What is the Radio-Fluoroscopy Systems Market Size?

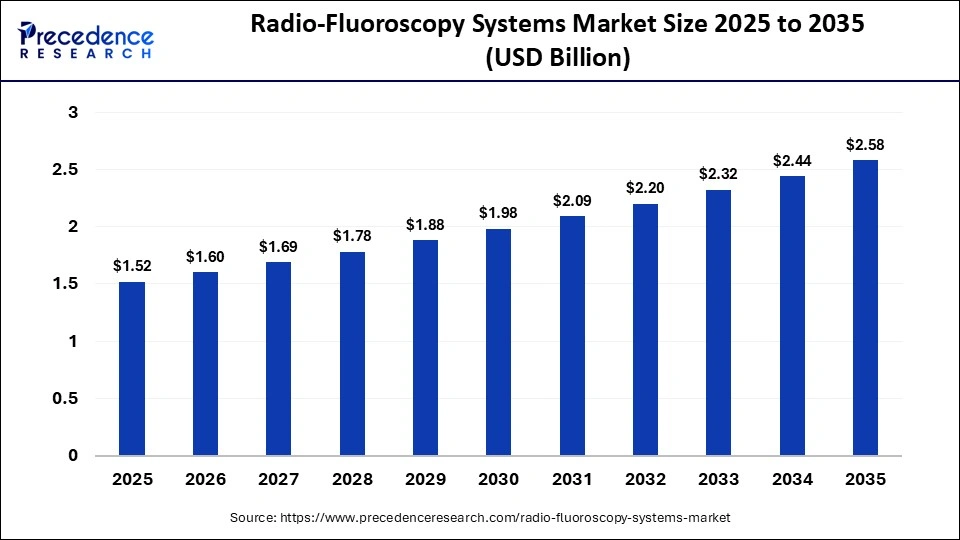

The global radio-fluoroscopy systems market size accounted for USD 1.52 billion in 2025 and is predicted to increase from USD 1.60 billion in 2026 to approximately USD 2.58 billion by 2035, expanding at a CAGR of 5.42% from 2026 to 2035. The market growth is attributed to rising demand for minimally invasive procedures and advanced real-time imaging solutions.

Market Highlights

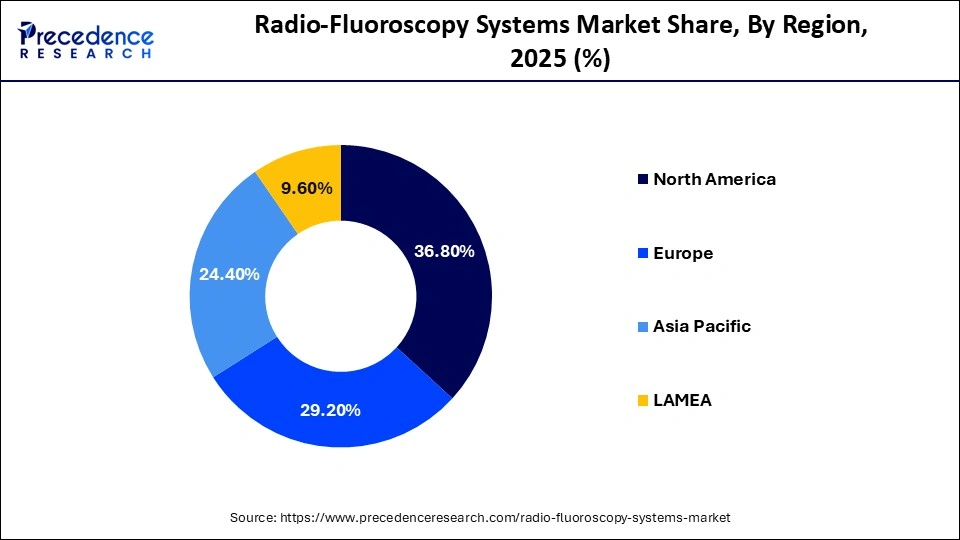

- North America dominated the market with 36.8% of the market share in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 6.7% between 2026 and 2035.

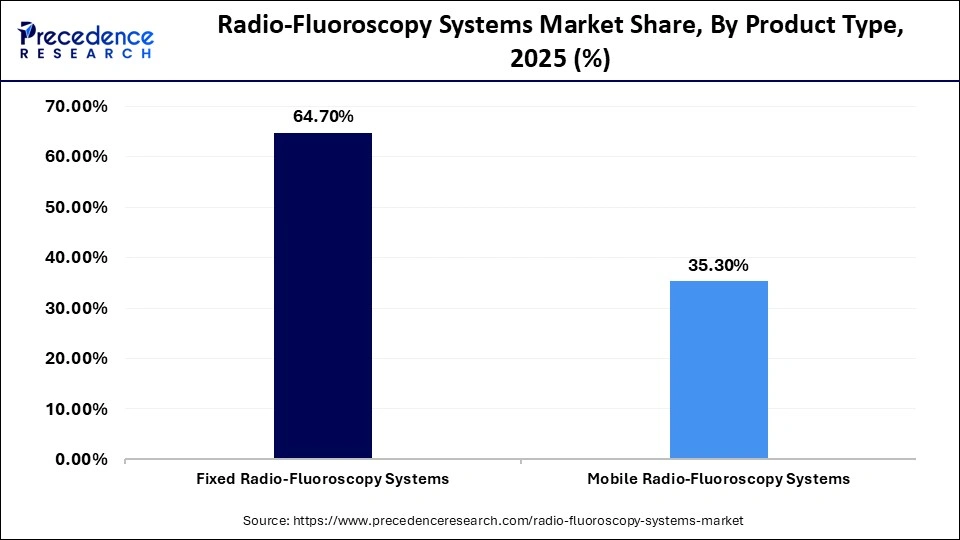

- By product type, the fixed radio-fluoroscopy systems segment contributed the highest market share of 64.7% in 2025.

- By product type, the mobile radio-fluoroscopy systems segment is growing at a strong CAGR of 6.8% between 2026 and 2035.

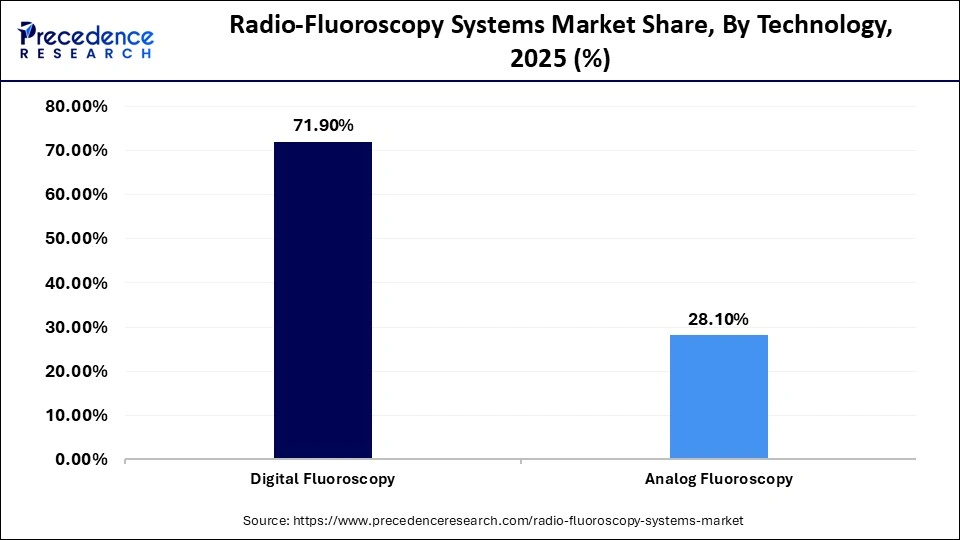

- By technology, the digital fluoroscopy segment held a major market share of 71.9% in 2025 and is expected to sustain its position during the forecast period with a 6.1% CAGR.

- By application, the gastrointestinal imaging captured the highest market share of 38.4% in 2025.

- By application, cardiovascular imaging is poised to grow at a healthy CAGR of 6.5% between 2026 and 2035.

- By end user, the hospitals segment generated the biggest market share of 56.2% in 2025.

- By end user, the ambulatory surgical centers segment is expanding at the fastest CAGR of 6.9% between 2026 and 2035.

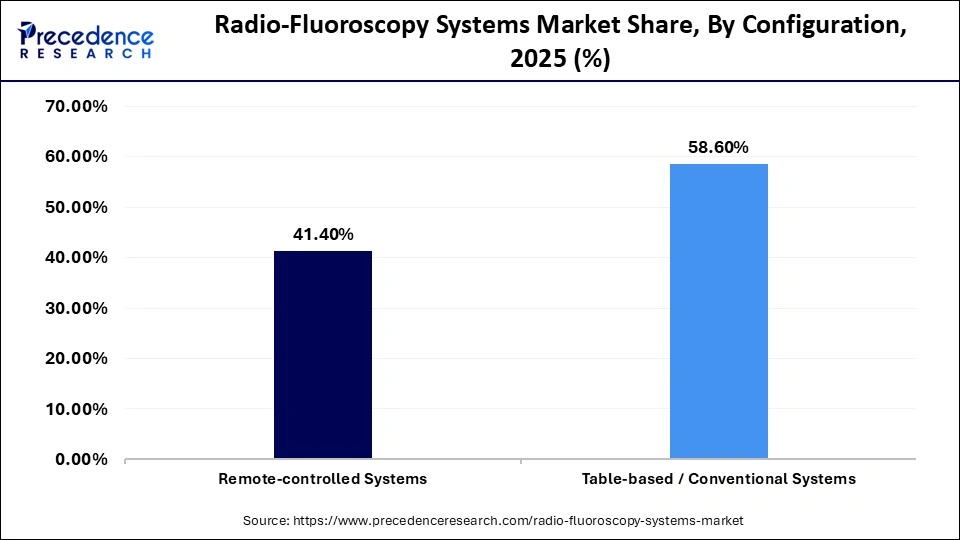

- By configuration, the table-based/conventional systems segment accounted for the largest market share of 58.6% in 2025.

- By configuration, the remote-controlled systems segment is projected to grow at a solid CAGR of 6.3% between 2026 and 2035.

Radio-Fluoroscopy Systems Market Overview

Real-time imaging demand is a key driver of growth in the radio-fluoroscopy systems market, fueled by the rising use of minimally invasive procedures. This is driven by the increasing adoption of minimally invasive surgical procedures that require ongoing visualization of X-rays to deliver the catheter and stents and minimize surgical trauma and patient recovery.

Fluoroscopy technology is a technology that creates a movie of live X-rays by traveling through the body and converting them to dynamic images. This further assists clinicians in determining whether the organs, contrast agents, and other instruments move during the procedure and improves the precision. Furthermore, the increased prevalence of chronic diseases and the aging population contribute to increased utilization of dynamic imaging modalities by clinicians in the coming years.

Beyond procedural guidance, real-time fluoroscopy supports faster clinical decision-making by allowing immediate assessment of device placement, anatomical response, and procedural outcomes during interventions. Continuous advancements in detector sensitivity, dose optimization, and image processing are also improving visualization quality while reducing radiation exposure, making fluoroscopy systems more suitable for frequent and complex interventional use.

Impact of Artificial Intelligence on the Radio-Fluoroscopy Systems Market

The radio-fluoroscopy systems market has been transformed by artificial intelligence, which has allowed clinicians to carry out fluoroscopy-guided procedures more accurately, faster, and safely. The AI-based algorithms are used to improve the processing of images in real-time to see the anatomical structures better and detect abnormalities during interventions more accurately. Moreover, the workflow management based on AI is being adopted in hospitals to minimize the time spent on procedures and increase the efficiency of the overall operations.

In addition, AI-supported dose management tools help optimize radiation exposure by dynamically adjusting imaging parameters based on patient anatomy and procedural complexity. These capabilities not only enhance patient safety but also support clinicians by reducing cognitive load and standardizing image quality across different operators and clinical settings.

Radio-Fluoroscopy Systems Market Growth Factors

- Rising Demand for Minimally Invasive Procedures: Increasing prevalence of interventional surgeries is driving the adoption of advanced fluoroscopy systems.

- Growing Integration of AI and Imaging Analytics: AI-assisted image interpretation is boosting diagnostic accuracy and procedural efficiency in hospitals.

- Expanding Healthcare Infrastructure in Emerging Economies: Rising hospital and surgical center developments are propelling fluoroscopy system deployment globally.

- Increasing Emphasis on Radiation Dose Reduction: Advanced digital detectors and safety protocols are fueling investments in safer imaging technologies.

- Advancements in Mobile and Remote-Controlled Systems: Innovative portable fluoroscopy units are growing clinical flexibility and bedside imaging adoption.

Tracking the Global Radio-Fluoroscopy Systems Market: Data-Driven Insights 2024-2025

- Siemens Healthineers received U.S. FDA 510(k) clearance for two new multifunctional radiography/fluoroscopy platforms, Luminos Q.namix R and Luminos Q.namix T, in July 2025, expanding its production footprint and reinforcing Germany's role as a key manufacturing and regulatory hub for advanced imaging systems.

- Germany is the world's largest exporter of high-end medical imaging equipment, accounting for an estimated 28-31% of global export value in 2024-2025, driven primarily by Siemens Healthineers' exports of fluoroscopy, angiography, and interventional imaging systems from German manufacturing hubs.

- Japan holds the third-largest export position, representing an estimated 17-19% of global imaging equipment exports, led by Canon Medical Systems and Shimadzu Corporation, with strong outbound shipments of fluoroscopy and X-ray systems to Southeast Asia, Europe, and North America.

- India imported approximately USD 392.6 million worth of X-ray and related medical imaging apparatus in 2023, with a total import volume of approximately 647,298 items; major sources were China, the United States, the Netherlands, the United Kingdom, and Germany.

- Saudi Arabia imported X-ray tubes valued at an estimated USD 8.84 million in 2023, with imports primarily from the United States (USD 4.44 M), Germany (USD 1.64 M), India (USD 0.98 M), Singapore (USD 0.37 M), and the Netherlands (USD 0.34 M).

- Brazil imported a substantial volume of X-ray equipment in 2024, valued at approximately USD 366 million under the broader X-ray equipment trade category.

- Vietnam appears among importing markets for X-ray/medical imaging equipment as a smaller but present destination, with import shipments recorded such as 593 units of X-ray equipment between mid-2024 and mid-2025, indicating adoption of imaging technology, including fluoroscopy-related systems.

- The FDA 510(k) clearance pathway remains the dominant regulatory approval route for fluoroscopy and radiography systems in the U.S., with approximately 4,200 fluoroscopic X-ray systems sold and installed annually, based on U.S. regulatory installation estimates and product classification data.

Radio-Fluoroscopy Systems Market Outlook

- Industry Growth Overview: The radio-fluoroscopy systems market is witnessing robust growth as hospitals and diagnostic centers increasingly prioritize minimally invasive imaging solutions. This technology is facilitated by the increasing need to have real-time visualization in interventional procedures and the growth of surgical and radiology departments globally. The technology of flat-panel detectors, high-definition imaging, and built-in dose-reduction functions is changing the workflow efficiency. They allow clinicians to carry out complex procedures precisely and safely. The trend towards clinical preference of flexible imaging systems, including mobile C-arms, hybrid fluoroscopy suites, and multipurpose diagnostic rooms. This is rapidly enhancing procurement trends, especially in areas experiencing increased investment in healthcare infrastructure. Moreover, the addition of software based workflow solutions and compatibility with hospital information systems is certain to increase the productivity of operations and secure the long-term growth curve of the market.

- Sustainability Trends: Sustainability considerations are increasingly influencing equipment design and procurement. The manufacturers are focusing on the use of energy-efficient imaging platforms and digital systems, which minimizes the environmental impact of procedural imaging. The strict requirements surrounding radiation safety and hospital ESG measures are promoting dose-reduction technology innovation, and recyclable materials and modular design are making it possible to manage the lifecycle longer.

- Global Expansion: The major manufacturers of radio-fluoroscopy systems are proactively growing internationally as a way of tapping the emerging and maturing markets. North America and Europe remain some of the primary adoption centers, owing to the already in place healthcare infrastructure and high volume of procedures. The Asia-Pacific region is becoming a hot zone courtesy of the high volume of hospital construction and modernization programs. Additionally, the government-sponsored healthcare programs, investment in hospital networks, and selective distribution deals are all speeding up expansion in Middle Eastern and Latin American markets.

- Major Investors: Private equity firms, sovereign wealth funds, and strategic corporate investors are increasingly recognizing the long-term potential of the radio-fluoroscopy sector. The focus of investment has been aimed at those companies that launch innovative dose reduction technologies, hybrid imaging suites, and AI-based workflow solutions. Furthermore, the latest acquisitions and strategic capital investments indicate the belief in the technological development of the market.

- Startup Ecosystem: The radio-fluoroscopy market is seeing a burgeoning startup ecosystem that emphasizes innovative imaging solutions and patient safety enhancements. New companies are building small, portable imaging devices, AI-supported fluoroscopy applications, and real-time dose metering devices that can be easily networked into hospital information networks. Such high-potential startups are the new target of venture capital investment, which promotes rapid prototyping, regulatory clearance, and pilot deployments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.52 Billion |

| Market Size in 2026 | USD 1.60 Billion |

| Market Size by 2035 | USD 2.58 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.42% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Technology, Application, End User, Configuration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

Why Are Fixed Radio Fluoroscopy Systems Dominating in the Radio-Fluoroscopy Systems Market?

Fixed radio-fluoroscopy systems segment dominated the radio-fluoroscopy systems market in 2025, accounting for an estimated 64.7% market share, as they are dependable, offer high-resolution images, and are used in a wide variety of clinical settings. These are able to work with a vast array of complicated interventional procedures, such as cardiovascular and gastrointestinal imaging. Their combination with hybrid operating rooms enhances efficiency and outcomes. Furthermore, the fixed systems also allow radiology teams to implement standardized safety and quality programs supported by guidance from societies such as the American College of Radiology (ACR), which fuels their demand in the coming years.

The mobile radio-fluoroscopy systems segment is expected to grow at the fastest rate in the coming years, accounting for 6.8% of CAGR, owing to their versatility and the increasing number of applications in a wide variety of clinical facilities. The systems allow imaging at the point of care, such as in emergency departments, operating theaters, and bedside procedures. This optimizes responsiveness and patient throughput in high-demand settings. Moreover, the usage of mobile units in hospitals is expected to promote the implementation of minimally invasive procedures and minimize transfers of patients, which enhances clinical performance and aids in improving patient experiences.

Technology Insights

Why Is Digital Fluoroscopy Dominating the Radio-Fluoroscopy Systems Market?

Digital fluoroscopy segment, which dominated the market with a 71.9% share, and is expected to sustain its position during the forecast period, with a 6.1% CAGR. It is used in hospitals that deal with high-resolution imaging and real-time guidance of procedures. It has the advanced technology of a detector that improves visualization of complex interventions. Moreover, the demand for digital fluoroscopy is facilitated by further continuous infrastructure improvements and the expansion of hybrid suites.

The shift from conventional image intensifiers to flat-panel digital detectors enables higher image clarity, faster frame rates, and improved dose efficiency during prolonged procedures. This makes digital fluoroscopy particularly suitable for high-volume interventional settings where precision, workflow continuity, and radiation management are critical.

Application Insights

Why Is Gastrointestinal Imaging Dominating Clinical Fluoroscopy Usage?

Gastrointestinal imaging segment dominated the radio-fluoroscopy systems market in 2025, accounting for 38.4% market share, due to the fact that fluoroscopy is used to assist in a variety of digestive tract assessments and interventions. Hospitals rely on dynamic imaging for upper GI series, small bowel follow-through studies, and therapeutic procedures, including ERCP, for which, in 2023, reports from Chinese tertiary hospitals indicated more than 43 million GI endoscopic procedures. GI imaging is at the center of the diagnosis of such conditions as dysphagia, strictures, obstructions, and bleeding. Experts are actively introducing image analysis paradigms introduced at RSNA 2025 GI sessions that target the detection of lesions with the help of AI and risk stratification of pancreatic cysts. Furthermore, the rising cases of GI disorders across the globe and the rising volumes of procedures are guaranteed to ensure that GI imaging will continue to be central in the procedures of interventional fluoroscopy.

Cardiovascular imaging segment is expected to grow at the fastest rate in the coming years, accounting for an estimated 6.5% CAGR, owing to the increased interventional cardiology that requires fluoroscopy in performing complicated vascular operations. The increase in cardiovascular disease prevalence also contributes to the increase in procedural demand. This is facilitated by the CDC statistics on heart disease as one of the most frequent causes of hospitalization and death among the major population groups. Additionally, the further establishment of cardiovascular fluoroscopy as a strategic clinical capability is further anchored by the escalating hybrid operating room constructions, as illustrated in the trends of surgical imaging.

End User Insights

Why Are Hospitals Dominating the Radio-Fluoroscopy Systems Market?

The hospital segment held the largest revenue share in the radio-fluoroscopy systems market in 2025, accounting for 56.2% of the market share, due to the high patient volumes. The large tertiary and teaching hospitals have fixed and sophisticated systems of fluoroscopy to perform complicated interventions. The high uptake is attributed to the multi-specialty procedures that involve GI, cardiovascular imaging, and orthopedic imaging. Furthermore, the leading institutions are likely to continue investing in hospital-based fluoroscopy infrastructure for long-term operational excellence.

Ambulatory surgical centers segment is expected to grow at the fastest rate in the coming years, holding a CAGR of about 6.9%. Mobile and compact fluoroscopy systems are found in smaller facilities more often to maximize space when there is limited space. Increase in demand in outpatient interventional cardiology, orthopedics, and gastroenterology promotes system adoption in ASCs. The growth in ASCs in developing regions is expected to drive the growth in mobile and digital systems.

Configuration Insights

Why Are Table-based Systems Leading the Radio-Fluoroscopy Market?

The table-based/conventional systems segment dominated the radio-fluoroscopy systems market in 2025, accounting for 58.6% market share. They are more reliable, stable, and easy to use in high-volume procedures by hospitals. These systems provide easy connectivity with the already installed imaging infrastructure and PACS networks. The radiology personnel prefer the traditional platforms, as there is less setup time and easy usability. The use of table-based fluoroscopy units is perpetuated by continuous procedural demand in the tertiary care hospitals. Long-term preference for these systems in hospitals is also driven by familiarity with the maintenance and service.

The remote-controlled systems segment is expected to grow at the fastest rate in the coming years, accounting for an estimated 6.3% CAGR, as these systems provide high-level automation. This allows high-quality imaging with the least amount of handwork. Hospitals and surgical centers are increasingly shifting towards remotely operated operating rooms. Remote operation will minimize the exposure of staff to radiation and enhance the safety of the procedures. Furthermore, the growth of hybrid operating rooms and minimally invasive surgeries drives the use of remote-controlled radio-fluoroscopy systems around the world.

Regional Insights

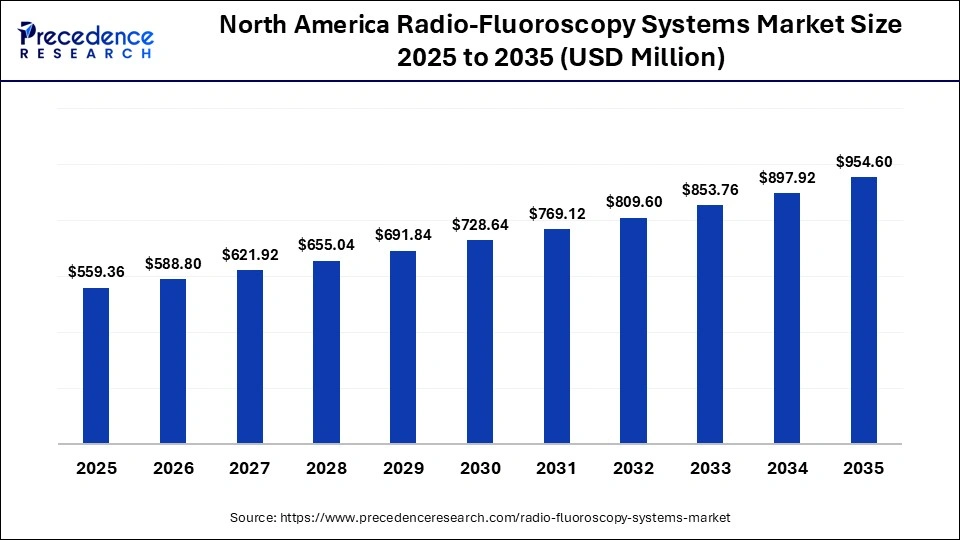

How Big is the North America Radio-Fluoroscopy Systems Market Size?

The North America radio-fluoroscopy systems market size is estimated at USD 559.36 million in 2025 and is projected to reach approximately USD 642.60 million by 2035, with a 5.65% CAGR from 2026 to 2035.

Why Does North America Dominate the Radio-Fluoroscopy Systems Market in 2025?

North America led the radio-fluoroscopy systems market, capturing the largest revenue share in 2025, accounting for 35% of the market share, due to the extensive hospital infrastructure and high procedural volumes. Hospitals spent a lot of money on fixed and digital systems, with more than 70% of tertiary care hospitals in the U.S. implementing AI-assisted fluoroscopy systems by 2025 (RSNA).

GE HealthCare, Siemens Healthineers, and Philips present a high-tech digital infrastructure that is helpful in real-time imaging, dose reduction, and precision of procedures. ACR, ASRT, and RSNA training programs ensure similarity of clinical standards in hospitals. The increase in cardiovascular procedures creates the need to have high-resolution fluoroscopy systems. Furthermore, the North American hospitals are increasingly focusing on workflow efficiency and clinician training, further reinforcing market growth in the region.

Favorable reimbursement frameworks and early adoption of advanced interventional technologies are accelerating system upgrades across large hospital networks. Continued investment in academic medical centers and specialized cardiac and vascular institutes is also sustaining demand for next-generation radio-fluoroscopy platforms.

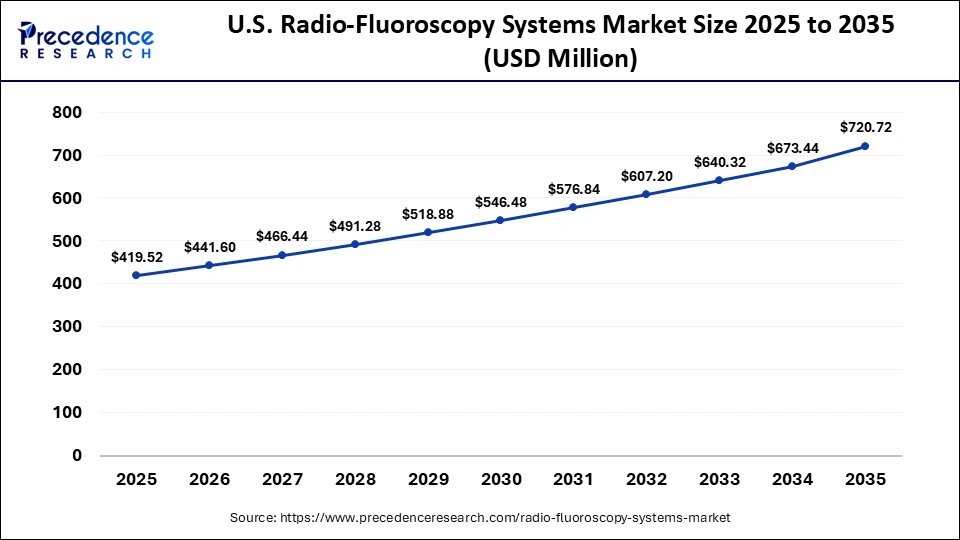

What is the Size of the U.S. Radio-Fluoroscopy Systems Market?

The U.S. radio-fluoroscopy systems market size is calculated at USD 419.52 million in 2025 and is expected to reach nearly USD 720.72 million in 2035, accelerating at a strong CAGR of 5.56% between 2026 and 2035.

U.S. Driving Innovation in Fluoroscopy Systems

The United States is a major player in the market, facilitated by developed healthcare facilities and the volume of procedures. Multi-modality imaging is incorporated into hybrid operating rooms and ambulatory centers, which improve workflow. Moreover, the hospitals in this region continue prioritizing technology upgrades to meet growing demand for minimally invasive procedures, thus facilitating the market growth.

The strong presence of specialized cardiac, orthopedic, and neurointerventional centers further supports sustained demand for advanced radio-fluoroscopy systems. In parallel, continuous investment in clinician training and digital infrastructure is enabling more efficient utilization of fluoroscopy platforms across both inpatient and outpatient care settings.

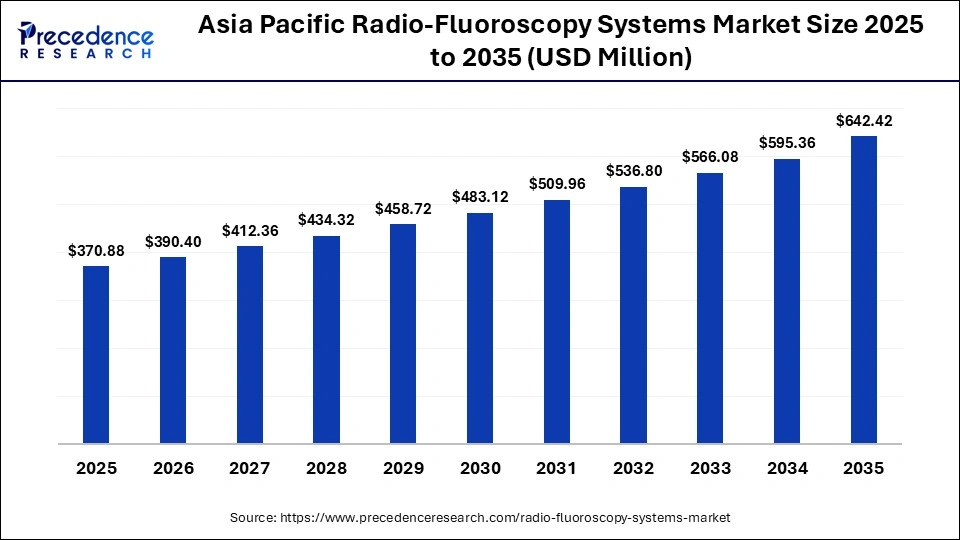

What is the Asia Pacific Radio-Fluoroscopy Systems Market Size?

The Asia Pacific radio-fluoroscopy systems market size is expected to be worth USD 642.42 million by 2035, increasing from USD 370.88 million by 2025, growing at a CAGR of 5.65% from 2026 to 2035.

What Factors Are Driving the Rapid Growth of Radio-Fluoroscopy Systems in Asia-Pacific?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, accounting for 6.7% of CAGR, owing to the rising healthcare infrastructure spending and large-scale hospital construction projects. China, India, Japan, and South Korea are the biggest adopters of mobile and remote-controlled systems. Modernization of the hospitals is financed by government programs, and it allows procuring high-resolution systems in both urban and tier-2 cities. Moreover, the increasing trend of cardiovascular and gastrointestinal diseases in China is creating a demand for these types of systems in this region.

The growing focus on expanding interventional cardiology and gastroenterology services is accelerating the deployment of flexible fluoroscopy platforms across public and private hospitals. In addition, rising adoption of mobile systems is improving access to real-time imaging in facilities with limited space and uneven patient loads, supporting broader regional market growth.

China: Leading Asia-Pacific In Fluoroscopy Adoption

China is leading the charge in the Asia Pacific market, increasing cardiovascular imaging. Mobile, remote-controlled, and digital systems are applied by hospitals to facilitate extensive implementation. Furthermore, the increasing rates of cardiovascular and gastrointestinal disorders are increasing the momentum of adoption of radio-fluoroscopy systems in the coming years.

Large public hospitals and tertiary care centers are accelerating procurement of high-throughput fluoroscopy platforms to support rising interventional cardiology and endoscopy case volumes. Government-backed hospital modernization programs are also enabling wider deployment of advanced imaging systems across provincial and tier-2 cities, strengthening long-term adoption trends.

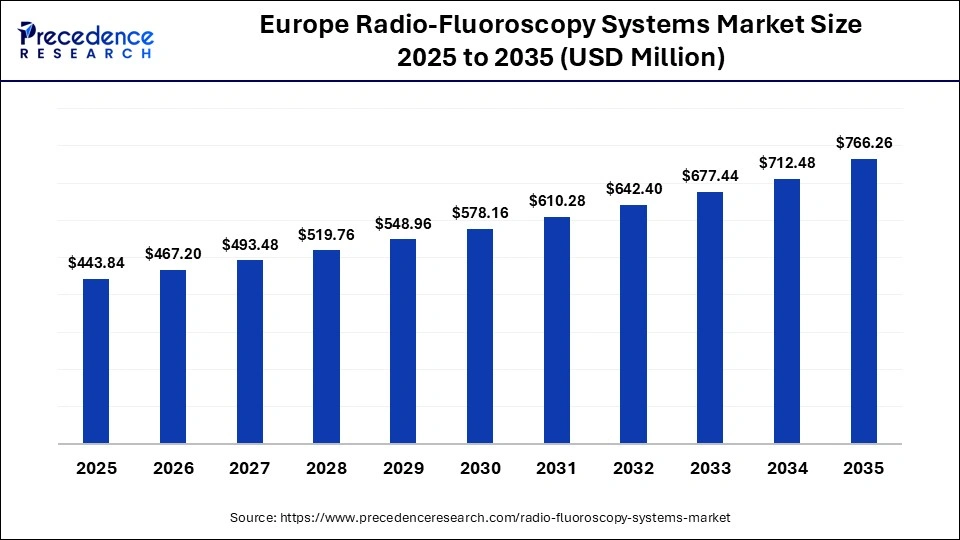

What is the Europe Radio-Fluoroscopy Systems Market Size and Growth Rate?

The Europe radio-fluoroscopy systems market size has grown strongly in recent years. It will grow from USD 443.84 million in 2025 to USD 766.26 million in 2035, expanding at a compound annual growth rate (CAGR) of 5.67% between 2026 and 2035.

How Is Europe Accelerating the Adoption of Advanced Fluoroscopy Systems in Hospitals?

The Europe region is expected to hold a notable revenue share of the market, which held a market share of about 30%, driven by the modernization of existing hospitals and the expansion of interventional radiology departments. Germany, France, and the United Kingdom are more focused on digital and remote-controlled systems of cardiovascular and gastrointestinal interventions. Furthermore, the collaboration between OEMs and clinical institutions is likely to introduce innovative procedural workflows, supporting long-term market expansion.

In addition, strict radiation safety standards and clinical quality requirements are accelerating the replacement of legacy fluoroscopy systems with dose-optimized digital platforms. Public healthcare funding mechanisms and cross-border research programs are also supporting faster adoption of advanced imaging technologies in academic hospitals. The growing demand for minimally invasive procedures among aging populations is further reinforcing sustained investment in high-precision fluoroscopy systems across the region.

Germany: Strengthening Cardiovascular and GI Imaging Capabilities

Germany leads the radio-fluoroscopy systems market due to the growing popularity of cardiovascular and GI imaging. With the help of AI-assisted digital and remote-controlled systems, hospitals can achieve a reduction in radiation exposure. Hospitals replace analog systems with high-resolution digital units, enhancing accuracy and procedural safety, thus boosting the market growth. In Germany, strong public hospital funding and well-established interventional cardiology and gastroenterology networks are accelerating system upgrades. Integration with hospital IT systems and structured clinician training programs is improving workflow efficiency and consistent system utilization. These factors are reinforcing sustained demand for advanced fluoroscopy platforms across tertiary and regional hospitals.

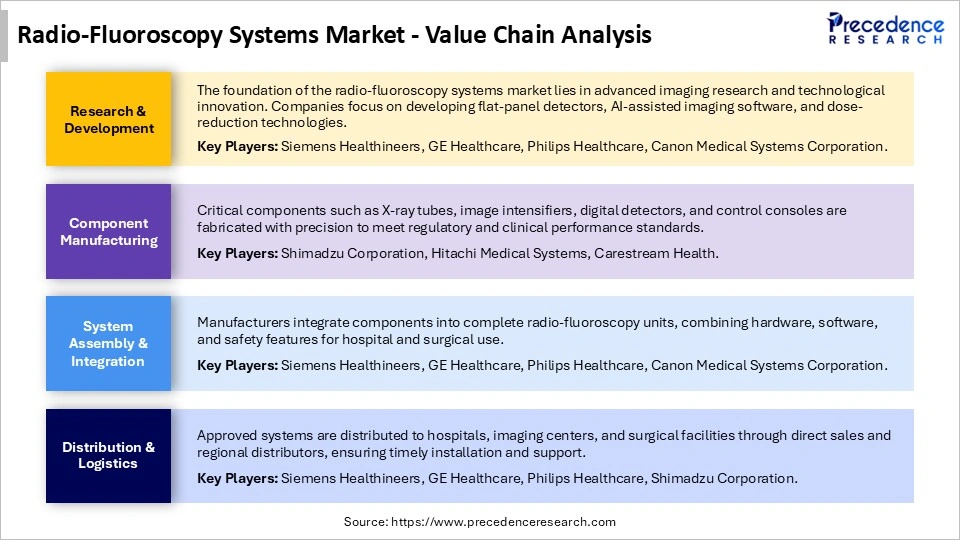

Radio-Fluoroscopy Systems Market Value Chain Analysis

Who are the major players in the global radio-fluoroscopy systems market?

The major players in the radio-fluoroscopy systems market include Canon Medical Systems Corporation, Carestream Health, GE Healthcare, Hitachi Medical Systems, Hologic Inc., Philips Healthcare, Shimadzu Corporation, and Siemens Healthineers.

Recent Developments

- In July 2025, Siemens Healthineers secured U.S. Food and Drug Administration clearance for two advanced multifunctional radiography and fluoroscopy platforms designed for real-time 2D imaging. The newly approved systems include the remote-controlled Luminos Q.namix R and the Luminos Q.namix T with tableside control. Both platforms support specialized and complex diagnostic examinations while streamlining clinical workflows through intuitive user interfaces, integrated system components, and AI-supported workflow guidance. Siemens Healthineers highlighted that these capabilities help maintain low patient radiation exposure, accelerate procedure times, reduce patient wait periods, and improve overall departmental productivity.(Source: https://www.siemens-healthineers.com)

- In March 2025, Canon Medical Systems USA announced the U.S. commercial launch of the Adora DRFi following FDA 510(k) clearance granted on December 23, 2024. The Adora DRFi enters the market as a next-generation hybrid system that combines radiographic and fluoroscopic imaging within a single platform. Canon positioned the system as a solution for healthcare providers seeking operational flexibility, space optimization, and consistent image quality across diverse clinical applications. The company stated that the launch marks a strategic expansion of its fluoroscopy portfolio in the U.S., supporting efficient diagnostic workflows and enhanced clinical performance.(Source:https://us.medical.canon)

Segments Covered in the Reports

By Product Type

- Fixed Radio-Fluoroscopy Systems

- Mobile Radio-Fluoroscopy Systems

By Technology

- Digital Fluoroscopy

- Analog Fluoroscopy

By Application

- Gastrointestinal Imaging

- Orthopedic Procedures

- Cardiovascular Imaging

- Urology

- Pain Management & Interventional Procedures

By End User

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Specialty Clinics

By Configuration

- Remote-controlled Systems

- Table-based/Conventional Systems

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting