Polyurethane Foam Market Revenue to Attain USD 102.13 Bn by 2033

Polyurethane Foam Market Revenue and Trends 2025 to 2033

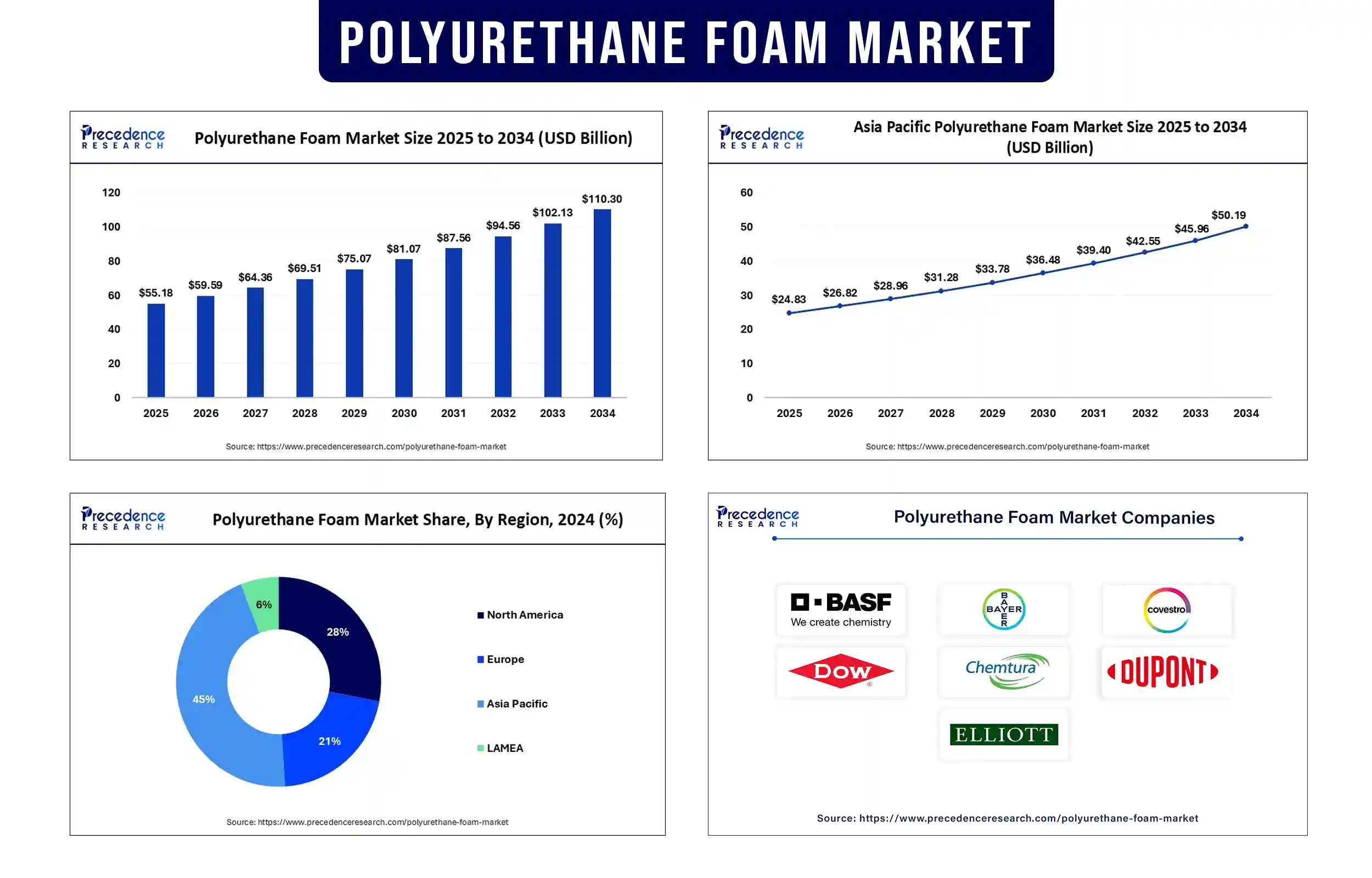

The global polyurethane foam market revenue reached USD 55.18 billion in 2025 and is predicted to attain around USD 102.13 billion by 2033 with a CAGR of 8%. The growth of the market is driven by the rising demand for polyurethane foam from the construction and automotive industries.

Market Overview

Polyurethane foam is utilized in various industries, including electronics, furniture, construction, automotive, and packaging. Due to its lightweight, shock-absorbing, and energy-saving qualities, polyurethane foam is being rapidly adopted in thermal insulation and cushioning systems. It protects the product from damage during shipping and handling. Polyurethane foams, rigid or flexible, perform vital roles in construction applications by contributing to structural rigidity and insulating effectiveness. Meanwhile, the automotive sector also applies flexible foams in reducing vehicle weight and enhancing ride comfort, which is concurrent with the world’s initiative to improve fuel economy. The market is also experiencing innovation through low-VOC and bio-based polyurethane foams, considering stricter environmental regulations and consumer demand for eco-friendly materials.

As a result of rapid urbanization and increased focus on green building certifications, the worldwide market for polyurethane foam is expected to grow at a robust rate during the forecast period. This growth is further complemented by improvements in foam production processes, increasing investment in infrastructure development across emerging economies, and the rising demand for high-performance, cost-efficient foams.

Major Trends in the Polyurethane Foam Market

Demand for Biodegradable and Sustainable Polyurethane Foams

The demand for bio-based polyurethane foams made from renewable sources is rising. Some PU foams create challenges in disposal, raising environmental concerns. As a result, there is a rapid shift toward sustainable and bio-based foams. With concerns regarding environmental conservation and stricter regulation on carbon emissions, manufacturers are focusing on developing low-VOC (volatile organic compounds) or environmentally friendly polyurethane foams, creating lucrative opportunities in the market.

Focusing on Thermal Insulation in the Construction Industry

Polyurethane foam is heavily used in the construction industry for thermal insulation. In the face of rising energy costs and a global emphasis on enhancing building energy efficiency, architects are using polyurethane foams as the best possible choice in insulation, roofing, and other construction materials. Stringent regulations promoting energy efficiency in buildings and the rising trend toward sustainable construction contribute to the growth of the market.

Increasing Applications in the Automotive Industry

Polyurethane foam finds extensive application in the automotive industry. It is widely used in seats, dashboards, and headliners due to its lightweight nature and ability to enhance comfort and safety. The increasing production of vehicles across the globe drives the market. Automakers are focusing on developing lightweight vehicles while improving comfort and fuel efficiency. As electric vehicles (EVs) and hybrid vehicles continue to gain traction, the demand for PU foam is likley to increase due to its ability to reduce noise and enhance comfort and safety.

Product Customization and Innovations

In a crowded market, several companies are marketing custom foam solutions to gain a competitive edge. There is heightened demand for customized foam in specialized applications like aerospace, medical devices, protective packaging, and luxury mattresses. Fire-retardant formulations are also in high demand for industrial uses. Innovations in polyurethane foam technology enhance insulation properties, expanding the scope of applications and contributing to the growth of the market.

Report Highlights of the Polyurethane Foam Market

Product Insights

The flexible foam segment dominated the market in 2024 and is expected to sustain its long-term growth in the coming years. This is mainly due to the increased use of flexible polyurethane foam in the production of chairs, beds, and specialty items. It is heavily used for its cushioning properties. Meanwhile, the rigid foam segment is projected to grow at a significant rate during the forecast period. Rigid polyurethane foam is heavily used for building insulation. It is used to Insulate entry doors and garage doors.

Application Insights

The construction segment dominated the market with the largest share in 2024. This is mainly due to the increased construction of residential, commercial, and industrial buildings. PU foam is used in construction due to its ability to provide excellent insulation and offers versatility in various applications like roofing. On the other hand, the automotive segment is expected to expand at a significant rate during the projection period. The growth of the segment is attributed to the rising production of vehicles. The rising focus on reducing vehicle weight while improving fuel efficiency further supports segmental growth.

Regional Outlook

In 2024, Asia Pacific dominated the polyurethane foam market with the largest share due to rapid industrialization, urban development, and increased construction activities in countries like China, India, Japan, and South Korea. The region has well-developed construction and automotive industries, representing the largest adoption of polyurethane foam. With the rising production of vehicles and consumer electronics, the demand for PU foam continues to rise. China is the largest consumer of HVAC systems and insulation materials, in which PU foam is widely used. Government regulations promoting energy efficiency and sustainable construction are likely to sustain the region’s long-term growth in the market.

North America is expected to witness the fastest growth in the upcoming period. The U.S. and Canada are experiencing high demand for PU foam in the automotive and construction industries. There is a high demand for eco-friendly and high-performance materials, creating immense opportunities in the market. The rising demand for furniture and bedding further propels the regional market growth. This region is home to automotive OEMs and aerospace manufacturers, boosting the demand for specialized foam. In addition, the rising construction of sustainable buildings supports the market's growth.

Polyurethane Foam Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 55.18 Billion |

| Market Revenue by 2033 | USD 102.13 Billion |

| CAGR from 2025 to 2033 | 8% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Development

- In April 2024, BASF released a new line of flexible polyurethane foams that claimed to be suitable for thermoplastic recycling at the end of their life, making them fully recyclable. These foams can be reused in different applications, including furniture, footwear, and auto parts.

- In April 2024, Huntsman Corporation introduced SHOKLESTM polyurethane foam technology to support electric vehicle battery applications. This ultralight foam is a source of structural and thermal protection for the battery and helps to enhance safety and performance. The SHOKLESTM foam systems provide flexible options for battery cell potting and landings and meet the industry demand for new advanced materials needed for constructing electric vehicle batteries.

- In September 2023, Covestro AG and Selena FM S.A. announced the development of bio-attributed polyurethane foams for building insulation. The newly launched Ultra-Fast 70 one-component foam has a cure time of 90 minutes.

Polyurethane Foam Market Key Players

- BASF SE

- Bayer AG

- Chemtura Corporation

- Covestro AG

- Dow Inc.

- Dupont

- Elliot Co.

- Foamcraft Inc.

- Future Foam

- Huntsman Corporation

- Reciticel

- Rogers Corp.

- Saint-Gobain S.A.

- Sekisui Chemicals

- Trelleborg AG

- UFP Technologies

- Woodbridge Group

Market Segmentation

By Product

- Rigid Foam

- Flexible Foam

- Spray Foam

By Application

- Bedding & Furniture

- Transportation

- Packaging

- Automotive

- Construction

- Electronics

- Footwear

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/2789

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344