Retail Banking Market Revenue to Attain USD 3.76 Bn by 2033

Retail Banking Market Revenue and Trends 2025 to 2033

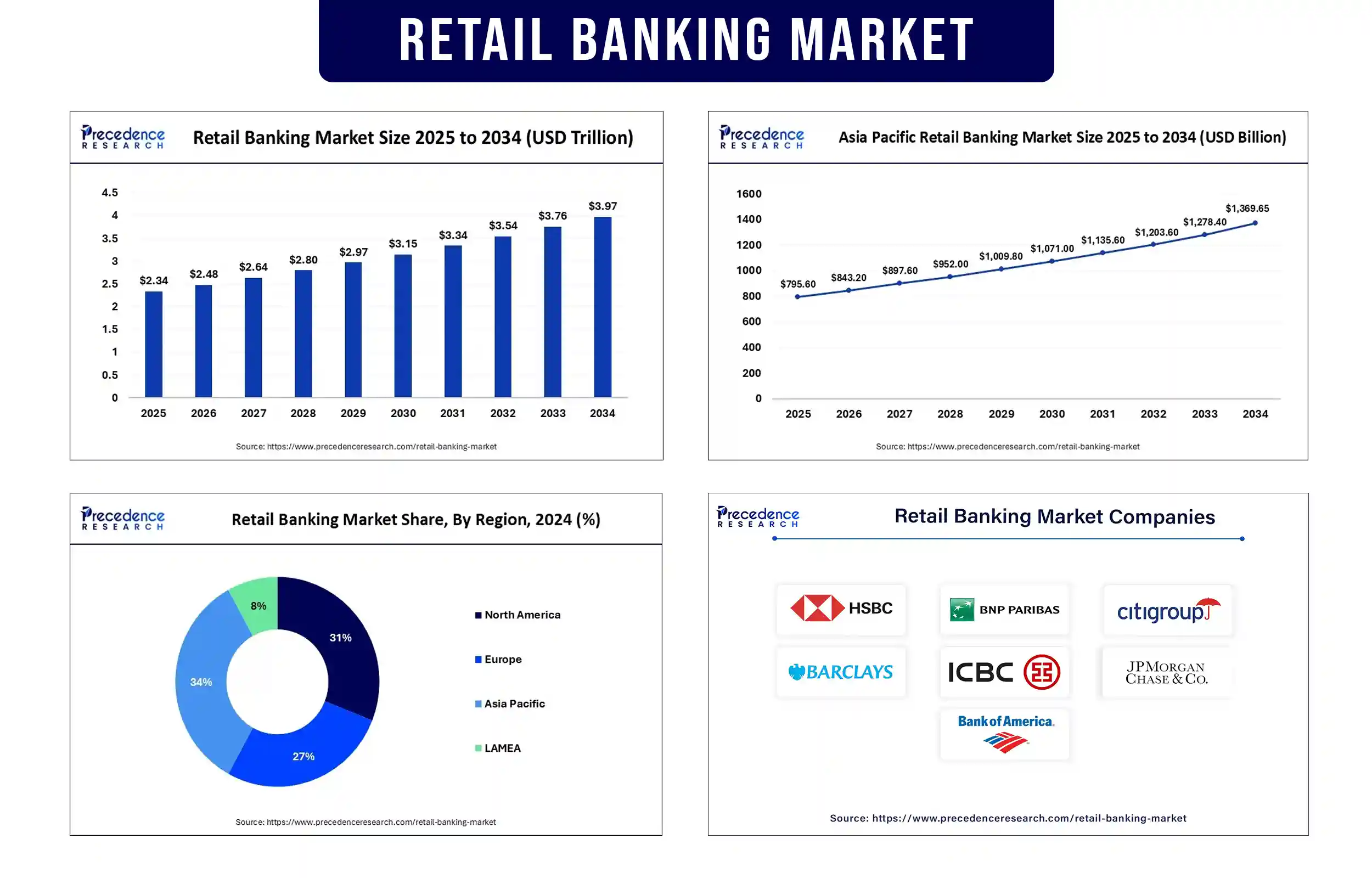

The global retail banking market revenue surpassed USD 2.34 billion in 2025 and is predicted to attain around USD 3.76 billion by 2033, growing at a CAGR of 6.03%.

Market Overview

The retail banking sector is undergoing rapid development and transformation, driven by technological advancements, connected consumers, and the demand for continuous digital financial services. Traditionally, retail banking focused on providing banking products like savings accounts, personal loans, credit cards, and mortgages to the general public, often through brick-and-mortar branches. However, with the rise of banking-as-a-service, retail banking is evolving beyond traditional models. It's becoming more product-flexible, embracing a digital-first (and even digital-only) approach, leveraging technology, and prioritizing customer experiences. Today's customers expect 24/7 real-time access to products and a personalized, intuitive, and seamless banking experience.

Advances in artificial intelligence, automation, and machine learning are evading into the traditional financial services industry both in terms of systems to serve customers and engage with them more and developing the ability to future enhance the one-day engagement experience and conduct business more effectively. Digital-only banks and fintech challengers are also accelerating the transformation of retail banking and forcing their traditional banking competitors to transform legacy banking models, all while attempting to still meet regulatory compliance and delivering exceptional customer experiences. At the other end of the spectrum are traditional banks that are simply trying to keep pace with advances in financial services and attractive banking products to customers who are decidedly a digitally connected customer base, where traditional service levels and pace do not matter. Fortunately, banking customers are largely sustaining their loyalty, not so much from lack of alternatives, but really more related to underwhelming expectations leading to inertia that ultimately turns into loyalty, but that is not forever.

Advances in artificial intelligence, automation, and machine learning are transforming the traditional financial services industry. These technologies enhance customer service, improve engagement, and streamline business operations. Digital-only banks and fintech companies are accelerating the transformation of retail banking, compelling traditional banks to modernize their legacy models while adhering to regulatory compliance and delivering superior customer experiences. Traditional banks are striving to keep pace with these advancements and offer appealing products to a digitally connected customer base. Customer loyalty is often maintained due to low expectations and inertia, but this is not guaranteed.

Major Trends in the Retail Banking Market

Omnichannel Engagement Strategy

Retail banks and credit unions are leveraging omnichannel marketing to provide customers with a seamless experience across all touchpoints. This includes integration and synchronization across mobile banking systems, social media, SMS alerts, and email notifications. Consistent messaging across these channels increases visibility, leading to repeat engagement and fostering customer loyalty through familiar and engaging user experiences.

Content Marketing

Content marketing has become a key pillar in retail banking marketing strategies. Banks and credit unions are producing valuable content such as blogs, webinars, podcasts, and interactive tools to educate customers on financial literacy, savings, and investment planning. By positioning themselves as trusted advisors, financial institutions build stronger emotional connections, fostering brand loyalty.

AI-Powered Conversational Marketing

AI-powered conversational marketing is also transforming customer engagement in retail banking. AI-driven chatbots (both visual and voice) offer 24/7 service, enabling continuous customer engagement. These tools personalize interactions, provide immediate responses, and deliver ongoing support, leading to improved customer experiences and conversion rates.

Ethical Marketing and Transparency in Data Usage

Banks are addressing consumer concerns about data protection and ethical marketing by increasing transparency in their data usage. By focusing communications on building trust through cybersecurity, ethical banking practices, and sustainable finance initiatives, banks are gaining credibility, especially among digitally skeptical consumers.

Report Highlights of the Retail Banking Market

Type Insights

In 2024, thr private sector banks segment held the largest market share and is projected to continue growing. These banks are highly competitive and aggressive in pursuing market share. Public sector banks, often subsidized by the government with capital injections and regulatory preferences, also have advantages. They can invest more in marketing, infrastructure, and technology to offer innovative products and services. This environment, characterized by resumed efforts to deliver superior value and fierce competition, benefits customers.

Service Insights

The savings and checking accounts segment led the market with the highest market share in 2024. Banking offers a secure place for deposits, a way to manage money, and a system for everyday transactions. Checking accounts provides easy access to funds without withdrawal restrictions. Savings accounts encourage regular deposits for wealth building and saving. Debit and credit cards enable cashless transactions, reducing the need to carry cash.

Regional Insights

Asia Pacific registered dominance in the retail banking market by holding a sizeable share in 2024. Rapid urbanization, a growing middle class, and the adoption of mobile banking technologies have fueled this region's growth. Financial institutions are heavily investing in digital infrastructure to cater to the tech-savvy population and improve customer experience.

On the other hand, North America is expected to grow at the fastest rate in the upcoming period. This is mainly due to the rising demand for personalized banking experiences. The region's banking sector is increasingly using advanced technologies, such as artificial intelligence and data analytics, to streamline banking operations and enhance customer experiences.

Retail Banking Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 2.34 Billion |

| Market Revenue by 2033 | USD 3.76 Billion |

| CAGR from 2025 to 2033 | 6.03% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In May 2025, Citigroup reported the sale of a consumer banking business in Poland to Velobank, satisfying its strategy to exit non-core retail markets. Similarly, HSBC chose to safely exit its U.S. business banking division to focus on markets where they felt have a competitive advantage, namely Asia and the U.K.

- In March 2025, NatWest partnered with OpenAI to improve its digital services. This includes a major upgrade to Cora, their chatbot, and staff assistant, AskArchie, to assist with fraud reporting and financial help.

Retail Banking Market Key Players

- BNP Paribas

- Citigroup, Inc.

- HSBC Group

- ICBC

- JP Morgan Chase & Co.

- Bank of America Corporation

- Barclays

- China Construction Bank

- Deutsche Bank AG

- Mitsubishi UFJ Financial Group, Inc.

- Wells Fargo

Market Segmentation

By Type

- Public Sector Banks

- Private Sector Banks

- Foreign Banks

- Community Development Banks

- Non-banking Financial Companies (NBFC)

By Service

- Saving and Checking Account

- Transactional Account

- Personal Loan

- Home Loan

- Mortgages

- Debit and Credit Cards

- ATM Cards

- Certificates of Deposits

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/3050

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344