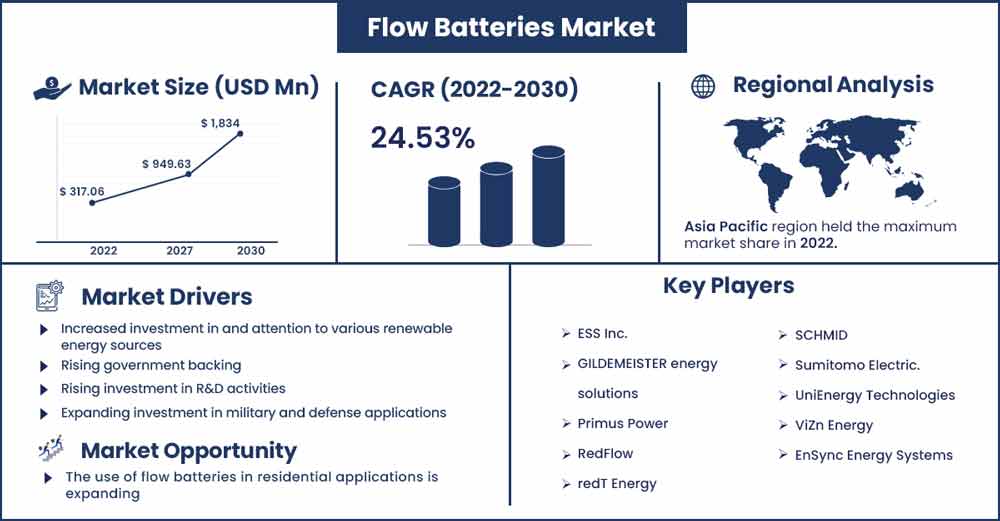

Flow Batteries Market Will Hit 24.53% Growth Through 2030

The global flow batteries market size surpassed USD 317.06 million in 2022 and is predicted to touch around USD 1,834 million by 2030, growing at a remarkable CAGR of 24.53% between 2022 and 2030.

The size of a large-scale electrical storage system grows in lockstep with the output of intermittent energy sources like solar and wind, improving its efficiency and balancing the supply and demand of renewable energy. Flow batteries are easily available on the market to meet these criteria and perform better than conventional batteries. These batteries are especially useful for electric power consumers, such as commercial and industrial buildings, who require higher capacity, backup power, and continuous supply. These are rechargeable electricity generation storage devices that work by forcing fluid through active material-filled cells. This promotes reduction and oxidation on both sides of the an ion-exchange membrane to produce an electric potential. The electrodes contain material that is electroactive. One positive electrode and one negative electrode are dipped into an electrolyte solution, which is kept in external tanks. Due to the fact that electrolytes do not alter physically or chemically, flow batteries have a long service life.

Iron, polysulfide bromine, hydrogen-bromine, zinc-bromine, and organic materials are among the many types of materials utilized in the manufacture of flow cells. Low energy density and little change and discharge rate, which need the charging of electrodes as well as membrane separators and raise the cost of flow batteries, are the two primary drawbacks of flow batteries.

The market for flow batteries is mostly driven by vanadium batteries. A significant contributing element to the growing sales of flow batteries is the price of vanadium batteries. The power output generated for flow batteries as a storage system varies with the new electricity producing capability of nearby renewable energy producers like solar and wind energy. Due of the frequency control and voltage assistance that flow batteries offer to utilities. In light of the fact that many developed and emerging nations are concentrating on using sources of renewable energy to produce electricity, the expansion of the flow battery market is expected to be significantly influenced by this trend.

The growing use of flow batteries in electric cars is supporting the expansion of the market for flow batteries, which is anticipated to see profitable growth. Other advantages offered by flow batteries include fast recharge capacity, a longer lifespan, and longer discharge hours. Contrarily, a flow battery storage system requires high-quality electrolytes, and it is projected that a lack of available raw materials would impede the growth of the market.

However, expanding use of flow batteries in EV is anticipated to fuel profitable expansion in the Flow Battery Market over the anticipated decade. Additionally, the market for flow batteries is anticipated to increase significantly due to growing investments in renewable energy sources.

Regional Snapshots:

The battery market in Asia-Pacific is predicted to grow at the greatest rate of any market worldwide over the anticipated timeframe. Working flow battery systems with high power ratings are available from APAC. While Australia has the most fluid battery projects globally for utility, residential, manufacturing, and corporate uses, China currently has the highest installed fluid battery capacity of any country in the area. Due to the growing need for flow batteries in significant nations like Australia and Japan, the market has grown. In addition, it is projected that operational projects utilizing battery flow systems would expand, and grid & microgrid flow batteries will be more in demand in China and India. During the projection period, the use of energy storage systems for commercial, utility, or other applications will also contribute to the growth of the regional market.

Flow Batteries Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 394.84 Million |

| Projected Forecast Revenue in 2030 | USD 1,834 Million |

| Growth Rate from 2022 to 2030 | CAGR of 24.53% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2022 To 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights:

- The flow battery market is anticipated to be dominated by the redox category. The rising demand for redox batteries from a variety of verticals, including the commercial, commercial, military, and utilities, is responsible for the segment's rise.

- During the anticipated period, the Zinc-Bromine material sector is anticipated to develop at the greatest CAGR. Zinc-Bromine is being used more frequently in residential, grids, industrial, microgrid, and commercial settings, which is what is driving the segment's growth.

- The biggest market share for flow batteries is anticipated to belong to the large-scale sector. The majority of industries, including commercial, industrial, utility, and military sectors, use large-scale flow batteries for effective production and storage.

- During the anticipated period, a utility segment is anticipated to increase at the greatest CAGR. This sector's rapid expansion may be attributable to the enormous demand for redox batteries in utilities.

- In the market for flow batteries, North America is anticipated to account for the highest proportion.

Drivers:

The key elements boosting the overall growth in the flow battery industry are quick recharge capabilities, prolonged longevity, and longer discharge hours. To integrate various renewable energy sources into the electrical grid, large-scale energy storage is necessary. Another element driving demand for flow batteries is increased investment in and attention to various renewable energy sources. The expanding usage of various types of flow batteries in several applications of electric vehicles has also led to predictions that the worldwide market for flow batteries would rise steadily throughout the anticipated period. Additionally, the business is expanding as a result of rising utility sector demand and the particular inherent benefits of flow batteries in a variety of industrial applications. Additionally, rising government backing, rising investment in R&D activities, and expanding investment in military and defense applications are all supporting the market's revenue growth.

Restraints:

The market for flow batteries is experiencing slow development due to intense competition from manufacturers of traditional batteries. The producers of commonly used traditional batteries like lead acid, sodium-based, and lithium ion are formidable competitors for flow battery manufacturers. Lithium ion batteries are the most well-liked and often utilized type of these. They are extensively employed in stationary applications, the consumer electronics sector, and the transportation industry. A relatively recent battery technology is the flow battery. Compared to other battery technologies like lithium-ion and lead acid, several of its varieties are still in the early stages of commercialization.

Opportunities:

Growing investments in renewable energy, rising utility sector demand, and an increase in telecommunications tower constructions will likely be the main factors propelling market expansion. Additionally, the inherent benefits of flow batteries and the substantial storage needs in data centers will further depress market value during the projected period. Additionally, it is predicted that throughout the projected period, technical advancements with increased capabilities and expanding residential application penetration would generate new chances for market growth.

Challenge

A significant market restriction for the global flow battery market is the high upfront cost involved in the production and installation of flow batteries. The main market restriction for the global flow battery industry is also the poor power density compared to lithium ion batteries.

Recent Developments:

- In March 2021: JenaBatteries has created metal-free redox flow batteries that generate green power from wind and solar parks, which are resource-efficient and sustainable energy storage devices.

- ESS Inc. announced the introduction of a new energy storage system with a 3 megawatt power capacity and a discharge duration of between 6 and 16 hours in February 2021: Large-scale renewable energy projects, transmission and distribution needs, and the provision of peaking energy capacity to replace gas plants are all supported by the storage system.

- Largo Resources introduced Largo Clean Energy, a vanadium redox flow battery, in December 2020 to offer sustainable energy storage options to the rapidly changing industry.

Major Key Players:

- ESS Inc.

- GILDEMEISTER energy solutions

- Primus Power

- RedFlow

- redT Energy

- SCHMID

- Sumitomo Electric.

- UniEnergy Technologies

- ViZn Energy

- EnSync Energy Systems

Market Segmentation:

By Type

- Redox

- Hybrid

- Membrane less

By Application

- Utilities

- Commercial

- Industrial

- Military

- EV Charging Station

- Off Grid & Micro grid Power

- Others

By Material

- All Vanadium

- All Iron

- Zinc–Bromine

- Hydrogen-Bromine

- Polysulfide Bromine

- Organic

- Others

By Storage

- Compact

- Large Scale

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2368

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333