Pharmaceutical Intermediates Market Size to Rise USD 154.47 Bn By 2032

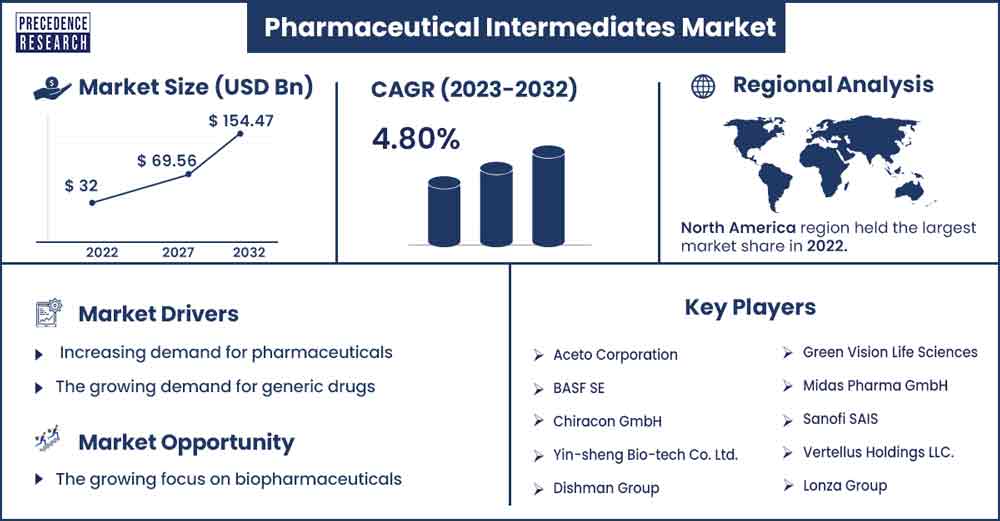

The global pharmaceutical intermediates market size surpassed USD 32 billion in 2022 and is expected to rise around USD 154.47 billion by 2032, poised to grow at a CAGR of 4.80% from 2023 to 2032.

Market Overview

The pharmaceutical intermediates market is a critical component of the pharmaceutical industry, providing essential building blocks for synthesizing active pharmaceutical ingredients (APIs) and finished pharmaceutical products.

The pharmaceutical intermediates market is significant in size and continues to grow steadily. Factors such as increasing demand for pharmaceutical products, rising investment in drug development and manufacturing, and technological advancements drive global market growth. Pharmaceutical intermediates serve as essential chemical compounds used in the synthesis of APIs, which are the active components responsible for the therapeutic effects of pharmaceutical products. Intermediate compounds undergo various chemical reactions and purification processes to yield APIs, enabling the production of safe, effective, and high-quality medications.

The pharmaceutical intermediates market is competitive, with numerous global and regional players competing based on product quality, reliability, cost competitiveness, and technical expertise. Market players engage in strategic initiatives such as mergers and acquisitions, collaborations, and capacity expansions to strengthen their market positions, expand product portfolios, and gain a competitive edge.

Regional Snapshots

North America dominated the global pharmaceutical intermediates market in 2023, driven by major pharmaceutical companies, advanced healthcare infrastructure, and robust research and development activities. The region is known for its technological advancements in chemical synthesis, process optimization, and drug development, contributing to producing high-quality pharmaceutical intermediates. Regulatory agencies such as the FDA (Food and Drug Administration) and Health Canada enforce stringent quality standards and regulatory requirements for pharmaceutical intermediates, ensuring product safety, efficacy, and compliance with good manufacturing practices (GMP). Pharmaceutical companies in North America often outsource intermediate synthesis and manufacturing activities to specialized CROs (Contract Research Organizations) and CMOs (Contract Manufacturing Organizations) to streamline operations and access expertise in chemical synthesis and process optimization.

- In August 2023, the U.S. FDA approved Reblozyl® (luspatercept-aamt) of Bristol Myers Squibb as the First-Line Treatment of Anemia in Adults with Lower-Risk Myelodysplastic Syndromes (MDS) and may require transfusions.

Asia-Pacific was the fastest-growing market in 2023. Many market players are investing in manufacturing facilities in different Asia-Pacific countries, including China, Japan, India, Singapore, and South Korea. The governments are also developing favorable policies to improve the pharmaceutical intermediates market.

- For instance, in November 2023, the Government of India proposed a (Production Linked Incentive) PLI scheme. The purpose of this scheme is to focus on pharmaceutical intermediates, agrochemical intermediates, dyes, and other chemicals. The scheme will increase the competitiveness of manufacturers.

- India also imported pharmaceutical ingredients in December 2023 from China and other countries. In 2022, India imported 264582 MT at a cost of ₹23,273 crore in 2021-22 to 300120 MT at a cost of ₹25,551 crore in 2022-23.

Pharmaceutical Intermediates Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 37.31 Billion |

| Projected Forecast Revenue by 2032 | USD 154.47 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.80% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for pharmaceuticals

The growing global population, rising prevalence of chronic diseases, and expanding healthcare infrastructure drive the demand for pharmaceutical products. The pharmaceutical intermediates market is essential in producing active pharmaceutical ingredients (APIs) and finished dosage forms, meeting the increasing demand for safe, effective, and affordable medications.

Outsourcing trends

Pharmaceutical companies increasingly outsource intermediate synthesis and manufacturing activities to specialized contract research organizations (CROs) and contract manufacturing organizations (CMOs) to streamline operations, reduce costs, and access expertise in chemical synthesis and process optimization. Outsourcing allows pharmaceutical companies to focus on core competencies such as drug discovery, formulation development, and commercialization while leveraging external partners for intermediate production.

Generic drug market growth

The growing demand for generic drugs, driven by patent expirations, cost containment measures, and healthcare cost pressures, stimulates market demand for the pharmaceutical intermediates market. Generic pharmaceutical manufacturers rely on intermediate suppliers to produce API equivalents of brand-name drugs, offering affordable alternatives to consumers and healthcare systems.

Restraints

Regulatory compliance challenges and complex supply chain dynamics

Stringent regulatory requirements and compliance standards governing pharmaceutical intermediates quality, safety, and efficacy pose challenges for manufacturers. Meeting regulatory requirements and compliance standards governing pharmaceutical intermediates' quality, safety, and efficacy pose challenges for manufacturers. Meeting regulatory standards set by authorities such as the US Food and Drug Administration (FDA), European Medicine Agency (EMA), and International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use (ICH) requires substantial investments in infrastructure, quality control systems, and documentation.

The pharmaceutical intermediates market operates within a complex global supply chain involving raw material suppliers, chemical manufacturers, contract manufacturing organizations (CMOs), and pharmaceutical companies. Supply chain disruptions, raw material shortages, transportation bottlenecks, and geopolitical uncertainties may impact production schedules, inventory management, and product availability, posing challenges for manufacturers and distributors.

Price volatility of raw materials and intellectual property rights issues

Fluctuations in the prices of raw materials used in pharmaceutical intermediate market synthesis, such as specialty chemicals, solvents, and reagents, can impact manufacturers' production costs and profit margins. Dependency on petroleum-based feedstocks, geopolitical tensions, currency fluctuations, and supply-demand dynamics contribute to price volatility and sourcing challenges, affecting manufacturing operations and pricing strategies. Intellectual property rights (IPR) protection and patent disputes in the pharmaceutical industry pose challenges for manufacturers and innovators. Patent expirations, generic competition, and legal challenges related to patent infringement may impact market exclusivity, revenue streams, and market share for pharmaceutical intermediates suppliers and API manufacturers, affecting profitability and investment in innovation.

Opportunities

Biopharmaceutical development

The growing focus on biopharmaceuticals, including monoclonal antibodies, recombinant proteins, and gene therapies, presents opportunities for pharmaceutical intermediates market suppliers to diversify their product portfolios and cater to specialized therapeutic areas. Intermediates for biopharmaceutical synthesis, such as cell culture media, growth factors, and purification reagents, are in high demand, driven by advancements in biotechnology and personalized medicine.

Emerging markets expansion

Emerging economies in Asia-Pacific, Latin America, and Africa offer significant growth opportunities for the pharmaceutical intermediates market. Rapid urbanization, economic development, and increasing healthcare investments drive demand for pharmaceutical products and intermediates in emerging markets, supported by population growth, rising disposable incomes, and expanding healthcare infrastructure.

Growing demand for generic drugs

The increasing demand for generic pharmaceutical products, driven by patent expiration, cost containment measures, and healthcare cost pressures, presents significant opportunities for pharmaceutical intermediates manufacturers. Generic drug manufacturers rely on intermediate suppliers to produce high-quality active pharmaceutical ingredients (APIs) and finished dosage forms, offering affordable alternatives to brand-name medications and expanding access to healthcare globally.

Recent Developments

- In December 2023, Ami Organics signed another agreement with Fermion for the manufacturing of 2 advanced pharmaceutical intermediates. The intermediated will be used in captive consumption and will increase the value of the end product.

- In December 2023, Asahi Kasei developed a novel membrane system. The system will be used for dehydrating organic solvents without using any pressure or heat. Organic solvents are highly essential for pharmaceuticals as they are used to dissolve intermediates and active ingredients.

Key Market Players

- Aceto Corporation

- BASF SE

- Chiracon GmbH

- Yin-sheng Bio-tech Co. Ltd.

- Dishman Group

- Green Vision Life Sciences

- Midas Pharma GmbH

- Sanofi SAIS

- Vertellus Holdings LLC.

- Lonza Group

Market Segmentation

By Product

- Chemical Intermediates

- Bulk Drug Intermediates

- Custom Intermediates

By Application

- Analgesics

- Ant-inflammatory Drug

- Cardiovascular Drugs

- Anti-Diabetic Drugs

- Anti-Cancer Drugs

- Others

By End User

- Biotech & Pharma Companies

- Research Laboratory

- CMO/CRO

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1356

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308