Medical Equipment Financing Market Size To Rake USD 277.89 Bn By 2030

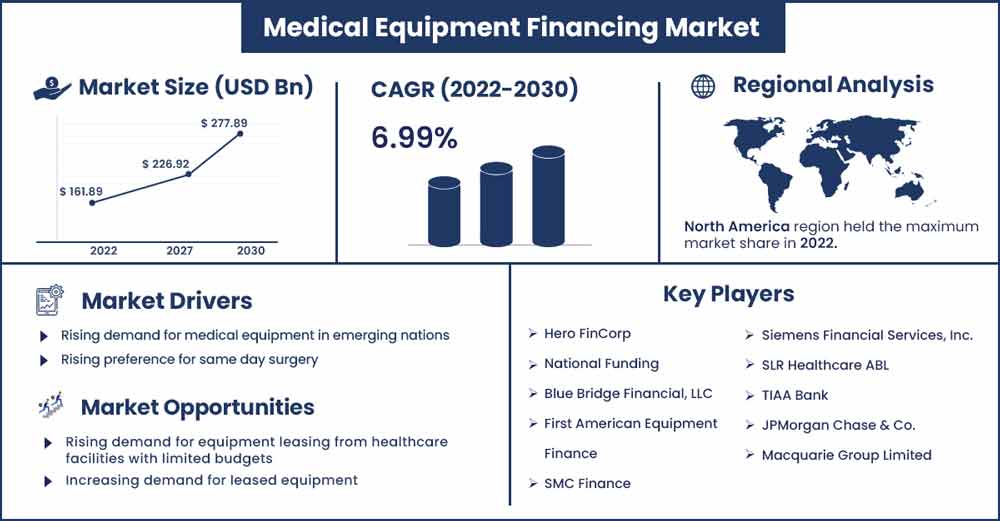

The global medical equipment financing market size surpassed USD 161.89 billion in 2022 and it is expected to rake around USD 277.89 billion by 2030, poised to grow at a CAGR of 6.99% during the forecast period 2022 to 2030.

Finance alternatives that can be used to assist pay for all of the medical facility's machinery and equipment are referred to as medical equipment finance. One of the most popular ways for large and small medical hospitals and clinics to invest in their respective businesses is through medical equipment financing. In order to provide patients with the finest medical care, it is essential to make sure that medical professionals have access to the best infrastructure and equipment. These kinds of medical equipment financing services provide the capital required to launch or grow a healthcare enterprise.

The global market demand is being driven by elements including the high price of healthcare equipment, the increasing need for medical equipment in emerging nations, and the existence of cutting-edge technology in well-developed countries.

COVID-19 has proven beneficial for the financing of medical equipment and has had a good effect on market growth. As the COVID-19 cases grew during the pandemic, there was a corresponding rise in demand for patient monitoring systems, therapeutic equipment, and diagnostic tools. Many healthcare facilities turned to medical equipment financing options when they were unable to instantly purchase medical equipment such as ventilators, hospital beds, oxygen concentrators, and others through internal accruals. As a result, this trend had a favorable impact on market expansion.

Additionally, using top-notch medical equipment is crucial for providing top-notch healthcare services given the ongoing advancements in medical technology. Medical professionals and hospitals might not be able to pay for modern diagnostic technology out of their own pockets due to their high cost. It is necessary to have access to affordable monthly payments and varied loan kinds for medical equipment. In the midst of the pandemic, such scenarios helped to support the market numbers.

Report Highlights:

- Globally increasing demand for high-end healthcare would have a beneficial impact on market statistics.

- Medical equipment financing is one of the primary methods used by both large and small hospitals and clinics to invest in their particular businesses and drive the expansion of the market as a whole.

- Medical equipment financing is a component of healthcare finance that is used to take advantage of the expanding global healthcare sector.

- Due to the presence of significant market participants in the region, North America accounted for a sizeable portion of revenue in 2019.

- The development of the firm, however, may be somewhat hampered by the lack of understanding about medical equipment financing in developing and impoverished nations.

Medical Equipment Financing Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 173.20 Billion |

| Projected Forecast Revenue in 2030 | USD 277.89 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 6.99% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 To 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Snapshots:

High adoption rates of cutting-edge medical technology are predicted to boost the regional industry. The existence of numerous market players committed to creating ground-breaking medical systems or goods for better patient care would also be advantageous for the company's development. Similar to this, a growing senior population, an increase in chronic sickness cases, and supportive government initiatives will drive regional market expansion.

Major financial institutions like Bajaj FinServ, HDFC, and Hero are establishing a number of plans to build hospitals and state-of-the-art laboratories in developing nations like India. Additionally, the regional government is launching a number of campaigns to increase knowledge of medical finance, which is boosting expectations for the local market.

Drivers:

Market developments will be supported by the rising demand for medical equipment in emerging nations. In the past ten years, both the medical device and healthcare industries have experienced remarkable growth. The market's need for medical equipment will increase as there are increasing medical facilities in many developing nations, like India and Japan. In India, there is a big gap between the supply and demand of medical devices, which presents a great opportunity for various manufacturing gadgets. In diagnosing various illnesses and medical conditions, medical equipment can be a lifesaving factor in the treatment of the older population.

Comorbid conditions like diabetes, chronic renal disease, and heart disease are more prevalent in the elderly population, which increases the need for medical equipment facilities. In comparison to other healthcare services, medical equipment use rates have increased quickly due to the growing elderly population base. Therefore, the increasing population of senior citizens will ensure the growth of the entire industry.

Restraints:

The market for financing medical equipment is declining as a result of factors like the high cost of maintaining hospital equipment and investors' preference for preserving their existing purchases as opposed to making new ones. This could be a significant obstacle for the market as a whole. Additionally, the current COVID-19 epidemic has had a significant impact on people all over the world, resulting in a complete lack of medical supplies and hospital staff.

However, the money raised for the sick patients battling the coronavirus could be of great assistance to the world and improve the market as well. In the upcoming years, this is projected to lead to profitable growth possibilities for the market, along with the introduction of artificial intelligence into the medical field and the assistance provided by robot assistants in medical diagnostic procedures.

Opportunities:

The industry is expanding as a result of the rising demand for equipment leasing from healthcare facilities with limited budgets. The cheap initial cost of acquiring assets, tax-deductible features, and simplicity of tax returns on leased equipment are just a few benefits of leasing. Additionally, there is no down payment necessary for the leased equipment. Future equipment upgrades for healthcare facilities are simple thanks to leasing. As a result, the global market for healthcare equipment leasing is being driven by small hospitals' increasing demand for leased equipment.

Challenge:

The need for reconditioned medical equipment could impede market expansion. To reduce exorbitant expenses, many end users prefer used medical equipment. Refurbished equipment costs about six or seven times less than new equipment. Therefore, instead of renewing a lease, small and medium hospitals and diagnostic facilities opt to purchase refurbished equipment. Refurbished equipment also includes a limited guarantee of a few years. Instead of purchasing new equipment, buyers can combine the components or replace a single component, which is more cost-effective. The sales and profit margins of vendors that sell original or new equipment will be significantly impacted by the rising demand for such refurbished goods.

Recent Developments:

- In July 2021, IFC and MIGA introduced the Trade Finance Guarantee Initiative, which will support the trade of vital items, such as food and medical supplies, in low-income nations in order to help them recover from the pandemic's effects.

- In June 2020, Wells Fargo and Company and Siemens Healthineers announced the beginning of a medical equipment financing initiative that will offer a variety of financing alternatives to hospitals and health systems across the United States. Siemens Healthineers would receive lease and credit products from Wells Fargo to aid in the sales process.

- In collaboration with Anaxago, Imageens raises $ 1.45 million in seed funding in April 2021. In order to increase the implementation of the company's software solutions, important R&D personnel will be added to the team.

Major Key Players:

- Hero FinCorp

- National Funding

- Blue Bridge Financial, LLC

- First American Equipment Finance

- SMC Finance

- Siemens Financial Services, Inc.

- SLR Healthcare ABL

- TIAA Bank

- JPMorgan Chase & Co.

- Macquarie Group Limited

- Truist Bank

- HDFC Bank

Market Segmentation:

By Equipment

- Diagnostics Equipment

- Therapeutic Equipment

- Patient Monitoring Equipment

- Laboratory Equipment

- Medical Furniture

By Type

- New Medical Equipment

- Rental Equipment

- Refurbished Equipment

By End User

- Hospitals

- Clinics

- Dermatology Clinics

- Dental Clinics

- Ophthalmology Clinics

- Laboratories & Diagnostic Centers

- Ambulatory Surgical Centers

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2364

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333