Next Generation Non-Volatile Memory Market Size and Forecast 2025 to 2034

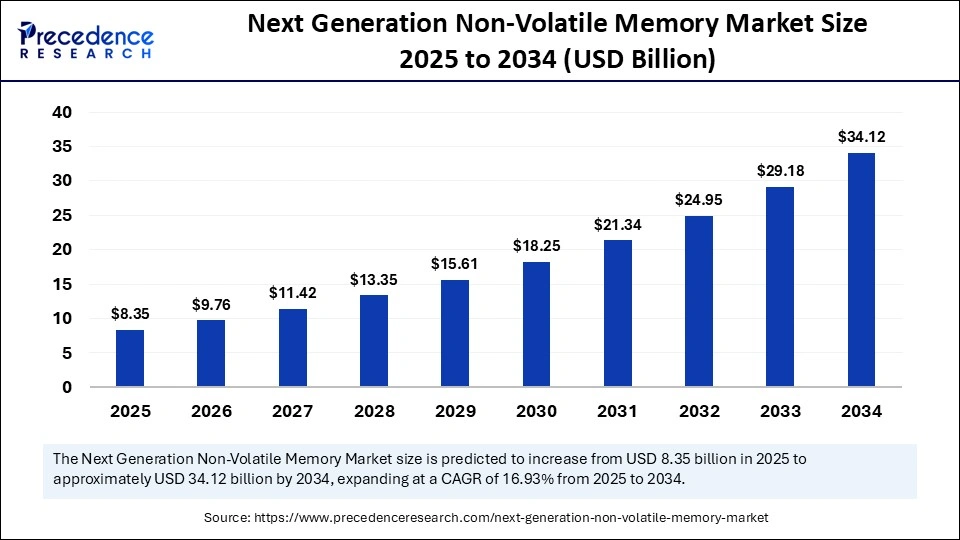

The global next generation non-volatile memory market size accounted for USD 7.14 billion in 2024 and is predicted to increase from USD 8.35 billion in 2025 to approximately USD 34.12 billion by 2034, expanding at a CAGR of 16.93% from 2025 to 2034.The growth of the market is driven by the rising need for high-speed data access and the increasing adoption of AI and IoT.

Next Generation Non-Volatile Memory MarketKey Takeaways

- In terms of revenue, the next generation non-volatile memory market is valued at $8.35 billion in 2025.

- It is projected to reach $34.12 billion by 2034.

- The market is expected to grow at a CAGR of 16.93% from 2025 to 2034.

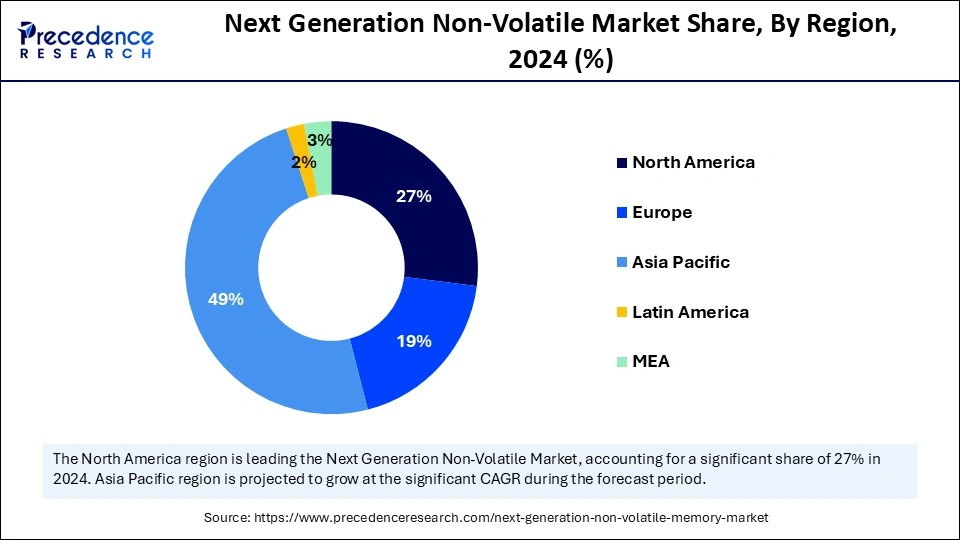

- Asia Pacific held the major revenue share of 49% in 2024.

- North America is expected to grow at a double digit CAGR of 18.04% from 2025 to 2034.

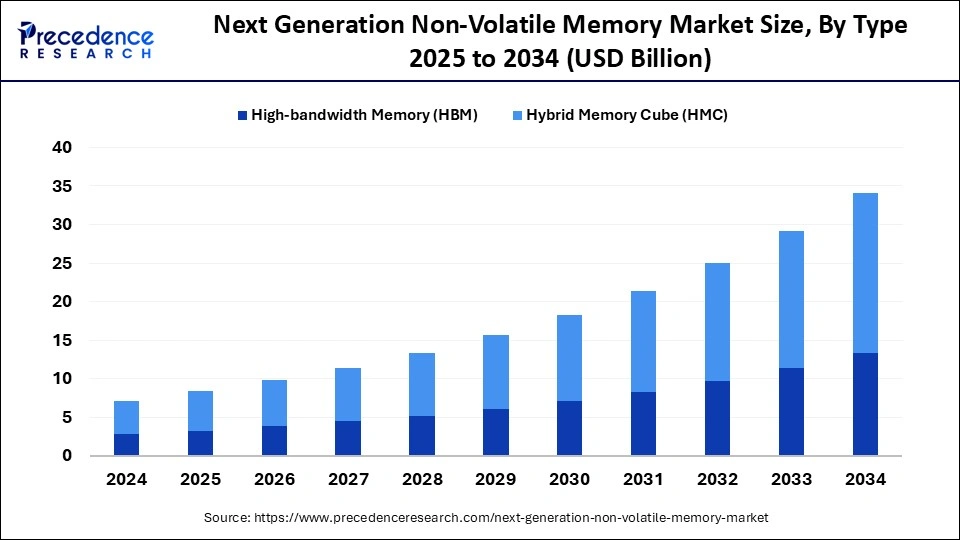

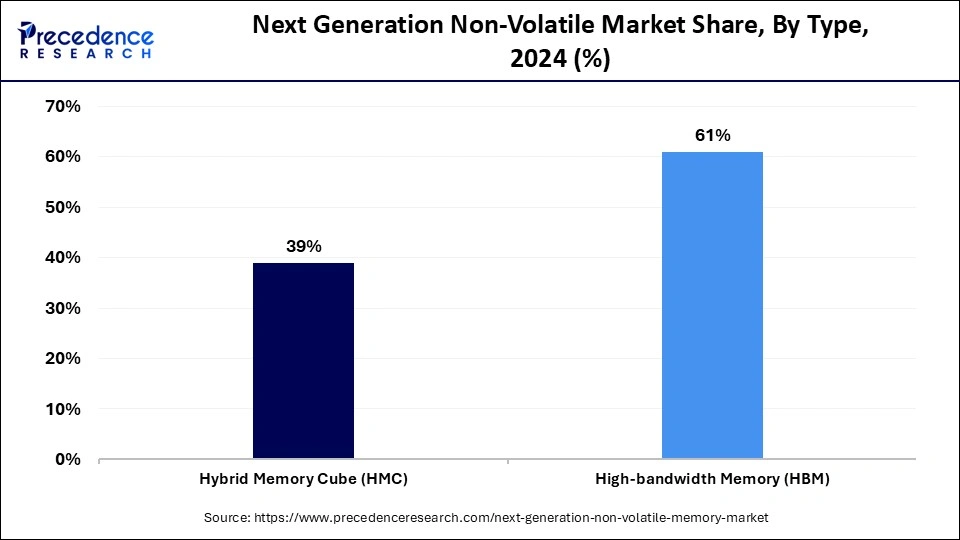

- By type, the high-bandwidth memory (HBM) segment contributed the biggest revenue share of 61% in 2024.

- By type, the hybrid memory cube (HMC) is expected to grow at the highest CAGR of 19.2% between 2025 and 2034.

- By wafer size, the 300 mm segment accounted for the highest revenue share of 64% in 2024.

- By wafer size, the 200 mm segment is growing at a significant CAGR of 19.77% from 2025 to 2034.

- By application, the BFSI segment generated the biggest revenue share of 24% in 2024.

- By application, the telecommunications segment is projected to grow at the fastest CAGR of 19.83% from 2025 to 2034.

Asia Pacific Next Generation Non-Volatile Memory Market Size and Growth 2025 to 2034

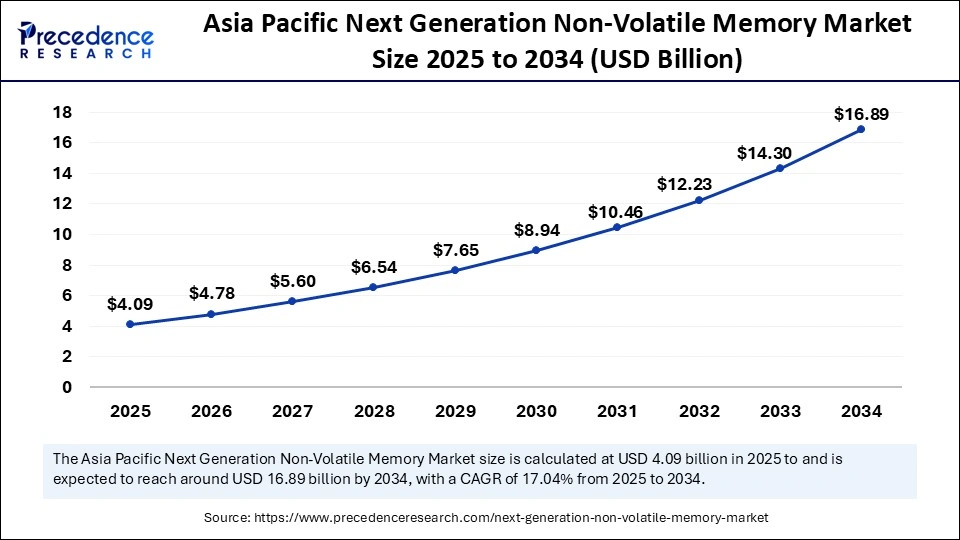

Asia Pacific next generation non-volatile memory market size was exhibited at USD 3.50 billion in 2024 and is projected to be worth around USD 16.89 billion by 2034, growing at a CAGR of 17.04% from 2025 to 2034.

What Factors Contributed to Asia Pacific's Dominance?

Asia Pacific dominated the next generation non-volatile memory market with the largest share in 2024. This is mainly due to the presence of a large number of semiconductors manufacturing companies, increased production of consumer electronics, and rapid digitalization. Countries like China, Japan, South Korea, and Taiwan are recognized as the silicon backbone of the world, housing some of the most advanced fabrication facilities and memory assembly units.

The explosive rise in mobile usage, smart devices, wearable tech, and internet of things (IoT) applications has created an urgent need for compact, durable, and energy-efficient memory technologies. Moreover, regional governments have started prioritizing semiconductor self-sufficiency through state-led initiatives and capital investment, ensuring the long-term sustainability of the memory supply chain. The development of smart cities, the expansion of artificial intelligence (AI) in public infrastructure, and the demand for affordable memory components for mid-range devices contribute to regional market growth.

North America is expected to grow at the fastest rate in the coming years. North America, particularly the U.S., has a robust ecosystem of technological leaders. The region is home to semiconductor giants, AI chip designers, quantum computing startups, and hyperscale data center operators, all driving innovations in memory technology. The strong presence of research institutions, combined with public-private collaborations and sustained government funding for advanced computing and defense technologies, propelled the development and adoption of NGNVMs like MRAM, ReRAM, and 3D XPoint.

Moreover, industries such as autonomous driving, space exploration, cyber security, and cloud infrastructure demand memory with superior speed, endurance, and energy efficiency. Another contributing factor is the region's early and aggressive implementation of artificial intelligence across BFSI, healthcare, aerospace, and defense sectors, which accelerates the need for low-latency, high-performance, non-volatile memory solutions. With continued investments in data infrastructure and AI-centric hardware acceleration, North America is likely to witness the fastest growth.

Europe is expected to grow at a considerable rate in the coming years, driven by its digital sovereignty and rapid industrialization. Unlike other markets that focus solely on performance and price, Europe is prioritizing memory technologies that support sustainable electronics and reduce the environmental footprint of data centers and smart factories. Countries like Germany, with a strong presence in automotive electronics and industrial automation, are driving the demand for next-gen memory that can endure harsh conditions while operating with minimal power consumption.

With the rise of electric vehicles and smart mobility, embedded memory solutions like MRAM and PCM are becoming critical for managing real-time control systems and ADAS (Advanced Driver-Assistance Systems). In addition, strict data privacy laws like GDPR have forced enterprises to adopt in-memory computing models and localized edge solutions, further boosting the need for fast, secure, and power-efficient memory. The EU's digital transformation agenda, supported by large-scale funding for chip manufacturing and R&D, is also igniting regional innovation in semiconductor materials and architecture.

Market Overview

Next-generation non-volatile memory technologies are transforming the global data storage landscape by offering faster, more energy-efficient, and highly scalable alternatives to conventional flash memory. The next generation non-volatile memory market is experiencing rapid growth, driven by the limitations of traditional NAND and DRAM in high-performance computing and high-tech appliances. As industries shift towards big data analytics and edge computing, the demand for memory that combines speed, non-volatility, and energy efficiency rises. Industries such as automotive, data centers, and consumer electronics are increasingly integrating NGNVM to overcome bottlenecks and unlock real-time intelligence. These advanced memory types, including MRAM, ReRAM, and 3D XPointer, are poised to become foundational in AI, IoT, and edge computing environments.

Key trends reshaping the NGNVM market

- Edge AI integration: The growing need for low-latency memory in edge devices is boosting the demand for ReRAM and MRAM, which are a type of non-volatile memory.

- AI workload acceleration: NGNVM is being adopted in AI chips and processes to improve performance under high data loads.

- Data-centric architectures: A shift from processor-centric systems is driving innovation in-memory computing.

- Miniaturization and 3D stacking: Advanced fabrication technologies enable higher density and lower power consumption.

- Sustainability push: NGNVMs offer energy efficiency, aligning with green data center initiatives and ESG mandates.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 34.12 Billion |

| Market Size in 2025 | USD 8.35 Billion |

| Market Size in 2024 | USD 7.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.93% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type Outlook, Wafer Size Outlook, Application Outlook, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for High-Performance Memory

The primary market driver of the next generation non-volatile memory market is the explosive growth of data-intensive applications, such as artificial intelligence, machine learning, 5G, and edge computing. Traditional memory technologies like NAND flash and DRAM struggle to keep up with the speed, endurance, and power requirements of these new-age workloads. This, in turn, boosts the demand for NGNVMs, including MRAM, ReRAM, and 3D XPoint. These memories offer ultra-fast read/write speeds, enhanced durability, and lower power consumption, making them ideal for next-gen computing environments. Their ability to retain data without power and enable real-time performance is accelerating their integration in data centers, automotive electronics, and consumer devices. The explosive growth of AI workloads demands memory solutions with ultra-low latency, high endurance, and fast write and read cycles. NGNVMs meet these needs by enabling real-time processing and in-memory computing, significantly accelerating deep learning models, autonomous systems, and smart applications.

Restraint

High Costs and Compatibility Issues

The next generation non-volatile memory market faces significant challenges. One such challenge is the high costs associated with NGNVM. High manufacturing complexity, limited foundry support, and lower production volumes contribute to elevated costs of NGNVM compared to conventional memory. This limits widespread adoption, particularly in price-sensitive markets. Moreover, the absence of standardization and compatibility issues with existing systems presents integration challenges. Overcoming these barriers requires thorough R&D, economies of scale, and collaborative innovation across the semiconductor ecosystem.

Opportunity

Proliferation of Edge Computing and IoT

The major market opportunity lies in the proliferation of edge computing and IoT ecosystems, where real-time data processing and instant decision-making are critical. NGNVMs are uniquely positioned to serve as enablers of decentralized intelligence by offering compact, energy-efficient memory solutions that can handle intermittent connectivity and extreme environmental conditions. Additionally, the growing adoption of AI-powered consumer electronics and the rising trend of in-memory computing in enterprises are creating lucrative prospects for market expansion across industrial, healthcare, and automotive sectors.

Type Insights

Why did High-Bandwidth Memory Segment Dominate the Market in 2024?

The high-bandwidth memory (HBM) segment dominated the next generation non-volatile memory market with the largest revenue share of 61% in 2024 due to the increased need for high bandwidth in various applications. HBM has emerged as the dominant memory type due to its ability to deliver exceptional data transfer speeds with minimal latency. Designed to support high performance computing (HPC), HBM offers vertically stacked memory dies connected through Through-Silicon Vias (TSVs), significantly reducing space and energy consumption. As AI and machine learning models become more complex, the demand for faster training and inference has propelled the adoption of HBM in data centers and enterprise-grade servers. Its capacity to process parallel workloads efficiently makes it indispensable in modern computing architecture.

On the other hand, the hybrid memory cube (HMC) is growing at the highest CAGR of 19.2% between 2025 and 2034, driven by its revolutionary architecture that combines logic and memory layers in a single 3D stack. With up to 15 times the performance of traditional DDR memory and greater energy efficiency, HMC is rapidly being embraced in AI training hardware, embedded systems, and high-end computing applications. Its high scalability, bandwidth capability, and ability to support simultaneous multitasking make it a preferred choice for next-generation computing platforms looking to break through performance ceilings.

Wafer Size Insights

What Made 300 mm the Dominant Segment in the Next Generation Non-Volatile Memory Market?

The 300 mm segment dominated the market with a major revenue share of 64% in 2024. This is mainly due to its capacity to produce a larger number of chips per wafer, reducing manufacturing costs and increasing throughput. Its superior scalability and compatibility with advanced memory architectures like MRAM and 3D XPoint make it the preferred choice for leading semiconductor foundries. Most high-performance memory chips for automotive, data centers, and industrial-grade electronics are fabricated on 300 mm wafers, supporting mass production and quality consistency.

Meanwhile, the 200 mm wafer segment is expected to grow at a double-digit CAGR of 19.77% from 2025 to 2034. This is mainly due to its widespread applications in power chips and microprocessors. Foundries are repurposing older 200 mm fabs to meet rising demand for cost-effective memory solutions in embedded systems, consumer electronics, and IoT devices. The lower initial capital investment and shorter development cycles make it ideal for a range of applications, increasing its demand.

Application Insights

Why did the BFSI Segment Dominate the Market in 2024?

The banking, financial services, and insurance (BFSI) segment dominated the market by holding more than 24% of revenue share in 2024, due to its intensive need for secure, high-speed data storage and real-time analytics. With increasing reliance on AI for fraud detection, algorithmic trading, and personalized customer experiences, financial institutions require memory solutions that offer speed, reliability, and durability. NGNVM enables faster data retrieval, improves system responsiveness, and supports uninterrupted service, all critical for a 24/7 financial ecosystem.

On the other hand, the telecommunications segment is expected to grow at the fastest CAGR of 19.83% in the upcoming period, fueled by the global expansion of 5G networks and cloud-native infrastructure. NGNVM technologies are ideal for base stations, network edge devices, and virtualized core networks that demand ultra-low latency and high bandwidth. With the surge in mobile data traffic, edge analytics, and IoT connectivity, telecom providers are integrating non-volatile memory into their systems to enhance speed, reduce energy consumption, and future-proof their infrastructure.

Next Generation Non-Volatile Memory Market Companies

- Samsung Electronics Co. Ltd

- Micron Technology, Inc.

- Rohm Co. Ltd

- Toshiba Electronic Devices & Storage Corporation

- Western Digital Technologies, Inc.

- Honeywell International Inc.

- Crossbar Inc.

- Fujitsu Ltd.

- Japan Semiconductor Corporation

- HDD Manufacturers

Recent Development

- In April 2025, Researchers at Fudan University in Shanghai have developed a groundbreaking non-volatile memory device named "PoX" (Phase-change Oxide), claiming it to be the fastest of its kind with a write speed of 400 picoseconds per bit. Utilizing a two-dimensional graphene-channel architecture combined with a charge-trapping stack, the device surpasses the speed of conventional volatile memories like SRAM and DRAM, and greatly outpaces traditional NAND flash storage. The PoX memory leverages a hot-carrier injection mechanism and a thin-body structure to enhance electric fields and improve carrier efficiency.

(source: https://gigazine.net)

Segments Covered in the Report

By Type Outlook

- Hybrid Memory Cube (HMC)

- High-bandwidth Memory (HBM)

By Wafer Size Outlook

- 200 mm

- 300 mm

By Application Outlook

- BFSI

- Consumer Electronics

- Government

- Telecommunications

- Information Technology

- Others

By Region

- North America

- Europe

- Latin America

- Asia Pacific

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting