Embedded Non-Volatile Memory Market Size and Forecast 2025 to 2034

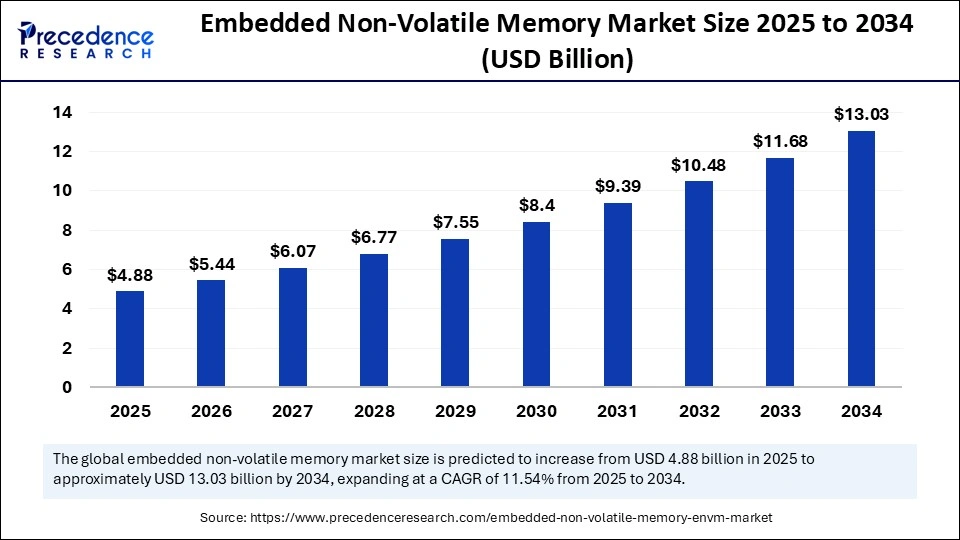

The global embedded non-volatile memory market size accounted for USD 4.37 billion in 2024 and is predicted to increase from USD 4.88 billion in 2025 to approximately USD 13.03 billion by 2034, expanding at a CAGR of 11.54% from 2025 to 2034. The growth of the market is attributed to the rising demand for energy-efficient and high-performance memory solutions in automotive, IoT, and consumer electronics applications.

Embedded Non-Volatile Memory Market Key Takeaways

- The embedded non-volatile memory market was valued at USD 4.37 billion in 2024.

- It is projected to reach USD 13.03 billion by 2034.

- The market is expected to grow at a CAGR of 11.54% from 2025 to 2034.

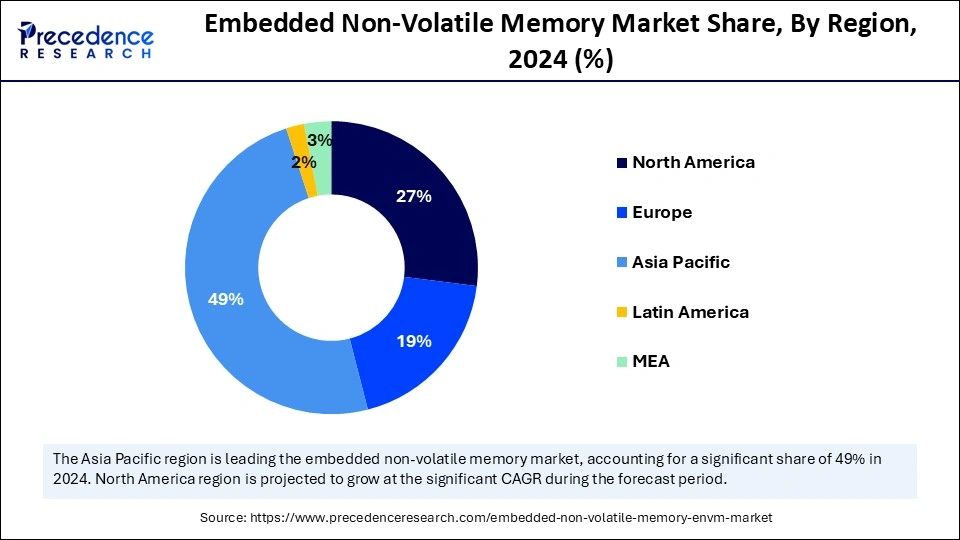

- Asia Pacific dominated the market with the largest market share of 49% in 2024.

- North America is expected to grow at the fastest CAGR in the upcoming years.

- By product, the eFlash segment held the largest share of 41% in 2024.

- By product, the eE2PROM segment is expected to grow at the highest CAGR of 12.05% during the forecast period.

- By wafer size, the >100mm segment led the market in 2024.

- By wafer size, the <100 mm segment is expected to grow at the fastest CAGR in the coming years.

- By application, the BFSI segment held the biggest market share in 2024.

- By application, the telecommunication segment is expected to grow at the fastest CAGR during the projection period.

How is AI Transforming the Embedded Non-volatile Memory Landscape?

Artificial intelligence is transforming the embedded non-volatile memory landscape by fueling the need for memory solutions that are quicker, more dependable, and use less energy. Memory technologies that can process data in real-time with little power are becoming more and more necessary as AI workloads increase in edge devices, internet of things (IoT) systems, and driverless cars. Because of its high endurance and low latency, eNVM is becoming more and more important for enabling these AI-driven applications. Furthermore, AI improves the eNVM development process by predicting failure patterns, increasing manufacturing yields, and optimizing chip design. AI tools are being used by businesses to optimize architecture and manage memory more intelligently, allowing for more intelligent and scalable storage solutions across industries.

Asia Pacific Embedded Non-Volatile Memory Market Size and Growth 2025 to 2034

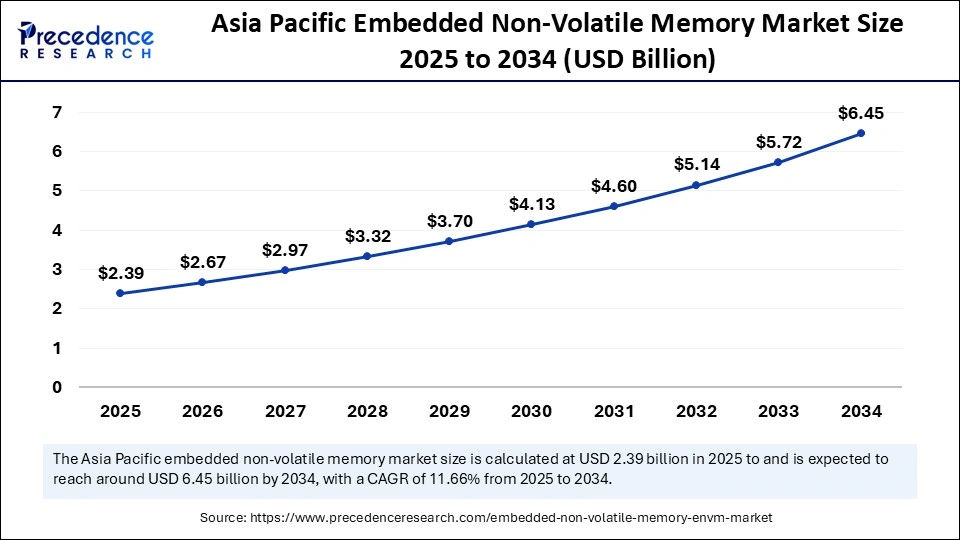

Asia Pacific embedded non-volatile memory market size was exhibited at USD 2.14 billion in 2024 and is projected to be worth around USD 6.45 billion by 2034, growing at a CAGR of 11.66% from 2025 to 2034.

What Factors Contributed to Asia Pacific's Dominance in 2024?Asia Pacific dominated the embedded non-volatile memory market by holding the largest share in 2024. This is mainly due to its rapidly growing electronics manufacturing base and robust automotive industry. Various Asian countries are investing strategically in semiconductor manufacturing facilities with a strong emphasis on supply chain diversification and self-reliance. The increased adoption of standalone and embedded memory components brought about by the widespread use of smartphones, electric cars, and IoT devices further bolstered the growth of the market in the region.

Favorable government initiatives encouraging local chip manufacturing and digital infrastructure development further support the region's growth trajectory. Advanced memory integration is seeing new opportunities due to the growing demand for 5G AI and high-performance computing. Asia Pacific is anticipated to be a key player in determining the direction of the global non-volatile economy as major data centers and tech startups continue to expand their operations throughout the region.

North America is expected to expand at the fastest CAGR in the upcoming years owing to the presence of top memory manufacturers, a sophisticated semiconductor ecosystem, and significant investment in R&D. There is a high demand for non-volatile memory as a result of the region's leadership in cutting-edge technologies like artificial intelligence (AI), autonomous driving, and cloud computing, all of which depend on quick and dependable memory. Its position in the market is further strengthened by strong government backing for boosting the production of semiconductors and partnerships between tech companies and academic institutions.

Europe is considered to be a significantly growing area. The growing focus on industrial automation, sustainable manufacturing, and automotive innovation is likely to propel the growth of the embedded non-volatile memory market within Europe. The region has shown a consistent need for embedded memory solutions for infotainment platforms, Industry 4.0-enabled machinery, and advanced driver assistance systems. Reliable and energy-efficient memory technologies are becoming more and more necessary as the manufacturing and mobility sectors place a greater emphasis on efficiency, safety, and digitization.

Furthermore, Europe is becoming more prominent in the global memory ecosystem because of its strategic efforts to increase semiconductor production, which include funding programs and cross-border R&D partnerships. Although the market is still smaller, Europe plays a significant role in innovation and the quality-driven adoption of non-volatile memory solutions because of its emphasis on specialized high-value applications.

Market Overview

The embedded non-volatile memory market is experiencing robust growth, driven by the increasing need for high-performance energy memory solutions in industrial, automotive, and consumer electronics applications. eNVM technologies such as embedded flash and MRAM are being directly integrated into chips to lower consumption, increase speed, and improve security as advanced nodes become more common in microcontroller units (MCUs) and system-on-chip (SoC) designs. The adoption of eNVM is being further accelerated by the move toward IoT devices, AI edge computing, and smart wearables.

Why is the Demand for Embedded Non-volatile Memory Increasing Across Industries?

The demand for embedded non-volatile memory is rising across industries due to the increasing need for high-speed, low-power, and secure data storage in small electronic systems. Real-time data logging and advanced driver assistance systems are supported by eNVM in automotive electronics. It guarantees firmware storage, quick boot times, and power-efficient operations in consumer electronics and IoT because eNVM is more integrated and reliable than external memory. It is perfect for environments with limited space or harsh conditions due to its improved system performance. Industries are shifting away from conventional standalone memory modules to embedded solutions.

Embedded Non-Volatile Memory MarketGrowth factors

- Rising Adoption of IoT and Edge Devices: The proliferation of IoT, smart appliances, and edge computing devices demands compact, power-efficient memory, boosting the need for embedded NVM solutions.

- Advancements in Automotive Electronics: The increasing use of advanced driver-assistance systems (ADAS), infotainment, and electric vehicle components drives demand for reliable, high-speed embedded memory.

- Growing Demand for AI and ML Integration: AI-based applications require fast and low-power memory for real-time processing, pushing the adoption of embedded NVM in edge and mobile AI chips.

- Transition to Smaller Technology Nodes: Semiconductor manufacturers are shifting to smaller process nodes, where embedded NVM technologies like MRAM and ReRAM offer better scalability and performance.

- Increased Use in Consumer Electronics: Smartphones, wearables, and gaming consoles are increasingly integrating eNVM to enhance data retention and speed without sacrificing battery life.

- Security and Data Protection Needs: Embedded NVM provides secure and tamper-proof memory, making it suitable for applications in the defense, finance, and healthcare sectors.

- Cost-Effectiveness and Integration Benefits: eNVM reduces the need for external memory components, lowering system costs and simplifying design, which appeals to OEMs and chip designers.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.03 Billion |

| Market Size in 2025 | USD 4.88 Billion |

| Market Size in 2024 | USD 4.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.54% |

| Dominating Region | Aisa Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Wafer Size, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market dynamics

Drivers

Growing Automotive Electrification and ADAS Adoption

The rising electrification of automobiles is a major factor driving the growth of the embedded non-volatile memory market. As the electrification of fleets increases, so does the need for automotive electronic devices. This, in turn, boosts the demand for reliable, quick, and thermally resilient memory. Moreover, the rising popularity of ADAS and electric vehicles (EVs) propels the market. In these applications, eNVM is essential for storing boot code logs and calibration data in microcontrollers and processors. For automotive-grade electronics, eNVM is ideal due to its capacity to operate in high-temperature settings and store data without continuous power.

Enhanced Security and Firmware Protection Needs

Embedded NVM plays a critical role in securing boot and data protection as it enables chip-tamper-resistant firmware storage. This is especially important in defense, healthcare, and financial applications. With increasing concerns over cyber security and data breaches, the demand for eNVM is rising in various industries. eNVM provides secure storage and encryption capabilities, which are essential for protecting sensitive data. OEMs are prioritizing embedded memory solutions with encryption, secure key storage, and fail-safe memory mechanisms.

Restraints

Scalability Challenges with Advanced Nodes

The rapid transition toward ultra-scaled process nodes (e.g., 3. 5nm and 3nm) challenges conventional embedded flash memory's performance, endurance, and retention. Promising emerging alternatives like MRAM and ReRAM have drawbacks like slow write speeds, unstable cells, and challenging integration with current foundry processes. These problems prevent them from growing alongside next-generation SoCs found in 5G infrastructure, edge AI devices, and smartphones. The trade-off between scalability prevents many manufacturers from implementing eNVM on a large scale.

- On 01 January 2025, Weebit Nano announced the licensing of its ReRAM IP to semi-finals for integration on 130nm BCD platforms. While this marks a commercial breakthrough, the technology is still largely limited to mature nodes, underscoring the hurdles in achieving reliable ReRAM scalability at sub-28nm geometries for advanced applications.

Complex Design and Integration Process

When designing SoCs with embedded non-volatile memory, power performance and physical area must be balanced. This frequently calls for a unique layout, extra IP blocks, and a longer verification period. Additionally, memory behavior needs to be matched with processor architecture in power domains and thermal requirements by engineering teams. These limitations make it more difficult to stick to design budgets and schedules, particularly for intricate systems like driverless cars or intelligent medical equipment. System-level simulations and safety certifications also need to take into consideration how memory properties change over time.

Opportunities

Growth of Wearables and Ultra-compact Devices

The increasing adoption of wearables and ultra-compact electronic devices creates immense opportunities in the embedded non-volatile memory market. Smartwatches, fitness bands, and medical monitors are examples of wearable electronics that need ultra-low power, high endurance memory that can withstand strict size and temperature restrictions. Manufacturers can reduce battery drain and save board space by integrating NVM into SoCs, which are important differentiators in consumer wearables. Memory companies have a clear chance to develop more compact, effective eNVM solutions as the need for connectivity and health monitoring grows.

Customization of IP for Foundry Portfolios

Foundries are increasingly integrating customizable eNVM IP blocks into their process technologies to offer end-to-end SoC solutions. This allows fabless chip designers to choose memory configurations optimized for power, performance, or endurance, helping them address diverse markets from automotive to consumer electronics. IP providers that offer scalable, process portable solutions stand to gain from these foundry partnerships.

- In February 2025, Weebit Nano and Sky Water Technology announced the qualification of ReRAM IP for use in Sky Water's 130nm CMOS platform, expanding options for custom SoC designs.

Product Insights

Why did the eFlash Segment Dominate the Market?

The eFlash segment dominated the embedded non-volatile memory market with the largest revenue share in 2024. This is mainly due to its ability to provide a reliable and affordable solution for embedded applications in a variety of industries, including consumer electronics, industrial automation, and automotive. For applications requiring reliable and long-term data retention, its high endurance for repeated write/erase cycles, compatibility with CMOS processes, and smooth integration with microcontrollers make it the perfect option. The increased production of smart devices and IoT devices has led to a greater dependence on eFlash because of its dependability and efficiency.

- On 29 October 2024, KIOXIA announced the mass production of the industry's first 512GB QLC UFS 4.0 embedded flash memory for mobile applications.

The eE2PROM segment is expected to grow at the highest CAGR during the forecast period. eE2PROM is suitable for low-power applications like wearables, smart cards, and medical devices. Its flexibility that permits byte level adjustments and long-term data storage even in challenging conditions makes it suitable for applications requiring data updates. As real-time analytics and edge computing spread throughout industries, EE2PROMs function in facilitating dependable data storage at the device level is growing quickly.

Wafer Size Insights

What Made >100mm the Dominant Segment in the Market?

The >100mm segment dominated the non-volatile memory market with a major revenue share in 2024. This is mainly due to its widespread application in the production of high-yield and large-scale semiconductors. >100 mm wafers maximize production efficiency and lower the cost per chip. Current infrastructure and equipment foundries and memory manufacturers highly favor them. Large memory volumes are still in high demand in the consumer electronics, automotive, and industrial sectors, all of which are supporting segmental growth.

The <100 mm segment is expected to grow at the fastest rate in the coming years due to its increasing importance in research labs' legacy systems and specialized applications in healthcare, aerospace, and defense. Precision manufacturing of low-volume high-value components, where dependability and performance are crucial, frequently uses these smaller wafers. The use of 100 mm wafers is growing as a result of the rising production of automotive electronics and wearable devices.

Application Insights

How Does the BFSI Segment Dominate the Embedded Non-volatile Memory Market?

The BFSI segment dominated the market in 2024. This is mainly due to its high dependence on safe and fast data storage systems. Financial institutions need memory technologies that guarantee zero data loss, low latency, and strong encryption in light of the growth of digital banking fintech services and real-time transaction processing. These requirements are successfully met by non-volatile memory solutions which make them crucial for mission-critical banking and financial operations.

The telecommunication segment is expected to grow at the fastest CAGR during the projection period, driven by the increased use of mobile data, the global rollout of 5G, and the growing use of sophisticated networking equipment. These trends necessitate high-performance memory in network switches, routers, and base stations for real-time processing, low power consumption, and quick data access. Its quick adoption is fueled by non-volatile memory capacity to facilitate high-speed data logging and system boot-up in telecom infrastructure.

Embedded Non-Volatile Memory MarketCompanies

- Samsung Electronics Co. Ltd

- Micron Technology, Inc.

- Rohm Co. Ltd

- Toshiba Electronic Devices & Storage Corporation

- Western Digital Technologies, Inc.

- Honeywell International Inc.

- Crossbar Inc.

- Fujitsu Ltd.

- Japan Semiconductor Corporation

- HDD Manufacturers

Latest Announcement

- In April 2025, Weebit Nano, along with DB HiTek, announced the first demonstration of chips integrating Weebit's embedded ReRAM in DB HiTek's 130 nm BCD process for mixed-signal and high-voltage applications. The CEO, Coby Hanoch, stated “Our collaboration with DB HiTek is advancing steadily toward making our ReRAM IP available for production in its 130nm BCD process. This demo provides a first look at the integrated technology and the advantages of integrating ReRAM on-chip.”

(Source: https://www.globenewswire.com)

Recent Developments

- In September 2023, GlobalFoundries (GF) and Microchip Technology, via its Silicon Storage Technology (SST) subsidiary, announced the immediate release to production of the SST ESF3 third-generation embedded SuperFlash non-volatile memory (NVM) solution in the GF 28SLPe foundry process.

(Source: https://gf.com) - In October 2022, Infineon Technologies AG announced the commercial availability of its highest density serial F-RAMs, the company's new 8- and 16-Mbit EXCELON F-RAM memories. The 8- and 16-Mbit EXCELON F-RAM (Ferroelectric RAM) memories address the non-volatile data-logging requirements of next-generation automotive and industrial systems to help prevent data loss in harsh operating environments.

(Source: https://www.infineon.com)

Segments Covered in the Report

By Product

- eFlash

- eE2PROM

- FRAM

- Others

By Wafer Size

- <100 mm

- >100 mm

By Application

- BFSI

- Consumer Electronics

- Government

- Telecommunications

- Information Technology

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting