Enterprise Flash Storage Market Revenue to Attain USD 44.41 Bn by 2033

Enterprise Flash Storage Market Revenue and Trends 2025 to 2033

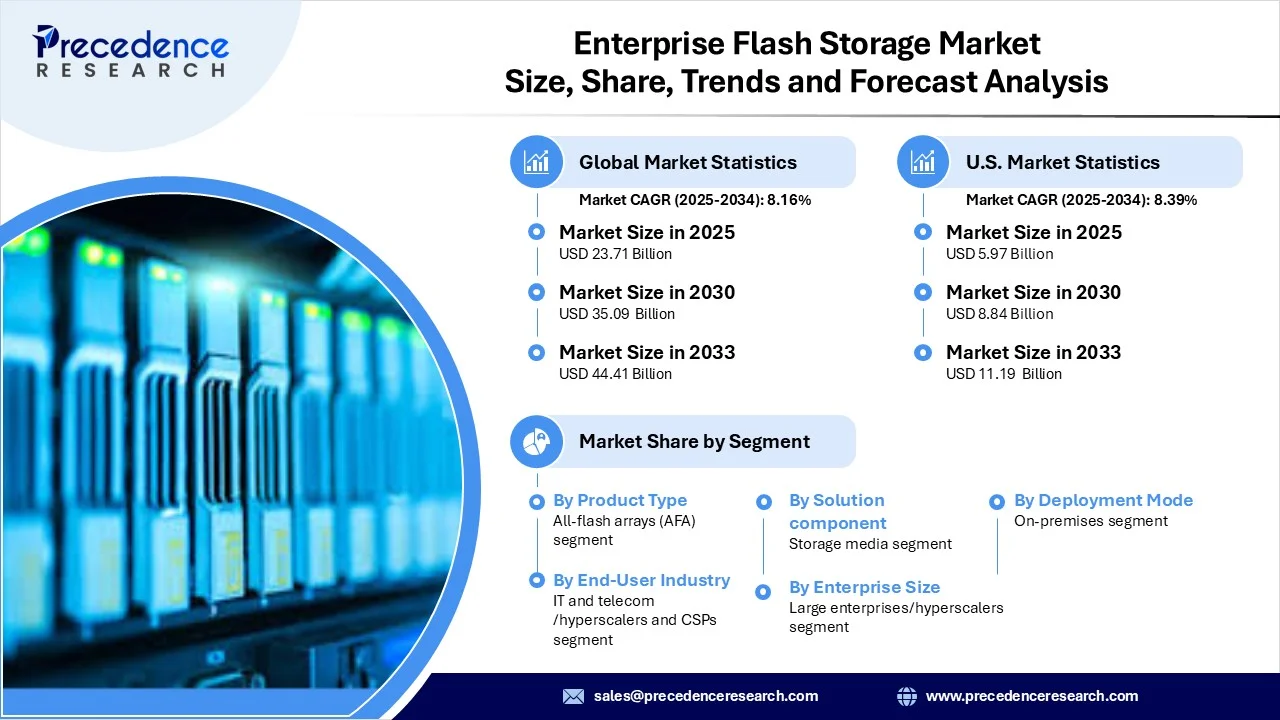

The global enterprise flash storage market revenue reached USD 23.71 billion in 2025 and is predicted to attain around USD 44.41 billion by 2033 with a CAGR of 8.16%. This market is rising because organizations are confronting exponentially growing data volumes and demanding faster processing, lower latency, higher throughput and more efficient power-use than traditional HDD-based storage can provide.

Key drivers enabling the growth of the Enterprise Flash Storage Market:

The enterprise flash storage market is being pushed forward by a number of capitalistic forces. The first, is the demands of cloud computing, virtualization and edge computing that require ultra-fast access to data, driving the adoption of high-performance flash arrays. The second is the overwhelming rise of artificial intelligence (AI), machine learning (ML), real-time analytics and IoT, are making it so enterprises are not only big data but also instantaneous time-based data, thus requiring the ever-growing demand for enterprises to upgrade to suitable storage. Convergence consideration of energy efficiency, smaller space and footprint consumptions, cooling costs, and total cost of ownership, it is altering the storage considerations of organizations by forcing them to move away from spinning disks.

Segment Insights

- By product type, All Flash Arrays (AFAs) dominates the market, because of their unparalleled latency, high IOPS and reliability for performance-critical enterprise workloads.

- By solution components, Storage media (SSDs) and array controllers together dominate because they provide the performance horsepower and control logic required in scalable flash storage systems.

- By form factor/packaging, the 2.5" U.2 / U.3 SSDs dominate. They are the preferred option in enterprise arrays, because their small size can still fit within existing server bays.

- By interface/protocol, SAS SSDs and NVMe in mixed environments dominate, since they offer the ideal backwards compatibility with legacy infrastructure to pair with the jump in performance from NVMe.

- By NAND / memory type, TLC-based 3D NAND dominates (TLC-based 3D NAND provides an adequate balance of cost, endurance and capacity for doing what most enterprise storage needs.)

- By capacity tier, 1-4TB class dominates, as it meets most use-cases in databases, virtualization, and mixed workloads while providing a good price per TB.

- By deployment model, On-premise arrays dominate, it is still very popular for large enterprises and hyperscalers to have direct control of their storage infrastructure when they are considering latency, compliance, and security.

- By workload/application, databases and virtualization workloads dominate the market as they require high IOPS and low latency with consistent performance.

- By end-user industry, hyperscalers and BFSI dominate the market, where scaling lights up an entire barn full of (performance, security and reliability) enterprise flash storage.

- By enterprise size, large enterprises-hyperscalers, since these offer very high enterprise data volume, complex and demanding workloads and the ability to justify both large infrastructure investments and/or capitalizing on economies of scale.

- By sales and distribution channel, direct OEM/vendor enterprise sales, where enterprise organizes its purchase directly through the storage vendor and as full systems, support, and custom service agreements.

Enterprise Flash Storage Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 23.71 Billion |

| Market Revenue by 2033 | USD 44.41 Billion |

| CAGR from 2025 to 2033 | 8.16% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Insights

North America remains the leader, as the high concentrations of hyperscale data centers being first early adopters of NVMe/TLC/QLC storage, and also of broader availability, and having established cloud and virtualization ecosystems that are highly matured and heavily funded to position for enterprise flash storage has been a strong competitive and funding boost into the flash enterprise storage market in North America alone.

Asia-Pacific is in second position is another quickly growing region. The developments of countries like China, India, Japan, and South Korea, are rapidly improving, if not completely reproducing existing forms of fast data-storage processing or infrastructure, with cloud, edge computing, and a general overall acceptance of cloud infrastructure availability in the market.

Enterprise Flash Storage Market Key Players

- Dell Technologies

- Pure Storage

- NetApp

- Hewlett Packard Enterprise (HPE)

- IBM · Samsung Electronics

- Western Digital

- Kioxia

- Micron Technology

- Intel (memory & persistent memory business)

- Hitachi Vantara

- Inspur

- Lenovo

- Huawei

- Inspur

Recent developments

- In Aug 2025, SanDisk introduced a 256 TB NVMe SSD (with a 128 TB variant) built on its UltraQLC platform, using 2 Tb BiCS8 3D QLC NAND, Direct Write QLC capability (avoiding pseudo-SLC buffering), and enhanced controller/firmware optimizations; designed for AI, cloud, and high-density enterprise workloads. (Source- https://www.sandisk.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6774

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344