Group Health Insurance Market Revenue to Attain USD 4.51 Bn by 2035

Group Health Insurance Market Revenue and Trends 2026 to 2035

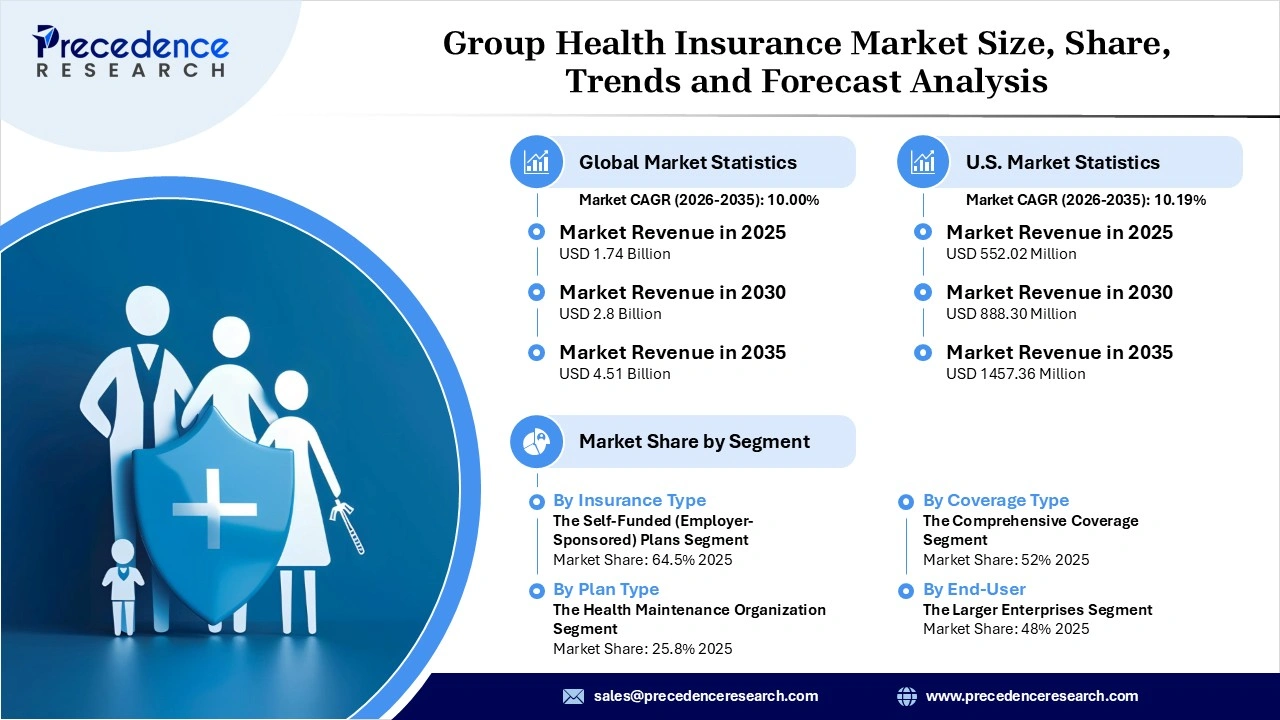

The global group health insurance market revenue was valued at USD 1.74 billion in 2025 and is expected to attain around USD 4.51 billion by 2035, growing at a CAGR of 10.00% during forecast period.This market is experiencing unprecedented growth, driven by the growing emphasis on preventive care within organizations and the increasing adoption of digital platforms

What are the Factors Contributing to the Growth of the Group health insurance market?

The rising costs of hospitalization and the growing prevalence of chronic illnesses are the major factors contributing to the overall growth of the market during the forecast period. Several companies are increasingly leveraging group health insurance to cover employees' medical expenses incurred during the treatment of any disease, injury, or physical impairment. Group health insurance serves as a compensation package to improve employee engagement and productivity.

Segment Insights

- By insurance type, the self-funded (employer-sponsored) plans segment held about 64.5% share of the market in 2025. The segment refers to an insurance policy that covers all employees' medical expenses within the organization. This policy assists in enhancing employee satisfaction and maintaining employee retention.

- By plan type, the health maintenance organization segment held the largest market share, accounting for 25.8% share in 2025. The health maintenance organization is a cost-efficient type of group health insurance plan, highly favored for the preventive care of employees, Additionally, the rising adoption of lower insurance premiums and the increasing prevalence of chronic diseases are anticipated to fuel the segment’s growth during the forecast period.

- By coverage type, the comprehensive coverage segment maintained a leading position in the market in 2025, accounting for an estimated 52% share. The comprehensive coverage segment involves insurance plans provided by employers covering various medical needs such as hospitalization, surgeries, maternity, critical illnesses, outpatient care, and others. The rising focus on lower premiums and preventive care propels the growth of the segment during the forecast period.

- By end user, the larger enterprises segment registered its dominant market share of approximately 48% share led the market in 2025. The large organizations leverage group insurance for cost-effective and customized coverage to manage rising healthcare costs and enhance employee retention.

Regional Insights

North America dominated the group health insurance market in 2025. The region's dominance is primarily driven by the increasing healthcare costs, rising prevalence of chronic illness, surge in the geriatric population, increasing focus to enhance employee’s satisfaction, and rapid digitalization in the insurance industry to manage administrative work smoothly. Moreover, increasing adoption of telemedicine and digital health technologies is anticipated to accelerate the growth of the market in the region.

- On the other hand, Asia Pacific is a rapidly growing region in the group health insurance market. The region's growth is attributed to the rapid digital transformation, the increasing number of financial services firms, the increasing prevalence of chronic health issues, rising healthcare expenses, and an increase in insurance premium costs. Several companies are increasingly focusing on their employees' preventive care and retention.

Group Health Insurance Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 1.74 Billion |

| Market Revenue by 2035 | USD 4.51Billion |

| CAGR from 2026 to 2035 | 10.00% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2025 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Recent Developments

- In November 2025, the North Carolina Chamber and Blue Cross N.C. announced the launch of Carolina HealthWorks, a new insurance program designed to make small business insurance coverage more affordable in North Carolina. The program provides insurance via a multiple-employer welfare arrangement, which allows small businesses to pool together their resources to buy a more affordable plan that would otherwise be accessible only to larger groups, through local chambers. Businesses with 2-50 employees who work a minimum of 30 hours a week will be able to start their coverage on January 1, 2026, if they are members of their local chamber. Employers must cover 50 percent of the employee-only premium, and 25 percent of eligible employees must participate.(Source: https://dailytarheel.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/7637

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344