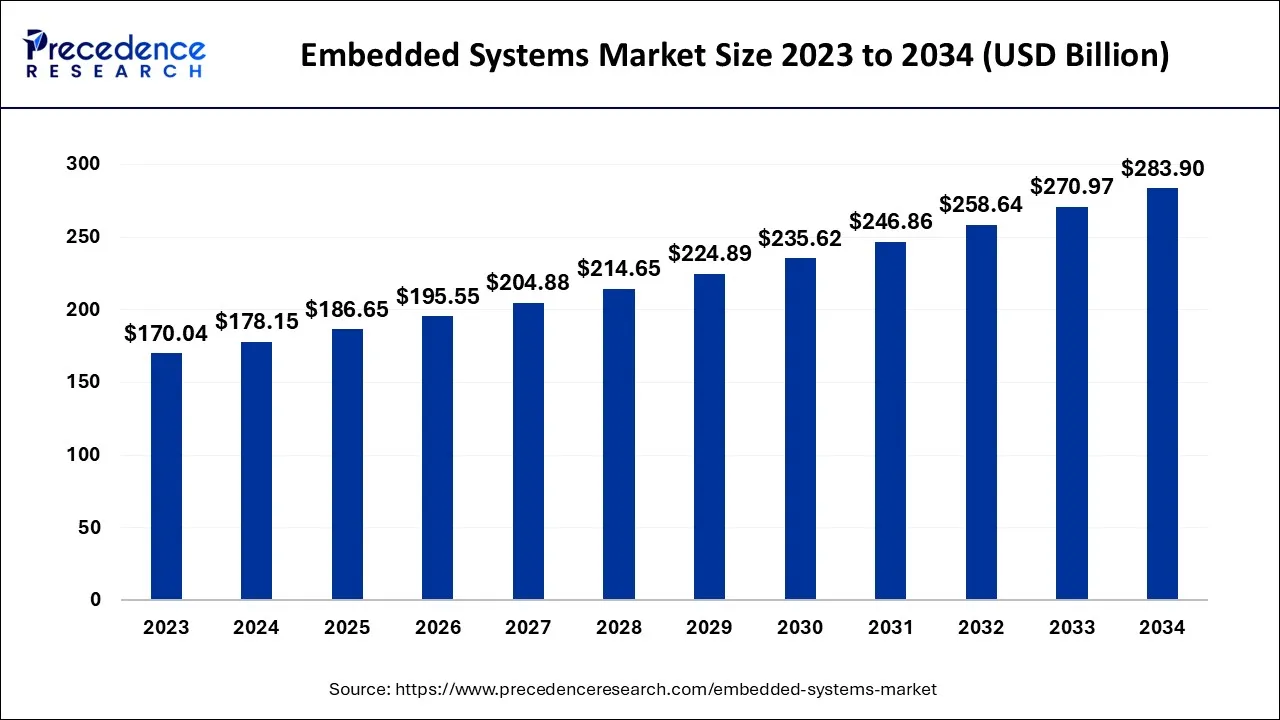

The global embedded systems market size is expected to be valued at USD 186.65 billion in 2025, and is projected to hit around USD 195.55 billion by 2026, and is anticipated to reach around USD 296.43 billion by 2035, expanding at a CAGR of 4.73% over the forecast period from 2026 to 2035.

Embedded Systems Market Key Takeaways

- In terms of revenue, the market is valued at $186.65 billion in 2025.

- It is projected to reach $283.90 billion by 2035.

- The market is expected to grow at a CAGR of 4.77% from 2026 to 2035.

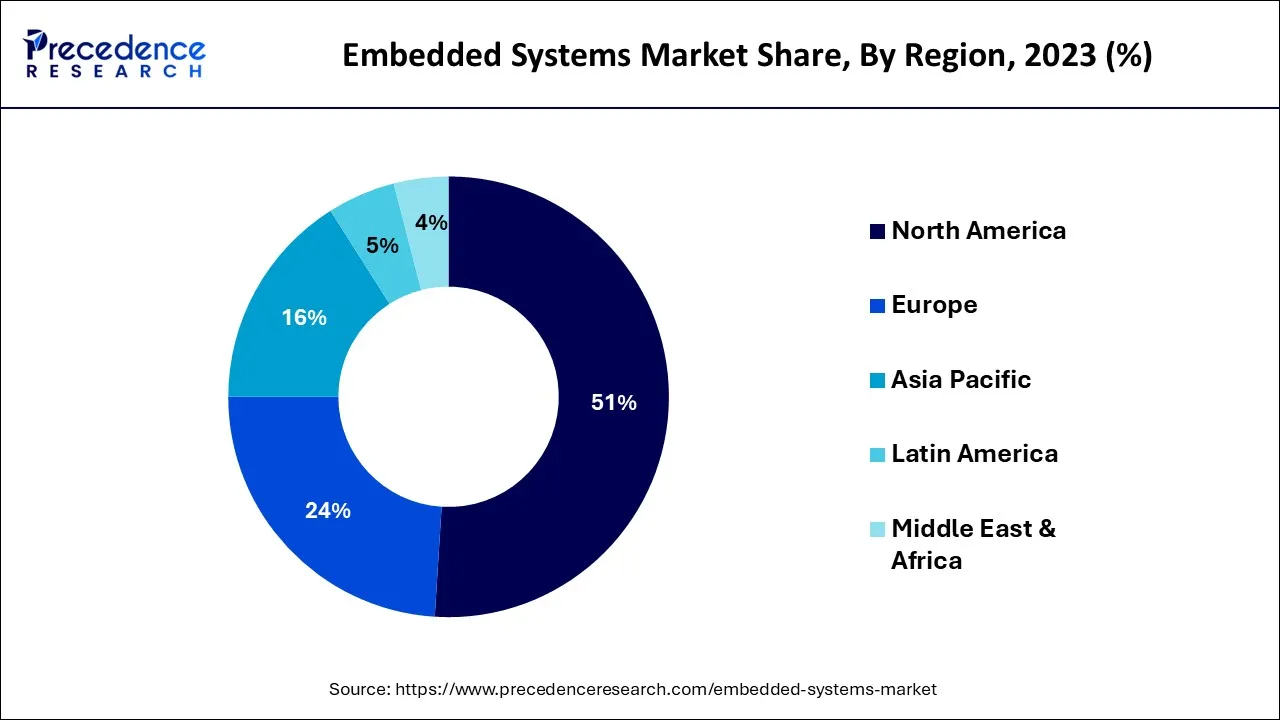

- North America has accounted for 51% of revenue share in 2025.

- Asia Pacific has held a 24% revenue share in 2025.

- By function, the standalone system segment has held a 69% revenue share in 2025.

- The mobile system segment has generated a revenue share of around 13% in 2025.

- By hardware, ASIC & ASSP segment has generated a 31.5% revenue share in 2025.

- The microprocessor segment has captured a 22.3% revenue share in 2025.

- By Application, the manufacturing segment has accounted for 11% of revenue share in 2025.

Market Overview

The embedded systems market is the market for computer systems integrated into other devices or systems to control or monitor their operations. These systems are designed to perform specific functions and are used in various applications, including automotive, healthcare, industrial automation, and consumer electronics. They are typically designed to be highly reliable and efficient, with low power consumption and small form factors. They can be programmed to perform various functions, such as controlling machines, monitoring sensors, collecting and transmitting data, and managing power and resources.

Furthermore, increasing demand for automation, connected devices, advancements in microprocessor technology, IoT adoption, smart homes and buildings, and medical devices. Additionally, the emergence of new technologies and advancements and the growing demand for electric and hybrid vehicles are the major factors driving the growth of the embedded systems market.

The Internet of Things (IoT) adoption drives the demand for embedded systems to collect and transmit data from connected devices to cloud-based applications. This data can then be used for analysis and decision-making. The advancements in microprocessor technology, such as miniaturization, low power consumption, and high processing power, are enabling the development of more sophisticated and complex embedded systems has fueled the global embedded systems market growth over the last few decades.

However, high development costs and the complexity of integration are anticipated to impede market growth. Integrating embedded systems into existing devices or systems can be complex and time-consuming, requiring specialized expertise and skills. This can limit the adoption of embedded systems in some applications and industries.

The COVID-19 pandemic have increased demand for healthcare applications. As healthcare systems around the world struggled to cope with the pandemic, there was a need for innovative solutions to help monitor and manage patient care. This has increased demand for medical devices and equipment, such as ventilators, monitors, and diagnostic tools, which rely heavily on embedded systems technology.

Artificial Intelligence: The Next Growth Catalyst in Embedded Systems

AI is significantly impacting the embedded system industry by driving a shift towards intelligent edge computing and enhancing the capabilities of devices with local, real-time decision-making abilities. This integration is enabling embedded systems to perform complex tasks like predictive maintenance, autonomous navigation, and sophisticated image recognition directly on-device, reducing latency and dependence on constant cloud connectivity.

Embedded Systems Market Growth Factors

The demand for accurate and reliable for accurate and reliable testing is the factor that propelled the market demand. The various factors are helping to drive the market are:

- Increasing demand for automation

- The growing use of connected devices

- Growing demand for electric and hybrid vehicles

Market Outlook

- Market Growth Overview: The embedded systems market is expected to grow significantly between 2025 and 2034, driven by the rising demand for smart home devices, wearables, and advanced electronics, the integration of advanced technology, and the massive expansion of connected devices.

- Sustainability Trends: Sustainability trends involve energy-efficient design, circular economy, lifecycle management, and enabling broader green initiatives.

- Major Investors: Major investors in the market include Intel, NVIDIA, Qualcomm, STMicroelectronics, Andreessen Horowitz, Lux Capital, Sequoia Capital, and EIC Fund.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 296.43 Billion |

| Market Size in 2025 | USD 186.65 Billion |

| Market Size in 2026 | USD 195.55 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.73% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Function, By Application and By Components |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing use of embedded systems technology for healthcare applications to brighten the market prospect

As healthcare systems worldwide become increasingly advanced and complex, there is a growing need for innovative medical devices that can improve patient outcomes, reduce costs, and increase efficiency. Embedded systems technology is crucial in developing these devices, providing the processing power, memory, and connectivity needed to support advanced functionality. For instance, devices monitor vital signs such as blood pressure, heart rate, and oxygen saturation levels. They often rely on embedded systems technology to collect, process, and transmit data and to provide alerts and notifications when abnormal values are detected.

In addition, there is also a growing demand for connected medical devices that can transmit data to healthcare providers in real-time. This drives the adoption of IoT-enabled medical devices, which often rely on embedded systems technology to support their connectivity and data processing requirements. Thus, the rising demand for medical devices is expected to drive the embedded systems market. As healthcare systems become increasingly advanced and connected, there is likely to be a growing need for innovative embedded systems solutions to support the development of new and improved medical devices.

Increasing demand for electric and hybrid vehicles

Growing demand for electric and hybrid vehicles further helps increase demand for the embedded system market. In the case of electric and hybrid vehicles, embedded systems are used for various functions such as controlling the electric motor, managing battery charging and discharging, monitoring the vehicle's performance, and providing information to the driver.

As the demand for electric and hybrid vehicles continues to grow, the demand for embedded systems that can handle these functions is also increasing. In addition, as these vehicles become more advanced and sophisticated, the complexity of the embedded systems required to run them also increases.

As a result, the embedded system market is expected to grow considerably, largely driven by the increasing demand for electric and hybrid vehicles. This growth is expected to be particularly strong in areas such as automotive electronics, power management systems, and electric vehicle charging infrastructure, which relies heavily on embedded systems technology.

Key Market Challenges

The high cost of embedded systems is causing hindrances to the market

The high manufacturing cost of embedded systems can restrain the demand for embedded systems in the market. Embedded systems can be complex to design and manufacture, requiring specialized components and production processes. This can result in higher manufacturing costs, making it difficult for some companies to enter and drive up consumer prices. In addition, the cost of developing embedded systems can be significant, particularly for highly specialized applications or industries with strict safety or regulatory requirements. This can be a significant barrier to entry for smaller companies and limit the pace of innovation in the market.

However, it is worth noting that the cost of embedded systems has been declining over time, partly due to technological advances and economies of scale. As demand for embedded systems grows, manufacturing costs will likely continue to decrease, making these systems more accessible to a broader range of companies and industries.

Key Market Opportunities

These are the following factor which is likely to create opportunity over the forecast period.

- Development of autonomous vehicles

- Increasing adoption of the internet of things

- Increasing demand for smart home technology

Segment Insights

Application Insights

On the basis of application, the embedded systems market is divided into automotive, consumer electronics, industrial, aerospace and defense, and others, with the automotive accounting for most of the market. This is partly due to the increasing use of embedded systems in modern vehicles, which are becoming more complex and sophisticated each year. Embedded systems are used in various automotive applications, including safety and driver assistance systems, infotainment systems, and powertrain control systems. These systems rely on a combination of hardware and software components and are essential for ensuring modern vehicles' safe and efficient operation.

Component Insights

The embedded systems market is divided into hardware and software, with the hardware accounting for most of the market. Hardware refers to the physical components of an embedded system, such as microprocessors, sensors, and other electronic components. Hardware components are essential for building embedded systems. In many cases, they are expensive and critical parts of an embedded system, and companies invest significant resources in developing and manufacturing these components.

In addition, hardware components are typically more visible and tangible than software components, making them easier for customers to understand and evaluate. This can lead to a greater emphasis on hardware regarding marketing and sales efforts.

The software segment is also growing in importance as embedded systems become more complex and sophisticated. Software plays a critical role in controlling and managing the hardware components of an embedded system, and companies that can develop high-quality software can gain a competitive advantage in the market.

Regional Insights

What is the U.S. Embedded Systems Market Size?

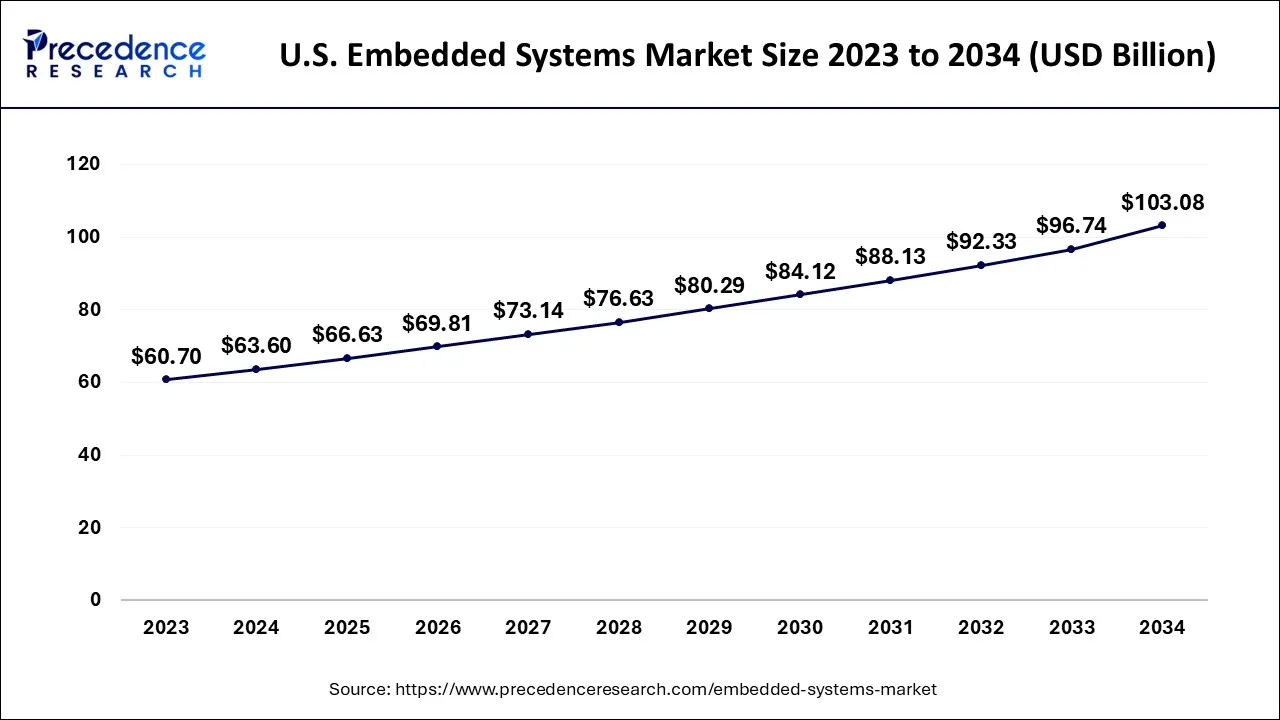

The U.S. embedded systems market size is exhibited at USD 66.63 billion in 2025 and is projected to be worth around USD 108.13 billion by 2035, growing at a CAGR of 4.96% from 2026 to 2035.

The USA has seen a significant growth in the embedded systems market. The growth is driven by the advancement in technology, such as the integration of AI and machine learning, and the internet of things, in the process, which helps in optimization and increasing demand across various industries, for automation technologies. Rising government initiatives promoting digitalization and smart infrastructure drive the growth of the market and help in expansion.

- Rising AI and machine learning integration, such as used in autonomous vehicles, predictive maintenance, smart cameras, and industrial robots.

- Vehicles now incorporate embedded systems for advanced driver-assistance systems and electric vehicle battery management.

- Adoption of real-time operating systems drives the growth.

North America dominates the market because the region is home to several leading companies in the embedded system industry, as well as many end-users in industries such as automotive, aerospace, healthcare, andindustrial automation. The high level of regional research and development investment drives the North American embedded system market. Companies in North America are investing heavily in developing new and innovative embedded systems, which is helping to drive growth in the market.

Another factor driving the growth of the North American embedded system market is the increasing demand for connected devices and systems. As more devices connect to the internet and each other, the demand for embedded systems that can handle this connectivity is growing rapidly.

U.S. Embedded Systems Market Trends

U.S.'s convergence of edge AI and 5G connectivity, enabling real-time, adaptive processing for industrial and automotive sectors. The shift toward electric and autonomous vehicles has positioned embedded systems as the backbone for critical functions like ADAS and battery management.

Europe embedded system market is another major region for embedded systems, with a strong focus on innovation, research, and development. The increasing use of automation and artificial intelligence in various industries drives the market. These technologies rely heavily on embedded systems to operate, and as they become more widespread, this will further create the demand for embedded systems that can handle these functions.

Germany Embedded Systems Market Trends

Germany's embedded systems market is driven by the rapid transformation of its automotive sector, where EV and ADAS integration has become standard for brands like Mercedes and Audi. The transition to Industry 4.0 remains a core catalyst, utilizing AI-enhanced embedded controllers to optimize robotics and smart factory efficiency.

The region in Asia-Pacific is anticipated to have the greatest CAGR driven by various factors, such as the growing adoption of connected devices, increasing demand for automation, and the rise of smart cities. The region is home to several large markets, including China, Japan, India, and South Korea, major global embedded system market players. These countries have strong manufacturing capabilities, significant investments in research and development, and growing demand for embedded systems in various applications in the Asia-Pacific region.

China Embedded Systems Market Trends

China's integration into devices enables smarter, real-time processing for enables smarter, real-time processing, growing demand for interconnected devices, and significant growth from software-defined vehicles, electric vehicles, and rising digital transformation in manufacturing, fueling the market growth.

South Korea is one of the Asia-Pacific region's leading markets for embedded systems, driven by strong government support for research and development and a highly skilled workforce. The country is home to many of the leading manufacturers of embedded systems and many end-users in industries such as automotive, consumer electronics, and industrial automation. One of the key drivers of the South Korean embedded system market is the increasing demand for connected devices and systems. The South Korean government has set a target of achieving a 5G penetration rate of 50% by 2022, driving innovation in developing new and more sophisticated embedded systems that can handle this connectivity.

Value Chain Analysis of the Embedded Systems Market

- R&D and Product Development

This initial stage involves the conception, design, and engineering of embedded systems, including hardware and software components.

Key Players: ARM Holdings, Intel Corporation, Qualcomm Incorporated, Infineon Technologies AG, and Renesas Electronics Corporation. - Sourcing and Inbound Logistics

This stage focuses on procuring raw materials, components (like microcontrollers, sensors, and memory), and managing their internal distribution to manufacturing facilities.

Key Players: Texas Instruments Inc., STMicroelectronics N.V., and Microchip Technology Inc. - Operations and Manufacturing

This is the core production stage where raw components are transformed into finished embedded systems or integrated into larger products, such as automobiles or industrial machinery.

Key Players: Robert Bosch, General Motors, Honeywell, and Siemens

Embedded Systems Market Companies

- Intel Corporation specializes in developing high-performance processors and memory solutions, contributing to embedded systems through a wide range of computing needs from industrial automation to networking infrastructure.

- Renesas Electronics provides essential microcontrollers (MCUs) and System-on-Chip (SoC) solutions that are crucial for automotive, industrial, and broad-based embedded applications, focusing on low power consumption and high reliability.

- Texas Instruments Inc.offers an extensive portfolio of analog and embedded processing integrated circuits (ICs), supplying critical components like MCUs, digital signal processors (DSPs), and power management ICs used across diverse market sectors.

- NXP Semiconductors focuses heavily on secure connectivity solutions for a smarter world, contributing to the embedded market with products for automotive systems, industrial automation, and secure IoT devices.

- Qualcomm develops advanced mobile processors and connectivity technologies, applying these innovations to embedded systems within the automotive, IoT, and edge computing spheres, particularly where wireless communication is key.

- Cypress, now part of Infineon, was known for delivering microcontrollers, memory, and connectivity solutions that addressed performance, power, and programmability needs in a variety of industrial and consumer embedded applications.

Other Major Key Players

- Infineon Technologies

- Analog Devices Inc.

- Microchip Technology Inc.

- STMicroelectronics N.V.

Recent Developments

- In January 2026, Digital Twin Composer (Siemens) launched on the Siemens Xcelerator Marketplace. This software creates 3D virtual replicas of physical products and processes for real-time simulation and optimization.(Source: https://news.siemens.com )

- In September 2024, microchip technology launched its PIC64 portfolio to address the growing need for power efficiency, hardware-level security, and high reliability in real-time, compute-intensive applications like smart embedded vision and machine learning. The PIC64 family aims to provide a single-vendor solution for microprocessors (MPUs), catering to markets requiring both real-time and application-class processing.

- In March 2025, Cognex launched a new AI-powered embedded vision system, the In-Sight 8900. The system is available in 8 and 24-bit HDR+ color and monochrome options. It has a die-cast aluminum and zinc housing, C-mount lens mount, and is rated IP40. The system is designed for applications such as automated inspections.

- In July 2024, Avnet announces the launch of a new product brand, Tria, and a corresponding business called Tria Technologies to consolidate its compute design and manufacturing. The Tria brand will be the new name for embedded compute boards, systems, and associated design and manufacturing services at Avnet.

- In April 2025, Keysight Technologies Inc. KEYS recently introduced the Next-Generation Embedded Security Testbench, a solution engineered to address growing security challenges of modern chips and embedded devices. Built on a modular framework, the solution uses high-speed PXIe architecture, which enables faster and precise security testing.

- In February 2020, Renesas Electronics announced the acquisition of IDT to expand its product portfolio and strengthen its position in the embedded system market.

- In December 2020, Infineon Technologies announced the acquisition of CypressSemiconductorto expand its product portfolio and strengthen its position in the embedded system market.

- In March 2021, Qualcomm announced the launch of its new Snapdragon 888 5G mobile platform, designed to deliver high-performance computing capabilities for mobile and embedded devices.

Segments Covered in the Report

By Function

- Standalone System

- Real-Time System

- Network System

- Mobile System

By Application

- Automotive

- Consumer Electronics

- Manufacturing

- Retail

- Media & Entertainment

- Aerospace and Defense

- Telecom

- Others

By Components

- Hardware

- ASIC & ASSP

- Microcontroller

- Microprocessor

- Power Management Integrated Circuit (PMIC)

- Field Programmable Gate Array (FPGA)

- Digital Signal Processor (DSP)

- Memory

- Software

- OS

- Middleware

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting