Enterprise Flash Storage Market Size and Forecast 2025 to 2034

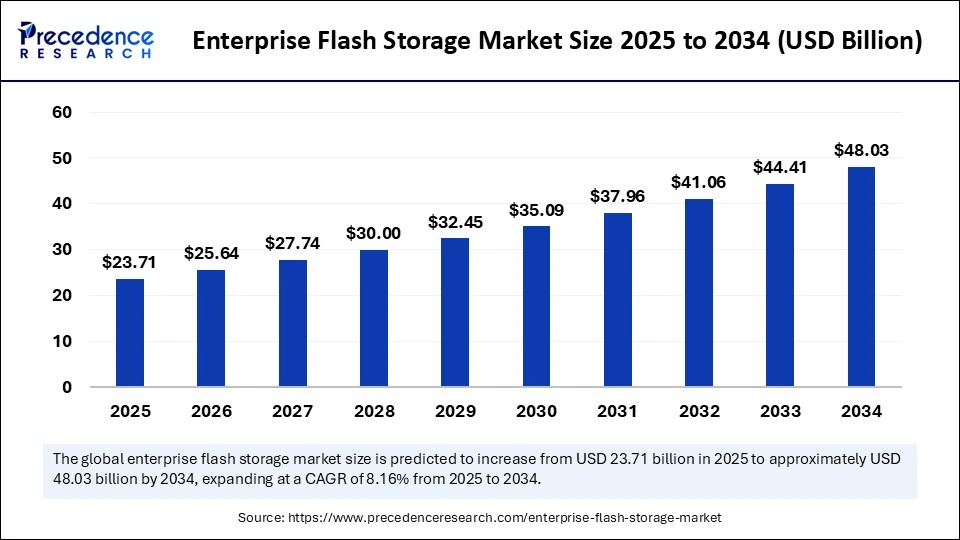

The global enterprise flash storage market size accounted for USD 21.92 billion in 2024 and is predicted to increase from USD 23.71 billion in 2025 to approximately USD 48.03 billion by 2034, expanding at a CAGR of 8.16% from 2025 to 2034. The increased adoption of cloud computing and virtualization is driving the global market. The market is further experiencing significant growth due to increased demand for enhanced data security and compliance.

Enterprise Flash Storage Market Key Takeaways

- In terms of revenue, the global enterprise flash storage market was valued at USD 21.92 billion in 2024.

- It is projected to reach USD 48.03 billion by 2034.

- The market is expected to grow at a CAGR of 8.16% from 2025 to 2034.

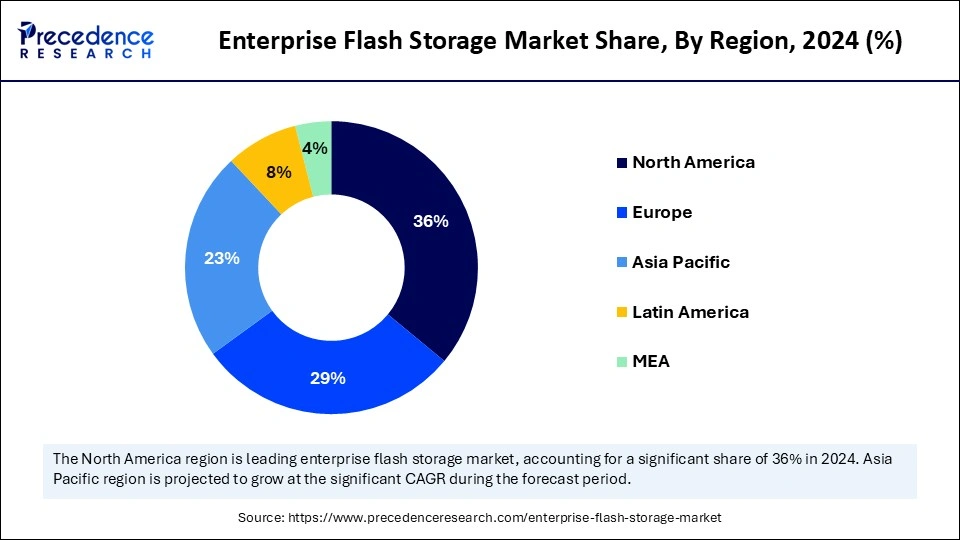

- North America dominated the global enterprise flash storage market with the largest market share of 36% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 20245 to 2034.

- By product type, the all-flash arrays (AFA) segment contributed the biggest market share in 2024.

- By product type, the NVMe-over-fabrics (NVMe-oF) appliances/disaggregated storage nodes segment is expected to grow at a notable CAGR between 2025 and 2034.

- By solution component, the storage media segment led the market in 2024.

- By solution component, the storage software segment will grow at a significant CAGR between 2025 and 2034.

- By deployment mode, the on-premises segment captured the highest market share in 2024.

- By deployment mode, the public cloud segment will grow rapidly between 2025 and 2034.

- By workload/application, the databases segment contributed the maximum market share in 2024.

- By workload/application, the AI/ML training and inference segment will grow at a notable CAGR between 2025 and 2034.

- By end-user industry, the IT and telecom/hyperscalers and CSPs segment accounted for significant market share in 2024.

- By end-user industry, the healthcare and life sciences segment will grow at a considerable CAGR between 2025 and 2034.

- By enterprise size, the large enterprises/hyperscalers segment generated the major market share in 2024.

- By enterprise size, the mid-market enterprises segment will grow significantly between 2025 and 2034.

Market Overview

The enterprise flash storage market refers to hardware, firmware, and software solutions that provide flash-based persistent storage for enterprises, including all-flash arrays (AFAs), NVMe storage, flash-optimized hybrid arrays, enterprise SSDs (U.2/U.3, EDSFF, M.2), persistent memory/SCM, and related management, data services, and deployment offerings, used to support enterprise workloads (databases, virtualization, analytics, AI/ML, backup/DR, VDI, HPC) across on-premises, cloud, and hybrid environments.

The market is experiencing rapid growth with increased need for high-performance storage solutions and next-generation technologies. The rapid use of cloud computing, big data analytics, and AI has increased data volume, leading to the need for advanced flash storage solutions in the enterprise sector. The global market is expanding significantly, driven by a strong emphasis on NVMe-based solid-state drives (SSDs) and innovations in software-defined storage (SDS) solutions. The cloud-based storage solution segment is gaining traction in the market.

U.S. Enterprise Flash Storage Market Size and Growth 2025 to 2034

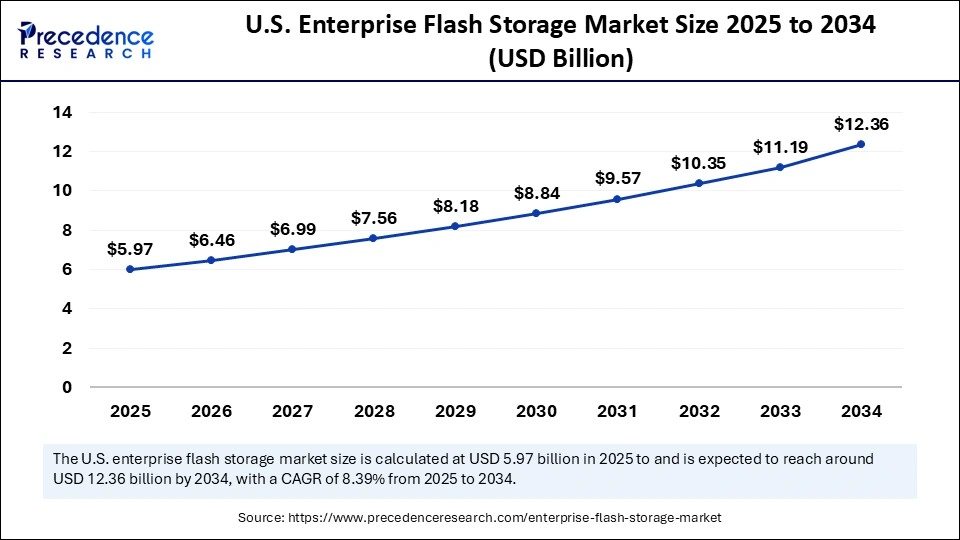

The U.S. enterprise flash storage market size was exhibited at USD 5.52 billion in 2024 and is projected to be worth around USD 12.36 billion by 2034, growing at a CAGR of 8.39% from 2025 to 2034.

North America Enterprise Flash Storage Market

North America dominates the global market, driven by the region's digital transformation initiatives, advanced IT infrastructure, and strong presence of major technology vendors across the U.S. and Canada. North America has a well-established IT infrastructure that enables the broad adoption of high-performance storage solutions across the region. The increased adoption of cloud computing, AI workloads, and increased demand for high-performance storage for data centers are leveraging this growth. Additionally, the rapid shift toward 3D NAND technology and a strong focus on NVMe and software-defined solutions are contributing to innovative approaches.

Strong Innovations Leading the U.S. Market Accessibility

The U.S. is a major player in the regional market, contributing to growth due to countries' large shift toward AI, cloud computing, hybrid cloud strategies, and increased demand for high-performance storage solutions. The strong surge for AI integration in the development of next-generation flash storage solutions is transforming the market. The ongoing innovations, like NVMe over fabrics for high speed and efficiency, are solidifying the position of the country's manufacturing giants in the global market.

- In August 2025, Intel Corporation signed an agreement with the Trump Administration to support the continued expansion of American technology and manufacturing leadership. Under this agreement, the United States government announced $8.9 billion investments in Intel common stock by reflecting the confidence of the Administration in Intel for advancing key national priorities and the critically important role of companies in expanding countries' domestic semiconductor industry. (Source: https://www.intc.com)

Asia Pacific Enterprise Flash Storage Market

Asia Pacific is the fastest-growing region in the global market, driven by the region's digital transformation initiatives and increased adoption of cloud computing. Asia has experienced rapid growth in industrial infrastructure and digital technology use, driving the need for advanced storage solutions among enterprises to handle increased data volume. The strong existence of international storage vendors is further contributing to innovations and developments. Additionally, the robust shift of technological advancements in 3D NAND and software-defined storage, with strategic partnerships for improving infrastructure and supply chain resilience, is contributing to this growth.

China's Market Reach

China is a major player in the regional market, driven by countries' strong focus on AI integration and data center expansion. China has boosted its emphasis on indigenous components. Government support for local market players like YMTC and stargicec partnerships and consolidation efforts are poisoning market growth. China's national strategy in replacing imported HDDs and SSDs with full in-house production of SSDs is fueling market expansion.

China's top flash memory market, Yangtze Memory Technologies Co (YMTC), established a US$3 billion venture in September in its home city of Wuhan, capital of central Hubei province. The company has doubled down on its next-generation NAND chips. According to information from Chinese corporate data provider Qichacha, YMTC chairman Chen Nanxian has incorporated registration capital of 20.7 billion yuan. (Source: https://finance.yahoo.com)

India as an Emerging Market

India is a significant player in the regional market, contributing to growth due to the country's rapid digitalization efforts and growing use of cloud computing and AI/ML applications. The expanding enterprises and need for high-performance storage across various enterprise sectors are leveraging this growth. SSD segment is solidifying its position in the counties market with internal SSDs showing spectacular QoQ and YoY growth.

What are the Key Trends of the Enterprise Flash Storage Market?

- Demand for Enhanced Data Security and Compliance: The growing demand for improved data security features like data deduplication and encryption inflates storage solutions for prioritizing data security, driving the market growth.

- Adoption of Big Data Analytics: The adoption of big data analytics and AI technology has increased, driving the need for day data access and processing, leading to the adoption of enterprise flash storage solutions.

- Cloud Computing and Virtualization Adoption: The increased adoption of cloud computing and virtualization technologies led providers to adopt flash storage to improve performance and reliability in virtualized infrastructure.

- Data Volume Growth: The increased data volumes and requirement for fast data access have boosted demand for high-performance storage solutions, including enterprise flash storage solutions.

- High-Performance Computing: Rapid industrialization has boosted the need for high-performance storage solutions, particularly in weather forecasting, financial modeling, and scientific research, driving the adoption of flash storage solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 48.03 Billion |

| Market Size in 2025 | USD 23.71 Billion |

| Market Size in 2024 | USD 21.92 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.16% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Solution Component, Deployment Model, Workload/Application, End-User Industry, Enterprise Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Need for Higher Performance and Low Latency

The demand for real-time data processing has increased, driving the need for fast data access and processing to support this need. Enterprises have experienced increased workloads like big data, real-time analytics, and AI, driving the need for fast data access and processing solutions, as an alternative to traditional storage solutions. The growing need for enhancing application performance and the growth of data-intensive workloads have shifted enterprises toward the adoption of advanced flash storage solutions with their high input/output operations per second (IOPS) and inherently lower latency. This solution enables enterprises to handle intensive applications, accelerate transactions, and enhance user experiences.

Restraint

High Initial Cost

The high upfront cost associated with enterprise-class storage solutions is the major barrier in the market, particularly for small and medium-sized enterprises. Enterprises need fast data access and high-performance storage, which can add to the cost. Advanced flash storage technologies like storage class memory systems and all-flash arrays require high investments for innovations and developments. The flash storage solutions face large concerns about security measures, limited lifespan, and compatibility issues, which can be complex, time-consuming, and costly to handle. Enterprises require flash storage solutions with high scalability, cost-effectiveness, and interoperability.

Opportunity

Digital Transformation

Rapid digital transformation across the globe has boosted the requirement for high-speed and high-capacity storage solutions for managing the massive data generated by AI, cloud, and IoT initiatives. The digital transformation needs scalable, agile, and efficient storage solutions for handling mission-critical applications and data-driven opportunities. The growing cyber security threats and need for hybrid-cloud environments, and the expanding use of flash storage solutions with extreme data protection and cutting-edge features. With expanding data growth driven by digitalization, there are significant innovative opportunities for enterprise flash storage solutions.

Product Type Insights

Which Product Type Leads the Enterprise Flash Storage Market in 2024?

In 2024, the all-flash arrays (AFA) segment led the market, due to increased need for superior performance, low latency, and speed. The all-flash arrays (AFA) enable high performance and low latency compared to traditional hard disk drives (HDDs), which enables fast data processing for critical applications. The increased use of flash memory, improved by cutting-edge software for data reduction, efficient management, and flexible integration, is leveraging the adoption of all-flash arrays (AFA) for its superior performance advantages.

The NVMe-over-fabrics (NVMe-oF) appliances/disaggregated storage nodes segment is the second-largest segment, driven by its advantages of superior speed, reduced latency, and parallelism for data-intensive applications. These products are suitable for modern and advanced cloud computing, big data analytics, and AI/ML workloads. The ability of these products to offer high performance and low-latency makes them ideal over networked fabrics like Fibre Channel, Ethernet, and InfiniBand.

Solution Components Insights

What Made the Storage Media Segment Dominate the Enterprise Flash Storage Market in 2024?

The storage media segment dominated the market in 2024, due to its superior benefits for high-performance and data-intensive environments. SSDs handle the large amount of enterprise needs, and SCM addresses niche and mission-critical functions. The ability of SCM to offer near-memory speeds with persistence and higher endurances than NAND flash drives its adoption in latency-sensitive and high-performance applications like databases and financial trading.

The storage software segment is expected to grow fastest over the forecast period, driven by increased need for data management, cutting-edge NVMe-based architectures, and software-defined storage (SDS). These technologies enable high performance and efficiency for big data, AI, and virtualization. The storage software features, including deduplication, compression, snapshots, and replication, provide enhanced efficiency, cost reduction, and improved data management.

Deployment Mode Insights

Which Deployment Mode Dominates the Enterprise Flash Storage Market?

The on-premises segment dominated the market in 2024, due to the need for high security, performance, and control for highly regulated industries. Enterprises that are required to meet regulatory requirements and complexities are highly adopters of enterprise flash storage solutions, which offer an array of offerings with lower latency and higher speed compared to cloud-based alternatives. This array enables enterprises to meet with strict data sovereignty and compliance requirements.

The public cloud segment is the second-largest segment, leading the market, driven by its offering of cost-effective, reliable, and high-performance flash-as-a-service. The massive data centers and investments in public cloud offer highly scalable and resilient advancements in flash memory density and efficiency. This advancement allows hyperslavers to provide storage at economics comparable to HDDs.

Workload/Application Insights

What Made Databases Dominate the Enterprise Flash Storage Market in 2024?

The databases segment dominated the market in 2024, due to increased demand for all-flash array products in database applications like OLTP and OLAP. Databases conduct applications like big data analytics and enterprise resources planning (ERP), which drives the need for high performance, low latency, and durability of flash storage. The solid-state drives (SSDs) are the most widely adopted flash storage in database applications.

The AI/ML training and inference segment is expected to grow fastest over the forecast period, driven by increased use of AI and ML technologies. The flash storage solutions enable the processing of massive datasets and complex, random-access workloads, which are essential in AI/ML training and inference. The ability of flash storage to provide high IOPS, required for data ingestion and processing during the initial learning phase, and response of low-latency required for real-time inference applications, drives their adoption in AI/ML training and inference applications.

End-User Industry Insights

Which End-User Industry Dominates the Enterprise Flash Storage Market in 2024?

In 2024, the IT and telecom/hyperscalers and CSPs segment dominated the market, due to increased demand for high-performance and scalable storage for big data, AI, and cloud-native applications. The use of cloud computing, AI/ML, IoT, and big data analytics has increased in the IT and telecom/hyperscalers and CSPs industries, driving a significant need for superior high-performance and low-latency flash storage solutions for the process of fast data access. The flash storage solutions are effective for data processing, particularly all-flash arrays, due to their modern digital infrastructure, suitable for IT and telecom/hyperscalers and CSPs industries.

The healthcare and life sciences segment is expected to lead the market over the forecast period, driven by increased digitalization in the healthcare and life sciences industries. The rapid use of digital devices and technologies has generated a massive amount of data, which is the driving need for the protection of sensitive data. Data volume from clinical trials, research, and patient care is driving the need for highly scalable, high-performance, and secure storage solutions. The growing reliance on AI and digital platforms in drug discovery and diagnostics is further contributing to an increase in demand for advanced flash storage solutions. Additionally, the need for healthcare and life sciences industries to work with regulatory compliance brings significant innovative opportunities for cloud and hybrid storage solutions.

Enterprise Size Insights

How Large Enterprise/Hyperscalers are Dominating the Enterprise Flash Storage Market?

In 2024, the large enterprises/hyperscalers segment dominated the market due to high demand for digital transformation, data-intensive applications, and scalable cloud infrastructure in large enterprises/hyperscalers. The massive use of AI, big data, and cloud workloads in these enterprises requires high-performance, scalable, and cost-effective solutions, including flash storage solutions. The large adoption of hybrid and cloud-based models in large enterprises/hyperscalers is a strong push toward fast speed and higher endurance of flash storage solutions, influencing a strong architecture of the market.

The mid-market enterprises segment is the second-largest segment, leading the market, driven by the increased need for cost-effective and scalable storage solutions in these enterprises. The cloud-native infrastructure and adoption of scalable solutions like NVMe have boosted the need for high-performance and resilient storage solutions in mid-market enterprises. The expanding digital operations are fueling the need for faster performance and enhanced management capabilities with affordability, leading to significant innovations in the market.

Value Chain Analysis

- Raw Material Procurement

The enterprise flash storage solutions involve the production of key components like flash memory chips, DRAM cache, flash controller, printed circuit boards (PCBs), and system enclosers.

Key Players: Samsung Electronics, Micron Technology, Kioxia, and Western Digital Corporation.

- Distribution to OEMs and Integrators

OEMs and system integrators (Sis) are distinct and collaborative distribution channels that offer customized and project-specific solutions that incorporate flash storage from different vendors.

Key Players: Dell Technologies, Hewlett Packard Enterprise (HPE), Pure Storage, and NetApp.

- Lifecycle Support and Recycling

Enterprise flash storage solutions lifecycle support and recycling evolves planning and acquisition of supplier agreements, capacity planning, and financial strategies.

Key Players: Dell, HPE, specialized IT asset disposition (ITAD) and IT asset lifecycle management (ITALM) providers like Iron Mountain, Sims Lifecycle Services, and Securis.

Enterprise Flash Storage Market Companies

- Dell Technologies

- Pure Storage

- NetApp

- Hewlett Packard Enterprise (HPE)

- IBM

- Samsung Electronics

- Western Digital

- Kioxia

- Micron Technology

- Intel

- Hitachi Vantara

- Inspur

- Lenovo

- Huawei

- Inspur

Recent Developments

- In September 2025, HPE announced the naming of a leader for the 2025 Gartner Magic QuadrantTM for enterprise storage platforms. This movement marks the 16th consecutive year of recognition as a leader for HPE's ability to execute and complete its vision. (Source: https://www.hpe.com)

- In August 2025, Samsung Electronics unveiled its vision for next-generation memory and storage innovation in the AI era at FMS (Future Memory and Storage) 2025. This event was held from August 5-7 at the Santa Clara Convention Center in San Jose, California. (Source: https://semiconductor.samsung.com)

- In August 2025, Kioxia group, a world leader in memory solutions, took center stage at FMS (the Future of Memory and Storage) to unveil its flash memory and SSD innovation in scalable and efficient infrastructure for artificial intelligence (AI). The company has launched the industry's first 245.76 TB NVMe SSD and announced development of 1 TB TLC products for use in next-generation NAND flash technologies. (Source: https://www.kioxia.com)

Segment Covered in the Report

By Product Type

- All-Flash Arrays (AFA)

- Flash-Optimized Hybrid Array

- Enterprise SSDs (internal and removable)

- NVMe-over-Fabrics (NVMe-oF) appliances/disaggregated storage nodes

- Storage-class memory/persistent memory modules (SCM)

- Software-defined flash storage (SDFS)/virtualized flash appliances

- Embedded/edge flash storage systems

By Solution Component

- Storage media (SSDs, SCM)

- Controllers and storage processors

- Storage software (data services: dedupe, compression, snapshots, replication)

- Networking/host adapters (NVMe HBAs, RDMA)

- Management and orchestration tools

- Professional services and integration

By Deployment Model

- On-premises (rack/array-based)

- Private cloud/hosted private cloud

- Public cloud (Flash-as-a-Service through hyperscalers)

- Hybrid cloud/multi-cloud storage

By Workload/Application

- Databases (OLTP/OLAP)

- Virtualization and VDI

- AI/ML training and inference

- Big data/analytics/data lakes

- Backup, archival and disaster recovery (flash-tier + capacity tier)

- Media and entertainment (rendering, post-production)

- HPC/scientific computing

By End-User Industry

- IT and Telecom/Hyperscalers and CSPs

- BFSI (banking, financial services)

- Healthcare and Life Sciences

- Government and Defense

Retail and eCommerce - Manufacturing and Automotive

- Media and Entertainment

- Education and Research

By Enterprise Size

- Large enterprises/hyperscalers

- Mid-market enterprise

- SMB (edge/appliance-based offerings)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content