High-performance Liquid Chromatography Market Size, Growth, Report By 2032

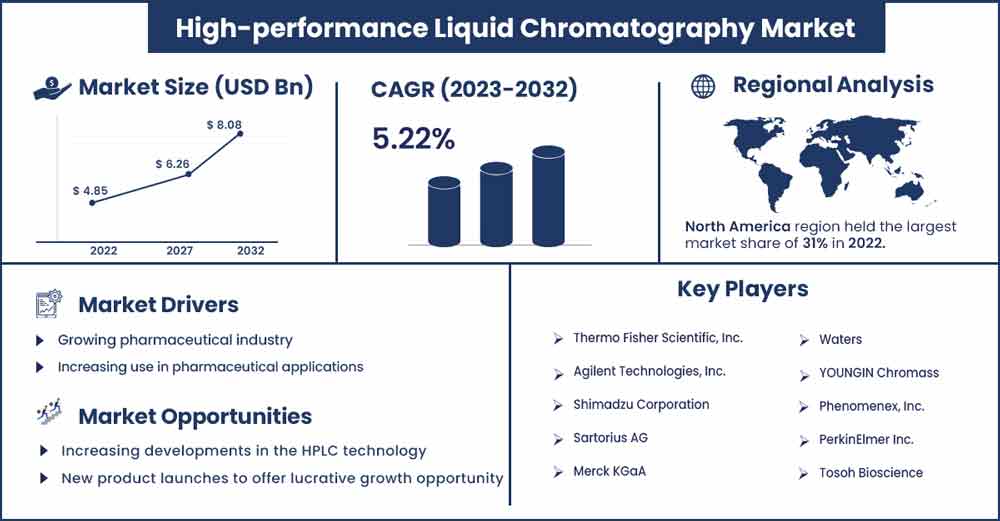

The global high-performance liquid chromatography market size surpassed USD 4.85 billion in 2022 and is projected to rise to USD 8.08 billion by 2032, anticipated to grow at a CAGR of 5.22 percent during the projection period from 2023 to 2032.

The major factors driving the market are the increasing demand from the pharmaceutical industry and growing clinical trials along with increasing investments in research & development of new generic drugs. Furthermore, the rising product launches along with the increasing improvement in the technology is also anticipated to augment the growth of the high-performance liquid chromatography market in the forecast period.

Market Overview:

In analytical chemistry and biochemistry, high-performance liquid chromatography is a chromatographic technique used to separate a mixture of substances in order to identify, measure, or purify each component of the mixture. Due to its properties, such as high sensitivity, this enables it to assess samples with extremely low concentrations, such as nano-gram and pictogram samples, to precisely identify molecules with comparable chemical properties, such as monoamines, as well as to detect compounds with complex chemistry.

Government involvement in environmental and food safety regulation, a growing emphasis on accurate diagnostics, and rising acceptance of chromatographic techniques as a normal practice for determining the expiration and specificity of drug components are all anticipated to contribute to the market growth in the years to come. It is also projected that the growth of the pharmaceutical and biotechnology industries will be impacted by the entry of current important players in emerging markets.

Furthermore, the expansion of the high-pressure liquid chromatography market is also being fueled by the introduction of ultra-high performance liquid chromatography (UHPLC) and the expanding use of automation in HPLC systems. Automation enhances analysis speed and accuracy while UHPLC offers quicker and more effective separations. Several industries, including biotechnology, pharmaceuticals, food and beverage, and environmental monitoring, are becoming more dependent on precise analytical data. The high-pressure liquid chromatography market is also growing due to its potent method for acquiring high-quality analytical results.

Regional Insights:

North America registered the largest revenue share of 31% in 2022. The market in the region is anticipated to grow rapidly due to the rising usage of highly sophisticated techniques and systems in the production of high-performance liquid chromatography (HPLC) and the technical advancements achieved in chromatographic studies. The strong market growth in the region is also mostly due to the high knowledge among research staff regarding the availability of cutting-edge chromatography studies in the industry. The HPLC approach is employed by a number of federal research institutions in the United States for the investigation of particular drug mixture components or comparable components. Furthermore, the use of HPLC methods as standardized procedures for sample analysis is also anticipated to augment the growth of the market within the estimated timeframe.

Asia Pacific is expected to register a rapid CAGR during the forecast period. The demography of the Asia Pacific (APAC) region is diverse. It includes developing nations like India, China, Thailand, Malaysia, Indonesia, as well as developed economies like Japan, Taiwan, South Korea, Singapore, and Australia. After North America, Asia has the second-largest pharmaceutical market worldwide. The increasing size of the population, particularly the elderly population, rising health expenditures, regulatory systems, and the prevalence of disease are all the factors that contribute to the growth of the market in this region. The pharmaceutical industry in the region is adjusting to new technologies and innovation in order to promote reforms in industry trends further supporting the regional growth of the market during the forecast period.

High-performance Liquid Chromatography Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 5.1 Billion |

| Projected Forecast Revenue in 2032 | USD 8.08 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.22% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 To 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights:

- By Product, the consumables segment is expected to grow at a substantial rate in the global high-performance liquid chromatography market during the forecast period. Consumables for high-performance liquid chromatography include the reagents, columns, tubes, and other products that are utilized in these procedures. The segment is expected to increase at considerable rates owing to the improvements in column technologies and pumps. Due to the increased demand for the creation of novel therapies to address the rising prevalence of chronic diseases throughout the world, it is projected that the pharmaceutical and biopharmaceutical industries would expand at a large rate which is further likely to support the segment growth.

- By End-User, the pharmaceutical & biotechnology companies segment held the largest share in the global high-performance liquid chromatography market. Quality control, characterizing drug candidates, determining drug purity, assessing the stability of pharmaceutical active components and many other tasks are carried out in these companies with the use of HPLC techniques. Due to the compatibility of HPLC with mass spectrometry, which improves the technique's selectivity and detection capabilities, the segment is likely to grow in the near future.

Market Dynamics:

Drivers:

Increasing use in pharmaceutical applications

The increasing use of HPLC in pharmaceutical applications is likely to augment the growth of the market during the forecast period. Since it can deliver the exact results needed, HPLC is the type of liquid chromatography that is typically utilized in the pharmaceutical business. The findings can be applied to a quantitative and qualitative manufacturing process analysis of the ingredients and finished medicinal products. This can be utilized to identify a medicine and track the success of a therapy on an illness. It is accomplished through the separation, measurement, and identification of components in a mixture.

The pharmaceutical sector also uses HPLC as a chromatographic technique, despite initial expectations that it would complement gas chromatography. Quantifying the concentration of contaminants and determining the structure in pharmaceutical formulations is one of the primary benefits of HPLC. High molecular weight, thermally unstable, and difficult to volatilize chemicals are particularly well suited for HPLC. It may therefore measure a medication in both its pure and dose form. In the pharmaceutical sector, reversed-phase, denaturing, and immobilized enzyme reactor (IMER) HPLC are also used. Thus, with the increasing use of HPLC in pharmaceuticals, the demand for HPLC is expected to increase in the years to come.

Restraint:

Lack of skilled professionals

HPLC is a complex technique that requires skilled professionals to operate and maintain the systems. The shortage of skilled professionals in some economies is likely to limit the adoption of HPLC systems. Due to the numerous combinations of HPLC's modules, columns or mobile phases, and operating parameters, it is a complicated method. For HPLC & UHPLC, the new standard platform of HPLC to be used effectively and a deeper understanding of the fundamentals are becoming more crucial. A key necessity for creating novel strategies to have significant influence on life science for a brighter future is passionate separation scientists with LC-MS skills and a thorough awareness of the major biological concerns.

Opportunities:

New product launches to offer lucrative growth opportunity

The introduction of numerous liquid chromatography method development systems and supporting software in recent years is anticipated to make HPLC system usage simpler and increase its productivity. For instance, Thermo Fisher Scientific, Inc. and ChromSword worked together to introduce the Thermo Fisher Vanquish HPLC and UHPLC method development system in August 2021. Similar to that, Shimadzu Corporation introduced the Nexera XS inert high-performance liquid chromatograph to the world in February 2022. In order to deliver reliable readings of biopharmaceuticals and medium molecule drugs, the Nexera XS inert integrates rust-resistant materials and nonmetallic elements that prevent the adsorption of chemicals. The introduction of such products is likely to create growth opportunities and increase the use of HPLC systems.

Recent Developments:

- In October 2021, a HPLC chromatography system called the Hipersep Process M was launched by Novasep, for the purification of pharmaceutical compounds such peptides, oligonucleotides, insulin, and other synthetic chemicals. The system is an upgrade on the company's 2017 Hipersep Pilot, which had a 2.5 sqm small design and the Hipersep SC software.

- In July 2020, the Waters Arc HPLC System, a novel high-performance liquid chromatograph (HPLC) for routine testing in the pharmaceutical, academic, food, and materials markets, was unveiled by Waters Corporation. Quality control labs testing small molecule pharmaceutical batch releases are a major target application. A new version of Waters Empower BC LAC/E with SecureSync, its data backup and recovery solution created especially for companies with distributed laboratory environments was also made available.

Major Key Players:

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Shimadzu Corporation

- Sartorius AG

- Merck KGaA

- Waters

- YOUNGIN Chromass

- Phenomenex, Inc.

- PerkinElmer Inc.

- Tosoh Bioscience

- KNAUER Wissenschaftliche Geräte GmbH

- Sykam GmbH

Market Segmentation:

By Product

- Instruments

- Consumables& Accessories

- Software

By Application

- Clinical Research

- Environmental

- Forensic

- Others

By End-User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2683

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333