Radio-Fluoroscopy Systems Market Revenue to Attain USD 2.58 Bn by 2035

Radio-Fluoroscopy Systems Market Revenue and Trends 2026 to 2035

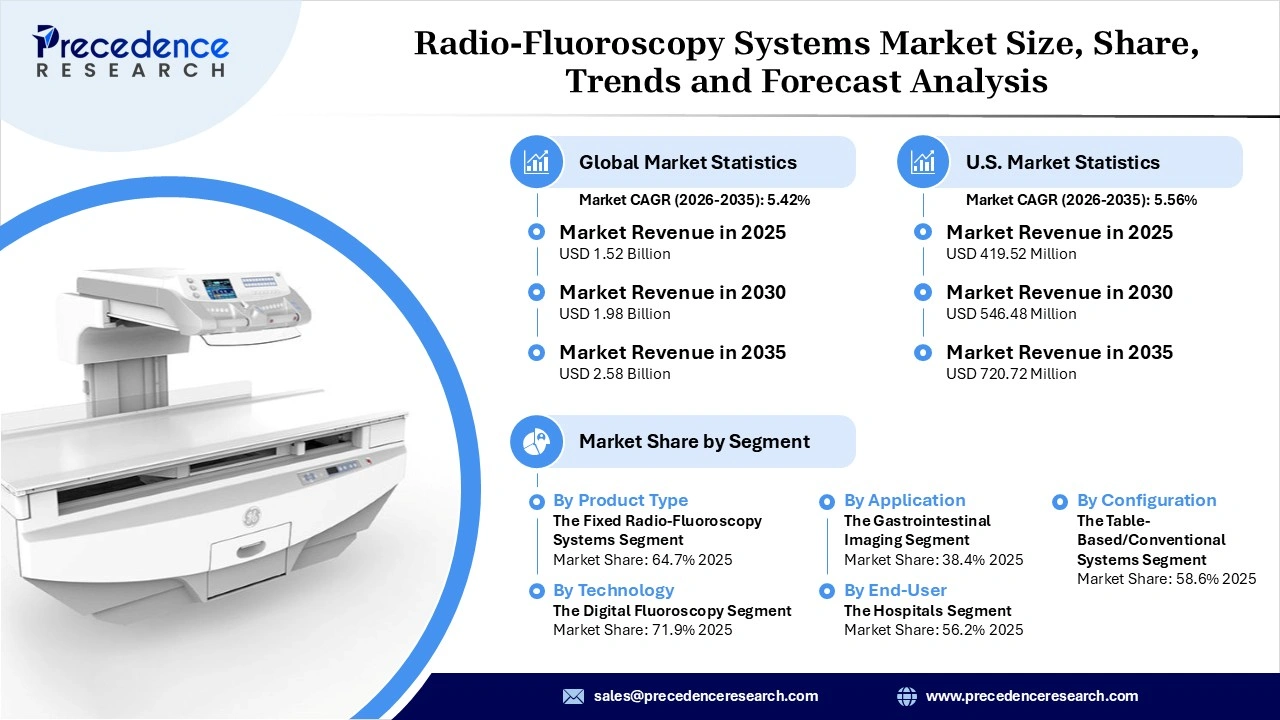

The global radio-fluoroscopy systems market revenue surpassed USD 1.52 billion in 2025 and is predicted to attain around USD 2.58 billion by 2035, growing at a CAGR of 5.42%. The market's growth is driven by several factors, including rapidly expanding healthcare infrastructure in emerging economies and rising emphasis on radiation dose reduction.

What are the Factors That Have a Significant Contribution to the Growth of the radio-fluoroscopy systems market?

The increasing burden of chronic diseases and rising demand for minimally invasive procedures are the major drivers, accelerating the growth of the market in the coming years. The increasing prevalence of cardiovascular, orthopedic, and gastrointestinal cases significantly increases the need for fluoroscopy for accurate diagnosis and treatment planning, such as angioplasty and stent placement. Fluoroscopy provides real-time treatment guidance, which is driving adoption in various surgeries. Additionally, the increasing integration of AI and imaging analytics is anticipated to propel the growth of the radio-fluoroscopy systems market during the forecast period.

Segment Insights

- By product type, the fixed radio-fluoroscopy systems segment contributed the highest market share of 64.7% in 2025. The rising need for detailed and high-quality images in advanced and complex procedures like cardiovascular, orthopedic, and neurosurgery within hospitals.

- By technology, the digital fluoroscopy segment accounted for the majority of the 71.9% share in 2025 and is expected to sustain its position during the forecast period, owing to its superior image quality, enhanced procedural efficiency, and reduced radiation exposure. This technology plays a crucial role in cardiology, orthopedics, and gastroenterology, enabling precise guidance in minimally invasive surgeries (MIS).

- By application, gastrointestinal imaging captured the highest market share of 38.4% in 2025. The rising cases of GI disorders such as stomach cancer, Inflammatory Bowel Disease (IBD), and other chronic diseases have led to an increasing demand for fluoroscopy equipment for both diagnosis and treatment planning.

- By end user, the hospitals segment held the largest market share of 56.2% in 2025. The growth of the segment is driven by the high patient volumes. The hospital has well-equipped diagnostic facilities that include GI, cardiovascular imaging, and orthopedic imaging. Moreover, increasing government and private investment in hospital infrastructure is anticipated to drive the segment’s growth during the forecast period.

- By configuration, the table-based/conventional systems segment dominated with 58.6% market share in 2025. The table-based/conventional systems are reliable, stable, and easy to use. These systems offer easy connectivity with already installed imaging infrastructure and PACS networks for seamless digital workflows in hospitals. The continuous need for certain procedures, such as gastrointestinal exams or orthopedic assistance in tertiary care hospitals, increased the use of these systems.

Regional Insights

North America holds the dominant share in the global radio-fluoroscopy systems market. The region’s leadership is driven by the presence of sophisticated healthcare infrastructure, growing demand for real-time imaging in minimally invasive procedures, and the increasing integration of artificial intelligence (AI), machine learning, 3D imaging, and robotically controlled C-arms.

- Additionally, the rising prevalence of chronic diseases that require advanced diagnostic and treatment capabilities is anticipated to fuel the expansion of the region in the coming years.

- In July 2025, the FDA granted 510(k) clearance for the Luminos Q.namix R and Luminos Q.namix T radiography/fluoroscopy systems that may enhance efficiency and reduce radiation exposure for specialized and complex examinations.

On the other hand, the Asia Pacific region is anticipated to grow at the fastest rate in the market during the forecast period. The region strongly focuses on modernizing healthcare infrastructure and improving treatment quality. The fastest growth of the region is attributed to the rising investments in diagnostic infrastructure, surging geriatric population, rising demand for minimally invasive surgeries, and supportive government initiatives for upgrading healthcare infrastructure. In addition, the increasing patient population with chronic diseases, along with the increasing number of hospitals and diagnostic laboratories, is expected to boost the market’s growth in the Asia Pacific region.

Radio-Fluoroscopy Systems Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 1.52 Billion |

| Market Revenue by 2035 | USD 2.58 Billion |

| CAGR from 2026 to 2035 | 5.42% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2025 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Recent Developments

- In August 2025, Paris Regional Health announced the addition of the cutting-edge GE P180 Fluoroscopy System to its diagnostic imaging capabilities. This advanced technology represents a significant upgrade in the hospital's commitment to providing high-quality, precise, and efficient care for its patients. The GE P180 Fluoroscopy System offers enhanced imaging capabilities that will significantly improve the hospital's ability to perform a wide range of diagnostic and therapeutic procedures.(Source: https://www.parisregionalhealth.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/7303

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344