Gynecological Devices Market Revenue to Attain USD 21.67 Bn by 2033

Gynecological Devices Market Revenue and Trends 2025 to 2033

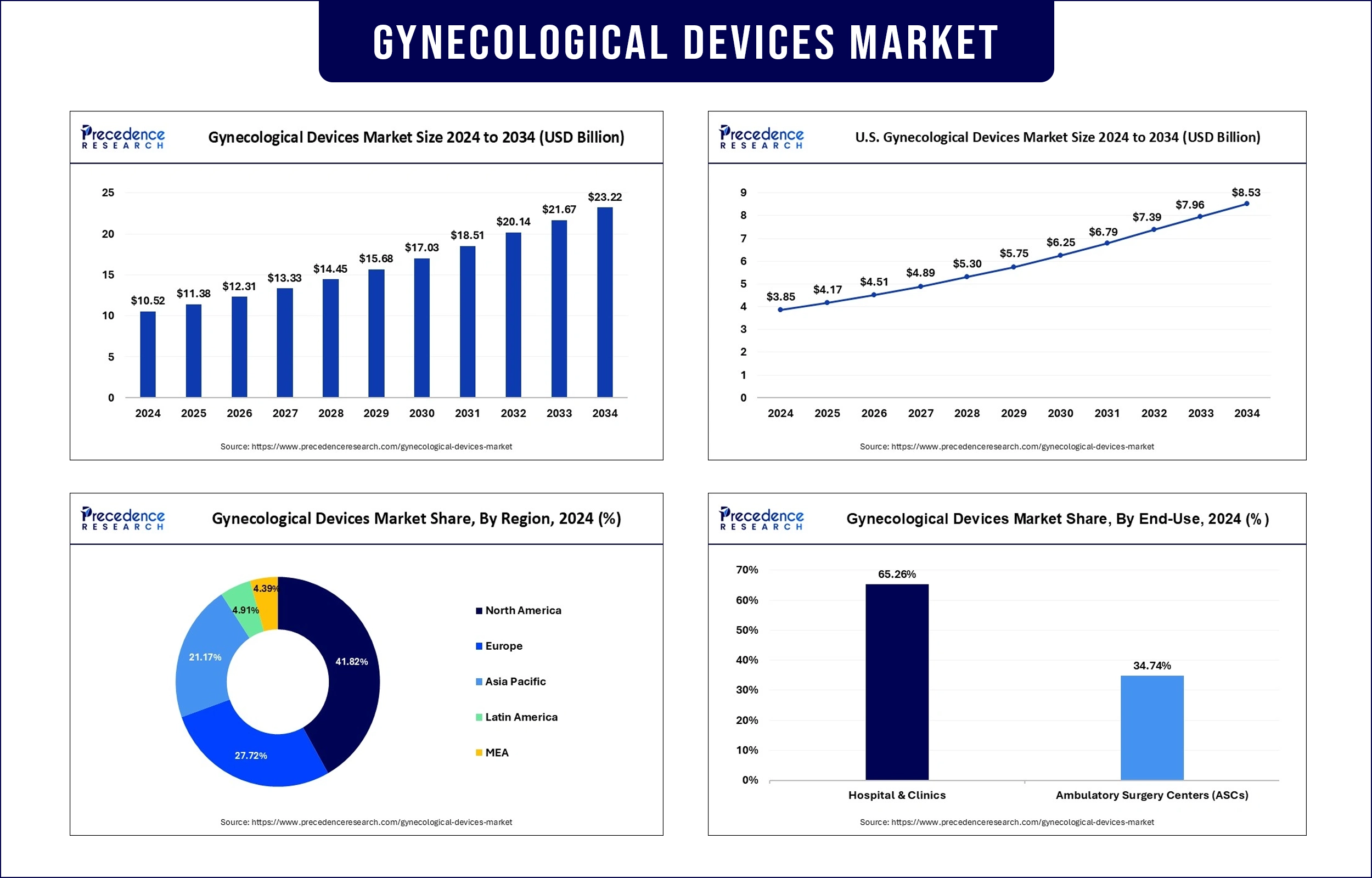

The global gynecological devices market revenue reached USD 11.38 billion in 2025 and is predicted to attain around USD 21.67 billion by 2033 with a CAGR of 8.25%. The growth of the market is driven by rising awareness of women’s health, increasing adoption of minimally invasive procedures, and technological advancements in diagnostic and surgical equipment.

Market Overview

The gynecological devices market revolves around the production and delivery of medical instruments for diagnosing, monitoring, and treating conditions that affect the female reproductive system. Medical instrumentation supports various surgical procedures, from hysteroscopy to intrauterine device (IUD) placements. Better imaging and diagnostic precision and improved reproductive healthcare policies drive the adoption of gynecological devices. The World Health Organization reports that women worldwide face gynecological problems yearly, including conditions like infertility, endometriosis, and cervical cancer. The FDA authorized a cutting-edge radiofrequency ablation device in 2024 to handle uterine fibroids, thus decreasing the requirement for hysterectomy procedures. Furthermore, the leading industry participants have launched real-time imaging technology with robotic-assisted systems to boost the precision of myomectomy and laparoscopy procedures.

Report Highlights of the Gynecological Devices Market

By Product

The surgical devices segment dominated the market with the largest share in 2024. This is mainly due to their widespread adoption, driven by the increasing preference for minimally invasive procedures and continuous advancements in gynecological surgical instruments. On the other hand, the diagnostic imaging systems segment is projected to experience significant growth in the coming years. The growth of the segment is attributed to the rising need for early detection of gynecological conditions and technological innovations in ultrasound and MRI systems.

By End-Use

The hospitals & clinics segment held the largest share of the market in 2024. This is mainly due to comprehensive surgical infrastructure and access to skilled gynecologists in these settings. The increased patient pool in hospitals further bolstered the segment. On the other hand, the ambulatory surgical centers segment is anticipated to register the fastest growth throughout the forecast period. The growth of the segment is attributed to the rising demand for outpatient gynecological procedures. Patients often prefer outpatient settings as they provide cost-effective and personalized services.

Gynecological Devices Market Trends

Increasing Burden of Uterine Disorders

The rise in the number of patients diagnosed with uterine fibroids, endometriosis, and pelvic inflammatory disease (PID) is boosting the demand for gynecological interventions. According to a report by the Office on Women’s Health, uterine fibroids affect nearly 20% to 80% of women by age 50, often leading to heavy menstrual bleeding and pain. These conditions create a high need for diagnostic devices and minimally invasive therapeutic systems. The WHO also emphasized that delayed diagnosis of gynecological conditions remains a public health concern, especially in low- and middle-income countries. Health systems worldwide now use improved diagnostic, screening, and awareness programs to enable early intervention.

Advances in Diagnostic Imaging and Robotics

Modern gynecological diagnostic methods now enable the precise identification of cervical cancer, endometrial hyperplasia, and ovarian cysts at earlier stages of development. AI-powered ultrasound systems and 3D laparoscopic imaging have gained FDA approvals in 2024, enabling improved visualization and targeted treatment planning. These technologies are now becoming common practice in both outpatient clinics and specialized women’s health centers. Moreover, improved diagnostic accuracy and real-time data processing are revolutionizing women's health treatments.

Rising Demand for Non-Invasive Contraceptive Devices

The worldwide drive for family planning, reproductive freedom, and the increasing need for long-acting reversible contraceptives (LARCs) has created the need for both hormonal and copper IUDs. According to the WHO, the use of Long-Acting Reversible Contraception (LARC) has increased in the last few years as public health campaigns highlight both the safety and accessibility of contraception. Current IUD designs with advanced insertion methods and minimal drawbacks are becoming increasingly popular.

The CDC noted that hormonal IUDs were the most commonly used LARC method in 2024 among U.S. women aged 20–34, with increased preference due to lower maintenance and higher efficacy. International non-governmental organizations teamed up with health ministries to provide more training about non-invasive contraception methods for healthcare professionals. Additionally, the wider availability of reproductive health services leads to equal access to reproductive care for all rural and underserved communities.

Aging Population and Postmenopausal Care

The increasing number of elderly women boosts the need for pelvic floor repair systems and urinary incontinence treatments. Research from the United Nations predicts the world expected to see a doubling of older women aged 60 and up by 2050, which lead to higher cases of pelvic organ prolapse and hormone-based gynecological conditions. Additionally, advanced pelvic floor therapy devices incorporating biofeedback and neuromodulation gained immense traction, offering non-surgical relief for millions of older women.

Regional Insights

North America dominated the gynecological devices market in 2024. This is mainly due to its robust healthcare infrastructure, facilitating early detection of gynecological conditions. The region is an early adopter of next-gen diagnostics and surgical instruments. The FDA's initiatives for women's health technologies through improved pathways for contraceptive and diagnostic innovations accelerated regional market growth. According to the CDC’s report published in 2024, over 65% of U.S. women aged 15–49 use some form of contraception, with a growing shift toward long-acting devices. NIH-funded initiatives in 2024 expanded clinical research into minimally invasive pelvic surgeries, supporting safety and efficacy for emerging technologies. Advanced gynecological tools received attention from outpatient settings, bolstering regional market growth.

Asia Pacific is anticipated to grow at the fastest rate in the coming years, driven by rising awareness of women’s health and growing access to gynecological procedures. The World Health Organization's efforts to boost reproductive wellness and diagnostic tools access across Southeast Asia support the market’s growth in the region. Moreover, the rising number of awareness campaigns on cervical cancer prevention led by WHO and local governments boosts the demand for early diagnostic tools. The rising modernization of healthcare facilities and the rise of digital health continue to improve patients' access to sophisticated gynecological treatments throughout the region, contributing to market growth.

Gynecological Devices Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 11.38 Billion |

| Market Revenue by 2033 | USD 21.67 Billion |

| CAGR | 8.25% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Major Breakthroughs in the Gynecological Devices Market

- In November 2024, Olympus Corporation showcased its latest gynecological innovations at the AAGL World Congress in New Orleans. The company presented the 8.5 MM Hystero-Resectoscope, VERSAPOINT II Bipolar Electrosurgery System, ESG-410 Surgical Energy Platform, and POWERSEAL Sealer/Divider with advanced vessel sealing. Olympus also presented containment systems like the PneumoLiner and Guardenia for safe tissue extraction.

- In April 2024, France’s Franche-Comté Polyclinic and Moon Surgical announced the clinical use of the Maestro System in 20 gynecological laparoscopic procedures across two hospitals, showcasing its efficiency and ease of training for surgeons.

- In March 2024, Cosm Medical gained FDA clearance for Gynethotics Pessaries, the first personalized pessary with nearly 10 million configurations. This innovation, also approved by Health Canada, marks a major advancement in pelvic health, backed by a 2023 clinical study published in Urogynecology.

Gynecological Devices Market Key Players

- Boston Scientific Corporation

- Ethicon Inc.

- Karl Storz Gmbh & Co. KG

- Cooper Surgical Inc.

- Hologic Inc.

- Medtronic plc

- Olympus Corporation

- Stryker Corporation

- Richard Wolf GmbH

- MedGyn Product Inc.

Market Segmentation

By Product

- Surgical Devices

- Handheld Instruments

- Diagnostic Imaging Systems

By End Use

- Hospital & Clinics

- Ambulatory Surgery Centers (ASCs)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/2523

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344