Radiation Hardened Electronics Market Revenue to Attain USD 3.06 Bn by 2033

Radiation Hardened Electronics Market Revenue and Trends 2025 to 2033

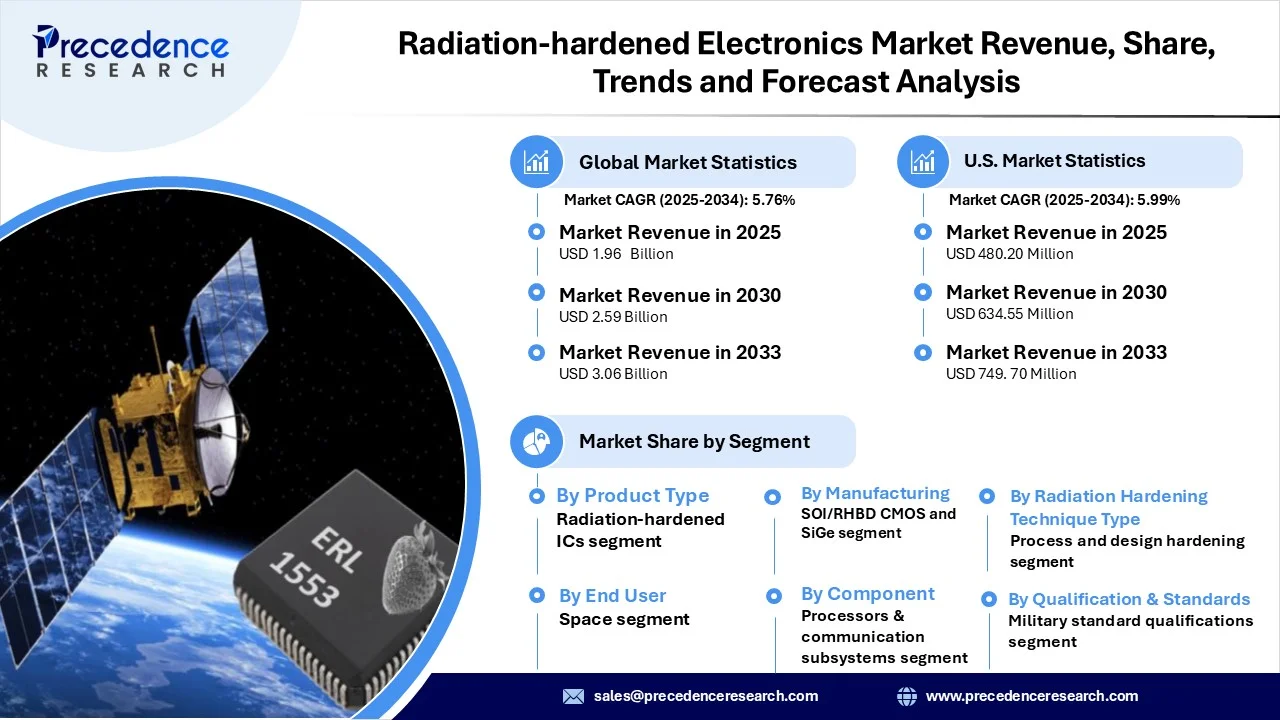

The global radiation hardened electronics market revenue reached USD 1.96 billion in 2025 and is predicted to attain around USD 3.06 billion by 2033 with a CAGR of 5.76%. The radiation hardened electronics market is experiencing steady growth, driven by increasing demand for space missions, defense applications, and reliable electronic systems in extreme environments.

Factors Contributing to the Expansion of Radiation-Hardened Electronics

The radiation-hardened electronics space is growing in response to rising demand for reliable components in defense, space explorationation, and satellites, along with the technology that supports these capabilities. Radiation-hardened electronics utilize semiconductors, ICs, and power devices that are hardened to deal with extreme radiation levels, large temperature swings, and other environments. Moreover, the increasing penetration of this technology into military/aerospace and nuclear applications is creating growth opportunities in the worldwide marketplace.

Segmental Analysis

- By Product Type- Radiation-hardened ICs, specifically processors and FPGAs, are the most dominant because they serve as the foundation of mission-critical space and defense systems that must have extreme reliability.

- By Radiation Hardening Technique- Process and design-level hardening, such as SOI and triple modular redundancy (TMR) are the most highly utilized because they provide ample protection against faults resulted from radiation for critical missions.

- By Manufacturing / Technology Node- SOI and RHBD CMOS and SiGe technologies are the most highly favoured due to their proven ability to withstand and perform in radioactive environments.

- By End-Use / Application- Space applications are dominated by satellites and launch applications, as they are some of the most challenging environments where systems must have the utmost reliability for long-lived missions under radiation.

- By Component / Subsystem- Processors and communications subsystems are the most prevalent as they are essential components in providing stable processing and reliable data capture and transmission through the difficult circumstances of space and defence applications.

- By Qualification & Standards- This segment is dominated by MIL-STD and QML qualified components, as those are the primary focus of defence and space agencies for mission assurance and safety of operation.

- By Service Offering- In regard to service offering, testing, qualification and custom manufacturing dominate as they either support systems meeting the assurance they can tolerate radiation levels for critical government and defence applications.

- By Sales / Delivery Model- The sales and delivery model is dominated by direct OEM supply to space and defence primes as the major players.

- By Business Model/Revenue Stream- Sales of new systems and components represent the largest revenue driver, primarily from defence contracts and growing (potentially in the long term) from requests on space programs.

- By Packaging & Form Factor- For packaging, ceramic hermetic is the dominant form factor because of its resilience and recovery from radiation and other environmental exposure, which is critical to ensure the component's integrity during the many month-long operational periods in space.

- By Qualification Level (TID/SEE Capability Tiers)- High-reliability qualification tiers are the dominant tier, especially for GEO and deep-space missions, where the government and defence applications seek to provide the highest amount of radiation exposure evident to these components..

Regional Analysis

North America leads the radiation-hardened electronics market because of robust defense expenditures, a well-established space technology program, and a high density of suppliers in the region. Demand for radiation-hardened processors, FPGAs, and power devices for use in satellite, military, and nuclear systems is widely driven by established original equipment manufacturers (OEMs) as well as government contracts. Sustained spending on R&D and supply chain stability encourages North America to maintain market leadership.

Asia Pacific is the fastest growing region fueled by growing satellite programs, commercial space start-ups, and increased defence modernization projects in India, Japan, South Korea and China. Increased investment in LEO constellations, improving local manufacturing capacity, and partnerships with Western vendors is pushing adoption of radiation-hardened ICs and modules in civil and military applications.

Radiation Hardened Electronics Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 1.96 Billion |

| Market Revenue by 2033 | USD 3.06 Billion |

| CAGR from 2025 to 2033 | 5.76% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Radiation Hardened Electronics Market Key Players

- Microchip Technology (Microsemi legacy)

- BAE Systems plc

- Honeywell International Inc.

- Advanced Micro Devices / Xilinx (AMD Space solutions)

- Analog Devices, Inc.

- Texas Instruments Incorporated

- STMicroelectronics

- Renesas Electronics Corporation

- Infineon Technologies AG

- Teledyne Technologies / Teledyne e2v

- Data Device Corporation (DDC, TransDigm)

- Cobham / Cobham Mission Systems

- Crane Aerospace & Electronics

- Mercury Systems, Inc.

- VORAGO Technologies

Recent Developments

- In March 2025, Infineon Technologies has introduced its first P-channel power MOSFET, which is cost-effective compared to conventional hermetic packaging generally utilized in rad-hardened devices and can be manufactured in greater quantities as conventional. (Source: https://www.eenewseurope.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6906

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344