Packaging Foams Market Revenue, Top Companies, Report 2032

Packaging Foams Market Revenue and Opportunity

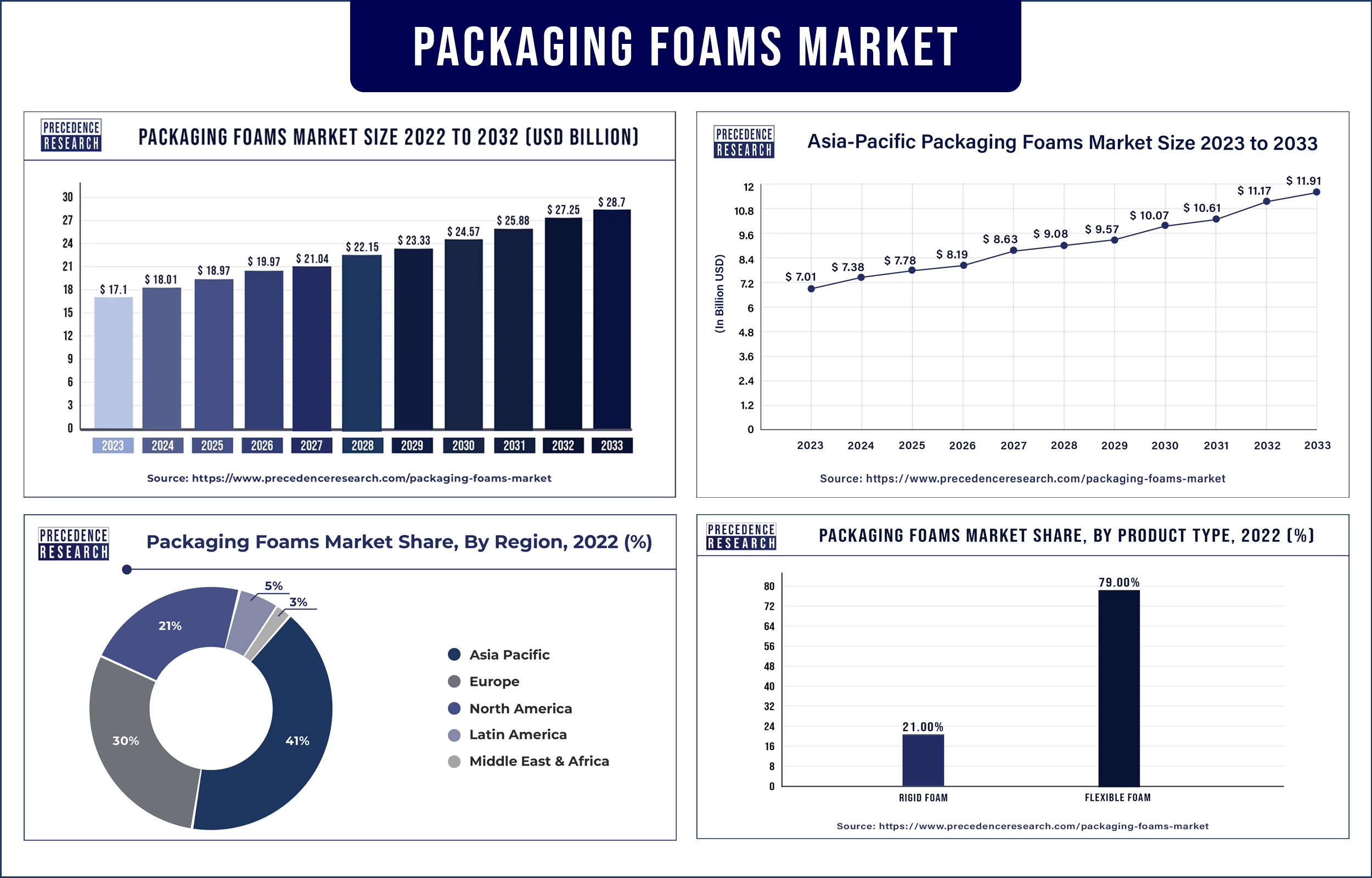

The global packaging foams market revenue was valued at USD 18.01 billion in 2023 and is poised to grow from USD 18.97 billion in 2024 to USD 28.7 billion by 2032, at a CAGR of 5.31% during the forecast period 2023 - 2032. The packaging foams market is expected to expand in the coming years due to the rise of the e-commerce market.

Market Overview

Foam packaging is a clear packaging material that is used to wrap things while shifting from one place to another. It absorbs shocks and reduces vibration that happens during shifting, making it safe to wrap delicate items. It is also easy to manage as it does not shred and create a mess in the surroundings. The advancement in technology and the number of people purchasing different electronic items require more foam packaging, hence the rise of the foam packaging market. Due to the increasing trend of online shopping, the demand for packaging has increased and is expected to grow exponentially during the forecast year 2024 to 2033. These are both safe and eco-friendly foams that are preferred by many on the market. A huge number of foam packaging is done by e-commerce businesses, so growth in e-commerce businesses is due to people choosing online shopping more than offline due to time consumption, and many more are directly linked with the growth of the packaging foams market.

The use of foam in different sectors for packaging is driving the market

There are various factors that are directly or indirectly responsible for driving the packaging foams market. It depends upon the usage of material to produce form, purpose, and choice of the user. After globalization, the use of foam packaging has increased worldwide. The material used in making these foams is expanded polypropylene (EPP), which can be recycled and is also cost-effective; this makes it even more preferable for users. These are found as flexible foam and rigid foam for different types of packaging. These are used for food service packaging, protective packaging, and many others. Protective packaging can be of several types, like medical packaging, automotive, electronics, personal, delicate things, etc. The advancement in the electronics sector and rising demand for them boost the production of polyurethane foams in the packaging industries. The growing usage of packaged food led to a high demand for safe packaging for the transportation and storage of perishable food. It helps to keep food fresh and leakproof storage and hence dominates in the packaging foams market.

However, the environmental concerns arising from foam packaging are a restraining factor for the growth of the packaging foams market. The foams are plastic-based and not biodegradable. They require a lot of time to degrade and end up creating more plastic micro-particles in the environment. Due to this, many industries are shifting towards eco-friendly and paper-based packaging, which mitigates the harmful impact of plastic.

Packaging Foams Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 18.97 Billion |

| Market Revenue by 2032 | USD 28.7 Billion |

| Market CAGR | CAGR of 5.31% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Top Companies in the Packaging Foams Market

- BASF SE

- Sealed Air

- Dow

- Kaneka Corporation

- Sonoco

- Pregis LLC

- Recticel

- Arkema S.A.

- Synthos SA

- Foamtech

- Covestro

- Huntsman Corporation

- Sekisui Chemical

- Versalis

- Rogers Corporation

- DS Smith

- Innovo Packaging

- Sing Home Polyfoam

- Zotefoams PLC

- Armacell

- Furukawa

- SABIC

- UFP Technologies

- Cruiz Foam

Recent Developments by Zotefoams PLC

- Zotefoams PLC is a company that produces high-performance, closed-cell, crosslinked foams from common and engineering polymers using temperature, pressure, and nitrogen borrowed from the atmosphere. Zotefoams, on May 2024, announced a global alliance agreement with Suzhou Shincell New Materials Co, Ltd.

Recent Developments by BASF SE

- In September 2023, BASF, a company known for creating plastic for the circular economy, developed Ultramid® Expand, a polyamide-based particle foam. The foam is extremely durable and resistant to high temperatures, chemicals, and other factors.

Regional Insights

North America's packaging foams market is predicted to grow significantly between this forecast year from 2024 to 2033. Due to the growing e-commerce market, there is a requirement to shift products from one place to another where safe deliveries are preferable, hence boosting the foam packaging market. In the region, the U.S. is the largest market shareholder with major companies. The U.S. also dominates in the usage of electronics and e-commerce, which mainly uses packaging foams for protection against damages and drives the growth of the packaging foams market in North America.

Asia Pacific dominated the packaging foams market in 2023. This area has observed significant development in recent years, mostly determined by countries like China, India, Japan, and South Korea. Asia-Pacific is sheltered by a large industrial base and has a strong demand for packaging resources across several trades, including electronics, consumer properties, automotive, and the e-market. The existence of major industrial hubs, tied with the growing population and increasing one-use income, has underwritten Asia-Pacific's supremacy in the market.

Market Potential and Growth Opportunity

Supportable and eco-friendly wrapping solutions

An important market drift in the worldwide packaging foams market is the growing demand for supportable and eco-friendly wrapping solutions. As ecological apprehensions continue to increase in prominence, customers, controlling bodies, and industries are progressively attentive to decreasing the environmental influence of wrapping materials. This has led to a rising choice for wrapping foams that are produced from recyclable or biodegradable resources. Producers in the packaging foam business are enthusiastically emerging advanced solutions that suggest the same level of shield and padding while diminishing their carbon footprint.

Packaging Foams Market News

- In December 2022, Engineered Foam Packaging (EFP), which is a leading designing and manufacturing company for custom protective packaging, announced the acquisition of the North Carolina-based company.

- In February 2023, Sealed Air Corporation announced that it had developed Foam Partner Group, which is a leading producer of sustainable packaging foams.

- In November 2022, The Dow Chemical Company announced that they had launched a new type of packaging foam that is designed to advance the sustainability of packaging.

Market Segmentation

By Material Type

- Polystyrene

- Polyethylene

- Polyurethane

- polypropylene

- Poly Vinyl Chloride

By Product Type

- Flexible Foam

- Rigid Foam

By Application

- Inserts

- Corner and edge protectors

- Anti-Static ESD Foam

- Liners

By End User

- Medical and Pharmaceutical

- Food and Beverages

- Aerospace and Defence

- Automotive

- Electrical and Electronics

- Personal Care

- Consumer Packaging

- Others

Buy this Research Report@ https://www.precedenceresearch.com/packaging-foams-market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308