What is the Radiation-hardened Electronics Market Size?

The global radiation-hardened electronics market size accounted for USD 1.85 billion in 2024 and is predicted to increase from USD 1.96 billion in 2025 to approximately USD 3.24 billion by 2034, expanding at a CAGR of 5.76% from 2025 to 2034. The market extends to chip designers, fabrication facilities, and radiation testing labs. Growth in the market is largely driven by the surge in intelligence, surveillance, and reconnaissance (ISR) operations, as well as advancements in multicore processors specifically designed for military and space applications. In addition, the rising demand for commercial satellite use and the development of electronic systems capable of withstanding extreme nuclear environments are further strengthening market dynamics.

Market Highlights

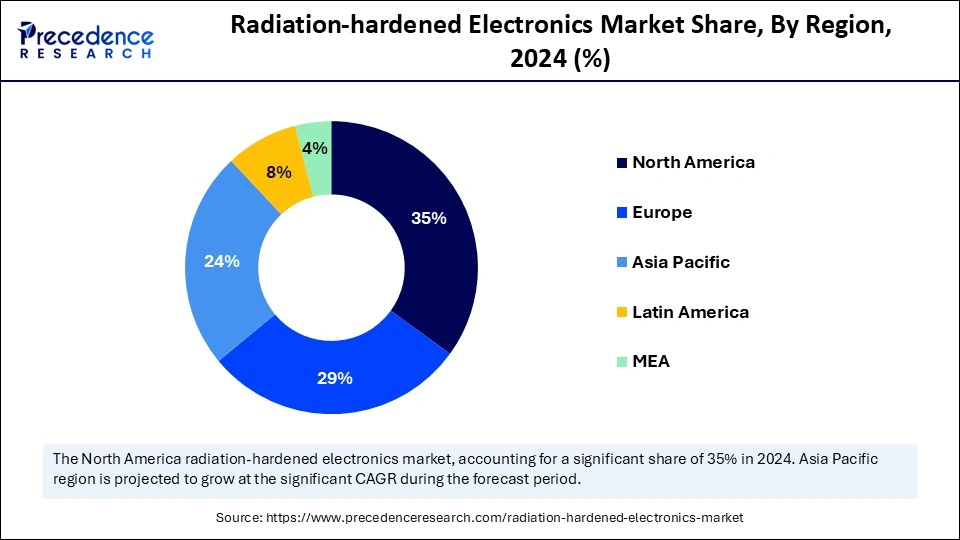

- North America dominated the radiation-hardened electronics market with the largest market share of 35% in 2024.

- By region, Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By product type, the radiation-hardened ICs segment held the biggest market share in 2024.

- By product type, radiation-tolerant/COTS and devices and power electronics (GaN/SiC) for LEO/mega-constellations is expected to grow at a remarkable CAGR between 2025 and 2034.

- By radiation hardening technique type, the process and design hardening segments held the largest market share in 2024.

- By radiation hardening technique type, system-level mitigation and COTS-with-mitigation approaches is expected to grow at a remarkable CAGR between 2025 and 2034.

- By manufacturing/technology node, the SOI/RHBD CMOS and SiGe segments captured the biggest market share in 2024.

- By manufacturing/technology node, GaN / SiC rad-tolerant power devices are expected to grow at a remarkable CAGR between 2025 and 2034.

- By end-user/application, the space segment contributed the highest market share in 2024.

- By end-user/application, LEO commercial constellations and small-sat platforms are expected to grow at a remarkable CAGR between 2025 and 2034.

- By component/subsystem, the processors & communication subsystems segment contributed the highest market share in 2024.

- By component/subsystem, payload electronics and power conditioning for electric propulsion / high-power payloads are expected to grow at a remarkable CAGR between 2025 and 2034.

- By qualification & standards, MIL-STD/QML-qualified parts for the defense/space primes segment accounted for the significat market share in 2024.

- By qualification & standards, commercial qualification streams for rapid small-sat procurement are expected to grow at a remarkable CAGR between 2025 and 2034.

- By service offering type, the testing & qualification and custom manufacturing segment held the largest market share in 2024.

- By service offering type, design/IP (hardened IP cores), and turnkey small-sat rad-hard modules, to grow at a remarkable CAGR between 2025 and 2034.

- By sales/delivery model, the direct OEM supply to the space/defense primes segment led the market in 2024.

- By sales/delivery model, distributor / COTS channels for commercial LEO are expected to grow at a remarkable CAGR between 2025 and 2034.

- By business model/revenue stream, the new system segment dominated the market in 2024.

- By business model/revenue stream, qualification to grow at a remarkable CAGR between 2025 and 2034.

- By packaging & form factor, the ceramic hermetic packages segment generated the major market share in 2024.

- By packaging & form factor, hybrid modules and integrated rad-hard subsystems are expected to grow at a remarkable CAGR between 2025 and 2034.

- By qualification level, the high-reliability segment led the market in 2024.

- By qualification level, mid-reliability is expected to grow at a remarkable CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 1.85 Billion

- Market Size in 2025: USD 1.96 Billion

- Forecasted Market Size by 2034: USD 3.24 Billion

- CAGR (2025-2034): 5.76%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is the Radiation-hardened Electronics Market?

Radiation-hardened electronics are electronic components and systems designed or processed to tolerate ionizing radiation and operate reliably in high-radiation environments using hardened process technologies, design mitigation, shielding, and fault-tolerant architectures.Growth in the radiation-hardened electronics market is driven by the inexorable need to safeguard critical systems against the pernicious effects of cosmic rays, solar flares, and nuclear radiation.

These electronics form the bulwark of reliability in satellites, spacecraft, military platforms, and nuclear facilities. With each new venture into space exploration and defense modernization, the demand curve rises inexorably. The technology has evolved from niche resilience tools into indispensable enablers of national security and scientific ambition. Its applications extend from orbiting satellites to terrestrial command centers, where failure is simply not an option. Thus, the market's foundation rests upon the triad of durability, dependability, and defense.

Radiation-Hardened Electronics Market Outlook

- Industry Growth Overview: Growth is spurred by the confluence of technological necessity and strategic imperatives. Defense agencies seek uncompromising resilience, while space agencies strive for longevity in their orbital hardware. Nuclear plants rely on radiation-hardened components to prevent catastrophic system failures. Industry growth is further fueled by technological cross-pollination between aerospace and terrestrial applications. As costs reduce, the market broadens from elite to essential, promising inclusive expansion.

- Sustainability Trends: Radiation-hardened electronics are quietly aligning with sustainability imperatives by extending product lifespans and reducing the need for replacement cycles. In space missions, longer-lasting electronics obviate the need for repeated launches, conserving fuel and resources. On Earth, they ensure the stable operation of nuclear facilities with reduced electronic wastage. Research into recyclable materials and energy-efficient designs also heralds greener horizons. Thus, sustainability and survivability walk hand in hand in this niche yet vital domain.

- Major Investors: The market has attracted the financial ardour of defense contractors, space-faring nations, and strategic venture capitalists. Sovereign funds and aerospace conglomerates recognize these electronics as the sine qua non of technological sovereignty. Capital inflows are directed towards research and development (R&D), facility expansion, and the integration of advanced materials. Investors, both public and private, perceive this sector as simultaneously patriotic and profitable.

- Startup Economy: Startups are emerging as agile catalysts, devising novel architectures and microchip designs specifically tailored to radiation resilience. Their innovations often orbit around miniaturization, cost reduction, and energy efficiency. By challenging legacy paradigms, they inject vitality into an industry that incumbents have long dominated. Collaborations with defense agencies and space startups provide them with both patronage and validation. This startup surge significantly accelerates the pace of market evolution.

Key Technological Shift in the Radiation-Hardened Electronics Market

The most profound technological shift lies in the evolution from shielding approaches to intrinsic resilience through design. Rather than encasing components in bulky armor, engineers are fabricating circuits inherently resistant to radiation's depredations. Advancements in silicon-on-insulator (SOI) technology, wide-bandgap semiconductors, and error-correcting architectures exemplify this progression. Miniaturization no longer equates fragility; it now coexists with robustness.

Market Key Trends

- Transition from physical shielding to intrinsic material resilience.

- Proliferation of commercial space ventures is expanding demand.

- AI-powered simulation and predictive modelling.

- Increasing use of wide-bandgap semiconductors.

- Growing intersection of defence, space, and nuclear industries.

- Miniaturisation with uncompromised durability.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.85 Billion |

| Market Size in 2025 | USD 1.96 Billion |

| Market Size by 2034 | USD 3.24 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.76% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Radiation Hardening Technique, Manufacturing / Technology Node, End-Use / Application, Component / Subsystem, Qualification & Standards, Service Offering, Sales / Delivery Model, Business Model / Revenue Stream, Packaging & Form Factor, Qualification Level, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Survival as a Strategic Necessity In Radiation-Hardened Electronics Market

The principal driver is the irreplaceable role of radiation-hardened electronics in safeguarding national defence, space missions, and nuclear infrastructure. Satellites navigating radiation-heavy orbits cannot rely on conventional circuitry. Defence systems exposed to nuclear environments demand fail-safe electronics. The rising tempo of geopolitical tensions magnifies this necessity. As humanity reaches further into deep space, the imperative for durable electronics only intensifies. Thus, survival in hostile environments propels demand relentlessly.

Restraint

The Price of Protection Holds Back the Market for Radiation-Hardened Electronics

The Achilles' heel of this market lies in its formidable cost structure. Radiation hardening demands specialised materials, complex fabrication, and rigorous testing, which dramatically inflates unit prices. These economic constraints hinder adoption in cost-sensitive missions or commercial ventures. Moreover, limited manufacturing facilities impede scalability. While indispensable, these electronics remain the privilege of critical sectors rather than ubiquitous applications. The price of protection, therefore, restrains universal diffusion.

Opportunity

The Celestial Expansion Expected to Drive Growth in the Future

The most tantalising opportunity arises from the renaissance of commercial space exploration. Private satellites, space tourism, and implementary missions all require radiation immunity. Emerging economies venturing into nuclear energy also constitute fertile demand centers. Opportunities abound in miniaturized radiation-hardened chips for small satellites and autonomous defence systems. This celestial expansion, coupled with terrestrial applications, opens vast frontiers. What was once a niche will become a necessity across industries.

Segment Insights

Product Type Insights

Why Radiation-hardened ICs are Leading the Radiation-hardened Electronics Market?

Radiation-hardened ICs are dominating the radiation-hardened electronics market, thanks to their unparalleled reliability. These ICs are meticulously designed to endure cosmic bombardment and single-event upsets, ensuring flawless operation in unforgiving environments. Defense systems, satellites, and nuclear applications rely on them as the non-negotiable backbone of critical infrastructure. Their resilience stems not from chance but from painstaking engineering and qualification processes. The legacy of decades of military and aerospace investments continues to sustain their supremacy. In short, Rad-Hard ICs embody the industry's uncompromising pursuit of invulnerability.

Their dominance is further strengthened by the broad scope of their application spectrum. From guidance systems in intercontinental ballistic missiles to communication arrays in deep-space satellites, these ICs serve as the sinews of security and exploration. The high barriers to entry, both technical and financial, as well as regulatory, also cement incumbents' advantage. Moreover, governments actively prioritize procurement of proven rad-hard ICs, reinforcing their dominance. If mission-critical reliability is paramount, ICs will remain the uncontested monarchs of the product hierarchy.

The fastest-growing product category lies in radiation-tolerant commercial-off-the-shelf (COTS) devices and power electronics tailored for low Earth orbit (LEO) missions. Unlike their hardened counterparts, these devices strike a balance between performance and affordability, serving the burgeoning constellation of small satellites. The economics of deploying hundreds or thousands of LEO units demand cost-effective yet sufficiently robust solutions. Power electronics play a pivotal role in sustaining electric propulsion systems and maintaining energy integrity. Thus, this segment flourishes at the nexus of scale, innovation, and pragmatism.

The growth trajectory is catalysed by the democratisation of space, where startups, universities, and private enterprises proliferate. These entities, often constrained by budgets, embrace COTS-based solutions as enablers rather than compromises. Advances in screening, selective shielding, and redundancy architectures further enhance tolerance levels, blurring the gap with rad-hard ICs. As mega-constellations for communications and Earth observation multiply, the demand for such devices will soar. In essence, what was once peripheral is now poised to become indispensable in LEO frontiers.

Radiation Hardening Technique Insights

Why Process-Level and Design Level are Shaping the Path Forward?

Process-level and design-level hardening represent the dominating radiation-hardened electronics Market, heralding a paradigm shift in how resilience is achieved. Instead of relying purely on physical shielding, manufacturers embed fault tolerance directly into the circuits' DNA. Techniques such as triple modular redundancy, silicon-on-insulator design, and hardened libraries exemplify this innovation. The result is smaller, lighter, and cheaper devices that retain formidable durability. This shift aligns perfectly with the needs of both LEO constellations and next-generation defence platforms.

The growth of this segment is propelled by its scalability and adaptability. Unlike shielding, which adds mass and complexity, design hardening optimises resilience without encumbrance. Startups and research labs are particularly active here, creating intellectual property cores that can be licensed across industries. The modular nature of design hardening also allows integration into diverse applications, from nuclear reactors to space probes. As missions demand higher efficiency, process-plus-design hardening stands as the technique of the future.

Manufacturing Insights

How SOI / RHBD CMOS and SiGe are the Key Principles Part of the Radiation-hardened Electronics Market?

Silicon-on-insulator (SOI), radiation-hardened-by-design (RHBD) CMOS, and silicon-germanium (SiGe) technologies are the dominant manufacturing methods in the radiation-hardened electronics market. These mature approaches have proven their efficacy in crafting devices resistant to both total ionising dose and single-event effects. SOI wafers insulate sensitive transistors from charge leakage, while RHBD architectures mitigate functional upsets. SiGe enhances the robustness of high-frequency communication systems. Their widespread adoption reflects decades of refinement and trusted deployment. Consequently, they form the fulcrum of global rad-hard electronics supply.

Their dominance is further reinforced by the extensive infrastructure supporting them. Foundries, design tools, and qualification protocols are optimised around SOI, CMOS, and SiGe. Governments prefer these time-tested approaches, minimising mission risk. Defence primes, too, mandate these manufacturing routes in procurement contracts. Thus, their dominance is as much institutional as it is technological. They are the default standards against which all other methods are measured.

Gallium nitride emerges as the fastest-growing contender, offering unrivalled efficiency and resilience in power electronics. Its wide-bandgap properties enable devices to operate at higher voltages, temperatures, and frequencies with minimal degradation. In the context of radiation, GaN demonstrates intrinsic tolerance, making it an ideal candidate for next-generation platforms. Applications in satellite power conditioning, radar systems, and propulsion electronics underscore its utility. Its promise lies not only in performance but also in disruptive potential.

The rapid growth of GaN is bolstered by escalating demand for lightweight, energy-efficient electronics. Space agencies and commercial players alike are investing aggressively in GaN research and development. As fabrication yields improve and costs decline, GaN devices are transitioning from experimental to mainstream. Their compactness and efficiency make them particularly attractive for LEO constellations and small satellite payloads. GaN thus represents not a challenger but an evolutionary leap in manufacturing paradigms.

End-Use/Application Insights

Why Space is Starring the Path Forward?

Space remains the dominant end-users in the radiation-hardened electronics market, as satellites, probes, and launch vehicles are inherently exposed to the tyranny of radiation. Deep-space missions, geostationary satellites, and scientific observatories rely on radiation-hardened components to operate reliably over decades. Governments and commercial operators alike view failure as anathema, ensuring space consistently drives demand. From communication constellations to planetary exploration, space is the crucible where resilience is tested and trusted. Its primacy is unassailable and perennial.

The sheer diversity of applications reinforces this dominance. Weather monitoring, navigation, reconnaissance, and scientific research all rely on radiation-hardened electronics. Agencies such as NASA and ESA, along with their counterparts, underpin this demand with robust funding streams. The private sector, led by space entrepreneurs, amplifies it further. Space, therefore, is not merely an end-user, it is the existential raison d'être of rad-hard electronics.

The fastest-growing end-user segment resides in LEO constellations and small satellite platforms. Unlike traditional billion-dollar satellites, these platforms emphasize agility, cost-efficiency, and scalability. Hundreds of satellites are launched annually, necessitating electronics that strike a balance between resilience and affordability. Radiation-tolerant solutions are sufficient for many LEO missions, driving a surge in their adoption. Their proliferation has created a veritable gold rush for rad-hard electronics vendors.

The communications revolution further fuels the momentum, as LEO constellations deliver internet and Earth imaging services worldwide. Universities, startups, and emerging economies also participate, multiplying demand. Small Sats require innovative packaging, lightweight power electronics, and rapid qualification, further invigorating growth. The sheer volume of deployments ensures compounding opportunities. Thus, LEO platforms epitomise the most dynamic growth frontier of the market.

Component Insights

Why Processors & Communication Subsystems Are Leading the Radiation-Hardened Electronics Market?

The processes and communication subsystem is dominating the radiation-hardened electronics market, largely due to its cognitive core, which ensures command, control, and connectivity under duress. Their reliability determines mission continuity in both space and defense applications. Their resilience directly governs the continuity of the mission in hostile radiation environments. Consequently, they remain indispensable across both governmental and commercial domains.

The payload electronics and power conditioning for electric propulsion is the fastest-growing segment in the radiation-hardened electronics market. This segment guides the functional purpose of satellites and spacecraft, ensuring payload efficiency and propulsion sustainability, even in the presence of radiation storms. As spacecraft adopt efficient propulsion technologies, the demand for robust power conditioning is growing rapidly. This segment is thus evolving into a linchpin of next-generation satellite infrastructure.

Qualification Insights

Why MIL-STD / QML qualified parts for defense/space prime the Radiation-hardened Electronics Market?

Military standard qualifications dominate as the global benchmark for radiation-hardened components. Defence agencies mandate these rigorous certifications to safeguard mission integrity in nuclear, aerospace, and battlefield environments. Their stringent protocols ensure survivability against extreme radiation and operational stressors. As a result, MIL-STD remains synonymous with absolute reliability.

Commercial qualifications streams are expanding swiftly, particularly for the rapid procurement of small satellites. They offer cost-effective validation methods, enabling quicker deployment cycles compared to traditional standards. Startups and new space companies embrace this model to accelerate constellation rollouts. This approach strikes a balance between risk tolerance and the demands of affordability and speed.

Service Offering Insights

Why Testing & Qualification and Custom Manufacturing are Dominating the Radiation-hardened Electronics Market?

Testing and qualification services dominate the radiation-hardened electronics market, driven by their indispensable role in validating the resilience of components. Every device undergoes rigorous trials, including assessments of radiation exposure and thermal endurance. Without these certifications, components cannot secure entry into mission-critical applications. Hence, testing remains the cornerstone of credibility in this industry.

Design and IP services represent the fastest-growing niche in the ecosystem. Startups and innovators develop reusable, red-handed cores, libraries, and architectures for licensing. This intellectual property accelerates system development while reducing costs for integrators. Such models herald a shift from hardware-centric to knowledge-driven growth.

Sales Insights

Why is Direct OEM Supply to Space/Defense Primes Dominating the Market?

Direct OEM supply dominates due to the trust and accountability demanded by space and defence primes. Critical missions require assured provenance, which intermediaries cannot always guarantee. Long-standing vendor relationships reinforce this channel's primacy. Hence, direct contracts remain the preferred mode of engagement for high-stakes projects.

Distributors are growing rapidly as they cater to startups, universities, and smaller enterprises. Their role lies in enabling frequent, lower-volume purchases of rad-hard components. This agility supports the democratization of space by lowering access barriers. Consequently, distributors are becoming an indispensable bridge in the expanding supply chain.

Business Model / Revenue Stream Insights

Why New System / Component Sales are Dominating the Radiation-hardened Electronics Market?

The dominant revenue stream continues to stem from sales of new systems and components. These contracts provide stability through large-volume, mission-critical procurements. Defence and aerospace primes rely heavily on such transactions. This traditional model forms the backbone of industry economics.

The fastest-growing streams arise from qualification services and IP licensing. They deliver recurring, knowledge-driven revenues while fostering technological innovation. As missions diversify, clients increasingly value reusable IP and third-party testing. These streams complement hardware sales while future-proofing the industry's growth.

Packaging & Form Factor Insights

Why are Ceramic Hermetic Packages Dominating the Radiation-hardened Electronics Market?

Ceramic hermetic packaging dominates due to its robustness in extreme environments. It provides unmatched protection against radiation, moisture, and thermal cycling. Military and GEO missions rely heavily on these time-tested enclosures. Thus, ceramic packaging remains the standard of choice for uncompromising reliability.

Hybrid modules and integrated subsystems are the fastest-growing packaging innovations. They combine multiple functionalities into compact, lightweight formats. These designs are particularly suited for LEO constellations and small satellites, where mass and cost are key considerations. Their adoption reflects the shift toward modular, scalable architectures.

Qualification Level Insights

How High-Reliability is Leading the Market?

High-reliability qualification levels are dominant in GEO, deep-space, and defense missions. These applications demand absolute immunity to total ionizing dose and single-event effects. Government agencies invest heavily in such components due to zero-failure tolerance. This segment embodies the pinnacle of rad-hard performance.

Mid-reliability tiers tailored for LEO commercial missions are expanding at the fastest rate. They strike a balance between cost efficiency and adequate radiation tolerance, making them suitable for constellation deployments. These solutions empower startups to scale operations affordably. As commercial LEO activity proliferates, this segment is set to outpace all others.

Regional Insights

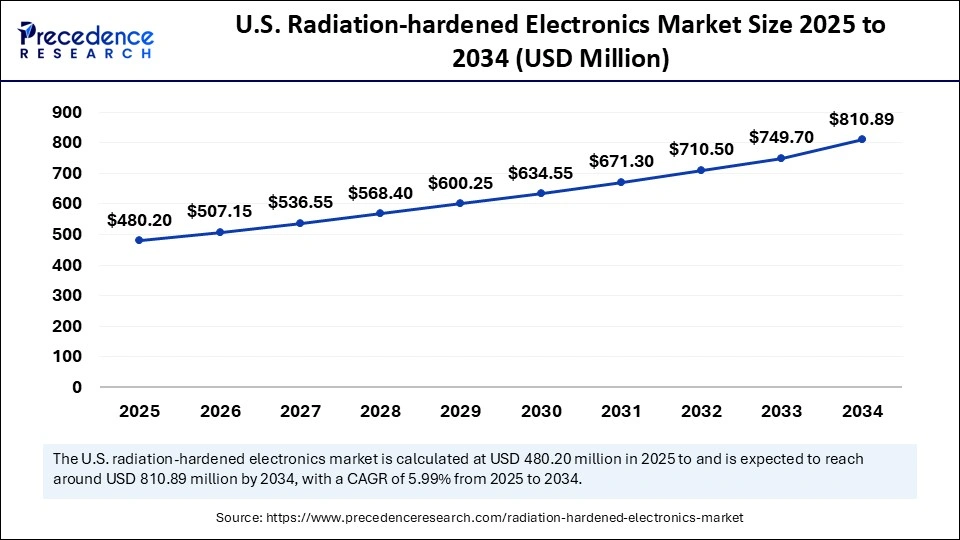

U.S. Radiation-hardened Electronics Market Size and Growth 2025 to 2034

The U.S. radiation-hardened electronics market size was exhibited at USD 453.25 million in 2024 and is projected to be worth around USD 810.89 million by 2034, growing at a CAGR of 5.99% from 2025 to 2034.

Why Did North America Dominate the Market in 2024?

North America dominated the radiation-hardened electronics market in 2024 owing to its sophisticated defence establishment, prolific space missions, and extensive nuclear infrastructure. The U.S., in particular, drives demand through both governmental programs and commercial space enterprises. Its ecosystem of advanced semiconductor firms, research institutions, and defence contractors creates a synergistic powerhouse. Furthermore, robust funding channels and governmental prioritisation underpin market leadership.

The region's dominance is also supported by its preparedness, redundancy, and supremacy. From NASA's deep-space explorations to DARPA's defence innovations, North America embodies the philosophy of technological invulnerability. The preponderance of venture capital further catalyzes innovation, ensuring the continuous replenishment of ideas. Its dominance, therefore, is not merely quantitative but qualitative, setting the benchmark for others.

How is Asia Pacific Leading the Market?

Asia-Pacific is the fastest-growing market, fueled by ambitious space programs in China, India, and Japan, alongside rising defense modernization budgets. The region's appetite for nuclear energy also multiplies demand. Governments are investing in indigenous fabrication facilities, reducing dependency on Western suppliers. Such initiatives create fertile soil for exponential growth.

The demographic dividend of skilled engineers and researchers further propels the growth trajectory. Local startups collaborate with national agencies, generating home-grown innovations tailored to regional needs. Strategic partnerships between Asian space agencies and commercial enterprises add further momentum.

Radiation-hardened Electronics Market: Value Chain Analysis

- Raw Material Sources: Specialized silicon wafers, wide-bandgap semiconductors such as gallium nitride, and radiation-tolerant polymers constitute the foundational inputs. Rare earths and high-purity metals also play pivotal roles in ensuring stability under duress.

- Technology Used: Silicon-on-insulator (SOI) design, error correction coding, and triple modular redundancy architectures dominate. These technologies create layers of resilience without excessive shielding bulk.

- Investment by Investors: Capital flows concentrate in fabrication plant expansion and collaborative R&D with space agencies. Defense contracts often serve as primary funding conduits, de-risking investor participation.

- AI Advancements: AI is increasingly deployed for predictive modelling of radiation impacts, reducing costly physical testing. It also optimizes design architectures for efficiency and resilience simultaneously.

Radiation-hardened Electronics Market Companies

- Microchip Technology

- BAE Systems plc

- Honeywell International Inc.

- Advanced Micro Devices / Xilinx

- Analog Devices, Inc.

- Texas Instruments Incorporated

- STMicroelectronics

- Renesas Electronics Corporation

- Infineon Technologies AG

- Teledyne Technologies / Teledyne e2v

- Data Device Corporation

- Cobham / Cobham Mission Systems

- Crane Aerospace & Electronics

- Mercury Systems, Inc.

- VORAGO Technologies

Recent Developments

- In September 2025, SpaceX Falcon 9 rocket lifted the Cyguns XL spacecraft skyward from launch complex 40 at Cape Canaveral Space Force Station. Designated the NG-23 mission, this launch marked yet another resupply journey to the ISS on behalf of NASA.(Source: https://www.nasa.gov)

Segments Covered in The Report

By Product Type

- Radiation-hardened ICs (microprocessors, microcontrollers)

- Radiation-tolerant / COTS+ mitigation devices

- Rad-hard / rad-tolerant FPGAs & CPLDs

- Memory (RAD-RAM, EEPROM, Flash)

- Discrete semiconductors (diodes, transistors)

- Power management & DC-DC converters (rad-hard PMICs)

- Analog & RF components (ADCs, DACs, PLLs, LNAs)

- Sensors & detectors (radiation-hardened imagers, gyros)

- Hybrid/module assemblies (SBCs, power modules)

By Radiation Hardening Technique

- Process hardening (SOI, SiGe, epitaxial, dielectric isolation)

- Design hardening (redundancy, TMR, EDAC, hardened libraries)

- Shielding & packaging (metal enclosures, leaded/ceramic packages)

- System-level mitigation (software watchdogs, fault management)

By Manufacturing / Technology Node

- SOI CMOS / RHBD process nodes

- Bipolar / BiCMOS / SiGe technologies

- Wide-bandgap (GaN, SiC) rad-tolerant power devices

- Standard CMOS (qualified/tolerant) with mitigation

By End-Use / Application

- Space (satellites: GEO, MEO, LEO; launch vehicles)

- Defense & Military systems (avionics, missiles, EW)

- Aerospace (high-altitude aircraft, UAVs)

- Nuclear & Research reactors (instrumentation)

- Medical & Industrial (radiation therapy, inspection)

By Component / Subsystem

- Processors & On-board computers

- Communication & Telemetry subsystems

- Power distribution & conditioning subsystems

- Attitude control & guidance electronics

- Payload electronics (imagers, sensors)

By Qualification & Standards

- QML / MIL-STD qualified parts (Class Q/V/Y)

- ESA / ECSS qualified parts

- NASA / GSFC qualified parts

- Commercially qualified (vendor test reports)

By Service Offering

- Design & IP (RHBD libraries, hardened IP cores)

- Custom manufacturing & foundry services (trusted foundries)

- Testing & qualification (TID, SEE, SEL, proton/ heavy-ion)

- Repair, refurbishment & lifecycle support

- Turnkey rad-hard module/system supply

By Sales / Delivery Model

- Direct OEM supply (prime contractors, satellite OEMs)

- COTS distribution (rad-tolerant parts via distributors)

- Contract manufacturing & foundry (trusted foundry partners)

By Business Model / Revenue Stream

- New system/component sales (CAPEX)

- Aftermarket & spares (OPEX)

- Qualification & testing services (fee-for-service)

- IP licensing (hardened cores, libraries)

By Packaging & Form Factor

- Ceramic hermetic packages (QFP, PGA, BGA hermetic)

- Rad-hard plastic/overmolded modules (qualified)

- Chip-scale / hybrid modules (high-density)

By Qualification Level

- High-reliability GEO/Deep-space (Mrad TID, SEU/SEL hardened)

- Mid-reliability LEO/MEO (krad-level tolerant, EDAC)

- Low-reliability / tolerant (short-mission, software-mitigated)

By Region

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting