Glycol Market Revenue, Top Companies, Report 2032

Glycol Market Revenue and Opportunity

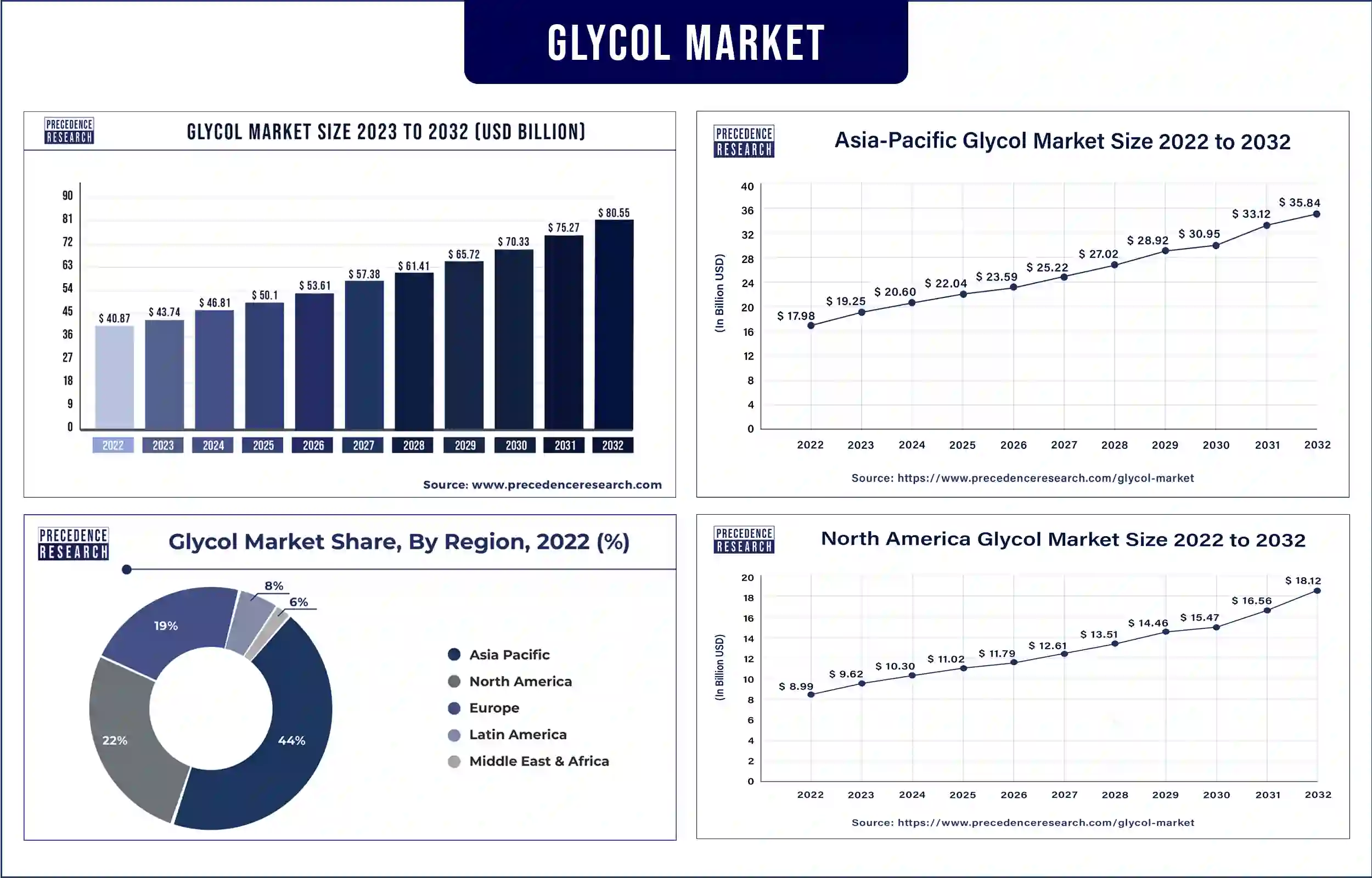

The global glycol market revenue was valued at USD 43.74 billion in 2023 and is poised to grow from USD 46.81 billion in 2024 to USD 80.55 billion by 2032, at a CAGR of 7.02% during the forecast period 2023 - 2032. The increasing demand for products such as antifreeze and coolants is expected to drive the growth of the glycol market during the forecast period.

Market Overview

The glycol market deals with organic compounds belonging to the alcohol family. The two hydroxyl groups are combined with the different carbon atoms in the glycol molecule. Glycol is a viscous, flammable, sweet-tasting, colorless, and odorless liquid. If glycol is taken in high concentrations, it can be toxic or harmful to human health. The increasing preference for using organic synthesis and rising demand for the compound in polyester resin manufacturing is expected to enhance the market's growth.

Increasing usage in the textile industry, increasing use of propylene glycol in the cosmetics, pharmaceuticals, and food and beverages industries, and increasing demand for ethylene glycol in the automotive industry are accelerating the growth of the market. In addition, the increasing eco-friendly manufacturing process of bio-based propylene glycol, increasing use of non-perishable, and rising government initiatives are further attributed to driving the growth of the glycol market during the forecast period.

Increasing usage of propylene glycol in the food industry to fuel market growth

Propylene glycol is commonly used in the food industry as a preservative and food additive. This colorless and odorless liquid has a little sweet taste, which makes it comfortable and suitable for several food products. Propylene glycol is versatile and helps to retain and absorb the moisture from the food and improve the shelf life and texture of food items. Propylene glycol can help food moisturize by maintaining the presence of water. Propylene glycol is utilized to help spread out colors and flavors in foods like frozen treats, sweets, and drinks. It can work with a lot of other things and doesn't harm the food.

Propylene glycol helps to make many foods nice-looking, fresh, and tasty. It acts as a stabilizer and solvent, prevents settling or separation, and stabilizes certain ingredients. Propylene glycol is a texture modifier that makes food palatable and smoother. In addition, propylene glycol is also found in several processed foods and beverages such as baked goods, dressings and sauces, ice-cream and frozen desserts, dairy products, soft drinks and flavored beverages, convenience foods, and candy and chocolates. These are the major driving factors enhancing the growth of the glycol market.

However, ethylene glycol has several drawbacks that may restrain the growth of the market. Ethylene glycol may create toxicity to animals and humans. Ethylene glycol is difficult to monitor in various ways. In the human body, ethylene glycol breaks down into harmful or toxic compounds. The toxic byproducts of ethylene glycol may negatively affect the kidneys, heart, and central nervous system of humans. The quick effects of exposure to higher accumulation of ethylene glycol can cause the deaths of fish, birds, or animals and also decrease the growth rate in plants. These are some restraining factors of glycol that may hinder the growth of the glycol market.

Glycol Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 46.81 Billion |

| Market Revenue by 2032 | USD 80.55 Billion |

| Market CAGR | CAGR of 7.02% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Glycol Market Top Companies

- Repsol

- Arch Chemicals Inc.

- Haike Chemical Group Co., Ltd

- Manali Petrochemicals Limited

- Chaoyang Chemicals, Inc

- ADEKA CORPORATION

- Huntsman International LLC

- INESOS Oxide

- Temix Oleo

- SKC

- DuPont Tate & Lyle Bio Products

- Global Bio-chem Technology Group Company Limited

- ADM

- BASF SE

- LyondellBasell Industries N.V.

- Dow

Recent Innovation in the Glycol Market by Dow

- In March 2024, in North America, Dow proudly announced the launch of the new renewable varieties of propylene glycol that were circular and bio-circular feedstocks. This new variety of propylene glycol is suitable for a wide range of applications. Consumers could offer their high-performance items with highly verified sustainability advantages.

Recent Innovation in the glycol market by DuPont

- In February 2024, to extend the life of electric vehicle coolants, DuPont, the chemicals company, launched AmberLite EV2X resin. This new resin is a glycol-purification service that increases the durability of an electric vehicle’s ion exchange filter, glycol components, and glycol coolants. In addition, this resin also helped to maintain the conductivity in electric vehicle systems and was introduced into the elevating conductivity levels and cooling loop.

Regional Insights

Asia Pacific is estimated to grow fastest during the forecast period. The increasing traditional centers of advancements for manufacturing, increasing initiatives to create an industrial ecosystem, increasing rapid expansion of the food, automotive, and industrial sectors, and rising focus on advanced industrial processes are expected to enhance the growth of the glycol market in Asia Pacific. India, China, Japan, and South Korea are the major leading countries in the Asia Pacific region.

India and China have the largest glycol market. Indian companies have developed various types of glycols, such as propylene, ethylene, and mono-ethylene glycol. Glycol manufacturers create green technology based on nutraceuticals, sugar, industrial gases, spirits, natural gums, consumer goods, fertilizers, and fuels. Glycol companies also hold green petrochemical technology and generate glycol from sustainable agricultural resources, namely sugar cane or molasses.

- For instance, in China, in 2023, leading major companies such as ITOURSCM INC, IKEA SUPPLY AG, and GLOBAL ETRADE SERVICES INC were at the frontline of shipping Ethylene glycol from China.

- In 2022, China became the first largest importer of Ethylene glycol because China imported 4.43B Ethylene glycol into the world. For Ethylene glycol, China is the fastest-growing export market.

North America dominated the glycol market in 2023. The growing automotive and robust industrial sectors, increasing presence of major glycol manufacturers, rising stringent quality standards, and well-developed chemical manufacturing infrastructure are attributed to fuel the growth of the market in North America. The U.S. and Canada are the major leading countries in the North American region. Propylene glycol is a common cosmetics and food ingredient that is generally safe in the U.S. Propylene glycol can be used as an indirect and direct food additive in the U.S. The government in the U.S. has developed guidelines and glycol regulations to protect workers and the public from potential health risks. These are the major factors that help to enhance the growth of the glycol market in North America.

Market Potential and Growth Opportunity

Increasing demand for glycol in the automotive industry

It is anticipated that the growing need for glycol in the automotive sector will propel market expansion. Due to its possibly lower melting point than water, ethylene glycol is used in engines as a coolant to avoid overheating in the summer and to prevent engines from freezing in water. Ethylene glycol is also used in electric cars to activate combustion heat. These are the principal changes that are anticipated to propel the glycol market's expansion and demand in the upcoming years.

Glycol Market News

- In February 2024, the groundbreaking class of polyethylene glycol Lipids was launched by Evonik Industries AG in collaboration with the University of Mainz. The aim behind this launch was to improve this advanced development to accelerate its excipients and ultimately bring technical grade rPEG-lipids to the market.

- In April 2022, Symrise launched the bio-based caprylyl glycol. Most of the caprylyl glycol is commonly manufactured by the petrochemical process. However, this innovative bio-based caprylyl glycol is made from natural components such as palms and coconuts.

- In October 2022, commercial operations at United Ethylene Glycol Plant 3, launched by Saudi Basic Industries Corp, commenced. The yearly production or capacity of monoethylene glycol was 700,000 metric tons.

Market Segmentation

By Product

- Ethylene Glycol

- Propylene Glycol

By Application

- Automotive

- HVAC

- Textiles

- Airlines

- Medical

- Pipeline Maintenance

- Polyester Fibers and Resins

- Food and Beverage

- Others

By End-User

- Automotive and Transportation

- Packaging

- Food and Beverage

- Cosmetics

- Pharmaceuticals

- Textile

- Other End-user Industries

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2788

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308